Electronic Clinical Outcome Assessment Solutions Market: Growth, Size, Share, and Trends

Electronic Clinical Outcome Assessment (eCOA) Solutions Market by Modality (Wearable, Mobile, BYOD), Type (PRO, CLINRO, OBSRO, PERFO), Application (Clinical Trial (Onco, Rare, Mental Health), RWE, Registery), End User (Govt, Med Device, Pharma) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global electronic clinical outcome assessment (eCOA) solutions market is projected to reach USD 4.13 billion by 2029, up from USD 1.94 billion in 2024, growing at a CAGR of 16.3% during the forecast period. The growth of this market is primarily driven by the increasing adoption of decentralized and hybrid clinical trials, demand for real-time patient data capture, and the need for regulatory-compliant, audit-ready digital documentation. Rising R&D expenditure by pharmaceutical and biotechnology companies and the increasing number of clinical trials, coupled with the growing emphasis on patient-centric trial designs, is accelerating adoption. The integration of advanced technologies such as AI, cloud computing, and mobile applications enhances data accuracy and usability. Additionally, the shift from paper-based to digital data collection to improve trial efficiency, reduce errors, and meet FDA and EMA compliance mandates further propels growth.

KEY TAKEAWAYS

- Asia Pacific to witness highest CAGR of 16.8% throughout the forecast period.

- Software segment accounted for largest share in 2024.

- Electronic Patie.nt Reported Outcomes (EPRO) segment accounted for the largest share of 57.1% in 2024

- Web & cloud-based model segment is expected to register highest CAGR of 16.4% throughout the forecast timeframe.

- The clinical trials segment accounted for the largest share owing to the significant utilization of eCOA solutions in clinical trials to digitally capture patient-reported outcomes.

- Pharmaceutical & biotechnology segment accounted for substantial share in 2024.

- Medidata (A Dassault Systèmes Company), Veeva Systems, IQVIA Inc.were identified as some of the star players in the eCOA Solutions market (global), given their strong market share and product footprint.

- Curebase Inc., Cloudbyz, ClinCapture among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the Electronic Clinical Outcome Assessment (eCOA) Solutions market is driven by several key factors. The increasing number of clinical trials globally and higher R&D expenditure on drug development are boosting demand for efficient data collection tools. Sponsors are shifting toward cost-effective and real-time data capture solutions to enhance trial accuracy and compliance. Government initiatives and funding for digital transformation in clinical research further accelerate adoption. The growing need for data standardization across multi-site trials and the rising trend of outsourcing clinical studies to CROs are also propelling eCOA deployment to streamline operations and ensure regulatory-ready documentation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on clients’ businesses arises from evolving clinical trial and patient data capture trends. Hotbets are providers of eCOA solutions, targeting applications across pharmaceutical, biotech, MedTech companies, and others. Shifts, such as digital patient-reported outcomes, hybrid eCOA, and cloud-based solutions, influence end-user revenues. These revenue impacts subsequently affect hotbets’ growth, ultimately shaping the overall revenue dynamics within the eCOA solutions market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing R&D expenditure for product development by medtech and pharma-biotech companies

-

Favorable government support and funding for clinical trials

Level

-

Dearth of skilled professionals to develop and operate eCOA solutions

-

High implementation and maintenance costs

Level

-

Surging eCOA adoption owing to the increasing number of clinical trials in emerging economies

-

Gradual shift from manual data interpretation to real-time data analysis

Level

-

Concerns regarding data security & privacy

-

Resistance from traditional healthcare professionals and concerns regarding software reliability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing R&D expenditure for product development by medtech and pharma-biotech companies

The increasing prevalence of fast-mutating microbes and the rising demand for effective antibiotics have intensified the focus on novel drug development across major healthcare markets. Over the past decade, pharmaceutical and biotech companies have significantly expanded R&D expenditures, with approximately 90% allocated to clinical research activities. Global pharmaceutical R&D investment increased from USD 144 billion in 2014 to USD 238 billion in 2021, accelerated by the COVID-19 pandemic, though growth is projected to moderate in subsequent years. Funding is sourced from both public and private sectors, with governments supporting early-stage research and industry driving translational and product-focused R&D, often supplemented by subsidies and tax incentives. Rising chronic disease prevalence, stringent regulatory requirements, and competitive pressures further necessitate increased R&D investment to enable innovation, regulatory compliance, and market leadership.

Restraint: Dearth of skilled professionals to develop and operate eCOA solutions

Developing and implementing effective eCOA solutions requires interdisciplinary expertise spanning healthcare, technology, and regulatory compliance. Robust electronic assessment tools demand proficiency in software development, user experience design, and a thorough understanding of clinical and regulatory standards, including GCP and CFR. A shortage of skilled professionals, particularly clinical trial associates (CTAs) and clinical research associates (CRAs), poses a significant constraint on market growth, as companies compete with pharmaceutical, biotech, medtech, and academic institutions for qualified talent. This talent gap increases operational costs and may slow technology adoption. By 2025, a projected demand-supply gap of 2.1 million healthcare workers underscores the urgency. Organizations must invest in targeted training, educational programs, and collaborative initiatives to address this shortage, enabling efficient deployment of eCOA solutions, enhancing clinical trial effectiveness, and ultimately improving patient outcomes.

Opportunity: Surging eCOA adoption owing to the increasing number of clinical trials in emerging economies

Emerging economies are experiencing rapid growth in clinical trial activities driven by large, diverse patient populations, cost advantages, and evolving regulatory frameworks that streamline trial processes. These regions offer greater genetic diversity and higher disease prevalence, enabling more representative study populations and enhancing the generalizability of trial outcomes. Between 2017 and 2021, the Asia Pacific region accounted for over 50% of new clinical trial registrations, surpassing the US and EU5. Countries such as Japan, China, and India have become key global research hubs, with Japan leading in trials and medical device innovation and China emerging as a major pharmaceutical market. This growth creates significant opportunities for advanced data collection tools, including eCOA solutions, to improve data quality, streamline trial management, and support broader adoption across emerging markets.

Challenge: Resistance from traditional healthcare professionals and concerns regarding software reliability

The integration of patient data in clinical research heightens privacy and security concerns, particularly as databases are shared among research institutions, CROs, and technology partners. Electronic clinical tools, including eCOA platforms, must comply with regulations such as the HITECH Act, HIPAA, and GDPR, safeguarding protected health information (PHI). Rising digital transformation has increased the frequency and impact of data breaches, with 707 healthcare breaches in 2022 affecting 52 million patients and contributing to identity fraud losses exceeding USD 52 billion. These incidents underscore the vulnerability of patient data and the critical need for robust security measures, including data anonymization, consent management, and real-time monitoring. Ensuring compliance with regulatory frameworks and implementing advanced cybersecurity protocols is essential for the safe deployment of eCOA solutions and maintaining patient trust in clinical trials.

Electronic Clinical Outcome Assessment (eCOA) Solutions Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Medidata eCOA captures patient-reported outcomes, symptoms, and quality-of-life data directly from mobile devices. | Increases patient adherence, reduces site visits, ensures accurate real-time data, and enables decentralized clinical trials. |

|

IQVIA eCOA integrates IRT to capture real-time patient data, reducing site and sponsor burden efficiently. | Improves data accuracy, accelerates study timelines, enhances patient engagement, and enables insightful, real-world clinical research. |

|

Signant SmartSignals eCOA platform collects high-quality site- and home-based clinical data efficiently and accurately. | Simplifies data collection, enables real-time review, provides actionable alerts, and reduces participant and site burden. |

|

ICON Digital Platform integrates eConsent, eCOA, eSource, and televisit modules for seamless decentralized clinical trials. | Enhances patient engagement, streamlines trial operations, ensures regulatory compliance, and accelerates end-to-end clinical study execution. |

|

Clario eCOA platform integrates multimedia and connected devices to capture comprehensive patient-reported outcomes remotely. | Enhances data accuracy, supports decentralized trials, improves patient compliance, and accelerates clinical study timelines efficiently. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The eCOA solutions market comprises entities responsible for delivering these solutions to end users via various deployment models. The ecosystem market map of the overall eCOA solutions market comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. The ecosystem of this market comprises various vendors, such as data center providers, network/connectivity providers, cloud professional platform providers, and hardware and supporting infrastructure providers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electronic clinical outcome assessment (eCOA) solutions Market, by Component

In 2023, the software segment led the electronic clinical outcome assessment (eCOA) solutions market, by component, due to its ability to electronically capture patient-reported outcomes, symptoms, and quality-of-life data with high accuracy. Software platforms provide customizable interfaces, advanced data capture, and seamless integration with CTMS and EHR systems, facilitating efficient clinical trial management. Growth is further driven by AI and ML-enabled analytics, enabling predictive modeling, trend analysis, and actionable insights. The software’s scalability, real-time data processing, and capacity to streamline clinical trials accelerate drug development, while continuous product innovation ensures alignment with evolving clinical and regulatory requirements.

Electronic clinical outcome assessment (eCOA) solutions Market, by Product

In 2023, the ePRO segment held the largest share of the electronic clinical outcome assessment (eCOA) solutions market, by product, due to its ability to capture real-time, patient-reported data on symptoms, treatment experiences, and quality of life using digital devices. ePROs enhance data accuracy, reliability, and timeliness, reducing errors inherent in paper-based or clinician-reported methods. This patient-centric approach supports early symptom management, improves care outcomes, and strengthens clinical trial validity. Growth is further driven by regulatory acceptance from the FDA and EMA, increased adoption in drug development, and the rising emphasis on patient engagement, enabling pharmaceutical companies and CROs to meet evolving clinical and compliance standards efficiently.

Electronic clinical outcome assessment (eCOA) solutions Market, by Application

In 2023, the clinical trials segment dominated the electronic clinical outcome assessment (eCOA) solutions market by application. The increasing adoption of decentralized and hybrid trial models further drives reliance on eCOA solutions, enabling remote data collection, real-time monitoring, and reduced protocol deviations. Rising R&D expenditure, the growing complexity of clinical trials, and the emphasis on patient-centric approaches collectively reinforce the segment’s market dominance. Many government organizations are also encouraging the use of electronic clinical solutions, such as eCOA, for the electronic data collection process during clinical trials. For example, the National Cancer Institute has endorsed Medidata Rave as the preferred electronic data collection system for CP-CTNet, aiming to enhance uniformity in data gathering across numerous institutions and trials.

Electronic clinical outcome assessment (eCOA) solutions Market, by End user

In 2023, the pharmaceutical and biotechnology companies segment dominated the electronic clinical outcome assessment (eCOA) solutions market due to its extensive clinical trial activities, which require accurate, timely, and efficient collection of patient-reported outcomes and clinical data. Adoption of eCOA solutions streamlines trial workflows, reduces costs, and accelerates drug development timelines. Rising R&D expenditure (USD 138 billion among the top 15 pharma companies in 2022) and a strong focus on innovation drive demand for these solutions. Tier-I companies leverage eCOA to meet regulatory requirements and enhance decision-making through real-time patient insights, while outsourcing by smaller firms highlights cost barriers, underscoring the segment’s leadership in adoption and market growth.

REGION

Asia Pacific to be fastest-growing region in global electronic clinical outcome assessment (eCOA) solutions market during forecast period

The Asia Pacific region is the fastest-growing electronic clinical outcome assessment (eCOA) solutions market during the forecast period. Significant government funding and tax incentives are accelerating pharmaceutical R&D and clinical trials. In September 2023, the Indian government unveiled a scheme amounting to Rs 5,000 crore (USD 605.52 million) to foster research & development (R&D) within the pharmaceuticals and medical technology sectors. The region offers lower operational costs and faster patient recruitment due to large, diverse populations in countries like China, India, South Korea, and Taiwan. Expanding healthcare infrastructure, the presence of numerous CROs and pharmaceutical companies, and increasing R&D investment further augmnet the growth of the market. For instance, Sun Pharma announced that the company intends to invest USD 600–650 million in R&D. Similarly, in November 2023, Boehringer Ingelheim announced plans to allocate more than 3.5 billion yuan (USD 483.25 million) towards R&D initiatives in China over the ensuing five years. The rising prevalence of chronic diseases, such as diabetes, is increasing trial volumes, which, in turn, drives demand for eCOA solutions to streamline data capture, improve patient engagement, and optimize trial outcomes.

Electronic Clinical Outcome Assessment (eCOA) Solutions Market: COMPANY EVALUATION MATRIX

In the electronic clinical outcome assessment (eCOA) solutions market, Medidata (Star), a Dassault Systèmes company, leads the eCOA solutions market with its comprehensive cloud-based platform for clinical research. Its offerings include Rave eCOA, myMedidata, and eCOA Image Capture, enabling seamless patient-reported outcome data collection via web, mobile devices, and connected technologies. Medidata supports pharmaceutical, biotechnology, medical device companies, academic institutions, and CROs, delivering enhanced patient engagement, operational efficiency, and data integrity. Strategic collaborations with Boehringer Ingelheim, Labcorp, and Novotech have strengthened its position in decentralized clinical trials and digital biomarker development. Veeva Systems (Emerging Leader) is an emerging leader offering unified, cloud-based eCOA and digital trial solutions through its Veeva Vault platform. Its ePRO, eClinRO, and MyVeeva for Patients solutions streamline data capture, enhance patient engagement, and simplify study management. Through its Veeva Digital Trials Platform, Veeva enables a connected clinical ecosystem across sponsors, sites, and patients. Partnerships with UCB, Lotus Clinical Research, and LEO Pharma highlight its growing presence in digital and patient-centric trial execution.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.67 Billion |

| Market Forecast in 2029 (Value) | USD 4.13 Billion |

| Growth Rate | CAGR of 16.3% from 2024-2029 |

| Years Considered | 2018–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Electronic Clinical Outcome Assessment (eCOA) Solutions Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Strategic evaluation of potential opportunities to expand market share and enhance position in eCOA solutions market |

|

Enables market opportunity assessment, competitive benchmarking, identification of technology and portfolio gaps, and strategic planning for partnership opportunities |

| Local Competitive Landscape |

|

Enables competitive benchmarking, identification of technology and portfolio gaps, and strategic planning for partnership opportunities |

RECENT DEVELOPMENTS

- January 2024 : Medable launched a new automation technology, which, when integrated into eCOA, produces standard configurations, such as schedules of assessments, anchor dates, and patient flags.

- October 2023 : Clario partnered with Trial Data to combine the latter’s vast DCT experience and eCOA solutions, along with deep clinical trial operations experience in China, resulting in increased capabilities and flexibility in clinical trial strategies for sponsors supporting clinical trials in China.

- June 2023 : Signant Health acquired DSG to extend its product suite to include comprehensive EDC/DDC capabilities, further strengthening its position in the market.

- June 2023 : ICON Plc launched the ICON Digital Platform, which is an end-to-end solution that enables patient services throughout clinical trials, including an easy-to-use patient mobile app, eConsent, eCOA, direct data capture for in-home services, televisits, and digital health technology management.

Table of Contents

Methodology

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the electronic clinical outcome assessment (eCOA) solutions market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess market prospects. The electronic clinical outcome assessment (eCOA) solutions market size was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), the Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), ClinicalTrials.gov, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the electronic clinical outcome assessment solutions system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of Electronic Clinical Outcome Assessment Solutions solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

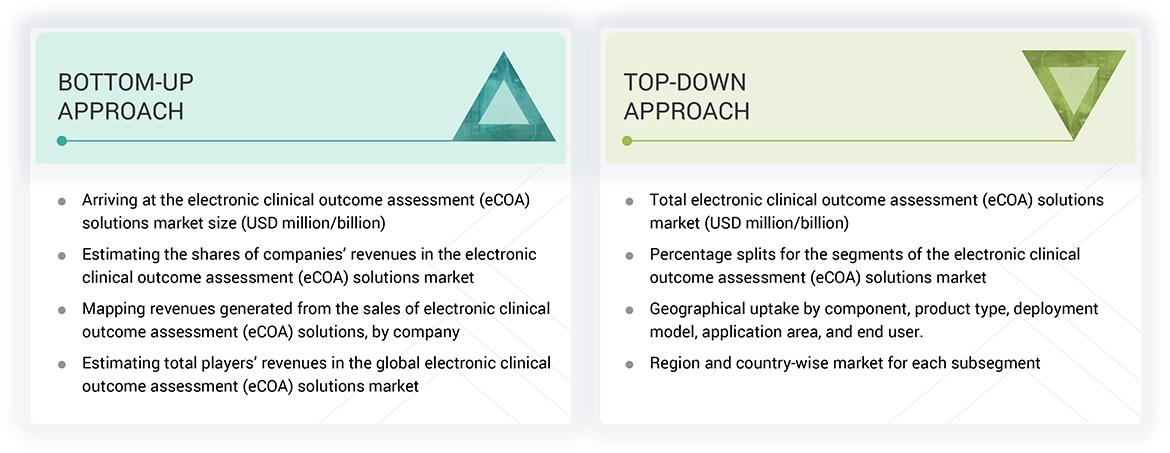

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

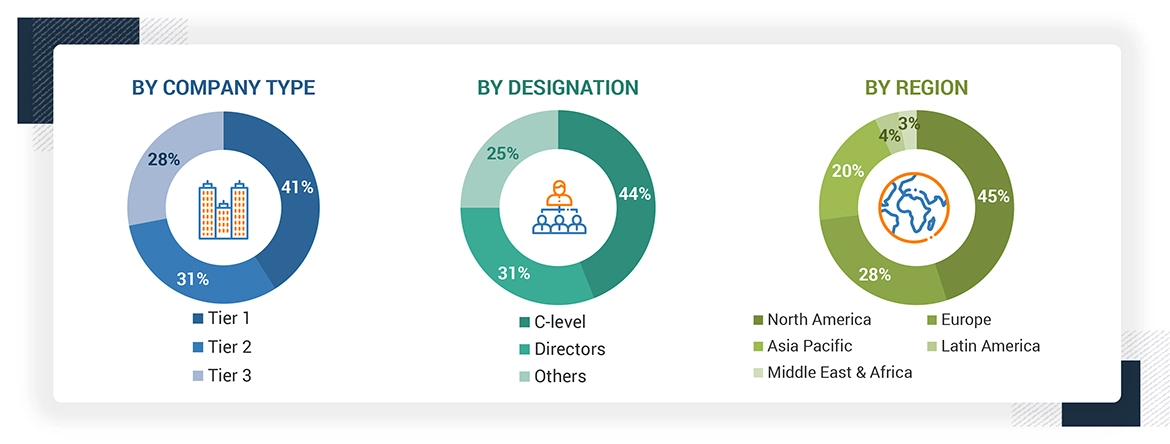

Breakdown of Primary Interviews

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends by component, product, deployment model, application, end user, and region).

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the electronic clinical outcome assessment (eCOA) solutions market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the electronic clinical outcome assessment (eCOA) solutions market.

Market Definition

Electronic Clinical Outcome Assessment (eCOA) uses electronic platforms or devices such as smartphones, tablets, or computers to collect patient-reported data on their health outcomes, symptoms, quality of life, or treatment responses in clinical trials or healthcare settings.

eCOA methods digitize capturing patient-reported data, enabling real-time data collection, analysis, and management. This electronic approach enhances the accuracy, efficiency, and convenience of gathering patient-reported information, streamlining the assessment of clinical outcomes and facilitating improved patient engagement in research or healthcare activities.

Stakeholders

- Electronic clinical outcome assessment (eCOA) solutions vendors

- Pharmaceutical & biotechnology companies

- Clinical research organizations (CROs)

- Research & development (R&D) companies

- Business research & consulting service providers

- Medical research laboratories

- Academic medical centers/universities/hospitals

- Regulatory bodies

- Healthcare service providers

- Venture capitalists

- Advocacy groups

- Investors & financial institutions

Report Objectives

- To define, describe, and forecast the electronic clinical outcome assessment (eCOA) solutions market by component, product, deployment model, application, end user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall eCOA solutions market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the eCOA solutions market in five central regions (and their respective countries): North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide key industry insights, such as supply chain, regulatory, patent, and recession impact analysis.

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches & upgrades, collaborations, partnerships, acquisitions, investments, contracts, agreements, alliances, mergers, funding, and expansions of the leading players in the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Key Questions Addressed by the Report

Who are the leading industry players in the Electronic Clinical Outcome Assessment (eCOA) Solutions market?

The prominent players in the Electronic Clinical Outcome Assessment (eCOA) Solutions market include IQVIA (US), Medidata (US), ICON Plc (Ireland), Signant Health (US), Clario (US), Oracle Corporation (US), Medable Inc. (US), Merative (US), Parexel International (MA) Corporation (US), Climedo Health GmbH (Germany), Healthentia (Belgium), Veeva Systems (US), assisTek (US), Curebase Inc. (US), Castor (US), EvidentIQ Group GmbH (Germany), YPrime, LLC (US), Clinical Ink (US), Clinion (US), Kayentis (France), TransPerfect (US), ObvioHealth USA, Inc. (US), WCG Clinical (Germany), ClinCapture (US), and Cloudbyz (US).

Which components have been included in the Electronic Clinical Outcome Assessment (eCOA) Solutions market report?

- Software

- Service

-

Wearables, mobile devices, and other devices.

- Bring Your Own Device (BYOD) Model

- Provisioned Device Model

- Hybrid Model

Which geographical region dominates the Electronic Clinical Outcome Assessment (eCOA) Solutions market?

The Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share. However, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period.

Which end user segments have been included in the Electronic Clinical Outcome Assessment (eCOA) Solutions market report?

The report contains the following end-user segments:

- Pharmaceutical & biotechnology companies

- Contract research organizations (CROs)

- Medtech companies & government organizations

- Academic & research institutes

- Hospitals & healthcare providers

- Consulting service companies

What is the expected CAGR for the Electronic Clinical Outcome Assessment (eCOA) Solutions market during 2025-2030?

The market is expected to hold a CAGR of 16.1 % during the forecast period (2025−2030).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electronic Clinical Outcome Assessment (eCOA) Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electronic Clinical Outcome Assessment (eCOA) Solutions Market