Europe Cloud Computing Market

Europe Cloud Computing Market by Service Model (IaaS [Compute, Storage, Networking], PaaS [Application Development & Integration, Database & Data Analytics & Reporting], SaaS [CRM, SCM, Collaboration & Productivity]), Impact of AI - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe cloud computing market is projected to grow from USD 325.92 billion in 2025 and reach USD 550.42 billion by 2030, at a CAGR of 11.0%. The market growth is supported by the rising digital transformation across industries. These organizations are moving from traditional legacy IT infrastructure toward cloud-based platforms. Such models are being adopted by enterprises to improve flexibility and manage costs. The influx of strict data protection rules, such as GDPR, is also heightening interest in sovereign cloud solutions. The manufacturing, healthcare, financial services, and public sectors are increasing the adoption of cloud computing. Continuous investments in data centres and cloud infrastructure is helping build a stable and long-term cloud computing market in Europe.

KEY TAKEAWAYS

-

BY COUNTRYThe UK is estimated to account for the largest share with a market size of USD 52.05 billion in 2025.

-

BY SERVICE MODELSaaS is estimated to be the largest segment among service models, with a market size of USD 63.22 billion in 2025.

-

BY DEPLOYMENT MODEThe hybrid cloud segment is projected to grow at the highest CAGR of 17.5% during the forecast period.

-

BY ORGANIZATION SIZEThe large enterprises segment is estimated to account for the largest market share in 2025.

-

BY VERTICALThe healthcare & life sciences segment is projected to grow at the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSMajor market players in the Europe cloud computing market have pursued both organic and inorganic strategies, including partnerships, technology integrations, and strategic investments. Microsoft, Google, AWS, IBM, and Oracle have strengthened their cloud portfolios to meet rising demand for AI-enabled services, hybrid deployments, and secure, scalable platforms supporting digital transformation across diverse industries.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESIn Europe’s cloud computing landscape, startups and SMEs like Zymr, pCloud, and Tudip Technologies are strengthening their presence by offering agile, cost-effective, and customizable cloud solutions. These companies focus on product engineering, secure cloud storage, and cloud-native development services for mid-market and enterprise customers.

The Europe cloud computing market is undergoing a major change as companies are updating their systems, integrating AI, and requiring a scalable digital infrastructure. The market is undergoing changes at different levels of service, deployment, and geography, as well as across sectors, each with different strategic implications as organisations move to cloud-native architectures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The primary factors that are changing the Europe cloud computing market for businesses are changing customer expectations and continuous digital disruption. Companies in the banking, financial services, and insurance (BFSI), healthcare, and life sciences industries, as well as the retail and e-commerce sectors, are progressively adopting the cloud. These industries use cloud platforms to facilitate digital engagement and service delivery. Organisations are becoming data-driven and are having to meet higher security requirements. Changes in revenue models and customer demand are the main factors driving increased cloud service usage and the growth of providers in Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Public sector digitalization across EU countries

-

Strong demand from regulated industries

Level

-

Complex data protection and privacy rules

-

Data residency and localization requirements

Level

-

Growth of sovereign and local cloud providers

-

Rising use of cloud for AI and data analytics

Level

-

Managing security across multi-country operations

-

High energy costs and sustainability pressure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Public sector digitalization across EU countries

Governments across Europe are moving public services online to improve access and efficiency. Cloud platforms are used for tax systems, welfare services, healthcare records, and digital identity programs. Many of these projects are supported by EU-level funding and national digital plans. Cloud helps public bodies manage growing data volumes without building new IT infrastructure. It also allows faster updates when policies or systems change. Security and data control remain important, which makes cloud platforms a practical choice. This ongoing shift keeps public sector cloud demand stable.

Restraint: Complex data protection and privacy rules

Europe has some of the strictest data protection laws in the world. GDPR requires clear control over how data is collected, stored, and shared. Rules can differ by country and by industry. Companies must document data flows and access rights. This adds legal and technical work during cloud migration. Compliance also increases operating costs. Smaller firms often lack the resources to manage these requirements easily. As a result, cloud adoption can be slower.

Opportunity: Growth of sovereign and local cloud providers

European organizations want more control over where their data is stored. This has increased interest in sovereign and local cloud providers. These providers are designed to meet EU laws and local regulations. Governments and regulated industries often prefer them over global platforms. Trust plays a major role in vendor selection. Local providers also support national digital goals. This creates strong growth opportunities within the Europe cloud market.

Challenge: Managing security across multi-country operations

Many European businesses operate across several countries. Each country has its own data and security rules. Cloud environments must meet all local requirements. Cyber threats are also becoming more frequent and complex. Managing security across borders is difficult. Companies need constant monitoring and regular updates. This increases operational effort and cost. Security management remains a major challenge at scale.

EUROPE CLOUD COMPUTING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Vestas moved from an on-premises supercomputer to Microsoft Azure High-Performance Computing. The existing system could not handle growing simulation demand. Azure enabled Vestas to run large-scale turbine and climate simulations more efficiently. The shift supported faster analysis and better planning for wind energy projects. | The migration improved system reliability and increased computing capacity. Vestas gained the ability to scale resources on demand. Maintenance effort and infrastructure costs were reduced. The move also supported sustainability goals and enabled new data-driven services. |

|

Starzdata migrated core workloads from a hyperscale cloud provider to OVHcloud to support its usage-based data activation platform. The earlier setup led to unpredictable costs, performance delays, and vendor lock-in. OVHcloud provided a flexible and transparent infrastructure to support scalable data processing and API-driven workflows. | Starzdata reduced infrastructure costs by around 75% and gained clear cost visibility. Use of OVHcloud Local Zones significantly lowered latency and accelerated data processing jobs. The new setup improved performance, supported sensitive data use cases, and enabled predictable scaling aligned with business growth. |

|

Liberbyte built its decentralized data exchange platform, bytEM, on UpCloud to support secure and low-latency data sharing. The platform is designed to give organizations and individuals control over how data is accessed and monetized. UpCloud was selected to provide stable, high-performance, and Europe-based cloud infrastructure. | The platform achieved millisecond-level latency and high system stability. Liberbyte ensured data security and sovereignty by using a European cloud provider. The flexible cloud setup also supports rapid deployment, automation, and future platform expansion. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cloud computing ecosystem in Europe consists of various players, including network and infrastructure providers, cloud infrastructure providers, cloud platform service providers, and software application solution providers. The cloud computing ecosystem in Europe also includes cloud service brokers and consultancies. This dynamic ecosystem has greatly contributed to innovation and growth of the cloud computing marketplace in Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Cloud Computing Market, by Service Model

By service model, SaaS is expected to account for the largest share of the Europe cloud computing market. Many organizations adopt subscription-based software to update their operations without spending heavily on new IT systems. SaaS applications are easy to deploy and do not require internal maintenance. Demand is increasing for CRM, ERP, and HR applications among enterprises and SMEs. Industry-specific SaaS platforms are also gaining adoption in finance, healthcare, retail, and manufacturing, supporting steady market growth.

Europe Cloud Computing Market, by IaaS

In the IaaS segment, the networking subsegment is expected to grow at the fastest rate. Enterprises are increasingly focusing on reliable, secure connectivity to support hybrid and multi-cloud setups. Companies are expanding edge deployments, which increases network requirements. Low latency and stable performance have become important priorities. The ongoing rollout of 5G and modern networking technologies continues to support growth.

Europe Cloud Computing Market, by PaaS

In the PaaS segment, database and data management services are expected to hold the largest market share. European enterprises are managing larger volumes of business and customer data. Cloud-based platforms support analytics, AI applications, and real-time processing. Shifting from on-premises databases reduces system complexity. Strong focus on compliance and data control further supports adoption.

Europe Cloud Computing Market, by SaaS

In SaaS applications, supply chain management is expected to grow at the highest rate. Organizations require better visibility across their supply networks. Cloud-based SCM solutions help track inventory, plan demand, and manage logistics. Many organizations rely on real-time data to improve decision-making. Sustainability reporting and regulatory requirements are further increasing demand for cloud-based SCM tools.

Europe Cloud Computing Market, by Deployment Mode

By deployment mode, the public cloud is expected to hold the largest market share in Europe. Enterprises prefer public cloud platforms as they allow easy scaling and better cost control. Public cloud supports faster application rollout and flexible resource use. Adoption is strong across sectors such as finance, healthcare, and retail. Large data center networks and strong compliance standards are helping build trust in public cloud services.

Europe Cloud Computing Market, by Organization Size

By organization size, SMEs are expected to grow at the fastest pace in the Europe cloud market. Small and mid-sized businesses are using cloud services to reduce IT costs and avoid owning physical infrastructure. Cloud platforms provide access to modern tools that were earlier available only to large enterprises. SaaS and public cloud models are widely used due to simple pricing and ease of use. This trend is increasing cloud adoption among SMEs across Europe.

Europe Cloud Computing Market, by Vertical

By vertical, the software and IT services segment is expected to hold the largest market share. Companies in this sector rely heavily on cloud platforms for application development, testing, and deployment. Cloud supports scalability and faster release cycles. Demand is driven by DevOps practices and cloud-native development. These organizations also manage large data volumes using cloud services, making them a key contributor to market growth.

REGION

The Netherlands is expected to be fastest-growing country in the Europe cloud computing market during the forecast period.

The Netherlands is projected to experience the highest CAGR in the Europe cloud computing market during the forecast period. This high growth is attributed to its well-developed digital assets as well as its robust networks. The country is strategically located in the centre of Europe and is home to many of Europe’s significant data centre operations. Companies operating in this region are experiencing greater digitisation potential and are becoming more innovative. Therefore, the acceptance of cloud technology within the business community is growing, especially in sectors such as financial services, logistics, and eCommerce. Companies in these sectors have begun to leverage cloud-based application platforms to maximise operational efficiencies and increase their operational scalability. Further, government support for digitalisation and data-driven service delivery is increasing the number of organisations that are leveraging cloud technologies.

EUROPE CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX

In the Europe cloud computing market matrix, Microsoft (Star) is at the forefront. The company is a major player in the region with its Azure platform, the go-to solution for most enterprises. Microsoft is very active in BFSI, healthcare, and government sectors. The company's emphasis on enterprise workloads and AI-powered services is helping it to maintain its leading position. OVHcloud (Emerging Leader) is becoming a major player in Europe. The company has a strong local presence. It has been operating several local data centers across different countries in Europe. OVHcloud is heavily investing in GDPR compliance and data residency. Its offerings in the sovereign cloud are being adopted by European enterprises at a rapid pace.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- AWS (US)

- IBM (US)

- Oracle (US)

- Scaleway (France)

- OVHcloud (France)

- UpCloud (Finland)

- Exoscale (Switzerland)

- gridscale (Germany)

- Elastx (Sweden)

- IONOS (Germany)

- Aruba Cloud (Italy)

- Cyso Cloud (Netherlands)

- Open Telekom Cloud (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 286.34 Billion |

| Market Forecast, 2030 (Value) | USD 550.42 Billion |

| Growth Rate | CAGR of 11.0% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE CLOUD COMPUTING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator |

|

|

| Enterprise (BFSI, Retail, Manufacturing) |

|

|

RECENT DEVELOPMENTS

- May 2025 : Microsoft and SAP launched the SAP Business Suite Acceleration Program, delivering a 99.95% SLA for SAP Cloud ERP on Azure and expanding SAP ERP and BTP availability on the Azure Marketplace. The integration of SAP Databricks and Microsoft 365 Copilot’s Joule highlights a commitment to AI-enhanced enterprise productivity, reinforced by a strategic focus on sovereign cloud expansion, European data center capacity, and AI-native ERP modernization.

- April 2025 : Capgemini and Google Cloud deepened their partnership to deliver industry-specific agentic AI solutions across telecommunications, retail, and financial services. By leveraging Agentspace and the Agent2Agent protocol, the collaboration drives automation, personalization, and security while advancing a strategic focus on vertical AI adoption, agentic cloud platforms, and customer experience transformation.

- March 2025 : Oracle and NVIDIA partnered to integrate NVIDIA AI tools and NIM microservices into Oracle Cloud Infrastructure, enabling scalable agentic AI deployment. This supports inference, vector search, and no-code AI blueprints across data centers, public clouds, and edge environments, underpinned by a strategic focus on AI-native cloud infrastructure, enterprise-grade inference, and multi-environment deployment.

Table of Contents

Methodology

This research study on the Europe cloud computing market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred cloud service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the europe cloud computing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and cloud service providers. It also included key executives from europe cloud computing solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

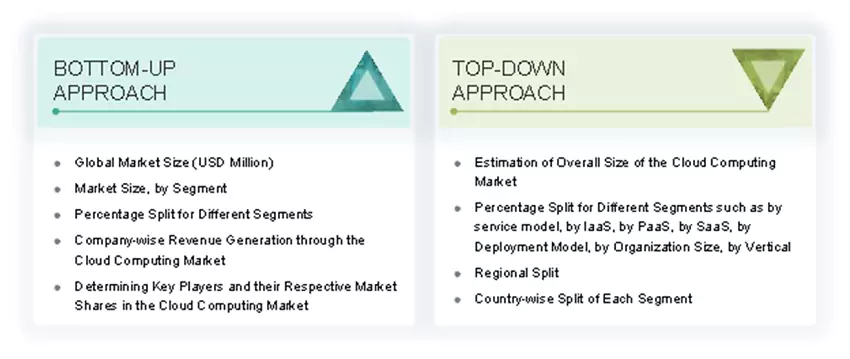

Multiple approaches were adopted to estimate and forecast the Europe cloud computing market. The first approach involved estimating the market size by companies’ revenue generated through the sale of europe cloud computing services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the Europe cloud computing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of cloud computing services among different verticals in key countries, with respect to their regions contributing the most to the market share, was identified. For cross-validation, the adoption of cloud computing services among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Europe cloud computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major europe cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated.

Europe Cloud Computing Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The cloud computing market involves delivering computing services such as servers, storage, databases, networking, software, and analytics over the internet, enabling organizations to access and manage data and applications remotely. It includes public, private, and hybrid cloud deployment models and supports various service models such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Cloud computing helps businesses reduce capital expenditure, improve scalability, enhance collaboration, and accelerate innovation. It plays a vital role in digital transformation, supporting emerging technologies such as AI, IoT, big data, and machine learning across industries.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Information Technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System Integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the Europe cloud computing market based on service model, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the Europe cloud computing market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Europe cloud computing market

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the Europe cloud computing market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches, acquisitions, and partnerships & collaborations, in the Europe cloud computing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the Europe cloud computing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Cloud Computing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Cloud Computing Market