ECG Sensor Patches Market: Growth, Size, Share, and Trends

ECG Sensor Patches Market by Lead Type (Single-Lead, 2 Lead, 3 Lead, 12 Lead), Product (Reusable, Disposable), Prescription Type (Physician Prescribed, OTC), Usage Modality (Wireless, Wired/Connected), End User (Hospitals & Clinics) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ECG sensor patches market is projected to reach USD 2.31 billion by 2032 from USD 1.04 billion in 2025, registering a CAGR of 12.0% during the forecast period. The growth is mainly attributed to the rising target patient population and increasing cases of CVD. Rising technological developments in wireless monitoring and wearable healthcare products are also expected to fuel market growth. The growing focus on mHealth apps, connected devices, and wearable tech is expected to fuel continuous advancements in cardiac monitoring, thereby increasing efficiency. Industry stakeholders are also focused on forging strategic partnerships and introducing new products to strengthen their market position.

KEY TAKEAWAYS

-

BY LEAD TYPEThe single-lead ECG sensor patches segment accounted for the largest share of the ECG sensor patches market in 2024. This high market share of the single-lead segment is due to its extensive use in long-term continuous monitoring for high-risk patients with intermittent symptoms.

-

BY PRODUCT TYPEThe disposable ECG sensor patches segment is projected to witness the highest CAGR during the forecast period (2025-2032), mainly due to the rising need for hygienic and infection-free cardiac monitoring solutions, especially in acute care and high-turnover clinical environments.

-

BY PRESCRIPTION TYPEThe physician-prescribed patches segment accounted for the largest share of the ECG sensor patches market in 2024, due to their ability to offer long-term cardiac monitoring, high clinical reliability, regulatory backing, and insurance coverage.

-

BY USAGE MODALITYThe wireless ECG sensor patches segment is expected to witness the fastest CAGR during the forecast period. The high CAGR is attributed to their ability to support remote and continuous cardiac monitoring without physical cables.

-

BY END USERHospitals & clinics accounted for the largest share of the ECG sensor patches market in 2024, mainly due to the substantial patient volume in hospitals and clinics and their role in providing inpatient & outpatient cardiac diagnostics and continuous monitoring.

-

BY REGIONIn 2024, North America accounted for the largest share of the ECG sensor patches market, followed by Europe. The large share of the North American market can be attributed to factors such as the high prevalence of CVD and growing chronic disease burden, rising adoption of RPM technologies, and the growing geriatric population.

-

COMPETITVE LANDSCAPEThe ECG sensor patches market has seen active efforts from major players between January 2022 and May 2025 through product launches, regional expansion, and strategic collaborations to strengthen technological capabilities and global presence. A strong focus on AI-driven innovations, real-time monitoring, and partnerships with healthcare providers and digital platforms has accelerated adoption in clinical and home care settings.

The global ECG sensor patches market is experiencing strong growth, driven by the increasing burden of cardiovascular diseases, an aging population, and the rising demand for continuous heart monitoring. Advancements in wireless and patch-based ECG systems and the integration of mobile health apps and connected devices are transforming cardiac care delivery. Despite challenges such as data privacy, reimbursement limitations, and regulatory complexities, expanding use in remote patient monitoring and chronic disease management programs is expected to create new growth opportunities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the dynamic landscape of medical diagnosis, it is essential to recognize the trends and disruptions shaping customer businesses. Understanding these influences helps the company stay competitive and adapt strategies effectively. This section explores key trends & disruptions impacting the ECG sensor patches market, providing valuable insights for stakeholders.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Geriatric Population

-

Growing Prevalence of Cardiovascular Diseases Globally

Level

-

High Cost of Advanced ECG Sensor Patch Devices

-

Data Privacy and Security Concerns in Digital Health Monitoring

Level

-

Expansion of Home Healthcare and Post-acute Monitoring Solutions

-

Growing Integration of Al and Predictive Analytics

Level

-

Regulatory Hurdles for Product Approval and Market Entry

-

Accuracy and Reliability Concerns Compared to Traditional ECG Devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing prevalence of cardiovascular diseases globally

The increasing burden of CVD is a critical growth driver for the ECG sensors market. These sensor patches facilitate early identification and ongoing tracking of heart conditions. CVDs such as heart attacks, strokes, and arrhythmias are still the number one cause of death globally. According to the World Health Organization (WHO), CVDs led to about 19.8 million deaths in 2022. These deaths are caused by cancer, diabetes, and respiratory diseases combined. Real-time rhythm monitoring is offered by ECG sensor patches, which are particularly beneficial for high-risk patients.

Restraint: High cost of advanced ECG sensor patch devices

The high cost of advanced devices, especially in low- and middle-income countries, is one of the significant restraints in this market. The patch developed by Medtronic, known as the SEEQ Mobile Cardiac Telemetry (MCT) patch, costs around USD 718, which is very high for emerging markets. The ZIO XT Patch by iRhythm Technologies has a sticker price of about USD 329, while the Netrin Clinical Grade ECG Sensor of India, priced at about USD 230, remains somewhat expensive for most patients accessing it in a lower-income setting. These upfront costs get further compounded by the limited reimbursements covered under insurance provisions in many countries. Stringent data documentation requirements placed on claim submissions and inconsistent approval policies deter patients and healthcare institutions from embracing these services or solutions. Hence, these financial barriers, in addition to regulatory and reimbursement challenges, impede the widespread use of ECG sensor patches.

Opportunity: Expansion of home healthcare and post-acute monitoring solutions

The growing interest in home healthcare and post-acute monitoring creates significant opportunities for the ECG sensor patches market. Home healthcare has traditionally been viewed as an alternative method for patient treatment, where medical care is provided in the patient's residence. This approach is often more cost-effective and convenient for chronic or recovering patients than hospital-based treatment. ECG sensor patches are designed with slim profiles for patient comfort and allow for continuous real-time monitoring. They enable prompt detection of cardiac anomalies following hospital discharge, which can help reduce readmissions and improve patient outcomes. This shift toward home care can be attributed to several factors, including an aging population, the increasing prevalence of chronic diseases, and ongoing efforts to control costs within the healthcare sector.

Challenge: Accuracy & reliability concerns

Hospital-based ECG systems provide high-resolution, multi-lead diagnostics with clinical oversight that ensures accurate cardiac evaluations. In contrast, wearable ECG sensor patches, designed for ambulatory or home use, may struggle to reliably detect subtle arrhythmias or complex cardiac abnormalities, especially in patients with unstable or critical conditions. These limitations raise concerns for clinicians when these patches are used in high-stakes diagnostic situations. Environmental influences, motion artifacts, and improper placement can degrade signal quality in practical settings, compromising data integrity. Although manufacturers are investing in advanced sensors, sophisticated algorithms, and artificial intelligence to narrow this performance gap, achieving clinical-grade reliability across various use cases remains a challenge. These issues hinder the broader acceptance of ECG sensor patches, particularly in hospital or emergency environments.

ECG Sensor Patches Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Wearable ECG sensor patches integrated into connected care solutions | Supports continuous heart monitoring and remote patient management, improving outcomes for patients with chronic cardiac conditions while reducing hospital readmissions |

|

Zio ECG sensor patches for long-term ambulatory cardiac monitoring | Provides continuous monitoring for up to 14 days, with AI-powered analytics to detect arrhythmias; reduces diagnostic delays and hospital visits; enables accurate remote cardiac care |

|

Wearable ECG sensor patches integrated with digital platforms and telehealth | Enables real-time heart monitoring, seamless data sharing with clinicians, and improved patient engagement in clinical and home care environments |

|

Advanced cardiac monitoring patches for outpatient and ambulatory care | Enhances early arrhythmia detection and supports patient management outside hospital settings, contributing to reduced healthcare costs and improved care delivery |

|

ECG sensor patches with wireless data transfer and cloud integration | Offers high-accuracy continuous ECG recording with secure data transmission, enabling physicians to analyze patient heart health remotely and efficiently |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ECG sensor patches market ecosystem involves leading manufacturers, healthcare providers, and global regulatory agencies working together to drive innovation, clinical adoption, and compliance. This collaboration enables developing and using advanced, non-invasive cardiac monitoring technologies, meeting rising demand across hospitals and ambulatory care settings.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ECG SENSOR PATCHES MARKET, BY LEAD TYPE, 2023–2032 (USD BN)

The single-lead ECG sensor patch segment accounted for the largest share of the market as it is predominantly utilized across ambulatory cardiac monitoring, especially atrial fibrillation and arrhythmia detection in an outpatient environment. Patches provide streamlined clinical practices with real-time data capture in minimal disruption to the patient. The prolonged wearability (usually up to 14 days) and FDA-cleared incorporation into smartphone-based telemetry platforms have made them the solution for primary care and telemedicine schemes. The availability of AI-based arrhythmia classification algorithms makes them popular in high-volume remote cardiac screening programs, especially in regions adopting decentralized diagnostics.

REGION

By region, North America dominated the market in 2024.

In 2024, North America accounted for the largest share of the market. The key factors contributing to market growth include high Medicare coverage, the robust adoption of wearable diagnostics in primary & secondary care, and the presence of key players in the region. Favorable regulatory environment, the availability of streamlined 510(k) routes and reimbursement coding for long-term ECG monitoring, has witnessed growing approvals and clinical uptake of ECG sensor patches. Additionally, the mass deployment of remote patient monitoring (RPM) programs in US health systems, especially among chronic cardiac patients, has driven the long-term demand for ECG sensor patches.

ECG Sensor Patches Market: COMPANY EVALUATION MATRIX

In the ECG sensor patchesmarket matrix, Philips (Star) leads with its global scale, strong distribution channels, and wide range of connected cardiac monitoring solutions. LifeSignals (Emerging Leader) is gaining momentum with its innovative sensor patch technologies and digital health platforms. While Philips dominates through market reach and established presence, LifeSignals’ innovation-driven approach positions it for rapid growth and a strong move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.95 BN |

| Market Size in 2032 (Value) | USD 2.31 BN |

| CAGR | 12.0% |

| Years Considered | 2023–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: ECG Sensor Patches Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of top ECG Sensor Patches products: Single-Lead, 2-Lead and 3-Lead ECG Sensor Patches | Helps clients identify the most suitable product type for different clinical and home care applications, supporting informed procurement and investment decisions |

| Company Information | Key players: Baxter International Inc. (US), iRhythm Technologies, Inc. (US), Koninklijke Philips N.V. (Netherlands), Boston Scientific Corporation (US), and Bittium Corporation (Finland); Top 3-5 players market share analysis at the Asia Pacific and European country-level | Provides clarity on competitive positioning and market dynamics, enabling benchmarking against leading players and evaluating partnership or expansion opportunities |

| Geographic Analysis | Further breakdown of the rest of Europe’s ECG sensor patches market into Austria, Finland, the Netherlands, and Switzerland, and the rest of Latin America’s ECG sensor patches market into Argentina, Colombia, and Chile | Delivers deeper regional insights, allowing clients to target niche markets and tailor regional strategies for higher market penetration |

RECENT DEVELOPMENTS

- May 2024 : Philips (Netherlands) expanded its footprint in Spain by introducing its Mobile Cardiac Outpatient Telemetry (MCOT) Patch to 14 healthcare providers across the country. This device is integrated with the company’s AI-driven Cardiologs analytics platform, enhancing real-time cardiac diagnostics in ambulatory care settings.

- October 2024 : iRhythm (US) received FDA clearance for design modifications and labeling updates for its Zio AT ECG sensor patch, reinforcing its regulatory standing in the U.S. market. Subsequently, in May 2025, the company launched its Zio Long-Term Continuous Monitoring (LTCM) system in Japan, offering up to 14 days of uninterrupted ECG monitoring powered by a deep learning AI algorithm approved by Japan’s PMDA. These developments highlight iRhythm’s commitment to global expansion and innovation in AI-enabled cardiac monitoring.

- December 2023 : GE HealthCare (US) entered into a joint commercialization agreement with AirStrip Technologies, Inc. (US), a vendor-agnostic clinical surveillance technology company and part of the NantWorks group of AI-driven companies. Through this agreement, GE HealthCare will distribute the cardiology and patient monitoring solutions of AirStrip across the US.

- May 2022 : Bittium Corporation (Finland) launched its new Bittium Faros 180L ECG device at the European Stroke Organisation Conference (ESOC) 2022. The device is designed for advanced long-term ECG monitoring, particularly supporting early detection of cardiac issues in stroke patients.

- January 2025 : Biotricity (US) partnered with B-Secur, a leader in biosensing technology, to co-develop one of the most advanced device-neutral platforms for integrated heart monitoring. This partnership aims to merge the expertise of Biotricity in remote cardiac diagnostics with the cutting-edge biometric algorithms of B-Secur to improve continuous cardiovascular care.

Table of Contents

Methodology

This study involved the extensive use of both primary & secondary sources. The research process involved the study of various factors affecting industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the ECG sensor patches market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the ECG sensor patches markets. Primary sources from the demand side include healthcare professionals from hospitals, ambulatory surgery centers, and diagnostic centers.

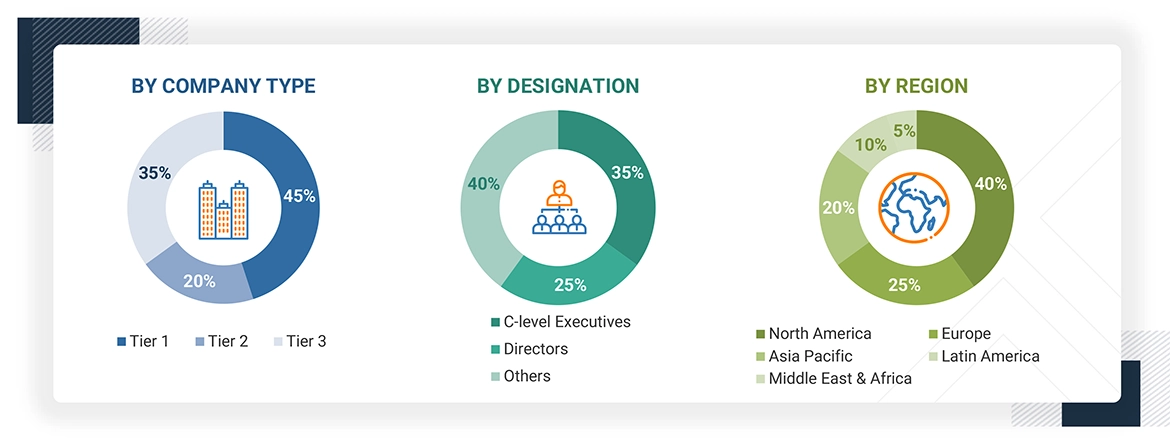

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

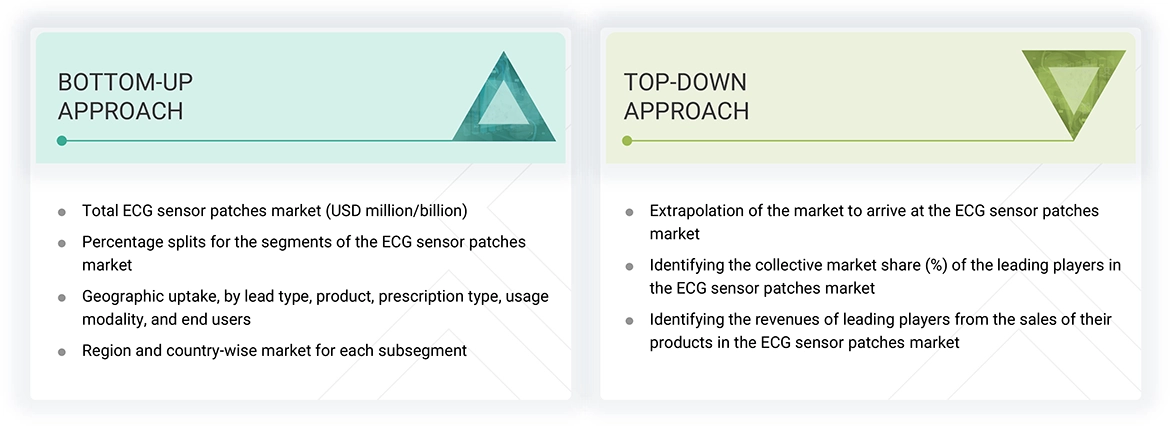

Market Size Estimation

The total size of the ECG sensor patches market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

The ECG sensor patches market comprises lightweight, wearable devices that monitor a patient’s heart activity by recording electrocardiogram (ECG) signals. These patches typically adhere to the chest and include integrated electrodes, sensors, and wireless transmitters to capture and send real-time cardiac data. Some versions may connect external electrode patches to a separate sensor unit or Holter monitor via lead wires, offering extended monitoring capabilities in a compact form. These products enable real-time, non-invasive cardiac monitoring. They are widely used for arrhythmia detection, post-operative surveillance, and remote patient management in modern cardiology and home-based healthcare settings.

Stakeholders

- ECG Sensor Patch Product Manufacturers

- Component Suppliers

- Software & Platform Developers

- Contract Manufacturing Organizations (CMOs)

- Healthcare Technology Companies

- Cardiologists & Electrophysiologists

- Primary Care Physicians & General Practitioners

- Hospitals & Clinics

- Ambulatory Surgery Centers (ASCs)

- Urgent Care Centers

- Home Healthcare Providers

- Telehealth & Remote Patient Monitoring Companies

- Health Insurance Companies & Payers

- Regulatory Authorities (e.g., the US FDA and the EMA)

- Distributors & Medical Device Wholesalers

- Fitness & Sports Medicine Clinics

- Research Institutes and Universities

Report Objectives

- To define, describe, and forecast the ECG sensor patches market by lead type, product, prescription type, usage modality, end user, and region.

- To provide detailed information about the key factors influencing market growth, such as drivers, restraints, opportunities, challenges, and industry trends.

- To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s five forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI/generative AI on the ECG sensor patches market, case study analysis, adjacent market analysis, unmet needs/end user expectations in ECG sensor patches market, and trends/disruptions impacting customers’ businesses in the market.

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall ECG sensor patches market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies

- To strategically analyze the ECG sensor patches market across North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches & approvals, acquisitions, partnerships, collaborations, and expansions in the ECG sensor patches market.

Key Questions Addressed by the Report

What are the opportunities in the ECG sensor patches market?

There are various opportunities for market growth in the ECG sensor patches market. These include the rising integration of AI and predictive analytics, the expansion of home healthcare, and the growing focus on post-acute monitoring solutions.

Which segments have been included in this report?

This report has the following main segments:

- By Lead Type

- By Product

- By Prescription Type

- By Usage Modality

- By End User

- By Region

Which are the top players in the ECG sensor patches market?

The top players in the global ECG Sensor Patches Market are Baxter International Inc. (US), iRhythm Technologies, Inc. (US), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (US), and Bittium Corporation (Finland).

What are the factors expected to pose a challenge to the market growth?

Regulatory hurdles for product approval and accuracy & reliability concerns for ECG sensor patches are expected to challenge this market's growth during the forecast period.

At what CAGR is the ECG sensor patches market expected to grow?

The ECG sensor patches market is expected to grow at a CAGR of 12.0% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the ECG Sensor Patches Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in ECG Sensor Patches Market