Electronic Potting Compound Market

Electronic Potting Compound Market for EV charger, By Charger Type (AC, DC), Setup Type (Wall Mount, Stationary), Material Type (Polyurethane, Silicone, Epoxy), Curing Technology, Application, EV Component, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electronic potting compound market for EV chargers is projected to grow from an estimated USD 0.36 billion in 2025 to USD 0.96 billion by 2032, registering a CAGR of 14.9%, during the forecast period 2025-2032. The growth is expected to be driven by the rapid transition toward ultra-fast charging systems operating at 800 V and above, which significantly increases electrical stress within compact charger modules. This shift is accelerating the use of advanced encapsulation materials that can withstand higher partial discharge resistance, long-term dielectric aging, and severe thermal cycling without compromising power module reliability. Additionally, the growing adoption of integrated power electronics, such as combined rectifier, inverter, and control modules, in both public and fleet charging stations, is increasing the complexity and sensitivity of internal components. To protect these densely packed assemblies from vibration, humidity ingress, and environmental contaminants, charger manufacturers are specifying higher volumes of application-specific potting compounds, directly supporting market growth.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific electronic potting compound market for EV chargers accounted for an 83.9% market share in 2025.

-

By Charger TypeThe DC charger segment is projected to register the highest CAGR of 17.7%.

-

By Setup TypeThe stationary segment is projected to grow at the fastest rate from 2025 to 2032.

-

By Material TypeThe silicon potting material is projected to dominate the market during the forecast period.

-

By Curing TechnologyThe UV cured technology is projected to grow at the fastest rate of CAGR 14.0%.

-

By EV ComponentEV battery cells are projected to grow at the fastest rate of 10.9% from 2025 to 2032.

-

Competitive Landscape - Key PlayersHenkel Corporation (Germany), Dow (US), and Parker Hannifin Corp (US) were identified as some of the star players in the electronic potting compound market for EV charger, given their strong market share and product footprint.

-

Competitive Landscape - StartupsMaster Bond (US), Wacker Chemie AG (Germany), and MG Chemicals (Canada), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The electronic potting compound market for EV charger is witnessing a shift toward low-modulus formulations that reduce mechanical stress on SiC- and GaN-based power devices during rapid thermal cycling. Manufacturers are increasingly adopting automated and vacuum-assisted dispensing processes to achieve void-free encapsulation in high-voltage DC charger modules. Material development is also focused on improving partial discharge resistance to support long operational lifetimes. For instance, suppliers such as WEVO-CHEMIE and ELANTAS offer epoxy and silicone potting systems engineered for high-voltage insulation performance, including enhanced partial discharge resistance for demanding power electronics applications. In parallel, fast-curing potting systems compatible with high-throughput charger assembly lines are gaining traction.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Current revenues in the electronic potting compound market for EV charger are mainly generated from conventional and well-established materials used in low- to mid-power charging applications. These revenues are largely based on incremental improvements to existing products, with limited differentiation beyond price, availability, and basic regulatory compliance. Looking ahead, the revenue mix is expected to shift toward advanced, application-specific, and higher-value potting solutions. This change is driven by increasing charger power levels and the rapid expansion of charging infrastructure. Future growth is likely to come from new applications, new charger designs, new customers, and premium formulations, rather than from volume growth alone.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising power density in charger electronics driving demand for high-thermal-conductivity potting materials

-

Tightening electrical safety, insulation, and high-voltage testing standards

Level

-

Regulatory tightening on flame-retardant chemistries and additive bans

-

Restrictions on SVHCs under REACH and tightening RoHS scrutiny

Level

-

Commercialization of high-thermal-conductivity silicone potting for WBG-enabled power modules

-

Turnkey integration of automated dispensing and advanced potting materials for high-volume EV charger production

Level

-

SiC/GaN high-stress behavior creating new reliability failure modes for existing potting systems

-

Circularity and end-of-life issues limiting high-performance polymer choices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising power density in charger electronics driving demand for high-thermal-conductivity potting materials

Rising power density in EV charger electronics, driven by higher switching frequencies, compact power module designs, and the adoption of SiC and GaN-based devices, is significantly increasing localized heat generation within chargers. Conventional encapsulants are unable to dissipate this concentrated heat effectively, leading to performance derating and reliability risks. As a result, charger manufacturers are increasingly adopting high thermal conductivity potting compounds to maintain thermal stability, electrical insulation, and long-term operational reliability under continuous high load conditions.

Restraint: Regulatory tightening on flame-retardant chemistries and additive bans

Regulatory tightening on flame-retardant chemistries and the restriction of certain halogenated and additive systems are limiting the formulation flexibility of potting compounds used in EV chargers. Compliance with evolving chemical regulations increases reformulation and qualification costs, particularly for high-performance materials used in DC fast chargers. These constraints can slow product approvals and delay time to market for new potting solutions.

Opportunity: Commercialization of high-thermal-conductivity silicone potting for WBG-enabled power modules

The increasing adoption of wide bandgap (SiC and GaN) power devices in EV chargers is creating strong demand for silicone potting compounds with significantly higher thermal conductivity. These materials enable efficient heat dissipation while maintaining electrical insulation and mechanical flexibility in high-frequency, high-voltage power modules. Commercializing such advanced silicone systems offers material suppliers an opportunity to secure design wins in next-generation DC fast chargers.

Challenge: Circularity and end-of-life issues limiting high-performance polymer choices

Circularity and end-of-life regulations are increasingly restricting the use of permanent, cross-linked potting compounds in EV chargers, as they complicate material recovery and component recycling. High-performance polymers with strong adhesion and thermal stability are particularly difficult to remove or reprocess at the end of life. This creates a technical challenge for manufacturers to balance durability, safety, and recyclability without compromising charger performance.

ELECTRONIC POTTING COMPOUND MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies silicone-based potting compounds for AC and DC fast chargers to protect power modules, PCBs, and connectors from moisture, vibration, and thermal stress | Enhances electrical insulation, improves thermal stability, and extends charger service life in outdoor environments |

|

Provides silicone encapsulants for high-voltage power electronics in fast-charging stations | Ensures long-term reliability, high dielectric strength, and resistance to extreme temperatures |

|

Uses epoxy and polyurethane potting compounds to encapsulate onboard charger modules and wallbox EV chargers | Improves mechanical protection, reduces failure rates, and supports compact charger designs |

|

Delivers silicone potting solutions for DC fast chargers requiring efficient heat dissipation and weather resistance | Improves thermal management, protects sensitive electronics, and enables high power-density charger designs. |

|

Supplies polyurethane potting compounds for commercial and residential EV charging stations | Balances cost and performance, improves ingress protection, and supports scalable charger manufacturing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electronic potting compound market for the EV charger ecosystem includes raw material suppliers, potting compound and encapsulation material manufacturers, power electronics & module suppliers, EV charger and EVSE manufacturers, and charging network operators & infrastructure providers. Some of the major potting compound manufacturers for EV chargers include Henkel Corporation (Germany), Dow (US), Parker Hannifin Corp (US), ELANTAS (Germany), and Momentive (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electronic Potting Compound Market for EV Charger, By Charger Type

DC chargers are expected to lead the market for EV charger due to their high operating voltages and power levels, which demand potting materials with superior dielectric strength and thermal conductivity to protect dense power electronics. Additionally, the compact design of DC fast charging modules increases heat concentration, driving higher potting compound usage per charger.

Electronic Potting Compound Market for EV Charger, By Setup Type

Stationary (public) chargers are expected to lead the market for EV charger because high-power DC fast chargers deployed in public locations require heavy encapsulation to withstand continuous operation, high thermal loads, and outdoor environmental exposure. In addition, public chargers typically integrate larger power modules and higher redundancy levels, resulting in significantly higher potting compound consumption per installation compared to residential systems.

Electronic Potting Compound Market for EV Charger, By Material Type

Silicone is expected to lead the market for EV charger due to its inherent ability to maintain dielectric strength and flexibility under continuous high-temperature operation in DC fast-charging modules. Its low modulus and resistance to thermal cycling reduce stress on power electronics and solder joints, making it well-suited for high-voltage, high-power charger architectures.

Electronic Potting Compound Market for EV Charger, By Curing Technology

Thermal-cured technology is expected to lead the market for EV charger due to its ability to deliver high cross-link density, resulting in superior dielectric strength and long-term thermal stability for high-voltage DC charger modules. Additionally, thermal curing enables controlled processing of thick potting layers required in high-power chargers, ensuring consistent performance and reliability under continuous high-temperature operation.

Electronic Potting Compound Market for EV Charger, By EV Component

EV battery cells are expected to drive the market for EV charger, as higher-energy-density chemistries and tighter cell-to-cell spacing increase the need for thermal management and electrical insulation. In addition, growing regulatory and OEM focus on mitigating thermal runaway propagation is driving higher potting compound usage at the cell and module level.

REGION

The Asia Pacific is projected to record the highest growth in the electronic potting compound market for EV chargers during the forecast period.

The Asia Pacific is expected to witness the highest growth in the market for EV charger due to the rapid expansion of high-power DC fast charging networks in China, Japan, and South Korea, which require advanced thermal and electrical insulation materials. The region's strong domestic manufacturing base for power electronics is increasing local sourcing of potting compounds for charger modules. In addition, faster adoption of 800 V charger architectures and stricter national safety certifications are driving higher potting compound consumption per charger.

ELECTRONIC POTTING COMPOUND MARKET: COMPANY EVALUATION MATRIX

In the electronic potting compound market for EV charger, Henkel Corporation (Star) leads through its broad, EVSE-qualified portfolio of high-thermal-conductivity and high-dielectric potting solutions, supported by strong OEM relationships and global application engineering capabilities. RAMPF (Emerging Leader) is gaining momentum through its focus on customized polyurethane and epoxy systems for power electronics, along with increasing penetration in high-power DC charger applications, positioning it as a strong contender to move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Henkel Corporation (Germany)

- Dow (US)

- Parker Hannifin Corp (US)

- ELANTAS (Germany)

- Momentive (US)

- RAMPF (Germany)

- Electrolube (UK)

- Demak Group (Italy)

- WEVO-CHEMIE GmbH (Germany)

- Epoxies, Etc (US)

- Kisling (Switzerland)

- Sika Automotive (Switzerland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.25 Billion |

| Market Forecast in 2032 (Value) | USD 0.96 Billion |

| Growth Rate | CAGR of 14.9% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion), Volume (Tons) |

| Report Coverage | Revenue forecast, competitive landscape, company share, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, North America, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: ELECTRONIC POTTING COMPOUND MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| EV Charger OEM (Europe) |

|

|

| Chemical Manufacturer (US) |

|

|

| Power Electronics Supplier (Asia Pacific) |

|

|

| EV Charging Infrastructure Provider (Global) |

|

|

RECENT DEVELOPMENTS

- January 2026 : Henkel Corporation (Germany) launched Loctite STYCAST US 8000 A/B, a two-component polyurethane potting compound designed for demanding industrial and power electronics applications. The material offers high dielectric strength, low ionic content for corrosion resistance, and low-viscosity flow for reliable, void-free encapsulation in power conversion modules, including those used in EV chargers.

- November 2025 : Henkel Corporation (Germany) launched thermal potting solutions that are designed for critical EV power conversion components, including on-board chargers and inverters, and provide different levels of thermal conductivity to meet varying design requirements. Loctite SI 5643 and Loctite SI 5637 are two-component, fast-curing, low-viscosity, thermally conductive silicone potting compounds developed for high-performance power electronics.

- November 2025 : RAMPF Group (Germany) strengthened its presence in China by building a new, modern production facility in Tianjin. The company has invested EUR 8 million (approximately USD 9.3 million) in the project. The 23,500-square-meter site will operate as a full system house for polyurethane, silicone, and epoxy reactive resin systems starting in July 2026. These advanced materials are used for sealing, potting, bonding, and tooling across industries such as automotive, electric mobility, electronics, household appliances, and packaging.

- September 2025 : Dow (US) launched DOWSIL EG-4175 Silicone Gel for high-voltage EV power electronics. The gel resists up to 180°C (356°F) and is designed for next-gen IGBT modules in EV batteries and inverters, enabling higher voltage and greater efficiency.

- June 2025 : WEVO-CHEMIE GmbH (Germany) introduced three new potting compounds: WEVOSIL 22106 FL, 22102 FL, and 22105 FL. These materials support efficient thermal management and are designed for reliable potting. They are suitable for a wide range of modern electronic components, including wire bonds and inductive parts such as chokes and transformers, with or without ferrite cores.

Table of Contents

Methodology

The research study draws extensively on secondary sources, including company annual reports, product brochures, industry association publications, EV charging standards documentation, technical white papers, trade journals, and paid databases to compile critical information on the electronic potting compound market for EV chargers. In-depth primary interviews were conducted with material suppliers, EV charger OEMs, power electronics engineers, distributors, and industry experts to validate key insights, refine market estimates, and assess growth potential. This integrated research approach ensures a robust understanding of market dynamics, technological advancements, regulatory influences, and future opportunities within the electronic potting compound landscape for EV chargers.

Secondary Research

Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and trade-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data were collected and analyzed to determine the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted following a comprehensive assessment of the electronic potting compound market for EV chargers. Multiple interviews were carried out with stakeholders across both demand and supply sides. Demand-side participants included EV charger OEMs, power electronics engineers, charging infrastructure developers, and system integrators. Supply-side respondents comprised potting compound manufacturers, raw material suppliers, distributors, dispensing equipment providers, and certification/testing agencies.

The study covered respondents across North America, Europe, the Asia Pacific, the Rest of the World, and key manufacturing hubs such as China, Germany, Japan, South Korea, and the US. Approximately one-third of the interviews represented charger manufacturers and system designers, while the remaining participants were material suppliers and technical experts. Primary insights were gathered through structured questionnaires, virtual interviews, and email interactions focusing on material performance requirements, thermal management needs, regulatory compliance, formulation trends, and future investment priorities shaping the market for EV charger.

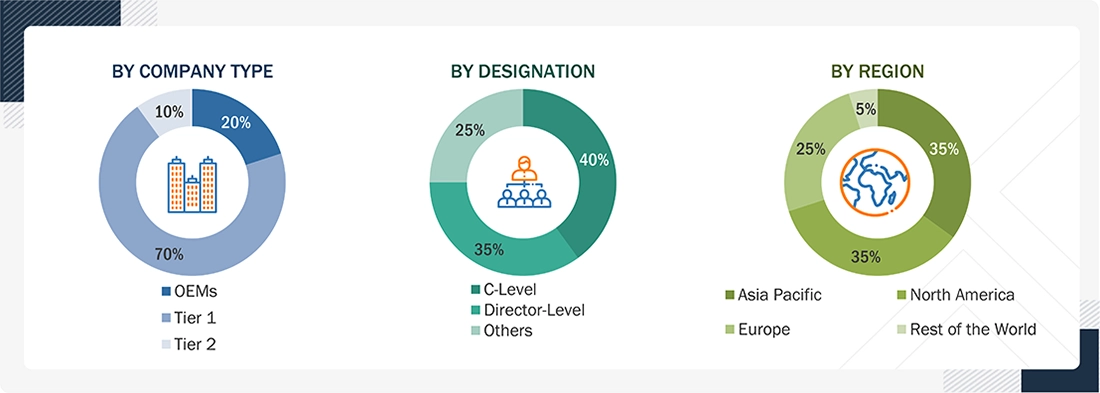

The following is a breakdown of the primary respondents

Notes:

Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

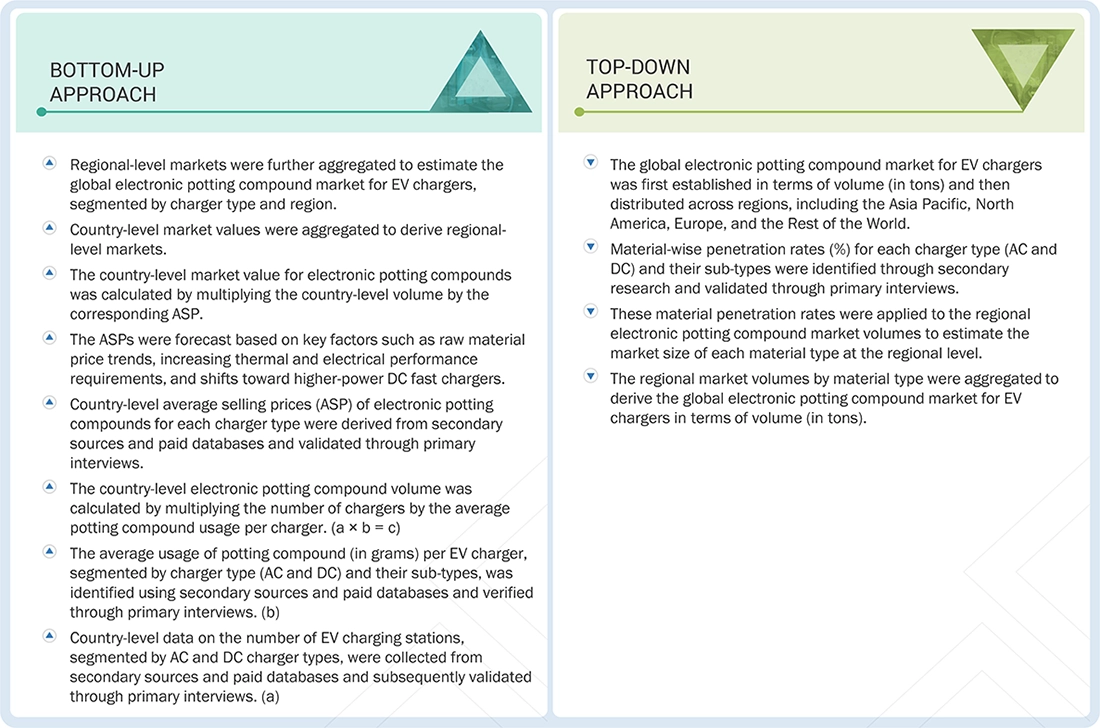

Market Size Estimation

Bottom-up and top-down approaches were used to estimate and validate the total size of the electronic potting compound market for EV charger. This method was also used extensively to estimate the size of various subsegments in the market.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The electronic potting compound for EV charger encompasses advanced insulating and encapsulating materials used to protect power electronics and control components within AC and DC charging systems. These compounds, typically silicone, epoxy, or polyurethane-based, provide electrical insulation, thermal management, mechanical stability, and environmental protection.

Key Stakeholders

- Charging network operators (CPOs)

- Contract manufacturers and EMS providers for charger assemblies

- Dispensing and automation equipment providers

- Distributors and specialty chemical suppliers

- Electric utilities and grid operators

- Electronic potting compound manufacturers

- EV charger OEMs

- EV charging infrastructure developers and integrators

- Government agencies and regulatory authorities

- Power electronics module manufacturers

- Raw material suppliers

- Testing, certification, and standards bodies

- Thermal management solution providers

Report Objectives

- To segment and forecast the electronic potting compound market for EV charger in terms of value (USD million), and volume (tons) based on the following:

- By Charger Type (AC Charger, DC Charger)

- By Region ( Asia Pacific, Europe, North America, Rest of the World)

- To segment and forecast the electronic potting compound market for EV charger in terms of volume (tons), based on the following:

- By EV Component (Electric Motor Stator, EV Battery Cell, EV Battery Cooling System, On-board Charger, In-vehicle Charging Connector, In-vehicle Power Converter, Others)

- By Curing Technology (Room Temperature Cured, Thermal Cured, UV Cured)

- By Material Type (Polyurethane, Epoxy, Silicone)

- By Setup Type (Wall Mount, Stationary)

- To analyze the electronic potting compound market for EV components (electric motor stator, EV battery cells, EV battery cooling system, on-board charger, in-vehicle charging connector, in-vehicle power converter, others) qualitatively

- To analyze technological developments impacting the market

- To provide detailed information about the major factors (drivers, challenges, restraints, and opportunities) influencing market growth

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

- To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Impact of AI/GenAI

- Trend and Disruption Impact

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Sustainability Initiatives

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments, such as product launches, expansions, and deals, carried out by key industry participants

Available customizations:

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electronic Potting Compound Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electronic Potting Compound Market