Supplement Testing Market

Supplement Testing Market by Test Type (Identity/Authentication, Potency, Contaminants, Microbiological, and Others), Product Tested (Ingredients and Finished Products), Technology, End-use, Service Provider, and Region – Global Forecast to 2030

OVERVIEW

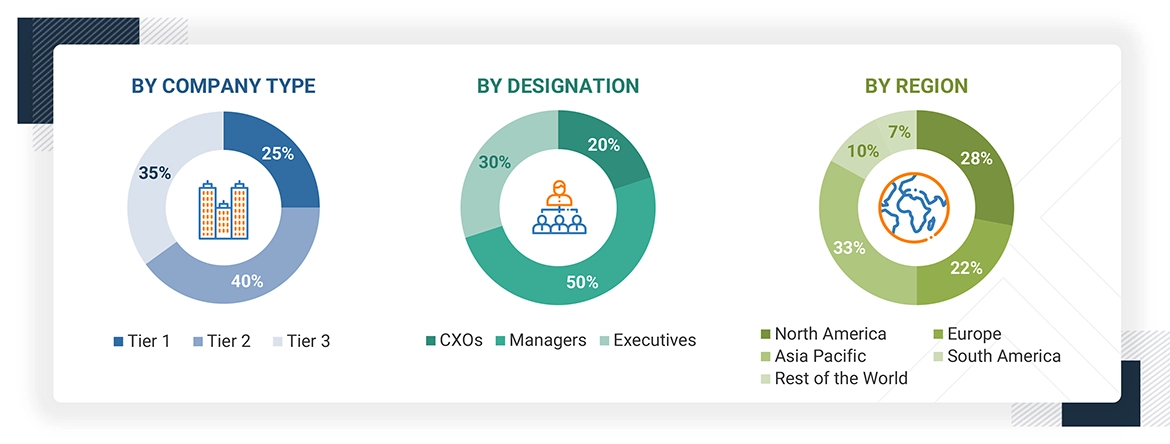

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The supplement testing market is projected to reach USD 3,652.2 million by 2030 from USD 2,400 million in 2025, at a CAGR of 8.8%. The growth is attributed to the increasing domestic market for supplement products that would need to comply with food safety norms and legislation.

KEY TAKEAWAYS

- North America is expected to account for a 35.7% share of the supplement testing market in 2025.

- By test type, the functional claims segment is expected to register the highest CAGR of 10.3%.

- By product tested, the ingredient-level testing segment is projected to grow at the fastest rate from 2025 to 2030.

- The technology segment is anticipated to lead the market, growing at a CAGR of 9.6%.

- Eurofins Scientific, SGS S.A., and Mérieux NutriSciences were identified as some of the star players in the supplement testing market, given their strong market share and service offerings.

- Anresco Laboratories, Beaconpoint Labs, and Twin Arbor Labs, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The supplement testing market is witnessing steady growth, driven by the implementation of stringent regulatory demands and increasing consumer concern about product safety and label accuracy. The globalization of the supplement supply chain allows contaminants, adulterants, or mislabeled products to enter markets rapidly from one country to another. Increased timelines for supply chains from sourcing ingredients to distribution of the final product can enhance the risk of potential contamination, degradation, or loss of potency due to time, temperature, and handling fluctuations. This is expected to increase the demand for intense quality control.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. There has been a growing trend toward natural products, and hence toward testing for natural or clean-label validation. Product claims are being paid attention to; supplement companies are investing in testing to offer valid certifications. There has been a significant rise in demand to supplement sports nutrition, testing for which has contributed to the disruption of the testing market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent regulations

-

Adulteration & contamination risks

Level

-

Limited testing standards for emerging ingredients

-

High cost of advanced testing methods

Level

-

Technological advancements in testing

-

Personalized nutrition trends

Level

-

Complexity of multi-ingredient formulations

-

Global supply chain risks and sample variability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent regulations

The global dietary supplements industry is governed by a complex web of regulatory frameworks aimed at ensuring product safety, efficacy, and transparency. Regulatory bodies such as the US Food and Drug Administration (FDA), European Food Safety Authority (EFSA), and agencies under Codex Alimentarius mandate strict guidelines for manufacturing, labelling, and claims.

Restraint: Limited testing standards for emerging ingredients

The rapid rise of novel dietary ingredients, such as adaptogenic botanicals, nootropics, postbiotic compounds, and fermented bioactives, has significantly outpaced the development of validated testing methods. As a result, many innovative ingredients lack standardized analytical protocols or reference materials, making it difficult for laboratories to ensure consistent safety and potency across different batches. Scientific literature highlights challenges in selecting appropriate Certified Reference Materials (CRMs) and Reference Materials (RMs) for supplement assays, with many ingredients missing fit-for-purpose standards essential for reproducible analysis.

Opportunity: Technological advancements in testing

The dietary supplement industry’s escalating complexity, spurred by multi-ingredient formulas, rising adulteration risks, and evolving consumer expectations, is driving the adoption of innovative testing methods that enable faster, more accurate, and more comprehensive quality assurance.

Challenge: Complexity of multi-ingredient formulations

As multi-ingredient dietary supplements, such as herbal blends and performance complexes, grow in popularity, testing laboratories face increasing analytical challenges. These complex formulations often contain multiple active compounds whose chemical interactions and overlapping properties can interfere with standard detection methods, making it difficult to accurately identify and quantify each ingredient.

Dietary Supplements Testing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In early 2023, SGS S.A. acquired a 60% majority stake in Nutrasource Pharmaceutical and Nutraceutical Services Inc., a Canada-based CRO with a US subsidiary. | By integrating Nutrasource’s specialized expertise, SGS S.A. strengthened its position as a comprehensive solutions provider in the supplement testing market. |

|

In July 2025, Mérieux NutriSciences finalized the acquisition of Bureau Veritas’ (France) food testing operations in Ecuador, integrating a 750 m² laboratory and more than 80 employees into its global network. | The acquisition strengthened Mérieux’s regional leadership, enabling it to better serve Ecuador’s export-driven food and dietary supplement industries with faster turnaround, enhanced compliance services, and broader analytical capabilities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map of the ecosystem is categorized into demand-side and supply-side companies. The supplement testing market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA. (Switzerland), Intertek Group plc (UK), Mérieux NutriSciences (US), UL Solutions (US), TÜV SÜD (Germany), ALS (Australia), and Tentamus (Italy) spearhead technological innovation and market penetration, while numerous smaller enterprises enhance the competitive landscape. The ecosystem includes testing service providers, regulatory bodies & associations, SMEs, and demand side companies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Supplement Testing Market, by Technology

Rapid testing service is projected to be the fastest-growing technology segment, offering faster turnaround times, high-throughput capabilities, and real-time monitoring that address the increasing demand for efficiency in supplement manufacturing and quality control. The combination of well-established traditional methods for accuracy and rapid testing for speed and flexibility ensures comprehensive coverage of dietary supplement quality, safety, and efficacy, enabling manufacturers to meet evolving regulatory requirements and consumer expectations.

Supplement Testing Market, by Test Type

Potency analysis leads the market for supplement testing because it guarantees that products have the same amounts of active ingredients as the labels state, satisfying both regulatory needs and consumer demand for effectiveness. Required by GMP and other international standards, it is critical for ensuring strength, composition, and safety, particularly for nutrients with small dosage ranges.

Supplement Testing Market, by Product Tested

Testing for finished dietary supplement products is expected to generate a significant opportunity in the market, as regulators, retailers, and consumers increasingly demand final product confirmation of safety, potency, stability, and label correctness. Unlike raw material testing, it ensures that manufacturing, ingredient interactions, and packaging have not compromised quality or introduced contaminants. With GMP regulations, retailer posting requirements, and growth in private label and contract manufacturing, brands are increasingly turning to third-party laboratories for compliance and consumer confidence, presenting this segment as a principal growth opportunity for testing companies.

REGION

Asia Pacific market is projected to grow at a competitive rate during the forecast period

The Asia Pacific market for supplement testing is estimated to grow at a high rate as a result of a combination of rising supplement consumption, changing regulatory systems, and the region's increasing position in the global production of ingredients. Increasing health consciousness, urbanization, and spending on health supplement products in countries such as China, India, Japan, South Korea, and Australia are driving the demand for vitamins, minerals, herbal supplements, and functional nutrition products, creating the need for stringent testing to ensure safety and compliance. Most Asia Pacific nations are tightening regulatory control; for instance, China's health food registration rules, India's FSSAI regulations, and Australia's TGA norms. Therefore, third-party testing is essential for both local sales and export permits.

Dietary Supplements Testing Market: COMPANY EVALUATION MATRIX

In the supplement testing market matrix, Eurofins Scientific (Star) leads with a strong market share and extensive service offerings. Its services include identity, potency, purity, and stability testing for raw materials and finished products. With more than 900 labs worldwide, the company supports compliance with regional and international standards, providing fast turnaround times and a strong focus on method validation and technical expertise. Elements Material Technology (Emerging Leader) is gaining visibility with its supplement testing service offerings, strengthening its position through innovation and niche technology.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2,219.0 MN |

| Market Forecast in 2030 (Value) | USD 3,652.2 MN |

| Growth Rate | CAGR of 8.8% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Market Share, Competitive Landscape, Growth Factors, Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Rest of the World (Middle East & Africa) |

WHAT IS IN IT FOR YOU: Dietary Supplements Testing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Testing Service Provider |

|

|

| Dietary Supplement Product Manufacturers | Testing types specific to supplements (potency, purity, contaminants, authenticity), regulatory requirements across key markets (FDA, EFSA, FSSAI), and a competitive landscape of leading testing service providers with benchmarking on cost, turnaround time, and accreditation |

|

RECENT DEVELOPMENTS

- July 2025 : Mérieux NutriSciences finalized its acquisition of Bureau Veritas’ food testing operations in Ecuador, marking its entry into the Ecuadorian market and expanding its footprint across Latin America.

- March 2025 : SGS SA entered into a strategic partnership with Nutralong, a biotechnology company specializing in dietary supplements, to establish a joint laboratory.

- October 2024 : SGS North America expanded its food and nutraceutical testing capabilities by relocating to a larger facility in Fairfield, New Jersey.

- June 2024 : Certified Laboratories, part of Certified Group, expanded its Melville, NY facility to include testing services for cosmetics, over-the-counter (OTC) drugs, and dietary supplements.

- February 2024 : Eurofins Healthcare Assurance launched a new GMP certification program for dietary and food supplements, aimed at improving global supply chain safety and regulatory compliance, especially in the US market.

Table of Contents

Methodology

This study involved two major approaches in estimating the current size of the dietary supplements testing market. Exhaustive secondary research was carried out to collect information on the market, test type, product tested, technology, end-use (qualitative), and service provider (qualitative) segments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food testing journals, certified publications, articles from recognized authors, directories, and databases were referred to to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the dietary supplements testing market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from safety testing service providers and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to test type, product tested, technology, and region. Stakeholders from the demand side, such as dietary supplement manufacturers and food health supplement product manufacturers, were interviewed to understand the buyers’ perspective on the suppliers, products, and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the

availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million = revenue = USD 1 billion; Tier 3:

Revenue

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY |

DESIGNATION |

|

Mérieux NutriSciences (US) |

Quality Analyst Microbiologist |

|

TÜV SÜD (Germany) |

Key Accounts Manager |

|

Eurofins Scientific (Luxembourg) |

Sales Head |

|

Certified Laboratories (US) |

Lab Research Head |

|

ALS (Australia) |

Lab Research Manager |

|

Gravity Diagnostics (US) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the dietary supplements testing market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Dietary Supplements Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall dietary supplements testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Dietary supplement testing involves evaluating ingredients and products to ensure they meet quality and safety standards, specifically that the ingredients listed on the label are present in the correct amounts and that the product is free from harmful contaminants. This process includes a wide array of analytical and operational offerings such as identity/authentication, potency testing, contaminants testing, microbiological testing, adulteration testing, stability & shelf life, allergen & GMO testing, and label claim verification, among others.

Stakeholders

- Dietary supplement testing laboratories and service providers

- Dietary supplement ingredient suppliers, intermediates, and end-product manufacturers and processors

- Contract research organizations (CRO)

-

Government organizations, institutes, and research organizations

- US Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- Center for Drug Evaluation Research (CDER)

- World Health Organization (WHO)

-

Associations and Regulatory Bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- Food Safety and Standards Authority of India (FSSAI)

- Consumer Healthcare Products Association (CHPA)

- Natural Products Association (NPA)

- European Federation of Associations of Health Product Manufacturers (EHPM)

- Food Supplements Europe (FSE)

- International Organization for Standardization (ISO)

Report Objectives

- To determine and project the size of the dietary supplements testing market based on test type, product tested, technology, end-use (qualitative), service provider (qualitative), and region, over five years, i.e., from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the dietary supplements testing market

- To understand the competitive landscape and identify the major growth strategies adopted by market players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe dietary supplements testing market into key countries

- Further breakdown of the Rest of Asia Pacific dietary supplements testing market into key countries

- Further breakdown of the South American dietary supplements testing market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the projected size of the dietary supplements testing market?

The dietary supplements testing market was valued at USD 2,219.0 million in 2024 and is projected to reach USD 3,652.2 million by 2030, at a CAGR of 8.8% from 2025 to 2030.

Which are the key players in the dietary supplements testing market, and how intense is the competition?

Key players include Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA. (Switzerland), Intertek Group plc (UK), Mérieux NutriSciences (US), UL Solutions (US), TÜV SÜD (Germany), ALS (Australia), Tentamus (Italy), AGROLAB GROUP (Germany), FoodChain ID (US), Certified Laboratories (US), Element Materials Technology (UK), NSF (US), Vimta Labs Ltd (India), Qalitex (US), Alkemist (US), and Anresco Laboratories (US). The market competition is intense, driven by continuous R&D investments, service launches, deals, and innovations.

What are the growth prospects for the dietary supplements testing market in the next five years?

The market is expected to see robust growth over the next five years due to increasing micronutrient deficiency, strict regulations, and rising adulteration & contamination risks, all of which are increasing the demand for supplement testing.

What kind of information is provided in the company profiles section?

The company profiles include a comprehensive business overview, details on business segments, financial performance, geographical presence, revenue composition, and business revenue breakdown. They also provide insights into service offerings, key milestones, and expert analyst perspectives.

How is the Asia Pacific region contributing to market growth?

The Asia Pacific region is a key driver of growth, supported by the implementation of strict food safety regulations. Countries such as China, India, Australia, and New Zealand have established regulatory frameworks to ensure the safety of consumers, producers, and regulators, boosting the demand for dietary supplements testing.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Supplement Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Supplement Testing Market