Cyclic Olefin Polymer Market

Cyclic Olefin Polymer Market by Type (Homopolymers, Copolymers), Process Type (Injection Molding, Extrusion), End-use Industry (Packaging, Automotive, Healthcare & Medical, Food & Beverages, Electrical & Electronics) and Region – Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cyclic olefin polymers market is projected to reach USD 1.5 billion by 2029 from USD 1.16 billion in 2024, at a CAGR of 5.9% during the forecast period. The cyclic olefin polymers market is growing rapidly due to growing need for high-performance materials in the packaging industry. COPs possess superior transparency, moisture barrier, and chemical resistance, which makes them suitable for food, pharmaceutical, and cosmetic packaging

KEY TAKEAWAYS

-

BY TYPEHomopolymers is projected as the fastest growing type in the cyclic olefin polymers (COP) market due to their exceptional properties and increasing demand in high-growing industries. While copolymers blend cyclic olefins with other monomers, such as ethylene, homopolymers consist of only a single cyclic olefin monomer, such as norbornene. This unique composition leads to outstanding purity, high optical clarity, and excellent chemical resistance, which makes them extremely sought after for specialty applications.

-

BY PROCESS TYPEExtrusion is projected to be the fastest growing process type in the cyclic olefin polymers market during the forecast period. This is because of its flexibility, scalability, and compatibility with increasing industrial needs. Extrusion is a manufacturing process where molten COP material is forced through a die to produce continuous forms such as films, sheets, or tubes, providing unmatched efficiency for making large quantities of uniform products. The increased demand for high-performance packaging, especially in pharmaceutical and food sectors, is a primary force.

-

BY END-USE INDUSTRYThe medical industry is one of the fastest-growing end-use industry in the cyclic olefin polymers market because it has excellent properties, which are compatible with the strict requirements of medical applications. COP is highly pure, biocompatible, and resistant to chemicals and is a best-suited material for medical devices, pharmaceuticals packaging, and diagnostic purposes. With advancements such as point-of-care diagnostics, personalized medicine, and wearable technology, the demand for high-performance materials that deliver precision, safety, and reliability has increased. COPs satisfy these requirements through dimensional stability and purity, essential in applications such as prefilled syringes, microfluidic parts, and diagnostic equipment, where slight contamination or distortion can invalidate results.

-

BY REGIONAsia Pacific is the leading market for the growth of cyclic olefin polymers (COP) due to a synergistic blend of accelerating industrialization, growing health care needs, and increasing manufacturing capacities. Economies such as China, India, Japan, and South Korea are leading the growth, being propelled by their large populations and growing middle class, which accelerate the demand for sophisticated medical equipment, pharmaceutical packages, and consumer products—all high-end applications of COP.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including mergers & acquisition. For instance, Biosynth acquired VIO Chemicals, a Zurich-based company renowned for its chemical R&D expertise and extensive network of large-scale manufacturing partners. This acquisition helped Biosynth to strengthen its customer supply chains, provide greater flexibility in scaling for complex chemical manufacturing.

Changing consumer demands towards lightweight and sustainable packaging solutions, COPs are emerging as a standout option because they are recyclable and can also increase the shelf life of the product, boosting their adoption. The healthcare and pharmaceutical sectors also play a leading role in propelling market growth. The biocompatibility of COPs, low extractables, and high purity make them a first-choice option for drug delivery systems, prefilled syringes, vials, and microfluidic devices. The increase in chronic conditions, biologics, and patient self-administration further increases the demand.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Cyclic olefin polymers are used in sensors, optical films, displays, lenses, and packaging. Optical clarity, chemical resistance, thermal stability, and low moisture absorption drive the adsorption of cyclic olefin polymers in different technologies. Advanced injection molding and extrusion technologies allow precise fabrication of medical devices, optical components, and packaging films, ensuring consistency and high purity. Additionally, advancements in additive manufacturing (3D printing) are expanding the use of COPs in customized medical devices, industrial components, and high-precision optics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand in healthcare and pharmaceuticals industry

-

Shift towards sustainable packaging

Level

-

High production cost of cyclic olefin polymers

-

Competition from alternative materials

Level

-

Increasing use of cyclic olefin polymers in optical applications

-

Rising demand for smartphone lenses

Level

-

Volatility of raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand in healthcare and pharmaceuticals industry

Pharmaceutical and healthcare industry's rising demand is the key driving factor for the cyclic olefin polymers market as they are particularly well-suited to the demands of the industry. COPs are a collection of amorphous, clear thermoplastics that possess strong chemical resistance, high transparency, and low water absorption. Such characteristics make them of ever-growing significance in medical and pharmaceutical uses where accuracy, reliability, and security cannot be compromised. In the medical field, the increasing demand for sophisticated diagnostic equipment, including lab-on-chip technology, microfluidics, and opto-sensors, has driven COP usage. They are as optically clear as glass but less heavy and break-resistant, making them perfect for manufacturing smaller components like lenses and diagnostic vials. Moreover, global aging and rise in chronic disease prevalence have promoted the demand for medical devices and drug delivery products, further elevating COP utilization. COP resists interaction with aggressive formulations and holds up under sterilization cycles, including autoclaving, unlike more conventional materials such as glass. The trend towards biologics that tend to have specific storage requirements has magnified the demand for packaging to reduce contamination risk—COP fulfills this requirement with its inertness and barrier properties.

Restraints: High production cost of cyclic olefin polymers

Cyclic olefin polymers (COPs) are a group of high-performance thermoplastic resins that are prized for their high optical transparency, low water absorption, and superior chemical resistance, which make them suitable for use in medical devices, packaging, and electronics. Their high cost of production is a major limiting factor on the COP market growth. This is attributed to a series of interlinked factors that make them difficult to scale and popularize. In the first place, raw materials that must be used in synthesizing COPs like norbornene derivatives are also sophisticated and are less accessible than for typical polymers like polyethylene or polypropylene. Monomers can be difficult and time-consuming chemical processes to achieve, increasing costs of procurement. Secondly, polymerization itself must take place with accurate conditions that include the need for sophisticated catalysts like metallocenes or Ziegler-Natta systems, which involve a high development and maintenance cost. These catalysts guarantee the desired molecular shape and characteristics, but their complexity contributes to the overall cost. Second, the production of COPs requires energy-consuming processes and rigorous quality control to ensure the high purity and consistency necessary for their intended applications, especially in medical and optical industries. This requires special equipment and cleanroom facilities, further increasing overheads of production. In contrast to commodity plastics, COPs are made in relatively small quantities because of their specialized applications, which do not allow manufacturers to take advantage of economies of scale that can be used to absorb costs. Finally, competition from cost lower options such as polycarbonates or acrylics with comparable properties at a reduced-price limits market penetration. Although COPs perform better in certain niches, i.e., biocompatibility or UV transparence, the cost versus benefit often swings in favor of substitutes for less demanding applications.

Opportunity: Increasing use of cyclic olefin polymers in optical applications

The increasing application of cyclic olefin polymers (COPs) in optical products offers a huge growth prospect for the market because of their superior optical properties and versatility. COPs are known to be highly transparent, low-birefringent, and have superior light transmission, and thus they provide a perfect substitute for conventional materials such as glass and other optical plastics such as polycarbonate or acrylic. Those are attributes especially worthwhile for industries involving precision optical elements, including photonics, electronics, and medical diagnostics. Because high-performance optics in the form of lenses, light guides, camera sensors, and displays find increased demand with applications in smartphone, AR, and VR applications, COPs become more widely utilized for bringing sharpness and dimensional stability into varying conditions. One of the important drivers for this opportunity is the fast-paced growth in consumer electronics and wearable devices, where strength, durability, and optically better materials are needed. COPs provide low water absorption as well as thermal resistance, such that consistent performance in high-temperature or humidity conditions can be maintained, different from some competing polymers. Such dependability is critical in applications such as optical films and touchscreens, where any minor distortion may affect functionality. Furthermore, the medical industry further accelerates this trend, with COPs being implemented in diagnostic equipment and lab-on-chip devices that require UV transparency and chemical resistance for precise readings. The market also gains from COPs' compatibility with new manufacturing methods, including injection molding, which enables the mass production of intricate, high-precision optical components. With industries focusing on sustainability, COPs' recyclability provides an added advantage. With continued advances in technology and increased investments in R&D, the optical segment presents a fertile landscape for COP market growth, making it a material of preference in future-proof optical solutions and catalyzing long-term growth across various applications.

Challenges: Volatility of raw material prices

Volatility of raw material prices is the key challenge to the cyclic olefin polymers (COP) industry, affecting production costs, pricing stability, as well as competitiveness. COPs are produced from petrochemical feedstocks such as ethylene and norbornene, whose prices follow closely the highly volatile world oil and gas market. When crude oil prices surge because of geopolitical tensions, supply chain outages, or changes in demand, the price of these raw materials increases, compressing manufacturers' margins. This volatility makes budgeting and long-term planning for COP producers difficult, as they have to either absorb the higher costs or transfer them to customers, which can lead to lower demand in price-sensitive industries such as packaging or consumer electronics. The challenge is compounded as COPs face entrenched competition from such well-known alternatives as polycarbonate and acrylic, which, although occasionally less optically performant, have more stable or diversified supply chains. Unforeseen increases in raw materials' prices can undermine the cost-effectiveness of COPs, making new market penetration or share retention in existing ones, e.g., optical and medical markets, increasingly difficult. Smaller producers, not having the scale to secure good terms from their suppliers, are especially at risk, possibly resulting in market consolidation as the larger operators with deeper pockets ride out the crisis more effectively.

Cyclic Olefin Polymer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Prefillable syringe uses cyclic olefin polymer to enable large-volume IV drug delivery. | Reduced breakage, glass-like transparency, and low extractables for safer large-volume infusion. |

|

Used in pharma fill-finish to avoid ion leach from glass. | Improves stability of sensitive biologics by eliminating glass-associated ion leach and reducing packaging-drug interaction risk. |

|

Polymer cartridge and syringe platforms utilize cyclic olefin polymer for the containment of injectable drugs. | Retains drug stability (especially for biologics) with break-resistant, inert polymer allowing ultra-low temperature storage. |

|

Applied in primary pharma packaging of biologics and cryogenic applications. | High break resistance, excellent moisture & oxygen barrier, no heavy-metal ion release, ideal for sensitive drugs and deep-freeze storage. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cyclic olefin polymers market has a complex ecosystem, including manufacturers, raw material suppliers, distributors, governments, and end-user industries. Prominent companies in this market include well-established, financially stable manufacturers of cyclic olefin polymers. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cyclic Olefin Polymer Market, By Type

Homopolymers are picking up momentum in the electronics and optics sectors because of their high transparency and low birefringence. Such properties suit the production of high-performance optical components, display panels, and lenses, particularly as demand booms for next-generation consumer electronics and high-resolution displays. The fact that they have a very simple molecular structure also ensures reliability of performance, a major point in precision-oriented applications compared to copolymers, which are subject to variability of their properties based on monomer composition.

Cyclic Olefin Polymer Market, By Process Type

Extrusion allows the production of thin, strong COP films with high clarity, water resistance, and barrier properties, suitable for sterile medical packaging and eco-friendly food wraps. These characteristics meets strict regulatory tests while targeting consumer demands for safe, green solutions, driving extrusion's ascendency. Extrusion's expansion also extends beyond packaging, driven by its versatility of application into various areas, including optical films and electrical components. The processing provides exacting control over surface quality and thickness, creating thin sheets of low-birefringence and high-transmission COP—paramount for screens, lenses, and sensors of the burgeoning electronics industry.

Cyclic Olefin Polymer Market, By End-use Industry

The worldwide increase in chronic illnesses and the aging population have stimulated demand for advanced medical solutions, and hence the use of COPs. In contrast to conventional materials such as glass or lower-purity plastics, COPs are resistant to breakage, lighter in weight, and able to withstand sterilization procedures, making them a drug packaging and delivery system material of choice. Cyclic olefin polymers resistance to sterilization procedures without compromising integrity further enhances its attractiveness in medical environments. In contrast to lower-cost options such as polyethylene, COP responds to the industry trend toward lightweight, resilient, and sustainable solutions despite its premium price.

REGION

Asia Pacific to be fastest-growing region in global cyclic olefin polymer market during forecast period

The health care sector in Asia Pacific is growing rapidly as governments and private sectors heavily invest in infrastructure driven by aging citizens in Japan and mass health consciousness in India and China. COP's properties of chemical resistance, optical clarity, and biocompatibility render it indispensable for the manufacturing of quality syringes, vials, and diagnostic instruments in view of these health care trends. Moreover, the regional leadership in electronics and packaging sectors further increases demand for COP. Japan and South Korea, the leaders in precision electronics, utilize COP's transparency and thermal stability for optical films and components in smartphones and cameras. China's enormous manufacturing base meanwhile gains from low-cost production and an expanding export market for COP-based products. The economic development in the region also draws international participants, with industries establishing manufacturing hubs to take advantage of cheaper labor and access to raw material vendors, increasing COP availability and price competitiveness

Cyclic Olefin Polymer Market: COMPANY EVALUATION MATRIX

In the cyclic olefin polymer market matrix, Mitsui Chemicals (Star), a Japanese company, leads the market through its high-quality products, which find extensive applications in various end-use industries such as packaging, medical, electronics, optics and others. Polysciences (US) is gaining traction with its technological advancements in cyclic olefin polymer market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.1 Billion |

| Market Forecast in 2029 (value) | USD 1.5 Billion |

| Growth Rate | CAGR of 5.9% from 2024-2029 |

| Years Considered | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Cyclic Olefin Polymer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Packaging & rigid container manufacturer |

|

|

| Distributor |

|

|

| Concern about raw-material volatility and supply chain | Developed supplier benchmarking & resin cost-tracker for COP monomer feedstocks |

|

| Interest in competitive benchmarking |

|

Supported go-to-market strategy and positioning vs competitors |

RECENT DEVELOPMENTS

- May 2024 : Sumitomo Bakelite has released an additive polymer and an additive copolymerized cyclo-olefin polymer and released as the SUMILITERESIN PRZ Series. The product has properties from its aliphatic cyclic main chain such as high transparency, high glass transition temperature (Tg), high rigidity, low dielectric constant, and low water absorption. Moreover, with the use of advanced polymerization technology, it is additionally enriched with properties like solvent resistance, developability, crosslinking-based curability, and enhanced flexibility.

- December 2023 : Biosynth acquired VIO Chemicals, a Zurich-based company renowned for its chemical R&D expertise and extensive network of large-scale manufacturing partners. This acquisition helped Biosynth to strengthen its customer supply chains, provide greater flexibility in scaling for complex chemical manufacturing.

- May 2023 : Borealis AG developed Stelora in collaboration with TOPAS Advanced Polymers. It is developed through a unique process that integrates cyclic olefin copolymers (COCs), a relatively new class of clear, high-purity polymers, with polypropylene (PP). This process results in an advanced material known as ethylene-propylene-norbornene (EPN), which is well-suited for a wide range of technically sophisticated applications, primarily in e-mobility and renewable energy generation.

- September 2020 : Polyplastics constructed a cyclic olefin copolymer (COC) production facility in Leuna, Germany, to address the increasing global demand for its TOPAS COC polymers. The new plant, operated by its local subsidiary, TOPAS Advanced Polymers GmbH, was expected to have an annual production capacity of 20,000 tons, more than doubling the company's existing output.

- April 2020 : Mitsui expanded new production line for its APEL series of cyclic olefin copolymers at Osaka Works in Takaishi, Osaka Prefecture. With the increased usage of multi-lens cameras in smartphones, demand for APEL had been increasing massively, especially for smartphone camera lenses. To counter this boom, Mitsui Chemicals wanted to reinforce its supply capacity. The commissioning of the new plant would raise the production capacity of the company's APEL by about 50 percent.

Table of Contents

Methodology

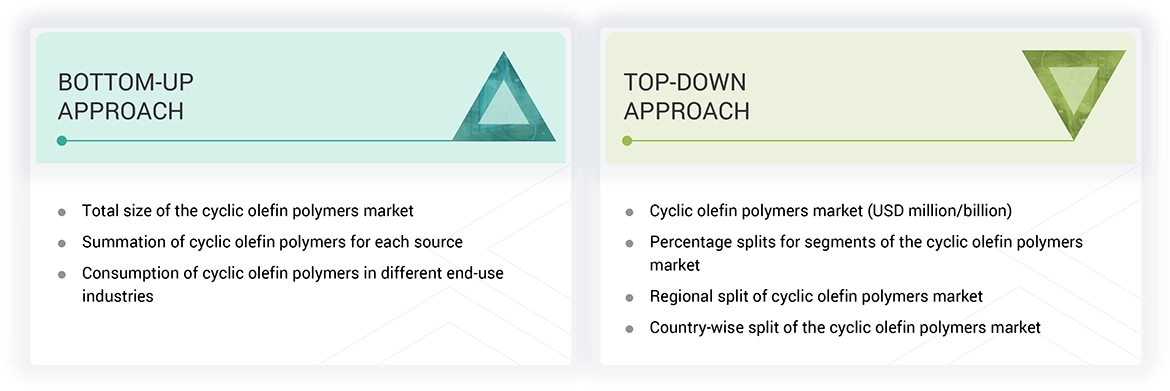

The study involved four major activities for estimating the current size of the global cyclic olefin polymers market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of cyclic olefin polymers through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the cyclic olefin polymers market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the cyclic olefin polymers market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The cyclic olefin polymers market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the cyclic olefin polymers market. Primary sources from the supply side include associations and institutions involved in the cyclic olefin polymers market, key opinion leaders, and processing players.

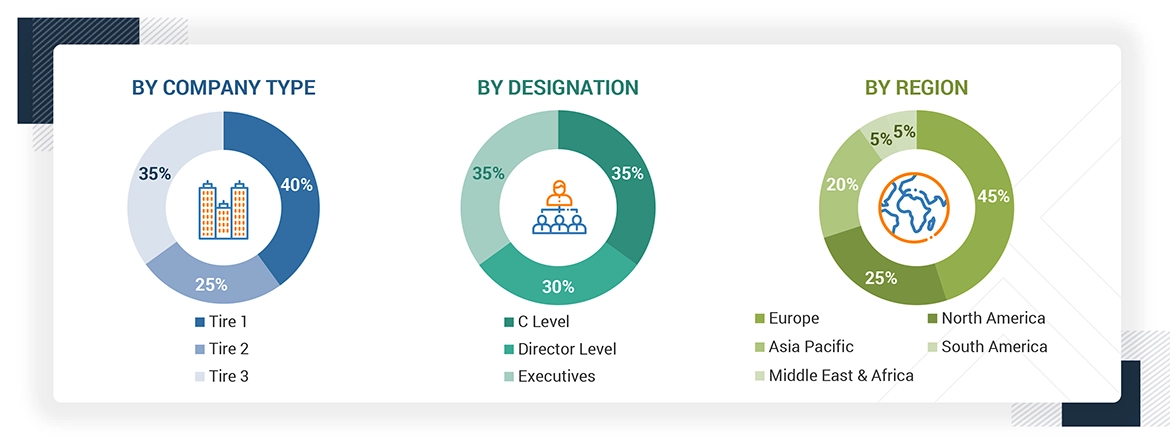

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the cyclic olefin polymers market by type, process type, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the cyclic olefin polymers market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Cyclic olefin polymers (COPs) are a family of high-performance thermoplastic materials with distinctive molecular structure composed of cyclic olefin monomers polymerized to form a hard, amorphous polymer chain. The polymers are commonly known in the market for their superior optical transparency, low birefringence, and high clarity, making them the perfect substitutes for glass in the use of optical lenses, medical equipment, and display elements. Also, COPs possess excellent chemical resistance, minimal water absorption, and superior dimensional stability, making them even more desirable for use in such industries as packaging, electronics, and medical applications. Demand for cyclic olefin polymers worldwide has witnessed a consistent upward trend owing to a rising demand for lightweight, rugged, and recyclable products, especially used in pharmaceutical packaging, microfluidic devices, and advanced diagnostic systems.

Stakeholders

- Cyclic Olefin Polymers Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the cyclic olefin polymers market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on type, process type, end-use industry, and region.

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the cyclic olefin polymers market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cyclic Olefin Polymer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cyclic Olefin Polymer Market