Cultured Marble Market

Cultured Marble Market by Type (Polyester, Cement, Composite, and Sintered), Application (Countertops, Vanities, Bathtubs, Flooring ), End-use Industry (Residential and Non-residential), and Region (2024-2029)

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cultured marble market is estimated to grow from USD 4.48 billion in 2023 to USD 6.26 billion by 2029, at a CAGR of 5.76% between 2024 to 2029. The growth in market is primarily due to increasing demand for cost-effective, durable, and visually appealing alternatives to natural stone in modern interior applications.

KEY TAKEAWAYS

-

BY APPLICATIONFlooring application is growing at the fastest pace due to cultured marble in flooring application is popular choice as it offers luxurious appearance, and practical benefits. Its non-porous surface mimics the elegance of natural stone while offering superior durability and ease of maintenance. The primary advantage of cultured marble is its resistance to stains and moisture. Further, its seamless installation adds up to its appeal as it minimizes grout lines and creates sleek and polished surface.

-

BY END-USE INDUSTRYThe non-residential segment of the cultured marble market is expanding at its fastest pace due to the growing need for cos-effective mmaterial for aesthetic and decorative puproses. Hospiatlity, healthcare and retail are adopting these materials to enhance functionality and aesthetics. Unlike natural stone, cultured amrble can be molded into specific shapes and sizes, making it ideal for unique design requirements in non-residential spaces such as retail stores, corporate offices, and public restrooms. Cultured marble are resistant to stains, moisture, and bacteria, making it ideal for high-traffic environments.

-

BY REGIONAsia Pacific has emerged as the fastest-growing cultured marble market due to increased industrialization, urbanization, and rising disposable incomes. The low labor costs and extensive industrial bases in China, and India have made them key production hubs for cultured marble products. In addition factores driving the demand of cultured marble are its affordability to natural stone making an attractive choice for homeowners and businesses looking for a luxurious look without the high price tag of quarried stone.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Lotte Chemical Corporation, launched ‘Premiere Collection,’ the new artificial marble series. The "Premiere Collection" is a new series from LOTTE Chemical's engineered stone brand, Staron.

Cultured marble is crushed limestone which are bounded together with resin to fabricate like natural stone. It is created in molds to produce elegant and unique pieces for home renovation and new constructions. Cultured marble is nonporous element that make it durable. The soldi surface material resists stains and chips. Cultured marble is cost effective than natural marble, granite and quartz. It is much lighter than the other natural stone or marble, but it has low installation cost than the natural marble

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing popularity of cultured marble in countertops and vanities is expected to drive market growth. The emerging sustainable cultured marble market is expected to change the functioning of the marble industry’s supply chain, which will also impact the cultured marble industry due to the consistent need for advanced solutions to enhance sustainable products and durability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in demand for affordable, luxury, and customized cultured marble

-

Growth in the residential and commercial construction

Level

-

Presence of alternative materials

Level

-

Economic growth and increase in per capita consumption

Level

-

Economic slowdown and supply chain volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in the residential and commercial construction

The construction industry and its broader ecosystem are the foundation for the growth of cultured marble. Construction is the biggest industry globally. Construction industry which consist real estate, infrastructure and residential structures accounts for 13 percent of the global GDP. Economic growth and higher incomes in the last few years have resulted in constructing several new houses and remodelling the old ones. The construction industry is proliferating, mainly in emerging Asia Pacific and the Middle East & Africa. High-income levels and the growing economy are the primary reasons for the market growth in this segment. Homeownership has seen rapid growth in the past few years, and the market is projected to grow during the next decade. Increasing urbanization and housing facilities have surged the demand for cultured marble. Cultured marble is popular material in new construction and remodelling projects due to its durability, aesthetics, and cost effectiveness

Restraint: Presence of alternative materials

Cultured marble offers benefits like alternative material such as granite, natural stone and marble and ceramic material. The market faces restraint from the alternative materials. Natural stone needs less maintenance and a simple method of processing which turns it into construction material. Several types of stones are used for decorative façade ornaments, interior design, as well as flooring which makes it viable alternative material for cultured marble. These materials perform better depending on the application where it is used. In bathroom vanity tops natural stone provide luxurious appearance, budget friendly and offers high durable, resists stains and scratches. In Kitchen countertops granite offers heat resistance and extremely durable for high traffic kitchens.

Opportunity: Economic growth and increase in per capita consumption

According to World Economic Outlook, global financial conditions remain accommodative. Emerging markets and developing economies growth has been revised upwards because of stronger economic activity in Asia, particularly China and India. In Latin and South America, the growth trend has remained in downward trend especially in Brazil economic sluggish growth. But the year 2025 is estimated to be beneficial for Brazil as the country will see recovery in economic discourse due to supportive structural factors such as growth in industrialization. The Middle East and Central Asia weighs a good progressive growth due to oil production and investment in building and construction activity fuelled by investment into construction as well as industrialization. As economies grow household income increases, leading to higher spending on home renovation or purchase of new houses. Consumers are more willing to invest into the aesthetic and durable material like cultured marble as it offers affordable yet stylish alternative to natural stone. This in turn will support the growth of cultured marble market.

Challenge: Economic slowdown and supply chain volatility

Economic downturns and disruption in the supply chain can affect the growth of the cultured marble market. These challenges impact production cost, consumer demand, raw material availability, and overall market expansion. Decline in disposable income leads to lower demand for home renovations and luxury finishes. Real estate slow down can burn down the growth of new housing construction, limiting cultured marble application in kitchens, bathrooms and countertops. Shipping delays and rising fright cost affect global supply chains, leading to longer lead times for cultured marble products. Inflation reduces the consumption purchasing power shifting demand towards more affordable building materials.

Cultured Marble Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cultured shower wall panels, vanity tops, and countertops for residential and commercial applications | Seamless, low-maintenance surfaces; mold and mildew resistance; wide range of color options |

|

Custom shower bases, vanity tops, and whirlpool designs for residential projects | Over 40 color choices; high gloss or matte finishes; durable and stain-resistant surfaces |

|

Custom countertops and vanity tops for clients in the Mid-Atlantic and New England States | Specializes in custom designs; caters to both residential and commercial clients |

|

Bathroom vanity tops, tub/shower surrounds, and shower pans for residential and commercial use | Custom-made cast polymer composite fixtures; extensive local manufacturing capacity |

|

Provides molds, equipment, supplies, training, and customer support to cultured marble manufacturers | Supports the establishment of cultured marble production facilities; offers comprehensive training and support |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cultured marble ecosystem includes distributors, manufacturers, raw material suppliers, and end-use industries. Raw materials suppliers provide the essential components needed to make cultured marble, including limestone, polyester resin, catalyst, fillers, and pigments. Manufacturers turn these materials into cultured marble, guaranteeing excellence, functionality, and creative designs for various applications. Distributors guarantee product distribution via channels such as wholesalers, retailers, and major producers, bridging the gap between manufacturers and end users. End-use industries include residential and non-residential. These industries generate a high demand for cultured marble

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cultured Marble Market, By Application

The countertops are expected to hold the highest share of the cultured marble market, owing to rising demand for affordable, trendy, and luxurious look without the high price of quarried stone. The demand for countertops is expected to be driven by rising installations of countertops which continue to be selected over freestanding or wall-mounted fixtures in kitchens and bathrooms of both residential and non-residential applications. Alongside consumer trends toward sustainability and fashion, emerging economies have witnessed rapid expansion of the countertops, fuelling the growth of the cultured marble market.

Cultured Marble Market, By End-use Industry

The residential industry is expected to hold the highest share of the cultured marble market, owing to rising demand for affordable, trendy, and aesthetic preference. Economic growth and higher incomes in the last few years have resulted in constructing several new houses and remodeling the old ones. The growth of the construction industry has been stalled for the last year and is returning to normal but at a much slower speed. Factors driving the growth in residential housing market globally are strengthening of domestic economy, high urbanization, various government initiatives, improved infrastructure. Alongside consumer trends toward sustainability and fashion, emerging economies have witnessed rapid expansion of the footwear industry, fuelling the growth of the synthetic leather market.

REGION

Asia Pacific to be largest and fastest-growing cultured marble market during forecast period

Asia Pacific will likely be the largest and fastest-growing cultured marble market during the review period. The presence of a strong manufacturing base in China, India, and South Korea, low labor costs, high production capacities, and the expansion of the new construction and remodelling are driving the regional market growth. Besides, the rising middle-class population, increasing disposable income, and growing preference for eco-friendly products that do not involve natural extracted materials are fuelling the demand for cultured marble in the region.

Cultured Marble Market: COMPANY EVALUATION MATRIX

In the cultured marble market matrix, LX Hausys Ltd. (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. KalingaStone (Classic Marble Company) (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While LX Hausys Ltd. dominates with scale, KalingaStone (Classic Marble Company) shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 4.48 BN |

| Revenue Forecast in 2029 | USD 6.26 BN |

| Growth Rate | CAGR of 5.76% from 2024-2029 |

| Actual data | 2019−2029 |

| Base year | 2023 |

| Forecast period | 2024−2029 |

| Units considered | Value (USD Billion) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Cultured Marble Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Cultured Marble Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Cultured Marble Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the applications | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- August 2024 : LOTTE Chemical released Premiere Collection, the new artificial marble series. The Premiere Collection is a new series from LOTTE Chemical's engineered stone brand, Staron.

- July 2024 : Kalinga Stone introduced Elixir. The product is primarily used in flooring for both residential and commercial projects. Elixir products are also perfect for countertops, wall cladding, and statement artifacts to uplift any living space.

- April 2024 : Corian (DuPont) launched Corian Quartz to its North American market. The new Quartzite looks with multidirectional veining and visual depth are combined with the high-performance benefits of engineered quartz.

- March 2020 : LX Hausys Ltd. invested USD 50 million in 2020 to expand its engineered stone production in Georgia, US, from 700,000 square meters to 1.05 million square meters, up by 50% from 2019.

Table of Contents

Methodology

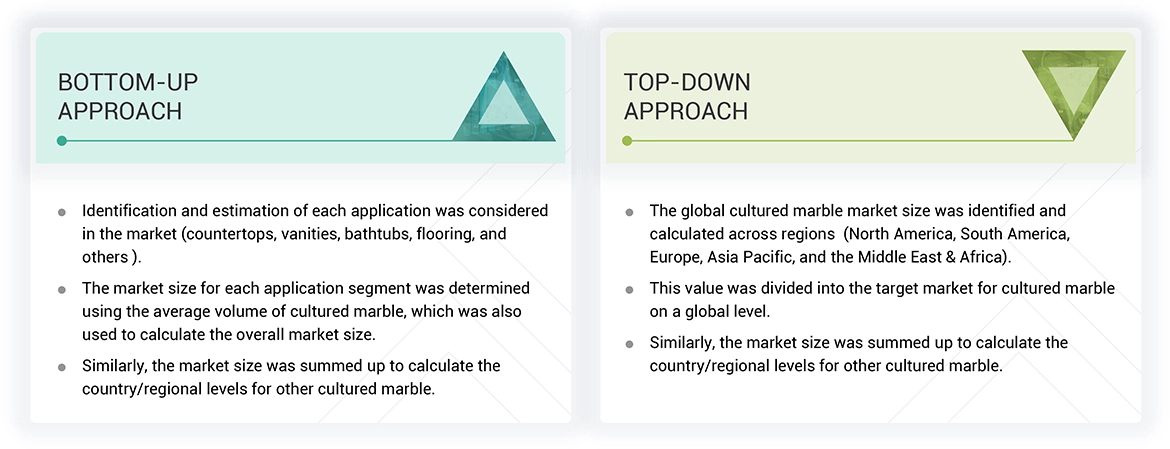

The study involved four major activities in order to estimating the current size of the cultured marble market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including The International Cast Polymer Association (ICPA), The Federation of Indian Granite & Stone Industry (FIGSI), and Association of Marble Companies of Lombardia.

Primary Research

Extensive primary research was carried out after gathering information about cultured marble market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cultured marble market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, application, end-use industry, and region.

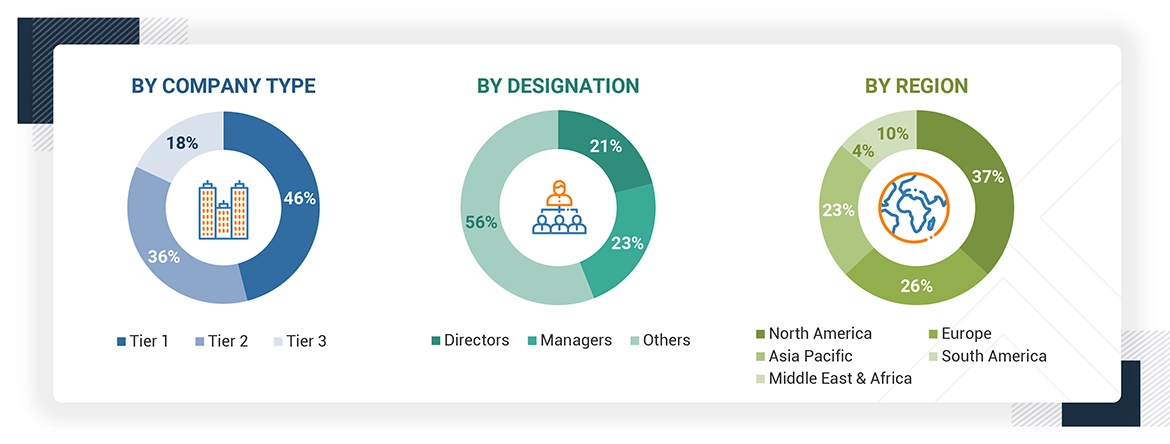

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

| CULTURED MARBLE MANUFACTURERS | ||

|---|---|---|

| LX Hausys Ltd. | MarCraft, Inc. | |

| Corian (DuPont) | Antolini Luigi & C. S.p.A | |

| Lotte Chemical Corporation | KalingaStone (Classic Marble Company) | |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the cultured marble market. The market sizing of the cultured marble market was undertaken from the demand side. The market size was estimated based on market size for cultured marble in various applications.

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Cultured marble, is manufactured with a precise blend of polyester resin, catalyst, fillers, and pigments that are mixed thoroughly and then poured into polished molds that have been coated with a clear gelcoat. It is molded into various shapes, including sinks, countertops, and shower walls. The material is designed to mimic the appearance of natural marble but is more affordable and easier to maintain. Cultured marble is known for its smooth, glossy finish and can be customized in different colors and patterns. It is often used in bathroom and kitchen applications due to its durability and aesthetic appeal.

Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the cultured marble market based on type, application, end use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the cultured marble market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cultured Marble Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cultured Marble Market