Europe Battery Recycling Market

Europe Battery Recycling Market by Chemistry (Lead Acid, Nickel, and Lithium), Material (Metals, Electrolytes, and Plastics), Source (Automotive, Industrial, and Consumer & Electronics), Processing State, Recycling Process, and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

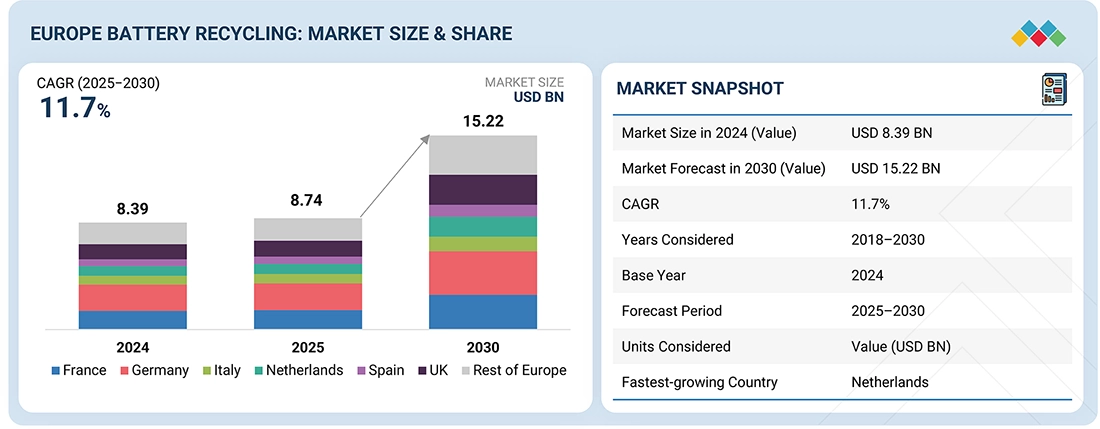

The Europe battery recycling market is projected to grow from USD 8.74 billion in 2025 to USD 15.22 billion by 2030, at a CAGR of 11.7% during the forecast period. In Europe, battery consumption has significantly increased due to the rising demand for batteries, fueled by the increasing adoption of electric vehicles, portable gadgets, and renewable energy storage systems. Handling the end-of-life batteries has led to a requirement for effective recycling procedures. Europe has been at the forefront of implementing stringent environmental regulations and waste management directives. Manufacturers, importers, and distributors are required under the European Union's Battery Directive and Waste Electrical and Electronic Equipment (WEEE) Directive to collect and recycle batteries. These regulations drive the need for battery recycling infrastructure in the region.

KEY TAKEAWAYS

-

BY COUNTRYThe Netherlands is expected to register the highest CAGR of 14.2% during the forecast period.

-

BY CHEMISTRYBy chemistry, the lithium-based battery segment accounted for a 50.8% share of the market in 2024.

-

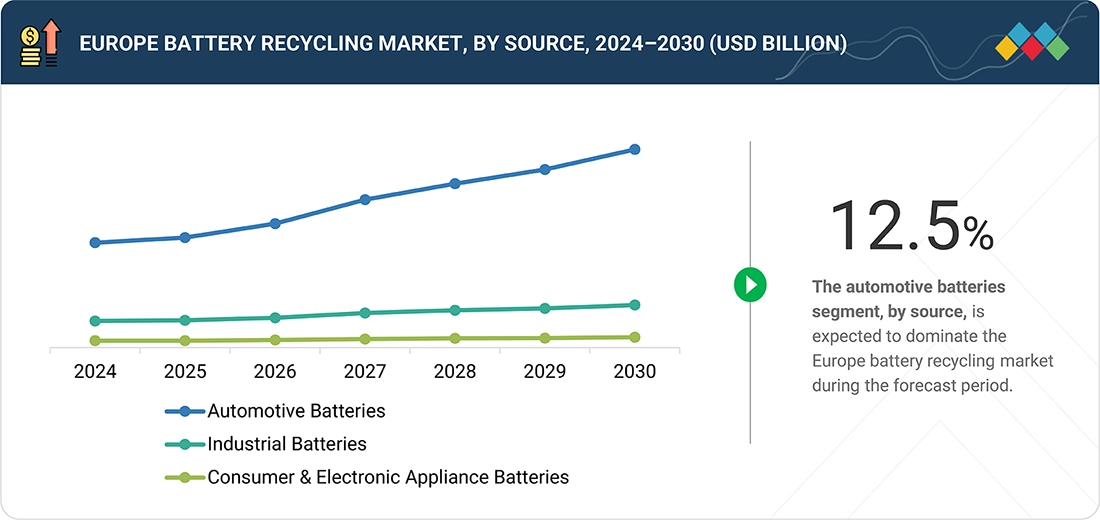

BY SOURCEBy source, the automotive segment is expected to register the highest CAGR of 12.5% during the forecast period.

-

BY PROCESSING STATEBy processing state, extraction of materials is expected to dominate the market.

-

BY RECYCLING PROCESSBy recycling process, lithium-ion battery recycling process is expected to dominate the market.

-

BY MATERIALBy material, the metals segment is expected to dominate the overall market.

-

Competitive Landscape - Key PlayersUmicore, Fortum, and Stena Recycling were identified as some of the star players in the Europe battery recycling market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsBatrec Industries AG, Duesenfeld Gmbh, Euro Dieuze Industrie (E.D.I.), and others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Europe battery recycling market is witnessing robust growth fueled by the rapid adoption of electric vehicles, expanding deployment of energy storage systems, and the surging volume of end-of-life lithium-ion and lead-acid batteries entering the recycling stream. Supportive government initiatives across Germany, France, and other countries for battery recycling are driving the market in the region.

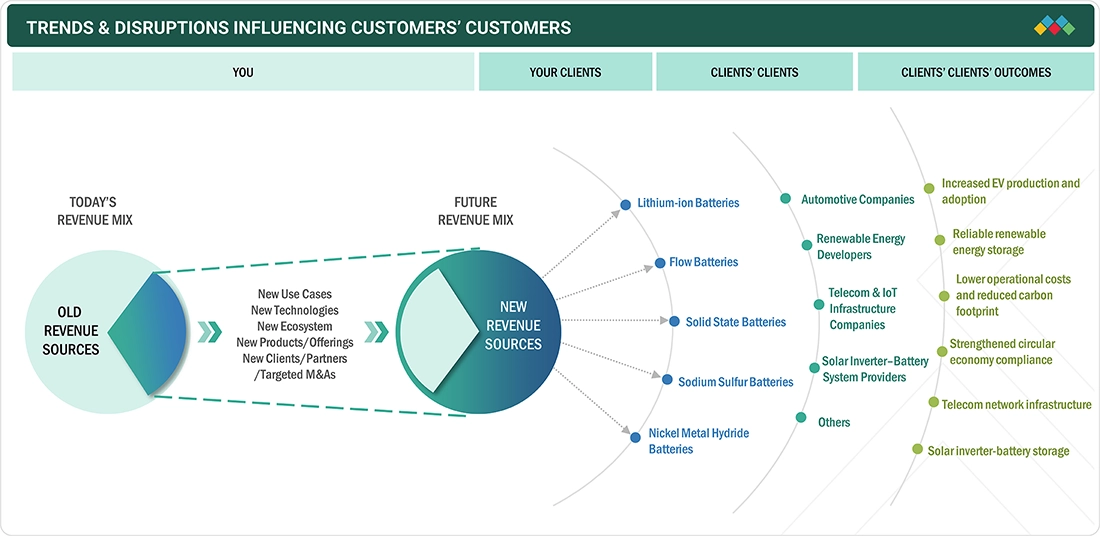

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. The growth of end-use industries, such as automotive batteries, industrial batteries, consumer & electronics batteries, energy storage system (ESS) batteries, leads to the growing demand. These megatrends are expected to drive growth and increase the revenue of the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent EU regulations and policies

-

Rising EV adoption and electrification

Level

-

Safety and logistics challenges

Level

-

Renewable energy storage expansion

-

Black mass trading and infrastructure investments

Level

-

High recycling costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising EV adoption and electrification

Rapid EV penetration across major European markets, including Germany, France, the Nordics, and the UK, continues to expand the future pipeline of end-of-life lithium-ion batteries. This surge in vehicle electrification increases the volume of production scrap, warranty returns, and post-consumer batteries entering recycling streams, driving consistent demand for high-capacity facilities and boosting recovery of critical materials such as nickel, cobalt, and lithium to support domestic battery manufacturing.

Restraint: Safety and logistics challenges

Battery recycling in Europe faces significant constraints due to stringent safety requirements for transporting, storing, and dismantling lithium-ion batteries. Cross-border movement of hazardous waste under EU regulations increases complexity, while risks of thermal runaway, improper handling, and high insurance costs add operational burdens. These factors elevate logistical expenses and limit the scalability of collection networks, especially for dispersed and small-format batteries.

Opportunity: Renewable energy storage expansion

Europe’s aggressive renewable-energy transition is creating strong opportunities for recycled materials to feed into stationary storage systems. Growth in grid-scale battery installations and commercial storage deployments increases the long-term demand for sustainable raw materials, supporting the adoption of second-life battery applications. This convergence of energy and recycling markets positions recyclers to become strategic suppliers to Europe’s expanding energy-storage value chain. The EU is a proud champion of renewable energy. By 2023, almost a quarter of all energy consumed came from renewable sources, double the share in 2010, when it stood at 12.5%. Building on this progress and to maintain momentum, in 2023, EU countries set a binding target of achieving a share of at least 42.5% renewables in the energy mix by 2030.

Challenge: High recycling costs

Despite strong regulatory momentum, battery recycling in Europe remains challenged by high operational costs driven by complex chemistries, energy-intensive processing technologies, and labor-intensive dismantling requirements. Capital expenditure for setting up compliant facilities is significant, and fluctuating commodity prices can limit profitability. These cost pressures can slow investment and make it difficult for recyclers to achieve competitive margins without long-term supply contracts or government incentives.

EUROPE BATTERY RECYCLING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Operates advanced lithium-ion and hybrid-battery recycling facilities in Belgium and across Europe, using proprietary ultra-high-temperature refining and hydrometallurgical processes to recover cobalt, nickel, lithium, and other battery metals | Partners with European OEMs, gigafactories, and consumer electronics companies for closed-loop material recovery | Delivers high-purity, battery-grade materials back to European cathode production, strengthens regional supply-chain security, reduces reliance on imported raw materials, and significantly lowers the carbon footprint of battery production through advanced circular-economy practices |

|

Runs industrial-scale lithium-ion battery recycling operations in Finland, leveraging low-CO2 hydrometallurgical processing and mechanical pre-treatment to extract cobalt, nickel, lithium, and other metals | Collects EV batteries, production scrap, and energy-storage modules from OEMs and fleet operators across the EU | Achieves high metal-recovery rates with low energy use, supports European EV manufacturers in meeting EU Battery Regulation requirements, reduces environmental impacts, and enables efficient closed-loop reuse of critical raw materials |

|

Operates collection, dismantling, and recycling facilities across Sweden, Norway, Denmark, and Germany, specializing in safe handling of EV batteries, industrial storage batteries, and consumer electronics| Uses mechanical and chemical recycling technologies to recover metals and safely process hazardous components | Improves battery-handling safety across Europe, reduces landfill waste and environmental hazards, extends material life cycles, and provides manufacturers with responsibly sourced recycled materials that align with regional sustainability and compliance goals |

|

A Germany-based specialist in lithium-ion and NiMH battery recycling, operating advanced pyrolysis and hydrometallurgical facilities for spent consumer batteries, EV modules, and industrial cells | Provides end-to-end material recovery, including black-mass processing and strategic raw-material extraction | Enables high-efficiency recovery of cobalt, nickel, and specialty materials, supports German and EU supply chains with domestic recycling capacity, and reduces dependency on primary mining by reintegrating recovered materials into European manufacturing ecosystems |

|

One of Europe’s largest lead-acid battery recyclers with expanding capabilities in lithium-ion battery recycling across the UK, France, and Germany | Operates extensive battery-collection networks, smelting facilities, and material-refining operations serving automotive, industrial, and energy-storage sectors | Ensures secure, high-volume recovery of lead and other materials, supports safe battery disposal, enables closed-loop recycling for automotive and industrial applications, and enhances supply-chain efficiency while meeting stringent European environmental and safety regulations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe battery recycling ecosystem consists of raw material suppliers (e.g., GRS Batterien, Haiki Cobalt, and others), producers (e.g., Umicore, Stena Recycling, Fortum, and others), distributors (e.g., Brenntag N.V., Riverland Trading), and end users (e.g., Bebat, Mercedes-Benz Group, and others).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Battery Recycling Market, By Chemistry

The lithium-based battery segment is expected to register the highest growth in the market, supported by surging EV adoption, expanding gigafactory capacity, and the rapid accumulation of manufacturing scrap from new cell production lines. The EU Battery Regulation, which mandates recovery efficiencies for lithium, cobalt, and nickel and requires minimum recycled content in new batteries, is driving large-scale investment in hydrometallurgical recycling infrastructure across the region. As OEMs shift toward higher-energy chemistries such as NMC and LFP, recyclers are scaling capabilities to process diverse lithium-ion chemistries while optimizing black-mass recovery yields. The combination of rising feedstock availability, regulatory pressure, and Europe’s strategic focus on securing critical raw materials is positioning lithium-based battery recycling as the fastest-expanding chemistry segment in the regional market.

Europe Battery Recycling Market, By Source

By source, the automotive segment is expected to register the highest growth in the market, as the region undergoes rapid electrification and a sharp increase in EV penetration. Rising volumes of end-of-life hybrid and electric vehicle batteries, along with substantial quantities of production scrap generated by Europe’s expanding gigafactory network, are creating a steady and scalable feedstock pipeline for recyclers. EU policies mandating responsible end-of-life battery management, coupled with OEM requirements for closed-loop material recovery, are accelerating partnerships between automakers and recycling companies. As a result, the automotive sector has become the dominant and fastest-growing source segment, underpinning long-term demand for advanced lithium-ion recycling technologies across Europe.

EUROPE BATTERY RECYCLING MARKET: COMPANY EVALUATION MATRIX

In the Europe battery recycling market matrix, Umicore (Star) leads with its integrated supply chain to maximize market reach and product diversification. Players under the Stars category primarily focus on new service & technology launches, as well as acquiring leading market positions through the provision of broad portfolios, catering to the different requirements of customers. They are also focused on innovations and are geographically diversified. They also have broad industry coverage. Apart from that, they have strong operational and financial strength and endeavor to grow organically and inorganically in the market. Batrec Industries AG (Emerging Leader) has a strong potential to build strategies to expand its business and stay on par with the star players. However, emerging leaders have not adopted effective growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Umicore (Belgium)

- Fortum (Finland)

- Stena Recycling (Sweden)

- ACCUREC Recycling GmbH (Germany)

- Ecobat (UK)

- Exide Industries Ltd. (India)

- GEM Co., Ltd. (China)

- Glencore (Switzerland)

- Neometals Ltd. (Australia)

- Sk Tes (Singapore)

- Contemporary Amperex Technology Co., Limited (CATL) (China)

- Batrec Industrie (Switzerland)

- Duesenfeld Gmbh (Germany)

- Euro Dieuze Industrie (E.D.I.) (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.39 BN |

| Market Forecast in 2030 (Value) | USD 15.22 BN |

| CAGR (2025–2030) | 11.7% |

| Years Considered | 2018–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Processing State (Extraction of Material, Reuse, Repackaging & Second Life, and Disposal) |

| Countries Covered | France, Germany, Italy, Netherlands, Spain, UK, and Rest of Europe |

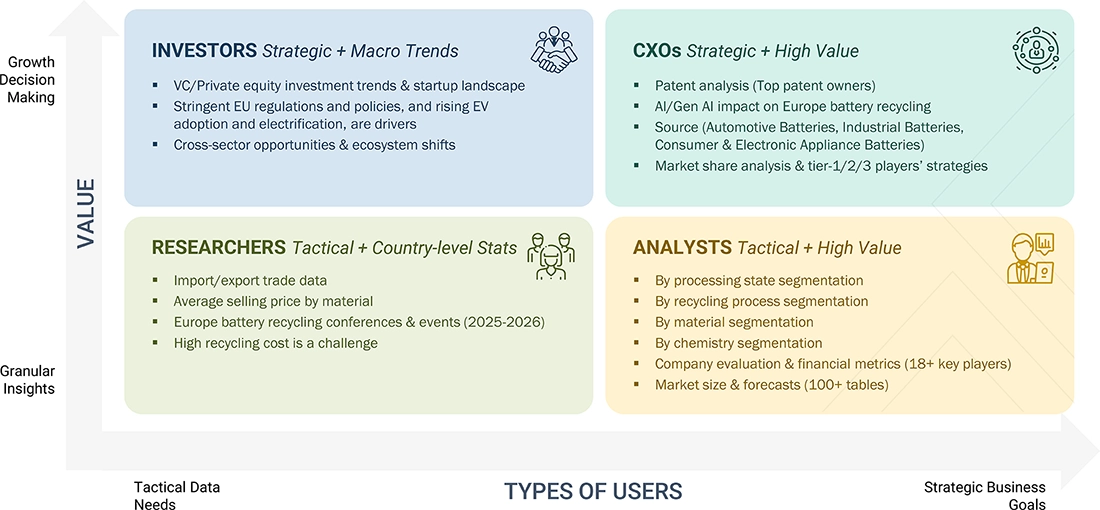

WHAT IS IN IT FOR YOU: EUROPE BATTERY RECYCLING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Support in meeting EU Battery Regulation and EPR compliance | Mapped EU compliance requirements and benchmarked processes with leading European recyclers | Ensured regulatory readiness and reduced compliance-related risks |

| Optimize recycling of production scrap from European gigafactories | Evaluated scrap generation and compared in-house vs. outsourced recycling economics | Improved scrap recovery yields and reduced overall recycling costs |

| Improve collection, transport, and safe handling of consumer Li-ion waste streams | Assessed WEEE collection systems and built optimized handling and sorting protocols | Enhanced safety, minimized incident risks, and increased collection efficiency |

| Assess end-of-life and second-life pathways for EV batteries across Europe | Modeled EoL flows and analyzed second-life feasibility across EU energy-storage markets | Enabled longer asset utilization and readiness for Europe’s circular-energy targets |

RECENT DEVELOPMENTS

- April 2023 : Stena Recycling and Freyr Battery have agreed on recycling services of scrap battery material from Freyr’s plant in Norway. The agreement includes handling of scrap material from the production site, and the reuse of the recycled material in their own production of new batteries.

- September 2022 : Umicore and PowerCo, the new battery company of the Volkswagen Group, announced a joint venture for precursor and cathode material production in Europe. From 2025 onwards, the joint venture will supply PowerCo's European battery cell factories with key materials. It also aims to include elements of refining and battery recycling based on Umicore's technology.

- March 2020 : Fortum entered into a cooperation agreement with BASF SE (Germany) and Norilsk Nickel Harjavalta Oy (Russia) to plan a battery recycling cluster in Harjavalta (Finland). The purpose of the agreement was to establish a closed-loop cycle to reuse the critical metals present in used lithium-ion batteries. The agreement helped Fortum in serving the electric vehicle market in the European region.

Table of Contents

Methodology

The study involved four major activities in estimating the current market size of Europe battery recycling market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of battery recycling through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The Europe battery recycling Market comprises several stakeholders, such as such as battery suppliers, processors, recycling companies, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Europe battery recycling industry. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom- up approaches were used to estimate and validate the total size of the Europe battery recycling industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the Europe Battery Recycling Market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive and non-automotive sources.

Market definition

Battery recycling refers to the process of collecting and reprocessing used batteries to recover valuable materials and reduce environmental impact. It involves the safe and responsible disposal of batteries, followed by the extraction and recycling of materials such as precious metals (e.g., lead, lithium, copper, nickel, cobalt) and other components (e.g., plastic, acid) that can be reused or repurposed. Battery recycling helps conserve natural resources, minimize pollution, and prevent hazardous substances from entering the environment.

Key Stakeholders

- Governments and research organizations

- Battery manufacturers

- Electric vehicle manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

- Battery recycling manufacturers/traders

Report Objectives:

- To analyze and forecast the market size of Europe battery recycling market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the Europe Battery Recycling Market on the basis of source, chemistry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To track and analyze the competitive developments, such as new technology launches, joint ventures, partnerships, contracts, collaborations, acquisitions, agreements, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the Europe Battery Recycling Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Battery Recycling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Battery Recycling Market