Data Center Immersion Cooling Fluids Market

Data Center Immersion Cooling Fluids Market by Technology (Single-Phase, Two-Phase), Data Center Type (Hyperscale, AI/ML, Cryptocurrency Mining), Type (Mineral Oil, Fluorocarbon-based Fluids, Synthetic Fluids), and Region - Global Forecast to 2032

Updated on : November 27, 2025

DATA CENTER IMMERSION COOLING FLUIDS MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The data center immersion cooling fluids market is projected to reach USD 0.83 billion by 2032 from USD 0.18 billion in 2025, at a CAGR of 23.9% from 2025 to 2032. Data center immersion cooling fluids market is driven by factors such as the expansion of the data center market, the rising use of liquid cooling technology in data centers, which boosts demand for both DTC and immersion cooling fluids, and increasing server rack density.

KEY TAKEAWAYS

-

BY TYPEThe data center immersion cooling fluids market comprises mineral oil, fluorocarbon-based fluids, synthetic fluids, and others (silicone oil, vegetable oil, bio-oil, and deionized water).

-

BY TECHNOLOGYBy technology segment includes single-phase cooling and two-phase cooling

-

BY DATA CENTER TYPEHyperscale Data centers, AI/ML data centers, cryptocurrency mining data centers, other data centers (edge and colocation data centers)

-

BY REGIONData center immersion cooling fluids market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America is the largest market for data center immersion cooling fluids market. It is home to several prominent data center companies, and is witnessing new hyperscale data center projects, all contributing to the increasing adoption of data center immersion cooling fluids.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Lubrizol partnered with iXora BV, one of the leaders in rack-mountable immersive cooling, to enhance its CompuZol immersion cooling ecosystem. The partnership strengthens Lubrizol’s growing ecosystem, which includes key stakeholders in chip manufacturing, digital infrastructure, and service markets.

The opportunities in the data center immersion cooling fluids market are the growing installation of AI-based mega data centers, the increasing demand for energy-efficient cooling solutions, data center owners and operators face growing pressure to lower their carbon footprint, and increasing demand for environmentally friendly fluid technology, such as PFAS-free and bio-based fluids. New deals and developments, including strategic partnerships between OEMs and material suppliers, investments in recycling technologies, and innovations in high-strength alloys and sustainable composites, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hot belts are the clients of data center immersion cooling fluids manufacturers, and target applications are the clients of data center immersion cooling fluids manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of data center immersion cooling fluids manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Expanding data center market

-

•Rising use of liquid cooling technology in data centers boosts demand for both DTC and immersion cooling fluids

Level

-

•Technology under development for two-phase PFAS-free fluids for immersion cooling

-

•Slower adoption in data center applications

Level

-

•Growing installation of AI-based mega data centers

-

•Growing demand for energy-efficient cooling solutions

Level

-

•Competition from DTC liquid cooling technology

-

•Maintenance challenges and cost burden in immersion cooling for data centers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising use of liquid cooling technology in data centers boosts demand for both DTC and immersion cooling fluids

According to the data center immersion cooling fluids market, growth is supported by the rising trend of liquid cooling technologies in data centers, thus increasing demand for direct-to-chip and immersion cooling fluids. Due to AI, machine learning, and HPC workloads, there are increased rack power densities of about 40-100 kW in modern data centers. Air cooling is inadequate in managing such thermal loads and supports operators in seeking efficient liquid cooling solutions. DTC delivers the liquid coolant to the chip via cold plates. At the same time, immersion cooling entails submerging whole servers in thermally conductive dielectric fluids, single-phase or two-phase. As both modalities try to attract the market, they pursue exceptional use cases depending on data center design and thermal needs. In this direction, the growing demand for sustainable cooling that gives energy savings, a better PUE, and water conservation are aspects that come into play as environmental regulations tighten. Objectives for carbon neutrality are laid down. Another reason for its rising adoption is the increase in edge and colocation data centers, where tight spaces demand compact and highly efficient cooling. Technological developments in fluid formulations, such as non-toxic, biodegradable, and thermally stable ones, also improve performance and lifecycle costs, thus promoting the growth of immersion cooling. Given these things, immersion cooling fluids are considered a key constituent in future data center infrastructure, and the market is projected to witness a strong double-digit growth rate until 2032.

Restraint: Technology under development for two-phase PFAS-free fluids for immersion cooling

The major restraints that hamper the growth of the data center immersion cooling fluids market is slow technological developments and increasing regulatory pressures on PFAS-free two-phase fluids. Traditionally, PFAS chemicals have been sought for these two-phase immersion cooling systems because of their good dielectric properties, thermal stability, and low boiling points. Now, with increasing environmental scrutiny on a global scale and imminent coming into force of legislation, particularly in the US, EU, and some parts of Asia, the regulatory agencies are forcing the elimination of PFAS compounds for their persistence in the environment and potential health risks. This has created an environment in which fluid manufacturers are pressured immensely to develop alternatives to two-phase systems that are performance-wise equal, if not better, and PFAS-free." While active R&D work is underway to produce non-fluorinated, PFAS-free dielectric fluids that can match thermophysical characteristics, these alternatives are still in the early merger of validation. The cardinality of currently available PFAS-free formulations falls short in thermal performance, material compatibility, longevity, and cost efficiency. For this reason, data center operators get skeptical and remain uncertain about transitioning into two-phase systems, more so in hyperscale deployments where reliability and performance are unarguable. Moreover, scarce commercial availability of PFAS-free fluids for two-phase cooling is a known hindrance to adoption, slows procurement cycles, and escalates the risk points for non-compliance with regulations. This technology gap, therefore, presents itself as an enormous restraint to the growth of the two-phase immersion cooling segment and keeps that inhibition toward further acceptance by rising demands for energy-efficient thermal solutions.

Opportunity: Growing installation of AI-based mega data center

The growth of AI-based mega data centers is an opportunity for the data center immersion cooling-fluid market. As artificial intelligence (AI), machine learning, and deep learning workloads rapidly evolve, so does the need for high-powered density computing infrastructure. AI-oriented data centers require powerful GPUs and accelerator heats that are difficult to deal with through air cooling technologies on conventional means. Hence, the operators increasingly use immersion to keep themselves thermally stable and energy-wise. This is especially true of hyperscale and AI-centric setups. Immersion cooling involves superior thermal provisions wherein IT equipment is submersed in a dielectric liquid, allowing for better heat dissipation, less power absorption, and a cut in the utility bill. As AI workloads reach higher capacities, particularly in autonomous vehicles, cloud services, fintech, and life sciences-related projects, mega data centers are now conceived with immersion cooling right inside the core rather than as an afterthought. This trend presents sturdy opportunities for fluid manufacturers to supply advanced single-phase and two-phase dielectric fluids for high-performance computing.

Challenge: Cost burden in immersion cooling for data centers

One of the significant challenges in the "data center immersion cooling market" is the high cost of implementing and maintaining immersion cooling systems. Compared to the conventional air or chilled liquid cooling applications, establishing immersion cooling itself demands a hefty capital investment. This includes the installation of specialized infrastructures such as immersion tanks and modified server hardware, the dielectric cooling fluids (much costlier than water or refrigerants), and specific facility redesigns to accommodate some rather unusual layouts. On top of the installation expense, single-phase fluids tend to be less costly. In contrast, the two-phase fluids, often fluorinated or synthetic, are a premium, driving up the total price. Having set up the system, operational and maintenance costs would remain the most significant impediments. Monitoring fluids and filtration systems, preventing leakage, and working on fluid replacement would mean additional expenses continually. Compatibility with existing server components and the need for immersion-compatible IT hardware specifically designed can lock the purchaser and increase the procurement price, or, through an alternative mode, severely diminish the option of suppliers to choose from. Price incentives arising from economies of scale will also probably not come into play anytime soon due to the niche position of immersion cooling and the smaller scale of adoption by emerging markets or smaller data center operators.

Data Center Immersion Cooling Fluids Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Single-phase dielectric immersion cooling fluids used to effectively dissipate extreme heat loads from CPUs and GPUs | These fluids efficiently absorb and transport heat away from CPUs and GPUs, enabling reliable cooling at power levels up to and beyond 1000W TDP per chip, which is essential for modern AI and HPC deployments. |

|

GRC’s ElectroSafe immersion fluid is used, which is specifically formulated for single-phase immersion cooling in data centers. | The consistent temperature maintenance of immersion fluid lowers heat stress on components, significantly reducing failure rates compared to conventional cooling methods. |

|

Shell installed a single-phase immersion cooling system in its Amsterdam data center (2022), using Shell’s specially developed Immersion Cooling Fluid S5 X | The Shell Immersion Cooling Fluid S5 X improves data center performance by reducing energy use, costs, and carbon footprint while enhancing cooling efficiency, hardware lifespan, and sustainability. |

|

LLNL adopted an immersion cooling solution for its HPC systems, submerging the server racks directly in a non-conductive cooling fluid. | Liquid cooling effectively transferred heat away from critical components, enabling LLNL to run their supercomputers at higher power densities while maintaining optimal performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center immersion cooling fluids market ecosystem is a network of companies, including material suppliers, data center immersion cooling fluids manufacturers, and end users. Each entity in the ecosystem impacts and is impacted by the others, and they compete and collaborate with each other to survive. The figure represents the names of the entities in the data center immersion cooling fluids ecosystem. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Immersion Cooling Fluids Market, by Type

Based on type, synthetic fluids are projected to grow at the fastest rate during the forecast period. These synthetic fluids are ester-based, engineered hydrocarbons, and novel PFAS-free formulations; unlike traditional mineral oil or natural esters, they possess better thermal stability, dielectric strength, oxidation resistance, and material compatibility. All these features make them appropriate for advanced immersion cooling operations, including high-performance, AI-intensive, and hyperscale data centers. One of the essential factors driving growth is the intensified demand for fluids that can maintain continuous operation under severe thermal stresses without degrading. Synthetic fluids maintain consistent performance throughout a longer life and thus further reduce frequent replacement and minimize the total cost of ownership. Also, their lower viscosity and superior flow characteristics result in efficient heat transfer with less energy consumption in pumping systems. Due to the global push for environmental compliance and sustainability, many data centers are moving away from PFAS-based and mineral oil fluids and toward synthetic alternatives that fit latest regulatory standards. Moreover, synthetic formulations are adapted to cooling needs, which gives system designers more options and allows them to realize them for single-phase and emerging PFAS-free two-phase immersion cooling technologies

Data Center Immersion Cooling Fluids Market, by Data Center Type

According to the type of data center, hyperscale data centers are projected to grow at the fastest rate in the data center immersion cooling fluids market during the forecast period. Hyperscale facilities operated mainly by cloud giants such as Amazon Web Services, Microsoft Azure, Google Cloud, and Meta require enormous computing power to support AI, big data analytics, IoT, and cloud services. These operations are associated with high heat densities, often exceeding 40-100 kW per rack, making traditional air-cooling systems inefficient and unsustainable at scale. Rapidly growing hyperscale facilities in North America, Europe, and Asia-Pacific are expediting market growth due to increased demand in AI applications, cloud storage, and high-speed data processing. Since such data centers prioritize performance and efficiency and promote sustainability, the investment in new cooling solutions, such as immersion cooling, will surge, making the hyperscale data centers the fastest-growing segment in the immersion cooling fluids market.

Data Center Immersion Cooling Fluids Market, by Technology

Based on technology, the single-phase cooling is estimated to grow fastest during the forecast period. The growth rate of this segment can be attributed to the fact that single-phase systems are easier and cheaper to operate and more stable than two-phase systems. In single-phase immersion cooling, the IT equipment is immersed in a dielectric liquid, which remains in the liquid state during heat dissipation. This straightforward principle reduces the complexities associated with changes in phase and vapor handling, which would otherwise make it difficult for this emerging technology to be adopted widely.

REGION

North America to be fastest-growing data center immersion cooling fluids market during forecast period

The CAGR of data center immersion cooling fluids market during the forecast period is estimated to surge at the maximum rate in North America. The significant growth is attributed to the region’s fast-paced growth of hyperscale and AI-based data centers, whereby tech giants such as Amazon, Microsoft, Google, Meta, and NVIDIA have kindled the fire of evolution. These companies are now putting a lot of money into next-generation data infrastructure for applications of high-performance computing, generative AI, and machine learning and cloud services systems that, of necessity, require high-density computing environments generating significant heat loads. Immersion cooling has seen significant traction in North America, being an answer for extreme thermal load while conserving power, using less water, and keeping down operation costs. A growing awareness of sustainability and environmental compliance in states such as California and Washington has made data center operators stay at the forefront and emphasize green cooling technologies. Government incentives and green initiatives also encourage this shift.

Data Center Immersion Cooling Fluids Market: COMPANY EVALUATION MATRIX

Shell plc (Star) leads with a strong market share and extensive product footprint, driven by its single-phase dielectric fluids and direct liquid cooling (DLC) fluids, formulated with its proprietary Gas-to-Liquids (GTL) technology. These fluids offer heat transfer, low viscosity, and material compatibility, reducing data center energy consumption. Green Revolution Cooling (GRC) (Emerging Leader) is gaining visibility with its specialized ecofriendly and high-performance single-phase liquid immersion cooling fluid named ElectroSafe. GRC was among the earliest innovators in single-phase immersion cooling, giving it a strong technological and market credibility edge.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

DATA CENTER IMMERSION COOLING FLUIDS MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.15 Billion |

| Revenue Forecast in 2032 | USD 0.83 Billion |

| Growth Rate | CAGR of 23.9.% from 2025–2032 |

| Actual Data | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Thousand), Volume (Thousand Liters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Data Center Immersion Cooling Fluids Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Data Center Immersion Cooling Fluids OEM |

|

|

| Fluid Manufacturer (Dielectric Fluids Producer) |

|

|

| Data Center Operator (Hyperscale, Colocation, Edge) |

|

|

| Raw Material Supplier (Chemical & Petrochemical Companies) |

|

|

| Technology OEM / System Integrator (Cooling Hardware Providers) |

|

|

RECENT DEVELOPMENTS

- November 2024 : Oleon NV launched Qloe, a brand that revolutionized data center cooling solutions through immersion cooling. Qloe products are plant-based, non-toxic, biodegradable, and have zero global warming potential, making them the most sustainable option in the market.

- October 2024 : Submer and Zero Two formed a strategic partnership to provide sustainable computing solutions for the UAE’s growing AI sector. The partnership will use advanced immersion cooling technology to address the increasing demands of AI workloads.

- May 2024 : Dell Technologies, Submer, and UNICOM Engineering joined forces to expand the immersion cooling market. This collaboration brings immersion-ready servers from UNICOM Engineering, featuring Dell technology powered by Intel and NVIDIA, enhancing data center performance and efficiency.

- February 2024 : GRC (Green Revolution Cooling), a leading provider of immersion cooling solutions for data centers, announced that the Special Fluids division of global multi-energy company TotalEnergies has joined its ElectroSafe Fluid Partner Program. This partnership aims to enhance the performance and sustainability of single-phase immersion cooling fluids.

Table of Contents

Methodology

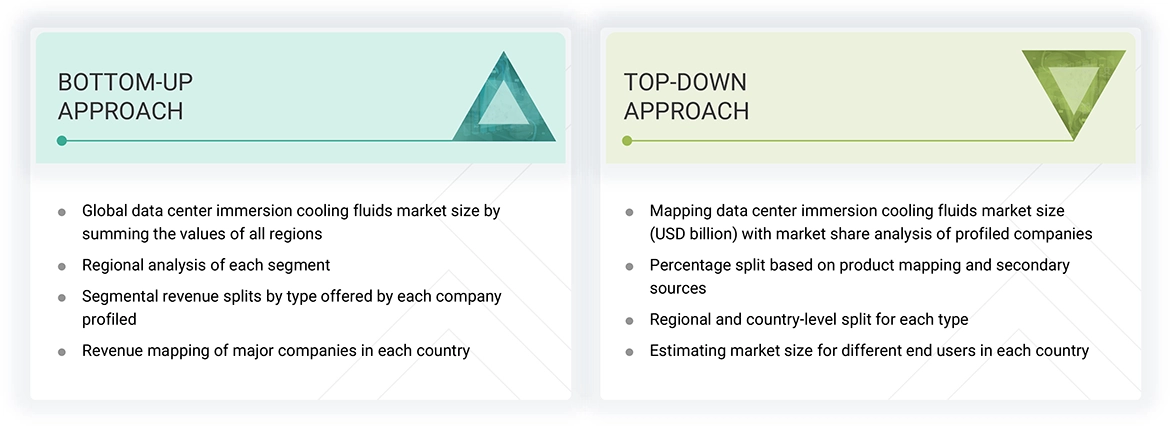

The study involved four major activities in estimating the current market size of data center immersion cooling fluids. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of data center immersion cooling fluids through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The data center immersion cooling fluids market comprises stakeholders, such as raw material suppliers, processors, recycling companies, data center immersion cooling fluids manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the data center immersion cooling fluids market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

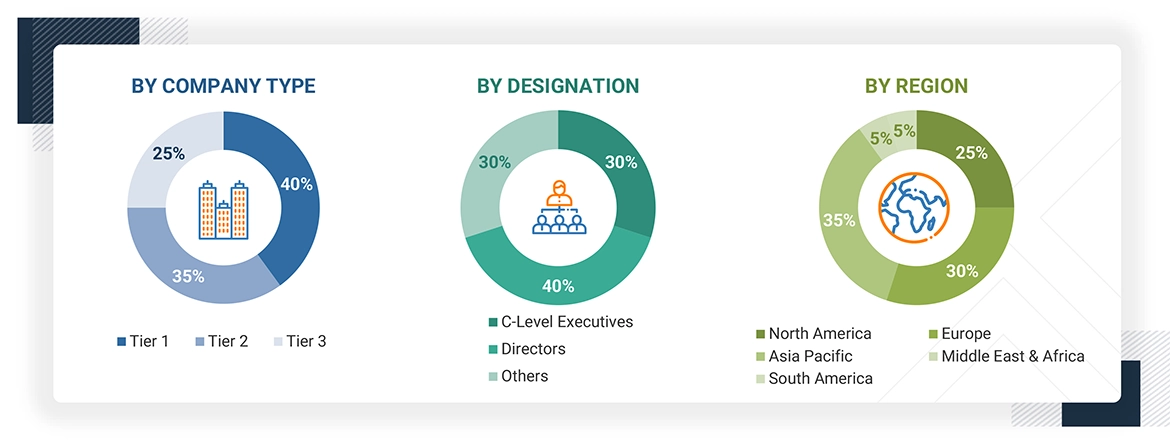

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the data center immersion cooling fluids market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- Primary and secondary research determined the value chain and market size of the data center immersion cooling fluids market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Data Center Immersion Cooling Fluids Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

An immersion cooling fluid dielectric is an electrically non-conducting fluid with a very high electric breakdown resistance at even high voltages. Mineral, fluorocarbon, synthetic, silicone, bio-oil, vegetable, and deionized water are dielectric fluids in immersion cooling systems. Immersion cooling is a thermal management process widely used as a cooling practice in various kinds of equipment, such as transformers, data centers, and EV batteries. Such equipment is submerged in a thermally conducting but electrically insulating dielectric fluid. Such dielectric fluids may directly contact components, transferring heat directly from the source more effectively than indirect cooling mechanisms such as air cooling, cold plates, and heat sinks. Low pour points of such dielectric fluids offer optimum thermal performance. Bio-based oils can restrict fire hazards and are non-toxic and readily biodegradable, thereby minimizing environmental footprints.

Stakeholders

- Manufacturers of immersion cooling fluids

- Traders, distributors, and suppliers of immersion cooling fluids

- OEMs

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Investment banks and private equity firms

- Manufacturers in end-use industries

Report Objectives

- To define, describe, and forecast the global data center immersion cooling fluids market based on technology, type, end-use, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To forecast the market size concerning five central regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, product launches, and research & development (R&D) activities in the data center immersion cooling fluids market

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the key driver for the data center immersion cooling fluids market?

The expanding data center market, increased adoption of liquid cooling technologies, and rising server rack density are key drivers boosting demand for immersion cooling fluids.

Which region is expected to register the highest CAGR in the data center immersion cooling fluids market during the forecast period?

North America is expected to register the highest CAGR during the forecast period.

What are the different types of data centers?

Major types include hyperscale data centers, AI/ML data centers, cryptocurrency mining data centers, and others (enterprise and colocation data centers).

Who are the major players of the data center immersion cooling fluids market?

Major players include The Chemours Company (US), FUCHS SE (Germany), The Lubrizol Corporation (US), Submer (Spain), and Inventec Performance Chemicals (France).

What is the total CAGR expected to be recorded for the data center immersion cooling fluids market from 2025 to 2032?

The market is expected to grow at a CAGR of 23.9% from 2025 to 2032.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Immersion Cooling Fluids Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Immersion Cooling Fluids Market