Entertainment Content and Goods Market Size, Share & Trends

Entertainment Content and Goods Market by Music Equipment and Memorabilia, Vinyl Record, Signed Merchandise, Lifestyle and Home Goods, Sporting Equipment, Collectible, Animated Content Creation, Film, TV/OTT and Apparel - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The entertainment content and goods market is projected to reach USD 239.52 billion by 2030 from USD 177.64 billion in 2025, at a CAGR of 6.2% from 2025 to 2030. The market encompasses music artist goods, licensed merchandise, and animated content, with growth driven by rising youth engagement with global IPs, digital-first fan interactions, and expanding omnichannel retail strategies. Increasing investments in immersive storytelling, personalization trends, and regional government support for creative industries are further accelerating content creation, distribution, and monetization across diverse platforms.

KEY TAKEAWAYS

- The North American entertainment content and goods market accounted for a 37.3% revenue share in 2024.

- By music artist goods, the music equipment and memorabilia segment is expected to register the highest CAGR of 5.7%.

- By licensed goods, the licensed sportswear segment is expected to dominate the market.

- By animated content creation, the TV/OTT segment is expected to dominate the market, growing at the highest CAGR of 8.2%.

- The Walt Disney Company, Nike, Inc., Merchbar, Inc. were identified as some of the star players in the global entertainment content and goods market, given their strong market share and product footprint.

The Entertainment Content and Goods industry is set to grow steadily, fueled by rising digital consumption, global fan engagement, and expanding merchandise demand. From music artist goods to licensed sportswear and animated content, the market benefits from omnichannel retail, personalization, and immersive technologies. Supportive investments and youth-driven cultural trends further accelerate adoption, positioning it as a key pillar of the global creative economy.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the entertainment content and goods market, hot bets include AI-powered personalization, blockchain/NFT technologies for digital goods, and immersive tech (AR/VR/XR), with target applications spanning streaming services, gaming studios, record labels, and licensing agencies. Disruptions such as generative content tools, D2C monetization platforms, and creator-focused technologies will reshape end-user revenues from retail consumers, advertisers/sponsors, regulatory bodies, fan communities, and e-commerce/marketplace platforms, which in turn influence hot bets and drive the overall revenue growth of entertainment content and goods providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising consumer demand for personalized and experiential entertainment goods

-

Rapid advances in Al, 5G, and immersive technologies

Level

-

Growing instances of content and merchandise piracy

-

Economic constraints and subscription fatigue

Level

-

Increasing collaboration between innovative brands and artists

-

Rising integration of blockchain and non-fungible tokens into digital goods

Level

-

High cost of premium merchandise production

-

Increasing competition among entertainment platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising consumer demand for personalized and experiential entertainment goods

The entertainment content and goods market is expanding rapidly as Gen Z and millennials demand personalized, immersive, and experiential offerings. AI-driven personalization, AR/VR-enabled engagement, and direct-to-consumer models drive curated content, exclusive merchandise, and fan-centric economies. This shift fuels monetization, brand loyalty, and revenue diversification through interactive storytelling, bespoke products, and community-driven content ecosystems.

Restraint: Growing instances of content and merchandise piracy

Rampant piracy and counterfeiting pose a major barrier, targeting films, music, animation, and branded merchandise. Illegal streaming platforms and counterfeit goods erode revenues, weaken brand integrity, and reduce artist royalties. With inconsistent IP enforcement and advancing replication technologies, piracy remains a structural challenge, demanding stronger industry collaboration and policy intervention.

Opportunity: Rising integration of blockchain and non-fungible tokens into digital goods

The entertainment goods market is witnessing new opportunities through blockchain and NFTs. These technologies enable creators, artists, and brands to monetize digital assets via secure, transparent ownership. NFTs drive value through exclusivity and authenticity, supporting collectibles, virtual goods, and metaverse experiences. Companies like Disney and Warner Music are leveraging NFT drops, with smart contracts ensuring royalties from secondary sales.

Challenge: Rapidly changing consumer preferences and volatility in market trends

Rapidly evolving consumer tastes and volatile trends, amplified by social media and viral culture, pose significant challenges for entertainment content and goods providers. These shifts heighten risks of overproduction and obsolescence, requiring agile supply chains, real-time analytics, and influencer insights to sustain relevance while balancing personalization, authenticity, and innovation.

Entertainment Content and Goods Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Immersive AR/VR experiences for animated content with synchronized merchandise launches across theme parks, streaming platforms, and retail channels | Cross-platform brand loyalty, seamless content-to-commerce conversion, and enhanced fan lifetime value with 40-50% increase in merchandise sales |

|

AI-powered artist merchandise personalization with blockchain-based NFT collectibles and direct fan-to-artist monetization through streaming integration | 25-35% revenue increase for artists, reduced intermediary costs, and authentic fan engagement through digital ownership and exclusive content access |

|

Smart licensing platforms integrating music content with gaming studios, sporting events, and lifestyle brands for cross-industry merchandise collaboration | Enhanced licensing revenue streams, global brand partnerships, and optimized royalty distribution with 30-40% operational cost savings |

|

D2C monetization platforms with generative content tools for personalized fan experiences and automated merchandise recommendations | Improved artist-fan relationships, streamlined revenue collection, and data-driven product development leading to 20-30% increase in direct sales |

|

AI-driven animated content production with automated licensing for show-based merchandise and personalized memorabilia through viewer data analytics | Accelerated content-to-market delivery, optimized licensing revenue, and enhanced consumer personalization driving 35-45% merchandise conversion rates |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The entertainment content and goods companies ecosystem spans technology enablers, creative studios, streaming and retail platforms, and distribution partners. Technology providers supply design and rendering tools, while content creators generate IPs. Platforms deliver global reach and fan engagement, and distribution players ensure seamless merchandising, logistics, and retail connectivity.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Entertainment Content and Goods Market, By Music Artist Goods

The apparel segment accounted for the largest share in 2024, supported by the rise in artist-led fashion collaborations and global merchandising partnerships, particularly for printed T-shirts, hoodies, and headwear. The music equipment and memorabilia segment is anticipated to grow at the fastest CAGR, fueled by the resurgence of retro-style experiences such as vinyl records, signed merchandise, and instruments. Accessories and lifestyle goods like bags, shoes, mugs, and posters continue to expand through direct-to-fan channels and evolving gifting cultures.

Entertainment Content and Goods Market, By Licensed Goods Type

The licensed sportswear segment held the largest share in 2024, driven by strong consumer demand for sustainable, influencer-backed, and limited-edition merchandise, including official jerseys, athletic caps, and outerwear. The lifestyle, fan gear, and memorabilia segment is projected to register the highest CAGR, as personalization trends and omnichannel retail strategies boost adoption of collectibles, scarves, drinkware, and photo-based memorabilia. Meanwhile, accessories and sporting equipment segments continue to benefit from brand collaborations and fan-driven customization.

Entertainment Content and Goods Market, By Animated Content Creation

The TV/OTT segment dominated in 2024 and is expected to record the fastest CAGR, reflecting surging demand for binge-worthy series and animated storytelling across global platforms. Films also contribute significantly, supported by rising investments in immersive storytelling and cross-generational appeal. By animation style, both 2D and 3D formats remain central to production, while stop-motion and mixed media are gaining traction for niche audiences and innovative projects.

REGION

Asia Pacific to be the fastest-growing region in the global entertainment content and goods market during the forecast period

The Asia Pacific entertainment content and goods market is poised for the fastest growth, fueled by rapid digitization, rising smartphone usage, and youth-driven demand for anime, K-pop, and regional IPs. Countries such as China, India, Japan, and South Korea are witnessing strong content creation, merchandising, and fan engagement. Government support for creative industries, private investments, and expanding digital platforms are further strengthening regional production, exports, and adoption of fan-centric entertainment goods.

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 164.39 Billion |

| Market Forecast in 2030 (Value) | USD 239.52 Billion |

| Growth Rate | 6.2% |

| Years Considered | 2021−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Market Segmentation, Value Chain/Ecosystem, Technology Analysis, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and the RoW |

WHAT IS IN IT FOR YOU: Entertainment Content and Goods Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North American Streaming Platform | Comparative benchmarking of AI-powered personalization vs. traditional content curation strategies for subscriber engagement |

|

| Global Sports Licensing Agency | Assessment of generative content tools for personalized fan merchandise and automated licensing workflows |

|

| Global Entertainment Conglomerate | Market research study on D2C monetization platforms for animated content merchandise and creator economy integration |

|

RECENT DEVELOPMENTS

- May 2025 : Nike, Inc. (US) and the LEGO Group (Denmark) signed a multi-year global partnership to promote active and creative play among youth. The campaign, which is supported by immersive brand activations worldwide, includes co-branded apparel, footwear, and LEGO sets. The partnership seeks to increase youth engagement and retail growth by combining sports culture with creative play.

- July 2025 : Adidas AG (Germany) unveiled a new licensed children’s collection featuring Simpsons, Iron Man, and Hulk-themed apparel and footwear. The collection includes brightly colored sneakers, joggers, and t-shirts for younger fans. This collaboration strengthens Adidas’ position in the licensed children’s fashion market ahead of the release of new Marvel content.

- July 2025 : Universal Studios, in collaboration with Illumination (US), launched “Minions: The Rise of Gru,” an animated film set in the 1970s that explores the early adventures of Gru and his Minions. The release strengthens studios’ positioning in global animated entertainment and supports related merchandise and licensed character goods.

- January 2025 : Comcast Corporation (US) and Paramount (US) partnered to extend multi-year distribution agreements, allowing Comcast to continue providing Paramount’s streaming services and entertainment networks, such as Paramount+, Pluto TV, and BET+, across Xfinity platforms. Comcast customers will benefit even more from the expanded access to Paramount’s content library.

- October 2024 : Fanatics Live (US), a business of Fanatics Inc., started in France, Germany, and the UK following the acquisition of Voggt (France), the European leader in live-commerce collectibles. The deal also establishes Fanatics Live’s global footprint and its reach in the real-time sports trading card and sports memorabilia market.

Table of Contents

Methodology

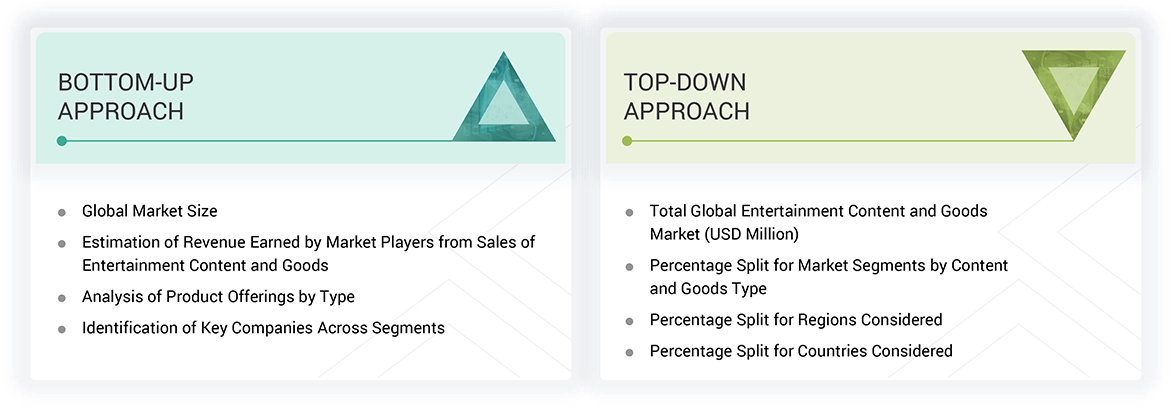

The research study involved four major activities in estimating the size of the entertainment content and goods market. Exhaustive secondary research has been done to collect key information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. The market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect the information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology-oriented perspectives.

The entertainment content and goods market report estimates the global market size using top-down and bottom-up approaches and several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

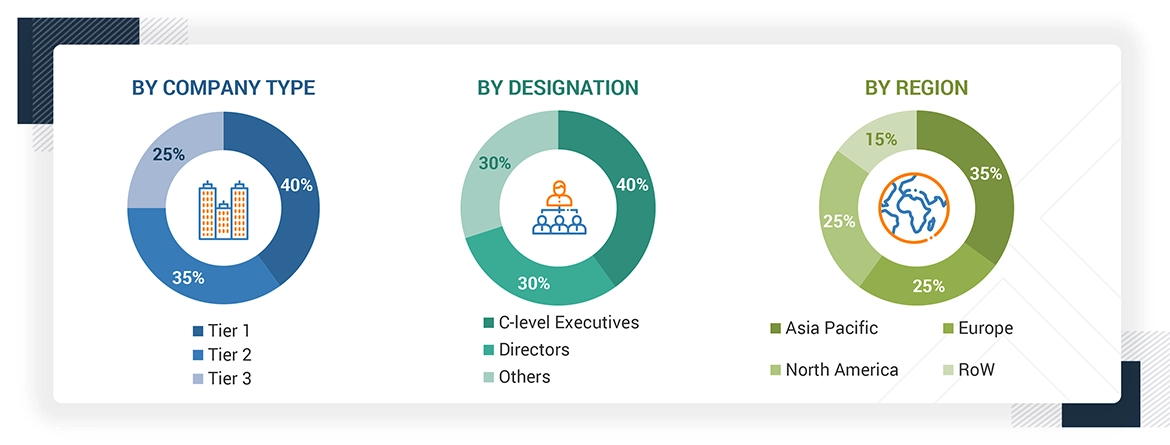

Extensive primary research has been conducted after understanding the entertainment content and goods market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews. Questionnaires and emails have also been used to collect data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the entertainment content and goods market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Estimating the market size of each key segment within the entertainment content and goods market, namely:

- Music artist goods (merchandise, collectibles, concert-linked items)

- Licensed goods (sporting equipment – licensed) (officially branded merchandise linked to major sports leagues and athletes)

- Animated content creation (film/OTT) (production and distribution of animated content via streaming platforms, cinema releases, and merchandise)

- Breaking down each segment by region—North America, Europe, Asia Pacific, and RoW—followed by detailed country-level estimation based on demand trends, consumption patterns, content popularity, and merchandise penetration rates

- Analyzing region- and country-level consumer behavior, fanbase size, IP monetization strategies, and cultural consumption preferences to derive segment-specific country revenues

- Aggregating the revenues of all segments at the country level to derive total market size by country, followed by aggregation of country-level data to estimate regional market sizes, and finally summing regional values to determine the global market size

- Validating segment-wise assumptions by triangulating with content consumption metrics, digital platform usage, IP franchise growth, and merchandising expansions from public sources, annual reports, streaming trends, and media publications, and finally aligning insights with the domain experts at MarketsandMarkets to ensure robustness and precision in market projections

Entertainment Content and Goods Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the entertainment content and goods market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply perspectives. Along with data triangulation and market breakdown, the market has been validated through the top-down and bottom-up approaches.

Market Definition

The Entertainment Content and Goods Market encompasses creating, commercializing, and consuming digital media content and associated branded merchandise derived from intellectual property (IP), artist influence, or licensed franchises. This market captures the intersection of cultural expression, consumer fandom, and monetization strategies across music, sports, animation, and other entertainment domains.

At its core, the market comprises two primary pillars: content creation and goods commercialization. Content creation includes digital formats such as films, TV/OTT series, and animated productions in 2D, 3D, stop-motion, and mixed media styles. These are increasingly delivered through global streaming platforms, forming the narrative foundation for merchandise, fandom, and brand engagement.

Complementing the content layer is a vast and diverse merchandise segment that includes music artist goods, such as printed apparel, accessories, lifestyle items, signed memorabilia, and branded instruments. Similarly, licensed goods related to sports teams, celebrities, esports, and entertainment franchises drive global demand for apparel, collectibles, sporting equipment, and lifestyle accessories. These goods are distributed through online artist stores, tour/event merchandising, e-commerce platforms, and retail partnerships.

The market is driven by rising consumer affinity for pop culture, the growing influence of artist-led branding, and the expanding global reach of content IPs. Fan-based consumption behavior and digital platforms enabling global access to content and merchandise continue to reshape how entertainment is monetized. As such, the market represents a dynamic convergence of media, commerce, and consumer identity.

Key Stakeholders

- IP Creators and Rights Holders

- Branded Merchandise Manufacturers and OEMs

- Licensing and Brand Collaboration Agencies

- Direct-to-Fan and E-commerce Platforms

- Retail Chains, Fashion Collaborators, and Pop-up Stores

- Streaming Platforms and Digital Content Distributors

- Digital Rights Management (DRM) and IP Protection Firms

- Fan Engagement, Loyalty, and Community Management Platforms

- Influencer Marketing and Talent Management Agencies

- Advertising, Branding, and Promotional Service Providers

- Regulatory Authorities and IP Protection Agencies

- Industry Associations and Entertainment Trade Forums

- Research Institutes and Academic Bodies

- Content Consumers, Fans, and Patronage Communities

Report Objectives

- To describe, segment, and forecast the size of the entertainment content and goods market, by music artist goods type, licensed goods type, and animated content creation, in terms of value

- To forecast the size of various segments for four regions: North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To offer detailed information on drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the entertainment content and goods market value chain analysis, pricing analysis, ecosystem analysis, technology analysis, case study analysis, trends/disruptions impacting customer business, and key conferences and events

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To benchmark the key players and analyze their market position in terms of revenue, market share, and core competencies, and a detailed competitive landscape for the market leaders

- To analyze competitive developments, such as product/services launches, expansions, acquisitions, partnerships, collaborations, and agreements, carried out by players in the entertainment content and goods market

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Key Questions Addressed by the Report

Who are the key players in the global entertainment content and goods market?

The Walt Disney Company (US), Sony Music Entertainment (US), Fanatics Inc. (US), Nike, Inc. (US), and Merchbar, Inc. (US) are the key market players.

Which region is expected to hold the largest market share and why?

North America is expected to hold the largest market share in the entertainment content and goods market during the forecast period, driven by strong consumer spending on licensed merchandise, a mature media and entertainment ecosystem, and the dominance of global content creators.

What are the primary forces fueling growth and significant opportunities within the entertainment content and goods market?

The entertainment content and goods market is rapidly growing due to demand for personalized experiences, tech-driven innovation, and global content integration. Key opportunities include artist-brand collaborations, NFT-based digital goods, and expanding consumer bases in emerging markets, such as India and Southeast Asia, fueling new revenue streams and fan engagement.

What are the prominent strategies adopted by market players?

Key players have adopted strategies such as product/service launches, partnerships, agreements, collaborations, acquisitions, and expansions to strengthen their position in the entertainment content and goods market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Entertainment Content and Goods Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Entertainment Content and Goods Market