Dental Anesthetics Market Size, Growth, Share & Trends Analysis

Dental Anesthetics Market by Drug Type (Lidocaine, Mepivacaine, Articaine, Bupivacaine, Mepivacaine, Prilocaine), Route of Administration (Topical, Injectable, Syringes, Needles), End User (Hospitals, Clinics, Others), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global dental anesthetics market is projected to reach USD 1.80 billion by 2030 from USD 1.48 billion in 2025, at a CAGR of 4.0%. The rising incidence of dental issues, such as periodontal diseases and dental caries worldwide, is one of the main factors propelling the market expansion for dental anesthetics. The market for dental anesthetics is estimated to grow substantially over the course of the forecast period due to the rise in dental tourism.

KEY TAKEAWAYS

-

BY DRUG TYPELidocaine accounted for the largest share of the dental anesthetics market by drug type due to its well-established clinical efficacy, rapid onset of action, and favorable safety profile. It is widely used as both an injectable and a topical anesthetic across a broad range of dental procedures.

-

BY ROUTE OF ADMINISTRATIONThe dental anesthetics market is segmented by route of administration into topical anesthetics, injectable anesthetics, and syringes & needles. Injectable anesthetics dominate due to their fast onset, reliability, and deep, long-lasting numbness, which are suitable for complex procedures. Their versatility across routine and surgical applications, along with customizable dosage and duration, contributes to their larger market share.

-

BY END USERThe demand for dental anesthetics is largely influenced by dental clinics. This is due to the increasing modernization of dental clinics and rising interest in cosmetic and restorative dental procedures.

-

BY REGIONThe dental anesthetics market covers Europe, North America, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries. Asia Pacific is projected to grow the fastest, at a CAGR of 4.8%, primarily driven by rising oral health awareness, expanding middle-class populations, and an increasing burden of dental caries and periodontal diseases.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. In December 2024, Septodont Holding (France) announced a strategic investment in Balanced Pharma, Inc. (US), a company developing next-generation dental anesthetics that retain standard cartridge format, safety, efficacy, and shelf life.

A blend of demographic, medical, and environmental factors is responsible for propelling the growth of the dental anesthetics market. One example is the increase in global dental conditions. Dental caries, periodontitis, and tooth extractions are some of the dental ailments typically seen due to unhealthy dietary habits, an aging population, and the constantly rising consumption of sugar-based products.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dental anesthetics market is undergoing a significant transformation, driven by advancements in anesthesia delivery technologies, evolving dental care models, rising dental disease prevalence, and changing patient expectations. While traditional revenue sources such as topical anesthetics, injectable anesthetics, syringes, and needles remain central, emerging trends like computer-controlled local anesthetic delivery systems, needle-free jet injectors, iontophoresis, pulsewave technology, intraosseous anesthesia systems, and vibration analgesia devices are reshaping the market landscape. These disruptions are creating new high-growth opportunities and applications for manufacturers, while also influencing the end-user profile across hospitals & dental clinics, dental support organizations, and other facilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in patient pool for dental treatments

-

Rise in demand for advanced cosmetic dental procedures

Level

-

Potential adverse effects

Level

-

Rise in number of DSOs and growing private equity investments

-

Growing dental tourism

Level

-

Dearth of trained dental practitioners

-

Needle phobia

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in patient pool for dental treatments

The growing number of people undergoing dental procedures, which is being driven by the incidence of oral diseases, aging populations, and greater tooth loss, is one of the primary reasons driving the dental anesthetics market. Of the 3.5 billion persons with oral health problems, the WHO estimates that 2.4 billion have cavities that have not been addressed. Smoking, eating too much sugar, not practicing good oral hygiene, and drinking alcohol are some of the factors that contribute to the decline of dental health. Lack of access to preventive care exacerbates the issue, particularly in disadvantaged communities. Growing patient awareness, improved healthcare infrastructure, expansion of dental clinics, and technical advancements in needle-free anesthetics delivery have made dental procedures requiring local anesthetics more popular.

Restraint: Potential side effects

The potential for side effects is a major obstacle to the dental anesthetics market's growth. Patients and medical professionals are worried about possible side effects such as allergic responses, systemic toxicity, and nerve damage, even though local anesthesia is normally safe. The negative effects include anomalies of the eyes, neurological impairment (such as persistent paresthesia), and rare cardiovascular problems (such as isolated atrial fibrillation). Ocular abnormalities, neurological impairment (like chronic paresthesia), and uncommon cardiovascular issues (like isolated atrial fibrillation) are also among the side effects. Nerve injuries are uncommon, but they can result in long-lasting sensory impairments that undermine a patient's confidence. Allergic responses to medications such as lidocaine and articaine have been documented; these reactions can sometimes have severe repercussions. Additionally, procedural issues such as incorrect technique, overdosage, and needle breakage enhance the likelihood of complications. Collectively, these safety issues prevent broader market adoption by discouraging patients from accepting dental procedures, exposing products to more stringent regulatory scrutiny.

Opportunity: Increase in demand across emerging countries

Large patient populations, rising middle-class incomes, and rising knowledge of dental treatment in emerging economies like China, India, and Mexico are expected to increase demand for dental anesthetics significantly. Dental tourism is flourishing in Brazil and Mexico due to their reasonably priced dental care. The rising geriatric population in these countries also offers a major opportunity for growth in dental anesthetics. China's old population is predicted to reach 402 million by 2040, while India's is predicted to grow from 153 million in 2024 to 347 million by 2050. So, Global population ageing is a sign of a broader trend that makes dental care more important in emerging countries.

Challenge: Dearth of trained dental practitioners

According to the National Health Resources and Services Administration (HRSA), almost 59 million people are affected by the 6,888 designated dental health professional shortage areas (HPSAs) as of 2024. Also, an extra 10,093 dentists would be required in the US to address these shortages. A similar problem of dental health professionals in short supply is found in many parts of the world, including Africa, Asia, and Latin America. According to a 2023 World Health Organisation (WHO) study, Africa had just 3.3 dentists per 100,000 people between 2014 and 2019, which is roughly a tenth of the global average. Despite the high patient volume in these areas, the lack of dentists presents a serious obstacle to the uptake of dental equipment, including dental anesthetics.

dental anesthetics market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Septoject dental needles designed for atraumatic and precise anesthetic delivery in routine dental procedures | Minimize tissue trauma, improve injection comfort, reduce risk of needle breakage, enhance accuracy of anesthetic delivery, widely used across clinics globally |

|

Oraqix (lidocaine/prilocaine topical anesthetic gel) indicated for anesthesia in periodontal scaling and root planing | Needle-free anesthesia option, improves patient comfort, rapid onset of action, reduces fear of injections, enhances compliance in minimally invasive periodontal care |

|

Orabloc injectable articaine-based anesthetic used in routine and complex dental procedures | Provides strong and reliable anesthesia, rapid onset with extended duration, a favorable safety profile, widely accepted alternative to lidocaine in dental surgeries |

|

Injectable dental anesthetics (lidocaine, articaine formulations) for local anesthesia during various dental treatments | Cost-effective solutions ensure consistent efficacy, expanding global availability, a strong presence in emerging Asian markets, supports a broad range of procedures |

|

Ultracaine (articaine hydrochloride with epinephrine) injectable anesthetic for routine and surgical dentistry | High potency and fast onset, excellent diffusion in bone tissues, extended duration of action, suitable for complex extractions and surgical interventions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the dental anesthetics market includes manufacturers, distributors, research & product developers, and end users. Manufacturers include organizations involved in research, design, product development, optimization, and launch. Distributors include third parties and e-commerce sites linked to the organization for the marketing of dental products. Researchers & product developers include in-house research facilities, contract research organizations, and contract development & manufacturing organizations, which play an essential role in outsourcing research for product development. End users include dentists who use dental anesthetics. On the other hand, investors/funders and health regulatory bodies are the primary influencers in this market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dental Anesthetics Market, by Drug Type

Since articaine has several advantages over other drug types, it is projected to grow at the highest CAGR. Due to its thiophene ring, articaine enhances the lipid solubility and tissue penetration of dental anesthetics. Its ability to diffuse more effectively into both soft and hard tissues makes it especially useful for mandibular infiltrations, where other anesthetics are typically required for nerve blocks. As a result, dentists found the use of articaine better in regions with high bone density. Several studies have also demonstrated its safety profile when administered as prescribed, especially in patient demographics that include both geriatric and pediatric patients.

Dental Anesthetics Market, by Route of Administration

The market for dental anesthetics is divided into four segments based on the route of administration: topical anesthetics, injectable anesthetics, syringes, and needles. Among them, injectable anesthetics are set to record the largest share due to factors like fast onset, high reliability, precise targeting through nerve blocks, and improvements in injection techniques. They provide deep and longer-lasting numbness, which makes them increasingly useful for more complex dental procedures. Because of their versatility in a range of procedures, from simple fillings and deep cleanings to complex. surgeries, root canals, and implant placements, dentists and oral surgeons are using them more frequently. Additionally, because injectable anesthetics can be tailored for dosage, technique, and duration, they are very popular and hold a larger market share in the dental anesthetics industry.

Dental Anesthetics Market, by End User

For various reasons, dental clinics hold the largest market share for dental anesthetics among all end users. More dental clinics are adopting the use of advanced anesthetic systems to precisely handle difficult dental cases, including those requiring specialized solutions. Their ability to treat a large number of patients and their wide availability are further enhanced by the presence of qualified professionals who can deliver top-notch dental care. Also, due to their well-established reputation, patients prefer to receive their dental care at dental clinics. Their competitive advantage in the dental anesthetics market is further strengthened by their capacity to provide a range of services under one roof, including general dentistry and endodontic procedures.

REGION

Asia Pacific to be fastest-growing region in global dental anesthetics market during forecast period

Due to a number of variables, the dental anesthetics market in Asia Pacific is projected to grow at the highest rate. The need for tooth loss treatments is driven by an aging population, while governments are promoting oral health awareness and providing subsidies. Dental care is part of the burgeoning middle class, and rising incomes are driving up healthcare costs. Dental products like implants, dentures, and veneers are still incredibly underused in many Asian nations, which offers significant growth potential for dental anesthetics. Demand is also being increased by the rise in medical tourism to nations like South Korea, Thailand, and India, which provide affordable, high-quality dental care. Asia Pacific is positioned as a major growing market for dental anesthetics due to the region's changing healthcare landscape, as well as greater accessibility and awareness.

dental anesthetics market: COMPANY EVALUATION MATRIX

In the dental anesthetics market matrix, Septodont Holding (Star) leads with a dominant market share and a comprehensive product footprint, driven by its broad portfolio of local anesthetics, advanced formulations, and strong global distribution network. The company’s continuous innovation in safer, more effective anesthetic solutions and its established brand reputation among dental professionals reinforce its leadership position. DFL Indústria e Comércio S/A (Emerging Leader) is gaining traction with its expanding range of dental anesthetic products and growing presence in Latin America. Through focused innovation, competitive pricing, and increasing exports, DFL is steadily strengthening its global visibility. While Septodont maintains leadership through scale, trust, and diversified offerings, DFL demonstrates strong potential to advance toward the leaders’ quadrant as demand for cost-effective, high-quality dental anesthetics continues to accelerate in emerging markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.43 Billion |

| Market Forecast, 2030 (Value) | USD 1.80 Billion |

| Growth Rate | CAGR of 4.0% from 2025 to 2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, Latin America, Middle East & Africa, GCC Countries |

WHAT IS IN IT FOR YOU: dental anesthetics market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis |

|

Identify interconnections and potential supply chain blind spots within the dental ecosystem |

| Company Information |

|

Insights on revenue shifts toward emerging innovations |

| Geographic Analysis | Detailed analysis on Rest of Asia Pacific was provided to one of the top players | Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- May 2024 : Laboratorios Inibsa (Spain), part of Septodont (France), announced the launch of Prestoject dental syringes. These syringes were designed to be compatible with 1.8?mL dental cartridges and needles with metric threads.

- December 2024 : Septodont Holding (France) announced a strategic investment in Balanced Pharma, Inc. (US), a company developing next-generation dental anesthetics that retain standard cartridge format, safety, efficacy, and shelf life.

- October 2024 : Septodont Holding (France) acquired a 51% controlling stake in Laboratorios Inibsa (Spain), a Spain-based pharmaceutical group specializing in injectable anesthetics and dental products, with Acteon (France) joining as a non-controlling partner.

- August 2023 : Pierrel (Italy) acquired 3M's (US) Dental Local Anesthetic portfolio, including brands such as Ubistesin, Xylestesin, and Mepivastesin.

- April 2022 : Pierrel (Italy) launched the Orabloc Dental Needles in the US. They would be available in five types, each associated with specific anesthesia needs in the dental field.

Table of Contents

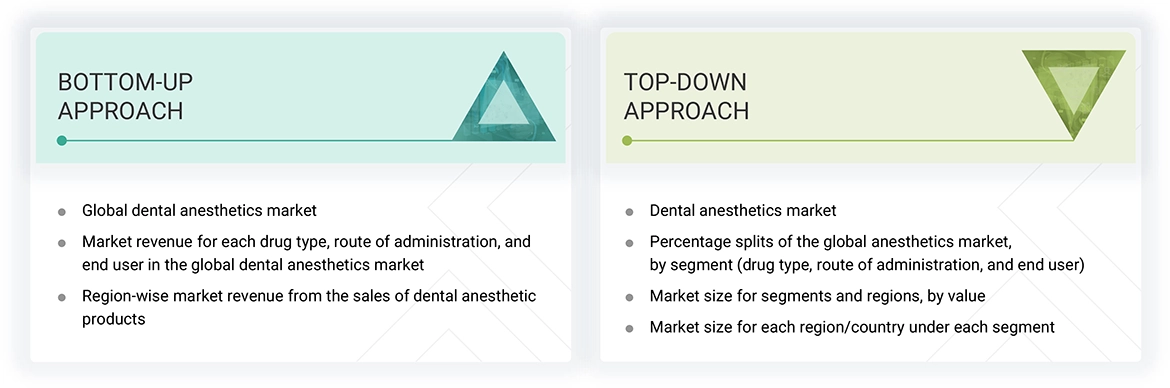

Methodology

The study comprised four main activities aimed at estimating the current size of the dental anesthetics market. First, comprehensive secondary research was conducted to gather information on the market, as well as related and parent markets. Next, the findings, assumptions, and estimations were validated through primary research with industry experts across the value chain. Both top-down and bottom-up approaches were employed to determine the overall market size. Finally, market breakdown and data triangulation were utilized to estimate the sizes of segments and subsegments within the market.

Secondary Research

In the secondary research process, various sources were utilized to gather information on the dental anesthetics market. These sources included annual reports, press releases, and investor presentations from companies, as well as white papers, certified publications, and articles by recognized authors. We also referred to reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva. This research helped us identify key players in the market and allowed us to classify and segment the data according to industry trends, down to the most detailed level. Additionally, we compiled a database of key industry leaders using the information obtained from our secondary research.

Primary Research

Extensive primary research was conducted after gathering information on the dental anesthetics market through secondary research. Several primary interviews were held with market experts from both the demand and supply sides across major regions, including North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC countries. Data was collected through questionnaires, emails, and telephone interviews.

Primary sources from the supply side included various industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), and Directors from business development, marketing, and product development/innovation teams. This also encompassed key executives from dental anesthetics manufacturers, distributors, and key opinion leaders.

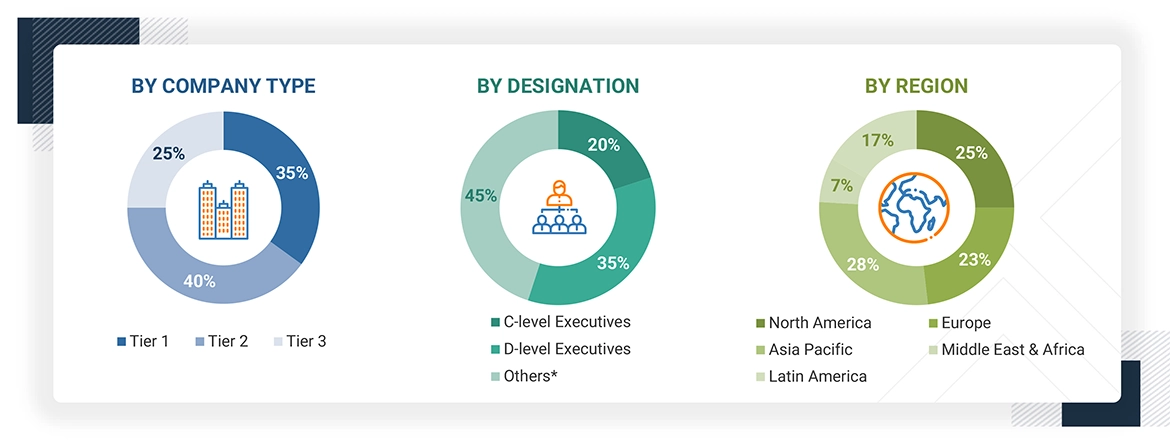

A breakdown of the primary respondents for the dental anesthetics market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 300 million, Tier 2 = USD 100 million to USD 300 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the dental anesthetics market includes the following details:

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the dental anesthetics market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall dental anesthetics market was obtained from secondary data and validated by primary participants to arrive at the total dental anesthetics market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

- Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

- Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental anesthetics market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Dental Anesthetics Market Size: Top-down and Bottom-up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Local dental anesthetics are medications that are injected directly into the area of the mouth where a dental procedure will be performed. They work by temporarily blocking nerve signals in that specific region, effectively numbing the site and preventing pain while the patient remains fully conscious. These anesthetics are primarily classified into two types based on their chemical structure: amides (such as lidocaine and articaine) and esters (such as benzocaine and procaine). They are mainly administered through two routes: injectable methods (infiltration or nerve block) and topical applications (gels, sprays, or ointments applied to the mucosa).

Stakeholders

- Dental Anesthetics Manufacturers

- Raw Material Suppliers for Dental Anesthetics

- Suppliers and Distributors of Dental Anesthetics Products

- Healthcare Service Providers

- Teaching Hospitals and Academic Medical Centers

- Government Bodies/Municipal Corporations

- Regulatory Bodies

- Medical Research Institutes

- Business Research and Consulting Service Providers

- Venture Capitalists

- Market Research and Consulting Firms

Report Objectives

- To describe, analyze, and forecast the dental anesthetics market by drug type, route of administration, end user, and region

- To describe and forecast the dental anesthetics market for key regions, such as North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the dental anesthetics market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile the key players and comprehensively analyze their market shares and core competencies in the dental anesthetics market

- To analyze competitive developments such as partnerships, collaborations, acquisitions, product launches, expansions, and R&D activities in the dental anesthetics market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Key Questions Addressed by the Report

Which are the top industry players in the global dental anesthetics market?

Septodont Holding (France), DENTSPLY SIRONA (US), Pierrel (Italy), Huons Global (South Korea), Normon (Spain), DFL Indústria e Comércio S/A (Brazil), Ultradent Products Inc. (US), Clarben Laboratories (Spain), New Stetic S.A (Colombia), and Primex Pharmaceuticals (Switzerland).

Which are the segments that have been included in this report?

By Drug Type, By Route of Administration, By End User, By Region

Which geographical region is dominating the dental anesthetics market?

Europe dominated the dental anesthetics market in 2024, followed by North America, Asia Pacific, Latin America, the Middle East & Africa, and the GCC countries.

Which is the leading segment in the dental anesthetics market, by drug type?

The lidocaine segment accounted for the largest share of the dental anesthetics market by drug type.

What is the CAGR of the global dental anesthetics market?

The global dental anesthetics market is projected to grow at a CAGR of 4.0% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental Anesthetics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dental Anesthetics Market