Electro Hydraulics Market Size, Share & Analysis

Electro Hydraulics Market for Off-Highway Equipment by Type (Excavators, Backhoe Loaders, Wheel Loaders, Agriculture Loaders), Component (Hydraulic Cylinders, Electric Motors, Hydraulic Pumps, Control Valves, Sensors, Electronic Control Unit, Programmable Logic Controller), Type, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electro-hydraulics market for off-highway equipment is projected to grow from 92,501 units in 2025 to 234,487 units by 2032 at a CAGR of 14.2%. Electrohydraulic systems use electronic control to operate hydraulic pumps and valves with greater precision. This improves energy efficiency and machine control and supports hybrid or electric drivetrains. Stricter emission rules like EU Stage V and US EPA Tier 4 Final also encourage adoption, as electro-hydraulics cut fuel use and reduce CO2 emissions compared to traditional hydraulics. They further enable advanced features such as auto-dig, payload weighing, and semi-autonomous operation for mining fleets. However, higher costs, integration with older systems, and reliability issues under extreme mining conditions remain key challenges.

KEY TAKEAWAYS

-

BY TYPEThe electrohydraulic types for off-highway vehicles have been segmented into conventional and electric hydraulic. Conventional hydraulic systems continue to dominate the market. They are lower priced and provide adequate control for low-precision operations. Electric hydraulic systems are growing faster owing to the growing demand for precision, accuracy, fuel cost reduction, and overall efficiency. They also optimize hydraulic power delivery by controlling pumps and valves electronically, resulting in enhanced energy management.

-

BY EQUIPMENT TYPEBy equipment type, the market has been segmented into excavators, wheel loaders, backhoe loaders and agriculture tractors. Excavators lead the market in terms of equipment type. Electrohydraulic systems provide superior control over hydraulic flow and pressure through electronic modulation. The precise control of the boom, arm, and bucket for smoother, more accurate operation will improve operator efficiency and equipment productivity. Backhoe loaders and wheel loaders are expected to have better adoption during the forecast period.

-

BY COMPONENTThe study consists of key components of the electro hydraulic systems, such as sensors, hydraulic cylinders, hydraulic pumps, control valves, electric motors, ECU and PLC. Sensors are estimated to have the fastest growth rate as they play an essential role in collecting and transmitting data from around the equipment to the ECU. Similarly, Control valves are estimated to dominate the market in terms of volume. The demand for intercity travel and the future growth potential for electric coaches will drive the market for the above 400 kWh segment.

-

BY REGIONEurope is estimated to be the largest market for electro hydraulics during the forecast period.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Danfoss Drives A/S (Denmark) and Innomotics GmbH (Germany) announced their partnership at HANNOVER MESSE. This partnership aims to meet the growing demand for comprehensive motor and drive solutions and ensure customers receive high-quality, efficient, and compatible products.

The market for electrohydraulics in off-highway equipment is being driven by the need for greater energy efficiency, precision, and productivity in construction, mining, and agriculture. Advancements in sensor integration, electronic controls, and hybrid/electric powertrains are helping reduce fuel consumption, cut emissions, and improve machine responsiveness.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The electrohydraulics market for off-highway equipment is rapidly shifting from traditional hydraulics toward smarter, digitally controlled systems. Over the next few years, most revenue will come from electrohydraulics, driven by the need for better efficiency, precision, and automation. OEMs and component makers are focusing on integrating sensors and digital controls to improve productivity, safety, and fuel savings. This shift also supports equipment electrification, easier maintenance, and enhanced operator comfort, making machines more efficient and sustainable overall highway equipment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Demand for improved efficiency and precision

-

Shortage of skilled/trained labor

Level

-

High initial cost of electro-hydraulic system components

Level

-

Future potential for adoption in excavators and backhoes

-

Steady adoption of electric equipment where electrohydraulic systems have high adoption

Level

-

Maintenance challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Demand for improved efficiency and precision

Electrohydraulic systems are gaining popularity in off-highway equipment due to their efficiency and precision, especially as fuel costs rise and energy efficiency becomes a priority. These modern systems use axial piston pumps, proportional valves, and electronic controllers to deliver the required pressure, reducing fuel use and improving control. Volvo’s Independent Metering Valve Technology (IMVT), used in EC530 and EC550 excavators, helps improve fuel efficiency by 25%. The company also claims that the technology increases the overall productivity by 20–35%, depending on cycle, bucket size, and job type. Similarly, OEMs like Deere, Komatsu, Caterpillar, and SANY are integrating electro-hydraulics for smoother operation, smarter energy use, and improved performance in tasks like digging and lifting. This demand for better productivity and fuel savings is a key driver of market growth.

Restraint: High Initial cost of the electro-hydraulic system and components

While the conventional and electro-hydraulic equipped equipment share common components like pumps and valves with conventional systems, electro-hydraulic equipment requires costlier advanced versions (axial piston pumps, proportional valves) plus added electronics such as sensors, joysticks, ECUs, PLCs, and modern displays. These upgrades make systems about 30% more expensive than traditional hydraulics and add complexity, so manufacturers typically offer them only in models with higher power requirements. The higher upfront investments in electro-hydraulic systems also increase the total cost of ownership, especially for smaller fleets or contractors with tight budgets, making it challenging to meet the payback despite long-term efficiency gains.

Opportunity: Rising adoption of electric off-highway equipment, where EH systems are standard

The rapid electrification of off-highway equipment, especially excavators and wheel loaders, is creating strong growth opportunities for electrohydraulic systems. Leading OEMs like Volvo Construction Equipment (Sweden), Caterpillar (US), Komatsu Ltd. (Japan), and J C Bamford Excavators Ltd. (UK) are actively developing and launching electric equipment to meet stricter emission norms, reduce operating costs, and benefit from government incentives. Since electro-hydraulics are standard in electric equipment, offering seamless integration with drivetrains, higher efficiency, and better controllability, their demand is set to increase. This positions electric off-highway equipment as key enablers for the adoption of electro-hydraulic systems into the off-highway industry.

Challenge: Maintenance challenges with electrohydraulic systems

Maintaining electro-hydraulic systems in off-highway equipment is challenging due to their reliance on sensitive electronic components. Also, these systems can differ a lot between OEMs in how they’re built, the software they use, and the way diagnostics work. Because of this, it’s hard for fleet operators and third-party service teams to maintain mixed fleets smoothly. These systems also depend heavily on ECUs (Electronic Control Units) and software for both operation and troubleshooting. If the ECU fails or the software has bugs, the whole hydraulic system can stop working even if the mechanical parts are not affected. Combining these limitations with limited service access, higher repair costs, and greater sensitivity makes maintenance a key hurdle for wider adoption in equipment that operates long hours under harsh conditions.

electro hydraulics market for off-highway equipment: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hybrid electro-hydraulic systems in larger excavators, which reduce energy losses by maintaining a common hydraulic rail pressure and improving control | Up to 20% better fuel efficiency vs previous conventional models, 15% lower CO2 emissions, improved energy efficiency and better performance under partial loads |

|

Modern DX series excavators with electronic pump control and operating modes (power/work/auto-idle) to reduce wasted hydraulic flow and improve efficiency | Better fuel economy, smoother operation, reduced unnecessary hydraulic flow losses (energy losses) |

|

Hybrid electro-hydraulic energy-conservation system on large excavators that uses motor/generator + capacitors to support engine and hydraulics | Up to ~20% fuel savings vs non-hybrid model |

|

Hydraulic hybrid excavator (energy recovery on swing/boom) with electro-hydraulic control and optimized hydraulics | OEM tests report up to 25% less fuel than baseline model and up to 50% improvement in tons-moved per liter in some cycles |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electro hydraulics market ecosystem comprises component manufacturers, OEMs, and end users. The ecosystem comprises component manufacturers who manufacture cylinders, pumps, motors, sensors, actuators, and valves for hydraulic systems. These components are assembled by the OEMs. These manufacturers then sell their systems to end users. Bosch Rexroth (Germany), Danfoss (Denmark), and Parker Hannifin Corp. (US) are the major component suppliers, while Volvo CE (Sweden), Caterpillar (US), Deere & Company (US) are the key OEMs equipping their equipment with electro hydraulics. Finally, key construction companies shown in the figure are the adopters of these equipment fitted with electro hydraulics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electro Hydraulics Market for Off-Highway Equipment, by Type

The electrically actuated hydraulic systems market is expected to grow faster than conventional hydraulics as demand for precision, efficiency, and automation rises in construction, agriculture, forestry, and mining. By combining hydraulic power with electronic controls, these systems deliver better fuel efficiency, lower emissions, and support advanced features like semi-autonomous operation, machine control, and precision operations. Key players in the off-highway equipment electrohydraulics market include Bosch Rexroth (Germany), Danfoss (Denmark), Parker Hannifin Corp. (US), and AB Volvo (Sweden). Europe has the highest adoption of electric/electrohydraulics, and Asia Pacific and the Americas are estimated to follow.

Electro Hydraulics Market for Off-Highway Equipment, by Equipment Type

Excavators are expected to see the highest adoption of electrohydraulic systems because they are among the most fuel-intensive off-highway machines. This equipment is continuously involved in digging, lifting, and swinging cycles that place heavy demand on hydraulics. Conventional load-sensing hydraulics waste significant energy through throttling losses, while electrohydraulics use independent metering and precise electronic control to deliver flow and pressure only when required. Electrohydraulics further enables advanced features such as boom energy regeneration, priority flow management between boom and swing, and integration with machine automation systems like auto-dig and payload measurement. Together, these improvements reduce operating costs, increase productivity per liter of fuel, and make excavators far better suited for hybrid and electric drivetrains, positioning them as the leading application for electrohydraulic adoption.

Electro Hydraulics Market for Off-Highway Equipment, By Component

The control valves segment dominates the market due to their crucial role in regulating hydraulic fluid flow, pressure, and direction, which are functions crucial to off-highway equipment performance. With electrohydraulic systems, traditional valves have advanced into solenoid-operated proportional and servo valves, enabling precise, sensor-based control for smoother and more efficient operations in excavators, loaders, and tractors. The use of valve banks has further increased demand by allowing centralized management of multiple actuators. Leading suppliers include Parker Hannifin, Bosch Rexroth, Danfoss, Kawasaki Precision Machinery, Poclain, Walvoil, and LHY Powertrain.

REGION

Europe to be largest region in electrohydraulics market for off-highway equipment during the forecast period

The European electrohydraulics market for off-highway equipment includes France, Germany, Spain, the UK, and the Rest of Europe, and is expected to account for the maximum share at a global level by 2025. Regional growth is driven by demand for efficient technologies, higher productivity, and the presence of major providers like Bosch Rexroth (Germany), Power-Packer Europa B.V. (Netherlands), Poclain (France), and Walvoil S.p.A. (Italy). France and Germany are projected to lead in volume, supported by leading OEMs such as AB Volvo (Sweden), Liebherr (Switzerland), JCB (UK), and CNH Industrial (Italy). These providers have developed advanced electrohydraulic systems widely adopted by equipment manufacturers. The region has also shown the highest adoption of electric off-highway equipment, most of which comes with electrohydraulics as standard, further driving market demand.

electro hydraulics market for off-highway equipment: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global electrohydraulics market for off-highway equipment, positioning key players based on their market share and product footprint. In the electrohydraulics market matrix, Bosch Rexroth (Germany) (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across all major regions. LHY Powertrain GmbH (Germany) (Emerging Leader) is gaining traction in the electrohydraulics market through its strong focus on integrating hydraulics, electronics, and powertrains to deliver more efficient, low-emission electro-hydraulic solutions, further strengthening its competitiveness in the electrohydraulics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Volume) | 92.5 Thousand Units |

| Market Forecast, 2032 (Volume) | 234.5 Thousand Units |

| Growth Rate | 12.9% |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Units) |

| Report Coverage | Market Forecast, Company Market Ranking, Competitive Landscape, Growth factors, Trends & Disruption, OEM Analysis, and Equipment-wise Adoption for Electrohydraulics |

| Segments Covered |

|

| Regional Scope | Americas, Europe, and Asia Pacific |

WHAT IS IN IT FOR YOU: electro hydraulics market for off-highway equipment REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Construction Equipment OEM (Japan) |

|

|

| Mining Equipment Manufacturer (US) |

|

|

| Agricultural Machinery OEM (India) |

|

|

RECENT DEVELOPMENTS

- March 2025 : Danfoss Drives A/S (Denmark) and Innomotics GmbH (Germany) announced their partnership at HANNOVER MESSE. This partnership aims to meet the growing demand for comprehensive motor and drive solutions and ensure customers receive high-quality, efficient, and compatible products.

- February 2025 : Parker Hannifin Corp (US) launched its first certified Mobile Electrification Technology Center (METC) in North America. This new center is part of a growing global Parker network designed to accelerate the transition to low-carbon mobile equipment operations.

- February 2025 : AB Volvo (Sweden) launched Hydraulic Hybrid Technology for its construction equipment. The technology was designed to store excess hydraulic energy and reuse it to power hydraulic functions, reducing the energy demand on the engine for excavation operations. The technology would be equipped with EC260 Hybrid, EC300 Hybrid, EC370 Hybrid, EC400 Hybrid, and EC500 Hybrid excavators.

- December 2023 : Bosch Rexroth (Germany) announced the expansion of its manufacturing plant in Mexico. This expansion will increase the company’s production capacity for the automation and hydraulics unit. The size of this new factory will be 42,000 sq. meters, and the company has invested USD 173 million for this expansion. The expansion is estimated to be completed by 2027.

- February 2023 : Bosch Rexroth AG (Germany) completed the acquisition of HydraForce, Inc. (UK). This acquisition was focused on compact hydraulics. The new acquisition would strengthen the company’s footprint in North America. The improved geographical presence would help the company expand the global presence of its hydraulics business.

Table of Contents

Methodology

The study encompassed four primary tasks to determine the present and future scope of the electro hydraulics market for off-highway equipment. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the supply chain corroborated and validated these findings and assumptions. The complete market size was estimated by using top-down and bottom-up methodologies. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

Secondary sources that were referred to included annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, technical articles, and databases, which were used to identify and collect information for an extensive study of the electro hydraulics market for off-highway equipment. Secondary sources used while estimating the market size include the Association of Equipment Manufacturers (AEM), European Agricultural Machinery Industry Association (CEMA), Construction Equipment Association (CEA), Committee for European Construction Equipment (CECE), and corporate filings (such as annual reports, investor presentations, and financial statements). This data was collected and analyzed to determine the overall market size, further validated through primary research. The primary sources—experts from related industries and OEMs—were interviewed to obtain and verify critical information and assess prospects and market estimations. Historical sales data was collected and analyzed, and the industry trend was considered to arrive at the forecast, which was further validated by primary research.

Primary Research

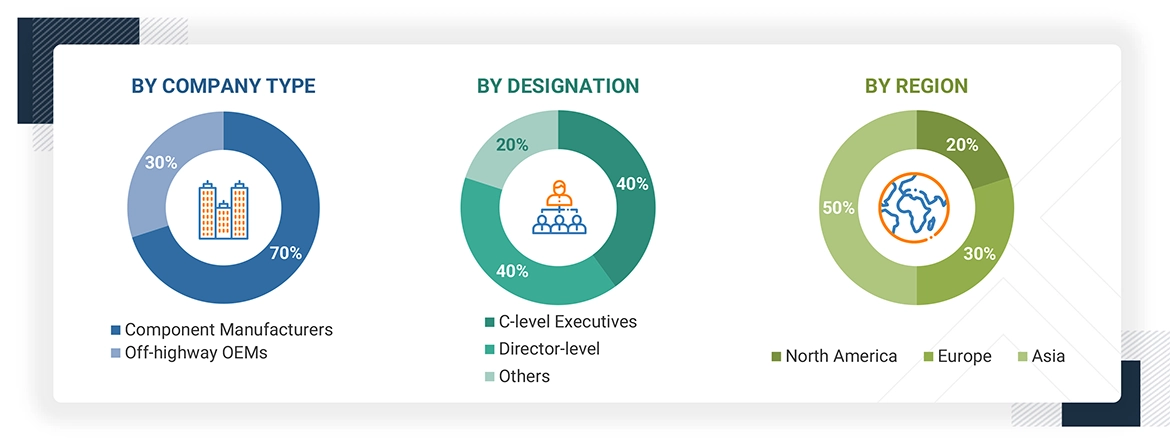

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights, such as sizing estimates on the electro hydraulics market for off-highway equipment, market forecast, future technology trends, and upcoming technologies in the electro hydraulics market for off-highway equipment. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides were interviewed to understand their views on the points mentioned above.

Note: Others include sales, marketing, and product managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

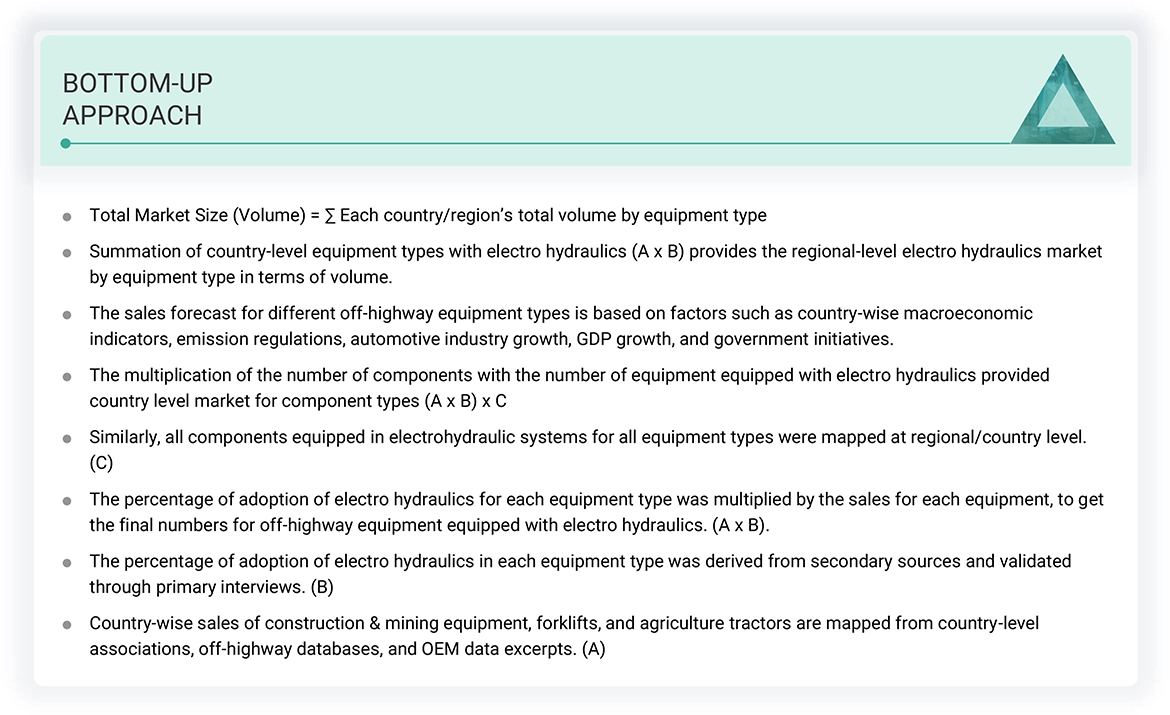

A detailed market estimation approach was followed to estimate and validate the value of the electro hydraulics market for off-highway equipment and other dependent submarkets.

The bottom-up approach was used to estimate and validate the size of the electro hydraulics market for off-highway equipment. Firstly, the country-wise sales of construction & mining equipment and agriculture tractors were mapped from country-level associations, off-highway databases, and OEM data excerpts. The sales forecast for different off-highway equipment types was based on country-wise macroeconomic indicators, emission regulations, automotive industry growth, GDP growth, and government initiatives. Secondly, the electro hydraulics market for off-highway equipment size, by equipment type and country, was derived by mapping different off-highway equipment for their technical specifications at the country/region level.

The electro hydraulics market forecast for off-highway equipment was estimated on factors such as developments by electrohydraulic component suppliers and adoption of these technologies by off-highway OEMs based on insights shared by industry experts.

Each country/region’s total volume was later summed up to reveal the total volume of the global electro hydraulics market for off-highway equipment. The data was validated through primary interviews with industry experts. The electro hydraulics market for off-highway equipment was further segmented by equipment type, and the penetration of different segments was derived from secondary research and primary interviews.

Electro Hydraulics Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Electro hydraulics refers to systems that integrate electronic controls with hydraulic components to manage and optimize the movement and operations of off-highway machinery. For off-highway equipment, including construction, industrial, and agricultural machines, electro hydraulic systems use electronic signals to control hydraulic pumps, valves, cylinders, and motors rather than relying only on manual or purely hydraulic controls.

Electro hydraulic systems combine hydraulics’ capabilities with electronic controls’ precision and programmability. These systems help improve the efficiency and accuracy of the equipment due to the pre-fed logic to the control units of this equipment.

Stakeholders

- Off-highway OEMs

- Component manufacturers

- Technology providers for electro hydraulic systems, such as steer-by-wire, hybrid, etc.

- Consulting companies

- Off-highway vehicle safety regulatory bodies, government agencies, and research institutions

Report Objectives

-

To define, describe, and forecast the size of the electro hydraulics market for off-highway equipment in terms of volume (units) based on

- Type (Conventional and Electric)

- Equipment Type (Excavators, Wheel Loaders, Backhoe Loaders, Forklifts, and Agriculture Tractors)

- Component (Hydraulic Cylinders, Hydraulic Pumps, Electric Motors, Sensors, Control Valves, Actuators, Electronic Control Unit, and Programmable Logic Controller)

- Electro Hydraulics market for forklifts by component (Hydraulic Cylinders, Hydraulic Pumps, Electric Motors, Sensors, Control Valves, Actuators, Electronic Control Unit, and Programmable Logic Controller)

- Region (Asia, Europe, and the Americas)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges)

- To analyze the market share of leading players operating in the regional markets and their evaluation matrix

- To analyze key players’ strategies and company revenue analysis for off-highway equipment in the electro hydraulics market and compare their revenue numbers from 2020 to 2024.

-

To study the following aspects of the report:

- Trends/Disruptions Impacting Market

- Market Ecosystem

- Technology Analysis

- Supply Chain Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Pricing Analysis

- Regional Macroeconomic Outlook

- Company Valuation and Financial Metrics

- Brand and Product Comparison

- Manufacturer’s Analysis

- Market Ranking Analysis, 2024

- US 2025 Tariffs

- OEM-wise Model Offerings with Electro Hydraulic Systems

- Regional Overview of Off-highway Equipment

- To analyze recent developments, including product launches and deals, among others, undertaken by key players in the market

- To analyze the opportunities offered by various market segments to its stakeholders

- To provide a brief understanding of the core business segments in the electro hydraulics market and how key business stakeholders will benefit from the available opportunities.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs. The following customization options are available.

ELECTRO HYDRAULICS COMPONENT MARKET, BY EQUIPMENT TYPE, AT COUNTRY LEVEL

- US

- Canada

- Mexico

- Germany

- France

- UK

- Spain

- China

- Japan

- India

ELECTRO MARKET FOR ELECTRIC OFF-HIGHWAY EQUIPMENT, BY COUNTRY

- US

- Canada

- Mexico

- Germany

- France

- UK

- Spain

- China

- Japan

- India

Key Questions Addressed by the Report

What is the current size of the electro hydraulics market for off-highway equipment?

The electro hydraulics market for off-highway equipment is projected to grow from 92,501 units in 2025 to 234,487 units by 2032 at a CAGR of 14.2%.

Which segment, by component, is projected to experience the highest growth during the forecast period?

The sensors segment is projected to achieve the highest growth in the electro hydraulics market for off-highway equipment during the forecast period.

Which region is projected to dominate the electro hydraulic market for off-highway equipment during the forecast period?

Europe is projected to account for the largest share of the electro hydraulics market for off-highway equipment during the forecast period, followed by the Americas. Market growth in Europe is mainly attributed to the presence of key technology providers and the presence of global off-highway OEMs.

What are the growth opportunities for the suppliers of electro hydraulic components?

The growing demand for precision, control, and fuel efficiency would create growth opportunities for component suppliers during the forecast period.

Which segment, by equipment type, is projected to account for the largest share of the electro hydraulics market for off-highway equipment during the forecast period?

The excavators segment is projected to lead the electro hydraulics market for off-highway equipment during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electro Hydraulics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electro Hydraulics Market