Electronic Parking Brake System Market Size, Share & Analysis

Electronic Parking Brake System Market by Type (Cable Pull, Electric-hydraulic Caliper, Brake-by-Wire System), Vehicle Class (A&B, C&D, E&F), Component (ECU, Actuator), Vehicle Type (PC, CV), EV Type, Sales Channel, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electronic parking brake (EPB) system market is expected to reach USD 4.70 billion by 2032, up from USD 2.51 billion in 2025, growing at a CAGR of 9.4%. The market expansion is mainly driven by advances in automotive braking technology, including the adoption of electro-mechanical actuators that enable precise and automated control, compatibility with advanced driver assistance systems (ADAS) such as auto-hold, automated parking, and emergency braking, and smooth integration with hybrid and electric vehicle designs that require minimal mechanical linkage.

KEY TAKEAWAYS

-

BY VEHICLE TYPEThe electronic parking brake market is segmented into passenger cars and commercial vehicles, with passenger cars comprising the majority share owing to the greater adoption of advanced braking technologies in premium and mid-segment models.

-

BY VEHICLE CLASSPremium vehicles continue to be the main adopters of EPB systems, while mid-range vehicles are increasingly adopting EPB as part of safety and comfort features, driven by regulatory standards and rising consumer preference.

-

BY EPB TYPECable-pull systems are the transitional technology, while Electric-Hydraulic caliper-integrated systems dominate due to their compact design and efficiency. Advanced systems with automatic hold and integration with ADAS are gaining popularity.

-

BY SALES CHANNELOEM installations dominate the market as automobile manufacturers incorporate Electronic Parking Brake (EPB) systems into new vehicle platforms. The aftermarket segment is progressively growing, bolstered by retrofitting options and replacement demand in regions with a substantial vehicle fleet.

-

BY REGIONAsia Pacific is expected to have the largest market, driven by growing vehicle production in China, India, and Japan, along with increasing adoption of safety regulations.

-

COMPETITIVE LANDSCAPEKey players in the EPB market are focusing on strategic initiatives such as partnerships, product innovation, and mergers to strengthen their market presence. Leading automotive suppliers, including Bosch, Continental, ZF Friedrichshafen, and Hyundai Mobis, are investing in advanced EPB solutions integrated with ADAS and autonomous driving features. Collaborations with OEMs remain central to capturing growth opportunities across different vehicle segments.

The electronic parking brake market is anticipated to experience consistent growth in the forthcoming years, propelled by the escalating demand for advanced safety and comfort features, the rising adoption within mid-segment vehicles, and regulatory initiatives aimed at enhancing braking systems. The integration of Electronic Parking Brakes (EPB) with Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies further amplifies its significance in the evolution of next-generation mobility. As penetration increases across passenger and commercial vehicles, EPB systems are poised to transition from a premium feature to a standard component, thereby reinforcing their essential role in the future development of automotive braking solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the EPB market reveal both current and future developments. The EPB market is undergoing a major shift driven by strict global safety regulations, moving the industry away from traditional cable pull systems toward electronics-based systems. The future revenue mix is increasingly led by EPB systems, which serve as the foundation for broader brake-by-wire technologies such as electro-mechanical and electro-hydraulic brake systems. These innovations are essential for meeting client needs across key segments, including ICE and electric passenger cars, commercial vehicles, and autonomous vehicles. This change highlights how evolving safety standards and emerging vehicle technologies are disrupting traditional revenue models, opening up new opportunities in the EPB space.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in demand for advanced safety and convenience features

-

Stringent government regulations for braking systems

Level

-

Reliance on vehicle electronics architecture

-

Limited aftermarket potential

Level

-

Shift toward wire-controlled systems

-

Rise in global supplier partnerships to access next-generation actuation technologies

Level

-

Integration challenges in existing platforms

-

Lack of localized manufacturing ecosystem

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in demand for advanced safety and convenience features

Electronic parking brakes (EPB) are replacing traditional handbrakes with advanced functions such as automatic parking, auto hold, and hill-start assist. They seamlessly integrate with ADAS, ABS, and ESC, improving vehicle stability, emergency braking, and adaptive cruise control. With features like remote parking and park-by-memory, EPBs are transforming driving comfort and automation in modern vehicles.

Restraint: Limited aftermarket potential

The aftermarket potential for EPBs remains constrained owing to their intricate integration with vehicle electronics and OEM-controlled software. Unlike conventional handbrakes, they necessitate specialized diagnostic tools and calibration, thereby limiting third-party servicing and retrofitting. This reliance primarily confines maintenance and replacements to OEM networks, particularly in markets where cost considerations are paramount.

Opportunity: Shift toward wire-controlled systems

The transition toward wire-controlled systems is fostering substantial growth opportunities for EPBs as original equipment manufacturers (OEMs) emphasize modular, software-centric architectures. Prominent suppliers are deploying integrated platforms that combine EPBs with advanced driver-assistance systems (ADAS) and stability control, thereby facilitating scalable and future-compatible solutions. These developments correspond with the industry trend towards centralized vehicle architectures and next-generation mobility systems.

Challenge: Lack of localized manufacturing ecosystem

A lack of local manufacturing for EPB components within India results in increased costs, decelerated production, and diminished supply chain flexibility. The majority of these components are sourced through imports owing to limited local technical expertise, making it hard for OEMs to provide EPB systems in affordable, mass-market vehicles. Consequently, EPB technology is predominantly available in premium or imported vehicle models, thereby limiting its broader market penetration.

Electronic Parking Brake System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrating EPB into premium, EV, and mid-segment vehicles with features like auto-hold, hill-start assist, and automated parking | Differentiates vehicle models, improves safety & comfort, and complies with global safety regulations |

|

Developing caliper-integrated EPB, brake-by-wire platforms, and software-upgradable systems integrated with ADAS | Provides modular, scalable solutions; strengthens long-term OEM partnerships; drives innovation in braking tech |

|

Deploying EPB-enabled vehicles for improved fleet safety, automated parking, and reduced driver fatigue | Enhances fleet reliability, lowers accident risk, and reduces TCO through standardized braking systems |

|

Leveraging EPB systems in autonomous and semi-autonomous fleets for park-by-memory and remote parking functions | Improves passenger safety, supports autonomous fleet deployment, and optimizes vehicle turnaround times |

|

Limited retrofitting and servicing of EPB-equipped vehicles via OEM diagnostic tools and software | Ensures compliance with OEM standards, creates service revenue, but restricted by proprietary software access |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the EPB market ecosystem, which is primarily represented by raw material providers, component manufacturers/technology providers, brake system manufacturers, OEMs, and dealers and distributors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electronic Parking Brake Market, By Type

Electro-hydraulic caliper EPBs dominate the market share because they offer proven reliability, scalability across different segments, and compatibility with driver assistance systems at a competitive price. This design is widely adopted by global OEMs in high-volume models such as the Volkswagen Golf, Audi A4, BMW 3 Series, Mercedes-Benz C-Class, Hyundai Tucson, and Ford Escape/Kuga, establishing it as a leading technology choice.

Electronic Parking Brake Market, By Vehicle Type

Passenger cars account for the largest share in the EPB market, driven by the widespread adoption of disc brake-based EPB systems that offer superior performance, compact packaging, and seamless integration with driver assistance functions like auto-hold and hill-start assist. While drum brake EPBs are still used in compact and cost-sensitive models, especially in emerging markets, disc brake EPBs dominate mid- to premium-segment passenger cars due to higher load-handling capacity and enhanced safety features.

Electronic Parking Brake Market, By Vehicle Class

The mid-sized segment accounts for the largest share in the EPB market because this class combines affordability with advanced features. OEMs such as Toyota, Honda, and Volkswagen have standardized EPB systems in several high-volume models like the Toyota Corolla (XLE and higher trims), Honda CR-V (EX and above), Volkswagen Passat (SE and R-Line trims), and Hyundai Tucson (SEL and higher), where consumers seek both safety and comfort.

Electronic Parking Brake Market, By EV Type

The BEV segment holds the largest share in the EV-type EPB market, primarily because fully electric platforms rely heavily on advanced electronic systems that enhance safety, efficiency, and driving comfort. Recent BEV launches highlight this shift, with models like the Tata Harrier EV, introduced in June 2025, featuring an EPB with auto-hold as part of its modern driver assistance package.

Electronic Parking Brake Market, By Component

The demand for actuators within the EPB market is expected to grow at a significant rate during the forecast period. This growth is primarily driven by their escalating adoption in passenger and commercial vehicles as manufacturers shift from mechanical to electronic braking systems. Notably, this demand is particularly pronounced in brake-by-wire EPB systems, which replace conventional cable-pull or hydraulic calipers with fully electronic control mechanisms. Consequently, an increase in the number of actuators is necessary to facilitate independent and precise braking at each wheel, as well as to support functions such as auto-hold and remote park assist.

Electronic Parking Brake Market, By Sales Channel

The OEM segment commands the largest share of the EPB market, mainly due to widespread adoption by global automakers in their latest vehicle launches. Major OEMs like BMW, Mercedes-Benz, Volkswagen, Hyundai, and Toyota have standardized EPB systems across high-volume models such as the BMW 3 Series, Mercedes-Benz C-Class, Volkswagen Tiguan, and Hyundai Tucson, making the system a key safety and convenience feature.

REGION

Asia Pacific to be largest region in global Electronic Parking Brake market during forecast period

Asia Pacific holds the largest share in the EPB market, mainly driven by strong adoption among mid- to high-end passenger vehicles in China, Japan, and South Korea, where OEMs like Toyota, Honda, Hyundai, and Nissan have made EPB a standard feature across premium trims to meet consumer demand for advanced safety and convenience options. The region’s dominance is also supported by the increasing penetration of SUVs and sedans in China and India, where suppliers such as Mando, Akebono, and ADVICS are expanding local production to satisfy automakers’ cost and volume needs.

Electronic Parking Brake System Market: COMPANY EVALUATION MATRIX

In the electronic parking brake market matrix, ZF (Star) leads with a strong presence and a comprehensive EPB portfolio, driving large-scale adoption among global OEMs through advanced brake-by-wire and integrated safety solutions. HL Mando (Emerging Leader) is gaining traction with cost-effective and innovative EPB systems, especially in the Asian market, supported by partnerships with regional automakers. While ZF dominates with scale and technology leadership, HL Mando shows strong growth potential to move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- Astemo, Ltd. (Japan)

- Brembo N.V. (Italy)

- ADVICS CO., LTD. (Japan)

- Wanxiang Qianchao Co., Ltd. (China)

- Brakes India (India)

- ANAND Group (India)

- HYUNDAI MOBIS (South Korea)

- HL Mando Corp. (South Korea)

- AKEBONO BRAKE INDUSTRY CO., LTD. (Japan)

- DURA | Shiloh (US)

- Bethel Automotive Safety Systems Co., Ltd. (China)

- Robert Bosch GmbH (Germany)

- KÜSTER Holding GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 2.51 Billion |

| Revenue Forecast in 2032 | USD 4.70 Billion |

| Growth Rate | CAGR of 9.4% from 2025-2032 |

| Actual Data | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) and Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Vehicle Type: Passenger Car and Commercial Vehicle, Vehicle Class: Entry Level (A & B), Mid-sized (C & D), and Premium (E & F), EV Type: BEV and PHEV, Sales Channel: OEM and Aftermarket, Components: ECU, Actuator, Switch, and Other, Components, EPB Type: Cable Pull, Electric-Hydraulic Caliper, and Brake-by-Wire |

| Regional Scope | Asia Pacific, Europe, and North America |

WHAT IS IN IT FOR YOU: Electronic Parking Brake System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Tier-1 Automotive Supplier | • Competitive intelligence on Tire-1supplier positioning | • Identify white space opportunities in emerging EV platforms |

| Electric Vehicle OEM | • EPB adoption rates across vehicle segments (premium to mass market) | • Support localization strategy for domestic EPB suppliers |

| Automotive Electronics Component Manufacturer | • Electronic control unit (ECU) market sizing and growth projections | • Identify opportunities in aftermarket EPB retrofit solutions |

| Automotive Investment Fund | • Market consolidation analysis and acquisition targets | • Support due diligence on EPB supplier acquisitions |

| Traditional Brake System Manufacturer | • Transition roadmap from mechanical to electronic systems | • Enable strategic pivoting from legacy brake technologies |

RECENT DEVELOPMENTS

- June 2025 : Astemo introduced its electro-mechanical brake-by-wire system, branded “Smart Brake”, at North American industry showcases, marking its commercial debut in the region.

- May 2025 : WBTL unveiled cutting-edge technologies at the exhibition WCBS 2.0H, leveraging its brake-by-wire expertise. The company pioneered a small-bore caliper solution that reduces unsprung mass by approximately 17% while lowering material costs for customers.

- April 2025 : Brembo partnered with Lucid to supply brake calipers for the Lucid Gravity, the highly anticipated SUV produced by the US-based electric vehicle manufacturer. Equipped with 828 horsepower in the Grand Touring variant and featuring excellent driving dynamics, Brembo’s high-performance brake calipers are an exemplary choice for Lucid’s inaugural SUV.

- January 2025 : ZF secured a large order from a global OEM, and nearly 5?million vehicles were equipped with its electro-mechanical brake (EMB) and by-wire technology.

- June 2024 : ADVICS signed a joint venture agreement with Brakes India Pvt. Ltd. to produce and localize advanced braking products in India, with production slated for around 2027.

Table of Contents

Methodology

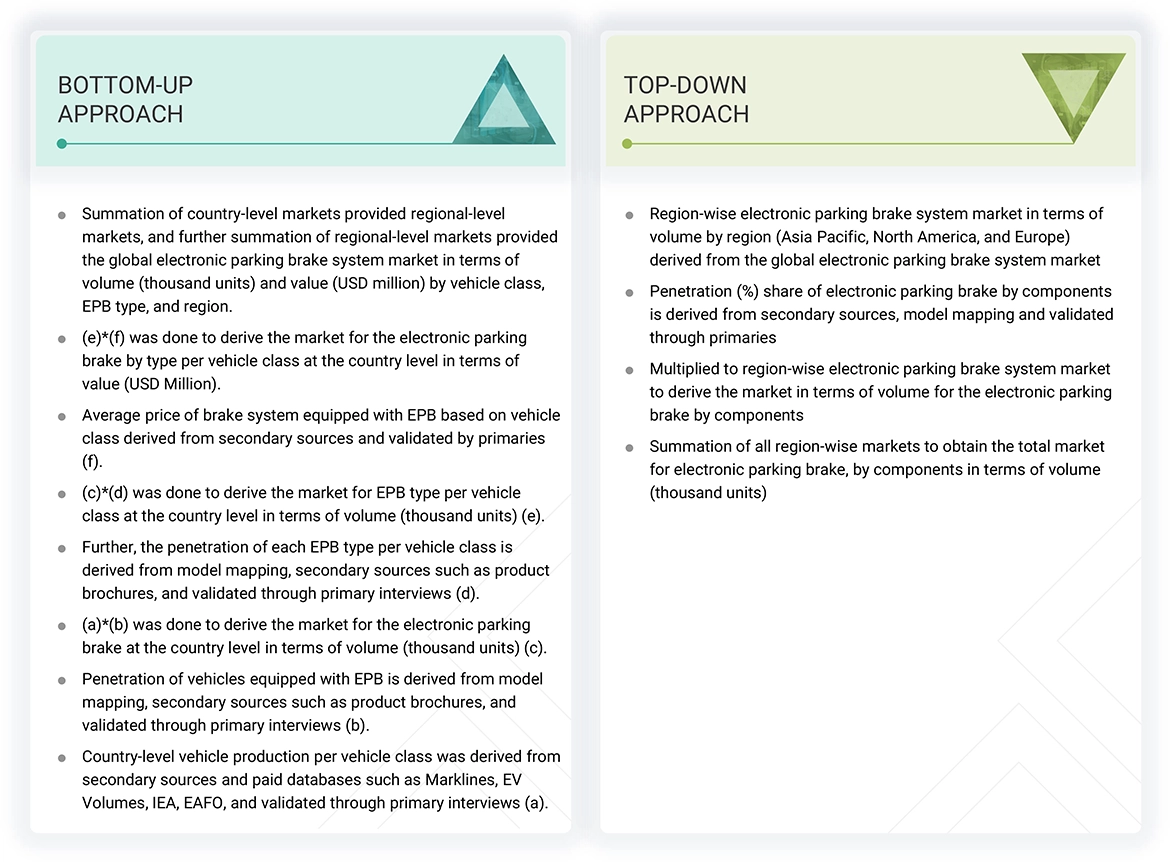

The study involved four major activities in estimating the current size of the electronic parking brake (EPB) system market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step involved validating these findings and assumptions and sizing them with industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the electronic parking brake system market for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

Extensive primary research was conducted after understanding the electronic parking brake system market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (electronic parking brake manufacturers and component manufacturers) sides across major regions, namely, North America, Europe, and the Asia Pacific. Approximately 35% and 65% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primary interviews. This, along with the opinions of in-house subject matter experts, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the electronic parking brake system market and other dependent submarkets, as mentioned below:

- The market size was derived by collecting production/sales of vehicles equipped with EPB through association and paid databases.

- Key players in the electronic parking brake system market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included the study of annual and quarterly financial reports, regulatory filings of major market players, and interviews with industry experts to gain detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the electronic parking brakes market were determined through secondary sources and verified through primary sources.

- All key macroindicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

Electronic Parking Brake System Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

According to the National Highway Traffic Safety Administration (NHTSA), an EPB "differs from the traditional mechanical parking brake mainly by the command used in applying the brake and the way the applied force is transmitted to the disc brakes." An EPB "can be engaged or disengaged by pushing a button fitted in the console." When the "electronic control unit (ECU) which manages the system receives an input command from the console mounted button, [it] gives a signal to the electric motors (one for each rear disc or an alternate, one motor for both rear discs). The motors then apply the brake force via the calipers on the discs."

Stakeholders

- Associations, Forums, and Alliances Related to Electronic Parking Brake

- Automobile Manufacturers

- Automotive Component Manufacturers

- Automotive Investors

- Automotive Software Manufacturers and Providers

- Brake Manufacturers

- Brake Components Manufacturers

- Companies Operating in the Autonomous Vehicle Ecosystem

- Distributors and Retailers

- Brake System Distributors and Retailers

- Government Agencies and Policy Makers

- Original Equipment Manufacturers

- Raw Material Suppliers for EPB or Components

- Technology Providers

- Transport Authorities

- Technology Providers

Report Objectives

- To segment and forecast the electronic parking brake (EPB) market in terms of volume (thousand units) and value (USD million)

- To define, describe, and forecast the electronic parking brake market based on vehicle type, vehicle class, EPB type, component, EV type, sales channel, and region

- To segment and forecast the market size by volume based on vehicle type (passenger car and commercial vehicle)

- To segment and forecast the market size by volume and value based on vehicle class (entry level, mid-sized, and premium)

- To segment and forecast the market size by volume and value based on EPB type (cable-pull, electric-hydraulic caliper, brake-by-wire system)

- To segment and forecast the market size by volume based on components (electronic control units, actuators, switches, and others)

- To segment and forecast the market size by volume and value based on EV type (BEV and PHEV)

- To segment and forecast the market size by volume based on sales channel (OEM and aftermarket)

- To forecast the market size with respect to key regions: Asia Pacific, Europe, and North America

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

- Supply chain analysis

- Ecosystem analysis

- Technology analysis

- HS code

- Case study analysis

- Patent analysis

- Regulatory landscape

- Key stakeholders and buying criteria

- Key conferences and events

- Impact of Generative AI

-

To estimate the following with respect to the market:

- Pricing analysis

- Market share analysis

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as deals, product launches and developments, and expansions, carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

Company Profiles

- Profiling of Additional Market Players (Up to 5)

Electronic parking brake system market, By Vehicle Class, At the Country Level

Electronic parking brake system market, By Component, At the Country Level

Key Questions Addressed by the Report

What is the current size of the global electronic parking brake system market?

The global electronic parking brake system market is projected to grow from USD 2.51 billion in 2025 to USD 4.70 billion by 2032 at a CAGR of 9.4% during the forecast period.

Who are the key players in the global electronic parking brake system market?

The electronic parking brake system market is dominated by established players such as ZF Friedrichshafen AG (Germany), Continental AG (Germany), Astemo, Ltd. (Japan), Brembo N.V. (Italy), and ADVICS Co., Ltd. (Japan), and others. These companies manufacture electronic parking brake systems and new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

Which region is the fastest-growing electronic parking brake system market?

Europe is the fastest-growing market for electronic parking brake systems as automakers in the region rapidly adopt advanced braking technologies to meet stringent safety regulations and rising consumer demand for premium features. The increasing penetration of electric and hybrid vehicles, along with strong OEM focus on integrating EPB into mid-sized and luxury segments, is further accelerating market growth.

What are the new trends impacting the growth of the electronic parking brake system market?

The electronic parking brake system market is witnessing a shift toward integrated braking with advanced driver assistance features, where electronic parking brakes are combined with automatic emergency braking and autonomous driving technologies. Additionally, lightweight and modular EPB designs are gaining traction as OEMs focus on vehicle electrification, cost efficiency, and improved cabin space utilization.

What countries are covered in the Europe region for the electronic parking brake system market?

The countries covered in the report for the electronic parking brake system market are France, Germany, Spain, the UK, and Russia.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electronic Parking Brake System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electronic Parking Brake System Market