Decorative Foils Market

Decorative Foils Market by Product Type (PVC Foils, Polyester Foils, Paper-based Foils), Application (Cabinets, Furniture, Flooring, Wall Panels, Counter Tops), End User (Residential, Non-residential, Transportation), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Decorative Foils market is projected to reach USD 3.29 billion by 2030 from USD 2.59 billion in 2025, at a CAGR of 4.8% from 2025 to 2030. The market for decorative foils is substantially expanding due to several factors including growth in construction and renovation activities and increasing demand for aesthetic enhancements and personalization. The product type segment is majorly contributing to the market in a positive way because due to high demand for cost-effective and sustainable surface solutions.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe Decorative Foils market includes PVC foils, polyester foils, paper-based foils. PVC foils, valued for their flexibility and durability in furniture wrapping; polyester foils, prized for their high– gloss finishes and color stability; and paper–based foils, which are lightweight and cost–effective options for surfaces requiring intricate patterns or smooth finishes.

-

BY APPLICATIONDecorative foils are widely used in cabinetry, furniture, flooring, wall panels, countertops, interior doors, picture frames, and moldings—offering an efficient alternative to natural materials like wood, stone, and metal.

-

BY END USERThe end user segment of the decorative foils market is broadly categorized into residential, non– residential, and transportation sectors. In the residential sector, decorative foils are extensively used in furniture, cabinetry, wall panels, and flooring to deliver stylish, durable, and cost–effective interior solutions.

-

BY REGIONThe decorative foils market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to grow fastest, with a CAGR of 5.4%, driven by rapid urbanization, particularly in countries such as China, India, and Southeast Asia

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Toppan Holdings Inc , Schattdecor , SURTECO GmbH, Taghleef Industries, and Kronoplus Limited . These companies are advancing manufacturing technologies and broadening end-use adoption, reflecting the growing demand for sustainable and cost-effective solutions.

The decorative foils market is driven by growing construction and renovation activities, rising disposable incomes, and rapid urbanization, especially in emerging regions like Asia Pacific. Technological advancements such as digital printing enhance design flexibility and product customization, boosting demand across residential, commercial, and automotive sectors

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of decorative foils suppliers, which, in turn, impacts the revenues of decorative foil manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in construction and renovation activities

-

Increasing Demand for Aesthetic Enhancements and Personalization

Level

-

Volatility in raw material prices

-

Availability of alternative solutions

Level

-

Advancements in Printing and Surface Customization Technologies

-

Growing Applications in Automotive And Consumer Electronics Sector

Level

-

Durability and Performance in Challenging Environments

-

Difficulty Replicating Natural Textures and Achieving Premium Visual Quality

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in construction and renovation activities

The decorative foils market has experienced tremendous growth, largely as a result of growth in construction and renovation across the globe. As urbanization increases and cities become more densely populated, the demand for new residential and commercial spaces becomes increasingly prevalent. This is particularly true in rapidly developing areas such as Asia Pacific and Latin America. The growth in infrastructure continues to support the need for new, cost-effective, and visually attractive elements, which decorative foils certainly can be. With their inherent flexibility in terms of finishes, aesthetic and texture, decorative foils are relatively inexpensive compared to wood, natural stone or metal surfaces.

Restraint: Volatility in raw material prices

The volatility of raw material prices is a major restraint on the decorative foils market, influencing production costs and the profitability of manufacturers. The primary raw materials for decorative foils include aluminum, PVC resin, PET film, and specialized coatings. These raw material prices are subject to fluctuations based on global supply chain management, geopolitical issues, energy cost fluctuations, shortages, and increased demand.

Opportunity: Advancements in printing and surface

Technological advances in printing and surface finish customization are opening considerable opportunities for the decorative foils market - greater flexibility in designs, improved cost-effectiveness, and increased personalization. The introduction of digital printing and digital hot foil printing has transformed the decorative printing industry - digital hot foil printers can now produce complex, saturated, and high-quality designs on foil substrates without the previous limitations of plate registration with pre-printed foil and paint or lacquer coatings.

Challenge: Durability and performance in challenging environment

The decorative foils market has a real opportunity to leverage enhanced durability and performance in extreme conditions, creating broader opportunities for the decorative foils to be used in more utilitarian situations that require resistance to abrasion, chemicals, moisture, or extreme conditions. The high-quality decorative foils are now being manufactured with advanced formulations that incorporate resistance to scratching, abrasion, and impacts - allowing for use in institutional and commercial environments such as commercial interiors, furniture, hospitality, and, to a lesser extent, marine and industrial environments.

Decorative Foils Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Decorative foils laminated onto desk’s work surface | Visually stunning desk with a woodgrain finish that rivalled natural wood, at a fraction of cost |

|

Foils used on office desk panels and cabinetry | Anti-fingerprint foils reduce cleaning time by 25% in high-traffic offices |

|

Decorative foils used on shelving surfaces and edges | Decorative foils reduce material costs by 25% compared to wood veneers, keeping products affordable |

|

Decorative foils laminated on MDF (medium density fiberboard) panels for corporate offices | Anit-fingerprint coatings on decorative foils reduce cleaning time by 30% in office environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The decorative foils ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The value chain of decorative foils starts with raw material suppliers who provide the key chemical compounds necessary for manufacturing various decorative foils. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Decorative Foils Market, by Product Type

PVC foils account for the largest market share, by product type, in the decorative foils market. The variety of different types of foils that can be used in decorative coverings, PVC foils represent the largest market share in decorative foils because they are the most cost-effective, functional, and have many uses. PVC (polyvinyl chloride) brings forth the largest market share for one simple reason - the aesthetic look with many available finishes, including wood grain finishes, metallic textures, and various products offering enough color and texture for all design needs. They provide excellent aesthetics at a reasonable price point.

Decorative Foils Market, by Application

The furniture segment held the largest share in 2024. Sustainability and eco–friendliness are increasingly influencing material choices, with many decorative laminates now produced using recycled content and low–VOC resins. As a result, decorative foils and laminates have become indispensable for creating stylish, durable, and sustainable furniture solutions in both residential and commercial interiors, meeting the evolving demands for performance, hygiene, and design sophistication.

Decorative Foils Market, by End User

The residential is the fastest-growing end-use industry in the decorative foils market. The fastest-growing end-use sector in the decorative foils market is the residential sector for many reasons. The rapidly urbanizing populations and increases in disposable incomes in developing economies such as Asia Pacific and Latin America have created a demand for new housing and home renovation projects. Moreover, decorative foils are becoming increasingly popular with homebuilders and renovators for various characteristics, including cost-effectiveness, durability, and design versatility compared to natural materials (wood, for example) and stone.

REGION

Asia Pacific to be fastest-growing region in global Decorative Foils market during forecast period

Rapid urbanization and increasing disposable income in the developing economies of Vietnam, Indonesia, and the Philippines are generating high demands for new residential and commercial development. This boom in development also creates areas for decorative foil use in interiors, backed by strong government programs and sustainable building regulations. The decorative foils market is economic, multi-use, and visually appealing finishing material that is highly sought as an alternative to traditional surfaces. Technological advances in production such as digital printing and automation, empower manufacturers to increase efficiency and modify process for better customization, which fits the varied tastes of the consumer in the region.

Decorative Foils Market: COMPANY EVALUATION MATRIX

In the decorative foils market matrix, SURTECO GmbH, is one of the leading global suppliers of decorative surface solutions, specializing in decor papers, finish foils, melamine edgebandings, and thermoplastic films for the furniture, flooring, and wood– based panel industries. Ahlstrom is gaining traction with Ahlstrom’s Spantex decorative foils, designed for furniture and cupboards, offer exceptional dimensional stability and moisture tolerance, making them ideal for high–pressure and low–pressure laminates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.48 Billion |

| Market Forecast in 2030 (value) | USD 3.29 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Mn Sq. Mtr.) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Decorative Foils Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Decorative Foils Manufacturers |

|

|

| Furniture Manufacturers |

|

|

| Decorative Foil Distributors |

|

|

| Raw Material Suppliers |

|

|

RECENT DEVELOPMENTS

- October 2024 : Felix Schoeller has begun offering its full range of premium specialty paper services directly to customers in Turkey and the Middle East through a new service and consulting hub in Istanbul.

- March 2024 : Interprint GmbH announced to expanding its international footprint with the construction of its tenth production facility in Türkiye.

- February 2024 : Taghleef Industries is set to showcase its latest SynDECOR innovations at Interzum, offering sustainable, PVC-free decorative surfacing foils as eco-friendly alternatives to traditional non-recyclable laminates and vinyl-based foils.

- February 2023 : Surteco Group SE acquired Omnova's laminates, performance films, and coated fabrics divisions from Synthomer.

- December 2022 : Felix Schoeller expanded its paper machine capacity in Drummondville, Canada, from 32,000 tons to over 40,000 tons per year, which was completed in the fourth quarter of 2023.

Table of Contents

Methodology

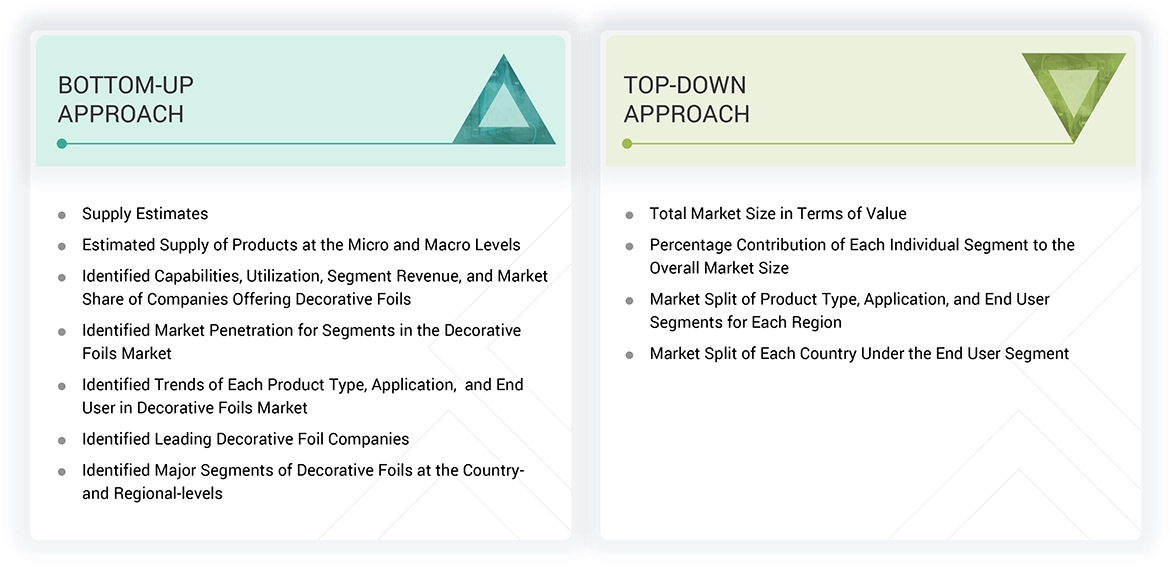

The study involved four major activities in estimating the market size of the decorative foils market. Exhaustive secondary research was conducted to gather information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Then, the market breakdown and data triangulation procedures were applied to estimate the size of segments and subsegments.

Secondary Research

Various sources were used to gather information for this study during the secondary research process. These sources include annual reports, press releases, investor presentations from companies, white papers, certified publications, trade directories, articles by recognized authors, gold and silver standard websites, and databases. This research helped collect key details about the industry’s value chain, market monetary flow, the pool of key players, market classification, and segmentation based on industry trends down to the regional level. It also provided insights into major developments from a market-focused perspective.

Primary Research

The decorative foils market includes several stakeholders in the value chain, such as manufacturers and end users. Various key sources from both the supply and demand sides of the decorative foils market have been interviewed to gather qualitative and quantitative information. On the demand side, primary interviewees include industry leaders and experts. On the supply side, primary sources consist of manufacturers, associations, and industry institutions involved in the decorative foils sector. These interviews provided insights into market statistics, revenue data, market segmentation, market size estimates, forecasts, and data validation. The research also helped identify trends related to product types, applications, end-users, and regions. Stakeholders from the demand side, including CIOs, CTOs, and CSOs, were interviewed to gain insights into the buyers’ perspectives on suppliers, products, current usage of decorative foils, and future business outlook, which influence the overall market.

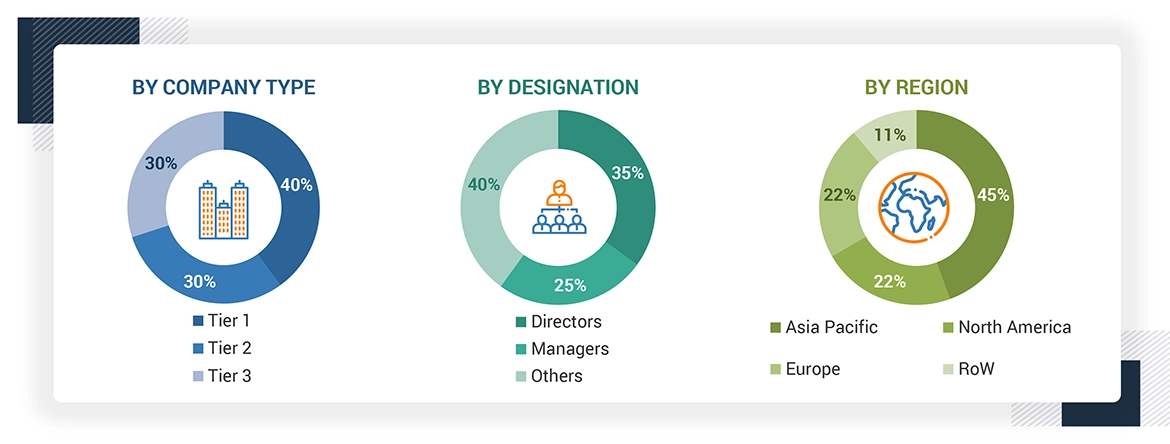

The breakdown of profiles of the primary interviewees is illustrated in the figure below.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the decorative foils market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain has been mapped through both primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All relevant parameters influencing the markets covered in this study have been considered, examined in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the analysis of reports, reviews, and newsletters of key market players, along with extensive interviews with leaders such as directors and marketing executives.

Data Triangulation

After estimating the total market size, the market was divided into several segments and sub-segments. Data triangulation and market breakdown methods were used wherever applicable to finalize the overall market analysis and obtain accurate data for all segments and sub-segments. The data was triangulated by examining various factors and trends from both demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches, along with primary interviews. For each data segment, three sources were used—top-down approach, bottom-up approach, and interviews with experts. The data was considered accurate when the values from the three sources matched.

Market Definition

The decorative foils market is a segment that manufactures and distributes thin, flexible sheets, usually made from PVC or PET materials, used to cover furniture, walls, doors, and other surfaces in a decorative way. Decorative foils mimic real and expensive materials such as wood, stone, and metal, offering a customizable, durable, and attractive covering for residential, commercial, automotive, and packaging applications at a much lower cost.

Stakeholders

- Senior management

- End user

- Finance/procurement department

- R&D department

- Manufacturers

- Raw material suppliers

Report Objectives

- To define, describe, and forecast the size of the decorative foils market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, application, end user, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the current size of the global decorative foils market?

The decorative foils market is projected to reach USD 3,291.0 million by 2030, up from USD 2,559.8 million in 2025, growing at a CAGR of 4.8% during the forecast period.

Who are the key players in the global decorative foils market?

Key players include Toppan Holdings Inc (Toppan Interamerica) (US), Schattdecor (Germany), SURTECO GmbH (Germany), Taghleef Industries (UAE), Kronoplus Limited (UK), Ahlstrom (Finland), Felix Schoeller (Germany), INTERPRINT GmbH (Germany), Impress Decor Inc (US), and Olon Industries Inc (Malta).

What are some of the drivers for market growth?

Growth in construction and renovation activities, increasing demand for aesthetic enhancements and personalization, and a focus on sustainability and eco-friendly trends are key market drivers.

What are the different product types used in decorative foils?

PVC, polyester, and paper-based foils are commonly used product types in the decorative foils market.

What are the major applications in the decorative foils market?

Cabinets, furniture, flooring, wall panels, and countertops are the major applications of decorative foils.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Decorative Foils Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Decorative Foils Market