Europe Composites Market

Europe Composites Market by Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites), Resin Type (Thermoset Composites, Thermoplastic Composites), Manufacturing Process (Layup, Compression Molding, Injection Molding, RTM, Filament Winding, Pultrusion), End-use Industry (Aerospace & defense, Wind Energy, Automotive & Transportation, Construction & Infrastructure, Marine, Pipes, Tanks & Pressure Vessels, Electrical & Electronics), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

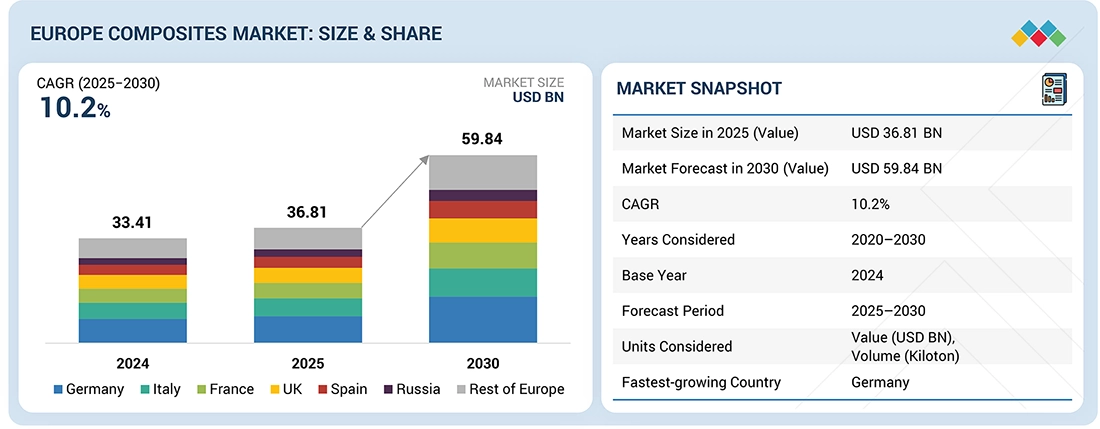

The composites market in Europe is estimated to be USD 36.81 billion in 2025 and is expected to reach USD 59.84 billion by 2030, at a CAGR of 10.2% during the forecast period. The market has been segmented based on fiber type, resin type, manufacturing process, end-use industry, and country. Strict European climate and emissions regulations (such as the Green Deal and Fit-for-55) are driving sectors toward lightweight, low-carbon materials, which is driving growth in Europe's composites business. The demand for high-performance composites in blades, vehicle structures, and airframes is fueled by the rapid growth of wind energy, electric vehicles, and efficient aircraft. Developments in bio-based composites and recyclable thermoplastics support circular economy goals and draw investment. Growth is further supported by robust industrial bases in Germany, France, Italy, and the UK through extensive supply chains for automobiles, aircraft, and construction.

KEY TAKEAWAYS

-

By CountryGermany dominated the composites market in Europe with a share of 22.94%, in terms of value, in 2024.

-

By Manufacturing TypeBy manufacturing process, the filament winding process is projected to grow at a CAGR of 14.6% during the forecast.

-

By Fiber TypeBy fiber type, the carbon fiber segment is projected to grow at a CAGR of 11.8% during the forecast, period in terms of value.

-

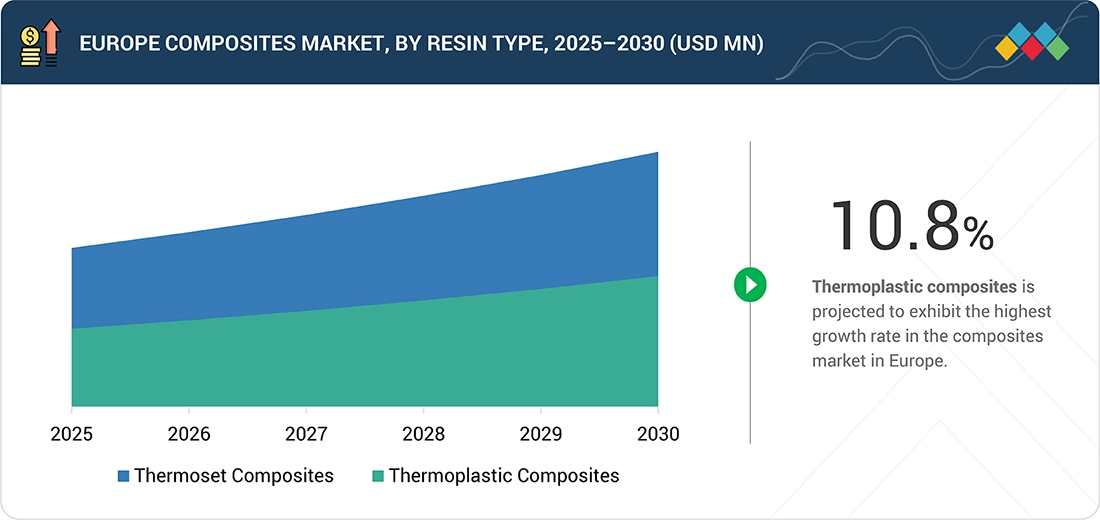

By Resin TypeBy resin type, the thermoplastic resin is projected to be the fastest-growing segment during the forecast period.

-

End Use IndustryBy end-use industry, the tanks & pressure vessels segment is projected to be the fastest-growing segment during the forecasted period.

-

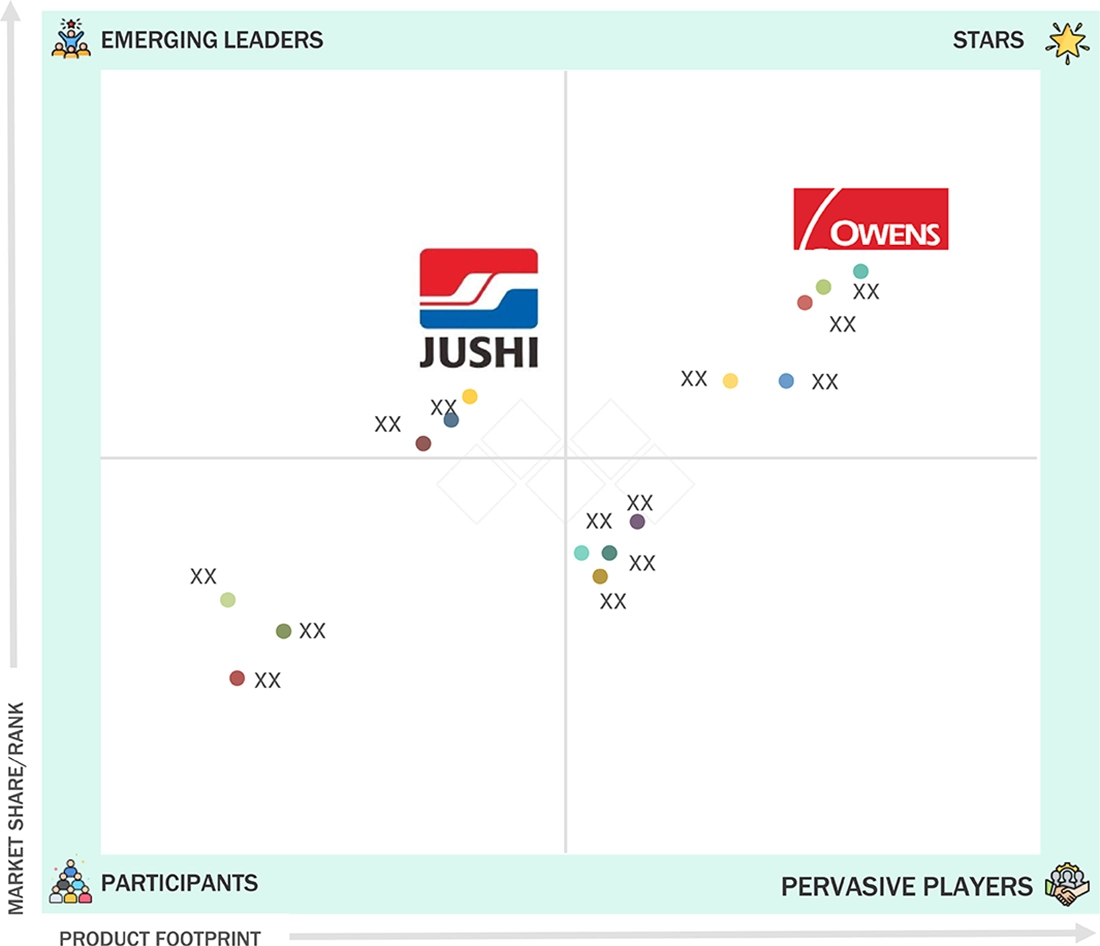

Competitive Landscape - Key PlayersToray Industries Inc., Owens Corning, and Hexcel Corporation are the star players in the composites market in Europe, given their broad industry coverage and strong operational & financial strength.

-

Competitive Landscape - StartupsFibraworks GmbH, AEON-T, Nova Carbon, and Antefil Composite Tech AG have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios

The composites market in Europe is expanding due to the region's significant emphasis on lightweighting, fuel efficiency, and emissions reduction in key industries, such as aerospace, automotive, and wind energy. The EU's sustainability and circular economy policies encourage the use of composites over heavier, less efficient materials, while the continued implementation of wind farms, electric vehicles, and aviation platforms increases material demand. Europe also has an improved manufacturing ecosystem, strong R&D base, and investments in automation and next-generation composite technologies, allowing for more widespread use of these materials in industrial and infrastructural applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

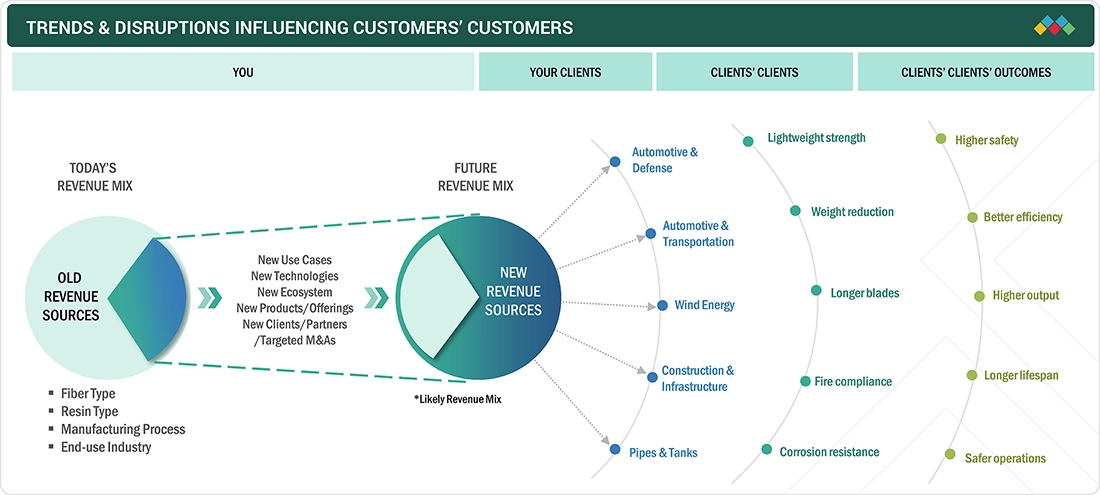

The demand for composites in Europe is shifting from traditional applications to high-growth sectors, such as aerospace & defense, automotive, wind energy, construction, and pressure vessels, owing to strict regional requirements for lightweighting, energy efficiency, safety, and sustainability. These industries are increasingly reliant on composites to reduce weight, increase component life, improve fire and corrosion resistance, and meet EU environmental and performance requirements. As a result, future revenue is expected to flow predominantly from advanced use cases enabled by new technologies, product offerings, and ecosystem collaborations. Composites adoption provides tangible benefits for European end users, such as increased safety in aircraft and vehicles, improved energy efficiency, increased power output from wind turbines, longer service life for infrastructure, and safer operations in industrial systems, all of which contribute to the region's broader goals of decarbonization and resource efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

European frameworks for green transition and circular economy

-

Increasing adoption of lightweight materials in major applications

Level

-

Declining production volumes and structural downturn in traditional composite segments cost

-

Lack of standardization in manufacturing technologies

Level

-

Increased investments in development of low-cost coal-based carbon fibers

-

Increasing demand for fuel cell electric vehicles (FCEVs)

Level

-

Production of low-cost carbon fiber

-

Capital-intensive production and complex manufacturing process

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: European frameworks for green transition and circular economy

The growth of the composites market in Europe is fueled by ambitious sustainability and decarbonization rules that compel industry to cut emissions, enhance material economy, and lengthen product lifecycles. Legislation such as the EU Green Deal, Fit-for-55, and Circular Economy Action Plan establish tight targets for reducing carbon footprints in transportation, construction, and energy sectors. These standards promote lightweight, corrosion-resistant composite materials as alternatives to traditional metals and other high-impact materials. The shift toward low-carbon solutions also hastens the use of composites in renewable energy systems, electric vehicles, and energy-efficient buildings. As European businesses strive to meet changing environmental criteria, composites provide a critical path to achieving long-term performance goals.

Restraint: Lack of standardization in manufacturing technologies

The lack of standardized production procedures and certification frameworks for composites, particularly in building, transport, and recycling, is a major restraint to the growth of the market. Composites use a variety of resins, fibers, lay-up procedures, curing systems, and testing protocols that vary by manufacturer. This discrepancy can lead to variations in mechanical qualities, processing performance, and durability. Before permitting widespread use, regulatory organizations, particularly in building and infrastructure, demand carefully specified material criteria as well as long-term validation. The lack of consistent standards inhibits adoption, extends qualification time, and increases costs for businesses that must do rigorous testing to meet compliance requirements.

Opportunity: Increased investments in development of low-cost coal-based carbon fibers

Europe sees significant opportunities to reduce the cost of carbon fiber production. Alternative precursors, such as coal and lignin, are being investigated through research programs, as are innovative process methods that reduce energy usage and cycle time. Developing more cost-effective carbon fiber would enable more use in mainstream automotive, infrastructural, and industrial sectors where price pressure is high. If successful, these developments could significantly broaden the market, allowing composite providers to serve higher volume areas that are currently dominated by steel and aluminum.

Challenge: Production of low-cost carbon fiber

Producing cost-effective carbon fiber at scale remains a major challenge in Europe. Traditional procedures rely on polyacrylonitrile (PAN) precursors and high-temperature furnaces, making production energy-intensive and costly. This cost structure limits the material's use in high-volume automotive, infrastructural, and industrial markets. Despite Europe's great innovation skills, scaling new processes from pilot to commercial scale necessitates significant effort, validation, and expenditure. The difficulty is not simply to reduce costs, but also to preserve mechanical performance, consistency, and quality assurance in safety-critical applications. This balance continues to be a hurdle to widespread adoption.

EUROPE COMPOSITES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In order to reduce weight and increase fuel efficiency in commercial and regional aircraft platforms, Airbus incorporates composite structures into aircraft wings, fuselage panels, and nacelle components. | Helps achieve sustainability goals, reduces maintenance, increases aircraft range and fuel efficiency, and permits significant weight reduction |

|

Siemens Gamesa employs composite blades with high stiffness and fatigue resistance in European wind farms for both onshore and offshore turbines that operate in challenging marine environments. | Lowers maintenance costs, improves fatigue life in offshore settings, boosts turbine energy output, and supports renewable energy goals |

|

BMW reduces vehicle bulk and improves performance in electric mobility applications by using composite components in EV platforms, structural components, and interior elements. | Increases EV range, strengthens structural stiffness and crash safety, and supports lightweighting and emission compliance objectives |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The European composites ecosystem extends across the entire value chain, beginning with raw material suppliers like Teijin, Huntsman, Toray, and Owens Corning, who supply fibers and resins to regional markets. Manufacturers such as Cabot, Solvay, and Hexcel convert them into prepregs and other intermediary materials, allowing Magna, Spirit AeroSystems, and Exel Composites to create lightweight, high-strength components. Major end customers, including Airbus, Lufthansa, and Mercedes-Benz, use these parts in aircraft, automobiles, and transportation systems, resulting in a steady demand for sophisticated composite solutions throughout Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Composite Market, By Resin Type

The thermoplastic composites segment is projected to grow at a higher rate in the European composites industry due to their excellent alignment with regional priorities such as recyclability, circular economy, and efficient production. Unlike thermoset resin, thermoplastics can be remelted, molded, and recycled, which helps to meet EU sustainability and waste management targets. Thermoplastic composites also allow for faster cycle times, high-volume production, and compatibility with automated processes like stamping, welding, and over-molding, making them ideal for large-scale automotive and transportation applications. As electric vehicles, lightweight structural components, and next-generation transportation platforms become more popular in Europe, the demand for thermoplastic composites is rising due to their ability to provide excellent strength-to-weight performance, impact resistance, and lower lifecycle costs.

REGION

Germany to be fastest-growing country in Europe composites market during forecast period

Germany is projected to be the fastest-growing country in the composites market in Europe, due to its strong industrial foundation, advanced manufacturing skills, and concentration of prominent aerospace, automotive, and engineering firms. The country is home to major OEMs and Tier-1 suppliers who are quickly increasing their usage of lightweight composite materials to enhance fuel efficiency, decrease emissions, and promote electric mobility, particularly in the automotive and transportation sectors. Germany is also a prominent aerospace production and R&D hub, which supports demand for high-performance composite structures. Ongoing investments in wind energy, hydrogen technology, and industrial infrastructure all drive material consumption. Germany remains a key driver of Europe's composites growth due to its highly qualified workforce, well-established supply chain, and ongoing manufacturing innovation.

EUROPE COMPOSITES MARKET: COMPANY EVALUATION MATRIX

In the Europe composites matrix, Owens Corning (Star) leads with a strong market share and extensive product footprint, which are widely adopted in aerospace & defense, automotive, sporting goods, and wind energy industries. China Jushi Co., Ltd. (Emerging Leader) is gaining visibility in the European composites market as it supplies large volumes of cost-competitive fiberglass products to major European industries through strong regional distribution and manufacturing presence. While Owens Corning dominates through scale and a diverse portfolio, China Jushi Co., Ltd. shows significant potential to move toward the leaders’ quadrant as demand for composites continues to rise in Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Toray Industries, Inc. (Japan)

- Owens Corning (US)

- Mitsubishi Chemical Group Corporation (Japan)

- Hexcel Corporation (US)

- Teijin Limited (Japan)

- SGL Carbon SE (Germany)

- Solvay S.A. (Belgium)

- Nippon Electric Glass Co., Ltd. (Japan)

- Huntsman International LLC (US)

- Gurit Holding AG (Switzerland)

- Weyerhaeuser Company (US)

- China Jushi Co., Ltd. (China)

- AGY (US)

- Saint-Gobain(France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 36.81 Billion |

| Market Forecast in 2030 (Value) | USD 59.84 Billion |

| Growth Rate | CAGR of 10.2% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Fiber Type: Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites I By Resin Type: Thermoset Composites, Thermoplastic Composites I By End-use Industry: Aerospace & Defense, Wind Energy, Automotive & Transportation, Construction & Infrastructure, Marine, Pipe, Tanks & Pressure Vessels, Electrical & Electronics I By Manufacturing Process: Layup, Filament Winding, Injection Molding, Pultrusion, Compression Molding, RTM |

| Countries Covered | Germany, Italy, France, UK, Spain, Russia |

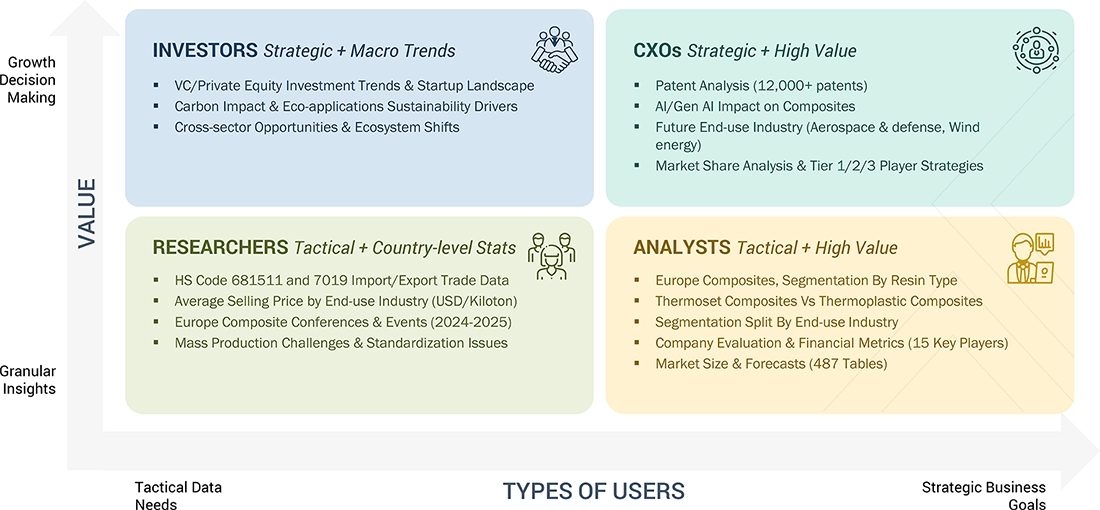

WHAT IS IN IT FOR YOU: EUROPE COMPOSITES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Composite Manufacturers | Competitive benchmarking of regional composite producers (capacity, automation, certifications) | Mapping of supply availability for fibers and resins in Europe |

| OEMs & Tier-1 Suppliers (Aerospace, Automotive, Wind) | Evaluation of lightweighting potential, material substitution (metals vs. composites), and end-use adoption barriers I Assessed composite performance, recyclability, and compliance with EU standards | Enabled faster adoption of lightweight composite structures, supported regulatory compliance I identified cost-saving opportunities in EV platforms, aircraft, and turbine blade components |

| Raw Material Providers (Fibers & Resins) | Mapping of precursor, resin, and reinforcement demand hubs I Assessment of Europe’s supply chain constraints, domestic production potential, and import risks | Strengthened sourcing strategies I Highlighted reshoring opportunities I Improving supply security and reducing reliance on imports |

| Construction, Marine & Infrastructure Stakeholders | Feasibility studies for fire-rated, corrosion-resistant composite solutions | Identified ROI and lifecycle benefits, enabling adoption of composites in infrastructure projects, with longer service life and reduced maintenance cost |

RECENT DEVELOPMENTS

- August 2022 : Huntsman International LLC signed an agreement to sell its textile effects division to Archoma, a portfolio company of SK Capital Partners for USD 718 million.

- April 2022 : Gurit Holding AG acquired a 60% stake in Fiberline Composites A/S, a technology provider for the pultruded manufacture of carbon and glass products.

- April 2022 : Gurit Holding AG agreed to sell its aerospace business segment to Isovolta Group, a composite manufacturer based in Austria, for USD 471.64 million.

Table of Contents

Methodology

The study involved two major activities in estimating the current size of the Europe composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Europe Composites and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the Europe Composites market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Europe Composites market scenario through secondary research. SThe primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Europe Composites industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the Europe Composites, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Europe Composites and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

The research methodology used to estimate the size of the Europe Composites market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations of Europe Composites in different applications at a regional level. Such procurements provide information on the demand aspects of the Europe Composites industry for each application. For each application, all possible segments of the Europe Composites market were integrated and mapped.

Data Triangulation

After arriving at the overall Europe Composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, wind energy, aerospace & defense, construction & infrastructure end-use industries. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Composites are materials that are created by combining two or more different constituents with different physical or chemical qualities to produce a new material with improved properties. These components usually consist of a matrix material (such as a polymer, metal, or ceramic) embedded with a reinforcement material (such as fibers or particles). The matrix material keeps the reinforcement in place and shields it from the elements, while the reinforcement material gives strength, stiffness, and other mechanical qualities. Composites have many benefits, such as a high strength-to-weight ratio, resistance to corrosion, durability, and flexibility in design, which makes them ideal for a variety of uses in a wide range of industries, including renewable energy, aerospace, automotive, and construction.

Key Stakeholders

- Europe Composites manufacturers and distributors

- Key application segments for Europe Composites

- Research and consulting firms

- R&D institutions

- Associations and government institutions

- Environmental support agencies

Report Objectives

- To analyze and forecast the size of the Europe Composites market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on resin type, fiber type, manufacturing process, and end-use industry

- To strategically analyze the micro markets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific Composites market

- Further breakdown of Rest of Europe Composites market

- Detailed analysis and profiling of additional market players (up to 10)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Composites Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Composites Market