Data Center Coolant Distribution Units Market

Data Center Coolant Distribution Units Market by Type (In-Row, In-Rack, FDU), Cooling Type (Direct to Chip Cooling, Immersion Cooling), End User (Colocation Providers, Enterprises, Hyperscale), and Region Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global data center coolant distribution units market is expected to grow from USD 1.05 billion in 2025 to USD 7.74 billion by 2032, with a CAGR of 33.0% during the forecast period. The increased adoption of AI, high-performance computing (HPC), and cloud workloads is fueling the market’s growth. These new workloads require higher rack densities and better heat management than traditional air-cooling solutions. From maintaining temperature control to enabling operational functionality in data centers, the cooling distribution units have become the backbone of liquid-cooling systems.

KEY TAKEAWAYS

- The data center coolant distribution units market comprises In-RoW CDU, In-Rack CDU, and FDU.

- Cooling type includes direct-to-chip cooling and immersion cooling.

- Process includes liquid-to-liquid CDU, and liquid-to-air CDU.

- Capacity includes small-scale, medium-scale, and large-scale.

- Data center type includes Small and Mid-Sized Data Centers and Large Data Centers

- End users include Colocation Providers, Enterprises, and Hyperscale Data Centers.

- Data center coolant distribution units market covers Europe, North America, Asia Pacific, South America, and the Middle East and Africa. North America is the largest market for Data center coolant distribution units and is home to several prominent coolant distribution units companies with growing demand fueled by hyperscale expansion, AI-driven workloads, and advanced computing needs.

The data center coolant distribution units market is experiencing consistent expansion, driven by the accelerated adoption of liquid cooling technologies in hyperscale facilities, the rapid growth of AI/ML and HPC workloads, and the enforcement of stricter energy efficiency and sustainability mandates. Widening deployment across colocation, enterprise, and telecom data centers is broadening the market outlook. Ongoing developments, including advanced product introductions, strategic collaborations with technology providers, and capacity expansions by major players, are reshaping the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hot belts are the clients of coolant distribution units manufacturers, and target applications are the clients of coolant distribution units manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of coolant distribution units manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth of high-density AI & HPC workloads

-

Increasing demand for modular and edge data centers

Level

-

High capital investment requirements

-

Incompatibility with legacy data center infrastructure

Level

-

Integration with waste heat recovery systems

-

Innovation in nanofluids and next-generation coolants

Level

-

Precision control and flow management complexity

-

Integration with diverse cooling architectures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of high-density AI & HPC workloads

The rapid development of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) presents significant challenges for thermal management due to increasingly dense server configurations. Unlike regular workloads, AI and HPC applications operate with higher power densities and typically require loads that impose intense computational stress on the hardware while generating large amounts of waste heat. Air-based cooling systems are inadequate for managing these heat loads, risking the thermal stability of the hardware, which could lead to overheating, performance throttling, or hardware failure. In this context, coolant distribution units are now considered vital components in liquid cooling systems. These units precisely control and circulate coolant between high-heat-load components and heat rejection systems, such as heat exchangers or chillers. By doing so, coolant distribution units help maintain equipment temperatures within safe limits for optimal performance during peak computational activity. The shift to liquid cooling with coolant distribution units reflects an industry-wide trend toward building infrastructure for heavy computing applications that prioritizes energy efficiency and reliability. Like other advancements in scalable thermal management systems, coolant distribution units will continue to see increasing demand alongside the growing workloads from AI and HPC technologies.

Restraint: High capital investment

The significant initial capital requirement for adopting coolant distribution units is a major barrier in the data center industry. Unlike air cooling systems, coolant distribution units are more complex liquid cooling devices that necessitate a complete redesign of thermal management infrastructure. These systems typically include costly components such as precision pumps, heat exchangers, coolant pipelines, fluid manifolds, and advanced control instruments. Moreover, coolant distribution unit-based cooling systems are more intricate and often demand engineering consultants and customized designs, particularly for full-scale implementations. This ultimately increases the costs involved in the overall construction of new data centers. The costs of retrofitting existing facilities are even higher because operators must redesign layouts, flooring, and mechanical subsystems to accommodate liquid cooling pathways. This type of financial burden creates a high entry barrier for operators, especially those managing smaller enterprises or edge facilities, where compute densities do not yet require liquid cooling. Even among hyperscale data centers, decisions are often delayed as ROI considerations come into focus. In markets with limited infrastructure financing or cost-sensitive purchasing strategies, high upfront costs become a significant obstacle, slowing the adoption of coolant distribution units.

Opportunity: AI-based cooling control and predictive optimization

An important opportunity in the coolant distribution units market is the integration of artificial intelligence (AI) and machine learning algorithms to improve system control, efficiency, and reliability. As data centers become more automated and intelligent, the cooling infrastructure is expected to evolve accordingly. AI can be used to monitor real-time data from coolant distribution units, including coolant temperature, flow rates, pressure, and thermal load, and make dynamic adjustments to optimize performance. For example, AI systems can regulate coolant distribution in response to workload shifts, ambient environmental changes, or energy pricing. Additionally, predictive analytics can help detect early signs of wear, inefficiency, or failure, enabling proactive maintenance and reducing unplanned downtime. This makes coolant distribution systems more resilient and reduces operational risk while also optimizing energy use and lowering costs. The use of AI not only modernizes the functionality of coolant distribution units but also positions these systems as a key part of intelligent, self-regulating data center environments, aligning with future trends in infrastructure management. The integration of artificial intelligence and machine learning algorithms to improve control, efficiency, and reliability of systems offers a significant opportunity for the data center coolant distribution units market. As automation and intelligent strategies are increasingly adopted in data centers, the cooling infrastructure will also evolve. AI can monitor real-time data from coolant distribution units, such as coolant temperature, flow rates, pressure, and thermal load, and can adjust settings to enhance performance. For instance, AI systems can manage coolant distribution based on workload changes, external conditions, or energy prices. Predictive analytics can detect signs of wear, inefficiency, or potential failure early, enabling proactive maintenance rather than waiting for unexpected downtime. This enhances the reliability of coolant distribution units, reduces operational risks, optimizes energy consumption, and cuts operating costs. AI will not only bring coolant distribution units up to modern standards but will also position these systems as essential components in a smart, self-regulating data center environment, aligned with future trends in infrastructure management.

Challenge: Precision control and flow management complexity

Coolant distribution units require highly precise control of coolant flow parameters, including temperature, flow rate, and pressure. Unlike air-cooled systems, liquid-cooled environments demand exact calibration to remove heat efficiently and evenly across all components. Differences in flow or pressure between parts of the system can create local thermal imbalances, which may lead to some servers or components being inadequately cooled, causing performance throttling or damage. This issue becomes even more critical in multi-loop installations, where coolant distribution units operate more than one cooling circuit with different heat intensities and loads. Real-time monitoring and feedback control are necessary for coolant distribution units to adapt to changing thermal loads, ensuring consistent cooling efficiency. Even minor flow control misalignments can lead to system-wide problems. As data centers increasingly adopt dynamic compute provisioning and AI technology for load distribution, shifting high loads in a dynamically dependent environment can place significant pressure on control software and the operations team responsible for balancing thermal loads.

Data Center Coolant Distribution Units Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides coolant distribution units that integrate with liquid cooling systems for high-density racks, ensuring precise delivery of coolant and real-time monitoring of flow and temperature. | Reliable thermal management for dense workloads, fewer hot spots, and higher overall system uptime. |

|

Offers modular coolant distribution units designed for scalable data center environments, with remote management features to support edge and hyperscale deployments. | Improved energy efficiency, simplified deployment, and scalable cooling with reduced operational costs. |

|

Specializes in coolant distribution units optimized for mission-critical environments, featuring leak detection, automatic shutoff, and redundancy to ensure system safety. | Higher operational resilience, minimized downtime risks, and compliance with safety requirements. |

|

Delivers compact and high-performance coolant distribution units engineered for space-constrained facilities, with integrated heat exchangers for efficient secondary loop cooling. | Maximized rack density, reduced cooling energy use, and flexible retrofitting of existing sites. |

|

Develops custom coolant distribution units and thermal management systems for hyperscale and colocation providers, integrating advanced monitoring platforms with predictive maintenance capabilities. | Greater sustainability, higher rack power support, and lower total cost of ownership. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Leading companies in this market include well-established and financially stable data center coolant distribution unit manufacturers. These companies have been operating for several years, offering diversified product portfolios and robust global sales and marketing networks. Key players include Schneider Electric (France), Vertiv Group Corp. (US), Delta Electronics, Inc. (Taiwan), nVent (US), and DCX Liquid Cooling Systems (Poland).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Coolant Distribution Units, By End Use

During the forecast period, the Hyperscale data center segment is expected to grow faster in the data center coolant distribution units market. This is mainly driven by rapid expansion in AI, HPC, big data applications, and significant investments from global cloud providers. Traditional air-cooling methods are proving inadequate as hyperscale data centers operate with high rack densities and power demands. Therefore, hyperscale operators are adopting more coolant distribution units to enable efficient liquid cooling, optimize energy use, and ensure reliable heat management for thousands of servers. Regions such as North America, Europe, and Asia-Pacific are leading the way in adoption, as operators aim to scale up while meeting sustainability goals. Coolant distribution units are becoming a crucial technology for next-generation hyperscale data centers, effectively supporting improved thermal efficiency and lowering operating costs.

Data Center Coolant distribution units market, By Type

The Floor-Mounted Distribution Unit (FDU) segment is expected to grow at the fastest CAGR during the forecast period due to increasing deployments of high-density racks in hyperscale and enterprise data centers. FDUs offer high cooling capacity, scalability, and the ability to support large IT loads, making them ideal for facilities that perform AI, HPC, and cloud-intensive workloads. They are designed to connect closely with facility-level chilled water systems, which makes them well-suited for precise and reliable heat removal. Large investments in data centers across North America, Europe, and Asia-Pacific, combined with a shift toward energy-efficient and sustainable cooling solutions, have driven the adoption of FDUs.

Data Center Coolant distribution units market, By Cooling Type

The Direct to chip cooling segment is projected to grow at the highest CAGR during the forecast period, driven by its ability to remove heat directly from high-performance processors and GPUs used in AI workloads, HPC, and advanced cloud computing setups. The efficiency of direct to chip cooling solutions surpasses traditional air cooling for thermal management at the source, supporting higher-density racks and overall system performance. The growth of this segment is largely due to the rise of AI-powered data centers, large-scale HPC deployments, and digital transformation initiatives by enterprises. Regions such as North America, Europe, and Asia-Pacific are further boosting adoption, with hyperscale and colocation providers investing heavily in liquid-cooling infrastructure. Direct to chip cooling technologies align with global sustainability and energy-efficiency goals. Besides reducing power consumption, DTC cooling improves operational reliability, making it one of the most in-demand cooling technologies in next-generation data centers.

REGION

North America is projected to hold the most significant market share during the forecast period

North America is expected to hold the largest share of the data center coolant distribution units market during the forecast period, driven by a mix of technological and economic factors in the region. The US, in particular, is a global leader in hyperscale data center development and operation, with major cloud providers, AI leaders, and colocation companies investing billions in new facilities. These significant investments are key growth drivers, as these newer data centers feature high-density server racks, often exceeding 50 kW, which push the limits of traditional air cooling. Therefore, liquid cooling solutions are becoming essential, with coolant distribution units being a critical component in managing the large heat loads generated by AI, high-performance computing (HPC), and other demanding workloads. The presence of top coolant distribution unit manufacturers and a robust regional supply chain solidifies North America’s leading position.

Data Center Coolant Distribution Units Market: COMPANY EVALUATION MATRIX

In the data center coolant distribution units market matrix, Schneider Electric (Star) leads with a strong market share and extensive product footprint, supported by its advanced cooling distribution solutions and integration capabilities across hyperscale, colocation, and enterprise data centers. Munters Group AB (Emerging Leader) is gaining visibility with its growing focus on liquid cooling and thermal management solutions for high-density IT environments, strengthening its position through innovation and targeted product offerings. Other notable participants are actively expanding their portfolios to address rising demand for energy-efficient, sustainable, and scalable coolant distribution units, positioning themselves to capture future growth opportunities in this rapidly evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Schneider Electric (France)

- Vertiv Group Corp. (US)

- Delta Electronics, Inc. (Taiwan)

- nVent.(US)

- DCX Liquid Cooling Systems (Poland)

- Boyd.(US)

- Munters Group AB (Sweden)

- Chilldyne, Inc. (US)

- Shenzhen Envicool Technology Co., Ltd. (China)

- Super Micro Computer, Inc. (US)

- LITE-ON Technology Corporation. (Taiwan)

- STULZ GMBH (Germany)

- COOLIT SYSTEMS (US)

- Hewlett Packard Enterprise Development LP (US)

- NIDEC CORPORATION (Japan)

- Nautilus Data Technologies. (US)

- Lenovo. (China)

- Rittal GmbH & Co. KG (Germany)

- Trane. (Ireland)

- KAORI HEAT TREATMENT CO., LTD. (Taiwan)

- LiquidStack Holding B.V. (US)

- FläktGroup

- Shanghai Venttech Refrigeration Equipment Co.,Ltd.

- Coolcentric.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.79 BN |

| Market Forecast in 2030 | USD 7.74 BN |

| CAGR (2025–2030) | 33.00% |

| Years considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the data center coolant distribution units market based on type, cooling type, process, capacity, data center type, end use and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles data center coolant distribution units market, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Type (In-Row Coolant Distribution Units, In-Rack Coolant Distribution Units, FDU) |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Data Center Coolant Distribution Units Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale Cloud Providers | · Forecast adoption of coolant distribution units in high-density AI/ML and HPC workloads. | · Improve thermal efficiency and reduce PUE |

| Colocation Data Center Operators | · Market sizing for coolant distribution unit adoption across multi-tenant facilities | · Enable flexible scaling with growing client demand |

| Enterprise Data Center Owners | · Benchmarking coolant distribution unit deployments for on-premise data centers | · Improve reliability of mission-critical workloads |

| Telecom & Edge Operators | · Forecast demand for compact coolant distribution unit systems in edge facilities | · Deliver low-latency services with efficient thermal control |

| Government & Defense Data Centers | · Assessment of coolant distribution unit adoption for HPC, cybersecurity, and defense workloads | · Ensure compliance with strict security & efficiency mandates |

RECENT DEVELOPMENTS

- October 2024 : Schneider Electric signed an agreement to acquire a controlling interest in Motivair Corporation, a company specializing in advanced liquid cooling for high-performance computing systems. This acquisition helps Schneider Electric expand its product portfolio and expertise in data center cooling solutions.

- November 2024 : Vertiv Group Corp. launched the Vertiv CoolChip CDU 2300kW model and the Vertiv CoolChip CDU 350kW model. The Vertiv CoolChip CDU 2300kW is a high-capacity liquid-to-liquid coolant distribution unit designed for hyperscale and colocation data centers, delivering 2.3 MW of cooling while reducing infrastructure space and cost. The Vertiv CoolChip CDU 350kW is a liquid-to-air solution suitable for direct to chip cooling. It provides 350kW of cooling without the need for facility chilled water, ensuring easier and faster deployment in existing or retrofit infrastructures.

- August 2022 : nVent launched the RackChiller CDU800 coolant distribution unit, which is the company’s first platform for high-density liquid cooling, high-performance computing (HPC), hyperscale, enterprise, and edge computing applications. The RackChiller CDU800 is designed to consistently deliver liquid coolant to maximize cooling efficiency while reliably removing heat from sensitive equipment through a continuous pumping and heat exchange cycle.

Table of Contents

Methodology

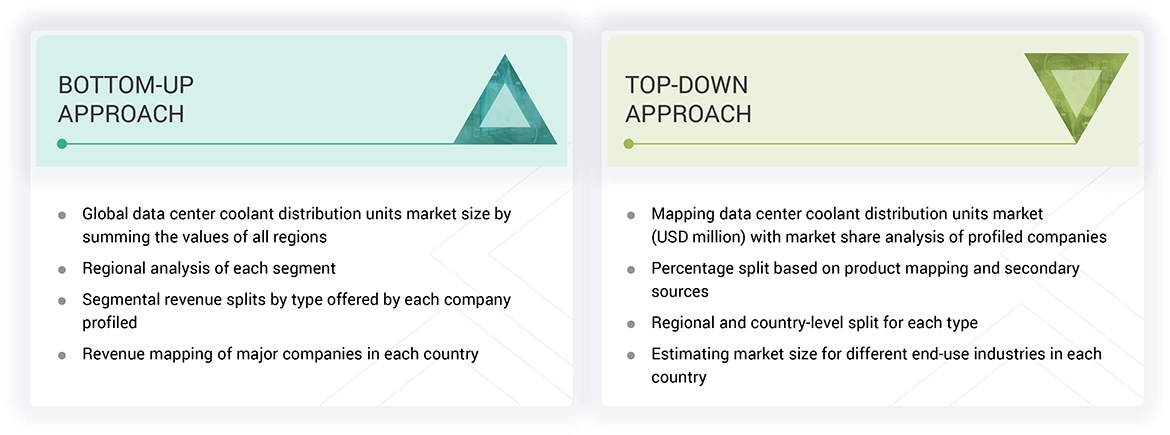

The study involved four main activities in estimating the current size of the data center coolant distribution units market: comprehensive secondary research gathered information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the data center coolant distribution units value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Then, market breakdown and data triangulation were applied to determine the sizes of segments and subsegments.

Secondary Research

Secondary sources for this research include annual reports, press releases, investor presentations, white papers, certified publications, articles by recognized authors, trusted websites, data center coolant distribution units manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research primarily aimed to gather key information about the industry’s supply chain, main players, market classification, and segmentation based on industry trends and regional markets. It was also used to obtain insights into significant developments from a market-focused perspective.

Primary Research

The data center coolant distribution units market includes several stakeholders, such as raw material suppliers, technology support providers, manufacturers of coolant distribution units, and regulatory organizations within the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. On the supply side, primary sources included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and other key executives from different companies and organizations operating in the data center coolant distribution units market. On the demand side, primary sources included directors, marketing heads, and purchasing managers from various sourcing industries.

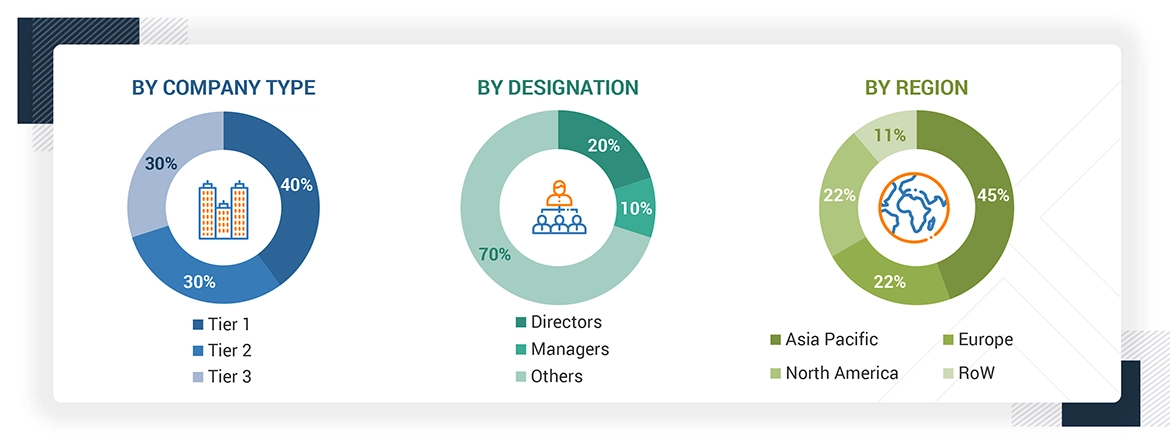

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the data center coolant distribution units market. These methods have also been widely employed to determine the size of various related market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- Market shares in each region were determined using both primary and secondary research.

- Primary and secondary research established the value chain and market size of the data center coolant distribution units market in terms of both value and volume.

- All percentage shares, splits, and breakdowns were calculated using secondary sources and verified with primary sources.

- All relevant parameters impacting the market that were covered in this study were thoroughly examined, verified through primary research, and analyzed to produce the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key quantitative and qualitative insights.

Global Data Center Coolant Distribution Units Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After estimating the overall market size using the methods described above, the market was divided into different segments and sub-segments. Data triangulation and market breakdown procedures were used when applicable to finish the overall market analysis and determine the exact data for each segment and subsegment. The data was triangulated by examining various factors and trends from both the demand and supply sides in the steel & iron sector.

Market Definition

Coolant distribution units are specialized subsystems within liquid cooling systems that are essential for managing temperature in high-density IT environments such as data centers, HPC clusters, and AI workloads. Located between IT equipment and the facility’s cooling loop, coolant distribution units control and circulate dielectric or water-based coolants to remove and transfer heat generated by processors, GPUs, and other high-power components. These units keep coolant at designated flow rates and temperatures, ensuring effective heat exchange while protecting IT hardware from thermal stress and potential contamination from untreated facility water.

Coolant distribution units are generally categorized into two configurations: Liquid-to-Liquid CDUs, which transfer heat from the IT loop to a facility water loop through a heat exchanger, and Liquid-to-Air CDUs, which use radiators and fans to dissipate heat into the surrounding air when water infrastructure is unavailable. Equipped with precision sensors, pumps, filters, and control systems, coolant distribution units provide real-time monitoring, leak detection, and redundancy to ensure continuous cooling. As demand for AI and compute-intensive applications increases, coolant distribution units support scalable, energy-efficient, and sustainable cooling solutions, decreasing reliance on traditional CRAC systems and significantly reducing operational carbon footprints.

Stakeholders

- Manufacturers of data center coolant distribution units

- Traders, distributors, and suppliers of data center coolant distribution units

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the market size of the data center coolant distribution units market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global data center coolant distribution units market based on type, cooling type, process, capacity, data center type, end user, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five major regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as product launches, acquisitions, collaborations, partnerships, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

What are the key drivers for the data center coolant distribution units market?

The rising use of AI, ML, and HPC workloads, the expansion of hyperscale data centers globally, and the adoption of liquid cooling technologies are the main drivers for the data center coolant distribution units market.

Which region is expected to register the highest CAGR in the data center coolant distribution units market during the forecast period?

North America is estimated to register the highest CAGR during the forecast period.

Which are the major end users of data center coolant distribution units?

The major end users include colocation providers, enterprises, and hyperscale data centers.

Who are the major players in the data center coolant distribution units market?

Key players include DCX Liquid Cooling Systems (Poland), nVent (US), Schneider Electric (France), Vertiv Group Corp. (US), Boyd (US), and Delta Electronics, Inc. (Taiwan).

What is the total CAGR expected to be recorded for the data center coolant distribution units market from 2025 to 2032?

The market is expected to record a CAGR of 33.0% from 2025 to 2032.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Coolant Distribution Units Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Coolant Distribution Units Market