Encryption as a Service Market

Encryption as a Service Market by Service Type (Data Encryption as a Service, Key Management as a Service, Email Encryption as a Service, Application-Level Encryption as a Service), Organization Size, Vertical, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global encryption as a service market size was valued at USD 1.57 billion in 2024. The market is projected to grow from USD 1.99 billion in 2025 to USD 5.98 billion by 2030, exhibiting a CAGR of 24.9% during the forecast period. The market growth is primarily driven by the rising adoption of cloud technologies and growing concerns over critical data loss. As organizations increasingly migrate their operations to the cloud, the risks surrounding data security and privacy escalate, prompting the need for robust encryption solutions to safeguard sensitive information.

KEY TAKEAWAYS

- The North America encryption as a service market accounted for a 39.3% revenue share in 2024.

- By service type, the application-level encryption as a service segment is expected to register the highest CAGR of 29.0%

- By organization size, the SMEs segment is projected to grow at the fastest rate from 2024 to 2030.

- By vertical, the IT & Telecommunications segment will grow the fastest during the forecast period.

- AWS, IBM, and HashiCorp, were identified as some of the star players in the encryption as a service market (global), given their strong market share and product footprint.

- Akeyless, Piiano, and Kloch, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Additionally, this shift toward stronger encryption not only enhances operational efficiency but also raises awareness about potential vulnerabilities, compelling enterprises to prioritize encryption measures. The surge in cyberattacks and data breaches, including incidents involving malware and phishing, further intensifies the demand for encryption services. Organizations are increasingly adopting these solutions to protect their digital assets and ensure compliance with evolving regulatory standards.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The EaaS market is evolving as organizations seek to leverage large data sets for faster analytics and improved decision-making. Rapid data growth introduces challenges in IT performance, governance, and security, while the integration of AI, ML, cloud computing, and IoT is set to enhance future EaaS capabilities and drive more efficient, scalable encryption solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising concerns to related to critical data loss

-

Need for compliance with regulations regarding data protection

Level

-

Limited control over data

-

Downtime in data accessing and processing

Level

-

Rise in IoT and BYoD adoption

-

Rising demand for integrated data protection solutions among SMEs

Level

-

Complexities in key management across diverse environments

-

Difficulties in integrating encryption services with existing infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for compliance with regulations regarding data protection

Organizations face increasing pressure to comply with strict data protection regulations like GDPR, HIPAA, and PCI DSS, driving demand for encryption solutions. SMEs, with limited resources, prefer scalable, cost-effective EaaS offerings that integrate seamlessly with existing IT. Growing cloud adoption and rising cyber threats further emphasize the need for robust encryption to ensure data confidentiality, integrity, and regulatory compliance.

Restraint: Limited control over data

While EaaS provides flexibility and scalability, organizations often relinquish control over encryption keys and data management to third-party providers. This reliance raises privacy, security, and compliance concerns, limits customization of encryption policies, and can deter adoption by organizations with strict regulatory requirements or high-security needs.

Opportunity: Rise in IoT and BYoD adoption

The rise of IoT devices and BYOD policies expands the EaaS market as personal and connected devices increase data access and transfer, heightening security risks. Scalable, flexible encryption solutions are essential to protect sensitive information, comply with regulations, and secure the growing attack surface created by diverse devices and IoT integration.

Challenge: Complexities in key management across diverse environments

The adoption of hybrid and multi-cloud infrastructures complicates encryption key management, as integration with existing IT frameworks must avoid operational disruption. Shared responsibilities, stringent compliance, and poor key practices increase risks, creating demand for advanced key management solutions that ensure data confidentiality, integrity, and a harmonized security posture across diverse environments.

Encryption as a Service Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

European energy supplier enhanced SCADA cybersecurity using Senetas CN6010 and CN4010 encryptors to protect critical electricity and gas grid data from tampering and cyber threats. | Secured SCADA data integrity and minimized risks of unauthorized access and operational disruption. |

|

A global food distributor strengthened Microsoft 365 email protection using Perception Point’s advanced security solution to counter phishing and ransomware threats. | Detected 20,000 malicious emails and reduced IT workload through automated threat detection. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The encryption as a service market ecosystem comprises key management as a service providers, data encryption as a service, email encryption as a service, application-level encryption as a service providers and verticals such as banking and financial services (BFSI), aerospace and defense, government and public utilities, IT & telecommunications, healthcare, retail and other verticals. Regulatory authorities and standardization bodies also play a crucial role in influencing market trends, innovations, and an organization's encryption as a service strategies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Encryption as a Service Market, By Service Type

The Key Management-as-a-Service (KMaaS) segment leads the EaaS market by securing highly confidential data across business segments. Its centralized, scalable, and flexible key management across multiple cloud deployments supports regulatory compliance, enhances security, and attracts enterprises and SMBs, with AI and ML further improving key management efficiency.

Encryption as a Service Market, By Organization Size

Large enterprises hold the largest market size in EaaS due to managing vast, complex data across multiple systems and cloud environments. Scalable encryption solutions with centralized key management ensure regulatory compliance, protect critical assets, reduce administrative overhead, and safeguard against sophisticated cyberattacks, maintaining data integrity, customer trust, and business continuity.

Encryption as a Service Market, By Vertical

The BFSI segment leads the EaaS market due to high data security needs, handling sensitive customer and transaction data vulnerable to cyberattacks. Cloud adoption, regulatory compliance, and sophisticated threats drive demand for advanced encryption, while AI and ML enhance protection, ensuring data integrity, risk mitigation, and customer confidence in digital financial services.

REGION

Asia Pacific to be fastest-growing region in global encryption as a service market during forecast period

The Asia Pacific region is emerging as a high-growth market for Encryption as a Service (EaaS), driven by increasing government and private sector investments in cybersecurity across China, India, and Japan. Strengthened data protection regulations, rising cyber threats, and the adoption of cloud, IoT, and BYOD technologies are fueling demand. The shortage of skilled cybersecurity professionals has further increased reliance on consulting services, positioning EaaS as a critical solution for data integrity, privacy, and regulatory compliance.

Encryption as a Service Market: COMPANY EVALUATION MATRIX

In the Encryption as a Service market matrix, AWS (Star) leads with a strong market share and comprehensive cloud encryption and key management services widely adopted across BFSI, healthcare, and government sectors. Thales (Emerging Leader) gains traction with advanced cloud security and quantum-ready encryption, showing potential to enter the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.57 Billion |

| Market Forecast in 2030 (Value) | USD 5.98 Billion |

| Growth Rate | CAGR of 24.9% from 2025-2030 |

| Years Considered | 2018-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Encryption as a Service Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Product Analysis: Service Matrix, which gives a detailed comparison of the service portfolio of each company | Improved clarity on competitive positioning and product strengths to drive informed decision-making. |

RECENT DEVELOPMENTS

- November 2024 : Thales enhanced its CipherTrust Data Security Platform to a cloud-based, as-a-service subscription model, offering CipherTrust Cloud Key Management as a Service (CCKM), with flexible data security, encryption, and key management solutions.

- October 2024 : Bluefin and Sycurio, a digital payment solutions provider entered into a strategic partnership to enhance payment security and improve customer and agent experiences. This partnership was expected to integrate Bluefin's PCI-validated encryption with Sycurio's multi-channel payment solutions, significantly reducing compliance burdens and ensuring secure, seamless transactions across all channels.

- November 2023 : Retarus launched a new service called User Synchronization for Encryption (USE), designed to automate email encryption management tasks, thereby reducing administrative burdens for IT security managers.

- Novermber 2023 : Utimaco launched u.trust LAN Crypt Cloud, an intuitive file encryption-as-a-service solution that uses client-side encryption to safeguard sensitive data across on-premises and cloud storage.

- November 2023 : Bluefin partnered with ID TECH, a secure payment solutions manufacturer, to offer PCI validated Advanced Encryption Standard (AES) solutions through its payment security products, Decryptx and PayConex. This partnership was expected to enable customers to utilize AES encryption, enhancing the protection of sensitive cardholder data, particularly benefiting sectors like healthcare and education.

Table of Contents

Methodology

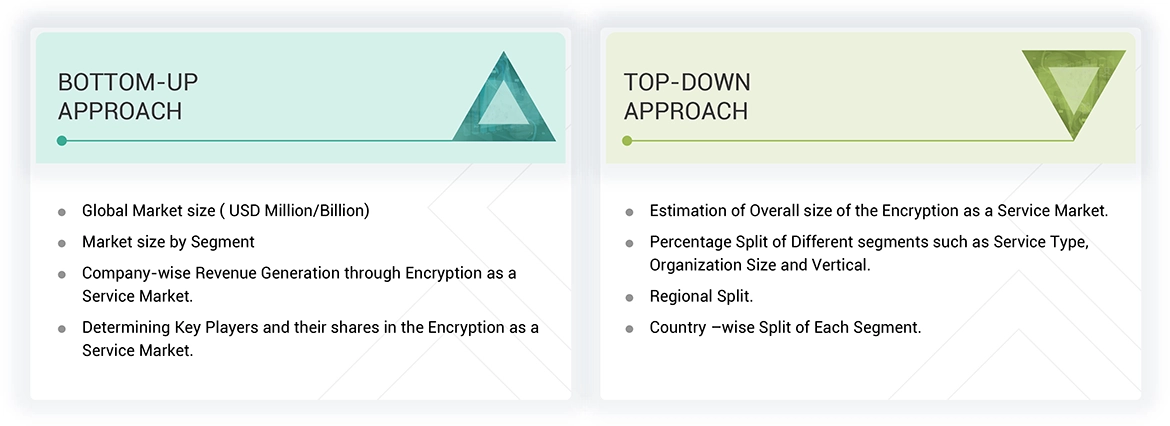

Secondary research was conducted to collect information useful for this technical, market-oriented, and commercial study of the global encryption as a service market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the encryption as a service market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included National Institute of Standards and Technology (NIST), annual reports, press releases, investor presentations of encryption as a service vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

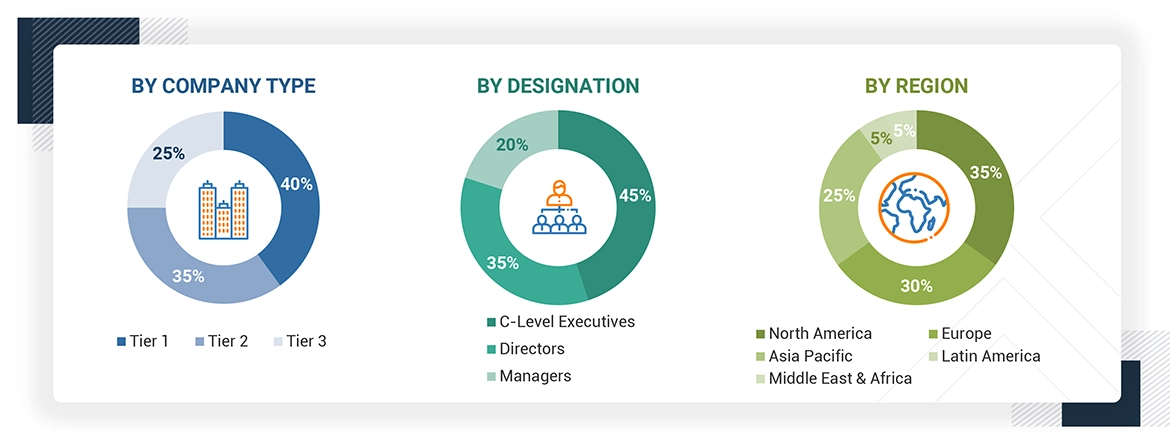

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the encryption as a service market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing encryption as a service solutions and services, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of encryption as a services offered by several market vendors, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the bottom-up and top-down approaches and several data triangulation methods were extensively used to estimate and forecast the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Tier 1 companies receive revenues higher than USD 10 billion; Tier 2 companies' revenues range between

USD 1 and 10 billion; and Tier 3 companies' revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the encryption as a service market and the size of various dependent sub-segments in the overall encryption as a service market. The research methodology used to estimate the market size includes the following details: critical players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Encryption as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, “Encryption as a Service (EaaS) is a cloud-based solution that enables organizations to encrypt data at rest and in transit using advanced cryptographic techniques. This service simplifies the implementation of robust encryption strategies by eliminating the need to manage complex infrastructure, ensuring data confidentiality and integrity while adapting to the varying needs of businesses.”

Stakeholders

- Government Agencies

- Encryption as a Service Provider

- Third-party providers

- Consultants/Consultancies/Advisory firms

- System integrators

- Value-added Resellers (VARs)

- Investors and Venture Capitalists

- Cybersecurity Vendors

- Managed Security Service Providers (MSSPs)

- Technology Providers

Report Objectives

- To describe and forecast the global EaaS market by service type, organization size, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and Latin America

- To provide detailed information related to significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the EaaS market and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To map the companies to get competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

- To track and analyze the competitive developments, such as product enhancements & new product launches, acquisitions, and partnerships & collaborations, in the EaaS market globally.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributes to the rest of the regional market size.

- Further breakup of the North American market into countries contributes to the rest of the regional market size.

- Further breakup of the Latin American market into countries contributing to the rest of the regional market size

- Further breakup of the Middle East & African market into countries contributing to the rest of the regional market size

- Further breakup of the European market into countries contributes to the rest of the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Encryption as a Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Encryption as a Service Market