Electrical & Electronics PEEK Market

Electrical & Electronics PEEK Market by Processing Method (Extrusion, Injection Molding), Reinforcement Type (Glass-Filled, Carbon-Filled, Unfilled), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electrical & electronics PEEK market is projected to grow from USD 0.47 billion in 2025 to USD 0.70 billion by 2030, at a CAGR of 8.1% during the forecast period. The demand for PEEK (Polyetheretherketone) in the electrical & electronics market is dramatically increasing. The material offers very high thermal stability, chemical resistance, and excellent electrical insulation, making it suitable for use in various electronic and electrical components. Moreover, the gradual shift toward smaller, lighter electronic components and stringent industry regulations that require higher reliability and performance are driving the market. The emergence of 5G, electric cars, and the need for more robust consumer electronics are driving the growing demand for PEEK in the electrical & electronics industry.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is projected to be the fastest-growing market for electrical & electronics PEEK during the forecast period.

-

BY REINFORCEMENT TYPEThe glass-filled segment is projected to be the fastest-growing segment during the forecast period.

-

BY PROCESSING METHODBy processing method, the extrusion molding is expected to dominate the electrical & electronics PEEK market during the forecast period.

-

Competitive Landscape - Key PlayersVictrex Plc, Syensqo, and Evonik Industries AG are identified as some of the star players in the electrical & electronics PEEK market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsLehmann&Voss&Co. and Bieglo GmbH, among others, have distinguished themselves as key startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The electrical & electronics PEEK market is growing, largely driven by demand for high-performance materials. PEEK's excellent properties, such as thermal stability, chemical resistance, and excellent electrical insulation, make it an ideal choice for the manufacturing of electronic and electrical components. Various factors, such as the continuous miniaturization of devices, 5G technology, electric vehicles, and consumer electronics, among others, are driving the market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growth of the electrical & electronics PEEK market is driven the increasing trends of electrification and connectivity. OEMs in the EV, 5G/telecom, industrial automation, data center, and semiconductor equipment sectors are driving the shift from traditional insulators and standard connectors to high-performance, miniaturized components that can withstand the heat, voltages, and power densities of the future. PEEK can help develop thinner-wall, high-reliability parts such as high-voltage connectors, sensor housings, and precision insulators, while allowing metal replacement and halogen-free designs. On the other hand, factors like the volatility in supply chains, price sensitivity, and competition from other high-performance polymers are leading OEMs to implement strategies, such as dual-sourcing, material-efficient designs, and selective substitution, which in turn requires PEEK suppliers to focus on specialty grades (glass-/carbon-filled, conductive, EMI-shielding, 3D-printing) and offer better design and compliance support to differentiate themselves.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High-performance material demand

-

Miniaturization of electronic devices

Level

-

High material cost

-

Processing challenges

Level

-

Expanding 5G networks

-

Emerging applications

Level

-

Intense competition from alternative materials

-

Supply chain constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High-performance material demand

One of the major factors contributing to the growth of the electrical & electronics PEEK market is the continuous increase in the demand for high-performance materials. The evolution of industries has created a constant demand for materials that, in addition to having excellent electrical and mechanical properties, can withstand extreme conditions. PEEK is increasingly used across a wide range of applications in the electronics and electrical industries because of its unique combination of thermal stability, chemical resistance, and electrical insulation. The properties of PEEK that are most attractive to the electronics sector are its ability to operate reliably at high temperatures, its resistance to harsh chemicals, and its excellent electrical performance. Thus, PEEK is becoming the material of choice for high-tech applications in connectors, insulators, and semiconductors, as well as other critical components. The ongoing trend of miniaturization, coupled with the need for better performance in electronic devices, has driven demand for PEEK-type materials that meet the strictest standards.

Restraint: High material cost

PEEK's high material cost is a significant restraint in the electrical & electronics sector. The high cost of PEEK significantly limits its application. Moreover, PEEK is hard to obtain due to its long, energy-intensive manufacturing process. The cost of the final PEEK product is higher than that of metals and conventional plastics. Thus, it is less attractive for use in high-volume, low-cost products, where budget constraints are the main issue. Consequently, companies may prefer to use alternative materials that offer a good balance of performance and cost in industries where price sensitivity is a crucial factor. The high cost of PEEK can also be a challenge for small manufacturers and startups that may not have the resources to invest in it, thereby limiting its application in the electrical & electronics sector.

Opportunity: Expanding 5G networks

The adoption of 5G networks is expected to be one of the most important drivers of the electrical & electronics PEEK market. The rollout and adoption of 5G technology are giving rise to a new market for high-performance materials capable of meeting the challenges it poses for infrastructure and devices. The exceptional features of PEEK, such as its electrical insulation properties, thermal stability, and resistance to chemical degradation, position PEEK as a top contender for 5G network components of utmost importance, including connectors, cables, antennas, and semiconductors. The mentioned components need to function flawlessly in high-frequency, high-temperature environments; hence, PEEK is the only material that meets these requirements. The adoption of advanced and efficient electronic systems for 5G networks is expected to drive the demand for PEEK in the electrical & electronics sector.

Challenge: Intense competition from alternative materials

The competition posed by alternative materials with comparable properties is one of the most challenging factors for the electrical & electronics PEEK market. PEEK has already established itself as a material with excellent properties, such as high thermal stability, electrical insulation, and chemical resistance; however, there are alternatives that offer the same advantages and are still cheaper than PEEK. For instance, polyimide, polyester, and ceramics can be considered substitutes for PEEK when its unparalleled performance is not an absolute requirement. These substitutes are usually less expensive and have more manageable processing, which makes them appealing to manufacturers trying to cut costs, especially in industries sensitive to prices. Moreover, the introduction of new and better-performing polymers and composites is offers significant competition to PEEK.

ELECTRICAL & ELECTRONICS PEEK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

PEEK used in high-performance connectors and insulators in 5G devices | High thermal stability and electrical insulation properties for reliable 5G performance |

|

PEEK components in industrial sensors and control systems | Excellent dielectric strength and chemical resistance, ensuring durability in harsh environments |

|

PEEK in electrical insulation for high-voltage equipment | Superior heat resistance and electrical performance, ensuring safety and reliability in power systems |

|

PEEK used in automotive electrical wiring and connectors | Lightweight, heat-resistant components that improve fuel efficiency and reduce emissions in electric vehicles |

|

PEEK used in aerospace electrical systems for insulation and protection | High dielectric strength, ensuring reliable performance and safety in critical aerospace applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electrical & electronics PEEK market ecosystem comprises several key players across segments. Polyether ether ketone manufacturers like Victrex, Syensqo, and Evonik play a central role in producing high-performance PEEK polymers, which are crucial for various applications. These manufacturers are supported by raw material suppliers such as Wanlong Chemical and OYI, which provide essential materials required for electrical & electronics PEEK production. The supply chain is further strengthened by distributors such as Conventus, which ensure the availability and distribution of electrical & electronics PEEK products. Lastly, end users such as ATA Gears and Elecon use PEEK across various industries, including automotive, aerospace, and industrial, where its superior properties are in high demand. This interconnected ecosystem facilitates the efficient flow of PEEK materials from production to end use, contributing to market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electrical & Electronics PEEK Market, By Processing Method

The extrusion segment is the fastest-growing processing method in the electrical & electronics PEEK market. The extrusion process is particularly advantageous for high-volume production of electrical and electronic components. The main factor driving the use of extrusion in this field is the ability to produce very finely detailed, long-lasting geometries, such as wires, cables, and insulators. This is partly due to the growing miniaturization of electronic devices, which has made these products highly sought after in the market.

Electrical & Electronics PEEK Market, By Reinforcement Type

The glass-filled PEEK segment is the fastest-growing reinforcement type in the electrical & electronics PEEK market. This growth is mainly driven by increasing demand for high-performance materials in electronic components. Glass-filled PEEK not only inherits the excellent properties of PEEK but also adds the strength and rigidity of glass fibers. It is therefore the right material for applications requiring high mechanical properties, excellent thermal stability, and electrical insulation. The high strength-to-weight ratio of glass-filled PEEK makes it suitable for miniaturized electronic devices, connectors, and components. The increasing miniaturization of electronics, together with the demand for durable and reliable materials in high-performance sectors such as telecommunications, automotive, and consumer electronics, has been a significant driving force behind the adoption of glass-filled PEEK.

REGION

Asia Pacific is estimated to account for the largest market during the forecast period.

Asia Pacific accounts for the largest share of the global electrical & electronics PEEK market. The presence of established electronics and automotive manufacturers, especially in countries such as China, Japan, South Korea, and India, is driving the demand for high-performance materials like PEEK. The rapidly growing electronics industry is a major driver of market expansion in the region, where miniaturization, greater functionality, and improved performance are the key trends. Moreover, the continuous expansion of consumer electronics, telecommunications (especially 5G networks), and electric vehicles in the Asia Pacific region will be the main driver of the rapid growth of the electrical & electronics PEEK market.

ELECTRICAL & ELECTRONICS PEEK MARKET: COMPANY EVALUATION MATRIX

In the electrical & electronics PEEK market matrix, Victrex Plc. (Star) leads with a strong market share and extensive product footprint. Lehmann&Voss&Co. (Emerging Leader) demonstrates substantial product innovations compared to its competitors. While Victrex Plc. dominates through scale and diversified portfolio, Lehmann’s PEEK shows significant potential to move toward the leaders’ quadrant as demand for electrical & electronics PEEK continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Victrex Plc (UK)

- Syensqo (Belgium)

- Evonik Industries AG (Germany)

- Jilin Joinature Polymer Co., Ltd. (China)

- JUNHUA (China)

- Mitsubishi Chemical Group (Japan)

- Avient Corporation (US)

- SurloIndia (India)

- J.K. Overseas (India)

- Caledonian Industries Limited (UK)

- RTP Company (US)

- Westlake Plastics (US)

- Drake Plastics (US)

- Americhem (US)

- LATI Industria Termoplastici S.p.A. (Italy)

- Lehmann&Voss&Co. (Germany)

- Polymer Industries (US)

- Toray Plastics Precision Co., Ltd.

- Trident Plastics Inc.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.44 billion |

| Market Forecast in 2030 | USD 0.70 billion |

| CAGR (2025–2030) | 8.1% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD billion/million) |

| Report Coverage | The report defines, segments, and projects the electrical & electronics PEEK market size based on reinforcement type, processing method, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions that they undertake in the market. |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: ELECTRICAL & ELECTRONICS PEEK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electronics & Semiconductor Manufacturers (IC sockets, connectors, wafer tools, chip equipment parts) |

|

|

| Automotive & EV OEMs/Tier-1 Suppliers (Battery systems, HV insulation, power electronics housings) |

|

|

| Aerospace & Defense Companies (Brackets, ducts, cable insulation, lightweight structures) |

|

|

| Medical Device Manufacturers (Implants, tool handles, imaging equipment components) |

|

|

| Industrial Equipment & Machinery Manufacturers (Gears, bearings, compressor parts) |

|

|

| 3D Printing/Additive Manufacturing Companies |

|

|

RECENT DEVELOPMENTS

- March 2025 : Syensqo partnered with Politubes Srl to develop slot-liner spiral-wound tubes using Ajedium PEEK and PPSU film. These spiral-wound slot-liner tubes leverage the high-performance properties of Ajedium PEEK films, providing superior insulation for electric motors.

- October 2023 : Evonik introduced new carbon-fiber-reinforced PEEK filaments for use in 3D-printed medical implants. These smart biomaterials can be processed in common extrusion-based 3D printing technologies, such as fused filament fabrication.

- January 2020 : Victrex Hong Kong Limited, a Victrex subsidiary, formed a joint venture with Yingkou Xingfu Chemical Company Limited to build and operate a new PEEK polymer manufacturing facility in Liaoning, China, subject to certain performance conditions, including finalizing land purchase and permit applications.

Table of Contents

Methodology

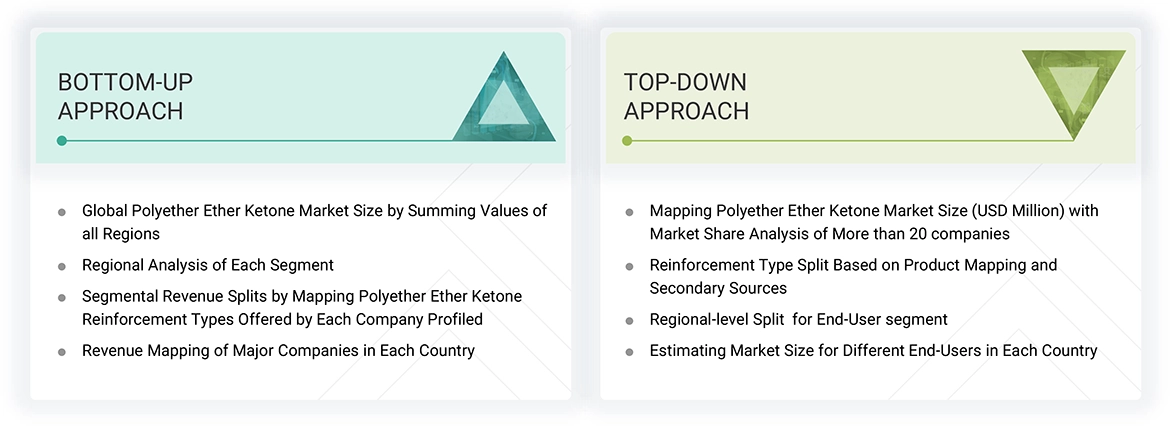

The research encompassed four primary actions in assessing the present market size of North America PEEK. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the North America PEEK value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to determine the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market is initiated by collecting revenue data from prominent suppliers using secondary research. During the secondary research, sources such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The North America PEEK market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of electrical & electronics, automotive, oil & gas, medical, aerospace, and other applications. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the North America PEEK market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the North America PEEK market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Electrical & Electronics PEEK Market Size: Bottom-Up and Top-Down Approaches

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyether ether ketone is a high-performance, semi-crystalline thermoplastic polymer known for its excellent mechanical strength, thermal stability, chemical resistance, and flame retardancy. It is widely utilized in demanding engineering applications due to its ability to maintain performance under extreme conditions. PEEK is available in several reinforcement types, including unfilled polyether ether ketone glass-filled polyether ether ketone for improved rigidity and dimensional stability, and carbon-filled polyether ether ketone for enhanced strength, stiffness, and thermal conductivity. The polymer is processed through advanced methods such as injection molding and extrusion, which allow for the production of complex components with high precision. Owing to its superior properties, North America PEEK finds extensive applications across various end-use industries, including electrical and electronics, aerospace, automotive, oil and gas, and medical. These industries leverage North America PEEK’s performance benefits for parts such as insulators, connectors, engine components, implants, and seals, making it a critical material in high-reliability environments.

Stakeholders

- Polyether ether ketone manufacturers

- Polyether ether ketone suppliers

- Polyether ether ketone traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global North America PEEK market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global North America PEEK market

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electrical & Electronics PEEK Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electrical & Electronics PEEK Market