Data Center Liquid Cooling Fluids Market

Data Center Liquid Cooling Fluids Market by Fluid Type (Water Glycol Mixtures, Synthetic Hydrocarbons, Fluorocarbon-Based Fluids), Cooling Method (Single Phase, Two Phase), Data Center Type, Cooling Technology, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The data center liquid cooling fluids market is projected to grow from USD 0.28 billion in 2025 to USD 2.01 billion in 2032, at a CAGR of 32.7% during the forecast period. Data centers need to handle rising heat levels in their high-density computing environments while improving energy efficiency and operational reliability. The use of liquid cooling fluids enables data centers to achieve better heat transfer than traditional air-based systems, allowing them to handle advanced workloads while maximizing space and power efficiency. The market offers solutions through its fluid classification, which includes water-based mixtures and specialty fluids that meet various thermal and material-compatibility needs. Liquid cooling systems enable data centers to handle performance increases by being adopted by hyperscale facilities, colocation centers, and enterprise data centers based on their specific requirements. The market includes cooling methods that range from direct-to-chip systems to immersion cooling systems, which can handle different heat levels and site configurations. The system uses both single-phase and two-phase cooling methods to provide operators with multiple options to achieve their needed efficiency, system complexity, and operational reliability. Collectively, these segments form the core structure of the data center liquid cooling fluids market. The demand for data center liquid-cooling fluids is increasing as data centers expand worldwide and organizations deploy high-performance computing systems that generate excessive heat.

KEY TAKEAWAYS

-

BY REGIONNorth America is expected to register the highest CAGR (31.0%) during the forecast period in terms of value.

-

BY FLUID TYPEBy fluid type, the water glycol mixtures segment is projected to grow at the highest CAGR (31.1%) during the forecast period in terms of value

-

BY DATA CENTER TYPEBy data center type, the hyperscale segment is projected to register the highest CAGR (32.4%) during the forecast period in terms of volume

-

BY COOLING METHODBy cooling method, the single phase cooling segment is projected to register the highest CAGR (33.8%) during the forecast period in terms of volume.

-

BY COOLING TECHNOLOGYBy cooling technology, the direct-to-chip cooling fluids segment is expected to dominate the overall market.

-

Competitive Landscape - Key PlayersShell plc, The Chemours Company, Dow Inc., Valvoline Global Operations, and Exxon Mobil Corporation were identified as some of the leading players in the data center liquid cooling fluids market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsAMER Technology and Shenzhen Huayi Brother Technology, among others, have become leading startups or SMEs by identifying niche gaps early and delivering solutions that precisely match unmet customer needs. Their agility, faster decision-making, and ability to innovate continuously allow them to outperform larger, less flexible competitors.

The data center liquid cooling fluids market experiences its primary growth because modern data centers show rapid increases in computing density. The rising use of advanced workloads which include artificial intelligence and cloud computing and high-performance applications, results in servers producing higher heat output. Liquid cooling fluids enable better heat dissipation which results in consistent system performance and higher energy efficiency and decreases the operational demands on cooling systems. The ability of liquid cooling fluids to handle increased power density without compromising system reliability makes them essential for data centers, which leads to their increasing use throughout these facilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The data center liquid cooling fluids market experiences growth because artificial intelligence and high-performance computing workloads have become mainstream, while rack power densities continue to rise and traditional air-cooling systems reach their operational limits. The market receives additional support from hyperscale data center development, increased development of energy- and water-efficient technologies, and the implementation of advanced cooling systems, including direct-to-chip and immersion cooling methods. The main market participants direct their resources toward research and development activities while they build their production capabilities for engineered water-based coolants, single-phase dielectric fluids, and upcoming low-GWP immersion fluids to satisfy the changing thermal performance, reliability, and sustainability needs of data center operators.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in data center market

-

Rising use of liquid cooling technology in data centers

Level

-

Technology under development for two-phase PFAS-free fluids for immersion cooling

-

Lack of widely accepted industry standards

Level

-

Growing installation of Al-based mega data centers

-

Growing demand for energy-efficient cooling solutions

Level

-

Fluid contamination risk increases maintenance burden

-

Maintenance challenges and cost burden in immersion cooling for data centers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in data center market

The data center market is expanding at a fast pace, which creates strong demand for data center immersion cooling fluids market. The need for advanced data centers has increased due to the growth of cloud computing, artificial intelligence (AI), edge computing systems, and 5G network infrastructure. The construction of hyperscale and colocation data centers has reached an all-time high to meet the increasing demand for data storage, processing power, and real-time data analysis. Data centers face challenges with air cooling systems because their increasing size and computing power create greater heat output, which results in additional costs and operational problems. Liquid cooling systems provide an energy-efficient, environmentally friendly cooling solution that reduces energy consumption and boosts server efficiency while supporting higher rack performance. The International Energy Agency IEA projects that global data center electricity consumption will keep increasing until 2030. The International Energy Agency IEA predicts that data centers worldwide will consume 945 TWh of electricity by 2030, which represents an increase from 415 TWh in 2024. The United States and China are currently the top two countries consuming data center electricity, and they will account for almost 80 percent of worldwide consumption growth until 2030. The US Department of Energy estimates that data centers will use between 6.7% and 12 percent of total US electricity by 2028, up from 4.4% in 2023. The American Council for an Energy-Efficient Economy ACEEE white paper from October 2025 reports that servers and other IT equipment consume approximately 80 percent of total energy, while cooling takes up 15%, and electrical devices and lighting account for 5%.

Restraint: Technology under development for two-phase PFAS-free fluids for immersion cooling

Two-phase immersion cooling systems depend on fluorocarbon-based fluids which include perfluorocarbons and per-and polyfluoroalkyl substances as their primary cooling substances. The fluids that use these chemicals create environmental and human health problems because their chemical components remain in the environment for extended periods. The growing environmental problems that result from PFAS chemicals together with the increasing regulatory requirements have created a demand for environmentally sustainable non-toxic chemical alternatives that will biodegrade naturally. The US Environmental Protection Agency (EPA) established its final National Primary Drinking Water Regulation (NPDWR) which covers six PFAS substances. The EPA regulations about per- and polyfluoroalkyl substances (PFAS) restrict two-phase immersion cooling systems which use these specific chemicals. Presently, researchers are developing PFAS-free two-phase fluids although there are currently few products on the market that can match the thermal performance and extended durability of fluorocarbon-derived solutions. The process of developing new fluid formulations through research and testing involves a lengthy period which needs detailed validation processes together with environmental standard requirements, thus making it harder to implement the new formulations. The absence of this technological capability prevents organizations from using two-phase immersion cooling systems on a wide scale, which creates an obstacle to market advancement. The market for two-phase immersion cooling liquids will experience growth restrictions until developers create effective PFAS-free solutions that match existing performance standards.

Opportunity: Growing demand for energy-efficient cooling solutions

The increasing need for energy-efficient cooling systems in data centers drives the market growth of immersion cooling fluids which create substantial business expansion chances. The power requirements of data centers have increased because digital workloads need to expand their operations which results in more power use and heat production that makes traditional air cooling methods too expensive to run. Immersion cooling provides an energy-saving solution because it operates by completely immersing IT equipment in dielectric fluids which decreases the requirement for power-consuming air conditioning and cooling systems. The system operates with enhanced reliability and performance which results in reduced power usage effectiveness (PUE) and lower operational expenses. Data centers achieve lower power usage effectiveness (PUE) through the implementation of liquid cooling technologies which establish operational standards for data centers while immersion cooling technology deployment is expected to decrease power usage effectiveness (PUE) further. The industry demands energy efficiency solutions to reduce operational costs and thus immersion cooling fluids have become the most favorable solution which boosts their market expansion. The data center market experiences strong growth opportunities through direct-to-chip cooling fluids because there is rising demand for energy-efficient cooling technologies. Direct-to-chip liquid cooling delivers coolant directly to high-heat-generating components such as CPUs and GPUs and AI accelerators which enables much better heat transfer while using less power than air-based cooling methods. This cooling method provides power usage effectiveness (PUE) reductions which enable systems to operate at higher rack power capacities.

Challenge: Fluid contamination risk increases maintenance burden

Data centers use liquid cooling systems that depend on operators to manage their fluids because this method maintains effective heat transfer and system uptime reliability. The installation and operation of cooling systems allows particles and corrosion materials to enter their circuits which creates a major problem for these systems. Direct to chip and cold plate systems experience severe operational issues because their coolant systems utilize extremely thin channels that become blocked by contaminants. Even a slight amount of contamination will decrease flow rates and impair heat transfer efficiency while increasing the chances of equipment overheating and breaking down. The Schneider Electric Data Center Research and Strategy white paper 210 states that technology cooling system fluid contamination control presents both installation and operational obstacles because debris and particles in coolant systems will build up inside the narrow cold plate channels which can cause flow restrictions and lead to chip overheating and damage. The white paper establishes a risk that needs to be controlled through coolant quality management which requires system designers to implement special filtration systems and safety monitoring procedures and material compatibility testing about system maintenance duties that exceed standard cooling system requirements.

DATA CENTER LIQUID COOLING FLUIDS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company creates and delivers advanced liquid cooling fluids which function as thermal management solutions for high-density data center environments and support direct-to-chip and immersion cooling methods. | The system gains four advantages from its ability to effectively release heat. Higher computing capacities become possible because the system enables data centers to achieve better energy efficiency and operational reliability. |

|

The company produces specialized dielectric fluids which serve immersion cooling and advanced liquid cooling systems used in data centers to achieve safe and efficient thermal management. | The system delivers electrical insulation which enables effective heat dissipation while decreasing the chances of equipment breakdown and maintaining consistent operation under high-power computing conditions. |

|

The company develops engineered cooling fluids and materials which function with data center liquid cooling systems while their design focuses on thermal performance and material protection. | The invention enhances thermal efficiency while it boosts fluid-material compatibility and it decreases the risk of corrosion and it extends the operational life of cooling systems and electronic components. |

|

Produces liquid cooler fluids for the purpose of handling heat in data centres with the equivalent increasingly rising power densities and ongoing operational requirements. | The system provides efficient thermal management which maintains constant cooling performance and increases equipment reliability while enabling data center infrastructure to operate without interruptions. |

|

The company provides synthetic fluids and specialty fluids which are specifically formulated for data center cooling systems that use immersion and single-phase cooling technologies. | The system provides consistent thermal performance while enabling high-temperature operation which decreases maintenance needs and increases the cooling systems' long operational life. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center liquid cooling fluids ecosystem consists of raw material suppliers (e.g., Exxon Mobil Corporation, Chevron Corporation), producers (e.g., Exxon Mobil Corporation, Dow Inc.), distributors (e.g., Third Coast Chemicals), and end users (e.g., Google LLC, Microsoft Corporation).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Liquid Cooling Fluids Market, By Fluid Type

Water-glycol mixtures represent the largest fluid type segment due to their proven performance, reliability, and widespread adoption across diverse cooling systems. Data centers use these mixtures because they transfer heat efficiently while providing essential freeze protection and corrosion resistance across all operating conditions and climates. Data center operators can use liquid cooling systems without major changes to their existing cooling systems because the new system works with their current infrastructure and materials. Water–glycol mixtures have established their reliability for industrial and data center applications, helping users trust their extended operational performance and maintenance schedules. The product line offers various formulations that meet different thermal and environmental needs, which helps the product maintain its position as the leading market shareholder.

Data Center Liquid Cooling Fluids Market, By Data Center Type

Hyperscale data centers hold the largest market share of liquid-cooling fluids because their computing power and high-density infrastructure needs exceed those of other data center types. The facilities provide essential support for cloud services, artificial intelligence systems, and data-intensive applications, which generate high heat output that requires effective thermal control to operate successfully. Hyperscale operators use liquid-cooling fluids to operate their data centers at higher power levels while boosting energy efficiency and ensuring system reliability during continuous operations. Hyperscale data centers achieve their dual objectives of performance enhancement, environmental responsibility, and long-term cost efficiency by extensively using liquid-cooling systems. The global expansion of hyperscale operators, together with their adoption of cutting-edge computing systems, has created the highest market demand for liquid cooling fluids among all operators.

Data Center Liquid Cooling Fluids Market, By Cooling Technology

The data center liquid cooling fluids market shows that direct-to-chip (D2C) cooling fluids form its biggest segment which uses this cooling method. The market for this product has expanded because high-performance computing environments need better thermal management systems. The direct-to-chip cooling method uses liquid coolant that operators direct to CPU and GPU components for better heat control than conventional systems. This technology enables data centers to achieve higher computing capacity by using energy-efficient cooling systems that prevent overheating without requiring additional physical space. The growth of hyperscale and enterprise data centers has created a demand for more efficient cooling systems to maintain system reliability and reduce operational expenses, leading to increased use of direct-to-chip cooling fluids. The liquid cooling fluids market identifies direct-to-chip cooling as the leading technology, combining superior thermal performance with cost-effective solutions and system expansion capabilities.

Data Center Liquid Cooling Fluids Market, By Cooling Method

The major segment of the data center liquid cooling fluids market operates through single-phase cooling, which provides the cooling solution. This system employs a liquid coolant that maintains its current phase to absorb and transfer heat, providing a constant thermal control. Single-phase cooling is widely adopted because it is simpler to implement, easier to maintain, and compatible with a wider range of data center hardware than more complex methods like two-phase cooling. The system effectively extracts heat from high-density components while protecting the system against both operational failures and physical equipment damage. The operational benefits of single-phase cooling systems combined with their financial savings make these systems essential for hyperscale and enterprise data centers which need to achieve high performance while using less energy. The liquid cooling fluids market mainly uses single-phase cooling as its primary method because of these reasons.

REGION

North America to be fastest-growing region in the data center liquid cooling fluids market during the forecast period

The data center liquid cooling fluids market will experience its most rapid growth in North America. The region's digital infrastructure development and its concentration of hyperscale and colocation data centers, where major cloud providers and technology firms operate, drive the adoption of liquid cooling solutions to handle thermal loads from AI, machine learning, and high-performance computing workloads. North American operators pursue energy efficiency and sustainability through liquid cooling adoption, which helps them lower power usage effectiveness (PUE) while achieving both regulatory and corporate environmental objectives. The market experiences growth because companies invest in advanced cooling technologies, the government establishes supportive policies, and there is a workforce with technical skills.

DATA CENTER LIQUID COOLING FLUIDS MARKET: COMPANY EVALUATION MATRIX

In the data center liquid cooling fluids market matrix, Shell plc (Star) is regarded as one of the leading players due to its chemical research capabilities, which enable it to develop specialized cooling fluids that meet the needs of direct-to-chip and immersion cooling systems. The company establishes itself as the top choice for hyperscale and high-density computing environments through its commitment to building systems that deliver high efficiency and dependable performance with upcoming data center technologies. PETRONAS Lubricants International (Emerging Leader) is emerging as a notable competitor with its specialized fluid products that deliver environmentally friendly, high-performance cooling solutions. The company develops advanced thermal management systems and establishes partnerships across various ecosystems to protect data centers throughout their operational life cycles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Shell plc

- The Chemours Company

- Valvoline Global Operations

- Dow Inc.

- Exxon Mobil Corporation

- TotalEnergies

- Chevron Phillips Chemical Company LLC (Chevron Corporation)

- Cargill, Incorporated

- ENEOS Corporation

- PETRONAS Lubricants International

- Honeywell International Inc.

- DCX Liquid Cooling Systems

- Lubrizol

- FUCHS SE

- Engineered Fluids

- Recochem Corporation

- Oleon NV

- Castrol Limited

- Submer

- Arteco

- Inventec Performance Chemicals

- Liquitherm Technologies Group Ltd

- Green Revolution Cooling

- Dynalene, Inc.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.21 BN |

| Market Forecast in 2032 (Value) | USD 2.01BN |

| CAGR (2025–2030) | 32.7% |

| Years Considered | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion), and Volume (Thousand Liters) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Fluid Type: Water Glycol Mixture, Synthetic Hydrocarbons, Fluorocarbon Based Fluids, and Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: DATA CENTER LIQUID COOLING FLUIDS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale data center operator weighs in on the best liquid cooling fluid to use for high-density racks. | The study evaluates three different cooling methods, which include direct-to-chip cooling and immersion cooling, and the evaluation of single-phase and two-phase fluid systems, and the development of an application-specific suitability matrix. | Make good thermal performance decisions, cut down deployment risk and develop the reliability of equipment. |

| Data center colocation providers are contemplating adoption of liquid cooling | The three main evaluation methods which will be used in this study include cost performance benchmarking and retrofit feasibility study and operational compatibility evaluation. | The organization achieved three outcomes through its efforts which included implementing a faster adoption strategy and creating better capital expenditure and operational expenditure procedures and reducing operational interruptions. |

| A liquid-producing company considers stepping into the data center cooling segment. | Market potential assessment and material handling of products; compatibility studies under regulations and material usage; competitive review | The company needs three improvements which include establishing better product position along with discovering new high-growth market segments and developing a more effective market entry approach. |

| An investment firm is investigating the liquid cooling fluids market. | Market expansion and the roadmap to adopt; on the value chain received, analysis of margins; risk and sensitivity treatment. | The three elements of the investment evaluation process which investors use to assess potential investments need to be improved through stronger investment validation methods and enhanced risk evaluation procedures. |

| A distributor of chemistry comprehending the purchases of the data centers from customers. | The study involves three main parts which are buyer behavior analysis according to different data center types and the creation of procurement criteria and evaluation of demand cycles. | The company achieved better customer targeting through data improvement and sales strategy optimization, which resulted in increased customer retention and spending by existing customers. |

RECENT DEVELOPMENTS

- June 2025 : Shell plc introduced Shell DLC Fluid S3, a propylene glycol as its primary fluid to deliver direct liquid cooling for high-performance computing and artificial intelligence systems through its ability to maintain optimal thermal conditions..

- May 2025 : The Chemours Company has formed a strategic partnership with Navin Fluorine to produce the Onteon two-phase immersion cooling fluid. The partnership which expands Chemours Liquid Cooling Venture aims to fulfill growing thermal energy and water requirements which advanced data centers and AI systems demand. The commercial use of two-phase liquid cooling technology will reach its first milestone when production starts in 2026. The partnership enhances Chemours manufacturing capacity and territorial distribution network which enables worldwide data centers to implement advanced cooling technologies.

- April 2024 : Exxon Mobil Corporation and Intel Corporation announced collaboration to bring data center immersion cooling solutions to the market. Through a multi-year partnership the two companies will develop and validate upcoming liquid cooling systems which meet energy efficiency standards for Intel's Xeon technology. The partnership works to speed up immersion cooling technology adoption in data centers through three main areas which include fluid compatibility testing and system reliability assessment and high-performance data center deployment testing.

Table of Contents

Methodology

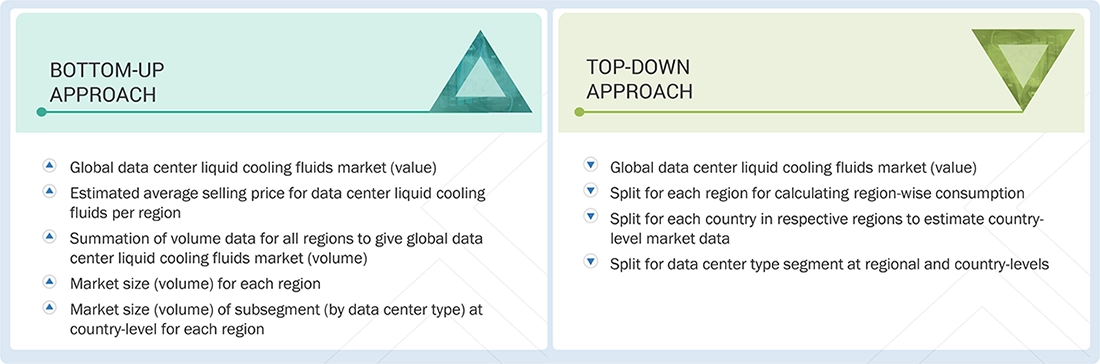

The research methodology used to estimate the current size of the data center liquid cooling fluids market consisted of four major activities. Extensive secondary research was conducted to obtain detailed information on the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from both the demand and supply sides of the Data center liquid cooling fluids value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market sizes for various segments and subsegments were finalized using full market segmentation and data triangulation.

Secondary Research

The research methodology for estimating and forecasting the data center liquid cooling fluids market begins with gathering data on key vendors' revenues by doing secondary research. The secondary research process involves consulting a range of secondary sources, including Hoover's, Bloomberg Businessweek, Factiva, the World Bank, and industry-specific journals. These secondary sources encompass annual reports, press releases, investor presentations, white papers, certified publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Also, vendor offerings are taken into consideration to inform market segmentation.

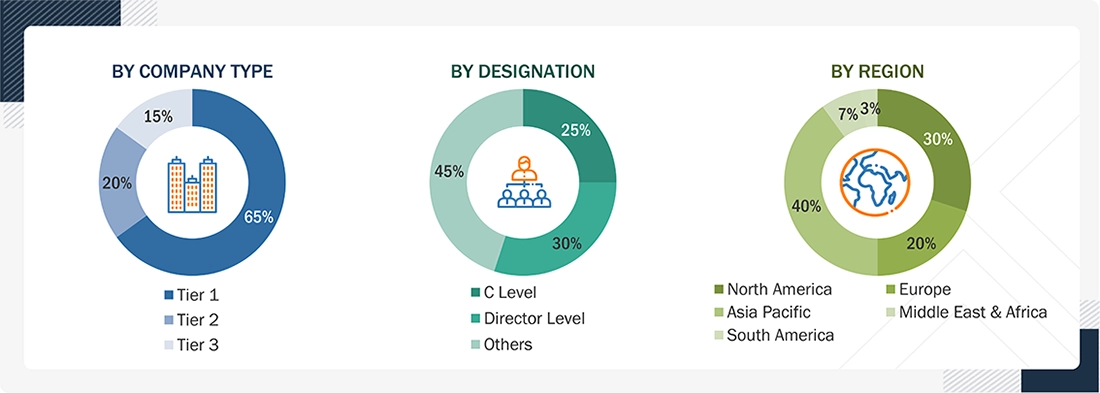

Primary Research

The data center liquid cooling fluids market comprises several stakeholders, including raw material suppliers, processors, end-product manufacturers, and regulatory organizations, throughout the supply chain. The demand side of this market is characterized by the development of various industries, including mobility, power, chemicals, industrial, and grid injection, among others. The supply side is characterized by technological advancements and a wide range of diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the data center liquid cooling fluids market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following.

The following segments provide details about the overall market size estimation process employed in this study:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size in terms of value of the data center liquid cooling fluids market were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives, is included in this research.

Data Center Liquid Cooling Fluids Market : Top-Down and Bottom-Up Approach

Data Triangulation

After estimating the overall market size using the above estimation process, the market was split into various segments and subsegments. Data triangulation and market segmentation techniques, along with the market engineering process, were employed to obtain precise market analysis data for each segment and its subsegments.

Research Methodology: The research methodology used to estimate and forecast the market size began by aggregating data and information from various levels, including country-level data.

Market Definition

The data center liquid-cooling fluids market is a segment of the data center cooling industry focused on liquid substances that provide thermal management for IT equipment, including servers, processors, and accelerators. These fluids are deployed in cooling architectures that include direct-to-chip, cold plate, immersion, and rear-door heat exchanger systems that use liquid as their primary heat transfer medium, either alone or in combination with air. The market includes multiple fluid categories, including water-based mixtures, engineered coolants, and dielectric fluids that operate under specific thermal and environmental conditions. The need for liquid cooling fluids stems from growing computing density and increasing heat loads, as well as the need for efficiency in hyperscale, colocation, and enterprise data centers. The market includes all aspects of cooling fluid supply, formulation, and application, serving both new data center designs and retrofitted facilities that operate as essential elements of current thermal management systems.

Key Stakeholders

- Data center immersion cooling fluids manufacturers

- Data center immersion cooling fluids suppliers

- Data center immersion cooling fluids traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

Report Objectives

- To define, describe, and forecast the size of the data center liquid cooling fluids market, in terms of volume and value, based on fluid type, data center type, cooling technology, cooling method, and region

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry–specific challenges, influencing the growth of the data center liquid cooling fluids market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five main regions: North America, Asia Pacific, Europe, South America, and the Middle East & Africa, along with their respective key countries

- To provide ecosystem analysis, case study analysis, value chain, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, investment and funding scenario, trade analysis, impact of AI/Gen AI and 2025 US tariff, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze competitive developments such as mergers & acquisitions, product launches, and research & development in the data center liquid cooling fluids market

- To provide the macroeconomic outlook for all regions considered under the study

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the data center liquid cooling fluids market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of each company's product portfolio.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Liquid Cooling Fluids Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Liquid Cooling Fluids Market