Electric Vehicle Tires Market Size, Share & Analysis

Electric Vehicle Tires Market by Propulsion (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEVs), Vehicle Type (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicles, Buses), Load Index, Application (On-Road, Off-Road), Rim Size (13–15”, 16–18”, 19–21”, > 21”), Sales Channel, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electric vehicle tires market is expected to reach USD 27.36 billion by 2032, up from USD 11.21 billion in 2025, at a CAGR of 13.6% from 2025 to 2032. EV tires incorporate reinforced sidewalls, advanced compounds, and sound-absorbing technology to handle the increased torque, weight, and unique wear of electric vehicles. Demand for EV tires is increasing due to the higher vehicle weight and torque, the need for lower rolling resistance to extend range, and a growing focus on noise reduction and ride comfort.

KEY TAKEAWAYS

-

BY VEHICLE TYPEThe market for electric vehicle tires is growing beyond passenger cars to include light commercial vehicles and buses, due to the increasing electrification of logistics and public transport fleets.

-

BY PROPULSION TYPETires designed for battery electric vehicles (BEVs) are specifically engineered to support the extra weight of battery packs. They are made with low rolling resistance to enhance energy efficiency and extend driving range. Additionally, their construction and materials are optimized to handle the instant torque produced by electric motors, while also minimizing road noise for a quieter driving experience.

-

BY RIM SIZEWhile common rim sizes maintain a large share, there is a clear trend toward larger rim sizes, particularly 19 inches and above, as automakers focus on enhancing the aesthetic appeal and performance of new EV models.

-

BY LOAD INDEXThe market is seeing increased demand for tires with a load index above 100, which is driven by the growing popularity of heavier electric SUVs, light trucks, and commercial vehicles.

-

BY APPLICATIONThe market is dominated by on-road applications, which include passenger vehicles and commercial fleets. The off-road segment is also emerging with the introduction of new electric trucks and SUVs built for rugged terrains and mining & construction applications.

-

BY REGIONThe fastest growth in Europe is due to strict emission regulations and a mature automotive sector driving demand for advanced, sustainable tire technologies. In North America, growth is fueled by expanding EV charging infrastructure, rising consumer preference for premium EVs, and increased investments by tire manufacturers in EV-specific product lines.

-

COMPETITIVE LANDSCAPEThe market is highly competitive, with major players such as Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, and Pirelli & C. S.p.A. investing heavily in research & development to create advanced, purpose-built tires for electric vehicles.

Tire technology advances, such as smart sensors, eco-friendly materials, and designs for electric commercial vehicles, are expanding the scope of electric vehicle tires. Collaboration with automakers enables faster fitments for new EV platforms, while innovations in foam, silica compounds, and lightweight structures improve efficiency and noise control. Rising EV adoption across segments is fueling strong demand for next-generation tires.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in consumer preferences and market disruptions significantly influence the revenue of electric vehicle OEMs and end users. Consequently, this impacts the demand for specialized electric vehicle tires, thereby affecting the revenues of tire manufacturers. As the adoption of electric vehicles accelerates and tire technology progresses, shifts in end-user purchasing behaviors and regulatory requirements will directly determine the growth trajectory and innovation priorities within the tire market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government initiatives for green and clean environment

-

Increasing demand for improved vehicle range

Level

-

Lack of awareness regarding electric tire vehicles in emerging economies

-

Increased longevity of tires affecting aftermarket sales

Level

-

Development of smart and connected electric vehicle tires

-

Focus on environmental sustainability

Level

-

Higher stress rates due to instant torque and vehicle weight

-

High cost and limited availability of electric vehicle tires

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government initiatives for green and clean environment

Government policies promoting clean mobility are increasing EV demand through stricter emission standards, subsidies, and investments in charging infrastructure. The EU has set a goal to reduce emissions by 55% by 2030, while several Asian countries are expanding charging networks, making EV adoption easier and supporting growth in the EV tire market.

Restraint: Increased longevity of tires affecting aftermarket sales

Increased tire longevity is limiting aftermarket sales, as electric vehicle tires are built with reinforced sidewalls, advanced tread compounds, and optimized designs that withstand heavier loads and torque. While this improves safety and durability, it reduces replacement frequency, lowering aftermarket demand for electric vehicle tires.

Opportunity: Development of smart and connected electric vehicle tires

Smart and connected electric vehicle tires with embedded sensors track pressure, wear, and road conditions in real time, enabling predictive maintenance, better safety, and efficiency. Future advances like adaptive treads and self-healing compounds will further boost performance and sustainability.

Challenge: Higher stress rates due to instant torque and vehicle weight

EVs create higher tire wear due to instant torque, regenerative braking, and added battery weight, leading to faster tread abrasion and shorter replacement cycles. Heavier loads and heat buildup strain tire durability, raising costs despite advances in reinforced compounds and extended-wear models.

Electric Vehicle Tires Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Specialized EV tire designs with low rolling resistance, noise-reducing tread, and reinforced structures | Improved battery range, reduced cabin noise, higher load-bearing capacity |

|

EV-specific tire compounds engineered for high torque and instant acceleration | Better grip, reduced wear, improved durability under EV loads |

|

Integration of sustainable materials such as recycled rubber and bio-based compounds in EV tires | Lower carbon footprint, compliance with sustainability goals, long-term cost savings |

|

Noise Cancelling System (PNCS) technology and foam inserts for EV comfort | Quieter driving experience, increased consumer satisfaction, premium positioning |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electric vehicle tires market ecosystem includes raw material suppliers, component makers, tire manufacturers, aftermarket providers, and end users working together to deliver reliable solutions. Collaboration across these stakeholders ensures innovation in tire design, performance, and sustainability. Key players such as Michelin (France), Bridgestone (Japan), Goodyear (US), Continental (Germany), and Pirelli (Italy) drive product development and market expansion.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Vehicle Tires Market, By Vehicle Type

The passenger cars segment held the largest share of the electric vehicle tires market in 2024. Strong EV adoption, supported by expanding charging networks, is boosting demand for advanced tires. Manufacturers are emphasizing low rolling resistance, noise reduction, and reinforced designs to enhance range, comfort, and durability. The launch of more electric sedans and SUVs through OEM–tire maker collaborations further secures this segment’s leadership.

Electric Vehicle Tires Market, By Propulsion Type

The battery electric vehicle segment is set to lead the electric vehicle tires market as automakers push all-electric strategies and phase out combustion models. Investments in fast-charging infrastructure and zero-emission mandates are boosting BEV adoption. This increases demand for tires with low rolling resistance, durability for heavier batteries, and extended range efficiency. Leading tire makers are launching BEV-focused products to capture this growth.

Electric Vehicle Tires Market, By Rim Size

The 16-18 inch segment is expected to hold the largest share in the electric vehicle tires market, as these sizes are common on small passenger cars, mid-size sedans, and crossovers. Rising sales of electric small cars and crossovers in markets such as China and Japan are boosting demand. Strong aftermarket replacement for 16-18 inch electric vehicle tires further supports their market dominance.

Electric Vehicle Tires Market, By Load Index

Tires with a load index below 100 dominate the electric vehicle tires market. They are mainly used in small and mid-size electric passenger cars due to their lighter weight and need for low rolling resistance to maximize range. Tires above 100 are designed for heavier commercial EVs with reinforced structures for durability. Examples such as Michelin e.Primacy show the market focus on efficient, lightweight tires tailored for passenger EVs.

Electric Vehicle Tires Market, By Application

The on-road segment is expected to lead the electric vehicle tire market. This growth is driven by the widespread adoption of electric passenger cars and buses. These vehicles use specialized on-road tires, such as the Michelin Pilot Sport S 5, designed for better grip and noise reduction. Increasing urban emission reduction initiatives are also boosting demand for these high-performance tires.

REGION

Asia Pacific to be largest market for electric vehicle tires during forecast period

Asia Pacific is expected to become the largest market for electric vehicle tires during the forecast period, driven by China's dominance in global EV sales, rapid EV adoption in India and Southeast Asia, and strong government incentives for electrification. The region has a dense supply chain of tire manufacturers like Bridgestone, Yokohama, and Zhongce Rubber, expanding their EV-focused product lines. Increasing demand for long-range EVs is boosting the adoption of low rolling resistance and high load-bearing tires, while fast urbanization and large shared mobility fleets are further driving replacement demand.

Electric Vehicle Tires Market: COMPANY EVALUATION MATRIX

In the electric vehicle tires market, Michelin is the leading company, recognized for its innovative tire technologies, energy-efficient materials, and strong global presence in both the passenger and commercial EV segments. Hankook Tire & Technology Co., Ltd. is emerging as a significant player, introducing EV-specific tire innovations such as noise reduction and extended tread life technologies. While Michelin has the advantage of scale and robust research and development capabilities, Hankook demonstrates considerable growth potential as it expands its product offerings and strengthens partnerships with major electric vehicle original equipment manufacturers (OEMs).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Michelin (France)

- Bridgestone Corporation (Japan)

- The Goodyear Tire & Rubber Company (US)

- Continental AG (Germany)

- Pirelli & C. SpA (Italy)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Nokian Tyres plc (Finland)

- Kumho Tire Co. (South Korea)

- Zhongce Rubber Group (China)

- Sailun Group Co., Ltd. (China)

- Cheng Shin Rubber Ind. Co., Ltd. (Taiwan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 11.21 Billion |

| Revenue Forecast in 2032 | USD 27.36 Billion |

| Growth Rate | CAGR of 13.6% from 2025-2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Volume (Thousand Units), Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, and North America |

WHAT IS IN IT FOR YOU: Electric Vehicle Tires Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based EV OEMs | Detailed profiles of EV tire manufacturers (product portfolio, regional presence, technology) Mapping of tire adoption trends by EV segment (passenger cars, SUVs, LCVs) Assessment of regulations, incentives, and infrastructure impact on tire adoption | Identified & profiled 15+ EV tire manufacturers in APAC Tracked EV adoption and fleet electrification trends impacting tire demand Highlighted emerging customer clusters for electric vehicle tires based on urbanization and fleet expansion |

| Global EV Tire Manufacturers | Segmentation of EV tire demand (low rolling resistance, high load index, noise reduction tires) Benchmarking of current vs. future EV tire technologies Analysis of OEM requirements and performance standards | Revealed revenue potential from advanced EV tire segments Pinpointed opportunities for EV-specific tire innovations Enabled targeting of high-margin, technology-focused EV tire applications |

| EV Fleet Operators | Insights on tire integration requirements for EV platforms Performance benchmarking of tire compounds under EV-specific load and torque conditions Supplier selection support for EV tire sourcing | Enabled Tier-1s to align product development with EV OEM needs Reduced risk in supply chain selection for electric vehicle tires Highlighted potential co-development opportunities with EV tire manufacturers |

RECENT DEVELOPMENTS

- 1-Jul-25 : Hankook Tire introduced the iON HT, its first highway-terrain tire for electric light-duty trucks. Built to support heavier EV batteries, it provides ultralow rolling resistance, robust durability with an 80,000-mile tread warranty, and all-season traction. Available in five sizes (18–22 inches) starting in August, it signifies Hankook’s growth in EV-focused tire solutions.

- 1-May-25 : Pirelli & C. SpA introduced the P Zero Fifth Generation tire, designed for EVs with AI-driven tread patterns and low rolling resistance to improve range, along with the Cinturato Summer Tire, intended for luxury EVs with top wet grip and noise reduction ratings. These launches aim to support Pirelli’s 12% volume growth target for 2025 and strengthen partnerships with leading global EV manufacturers.

- 1-Apr-25 : Bridgestone Corporation announced the launch of Turanza 6, developed with ENLITEN technology for reduced weight and rolling resistance. The tire was selected as the original equipment tire for the NEW MG S5 EV launched in Thailand. The tire is designed to enhance energy efficiency, road grip (especially wet surfaces), and ride comfort for EVs and is UN R117-04 certified.

- 1-Feb-25 : Continental AG introduced the Conti Eco HS 5 and Conti Efficient Pro HS 5 tire lines, specifically designed for electric commercial vehicles. These tires feature higher load ratings to support heavier EVs, lower rolling resistance for increased range, and are developed in collaboration with Designwerk Technologies. The new lines aim to optimize total cost of ownership (TCO) and promote the electrification of commercial vehicle fleets across Europe.

- 1-Feb-25 : Sumitomo Rubber Industries, Ltd. introduced DUNLOP “SPORT MAXX LUX” premium comfort tires, which feature an “EV Suitable” mark. These tires are designed to meet EV standards for rolling resistance, load capacity, quietness, durability, and wet grip. The product will be available in 72 sizes in Japan starting February 2025.

Table of Contents

Methodology

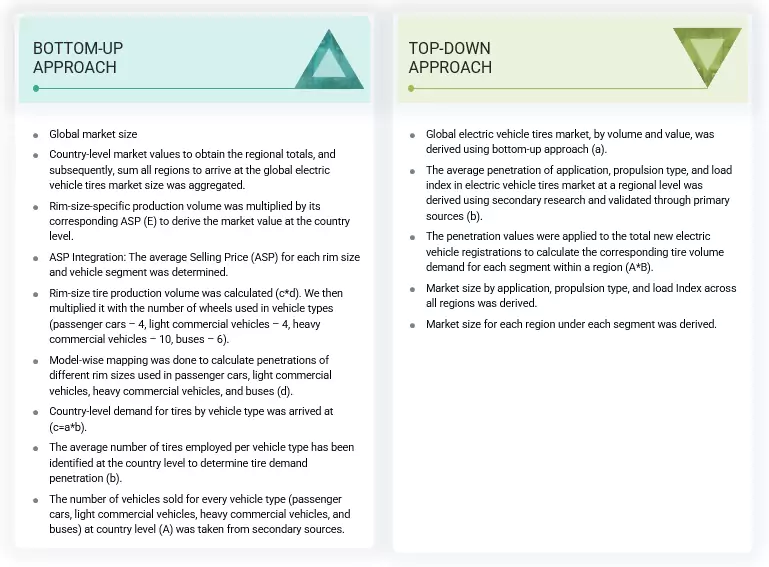

The study involved four major activities. The first step was to estimate the current size of the electric vehicle tires market and conduct exhaustive secondary research on the market, peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. In the third step, the bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to determine the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

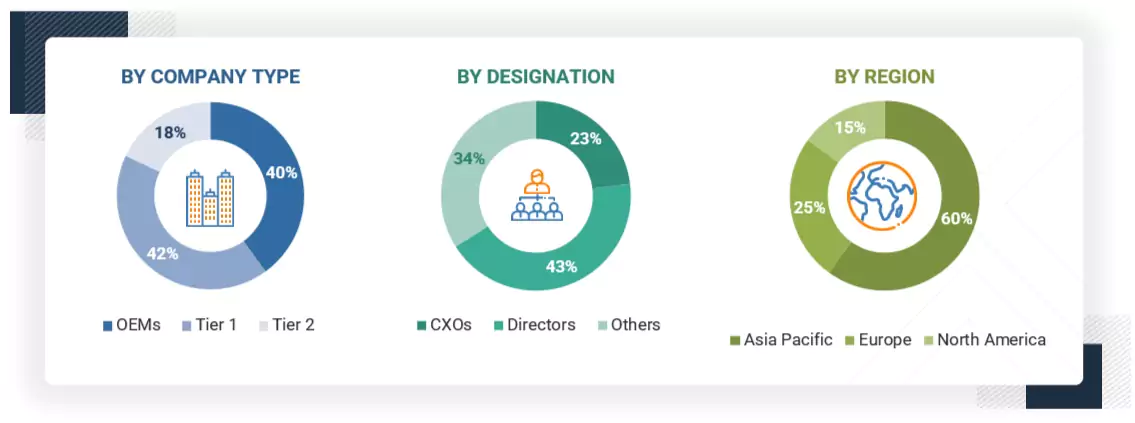

Primary Research

Extensive primary research has been conducted after understanding the electric vehicle tire market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand-side electric vehicle manufacturers (country-level government associations and trade associations) and supply-side OEMs and component manufacturers across five major regions: North America, Europe, Asia Pacific, the Middle East, and Africa. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the process of primary interviews, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume and value of the electric vehicle tires market. Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research. The research methodology included the study of the annual and quarterly financial reports, regulatory filings of significant market players, and interviews with industry experts for detailed market insights. All major penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources, model mapping, and verified through primary sources. All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data. The market data gathered was consolidated and added with detailed inputs, analyzed, and presented in this report.

Electric Vehicle Tires Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Electric vehicle tires are defined as tires catered toward specific needs and challenges associated with electric vehicles. These needs and challenges include increased vehicle weight, higher torque from the electric powertrain, and more. Electric vehicle tires are expected to offer lower rolling resistance and lower road noise compared to standard automotive tires. Additionally, silica, nylon, steel belts, and synthetic rubber in the construction process add these features and improve the traction and safety of electric vehicles in different conditions.

Stakeholders

- Associations, Forums, and Alliances related to Electric Vehicle Tires

- Automobile Manufacturers

- Automotive Component Manufacturers

- Automotive Investors

- Aftermarket and Tire Retreading Associations

- Companies Operating in the Autonomous Vehicle Ecosystem

- Distributors and Retailers

- Electric Pick-up Truck Manufacturers

- Electric Medium and Heavy-duty Truck Manufacturers

- Electric Vehicle Manufacturers

- Electric Vehicle Distributors and Retailers

- Electric Vehicle Tire Manufacturers

- Electric Vehicle Tire Traders, Distributors, and Suppliers

- Government Agencies and Policy Makers

- Government and Research Organizations

- Original Equipment Manufacturer (OEM)

- Organized and Unorganized Aftermarket Suppliers

- Raw Material Suppliers of Tires/Tire Components (Suppliers for Tier I)

- Transport Authorities

- Technology Providers

Report Objectives

-

To segment and forecast the size of the electric vehicle tires market in terms of volume and value.

- To segment and forecast the size of the global market, by volume and value, based on propulsion type (battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), hybrid electric vehicle (HEV), and fuel cell electric vehicle (FCEV)

- To segment and forecast the size of the global market, by volume and value, based on vehicle type (passenger cars, light commercial vehicles, heavy commercial vehicles, and buses)

- To segment and forecast the size of the global market, by volume and value, based on rim size (13–15”, 16–18”, 19–21”, and > 21”)

- To segment and forecast the size of the global market, by volume and value, at the regional level, based on application (on-road and off-road)

- To segment and forecast the size of the global market, by volume at the regional level, based on load index (less than 100 and above 100)

- To provide qualitative insight for the sales channel (OEM and Aftermarket)

- To segment and forecast the market size, by volume and value, based on region (Asia Pacific, Europe, North America, Middle East, and Africa)

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

-

To study the following with respect to the market:

- Impact of AI/Gen AI

- Trend and Disruption Impacting Customer Business

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Investment & Funding Scenario

- Key Stakeholders & Buying Criteria

- Key Conferences & Events

- Average Selling Price Analysis

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available:

- Electric Vehicle Tires Market, By Vehicle Type at Country Level

- Electric Vehicle Tires Market, By Rim Size at Country Level

- Electric Vehicle Tires Market, By Propulsion Type at Country Level

- Profiling of Additional Market Players (Up to 3)

Key Questions Addressed by the Report

What is the current size of the global electric vehicle tires market?

The global electric vehicle tires market size is estimated to be USD 11.21 billion in 2025 and projected to reach USD 27.63 billion by 2032.

Who are the winners in the global electric vehicle tires market?

Global players such as Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. SpA, and Sumitomo Rubber Industries, Ltd dominate the electric vehicle tires market. These companies develop new products; adopt expansion strategies; and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the electric vehicle tires market.

What are the new market trends impacting the growth of the electric vehicle tires market?

The new market trends include a shift of tire manufacturers to sustainable materials and a rising demand for low rolling resistance tires.

Which region is projected to be the largest market during the forecast period?

Asia Pacific is projected to be the largest market in the electric vehicle tires market during the forecast period.

What is the projected CAGR for the electric vehicle tires market during the forecast period (2025–2032)?

The electric vehicle tires market is projected to grow at a CAGR of 13.6% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Vehicle Tires Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electric Vehicle Tires Market