Data Protection as a Service Market

Data Protection as a Service Market by Service Type (Backup as a Service, Storage as a Service, Disaster Recovery as a Service, Data Archiving, Other Services), Deployment mode, Organization Size, Vertical and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Data Protection-as-a-Service (DPaaS) market is projected to reach USD 26.04 billion by 2024 from USD 74.91 billion in 2030, at a CAGR of 19.3% from 2024 to 2030. Increasing cyber threats, including ransomware, phishing, and data breaches, are encouraging organizations to adopt reliable and scalable data protection solutions to safeguard critical information and maintain business continuity.

KEY TAKEAWAYS

-

By RegionThe North America DPaaS market accounted for 33.8% revenue share in 2024.

-

By Service TypeBy service type, the Disaster Recovery-as-a-Service (DRaaS) segment is expected to register the highest CAGR of 21.7%.

-

By Deployment ModeBy deployment mode, the hybrid cloud segment is projected to grow at the fastest rate from 2024 to 2030.

-

By Organization SizeBy organization size, the large enterprises segment is expected to dominate the market, in terms of market share.

-

By VerticalBy vertical, the healthcare segment will grow the fastest during the forecast period.

-

Competitive LandscapeAWS, IBM, and Microsoft were identified as some of the star players in the DPaaS market (global), given their strong market share and product footprint.

-

Competitive LandscapeTierPoint, Cloudian, and NxtGen Datacenter & Cloud Technolgies, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The growing reliance on cloud-based infrastructures and hybrid IT environments is intensifying the need for flexible, cost-efficient, and automated data protection models. Organizations are prioritizing solutions that offer rapid recovery, immutable backups, and seamless scalability to address evolving security risks. This shift is further supported by regulatory compliance demands, urging enterprises to implement advanced DPaaS platforms that ensure robust data governance, resilience, and long-term operational stability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The evolving data protection landscape is reshaping how organizations generate value, as shifting customer needs, emerging technologies, and new regulatory pressures drive a transition from traditional revenue sources to advanced, future-ready offerings. As enterprises increasingly adopt AI/ML, blockchain, cloud-native disaster recovery, and multi-cloud environments, service providers must innovate to support real-time backup, continuous data protection, and multi-layered security. This transformation is influencing not only direct clients, across BFSI, healthcare, government, and other sectors, but also their end customers, who now demand stronger data loss prevention, resilient cloud backup, AI-driven recovery, and scalable multi-cloud storage solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Maximizing cost efficiency with adoption of DPaaS

-

Surging cybersecurity threats

Level

-

Loss of data control

-

Vendor lock-in strategies restrict flexibility and increase long-term costs

Level

-

Increasing demand for business continuity and disaster recovery solutions

-

Integration of Al /ML and automation in data protection

Level

-

Lack of skilled professionals

-

Integration and security complexities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Maximizing cost efficiency with adoption of DPaaS.

Organizations are increasingly adopting Data Protection as a Service (DPaaS) to reduce capital expenditure associated with traditional on-premises backup infrastructure. DPaaS offers a subscription-driven, pay-as-you-grow model that eliminates hardware investments while optimizing storage utilization and automating backup processes. This cost efficiency is especially valuable for enterprises with expanding data volumes, enabling predictable spending, simplified management, and access to advanced protection capabilities without the burden of maintaining in-house systems.

Restraint:Loss of data control.

Despite its advantages, DPaaS raises concerns about reduced control over sensitive data, particularly when stored and managed by third-party cloud providers. Organizations in regulated industries may struggle with visibility into where data is stored, how it is handled, and who has access. This perceived loss of direct oversight can create hesitation in adoption, as enterprises must rely heavily on vendor security practices, compliance adherence, and transparency to ensure data sovereignty.

Opportunity: Increasing demand for business continuity and disaster recovery solutions.

The growing frequency of cyberattacks, natural disasters, and unexpected system failures is driving organizations to seek robust business continuity and disaster recovery capabilities. DPaaS solutions offer automated failover, rapid restoration, and multi-region redundancy, making them an attractive option for minimizing downtime and data loss. As enterprises prioritize resilience and uninterrupted operations, demand for scalable, cloud-enabled recovery solutions is expected to accelerate significantly.

Challenge: Integration and security complexities.

Migrating to DPaaS can introduce integration challenges, especially for organizations operating hybrid or multi-cloud environments with diverse legacy systems. Ensuring compatibility across platforms, maintaining consistent backup policies, and securing data in transit and at rest require significant planning and expertise. Additionally, managing encryption, identity access, and compliance frameworks adds complexity. These factors can delay deployment and increase operational burdens if not addressed with strong architecture and vendor support.

DATA PROTECTION AS A SERVICE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

-market-cloudian.svg) |

Legacy storage scalability, data-security gaps, high costs, and need for agile S3-compatible object storage for petabyte-scale data management. | Improved scalability, cost-efficient object storage, robust cross-site data protection, simplified self-managed storage, enhanced customer satisfaction, and reduced operational overhead. |

-market-stonefly.svg) |

Outdated DR infrastructure, high-cost proprietary solutions, Veeam incompatibility, and need for secure, tiered storage with robust data protection. | Air-gapped immutable backups, efficient hot/cold tiered storage, seamless cloud/on-prem data transfer, reduced CapEx, and high ROI through optimized per-TB pricing. |

-market-druva.svg) |

Manual, error-prone backup processes, limited scalability, high operational effort, and strict financial-sector compliance requirements. | Automated backups, reduced manual overhead, improved regulatory compliance, enhanced data durability, multi-region resilience, end-user restore autonomy, and scalable data management. |

-market-cohesity.svg) |

High ransomware risk, need for enterprise-wide data protection, compliance requirements, and vulnerability reduction across 47 global sites. | Lower ransomware exposure with immutable storage, stronger cyber resiliency with robust BDR, simplified data integration via Cohesity Gaia, and improved compliance across subsidiaries. |

-market-hycu.svg) |

Inefficient, time-consuming legacy backups, multi-cloud expansion issues, high storage-array complexity, and need for seamless Nutanix integration with cost-effective scalability. | Simplified Azure-based cloud backups without extra appliances, faster backup operations, and enhanced client experience through personalized HYCU support. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The DPaaS market ecosystem comprises a diverse set of providers delivering cloud-based backup, disaster recovery, and storage services tailored to modern enterprise needs. Leading vendors across BaaS, DRaaS, and STaaS segments offer scalable, secure, and cost-efficient solutions that help organizations safeguard critical data, ensure business continuity, and address growing cyber risks. This ecosystem enables seamless data protection across hybrid and multi-cloud environments, supporting enterprises’ digital transformation initiatives.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DPaaS Market, By Service Type

Storage as a Service (STaaS) represents the largest service type segment of the DPaaS market due to rising enterprise demand for scalable, flexible, and cost-efficient cloud storage solutions. As data volumes surge across industries, STaaS enables organizations to eliminate capital investments in physical storage infrastructure while benefiting from on-demand capacity, automated data tiering, and enhanced accessibility. Its ability to support diverse workloads, multi-cloud environments, and robust data durability makes it the preferred choice for modern data protection strategies.

DPaaS Market, By Deployment Mode

In 2024, the public cloud is the largest deployment segment in the DPaaS market as enterprises increasingly shift toward cloud-first strategies for data protection, backup, and recovery. Public cloud platforms offer unmatched scalability, global availability zones, automated management, and lower upfront costs compared to private deployments. Their built-in redundancy, strong SLAs, and integration with advanced security capabilities attract organizations seeking agile and resilient data protection. Additionally, simplified provisioning and pay-as-you-go pricing drive widespread adoption across industries.

DPaaS Market, By Organization Size

Large enterprises dominate DPaaS adoption due to their massive data footprints, complex IT environments, and stringent compliance requirements. These organizations prioritize advanced, automated, and scalable data protection solutions capable of handling multi-region operations and mission-critical workloads. DPaaS equips large enterprises with unified management, strong ransomware resilience, predictable operational costs, and seamless integration across hybrid and multi-cloud ecosystems. Their growing focus on modernization and cyber resilience continues to make them the highest-adopting customer group.

DPaaS Market, By Vertical

The IT & ITeS sector leads the DPaaS market as this vertical manages high data volumes, continuous service delivery, and globally distributed operations requiring robust data protection. Companies in this segment rely heavily on cloud-native infrastructures, multi-cloud architectures, and rapid data provisioning, making DPaaS essential for ensuring uptime, compliance, and resilience. With increasing reliance on digital services and managed IT offerings, IT & ITeS firms prioritize DPaaS to achieve secure, scalable, and automated protection for diverse client workloads.

REGION

Asia Pacific to be fastest-growing region in global DPaaS market during forecast period

Asia Pacific is the fastest growing region in the DPaaS market driven by rapid cloud adoption, expanding digital ecosystems, and rising awareness of cybersecurity threats. Enterprises across sectors are accelerating investments in data protection to support modernization, migrations to hybrid cloud, and compliance with evolving regional regulations. Government-backed cybersecurity initiatives and increasing ransomware incidents fuel demand for advanced backup, disaster recovery, and storage services. The region’s strong economic growth and digital transformation are expected to sustain this momentum.

DATA PROTECTION AS A SERVICE MARKET: COMPANY EVALUATION MATRIX

In the DPaaS market matrix, AWS (Star) leads with its expansive cloud-native backup, storage, and disaster recovery ecosystem, offering unmatched scalability and global resilience. Veeam (Emerging Leader) is gaining traction with its robust hybrid-cloud backup capabilities, ransomware-proof immutability, and broad workload support. While AWS dominates through scale and service depth, Veeam shows strong growth potential as demand for flexible, cloud-agnostic data protection rises.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- AWS (US)

- Microsoft (US)

- IBM (US)

- Oracle (US)

- Dell Technologies (US)

- Quantum Corporation (US)

- Huawei (China)

- HPE (US)

- VERITAS (US)

- Hitachi Vantara (US)

- Veeam (US)

- Cohesity (US)

- 11:11 Systems (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 21.90 Billion |

| Market Forecast in 2030 (Value) | USD 74.91 Billion |

| Growth Rate | CAGR of 19.3% from 2024-2030 |

| Years Considered | 2018–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: DATA PROTECTION AS A SERVICE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Matrix offering an in-depth comparison of each vendor’s DPaaS capabilities, covering backup as a service (BaaS), disaster recovery as a service (DRaaS), and storage as a service (STaaS), along with immutability features, ransomware protection, cloud-native integration, multi-cloud support, automation levels, and scalability. | Clear understanding of competitive positioning, solution differentiation, and technology strengths to guide product strategy, cloud modernization, and investment decisions. |

| Leading Service Provider (EU) | Detailed profiling and evaluation of additional DPaaS providers (up to 5), covering service models, deployment modes, data security capabilities, integration with public cloud platforms, compliance readiness, vertical focus, and strategic initiatives supporting data protection across enterprise and SMB segments. | Comprehensive view of the DPaaS landscape, highlighting growth opportunities, emerging cyber resilience needs, and potential areas for partnerships, service expansion, or integrated cloud data protection adoption. |

RECENT DEVELOPMENTS

- October 2024 : Quantum partnered with Veeam to develop advanced solutions for accelerated ransomware recovery, ensuring data security and business continuity.

- September 2024 : Dell enhanced its Apex Cyber Recovery Services to provide faster and more secure ransomware recovery. The upgraded service was expected to leverage Al and ML to minimize downtime and protect critical data from sophisticated cyber threats.

- September 2024 : Commvault acquired Clumio, a technology innovator in AWS cloud data protection. This strategic move was expected to allow Commvault to enhance its cyber resilience offerings for next-generation AWS applications. Clumio's groundbreaking innovations, such as near-instant Amazon S3 data access for time-critical recovery, are used by notable customers. This acquisition intended to address the growing reliance on Amazon S3 for cloud storage and Al development.

- April 2024 : Arrow Electronics expanded its managed services with Arrow Cloud Object Storage for Backup built on IBM Cloud. It offers scalable, secure, and user-friendly data backup solutions for EMEA.

- March 2022 : IBM and Cohesity collaborated to launch IBM Storage Defender, combining data protection and cyber resilience solutions for hybrid cloud environments, enhancing data security and recovery.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

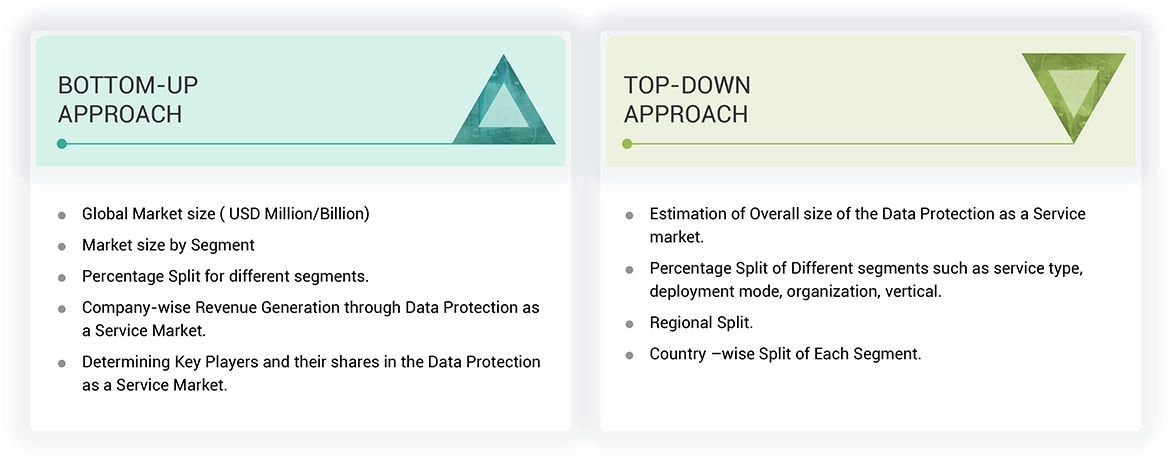

Secondary research was conducted to collect information useful for this technical, market-oriented, and commercial study of the global DPaaS market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the DPaaS market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included DPaaS news, DPaaS foundations, annual reports, press releases, investor presentations of DPaaS vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

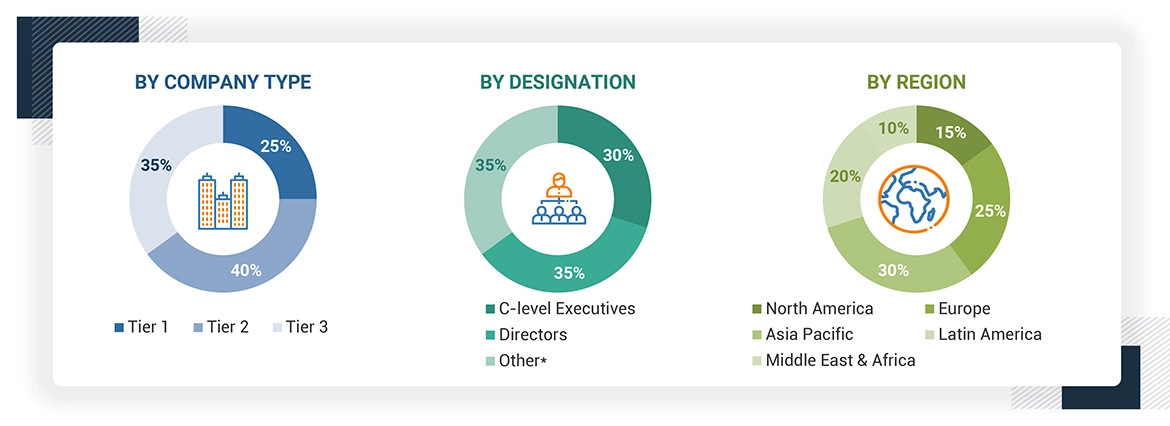

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the DPaaS market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing DPaaS solutions, tools and applications, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of data protection services, tools, and applications offered by several market vendors, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the bottom-up and top-down approaches and several data triangulation methods were extensively used to estimate and forecast the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other levels include sales, marketing, and product managers.

Tier 1 companies receive revenues higher than USD 10 billion; Tier 2 companies' revenues range between USD 1 and 10 billion; and Tier 3 companies'

revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts and MarketandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the DPaaS market's size and various other dependent sub-segments in the overall DPaaS market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data protection as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Data Protection as a Service (DPaaS) is a cloud-based model that provides organizations with comprehensive data protection solutions, including data backup, recovery, and disaster recovery services. It centralizes and automates data security, ensuring information is safeguarded against loss or breaches. DPaaS offers scalable, cost-effective protection without requiring extensive on-premise infrastructure, allowing businesses to maintain compliance and enhance operational resilience.

Stakeholders

- Chief Technology and Data Officers

- Data protection Service Professionals

- Business Analysts

- Information Technology (IT) Professionals

- Investors and Venture Capitalists

- Third-party Providers

- Consultants/Consultancies/Advisory Firms

- Product Designers/Computer-aided Software Engineers

- System Integrators

- Value-added Resellers (VARs)

Report Objectives

- To describe and forecast the global DPaaS market based on service type, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five regions: North America, Europe, Middle East & Africa, Asia Pacific and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies

- To track and analyze competitive developments such as product enhancements and new product launches, acquisitions, and partnerships and collaborations in the market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributes to the rest of the regional market size.

- Further breakup of the North American market into countries contributes to the rest of the regional market size.

- Further breakup of the Latin American market into countries contributes to the rest of the regional market size.

- Further breakup of the Middle East & African market into countries contributing to the rest of the regional market size

- Further breakup of the European market into countries contributes to the rest of the regional market size.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Protection as a Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Protection as a Service Market