Precision Livestock Farming Market Size, Share and Growth Analysis

Precision Livestock Farming Market by System Type (Milking Robotic Systems, Precision Feeding Systems, Livestock Monitoring Systems), Application, Offering, Farm Type (Dairy, Swine, Poultry), Farm Size, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market for precision livestock farming is estimated to be USD 7.94 billion in 2025 and is projected to register a CAGR of 8.8% from 2025 to 2030, reaching USD 12.13 billion by 2030. The use of precision livestock farming products is highly increased globally, specifically in European and American regions.

KEY TAKEAWAYS

-

BY SYSTEM TYPEThe system type segment in the precision livestock farming market encompasses milking robotic systems, precision feeding systems, livestock monitoring systems, and poultry monitoring and robotic systems. The milking robotic systems lead the system segment of the precision livestock farming market as dairy producers increasingly turn to automation to address efficiency, labor, and productivity challenges. Technology has gained strong traction in developed markets such as Europe, where large-scale dairy farms and supportive government policies have accelerated adoption, while emerging economies are gradually catching up as awareness and investment in smart dairy solutions increase. These systems offer significant benefits, including reduced labor dependency, improved milk yield, enhanced udder health monitoring, and better animal welfare outcomes, which make them highly attractive for modern dairy operations.

-

BY OFFERINGThe offering segment covers hardware, software, and services. The offering segment is primarily driven by hardware solutions, as systems such as sensors, RFID tags, automated milking machines, feeding robots, and environmental control technologies represent the largest share of adoption. Hardware forms the backbone of precision livestock farming by enabling accurate, real-time monitoring of animal health, productivity, and behavior, while also reducing reliance on manual labor.

-

BY APPLICATIONThe application segment of the precision livestock farming market includes milk harvesting, feeding management, livestock health & behavior monitoring, and others. The milk harvesting segment holds the dominant position due to the central role dairy farming plays in global livestock production and the rapid adoption of automation in this sector. Robotic milking systems, automated milk analyzers, and advanced dairy management platforms have become increasingly widespread, particularly in regions with large-scale dairy operations and high labor costs. These solutions not only streamline the milking process but also provide valuable data on milk yield, udder health, and animal well-being, enabling farmers to optimize herd performance and ensure higher product quality.

-

BY FARM SIZEThe farm size segment is divided into small, medium, and large. The small farm segment represents the largest share within the farm size category, primarily due to the prevalence of small-scale livestock operations across Asia-Pacific, Africa, and Latin America. These farms, which constitute most global livestock production units, are increasingly adopting cost-effective precision solutions such as basic sensors, mobile-based management tools, and entry-level automation to enhance productivity and animal health.

-

BY FARM TYPEThe farm type segment comprises dairy farm, swine farm, poultry farm, and others. The dairy farm segment dominate the precision livestock farming market due to its pivotal role in meeting global demand for milk and meat, coupled with rapid adoption of automation and digital technologies. Dairy farms have led this shift through robotic milking systems, automated feeding solutions, and herd health monitoring tools that improve milk yield, animal welfare, and labor efficiency, while beef farms are increasingly utilizing precision tools for feed optimization, weight tracking, and disease prevention to ensure consistent meat quality and profitability.

-

BY REGIONAsia Pacific is expected to account for the largest share of the precision livestock farming market over the forecast period, supported by its extensive livestock base, growing demand for animal protein, and rising integration of digital technologies in farm operations. Key markets such as China, India, Japan, Australia, and New Zealand are driving this growth through a combination of government-backed modernization initiatives, private sector investments, and increasing farmer awareness of the economic and sustainability benefits of precision solutions.

-

COMPETITIVE LANDSCAPEThe livestock precision farming market is dominated by several key global players who lead through technological innovation, extensive product portfolios, and strong geographic presence. Companies like GEA Group, DeLaval, Afimilk, Lely International, and Nedap N.V. have established leadership by offering advanced solutions such as automated milking systems, precision feeding, herd monitoring, and health management platforms. These players maintain competitive advantages through continuous R&D investment, integration of AI and IoT technologies, and strategic partnerships or acquisitions to expand capabilities. Their robust global distribution networks and service infrastructure enable them to capture significant market share across North America, Europe, Asia Pacific, and Latin America, positioning them as preferred providers for modern, data-driven livestock farming operations. Collectively, these leaders shape industry trends, set benchmarks for innovation, and drive adoption of precision livestock technologies worldwide.

The Precision Livestock Farming market is witnessing significant growth, driven by innovations in automation, IoT, sensors, and advanced data analytics that enable real-time monitoring and informed decision-making in livestock operations. Solutions such as robotic milking systems, automated feeding technologies, and animal health wearables are enhancing labor efficiency, improving animal welfare, and facilitating early disease detection. By optimizing resource utilization, minimizing waste, and boosting overall productivity, Precision Livestock Farming is reshaping conventional farming into a more efficient, sustainable, and welfare-centric model.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of precision livestock farming product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Implementation of IoT- and AI-enabled devices for livestock monitoring

-

Regulatory compliance and food safety

Level

-

High upfront cost and marginal return on investment

-

Technical Complexity and Skill requirement

Level

-

Emerging Markets in Asia-Pacific and Latin America

-

Government support

Level

-

Global warming and other environmental concerns

-

Connectivity & Infrastructure Limitations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Implementation of IoT- and AI-enabled devices for livestock monitoring

One of the key growth drivers in the precision livestock farming market is the adoption of IoT and AI-enabled devices for real-time monitoring of animal health, behavior, and activity. Smart collars, ear tags, sensors, and cameras generate continuous data streams, which AI analyzes to detect early signs of disease or stress, enabling timely intervention and reducing economic losses. These technologies also improve productivity by optimizing feeding, reproduction, and overall herd management, while robotic milkers and automated feeders cut labor costs and minimize errors. Cloud-based platforms further enhance scalability, allowing farmers to access dashboards, collaborate with veterinarians, and manage multiple sites efficiently. Improved connectivity through 5G and low-power networks has made these solutions more accessible, even in rural areas. Additionally, stricter food safety, traceability, and animal welfare regulations are accelerating adoption, as IoT data supports compliance and consumer trust. Collectively, IoT and AI are reshaping livestock farming through efficiency, automation, and sustainability.

Restraint: High upfront cost and marginal return on investment

The precision livestock farming market faces adoption challenges due to the high capital investment required for technologies such as automated milking systems, wearable health sensors, feed optimization platforms, and real-time monitoring tools. Costs related to equipment, installation, integration, and training pose significant hurdles, particularly for small- and medium-sized farms with limited financial resources and access to credit. Although these solutions improve herd management, feed efficiency, and disease control, the return on investment is often slow, with benefits realized over the medium to long term. While automated milking systems enhance labor efficiency and milk yield, the payback period may span several years. Limited technical expertise, inadequate maintenance support, and financing constraints in certain regions further restrict adoption. As a result, high upfront costs and delayed ROI remain key barriers to the widespread implementation of precision livestock technologies, despite their long-term operational and sustainability advantages.

Opportunity: Emerging Markets in Asia-Pacific and Latin America

The precision livestock farming market encounters notable constraints in emerging regions such as Asia-Pacific and Latin America due to economic, infrastructural, and educational challenges. Small- and medium-sized farms in these regions generally operate on limited budgets, making the high costs of automated milking systems, herd monitoring platforms, and wearable sensors difficult to justify. Restricted access to financing or government support further hinders adoption. Infrastructure gaps, including unreliable electricity, limited internet connectivity, and scarce maintenance services, complicate deployment, while low technological literacy and limited awareness reduce adoption rates. Additionally, variations in local farming practices may influence the perceived value of these solutions. Companies like DeLaval and SCR Dairy have seen slower uptake due to high costs and connectivity issues, while GEA Group has initiated training and support programs to address awareness and technical barriers. Nonetheless, financial limitations, infrastructure deficits, and low awareness continue to pose significant barriers to market growth.

Challenge: Global warming and other environmental concerns

Livestock farming has a considerable environmental footprint, accounting for 14–15% of man-made greenhouse gas emissions, mainly from methane and nitrous oxide. It contributes to land and water degradation, biodiversity loss, deforestation, and uses about 10% of global agricultural land and 8% of freshwater. FAO estimates that cattle have the highest emission intensity at 25–30 kg CO2 eq/kg, followed by sheep at 20–25 kg CO2 eq/kg. With global demand for meat projected to rise by 73% and milk by 58% between 2010 and 2030, environmental pressures are expected to intensify. Chicken demand is also growing due to affordability and accessibility. According to FAO, livestock products generate more greenhouse gas emissions than most other food sources, largely from feed production, animal waste, land use, and enteric fermentation. Cattle alone contribute about two-thirds of livestock emissions, with methane from rumen fermentation accounting for 30%. Addressing enteric methane emissions is crucial for mitigating climate change.

Precision Livestock Farming Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys precision feeding systems and automated monitoring tools across its production units | Improved feed efficiency and reduced waste |

|

Implements IoT-based monitoring and smart climate control systems in swine barns | Early disease detection reduces mortality |

|

Uses digital traceability systems linking farm-level swine data to processors and retailers | Increased supply chain transparency for premium pork branding |

|

Uses wearable sensor technology and welfare monitoring platforms in swine herds | Reduced antibiotic usage through better health monitoring |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of precision livestock farming products. These companies have been operational in the market for over a decade and have diversified portfolios, latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include DeLaval (Sweden), GEA Group (Germany), Afimilk Ltd. (Israel), Merck & Co., Inc (US), Nedap N.V. (Netherlands).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Precision Livestock Farming Market, By Application

Milk harvesting systems hold the largest share in the application segment of the precision livestock farming market, driven by the widespread adoption of automated milking technologies that enhance productivity, improve animal welfare, and reduce labor dependency. The integration of sensors and data analytics in milking systems enables real-time monitoring of milk yield and cow health, supporting efficient herd management and higher profitability for dairy farms.

Precision Livestock Farming Market, By System Type

Milking robotic systems hold the largest share in the system type segment of the precision livestock farming market, driven by their ability to automate milking operations, reduce labor dependency, and improve milk yield and animal health monitoring. The growing adoption of automated milking solutions among dairy farms, particularly in developed markets, has further supported this segment’s dominance by enhancing operational efficiency and ensuring consistent milk quality.

Precision Livestock Farming Market, By Offering

Hardware holds the largest share in the precision livestock farming market as sensors, cameras, and automated feeding and milking systems form the backbone of monitoring and management operations. These components enable real-time data collection on animal health, behavior, and productivity, driving efficiency and profitability on farms. The growing use of connected devices and robotics further strengthens the dominance of the hardware segment across livestock farms in the region.

Precision Livestock Farming Market, By Farm Size

Small farms hold the largest share in the farm size segment due to their high prevalence across developing countries in Asia-Pacific and Africa. The adoption of cost-effective precision livestock farming tools such as automated feeders, health sensors, and mobile-based monitoring systems has enabled smallholders to improve productivity, animal health, and resource efficiency, driving their dominance in the market.

Precision Livestock Farming Market, By Farm Type

The dairy farm segment holds the largest share in the precision livestock farming market, driven by the widespread adoption of automated milking systems, herd management software, and sensor-based health monitoring solutions. The need to improve milk yield, ensure animal welfare, and optimize feeding and reproduction management has encouraged dairy producers to invest in precision technologies, making this segment the dominant contributor to market growth.

REGION

Asia Pacific to be fastest-growing region in global precision livestock farming market during forecast period

Asia Pacific is expected to account for the largest share of the precision livestock farming market over the forecast period, supported by its extensive livestock base, growing demand for animal protein, and rising integration of digital technologies in farm operations. Key markets such as China, India, Japan, Australia, and New Zealand are driving this growth through a combination of government-backed modernization initiatives, private sector investments, and increasing farmer awareness of the economic and sustainability benefits of precision solutions. China is advancing smart dairy practices to improve productivity and environmental sustainability, while Japan is actively promoting technology adoption to address its aging agricultural workforce. In India, the expansion of commercial dairy and poultry farms is fueling demand for herd management systems and automated feeding and milking solutions. Australia and New Zealand, recognized for their advanced dairy sectors, are early adopters of livestock monitoring and welfare technologies, reflecting high awareness among farm owners. With strong contributions from both developed and emerging economies, Asia Pacific is positioned not only as the largest market globally but also as the fastest-growing region, offering significant opportunities for continued adoption of precision livestock farming technologies.

Precision Livestock Farming Market: COMPANY EVALUATION MATRIX

In the precision livestock farming market matrix, DeLaval (Star) leads the market with its advanced portfolio of dairy automation and animal welfare solutions, including robotic milking systems, herd management software, and sensor-based monitoring tools that help farmers improve productivity, milk quality, and operational efficiency. Afimilk (Emerging Leader), meanwhile, is gaining strong market presence by expanding its precision dairy solutions, focusing on advanced data analytics, real-time monitoring technologies, and herd performance optimization, positioning itself as a key innovator in intelligent livestock management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.19 Billion |

| Market Forecast in 2030 (value) | USD 12.13 Billion |

| Growth Rate | CAGR of 8.8% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Precision Livestock Farming Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Precision Livestock Equipment Manufacturers |

|

|

| Asia-Pacific Precision Livestock Innovators |

|

|

| Global Precision Livestock Solution Distributors |

|

|

RECENT DEVELOPMENTS

- August 2025 : Lely International launched Lely Quaress Fovum, an advanced uddercare spray designed to disinfect and enhance teat skin condition. This product aims to support udder health and promote animal welfare on dairy farms, strengthening Lely’s commitment to sustainable and welfare-focused dairy farming solutions.

- May 2025 : Connecterra launched Reproductive Metrics (DIM at First Heat, % Cows Pregnant), fertility-focused metrics to its analytics suite, enabling more precise monitoring of herd reproductive performance

- September 2024 : Fancom BV launched eYeGrow Weight Monito, an upgraded eYeGrow system, offering precise, automated weight monitoring for finisher pigs to enhance animal welfare and optimize farm management.

- May 2024 : Livestock Improvement Corporation partnered Fonterra, Open Country, OSPRI to upgrade LIC’s MINDA software, allowing farmers to seamlessly transfer animal data to industry systems, reducing admin work and improving accuracy.

Table of Contents

Methodology

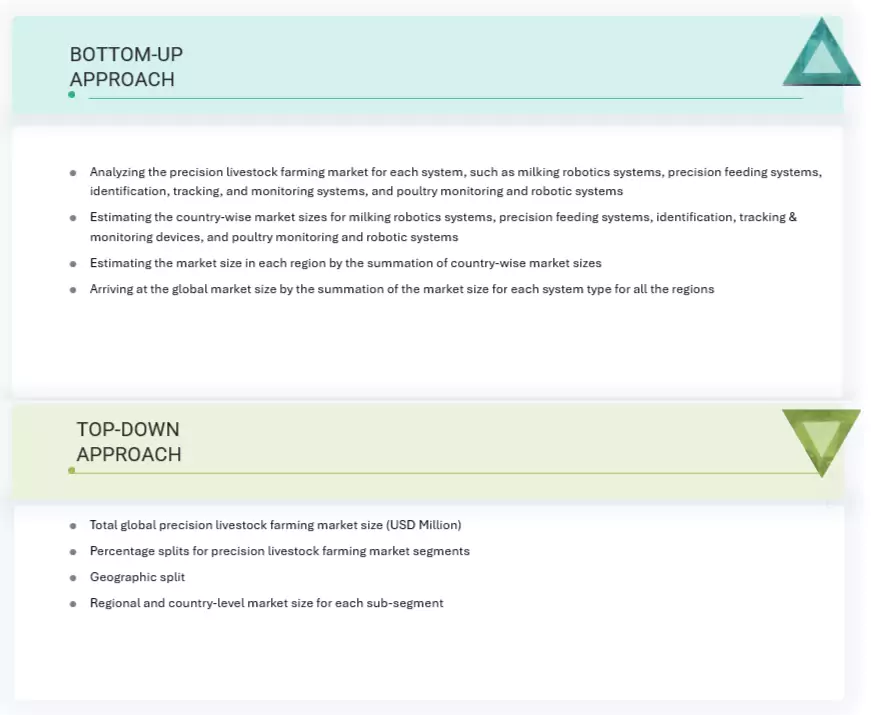

The study involved two major approaches in estimating the current size of the precision livestock farming market. Secondary research was performed to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study extensively used secondary sources, directories, and databases, such as Bloomberg Businessweek and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was primarily used to gather key information about the industry’s supply chain, the total number of major players, and market classification and segmentation based on industry trends down to the most detailed level, regional markets, and important developments from both market and technology perspectives.

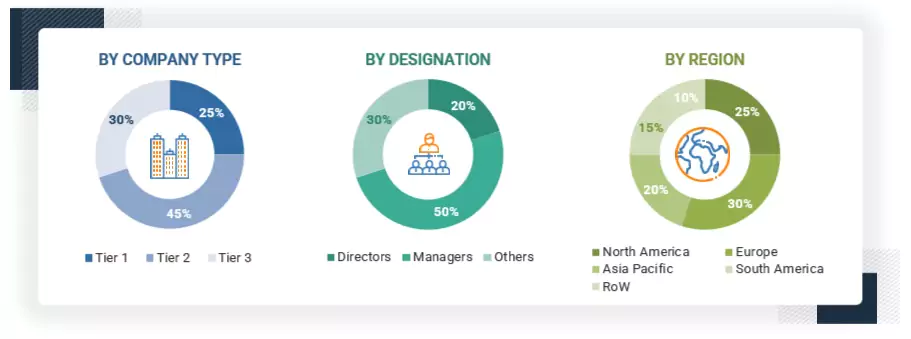

Primary Research

Extensive primary research was conducted after obtaining information regarding precision livestock farming through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides in major countries across North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, research, and development teams as well as related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation.

Primary research also helped in understanding the various trends related to the precision livestock farming market based on application, system type, offering, farm type, & farm size. Stakeholders from the demand side, including livestock companies, agricultural cooperatives and distributors, agri-input retailers and dealers, and farmers and growers, were interviewed to gain insights into their perspectives on suppliers, products, and their current usage of the precision livestock farming market. This understanding will help us assess the overall market outlook and its impact on business trends.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, according

to the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue =

USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

DeLaval (Sweden) |

Sales Manager |

|

Gea Group (Germany) |

Sales & Service Engineer |

|

Afimilk Ltd. (Israel) |

Regional Marketing Manager |

|

Merck & Co. Inc. (US) |

Operation Manager |

|

Nedap N.V. (India) |

Marketing Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the precision livestock farming market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Precision Livestock Farming Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall precision livestock farming market and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

Precision livestock farming involves livestock management by continuous, automated, real-time monitoring of livestock production, reproduction, health and welfare, and environmental impact based on livestock image analysis, sound analysis, sensors, software, and AI-based solutions.

Stakeholders

Associations, regulatory bodies, and other industry-related bodies:

- Primary users implementing precision livestock farming technologies to optimize herd health, productivity, and efficiency

- Companies developing milking robots, sensors, feeders, wearable devices, and farm management software

- Providers of AI, IoT, and cloud-based analytics platforms for real-time livestock monitoring and decision support

- Consumers using PLF data to diagnose, prevent, and treat animal health issues

- Users adopting new precision livestock farming technologies, algorithms, and sustainable livestock practices

- International Society for Precision Agriculture (ISPA)

- European Association for Animal Production (EAAP)

- American Society of Agricultural and Biological Engineers (ASABE)

- Global Dairy Farmers (GDF)

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- International Organization for Standardization (ISO)

- Dairy Farmers of America (DFA)

Report Objectives

- To determine and project the size of the precision livestock farming market based on application, system type, offering, farm type, farm size, and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the precision livestock farming market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe precision livestock farming market into key countries

- Further breakdown of the Rest of Asia Pacific precision livestock farming market into key countries

- Further breakdown of the Rest of South America precision livestock farming market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the precision livestock farming market?

The precision livestock farming market is estimated to be USD 7.94 billion in 2025 and is projected to reach USD 12.12 billion by 2030, registering a CAGR of 8.8% during the forecast period.

Which are the key players in the market, and how intense is the competition?

DeLaval (Sweden), GEA Group (Germany), Afimilk Ltd. (Israel), Merck & Co., Inc. (US), and Nedap N.V. (Netherlands) are some of the key market players.

The market for precision livestock farming is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to record the fastest growth in the precision livestock farming market?

The Asia Pacific region is projected to account for the fastest growth in the precision livestock farming market, driven by its vast livestock population, rising demand for animal protein, government-led modernization initiatives, and rapid adoption of advanced digital farming technologies.

What kind of information is provided in the company profiles section?

The company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company’s potential.

What are the factors driving the precision livestock farming market?

Two key factors driving the precision livestock farming market are the increasing global demand for animal protein and advancements in technology. As the demand for animal protein rises, farmers are adopting new technologies to enhance efficiency and productivity. Additionally, innovations such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics are facilitating smarter, data-driven management of livestock.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Livestock Farming Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precision Livestock Farming Market