Europe Advanced Ceramics Market

Europe Advanced Ceramics Market by Material (Alumina, Zirconia, Titanate, Silicon Carbide, Piezo Ceramic, Others), Application (Monolithic Ceramics, Ceramic Matrix Composites, Ceramic Coatings, Ceramic Filters, Others), End-use Industry (Electrical & Electronics, Transportation, Medical, defense & Security, Environmental, Chemical, Others), Region – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe advanced ceramics market is growing steadily, driven by the region’s strong industry, technological leadership, and demand for high-performance materials in automotive, aerospace, electronics, medical devices, energy, and manufacturing. Growth factors include the need for lightweight, durable, and thermally stable materials, expansion of semiconductor and EV production, automation, and Industry 4.0 adoption, and Europe’s move toward renewable energies requiring high-temperature and corrosion-resistant ceramics. Innovations like additive manufacturing and strong R&D support wider applications. Challenges involve high costs, energy-intensive processes, raw material supply issues, competition from polymers and composites, and strict environmental regulations urging cleaner, efficient production. Still, focus on sustainability, electrification, miniaturization, and high-precision engineering keeps demand strong, making advanced ceramics vital for Europe’s future growth.

KEY TAKEAWAYS

-

BY COUNTRYGermany is expected to grow at the highest CAGR in Europe during the forecast period.

-

BY MATERIALBy material, alumina is expected to register the highest CAGR of 5.9% during the forecast period.

-

BY APPLICATIONBy application, monolithic ceramics expected to account for 74.2% of the market in 2025.

-

BY END-USE INDUSTRYBy end-use industry, the medical segment is expected to be the fastest-growing during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSKYOCERA Fineceramics Europe GmbH (Germany), 3M (US) and Morgan Advanced Materials (UK) were identified as some star players in the Europe advanced ceramics market, given their strong market share and product footprint

-

COMPETITIVE LANDSCAPE- STARTUPSFinal Advanced Materials, Vesuvius and Dyson Technical Ceramics among others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as responsive companies

The Europe advanced ceramics market is driven by the region’s strong industrial ecosystem, increasing demand for high-performance materials, and rapid technological advancements across key sectors. Growth is fueled by the expanding semiconductor and electronics industry, where ceramics are essential for substrates, insulators, and high-temperature components. The shift toward electric vehicles, renewable energy, and hydrogen technologies boosts demand for durable, thermally stable ceramics. Additionally, Europe’s advanced aerospace, medical device, and automotive manufacturing sectors rely heavily on materials that offer superior strength, corrosion resistance, and reliability. Continuous R&D investments, along with advancements in ceramic processing and additive manufacturing, further accelerate market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe advanced ceramics market is seeing key trends and disruptions driven by technological innovation, sustainability pressures, and rising performance demands. A major trend is the quick adoption of advanced ceramics in electric vehicles, power electronics, and renewable energy systems, where thermal and dielectric stability are vital. Europe’s push for miniaturization in electronics, automation, and manufacturing boosts demand for ceramic substrates, capacitors, sensors, and insulators. Disruptive innovations like ceramic 3D printing enable complex geometries, reduce waste, and accelerate prototyping. Advances in ceramic matrix composites and ultra-high-temperature ceramics are transforming aerospace and defense. EU sustainability rules push for eco-friendly processes, recyclable materials, and energy-efficient production. Supply chain issues, geopolitical tensions, and reliance on raw materials like zirconia and alumina lead companies to localize sourcing and seek alternatives. Digitalization and Industry 4.0, including AI quality control and automated machining, are reshaping manufacturing. These trends boost market evolution but also challenge producers to innovate and adapt in Europe’s fast-changing industrial landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong demand from Europe’s high-tech industries like automotive, aerospace, electronics, medical, and industrial machinery

Level

-

High production costs due to expensive raw materials and energy-intensive sintering processes

Level

-

Growing investment in hydrogen technologies, fuel cells, and clean energy systems requiring ceramic membranes and electrolytes

Level

-

Difficulty in integrating ceramics with metals and polymers due to advanced joining and bonding requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVER – Strong demand from Europe’s high-tech industries like automotive, aerospace, electronics, medical, and industrial machinery

A key driver of the Europe advanced ceramics market is the strong demand from high-tech industries such as automotive, aerospace, electronics, medical devices, and industrial machinery, all of which depend heavily on materials that can withstand extreme operating environments. Advanced ceramics offer exceptional thermal resistance, mechanical strength, dielectric stability, and biocompatibility, qualities that align perfectly with Europe’s innovation-driven sectors. In automotive and aerospace, they are crucial for lightweighting, emissions reduction, and high-temperature components. In electronics, ceramics enable substrates, sensors, insulators, and power electronics essential for EVs, 5G networks, and semiconductor manufacturing. The region’s advanced medical industry further boosts consumption through applications in implants, prosthetics, dental systems, and surgical tools. Europe’s push toward electrification, automation, renewable energy, and precision engineering amplifies this demand, making advanced ceramics indispensable to meeting performance, reliability, and sustainability goals across multiple high-value industries.

RESTRAINT – High production costs due to expensive raw materials and energy-intensive sintering processes

A major restraint in the Europe advanced ceramics market is the high production cost associated with expensive raw materials and energy-intensive sintering processes. Key ceramic inputs such as zirconia, alumina, and silicon carbide often face supply constraints, price volatility, and dependence on imports, which increases cost pressures for European manufacturers. Additionally, the sintering and firing processes required to achieve the superior mechanical and thermal properties of advanced ceramics consume significant energy, an even more critical challenge in Europe, where energy prices are among the highest globally due to environmental regulations and the transition toward renewables. These cost burdens make advanced ceramics less competitive in applications where metal or polymer alternatives may offer adequate performance at lower expense. Small and mid-sized manufacturers also face barriers in adopting advanced furnaces, automation, and precision machining equipment, further limiting production scalability. As a result, high costs can slow adoption and restrict penetration into cost-sensitive end-use sectors across Europe.

OPPORTUNITY –Growing investment in hydrogen technologies, fuel cells, and clean energy systems requiring ceramic membranes and electrolytes

A major opportunity for the Europe advanced ceramics market lies in the region’s rapidly growing investment in hydrogen technologies, fuel cells, and clean energy systems, all of which rely heavily on ceramic membranes, electrolytes, and high-temperature components. Europe’s Green Deal, hydrogen strategies from Germany, France, and the EU, and accelerating deployment of solid oxide fuel cells (SOFCs) and electrolyzers are creating strong future demand for advanced ceramics capable of operating in corrosive and high-temperature environments. Ceramics such as yttria-stabilized zirconia, perovskites, and ceramic composites are essential for ion transport, thermal insulation, and structural stability in hydrogen production and storage systems. As Europe expands its focus on decarbonization, renewable integration, and energy storage, advanced ceramics will play an increasingly critical role in enabling efficiency, durability, and environmental resilience. This opens significant opportunities for manufacturers to innovate and scale production of ceramic components tailored for clean-energy applications.

CHALLENGE – Difficulty in integrating ceramics with metals and polymers due to advanced joining and bonding requirements

A key challenge for the Europe advanced ceramics market is the difficulty of integrating ceramics with metals and polymers due to complex joining and bonding requirements. Advanced ceramics possess high hardness, brittleness, and thermal stability, which make them ideal for high-performance applications but also create substantial compatibility issues when assembling multi-material systems. Automotive, aerospace, and electronics manufacturers often require hybrid components where ceramics must be reliably bonded to metallic housings, polymer insulators, or composite structures. Differences in thermal expansion, mechanical behavior, and chemical properties heighten the risk of cracking, delamination, or performance failure during operation. While techniques such as brazing, diffusion bonding, and advanced adhesives are improving, they remain costly and technically demanding. These challenges slow adoption, increase design complexity, and limit the broader use of ceramics in integrated systems, especially in industries moving toward lightweighting, modular designs, and compact electronic architectures.

EUROPE ADVANCED CERAMICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of advanced technical ceramics for industrial machinery, semiconductor fabrication, medical implants, defense armor, and energy applications. Specializes in ceramic components requiring extreme wear resistance, thermal stability, and chemical inertness. | Improved component lifespan, reduced maintenance cycles, higher mechanical reliability under extreme workloads, and enhanced operational efficiency for OEMs and industrial users across Europe. |

|

Integration of advanced ceramic materials into medical devices, automotive sensors, and electronic insulation systems. Provides high-performance bioceramics, piezoceramics, and ceramic composites for precision applications. | Higher device accuracy, improved biocompatibility in implants, lower electrical losses, and long-term durability, supporting innovation across healthcare and automotive sectors. |

|

Manufacturing of ceramic substrates, cutting tools, semiconductor packaging materials, and thermal management solutions for electronics and telecommunications in Europe. | Enhanced heat dissipation, increased tool productivity, reduced equipment wear, and improved performance of high-frequency electronic systems. |

|

Production of ceramic insulation, ceramic seals, thermal components, and engineered ceramic assemblies for aerospace, energy, defense, and industrial heating systems. | Superior thermal shock resistance, higher energy efficiency, extended service life under high temperatures, and reduced operational downtime for critical applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the Europe advanced ceramics market is a well-structured network involving raw material suppliers, component manufacturers, technology providers, distributors, and end-use industries that collectively drive innovation and commercialization. Key raw material suppliers provide high-purity alumina, zirconia, silicon nitride, and carbides essential for high-performance applications, while manufacturers convert these materials into advanced ceramic components such as substrates, coatings, seals, and insulators using precision forming, sintering, and additive manufacturing technologies. Equipment and technology providers support the ecosystem through advanced kilns, processing machinery, and digital manufacturing tools that enhance efficiency and product consistency. Distributors and specialized suppliers bridge manufacturers and end users across the automotive, aerospace, electronics, medical, energy, and industrial sectors by providing logistics, technical support, and customization. Collaboration between research institutes, universities, and industrial players further strengthens the ecosystem through continuous R&D, leading to innovations in lightweight materials, thermal management solutions, and bioceramics. Additionally, regulatory bodies and sustainability frameworks influence production standards, waste management practices, and material safety, shaping long-term market direction.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Advanced Ceramics Market, by Material

Alumina dominates the Europe advanced ceramics market due to its exceptional combination of mechanical, thermal, and chemical properties, making it highly versatile across industries. It offers high hardness, wear resistance, excellent electrical insulation, and thermal stability, which are critical for applications in electronics, automotive components, aerospace, and medical devices. Its affordability compared to other technical ceramics further supports widespread adoption. Additionally, Europe’s strong focus on high-performance manufacturing, renewable energy technologies, and industrial automation drives demand for alumina-based components. The material’s adaptability for substrates, insulators, cutting tools, and protective coatings reinforces its position as the largest material segment in the region.

Europe Advanced Ceramics Market, by Application

Monolithic ceramics lead the Europe advanced ceramics market due to their simplicity, versatility, and cost-effectiveness across a wide range of industrial applications. Unlike composite or coated ceramics, monolithic ceramics are used as single, solid components that offer high mechanical strength, wear resistance, thermal stability, and chemical inertness, making them ideal for electronics, automotive, aerospace, medical devices, and industrial machinery. Europe’s growing emphasis on precision manufacturing, renewable energy, and high-performance electronics further fuels demand. Their ease of fabrication, reliable performance under extreme conditions, and compatibility with mass production processes reinforce monolithic ceramics as the largest application segment in the region’s advanced ceramics market.

Europe Advanced Ceramics Market, by End-use Industry

The electrical and electronics sector is the largest end-use industry for Europe’s advanced ceramics market, driven by the region’s strong semiconductor manufacturing, industrial automation, telecommunications, and consumer electronics. Advanced ceramics like alumina, zirconia, and silicon nitride are widely used for substrates, insulators, sensors, capacitors, and chip packaging because of their excellent dielectric properties, thermal stability, and durability. Rising demand for miniaturized, high-performance, and energy-efficient electronic devices further drives adoption. Additionally, Europe’s focus on innovation, smart manufacturing, and renewable energy applications in electronics ensures consistent growth, positioning electrical and electronics as the dominant end-use segment for advanced ceramics.

REGION

Germany to register highest growth in Europe Advanced ceramics market during forecast period

Germany is Europe's fastest-growing market for advanced ceramics, driven by its strong industrial ecosystem, technological leadership, and rising demand in precision sectors. As a hub for automotive, electronics, machinery, and aerospace, it increasingly uses advanced ceramics for their thermal stability, wear resistance, electrical insulation, and lightweight properties. The shift toward electric mobility, autonomous tech, and power electronics accelerates the use of alumina, zirconia, silicon carbide, and piezoelectric ceramics. A robust semiconductor and sensor sector, supported by R&D institutions like Fraunhofer and universities, drives innovation. The push for renewable energy technologies boosts demand for high-temperature and corrosion-resistant ceramics. Government initiatives promoting Industry 4.0, sustainability, and energy efficiency aid adoption across industries. With leading ceramic manufacturers, exports, and investments in material science, Germany remains a top, competitive market in Europe.

EUROPE ADVANCED CERAMICS MARKET: COMPANY EVALUATION MATRIX

In the Europe advanced ceramics market, 3M (Star) remains a leader due to its extensive expertise, broad product range, and presence in electronics, automotive, aerospace, medical, and industrial sectors. Its ongoing innovation in high-purity alumina, zirconia, ceramic coatings, and structural ceramics offers superior thermal, electrical, wear, and chemical properties. This positions 3M as a key supplier for semiconductor packaging, electric vehicle parts, aerospace insulation, and medical implants. Paul Rauschert GmbH & Co. KG (Emerging Leader) is quickly growing in Europe by focusing on engineering-driven manufacturing, customized designs, and precision forming. It expands its product offerings for electronics, energy, fluid handling, and industrial processing, where high-strength, temperature-resistant ceramics are crucial. As manufacturers seek reliable, high-quality ceramic solutions for specific applications, Paul Rauschert’s modular, application-specific components and flexible production enable it to increase market share. While 3M maintains leadership through innovation and OEM relationships, Paul Rauschert gains momentum with industries adopting lightweight, durable ceramic solutions across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- KYOCERA Fineceramics Europe GmbH (Germany)

- CeramTec GmbH (Germany)

- CoorsTek Inc. (US)

- Morgan Advanced Materials (UK)

- 3M (US)

- MARUWA Co., Ltd. (Japan)

- NGK CERAMICS EUROPE S.A.(Belgium)

- Saint-Gobain Performance Ceramics & Refractories (France)

- Paul Rauschert GmbH & Co. KG. (Germany)

- AGC Inc. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.70 Billion |

| Market Forecast in 2030 (Value) | USD 3.72 Billion |

| Growth Rate | CAGR of 5.5% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Europe |

WHAT IS IN IT FOR YOU: EUROPE ADVANCED CERAMICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Breakdown | Provides detailed country-specific insights for major European markets such as Germany, France, Italy, Spain, and the UK, including demand distribution across electronics, automotive, aerospace, medical, and energy sectors. Covers installed manufacturing capacities, supply chain availability for alumina, zirconia, silicon carbide, and silicon nitride, import–export flows, OEM presence, domestic fabrication strengths, and government policies related to industrial modernization, clean energy, and advanced manufacturing. | Helps clients identify high-growth countries in Europe, evaluate domestic production and expansion opportunities, understand EU and national incentives, assess reshoring potential, and align market-entry strategies based on demand concentration and technological readiness. |

| Application-specific Deep Dive | Offers segmentation of monolithic ceramics, ceramic coatings, ceramic matrix composites (CMCs), and ceramic filters across key applications such as electronic substrates, sensors, fuel cells, implants & prosthetics, aerospace engine components, automotive emission systems, and industrial machinery. Includes performance benchmarking, process compatibility, thermal/mechanical property evaluation, and real-world adoption case studies in the European context. | Enables stakeholders to focus on fast-growing application clusters, optimize R&D for high-performance materials (e.g., CMCs for aerospace, alumina substrates for electronics), enhance product positioning, and develop Europe-specific innovation roadmaps aligned with OEM requirements. |

| Material Based Customization | Comparative assessment of alumina, zirconia, silicon carbide, silicon nitride, and piezoelectric ceramics across performance metrics, cost structures, processing technologies, and end-use suitability in Europe. Includes material substitution trends, design considerations for miniaturized electronics, and lifecycle performance under European industrial conditions. | Supports OEMs and material suppliers in selecting optimal ceramics for durability, thermal performance, electrical insulation, biocompatibility, or wear resistance. Helps balance performance vs. cost, identify high-volume material opportunities, and design tailored solutions for electronics, medical implants, and aerospace systems in Europe. |

| End-use Industry Customization | Breakdown of consumption patterns across electronics, automotive, aerospace & defense, energy, medical devices, and industrial equipment, with Europe-specific data on demand drivers, technology integration, investment trends, and adoption potential. Includes mapping of key end-user clusters, procurement behavior, and certification requirements (e.g., CE marking, ISO, EN standards). | Assists clients in targeting high-revenue verticals, aligning production capability with industry-specific standards, and developing strategic partnerships across Europe. Helps identify sectors with stable long-term demand, such as semiconductors, implants, aerospace engine components, and renewable energy applications. |

RECENT DEVELOPMENTS

- June 2024 : KYOCERA Corporation opened a new production facility at the Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture. The company opened this factory to produce fine ceramic components for semiconductor-related applications and packages. This helped the company to strengthen its manufacturing capacity to meet the rising market demand for its products.

- May 2024 : Morgan Advanced Materials and Penn State University have signed a five-year Memorandum of Understanding (MOU) to drive research and development in silicon carbide (SiC) crystal growth in the semiconductor industry. This collaboration is part of a multimillion-dollar initiative that highlights both organizations' commitment to advancing innovation in semiconductor materials.

- April 2024 : KYOCERA Corporation merged its Shiga Yohkaichi Plant and Shiga Gamo Plant to form the newly named "Shiga Higashiomi Plant" in order to improve operational efficiency. The plant produces fine ceramic components, semiconductor components, electronic components, industrial tools, and medical products.

- May 2022 : CeramTec GmbH developed a new product under the name AIN HP. It is a high-performance substrate made of aluminum nitride. The newly launched AIN HP substrate offers 40 percent more flexural strength than the previous generation of AIN substrates.

Table of Contents

Methodology

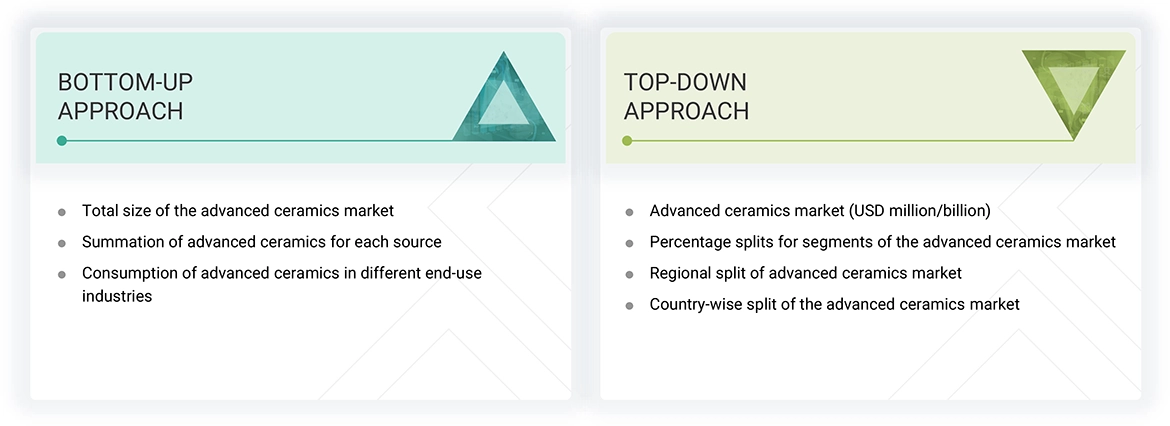

The study involved four major activities for estimating the current size of the Europe Advanced Ceramics market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Europe Advanced Ceramics through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Europe Advanced Ceramics market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the Europe Advanced Ceramics market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The Europe Advanced Ceramics market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Europe Advanced Ceramics market. Primary sources from the supply side include associations and institutions involved in the Europe Advanced Ceramics market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the Europe Advanced Ceramics market by material, application, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the Europe Advanced Ceramics market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Advanced Ceramics are a group of engineered ceramic materials with high strength, thermal resistance, electrical conductivity, and chemical stability. They are generally manufactured using advanced processing methods and are intended for high-performance applications in the aerospace, automotive, electronics, healthcare, and defense industries. Advanced Ceramics comprise alumina, zirconia, and silicon carbide, which are applied in electronic substrates, medical equipment, cutting tools, and armor systems. The Advanced Ceramics market is fueled by continuous technological improvements, miniaturization needs, and the demand for high-performance, long-life materials in hostile environments.

Stakeholders

- Europe Advanced Ceramics Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the Europe Advanced Ceramics market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, application, end-use industry, and region.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the Europe Advanced Ceramics market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Advanced Ceramics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Advanced Ceramics Market