Dry Transformer Insulation Market

Dry Transformer Insulation Market by Type (Coatings (Electrical Insulation, Fire-Resistance & Thermal Protection, Moisture & Environmental Protection), Solid Insulators (Electrical Insulation, Bushings & Terminals, Other)), Component (Winding, Core, Enclosure, Bushing, Spacers & Supporters), and Region - Global Forecast to 2030

Updated on : November 27, 2025

DRY TRANSFORMER INSULATION MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The dry transformer insulation market is projected to reach USD 1.21 billion by 2030 from USD 0.93 billion in 2025, at a CAGR of 5.5% from 2025 to 2030. The dry transformer insulation market is fueled by increasing demand from utility, commercial, renewable energy, manufacturing, and infrastructure sectors.

KEY TAKEAWAYS

-

BY TYPEThe dry transformer insulation market comprises coatings and solid insulators. Solid insulators are likely to be the most rapidly growing segment of the dry transformer insulation market, owing to their unique properties and essential role in ensuring electrical safety and reliability. These materials, such as epoxy resins, ceramics, and fiberglass composites, are ideal for high-voltage insulation applications due to their excellent dielectric strength and thermal endurance. The increase in renewable energy projects and urban infrastructures has boosted the demand for dry-type transformer solid insulation in high-risk applications.

-

BY COMPONENTKey components include windings, cores, enclosures, bushings, spacers & supporters, and other components. Bushings play a vital role in high-voltage insulation and system reliability, and are expected to be the fastest-growing component segment in the dry transformer insulation market. As more dry-type transformers are adopted in renewable energy, industrial, and commercial spaces, the demand for reliable bushing insulation that is resistant to thermal stress, pollution, and environmental aging is growing significantly.

-

BY APPLICATIONKey applications of dry transformer insulation include commercial, industrial, and other applications. Industrial applications hold the largest market share in the dry transformer insulation market due to the high and continuous demand for power demands offrom manufacturing plants, refineries, and processing facilities. These environments require reliable, durable, and low-maintenance power distribution systems, which dry-type transformers effectively provide. Their fire-resistant and environmentally safe insulation makes them ideal for indoor industrial use where safety and compliance with regulations are critical.

-

BY REGIONThe dry transformer insulation market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. The Asia Pacific is the largest region in this market, driven by urbanization, industrialization, and the rising power infrastructure in developing economies such as China, India, and Southeast Asia. With growing electricity demand in densely populated countries, the demand for safe, reliable, and environmentally friendly power distribution systems is driving dry-type transformers even more superior to oil-filled transformers. Regional governments are undertaking large-scale smart city and infrastructure projects, as well as transportation and renewable energy electrification projects.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Huntsman International LLC (US), PPG Industries, Inc. (US), and WEG (Brazil) have entered into a number of agreements and partnerships to cater to the growing demand for medical polymer across innovative applications.

The increased demand for safe, environmentally sustainable, and maintenance-free solutions is increasing growth in the dry transformer insulation market. The rise of urbanization, growing integration of renewable energy systems, and installation of dry-type transformers inside commercial and industrial buildings is driving the demand for more efficient insulation products. The key driver of demand in the market includes the increased concern about fire safety regulations and improved technology in epoxy and cast resin insulation

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hitachi Energy Ltd., Eaton, Schneider Electric, and Siemens are clients of dry transformer insulation manufacturers, and their target applications are also clients of these manufacturers. These clients prioritize fire resistance and sustainability, delivering reduced risks and lower costs to utilities and industries, driven by eco-friendly demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRY TRANSFORMER INSULATION MARKET DYNAMICS

Level

-

Rising installations in commercial and residential areas

-

Increasingly stringent safety and environmental regulations supporting sustainability and green building goals

Level

-

Environmental sustainability concerns

-

High initial costs of dry transformer coatings

Level

-

Demand for minimally invasive devices

-

Rapid expansion of renewable energy projects

Level

-

Long term durability and controlling degradation

-

Sensitivity to moisture and environmental conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising installations in commercial and residential areas

Dry transformers represent a more environmentally friendly and safer alternative to oil-filled transformers, requiring advanced coatings that enhance their insulation capabilities, thermal stability, and mechanical durability. Protection against water, dust, and external contaminants, as well as fire protection and environmental adaptability, is achieved through the use of coatings in transformer applications. With the increasing popularity of smart cities, metro lines, and renewable energy installations, demand for nontoxic, high-performance coatings is on the rise. They enhance energy efficiency and thermal conductivity, and their applications in modern systems are crucial.

Restraint: Thermal limitations of dry transformer coatings

Dry-type transformers utilize air as the medium for cooling and thus are generally more susceptible to heat buildup. Insulation coatings must withstand high operating temperatures without breakdown, as breakdown would result in short circuits or dielectric failure. Thermal class ratings are to be expected from coatings typically Class B (130°F), F (155°F), or H (180°F). Above these ratings can cause cracking, delamination, or poisonous off-gassing. Thermal fatigue from cycling of loads and repeated heating/cooling cycles can also reduce the life of insulation coatings, especially in industrial applications. These are compounded by the conditions of enclosed or low-ventilation areas such as hospitals, high-rise buildings, or data centers, where heat dissipation is restricted.

Opportunity: Advancements in coatings technologies

New coating technologies offer broad horizons to enhance dry transformer insulation in terms of performance, reliability, and ecology. Dry transformers that utilize air as a liquid alternative to cool and insulate are used when safety against fire and ecology are critical. Exposure to moisture, dust, thermal cycles, and corrosive materials calls for sophisticated coatings that accelerate service life and decrease efficiency. Nanocomposite and polymeric coating advancements offer superior electrical insulation, hydrophobicity, and thermal and mechanical resistance. Such coatings are applied to critical components like windings and cores, which reduce partial discharge and dielectric failure hazards. Environmentally friendly low-VOC coatings also offer global sustainability, which creates market opportunity in sensitive areas. Smart coatings that appear and disappear when needed, self-heal, and track their condition offers predictive maintenance, reducing downtime in critical facilities such as hospitals, data centers, and renewable energy power plants.

Challenge: Complex manufacturing and application processes

The dry-transformer insulation industry is negatively impacted due to complex manufacturing and application processes. Epoxies and other advanced polymers require precise, multi-step application processes, including surface preparation, chemical blending by trained specialists, and advanced techniques such as vacuum pressure impregnation or electrostatic spraying. These processes require high-skilled labor and specialized equipment to ensure even coverage and bonding, as defects such as air bubbles or uneven curing can lead to electrical failure, safety issues, and reduced transformer life. It makes production more expensive and less scalable, especially as demand increases with the use of renewable energy sources like wind and solar farms. Formal quality control standards (e.g., IEC, NFPA 70) also make manufacturing more challenging, as temperature or humidity variations during application can lead to inconsistent coating performance and necessitate expensive rework.

Dry Transformer Insulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides high-performance coatings and insulation materials for dry transformers, ensuring electrical insulation and thermal stability. | Excellent dielectric strength, thermal resistance, and long-term durability. |

|

Offers advanced resin systems and insulating varnishes for dry transformers, enhancing mechanical and electrical properties. | Superior adhesion, chemical resistance, and improved transformer efficiency. |

|

Supplies epoxy-based insulation systems and components for dry transformers, supporting reliable power distribution. | High mechanical strength, heat resistance, and cost-effective manufacturing. |

|

Develops innovative insulation tapes and films for dry transformers, ensuring safety and performance in electrical applications. | Enhanced thermal stability, electrical insulation, and ease of application. |

|

Manufactures high-quality dielectric films and insulation materials for dry transformers, optimizing energy efficiency. | Outstanding electrical properties, lightweight design, and environmental resilience. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dry transformer insulation market ecosystem consists of raw material suppliers (Axalta Coating Systems, Shreeji Chemicals, Essar International Pvt. Ltd., Hunan Hua He Xing Chemical Trading Co., Ltd.), manufacturers (3M, WEG, The Sherwin-Williams Company, PPG Industries, Inc., DuPont), distributors (KRAHN Chemie Group, R.E. Carroll, Inc., Barentz International) and end users (Siemens Energy, Schneider Electric, Hitachi Energy Ltd., General Electric). Raw materials like epoxy resin, polyurethane resins, silicone resins, hardeners, and curing agents are used in dry transformer insulation. End users drive demand for product development, quality standards, and pricing strategies. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dry Transformer Insulation Market, By Type

Solid insulators are probably the fastest-growing segment of the dry transformer insulation market due to their unique properties and crucial role in ensuring electrical safety and reliability. These materials, such as epoxy resins, ceramics, and fiberglass composites, are ideal for high-voltage insulation because of their excellent dielectric strength and thermal durability. The rise in renewable energy projects and urban infrastructure has increased demand for dry-type transformer solid insulation in high-risk applications. Their natural resistance to moisture, fire, and impurities makes them especially valuable in environments where weather and industrial conditions necessitate liquid insulation. Furthermore, solid insulators are highly stable over time, with little degradation, which reduces maintenance and extends transformer lifespan. Their compatibility with advanced manufacturing techniques like vacuum pressure casting and modular encapsulation allows for proper application and customization, enabling the development of smaller and more efficient transformer designs.

Dry Transformer Insulation Market, By Component

Bushings are expected to be the fastest-growing component segment in the dry transformer insulation market, driven by their essential role in ensuring high-voltage insulation and system reliability. The increasing adoption of dry-type transformers across renewable, industrial, and commercial applications is fueling demand for bushings that withstand thermal stress, pollution, and aging. Manufacturers are increasingly using advanced materials like epoxy resin composites and silicone rubber, which offer high dielectric strength, mechanical durability, and improved performance under harsh grid conditions.

Dry Transformer Insulation Market, By Application

Industrial applications dominate the dry transformer insulation market, driven by the constant and high power demand from manufacturing plants, refineries, and processing facilities. These sectors require durable, low-maintenance, and reliable power distribution systems, which dry-type transformers efficiently deliver. Their fire-resistant and eco-friendly insulation makes them ideal for indoor environments with strict safety standards. Moreover, industries benefit from longer service life, minimal cooling needs, and low leakage risk. With accelerating global industrialization, the need for robust transformer insulation continues to grow steadily.

REGION

Asia Pacific to be fastest-growing region in global dry transformer insulation market during forecast period

Rapid industrialization, urban infrastructure expansion, and the growth of renewable energy projects in nations such as China, India, and Japan are driving the Asia Pacific dry transformer insulation market. The increasing demand for safe, energy-efficient, and low-maintenance transformers, combined with stricter safety regulations and grid modernization programs, is driving the adoption of next-generation dry-type insulation materials in the region.

Dry Transformer Insulation Market: COMPANY EVALUATION MATRIX

The Sherwin-Williams Company is a leading player in the dry transformer insulation market, offering a broad product portfolio of high-performance insulating coatings and varnishes that enhance thermal stability, electrical strength, and environmental resistance. It possesses strong R&D capabilities and a global presence, enabling the company to reliably innovate and collaborate with clients worldwide. ATLANTA AG is emerging as a leader with its advanced epoxy resin systems, new sustainable insulating products, and customized products for modern dry-type transformers. ATLANTA AG is expanding its partnerships with transformer manufacturers, along with developing eco-friendly and high-durability materials that will be tough competitors in the changing insulation market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.88 Billion |

| Market Forecast in 2030 (value) | USD 1.21 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Dry Transformer Insulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Transformer Manufacturer |

|

|

| Insulation Material Supplier |

|

|

| Utility & Power Distribution |

|

|

| Raw Material Supplier |

|

|

| Renewable Energy Provider |

|

|

RECENT DEVELOPMENTS

- June 2024 : Huntsman opened a new Innovation Center in Belgium to develop advanced coatings for dry-type transformers, focusing on better thermal stability, fire resistance, and moisture protection.

- March 2024 : WEG’s new manufacturing investments in Mexico and Brazil significantly boost dry-type transformer production, driving higher demand for critical insulation coatings like epoxy, silicone, and aramid materials.

- September 2023 : PPG Industries expanded its Sumaré, Brazil facility by 40% to boost local supply of powder coatings critical for thermal protection and insulation in dry-type transformers across South America.

- May 2023 : PPG’s USD 44 million investment in U.S. and South American powder coatings facilities enhances efficiency and innovation, supporting high-performance coating needs in dry-type transformers.

Table of Contents

Methodology

The study comprised four key activities aimed at estimating the current size of the global dry transformer insulation market. Comprehensive secondary research was initially undertaken to gather pertinent data regarding the market, related product categories, and the overarching product group. Following this, the findings, assumptions, and size estimates were validated through primary research with industry experts spanning the entire value chain of dry transformer insulation. To ensure accuracy, both top-down and bottom-up methodologies were utilized to estimate the overall market size. Subsequently, market segmentation and data triangulation techniques were employed to delineate the dimensions of various segments and sub-segments within the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the dry transformer insulation market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The dry transformer insulation market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the dry transformer insulation market. Primary sources from the supply side include associations and institutions involved in the dry transformer insulation market, key opinion leaders, and processing players.

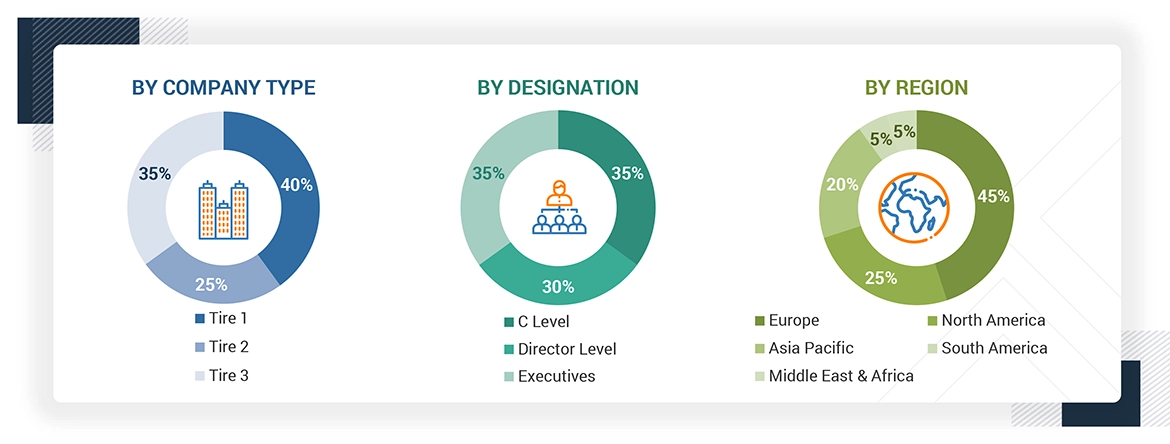

Following is Breakdown of Primary Respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the dry transformer insulation market by type, component, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the dry transformer insulation market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Dry transformer insulation encompasses the comprehensive system of solid insulation materials employed in dry-type transformers. This system is crucial for preventing electrical discharges, managing heat dissipation, and ensuring safe and efficient operational conditions. Unlike oil-immersed transformers that rely on a liquid insulation medium, dry transformers utilize solid insulating materials such as epoxy resin, fiberglass, or Nomex to safeguard windings and other internal components. The dry transformer insulation system enhances safety by eliminating the risks of leaks or fires associated with oil-filled transformers, making it particularly suitable for indoor environments, environmentally sensitive applications, and areas with limited space in densely populated urban settings. Furthermore, this insulation system is characterized by low maintenance requirements, environmental sustainability, and adaptability to the renewable energy, industrial, and commercial sectors. As such, dry transformers represent a compelling option for organizations seeking reliable and efficient power solutions.

Stakeholders

- Dry transformer insulation manufacturers

- Raw material suppliers

- Regulatory bodies and government agencies

- Distributors and suppliers

- End-use industries

- Associations and industrial bodies

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the size of the dry transformer insulation market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on type, component, and region.

- To forecast the market size for the five main regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals, in the dry transformer insulation market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study and the macroeconomic outlook.

Key Questions Addressed by the Report

Which factors are propelling the growth of the dry transformer insulation market?

Increasingly stringent safety and environmental regulations, supporting sustainability and green building goals, rising installations in commercial and residential areas, and the expansion of smart grid technologies are the primary factors driving market growth.

What are the major challenges to the growth of the dry transformer insulation market?

Complex manufacturing and application processes are the major challenges impacting market growth.

What are the major opportunities in the dry transformer insulation market?

Advancements in coatings technologies, rapid expansion of renewable energy projects, and rising capacity expansions offer lucrative growth opportunities.

What are the major factors restraining the growth of the dry transformer insulation market?

High initial cost and thermal limitations of dry transformer coatings are key restraining factors.

Who are the major players in the dry transformer insulation market?

Major players include 3M (US), Sherwin-Williams (US), PPG Industries, Inc. (US), and DuPont (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dry Transformer Insulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dry Transformer Insulation Market