Data Center UPS Market Size, Share, Trends, & Growth Opportunities

Data Center UPS Market by Capacity (201–500 kVA, 501–1,000 kVA, above 2,000 kVA), Phase Type (Single-phase, Three-phase), Configuration Type (Online Double Conversion, Line-interactive, Offline), Design Type (Modular, Monolithic) - Global Forecast to 2030

Data Center UPS Market Overview

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Data Center UPS Market size was valued USD 8.76 billion in 2025 and is poised to reach USD 12.47 billion by 2030, at a robust CAGR of 7.3%. Growth is driven by escalating data traffic from AI and cloud workloads, rising hyperscale facility expansions, and the critical need for high-efficiency UPS architectures that ensure power resilience, minimize downtime, and support low-carbon, energy-optimized data center environments.

KEY TAKEAWAYS

-

BY CONFIGURATION TYPELine-interactive UPS systems are poised to record the second-highest CAGR within the configuration type segment, driven by rapid adoption across edge and colocation facilities prioritizing cost-efficient resilience. Their voltage regulation precision and hybrid design enable seamless performance in regions with unstable grids, reducing reliance on overprovisioned double-conversion units. As data centers emphasize localized uptime and energy optimization, line-interactive architectures are emerging as a strategic bridge between traditional standby systems and high-efficiency on-line models.

-

BY DESIGN TYPEConventional (monolithic) UPS systems retain strategic relevance in hyperscale and enterprise facilities managing dense AI and HPC workloads that demand uninterrupted, high-power delivery. Their single-cabinet architecture enables tighter electrical control, reduced conversion losses, and optimized thermal performance, aligning with operators standardizing on centralized power blocks for predictable efficiency and simplified compliance. As facilities scale beyond multi-megawatt capacities, monolithic designs remain critical for ensuring synchronized load protection, stable grid interaction, and seamless integration with advanced power distribution and cooling ecosystems.

-

BY PHASE TYPESingle-phase UPS systems are increasingly deployed in distributed and edge infrastructures supporting AI inference, CDN nodes, and IoT processing. Their compact design and high power density enable precise power delivery for localized workloads while minimizing footprint and energy loss. As operators push intelligence closer to end users, single-phase architectures are becoming critical enablers of resilient, low-latency power continuity at the network edge.

-

BY BATTERY TYPELithium-ion batteries are projected to record the highest CAGR within the data center UPS market as operators transition toward AI-driven and high-density architectures demanding rapid power recovery and precise thermal management. Their advanced BMS integration, higher charge throughput, and reduced maintenance align with hyperscale strategies targeting real-time energy optimization. With grid-interactive storage gaining traction, lithium-ion systems are redefining UPS design as intelligent energy assets rather than passive backup components.

-

BY CAPACITYThe 501–1,000 kVA UPS segment is projected to record the highest CAGR as data centers scale power infrastructure to support GPU-intensive AI training clusters and HPC environments. This range delivers the electrical headroom and modular redundancy required for multi-megawatt white space expansion. With operators standardizing on scalable power blocks to optimize load segmentation and thermal efficiency, 501–1,000 kVA systems are emerging as the operational core of next-generation hyperscale and colocation facilities.

-

BY FORM FACTORFreestanding UPS systems are projected to record the highest CAGR, driven by their ability to support high-capacity power distribution in hyperscale and colocation environments. Their standalone architecture accommodates larger battery arrays, superior airflow management, and higher fault tolerance, making them ideal for AI and HPC data halls with escalating rack densities. As facilities pursue flexible power block configuration and easier maintenance access, freestanding UPS solutions are redefining large-scale power reliability and operational continuity.

-

BY DATA CENTER TYPEColocation data centers are set to record a significant growth in the UPS market as operators re-architect power infrastructure to support multi-tenant AI, analytics, and cloud interconnect workloads. Rising rack densities and variable load profiles demand advanced UPS configurations with modular scalability and dynamic power allocation. By integrating lithium-ion storage, intelligent controls, and grid-synchronized redundancy, colocation facilities are transforming UPS systems into strategic assets that deliver differentiated uptime, power visibility, and operational efficiency for enterprise tenants.

-

BY REGIONThe Asia Pacific is projected to record the highest CAGR in the data center UPS market, driven by rapid digital expansion, grid upgrades, and the growing demand for AI and cloud workloads. Emerging markets, such as India, Indonesia, Malaysia, and Vietnam, are attracting investments through data localization mandates, renewable energy incentives, and enhanced power and fiber infrastructure. India’s Digital India push, Indonesia’s data sovereignty drive, and Malaysia’s hyperscale investment programs are fueling demand for high-efficiency UPS systems. Alongside, mature hubs like Singapore, Japan, and South Korea are advancing modular and lithium-ion UPS integration, making Asia Pacific the focal point for next-generation power resilience and sustainability.

-

COMPETITIVE LANDSCAPEMajor players in the data center UPS market are pursuing both organic and inorganic strategies, focusing on partnerships, product innovations, and technology integrations to strengthen their market presence. Schneider Electric, Huawei, Vertiv, Eaton, and ABB are actively collaborating with hyperscale operators and colocation providers to develop high-efficiency, lithium-ion–based UPS platforms, AI-enabled power monitoring, and grid-interactive architectures. These initiatives aim to enhance energy performance, support sustainability goals, and deliver intelligent, resilient power continuity across next-generation data center environments.

The data center UPS market is projected to reach USD 12.47 billion by 2030 from USD 8.76 billion in 2025, at a CAGR of 7.3%. The market is strengthening as data centers transition toward high-density computing, AI inference, and low-latency workloads that demand uncompromising power continuity. Operators are transitioning to advanced UPS topologies featuring intelligent energy storage, grid-interactive capabilities, and predictive maintenance to minimize downtime and energy waste. Lithium-ion and modular UPS systems are becoming strategic assets, enabling higher rack utilization and flexible capacity scaling. As hyperscale and edge environments converge, UPS architectures are evolving into dynamic energy management systems that underpin data center reliability, sustainability, and operational intelligence.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the critical trends and disruptions reshaping customer strategies in the data center UPS market, focusing on how energy resilience and intelligent power infrastructure are redefining operational priorities. It examines shifting needs across hyperscalers and cloud data centers, colocation providers, and enterprise data centers as they integrate advanced UPS systems to support AI-driven workloads, sustainability targets, and grid-interactive operations. It links these strategic priorities to measurable outcomes such as optimized energy usage, lower lifecycle costs, improved uptime, and strengthened ESG performance, positioning UPS modernization as a cornerstone of future-ready digital infrastructure.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Hyperscale AI workload power demand

-

Rising rack power densities

Level

-

Grid power availability constraints

-

Longer equipment and component lead times

Level

-

Modular and scalable UPS adoption

-

Integration of renewables with AI power management

Level

-

Complex legacy-system integrations

-

Skilled workforce shortages

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Rack Power Densities

Rising rack power densities driven by AI, GPU, and HPC workloads are driving a major shift in data center UPS design. As rack loads exceed 100 kW, centralized UPS systems encounter increasing limitations in efficiency and thermal management. This is accelerating the adoption of distributed, rack-level UPS architectures optimized for liquid-cooled environments. In October 2024, Vertiv and NVIDIA introduced a 132 kW liquid-cooled rack UPS for AI platforms. Meanwhile, Toshiba’s March 2025 launch of a modular high-density UPS highlights how next-generation designs are enabling efficient and resilient power delivery in high-density data centers.

Restraint: Grid Power Availability Constraints

Severe grid power limitations in fast-expanding digital hubs are constraining large-scale data center deployment, intensifying reliance on UPS systems as primary power stabilizers. In regions where high-load approvals and grid reliability remain inconsistent, operators are compelled to design hybrid architectures that integrate battery storage, gas or diesel backup, and on-site renewables to maintain uptime. This challenge is reshaping UPS design toward grid-interactive, island-ready systems that enable energy independence and operational continuity in power-deficient markets.

Opportunity: Modular and Scalable UPS Adoption

The rising adoption of modular and scalable UPS systems is creating a key growth avenue in the data center UPS market. As operators pursue flexible, growth-aligned power infrastructure, modular architectures enable seamless capacity expansion, faster deployment, and lower lifecycle costs. The Schneider Electric–Compass Datacenters partnership, announced in November 2023, highlights the growing demand for prefabricated UPS power blocks in large-scale builds. Vendors delivering hot-swappable, pre-certified, and remotely managed UPS modules can accelerate deployment cycles and position themselves as critical enablers of agile, future-ready data center power ecosystems.

Challenge: Complex Legacy-system Integration

Legacy power infrastructures pose a significant barrier to UPS modernization, as many data centers operate proprietary, closed-loop systems that hinder integration with advanced power management and lithium-ion technologies. These constraints heighten downtime risks, disrupt DCIM synchronization, and limit energy optimization. Addressing this challenge requires universal protocol adapters, real-time migration simulators, and pre-qualified retrofit kits that enable phased modernization without operational interruption, positioning vendors that master legacy integration as essential partners in next-generation data center transformation.

data center UPS market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Eaton delivers a compact modular UPS enclosure for a northwest US data center client | Significant space savings through compact enclosure design, improved power efficiency up to 99% (ESS mode), faster installation and commissioning due to pre-assembled structure, enhanced reliability via redundant UPS and HVAC systems |

|

Vertiv enhances energy efficiency and reliability for Contabo’s data centers in Germany | PUE reduced from 2.0 to approximately 1.2, 70% reduction in total energy consumption, annual electricity cost savings exceeding €1 million (USD 1.1 million), fourfold increase in fan energy efficiency through EC fan retrofits, seamless modernization with zero downtime during implementation, recognition with the 2017 German Data Centre Award for energy efficiency improvement |

|

Schneider Electric powers a UPS smart hub with Ecostruxure for scalable, energy-efficient operations | Enhanced operational agility and scalability for rising e-commerce demand, real-time insights enabling faster, data-driven decision-making, improved reliability and performance across automation and power systems, simplified operations with remote access and predictive maintenance |

|

ABB and Applied Digital partnered to build an AI-ready 400 MW data center campus with HiPerGuard medium voltage UPS | Enabled modular expansion in 25 MW capacity blocks to support rapid scaling, improved energy efficiency by lowering conversion losses and reducing thermal output, increased system reliability through simplified architecture and reduced failure points, delivered higher power density tailored to the needs of AI and HPC environments |

|

21Vianet constructs a future-oriented data center with Huawei SmartLi UPS | Reduced physical footprint by 50%, creating space for additional IT cabinets and improving out-of-counter rate by 10%, achieved 97% energy efficiency, significantly lowering electricity expenditure, doubled battery lifespan to ten years, minimizing replacement costs and extending service continuity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center UPS ecosystem includes technology providers delivering power protection for mission-critical infrastructure across two key categories: Traditional and Modular UPS systems. Traditional UPS solutions offer centralized, continuous power protection, while Modular UPS enable scalable and flexible power management. Major vendors such as Schneider Electric, Eaton, ABB, Vertiv, and Toshiba operate across both segments, underscoring the market’s transition toward adaptable and scalable power infrastructures aligned with evolving data center needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center UPS Market, By Configuration Type

Online double-conversion UPS systems are expected to command the largest market share, driven by their adoption in hyperscale and AI-optimized data centers that require precise voltage stability and continuous power isolation. These systems enable the delivery of clean power to GPU-dense racks and high-load IT clusters, mitigating harmonic distortion and transient fluctuations that are common in grid-interactive environments. Their integration with intelligent power distribution and lithium-ion battery systems enhances fault tolerance, making them the preferred architecture for facilities pursuing near-zero downtime and power quality assurance in high-density digital infrastructures.

Data Center UPS Market, By Design Type

Modular UPS systems are expected to secure the largest market share, by design type, as operators transition toward high-density, AI-ready, and prefabricated data center architectures. Their segmented power blocks enable granular scalability, synchronized load balancing, and fault isolation, capabilities critical for hyperscale and edge facilities operating under variable power intensities. The integration of advanced digital control, real-time diagnostics, and plug-and-play expandability allows modular UPS units to support phased capacity growth and hybrid deployment models. This adaptability positions modular UPS as the preferred backbone for next-generation facilities demanding precision power orchestration and zero-disruption scalability.

Data Center UPS Market, By Phase Type

Three-phase UPS systems will command the largest market share as hyperscale and HPC facilities scale to support multi-megawatt AI workloads. Their precise phase balancing, low THD, and high conversion efficiency ensure stable power delivery to dense compute clusters. Integrated with lithium-ion batteries and smart switchgear, these systems enable seamless synchronization with on-site generation, forming the backbone of high-capacity, performance-critical data center infrastructure.

Data Center UPS Market, By Battery Type

Lead-acid batteries are expected to retain the largest market share, as large-scale and colocation data centers continue to rely on their proven electrochemical stability and high surge tolerance for mission-critical UPS operations. Their robust float performance under constant voltage and compatibility with parallel string configurations make them ideal for multi-megawatt facilities prioritizing fault-tolerant backup. Advanced VRLA and AGM variants further enhance energy density and thermal resilience, enabling deployment in high-temperature or space-constrained environments. With mature recycling ecosystems and predictable service intervals, lead-acid technology remains the operational standard for dependable, large-capacity UPS architectures.

Data Center UPS Market, By Capacity

The 51–200 kVA UPS segment will command the largest market share as it forms the operational core of modular and edge data centers supporting AI inference, enterprise workloads, and regional cloud zones. Its optimized power density and compatibility with rack-level distribution architectures make it ideal for scalable multi-rack configurations. With growing demand for flexible redundancy (N+1, N+2) and lithium-ion retrofits, this range delivers the reliability and efficiency required for high-availability mid-tier data centers.

Data Center UPS Market, By Form Factor

Rack-mounted UPS systems are expected to capture the largest market share, driven by increasing rack power densities and the shift toward space-optimized, high-efficiency power architectures. Their integration within IT racks enables direct power delivery to AI and GPU servers, minimizing transmission losses and improving thermal alignment with liquid and hybrid cooling systems. Rack-mounted designs also support modular scalability, hot-swappable maintenance, and seamless integration with busbar and PDU infrastructure, making them essential for edge, colocation, and hyperscale facilities seeking dense, energy-efficient power protection within constrained footprints.

Data Center UPS Market, By Data Center Type

Hyperscale and cloud data centers are expected to secure the largest market share as operators deploy multi-megawatt UPS systems designed for AI training clusters, GPU-optimized workloads, and real-time cloud orchestration. These facilities demand ultra-high power density, millisecond transfer reliability, and advanced synchronization across redundant power trains. Integration with lithium-ion and flywheel hybrid systems enhances discharge efficiency and transient response, while intelligent UPS controllers optimize grid interaction and load sequencing. As hyperscalers standardize on modular, AI-integrated UPS platforms for global campus expansion, they define the industry benchmark for resilient, high-performance power continuity.

REGION

Asia Pacific to be fastest-growing region in global data center UPS market during forecast period

Asia Pacific is emerging as the strategic center for data center UPS deployment, driven by hyperscale investments, AI training clusters, and grid modernization programs. China’s AI and cloud campuses require high-density, lithium–ion–based modular UPS systems with integrated battery monitoring, whereas India’s Tier III and IV facilities are increasingly adopting scalable, hot-swappable architectures for load balancing and redundancy. Markets such as Malaysia, Indonesia, and Taiwan are emphasizing prefabricated UPS modules and hybrid AC-DC configurations to align with renewable-backed data centers. These region-specific developments underscore Asia Pacific’s pivotal role in advancing intelligent, high-efficiency UPS infrastructure for next-generation digital ecosystems.

data center UPS market: COMPANY EVALUATION MATRIX

In the data center UPS market matrix, Schneider Electric (Star) leads with a strong global presence and an extensive portfolio that spans modular, double-conversion, and lithium-ion UPS systems, powering hyperscale, colocation, and enterprise facilities. Its AI-enabled monitoring, digital twin integration, and energy optimization capabilities solidify its dominance in critical power infrastructure. Hitachi (Emerging Leader) is gaining momentum through advanced UPS platforms engineered for high-load efficiency, compact footprints, and enhanced grid interaction. While Schneider Electric drives large-scale deployments through breadth and innovation, Hitachi is steadily advancing toward the leaders’ quadrant with precision-engineered solutions tailored for next-generation data centers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.50 Billion |

| Market Forecast in 2030 (Value) | USD 12.47 Billion |

| Growth Rate | 7.3% |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: data center UPS market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Enterprise Data Center (US) | Regional Deployment Analysis: Evaluation of UPS design standards, redundancy configurations, and regulatory compliance requirements for distributed edge and 5G colocation sites | Provides actionable insights for optimizing site power resilience and ensuring seamless scalability across regional deployments |

| Colocation Service Provider (Asia Pacific) | Competitive Portfolio Mapping: Detailed analysis of vendor offerings across modular, rack-level, and containerized UPS categories, tailored to regional grid conditions and density requirements | Supports strategic sourcing decisions and identifies best-fit suppliers for high-density and renewable-integrated data centers |

| Major Hyperscaler (US) | Extra Vendor Profiling: Identification of regional and niche UPS vendors specializing in high-efficiency power modules, lithium-ion retrofits, and AI-enabled monitoring solutions | Expands client visibility into innovative suppliers, facilitates technology partnerships, and supports adoption of next-generation UPS architectures |

RECENT DEVELOPMENTS

- September 2025 : AVAIO Digital Partners collaborated with Schneider Electric to deploy high-performance UPS systems as part of four AI-ready data center campuses across the US. The partnership focuses on Schneider’s modular three-phase UPS architecture designed to support high-density AI and cloud workloads with low latency and energy efficiency. These UPS systems integrate predictive maintenance, condition-based monitoring, and EcoDesign principles to ensure long-term reliability, reduced carbon footprint, and optimized power continuity for AI-intensive environments.

- June 2025 : Oklo and Vertiv partnered to co-develop advanced power and thermal management solutions for US hyperscale and colocation data centers. The partnership leverages Oklo’s advanced nuclear power plants and Vertiv’s cooling and power systems to enhance energy efficiency, provide resilient AI and high-performance computing power, and produce end-to-end reference designs for integrated, sustainable data center operations.

- June 2025 : ABB partnered with Applied Digital to deliver AI-ready electrical infrastructure at a 400 MW greenfield data center campus in North Dakota. The collaboration implements ABB’s HiPerGuard Medium Voltage UPS to increase power density, reduce electrical plant footprint, and improve energy efficiency. The project covers the complete design, development, and optimization of the site’s electrical infrastructure to support advanced AI workloads.

- June 2025 : Sol Distribution announced the addition of Legrand’s uninterruptible power supply (UPS) solutions to its power infrastructure portfolio. The partnership enables Sol’s channel partners, including MSPs and VARs, to access Legrand’s scalable UPS technology to enhance power resilience and uptime for hybrid work, edge computing, and critical IT environments.

- June 2025 : Eaton launched its next-generation 9PX Gen2 UPS (5–11 kVA) and partnered with Fengsheng Electric as an authorized distributor for single-phase UPS solutions in Singapore. The partnership enhances Eaton’s local market access and supports critical infrastructure across residential, commercial, and industrial sectors. The 9PX Gen2 UPS features advanced silicon carbide components for superior efficiency, a compact design, and reliable power continuity, addressing the growing demands of edge and IT infrastructure in energy-intensive environments.

- January 2025 : Delta Electronics completed the second phase of the Westerscheldetunnel project, supplying IPT 50 kVA online double-conversion UPS units to enhance critical power infrastructure. The systems’ inverter-integrated isolation transformers, 10-inch waterproof touch panels, and compact design improved operational efficiency, space utilization, and system safety, guaranteeing continuous power for essential tunnel functions such as lighting, ventilation, and signaling.

Table of Contents

Methodology

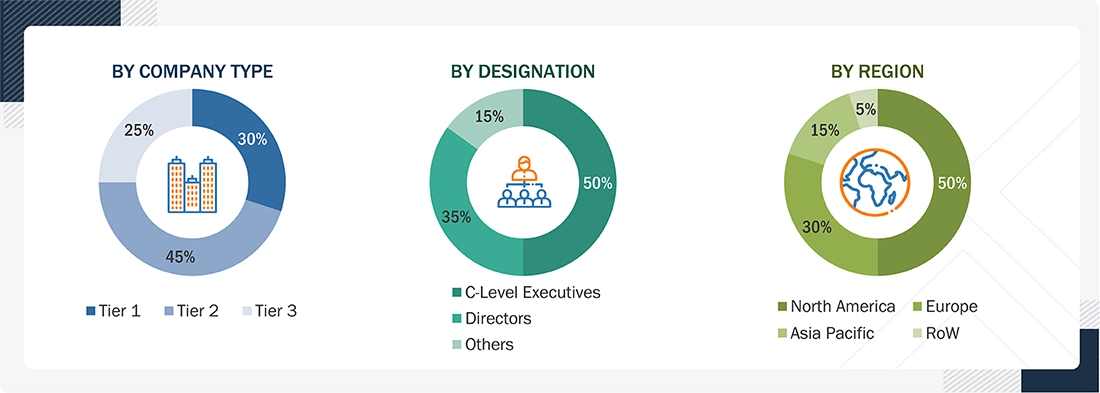

This research study on the data center UPS market involved extensive secondary sources, including directories, IEEE Communication-Efficient: Algorithms and Systems, and the International Journal of Innovation and Technology Management, as well as paid databases. Primary sources were mainly industry experts from core and related industries, preferred data center UPS providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to gather and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the data center UPS spending of various countries was extracted from the respective sources.

Primary Research

PIn the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors specializing in business development, marketing, and data center UPS services. It also included key executives from data center UPS vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and

10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion. Other designations include sales, marketing, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

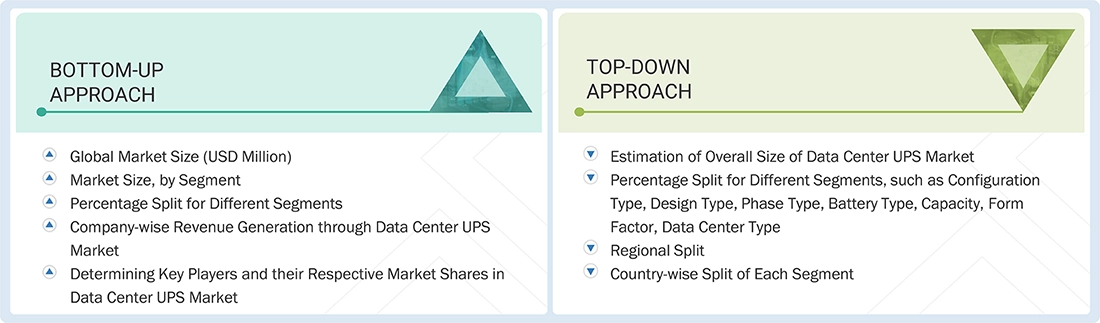

Multiple approaches were adopted to estimate and forecast the data center UPS market. The first approach involved estimating the market size by companies’ revenue generated through the sale of data center UPS products.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the data center UPS market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach identified the adoption rate of data center UPS products across different verticals in key countries, considering the regions that contribute the most to the market share. For cross-validation, the adoption of data center UPS products among enterprises and other use cases for their regions was identified and extrapolated. Use cases identified in different areas were weighed for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the data center UPS market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major data center UPS service providers, and organic and inorganic business development activities of regional and global players were estimated.

Data Center UPS Market : Top-Down and Bottom-Up Approach

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the data center UPS market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major data center UPS service providers, and organic and inorganic business development activities of regional and global players were estimated.

Market Definition

According to MarketsandMarkets, data center uninterruptible power supply (UPS) comprises systems designed to provide reliable, instantaneous, and conditioned power backup to mission-critical IT and facility infrastructure within data centers. These systems ensure power continuity, protect sensitive equipment from voltage fluctuations and power disturbances, and minimize downtime during utility failures. The market includes various UPS configurations, design types, battery technologies, and capacities deployed across hyperscale, colocation, and enterprise data centers to support uninterrupted digital operations.

Eaton defines an uninterruptible power supply (UPS) as “an electrical device that provides emergency power to connected equipment when the main power source (typically utility power) fails. It conditions incoming power to ensure clean and uninterrupted power, protects devices from power problems, and enables seamless system shutdown during complete outages.” With aging electrical grids, increasing power demand, and growing data center dependency on continuous uptime, UPS systems have become a critical investment to prevent operational disruption, equipment damage, and data loss.

Stakeholders

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Software providers

- System integrators

- Network service providers

- Consulting service providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Colocation providers

- Enterprises

- Government and standardization bodies

- Telecom operators

- Healthcare organizations

Report Objectives

- To define, describe, and forecast the data center UPS market based on configuration type (online double conversion, line-interactive, offline/standby/battery backup), design type (modular UPS, conventional (monolithic) UPS), phase type (single-phase, three-phase), battery type (lead-acid batteries, lithium-ion batteries, nickel-cadmium batteries), capacity (up to 50 kVA, 51-200 kVA, 201-500 kVA, 501-1,000 kVA, 1,001-2,000 kVA, above 2,000 kVA), form factor (rack-mounted UPS, freestanding UPS), data center type (hyperscalers & cloud data centers, colocation data centers, enterprise data centers (BFSI, healthcare & life sciences, energy & utilities, manufacturing, IT & telecom, media & entertainment, government & public sector, retail & e-commerce, transportation & logistics, and other enterprise data centers (education and media & entertainment)).

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market.

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market.

- To analyze industry trends, patents and innovations, and pricing data related to the market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To analyze the impact of AI/generative AI on the market.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches, and partnerships & collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American data center UPS market

- Further breakup of the European data center UPS market

- Further breakup of the Asia Pacific data center UPS market

- Further breakup of the Middle East & Africa data center UPS market

- Further breakup of the Latin American data center UPS market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center UPS Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center UPS Market