This study involved the extensive use of both primary and secondary sources. The research process involved evaluating various factors affecting the industry to identify the segmentation, industry trends, key players, competitive landscape, market dynamics, and growth strategies.

Secondary Research

In the secondary research process, various secondary sources were referred to, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect valuable information for an extensive, technical, market-oriented, and commercial study of the dairy herd management market. It was also used to obtain information about the key players, market classification & segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain critical qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, vice presidents, chairpersons, chief executive officers, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the dairy herd management market. Primary sources from the demand side include professionals from livestock farmers, dairy farmers, and research & academic institutions.

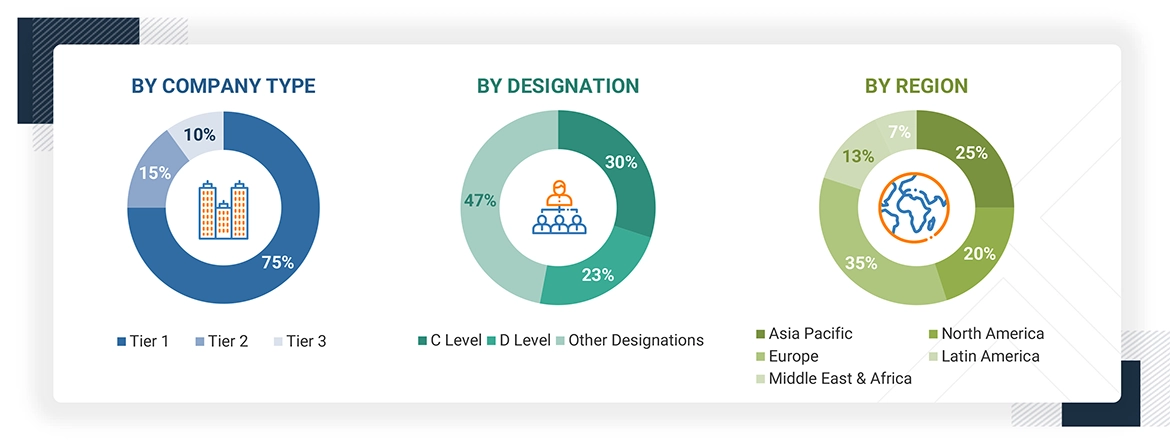

Breakdown of primary interviews

Note: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the dairy herd management market was determined after data triangulation from two approaches, as mentioned below. After each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Dairy herd management solutions enable dairy producers to efficiently plan and coordinate all aspects of dairy farming while ensuring cattle health. These include applications (such as animal comfort management, calf management, feeding management, heat stress management, milk harvesting, and reproduction management) to monitor the overall health of cattle. Dairy herd management products maximize milk production while minimizing their effect on animal health and safety.

Stakeholders

-

Dairy Herd Management System Manufacturers and Vendors

-

Associations Related to Dairy Herd Management

-

Medium-scale And Large-scale Dairy Farms

-

Research And Consulting Firms

-

Dairy Herd Management Software Manufacturers and Vendors

-

Device Manufacturers

-

Software Developers

-

System Integrators

-

Distributors and Resellers

-

Consultants and Service Providers

-

Regulatory Bodies

-

Government and Agricultural Agencies

-

Research and Development Institutes

Report Objectives

-

To define, describe, and forecast the dairy herd management market by offering, application, end user, and region

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

-

To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s Five Forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI, unmet needs/end-user expectations, and trends and disruptions impacting customer business in the market

-

To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities for stakeholders and provide details of the competitive landscape for key players

-

To strategically profile key players in this market and comprehensively analyze their market shares and core competencies

-

To track and analyze competitive developments such as product launches, partnerships, and collaborations in the market

Growth opportunities and latent adjacency in Dairy Herd Management Market