Electric Mountain Bike Market Size, Share & Analysis

Electric Mountain Bike Market by Battery Capacity (<250W, >250W-<450W, >450W-<650W, >650W), Class, Speed, Drive System (Chain Drive and Belt Drive), Mode (Pedal Assist and Throttle Assist), Motor Type, Component, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electric mountain bike (e-MTB) market is projected to grow from USD 16.91 billion in 2025 to USD 31.96 billion by 2032 at a CAGR of 9.5%. Electric mountain bikes are growing rapidly due to technological advancements, changing rider behavior, and expanding trail ecosystems. Modern e-MTBs now feature high-torque mid-drive motors (70–100 Nm), long-range batteries, and lightweight carbon or advanced aluminum frames, enabling riders to tackle steeper, longer, and more technical trails with greater efficiency. At the same time, the global e-MTB rider community is expanding through local riding clubs, online forums, and brand-led trail events, accelerating peer-driven adoption. The rapid growth of bike parks, adventure tourism, and dedicated trail networks, especially in Europe, along with clear regulatory support the growth of e-MTBs in the region. Together, performance innovation and strong community engagement are driving the e-MTB market.

KEY TAKEAWAYS

-

BY REGIONThe European electric mountain bike accounted for a market share of over 52% in 2025.

-

BY DRIVE SYSTEMThe belt drive system is expected to register the fastest growth at a CAGR of 13.2% during the forecast period.

-

BY CLASSThe Class I segment is projected to grow at the fastest rate from 2025 to 2032.

-

BY MOTOR TYPEThe mid-drive motor segment is projected to grow the fastest CAGR of 10.3% during the forecast period.

-

BY MODEThe pedal assist segment is expected to dominate the market and is projected to grow at a CAGR of 7.0%.

-

Competitive LandscapeCompanies such as Pon. Bike and Yadea Group were identified as among the STAR players in the global electric mountain bike market, primarily due to their strong business networks and strategic growth, which have enabled these companies to establish their market position.

The electric mountain bike market is witnessing strong growth, driven by several factors such as advancements in battery technology that are improving efficiency and affordability, enabling longer ranges at lower costs. At the same time, the integration of IoT and app-based connectivity is enhancing user experience for both individual commuters and commercial fleets. Further, product innovation and expanding trail infrastructure, rather than urban mobility use cases, are also helping to drive the demand for electric mountain bikes.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The electric mountain bike market is undergoing rapid transformation driven by technology convergence, premiumization, and evolving rider expectations. Advancements in mid-drive powertrain systems, long-range batteries, and connected riding platforms are redefining product differentiation. At the same time, shifts toward experience-led outdoor recreation, bike-park ecosystems, and service-based business models are disrupting traditional OEM and component supplier strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in High-performance e-MTB Powertrains

-

Growth of e-MTB Sports, Events, and Trail-based Tourism

Level

-

High Upfront Pricing of Premium e-MTBs

Level

-

Software-defined & Connected e-MTB Platforms

Level

-

Battery Weight, Thermal Stress, and Durability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in High-performance e-MTB Powertrains

Rapid technological innovation in high-torque mid-drive motors (85–100 Nm), paired with 600–750 Wh high-density battery packs, is significantly elevating the performance of electric mountain bikes. These next-generation systems deliver stronger climbing capability, better thermal stability, and smoother power delivery across variable terrain. At the same time, the adoption of lightweight carbon and advanced aluminum frame architectures is improving handling precision, mass centralization, and overall ride efficiency. For instance, OEMs such as Santa Cruz (US) offer their Heckler model e-MTB with a Carbon CC frame and an integrated 720 Wh battery. Together, these engineering advancements are enabling OEMs to build more capable, longer-range, and trail-optimized e-MTBs, directly driving premium consumer demand and accelerating global market growth.

Restraint: High Upfront Pricing of Premium e-MTBs

The electric mountain bike market continues to face a significant restraint from the high upfront cost of premium models, which limits adoption beyond affluent consumer segments. Flagship e-MTBs such as the Specialized Turbo Levo (USD ~7,000–13,500), Trek Rail (USD ~5,800–12,000), and Santa Cruz Heckler (USD ~7,400–12,300) are priced substantially higher than conventional mountain bikes, primarily due to the cost of mid-drive motors, large battery packs, advanced suspension, and carbon frames. In comparison, a high-performance non-electric MTB typically retails in the USD 2,000–5,000 range. This wide price gap slows the penetration of electric mountain bikes in price-sensitive regions and among first-time buyers, despite strong interest in performance and adventure riding. As a result, affordability remains a key barrier to mass-market scaling of e-MTBs.

Opportunity: Software-defined & Connected e-MTB Platforms

The integration of smart connectivity, adaptive ride modes, GPS tracking, and over-the-air (OTA) updates is creating a growth opportunity through recurring software- and service-led revenue streams in the electric mountain bike market. Leading OEMs such as Specialized (Mission Control), Trek/Bosch (eBike Flow app), Giant (RideControl), and Shimano (E-TUBE Project) are already deploying app-based motor tuning, ride analytics, theft protection, and remote diagnostics. This shift from hardware-only sales to connected performance ecosystems enables OEMs to monetize subscriptions, digital upgrades, and fleet management solutions. As riders increasingly demand personalized power delivery, navigation, and data-driven performance insights, connected e-MTBs are becoming a key differentiator in the premium segment. Over the next few years, software integration is expected to play a central role in boosting margins and strengthening long-term customer retention.

Challenge: Battery Weight, Thermal Stress, and Durability

One of the primary challenges in the e-MTB market is managing battery weight, thermal runaway, and long-term degradation under extreme trail conditions. High-torque climbing, continuous boost modes, and aggressive riding generate significant heat, which can accelerate cell aging and reduce usable battery life. Larger 600–750 Wh batteries improve range but also add mass, negatively impacting handling, suspension response, and overall ride agility. However, several leading OEMs are actively developing solutions to improve thermal stability and reduce battery weight without compromising range. For instance, Specialized’s Turbo Levo SL integrates a lightweight 320 Wh battery and magnesium-case motor system to reduce heat buildup and overall mass. Trek’s Fuel EXe utilizes the compact TQ-HPR50 motor paired with a thermally efficient 360 Wh battery to maintain stable performance under sustained loads. Ensuring thermal stability, safety, and performance consistency without increasing system weight remains a critical engineering trade-off for OEMs as E-MTB performance expectations continue to rise.

Electric Mountain Bike Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Bike park & trail riding: Turbo Levo is widely used in lift-access bike parks and technical trail networks for repeated uphill access and downhill sessions. | Enables multiple climbs in a single session, reduces rider fatigue, and improves trail accessibility for varied skill levels |

|

Adventure tourism & guided trail tours: Trek Rail E-MTBs are deployed by tour operators across alpine and forest trail routes. | Supports long-distance off-road touring, enhances rider safety on climbs, and increases daily route coverage for operators |

|

Mixed-use off-road commuting & weekend trail riding: Trance X E+ is used for weekday gravel/fire-road travel and weekend mountain trails. | Delivers one-bike versatility, lowers transportation costs, and provides fitness through assisted long-distance riding |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various electric mountain bike market players, primarily represented by raw material suppliers, component manufacturers, e-MTB manufacturers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Mountain Bike Market, By Motor Type

Mid-drive motors dominate the e-MTB market due to their superior torque delivery, efficient power transfer through the drivetrain, and optimized weight distribution, which is particularly beneficial for technical off-road riding. The demand for mid-drive systems is highest in Europe and North America, where trail regulations favor pedal-assist Class 1 bikes and riders prioritize steep-climb capability, precise cadence control, and natural handling. In these areas, mid-drives significantly outperform hub motors. e-MTBs equipped with mid-drive units typically pair with 600–750 W battery systems, providing the high energy density required for long-distance trail, enduro, and all-mountain riding. Leading OEMs offering mid-drive E-MTBs include Specialized (Turbo Levo – Brose motor), Trek (Rail – Bosch Performance Line CX), Giant (Trance X Advanced E+ – Yamaha SyncDrive Pro), Canyon (Spectral: ON – Shimano EP8), Santa Cruz (Bullit/Heckler – Shimano EP8), and Haibike (AllMtn – Bosch/Yamaha). Recent advancements in mid-drive technology include higher torque outputs (up to 90–100 Nm), improved thermal management, quieter motor acoustics, compact magnesium housings, smoother assist algorithms, and IoT-enabled motor tuning via mobile apps. These innovations are strengthening mid-drive motors’ position as the preferred solution for premium and performance-focused e-MTBs globally.

Electric Mountain Bike Market, By Mode

Pedal-assist e-MTBs dominate in Europe and North America, where trail access regulations permit Class 1 pedal-assist systems on most public mountain trails, especially under the widely adopted 25 km/h (EU) and 20 mph (US Class 1) limits. Pedal-assist platforms almost exclusively use mid-drive motors (Bosch, Shimano, Yamaha, Brose), as these provide better torque modulation, efficient gear usage, and natural climbing performance. Throttle-assist E-MTBs are more common in North America and parts of the Asia Pacific. They typically use hub motor drive setups, as these systems deliver instant torque but are less aligned with technical trail requirements. Europe maintains strict restrictions banning throttles on MTB trails, while the US allows Class 2 throttles on many multi-use trails, contributing to their faster growth. This regulatory split continues to support pedal-assist market growth in e-MTB categories.

Electric Mountain Bike Market, By Battery Capacity

Battery capacities in the range of >650W are expected to hold the largest share in the market, as they offer the optimal balance between range, weight, and performance required for trail, all-mountain, and enduro riding. This capacity band enables riders to complete long climbs, multi-hour trail sessions, and high-torque enduro segments without compromising thermal stability or adding excessive battery mass. It also pairs efficiently with high-torque mid-drive motors (85–100 Nm), which are prevalent in premium e-MTBs in Europe and North America. Leading OEMs, including Specialized, Trek, Giant, Canyon, and Haibike, have standardized 600–750 W packs across most trail and enduro platforms.

Electric Mountain Bike Market, By Drive System

Electric mountain bikes equipped with chain-drive systems are most prominent in Europe and North America, where performance-oriented trail, enduro, and all-mountain riding dominate consumer demand. The growth of chain-drive E-MTBs in these regions is primarily driven by the need for high-torque capability, wide gear ranges (1×11 / 1×12), strong climbing performance, and easy serviceability. Leading OEMs such as Trek, Specialized, Giant, Canyon, Santa Cruz, and Haibike continue to develop and launch advanced chain-drive e-MTBs built around Bosch, Shimano, Yamaha, and Brose mid-drive systems, reinforcing the chain drive’s dominant position in the performance e-MTB segment. In contrast, belt-drive systems remain a niche segment, primarily used in urban, trekking, and low-maintenance off-road hybrids, as they have lower torque tolerance and limited gear range. While belts offer benefits such as silent operation and zero lubrication, their frame design constraints and higher system cost restrict large-scale adoption in performance market.

Electric Mountain Bike Market, By Class

Class I e-MTBs hold the largest share of the global market due to their broad trail legality, regulatory acceptance across Europe and parts of North America, and natural riding experience for performance trail and all-mountain use. These models dominate premium segments powered by mid-drive motors and long-range battery systems. Class II e-MTBs (throttle + pedal assist) are the fastest-growing segment, particularly in North America and the Asia Pacific, driven by the demand for ease of use, instant torque, and rental/fleet applications. Class III e-MTBs (pedal-assist up to ~45 km/h) are most widely adopted in North America, driven by more flexible regulations that permit higher-speed e-Bikes on multi-use trails, forest roads, fire roads, and mixed-use commuting routes. The US market favors these models as riders often seek higher cruising speeds for long-distance trail riding, dual-purpose commuting, and backcountry exploration. Overall, market growth is being shaped by Class 1 for volume leadership and Class II–III for incremental expansion and new use cases.

REGION

Europe is expected to be the largest region in the global electric mountain bike market during the forecast period.

Europe is projected to remain the largest market for electric mountain bikes during the forecast period, driven by a deeply embedded cycling culture, dense mountain trail networks, and strong regulatory support for pedal-assist e-Bikes. Countries such as Germany, France, Austria, Switzerland, and Italy continue to lead demand due to their well-developed bike park infrastructure and vibrant mountain tourism ecosystems. The region benefits from clear 25 km/h pedelec regulations, enabling widespread trail access and mass adoption of Class 1 E-MTBs. Demand is further strengthened by active sports clubs, e-MTB racing events, and organized mountain-bike festivals such as the UCI E-MTB World Cup, European E-Bike Festival, Sea Otter Europe, and local Alpine trail competitions, which are driving strong consumer interest in performance electric mountain bikes. In addition, high consumer spending on premium performance bikes, strong OEM presence, and continuous investment in cycling infrastructure are structurally supporting long-term market growth across Europe.

Electric Mountain Bike Market: COMPANY EVALUATION MATRIX

Microquadrant provides information on major players that offer electric mountain bikes and outlines the findings and analysis of how well each vendor performs within the predefined criteria. The company evaluation matrix for the electric mountain bike market positions players based on their market share/rank and product footprint. Companies in the Stars quadrant, such as Pon.Bike leads the market with a strong market presence and a wide product portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Pon.Bike (Netherlands)

- Accell Group N.V. (Netherlands)

- Giant Manufacturing Co., Ltd. (Taiwan)

- Merida Industry Co., Ltd. (Taiwan)

- Yamaha Motor Co., Ltd. (Japan)

- Specialized Bicycle Components Inc (US)

- Trek Bicycle Corporation (US)

- Cube (Germany)

- Yadea Group Holdings Ltd. (China)

- AIMA Technology Group Co. Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 16.91 billion |

| Revenue Forecast in 2032 | USD 31.96 billion |

| Growth Rate | 9.5% |

| Years Considered | 2021 – 2032 |

| Base Year | 2024 |

| Forecast Period | 2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Regional Market Shares, Competitive Landscape, Driving Factors, Trends & Disruption, OEM Analysis, Bill of Materials, Total Cost of Ownership, and Others |

| Segments Covered | • By Class (Class I, Class II, Class III) • By Speed (Up to 25 Km/h, 25-45 Km/h) • By Motor Type (Hub and Mid-drive Motor) • By Mode (Pedal Assist and Throttle Assist) • By Component (Battery, Electric Motor, Frame with Fork, Crank Gear, Wheel, Motor Controller, and Brake Systems) • By Battery Capacity (<250W, >250 & <450W, >450 & <650W, and >650W) • By Drive System (Chain Drive and Belt Drive) |

| Regional Scope | Asia Oceania, Europe, and North America |

WHAT IS IN IT FOR YOU: Electric Mountain Bike Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market size of e-MTBs at the regional level for the US and Europe | Market sizing and forecast model for electric mountain bikes at the regional level for the US and the collective European market | With separate forecasts for the US and Europe, the report supports targeted go-to-market strategies, helping OEMs, suppliers, and investors prioritize regions based on growth rate, demand intensity, and regulatory environment. |

| e-bike OEM-wise Global Market Share | OEM-wise global market share for Accel Group, Pon.Bike, GIANT, MERIDA, DECHATHLON, YAMAHA, CUBU, TREK, and Specialized in 2023 – 2024 |

|

| e-Bike Drive Unit | Global Drive Unit Market Share: Bosch, Shimano, Yamaha, Brose, Bafang, Panasonic, 2023 – 2024 |

|

RECENT DEVELOPMENTS

- March 2025 : Accell Group officially inaugurated a brand-new KOGA Experience Center in Heerenveen, Netherlands. The latest KOGA models are on display and available for trial rides at this experience center, which demonstrates Accell’s commitment to preserving premium bike production in Heerenveen, Netherlands.

- March 2025 : Brose SE sold its eBike drives business to Yamaha Motor Co., Ltd., subject to approval by the antitrust authorities. Yamaha Motor's eBike Systems GmbH will take over the eBike drive and systems business. In the future, Yamaha will use Brose's development resources in the eBike sector to further optimize the planning and design of new products in the field of electric mountain bikes.

- March 2025 : Giant Group announced a new operations facility in Kunshan, China. The new 17,00?m² building will have a Bike Park experience zone and an e-commerce operations center.

- December 2024 : Accell Group signed a four-year partnership with the Dutch cycling team, Team Picnic PostNL. Its Lapierre brand became the team’s bike sponsor, while XLC (Accell’s European brand) supplied accessories and travel essentials. The partnership took effect on January 1, 2025.

Table of Contents

Methodology

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, electric mountain bike magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the electric mountain bike market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources for this research study included the electric mountain bike industry association, internal databases, corporate filings (such as annual reports, investor presentations, and financial statements), and data from trade and business. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

In the primary research process, several primary interviews were conducted with market experts from the demand and supply sides across three major regions: North America, Europe, and Asia Oceania. 20% and 80% of primary interviews were conducted with the OEMs and Tier-1 players, respectively.

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This and insights by in-house subject-matter experts led to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

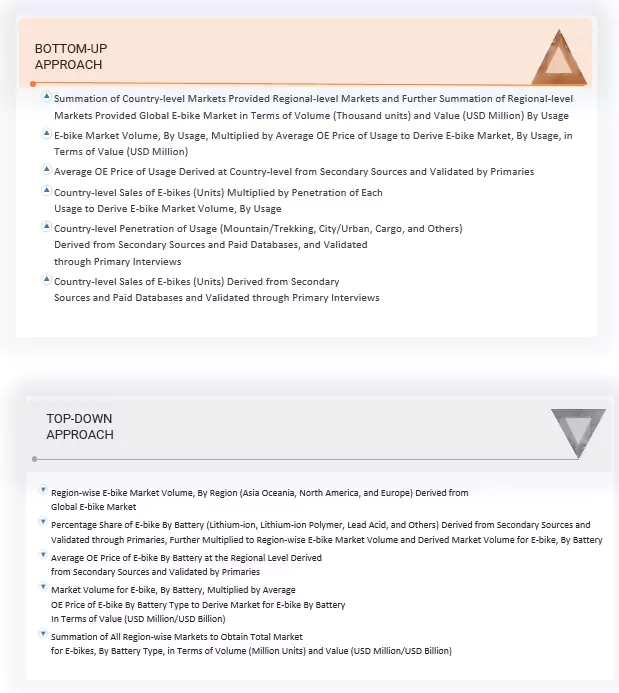

The bottom-up approach was used to derive the electric mountain bike market size based on volume and value. This was followed by primary interviews and feature mapping on a regional basis from the MarketsandMarkets repository.

The market size was validated through in-depth interviews with industry experts—excerpts available in the discussion guide in the appendix—and secondary research. The report-writing phase began after arriving at the final numbers for the market size.

By estimating the regional market size for electric mountain bikes by battery type, the global market was derived in terms of volume. The percentage share of electric mountain bikes by battery type (lithium-ion, lithium-ion polymer, lead-acid, and others) was derived from secondary sources and validated through primary sources. It was multiplied by the region-wise market volume. The market volume for electric mountain bikes, by battery type, was derived from this. The average OE price of an electric mountain bike by battery type at the regional level was derived from secondary sources, and primary sources validated the same. The market volume for electric mountain bikes, by battery type, was multiplied by the average OE price of electric mountain bikes. The market for electric mountain bikes by battery type was derived in terms of value (USD million). All region-wise markets were summed to obtain the total market for electric mountain bikes by battery type in terms of volume (thousand units) and value (USD million).

A similar approach was followed to obtain the electric mountain bike market by motor type, mode, component, and speed.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach was used to estimate and validate the size of the market by usage. Country-level electric mountain bike sales (in terms of volume) were derived from secondary sources such as country-wise manufacturing associations. They paid for databases and validated them through primary interviews to determine the size of the market by class and usage in terms of volume. Country-level penetration by usage type (mountain/trekking bikes, city/urban, cargo, and others) was derived from secondary sources and paid databases and validated through primary interviews.

The market was then forecasted based on various parameters such as analysis of the historical data, market trends, and growth drivers such as increasing bike sales, an increase in infrastructural development activities, economic conditions, and government incentives and subsidies. Technological advancements in electric mountain bike motors, emerging market opportunities, and competitive landscape assessments were also considered to arrive at the country-wise forecast of the electric mountain bikes by usage.

The country-level electric mountain bike sales (by volume) were multiplied by the penetration of each usage type. The market volume, by usage type, was derived through this. The average OE price by usage type was derived from secondary sources, and primary sources validated the same. The market volume, by usage, was multiplied by the average OE usage price. The market, by usage type, in terms of value (USD million), was derived through this. The summation of country-level markets provided the regional-level market. Further summation of the regional-level markets provided the global market in terms of volume (thousand units) and value (USD million) by usage.

Electric Mountain Bike Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

An electric mountain bike is a bicycle with a small electric motor and a rechargeable battery to assist the power provided by the rider. The batteries can be recharged by connecting them to a plug. A typical electric mountain bike needs 6 to 8 hours to charge the battery and has a range of 35 to 50 km at a speed of about 20 km/h.

Stakeholders

- electric mountain bike manufacturers

- electric mountain bike battery & motor manufacturers

- Component suppliers for electric mountain bikes

- Raw material suppliers for electric mountain bikes

- Country-level associations

- Traders, distributors, and suppliers of electric mountain bikes

Report Objectives

-

To define, describe, and forecast the size of the global electric mountain bike market in terms of value (USD million) and volume (thousand units)

- By Class (Class-I, Class-II, Class-III) at the regional level

- By Speed (up to 25 km/h, 25-45 km/h) at the regional level

- By Battery Type (Lithium-ion, Lithium-ion Polymer, Lead Acid, and Others) at the regional level

- By Motor Type (Hub and Mid) at the regional level

- By Mode (Pedal Assist and Throttle) at the regional level

- By Component (Batteries, Electric Motors, Frames With Forks, Wheels, Crank Gears, Brake Systems, and Motor Controller) at the regional level

- By Usage (Mountain/Trekking, City/Urban, Cargo, and Others) at the regional level

- By Ownership (Shared and Personal)

- By Battery Capacity (<250W, >250 & <450W, >450 & <650W, and >650W)

- By Motor Weight (<2 kg, >2 kg & <2.4 kg, >2.4 kg)

- By Motor Power (<40nm, >40nm-<70nm, >70nm)

- Country-level analysis of class-wise and usage-wise segments (Asia Oceania, Europe, and North America)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To strategically analyze the market with trade analysis, pricing analysis, recession impact, case study analysis, patent analysis, technology analysis, regulatory analysis, key conferences and events, bill of material, the total cost of ownership, pricing analysis trends/disruptions impacting buyers, financial matrix, investment, and funding case scenario

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking

- To analyze the competitive leadership mapping of the global and regional electric mountain bike manufacturers and electric mountain bike component suppliers in the market

- To analyze a detailed listing of OEMs and their brands, OEM-wise technical specifications, mergers & acquisitions, partnerships, collaborations, expansions, and new product launches/developments undertaken by critical participants in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs. The following customization options are available for the report:

BY DESIGN

- Foldable

- Unfoldable

BY FRAME MATERIAL

- Carbon Fiber

- Carbon Steel

- Aluminum

- Aluminum Alloy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Mountain Bike Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electric Mountain Bike Market