Europe Data Center Rack Market

Europe Data Center Rack Market by Rack Type (Open Frame, Enclosed), Type (Server Racks, Network Racks), Rack Height (42U & Below, 43U up to 52U), Rack Width (19 Inch, 23 Inch), Data Center Type (Enterprise, Colocation, Hyperscale) - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

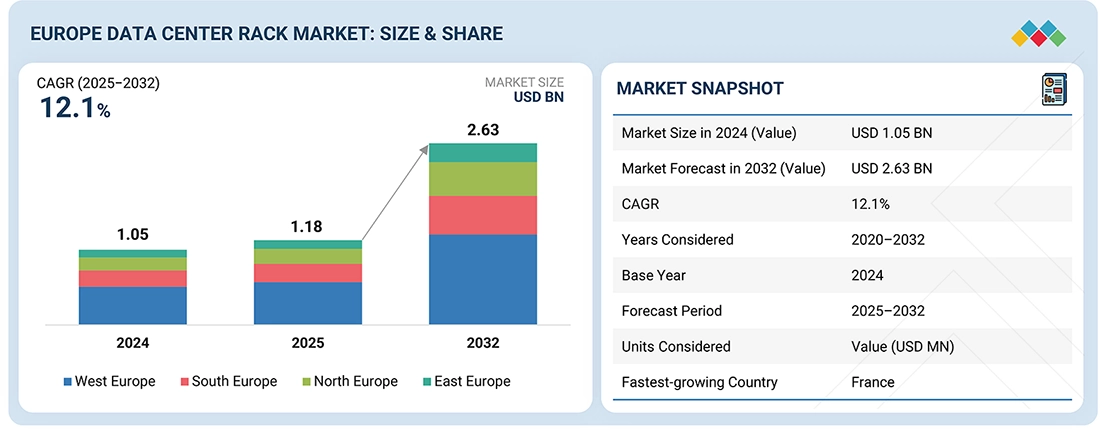

The Europe data center rack market is projected to reach USD 2.63 billion by 2032, up from USD 1.18 billion in 2025, at a CAGR of 12.1%. The current drivers of this market are hyperscale campus expansion, increased adoption of sovereign clouds, and the growing compute intensity of regulated workloads. Current rack densities (8-12 kW) are expected to rise to 30-50 kW with the introduction of high-performance servers and accelerated systems, requiring racks that can handle this increase. This shift will reinforce structural integrity and higher power capacity, control and regulate airflow, and be ready for liquid cooling. There is also a trend toward modular racks as operators move to standardized rack designs in multi-country facilities and edge deployments. Many organizations will consider sustainability targets when making decisions about future purchases, as well as pressure from electricity costs. As such, there will continue to be an increase in the use of energy-efficient racks with integrated monitoring and data center infrastructure management (DCIM) capabilities within modern European data center environments.

KEY TAKEAWAYS

-

BY COUNTRYFrance is emerging as the fastest-growing country in the Europe data center rack market.

-

BY OFFERINGThe services segment is expected to grow at the fastest rate of 13.2% during the forecast period of the Europe data center rack market.

-

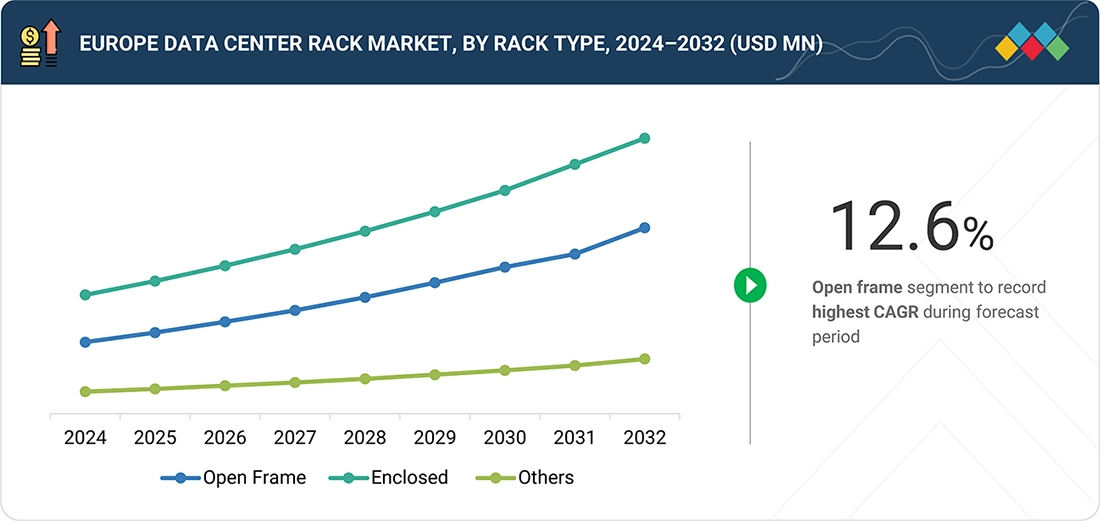

BY RACK TYPEEnclosed racks will account for the largest share in the Europe data center rack market.

-

BY SERVICESSupport & maintenance services will show the fastest growth in the Europe data center rack market.

-

BY TYPEThe server racks segment, by type, is expected to account be valued at USD 1.13 billion in 2032.

-

BY RACK HEIGHTBy rack height, the above 52U segment is expected to achieve the highest CAGR of 12.9% in the Europe data center rack market during the forecast period.

-

BY RACK WIDTHBy rack width, 19-inch racks are expected to capture the majority share in the Europe data center rack market.

-

BY DATA CENTER SIZELarge data centers will capture a larger market due to hyperscale investments, AI-driven density, and superior operational scale efficiencies.

-

BY DATA CENTER TYPEBy data center type, hyperscale will show the fastest growth as large-scale colocation demand and capital-backed capacity consolidation intensify.

-

BY ON-PREMISES/ENTERPRISE VERTICALBy vertical, IT & telecom will capture the largest share due to hyperscale expansion, network modernization, and sustained demand for standardized, high-density rack deployments.

-

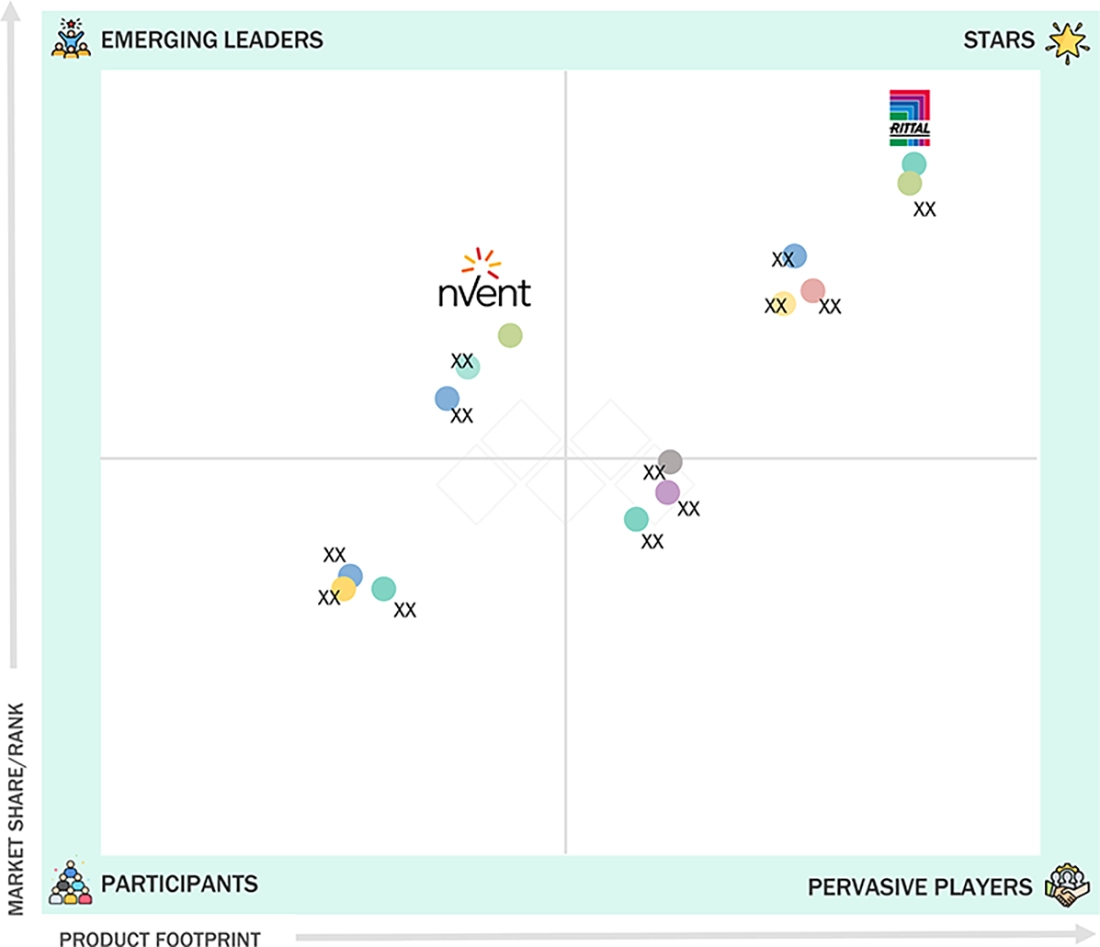

COMPETITIVE LANDSCAPE - KEY PLAYERSLegrand, Ritttal, and Nvent Electric are among the major players in the Europe data center rack market, collaborating with enterprises to deliver cloud-based replication, automated failover, isolated recovery environments, and compliance-ready resilience across hybrid and multi-cloud architectures.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMEsEDP, ITRack, and Schafer GmbH have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

Data center rack capacity is expected to rise dramatically across Europe, as new construction shifts away from already congested Tier-1 urban areas toward second- and third-tier areas with more reliable power access and grid stability. Consequently, data center operators need solutions that maximize usable space, offer refurbishment options for older facilities, and enable rapid deployments. Demand for high-load, safety-certified, liquid-cooled racks will increase as computing power continues to rise in both centralized data centers and edge facilities. This trend is further accelerated by the expansion of distributed edge data centers that support low-latency and regulatory workloads. As operators move toward a common rack design strategy, they will be able to replicate rack designs more quickly across multiple countries, reduce energy use amid rising energy prices, and lower operational risk during facility refurbishments throughout Europe, where safety, fire, and environmental compliance regulations vary.

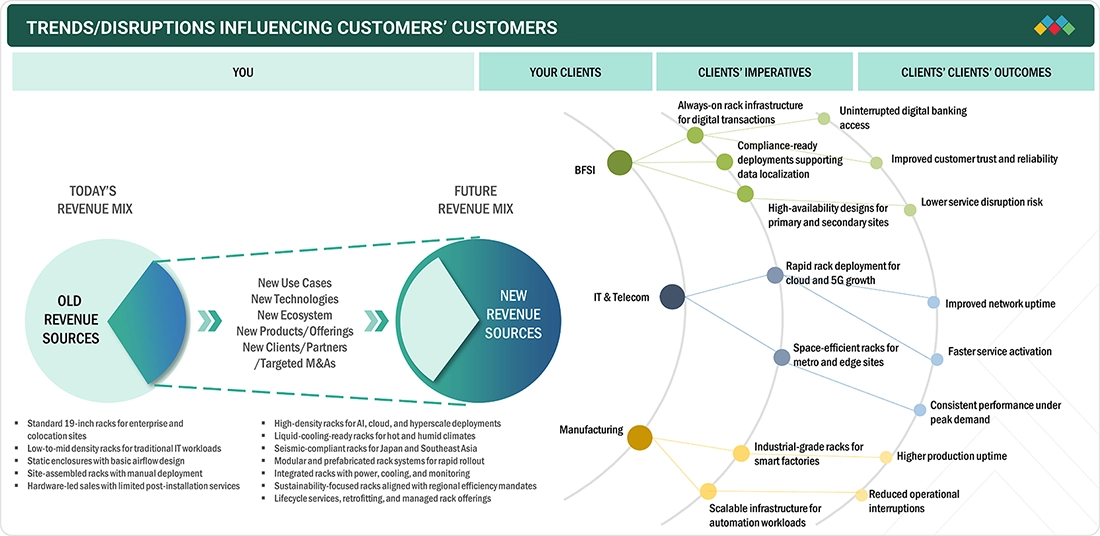

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe data center rack market is evolving as customers and end users develop new expectations regarding sovereign cloud requirements, rising energy prices, and stricter regulatory and sustainability requirements. Customers in the BFSI, IT & telecom, and manufacturing sectors demand infrastructure that is compliant, energy-efficient, and operationally resilient. Due to these pressures, standardized, high-density rack architectures that enable repeatable deployments, regulatory assurance, and predictable service levels across multiple independent countries within Europe are being adopted at an accelerating pace.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Sovereign cloud expansion driving standardized rack deployment across Europe

-

Rising compute intensity increasing demand for high-density rack systems

Level

-

Power constraints and slow permitting limit rack deployment speed

-

Legacy facility limitations restricting rapid rack densification

Level

-

Standardized modular racks enabling multi-country deployments

-

Liquid-cooling-ready racks supporting higher densities under EU mandates

Level

-

Fragmented national regulations complicating rack standardization efforts

-

Balancing rack density with energy efficiency compliance requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Sovereign cloud expansion driving standardized rack deployment across Europe

In Europe, demand for data center racks is increasing due to the implementation of sovereign cloud-based solutions and the rigorous enforcement of data residency requirements by the government and public sector, the BFSI, and the critical infrastructure industries. The government and regulated businesses are pushing for maximum in-country data center capacity, ultimately leading to the creation of large, standardized, auto-scaling server halls. As demand for certified rack systems that can be reused (while complying with national security, safety, regulatory, and legislative requirements) continues to grow, suppliers will have greater opportunities to pursue new business partnerships with prospective customers.

Restraint: Power constraints and slow permitting limit rack deployment speed

Rack installations in Europe are constrained by limited grid capacity and prolonged permitting processes, particularly in mature data center markets. Even when physical space is available, delays in securing power connections and environmental approvals slow rack deployment and densification. These constraints create a mismatch between infrastructure demand and actual rack installation timelines across European facilities.

Opportunity: Standardized modular racks enabling multi-country deployments

Data center operations are moving toward standardizing rack design. As a result, operators are seeking ways to reduce engineering variation and, in turn, compliance risk across Europe. From a vendor perspective, providing modular, factory-integrated racks designed to meet common European safety and fire regulations will be a strong opportunity. In addition, these products enable faster equipment deployment, greater performance predictability, and greater operational consistency across geographically distributed sites.

Challenge: Fragmented national regulations complicating rack standardization efforts

As operators in Europe face rising rack densities, they must meet stringent energy-efficiency goals, sustainability reporting requirements, and emissions regulations. Higher rack density adds complexity to cooling and power management operations and puts upward pressure on both design and operational costs. Balancing performance needs with compliance costs to meet regulatory mandates and achieve long-term energy efficiency remains a major challenge in rack deployment decisions.

EUROPE DATA CENTER RACK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Rittal delivers high-density, liquid-cooled data center rack infrastructure for Meyer Werft | Space-optimized TS IT data center racks | Support for up to 30 kW per rack with liquid cooling | Vibration-resistant rack design for maritime environments | High availability through redundant rack-level power and cooling | Secure, access-controlled rack enclosures | Standardized rack architecture enabling scalability and refits | Reliable rack operation across temperature and humidity variations | Global lifecycle support for rack infrastructure |

|

nVent and 2bm enables high-density data center rack retrofits for a UK broadcasting company | Higher rack-level cooling capacity without full facility rebuild | Support for high-density server racks in legacy data center space | Rear-door liquid cooling integrated directly at the rack level | Reduced rack heat exhaust and stabilized room temperatures | Lower capex through reuse of existing rack infrastructure| Improved rack scalability with minimal operational disruption | Extended lifecycle of rack-mounted IT equipment |

|

Rittal enables rapid hyperscale data center rack deployment for Chindata | Rapid deployment of hyperscale data center racks in seven months | Large-scale deployment of over 8,000 TS8 IT racks | High-density 52U rack configurations supporting hyperscale workloads | Modular and pre-configured rack architecture enabling parallel construction | Intelligent rack-level power distribution and energy monitoring | Integration of hot aisle containment for improved thermal efficiency | Scalable and repeatable rack design supporting future data center expansion |

|

Rittal delivers secure rack-based Micro Data Center for B. Braun manufacturing facility | Rapid deployment of rack-based micro data centers without construction | Secure rack-level enclosure for business-critical IT systems | Redundant rack configurations supporting high availability manufacturing | Integrated liquid-cooled server racks for compact environments | Centralized rack monitoring for power, temperature, and access control | Built-in fire detection and rack-level suppression | Modular rack design supporting Industry 4.0 and future scalability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The European data center rack ecosystem comprises segments such as rack manufacturers/providers who deliver standardized/high-density enclosures; rack accessory providers who furnish electrical power distribution systems, cabling products, monitoring systems, and airflow-optimizing systems; and rack security providers who ensure physical security, reliability, and availability for the racks. All these segments work together to comply with Europe’s energy-efficiency requirements for durable data centers in colocation, enterprise, and hyperscale environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Data Center Rack Market, By Offering

The solutions segment leads the Europe data center rack market as operators prioritize integrated rack infrastructure to address compliance requirements, rising power density, and tighter coordination of power and cooling. To meet these needs, data centers throughout Western and Northern Europe have been investing in closed, open-frame, and containment systems to enable refurbishment-based builds, multi-tenant colocation environments, and the enforcement of safety-related requirements through local laws and regulations. The continued movement toward standardized, modular rack ecosystems that enable repeatable deployments is in line with current regulations and provides a uniform experience across multiple countries where data center operators operate. This trend continues to drive spending on solution-based purchases and further reinforces comprehensive rack platforms as the primary area of investment among data center operators across all of Europe.

Europe Data Center Rack Market, By Rack Type

The European data center rack market is seeing accelerated adoption of open-frame racks as an efficient option for operators at edge sites, in network rooms, or in technical facilities within commercial or colocation applications. Adoption is driven by growth in edge connectivity, expansion of regional internet exchanges, and the completion of digitalization of industrial businesses in smaller cities across Europe. The simplicity, unobstructed airflow, and flexibility to add capacity make open-frame racks a good option for deploying facilities while considering space and budget constraints.

Europe Data Center Rack Market, By Service

Installation and deployment services are increasingly important in Europe's data center rack market as operators manage complex build programs across brownfield sites and distributed colocation campuses. Many data centers require precise placement of racks within existing floor layouts, with individual containment systems and electrical distribution paths. Deployment partners often coordinate multiple phases of installation, validate rack stability and accessibility, and ensure successful transitions to new owners/run within tight operating timeframes. As operators in Europe continue to place significant emphasis on service continuity and compliance with country-specific installation standards, deployment services will be required to facilitate fast turnaround times for new data centers while maintaining service continuity in live environments.

EuropeData Center Rack Market, By Type

Server racks are expanding at the fastest pace in the European data center rack market as hyperscalers, colocation operators, and regulated enterprises scale compute-intensive environments. The growth of cloud computing platforms, sovereign workloads, and enterprise applications that are heavily reliant on data in the largest European cities is creating a need for racks that can support higher loads, provide controlled airflow, and feature robust power distribution. This is leading to an increasing number of these racks being adopted across Europe for multi-tenant and compliance-driven facilities.

Europe Data Center Rack Market, By Rack Height

Because they comply with the relevant floor-loading limitations, ceiling heights, and fire-safety regulations for colocation, enterprise, and hyperscale facilities, 42U and smaller racks dominate European data center rack sales. They are ideal for refurbishment projects or mixed-density deployments because they support safe equipment access, structured cabling, and predictable airflow. In addition, operators prefer this format because it helps them keep their multi-country portfolios standardized and makes it easier to certify, maintain, and run them over the long term.

Europe Data Center Rack Market, By Rack Width

The 23-inch rack-width segment is growing fastest in the European data center market as telecom and network-based data centers expand their 5G core infrastructure, internet exchanges, and cross-border networks. Wider racks enable higher port density, better cable management, and improved airflow for carrier-grade telecommunications equipment. The growth of edge aggregation sites, cloud interconnection, and cross-European network backbones is also driving increased use of 23-inch formats in Europe.

Europe Data Center Rack Market, By Data Center Size

By data center size, small and mid-sized facilities are expected to grow the fastest in the Europe data center rack market as capacity expansion increasingly shifts beyond large hyperscale campuses into localized and regional deployments. Growth will be driven by the need for a sovereign cloud, edge computing, and low-latency in-country enterprise processing. As more of these facilities come online quickly, operators are adopting modular designs and standardized rack infrastructure to facilitate quicker rollouts, easier regulatory compliance, and ongoing capacity expansion without extensive redesigns.

Europe Data Center Rack Market, By Data Center Type

By data center type, on-premises/enterprise facilities are expected to capture the largest share of the Europe data center rack market. This predominance is driven by strict data security laws, distinct sector-specific compliance regulations, and the widespread use of hybrid IT solutions, which are prompting companies to invest in owned data centers. In addition to enterprises upgrading their existing buildings to host sensitive, mission-critical applications, these factors continue to drive demand for standardized, compliant, and long-lifecycle rack infrastructure.

Europe data center rack market, By On-premises/Enterprise Vertical

The healthcare sector is one of the fastest-growing verticals in the data center rack market across Europe, as the digital transformation of health continues to expand, affecting hospitals, research organizations, and national health systems alike. As electronic health records, medical imaging, and connected-care systems expand, so do the needs for both in-house and regional data centers, with standard racks supporting high-density computing, secure storage, and resilient power and cooling. The stringent requirements for protecting, maintaining the availability of, and complying with regulations for patient data contribute to the ongoing capital investment needed to support dedicated rack infrastructure in the European healthcare sector.

REGION

Germany is expected to hold the largest share in the Europe data center rack market during the forecast period.

Germany is expected to hold the largest share in the Europe data center rack market, driven by its superior interconnection density, regulatory certainty, and a concentration of hyperscale and colocation campuses, especially around Frankfurt. Additionally, the strong enforcement of data protection laws and increased use of sovereign clouds are encouraging in-country processing of BFSI, government & defense, and industrial workloads. High-quality power infrastructure, greater integration of renewables, and a developed EPC ecosystem are making the country even more attractive. Vendors are seizing this opportunity by offering products that meet German safety and efficiency standards, integrating locally, and establishing long-term partnerships with cloud and colocation service providers to enable repeatable, large-scale deployments.

EUROPE DATA CENTER RACK MARKET: COMPANY EVALUATION MATRIX

Rittal (Star) dominates Europe's data center rack market with a vast collection of modular, quality-certified, fire-resistant rack systems, broad geographic coverage, and comprehensive integration of power, cooling, and monitoring components. Nvent (Emerging Leader) is gaining market share for its rack-centric air conditioning, leakage control, and computer room efficiency solutions, especially in retrofit and high-density environments, by increasing its relevance across colocation, enterprise, and regulatory requirements related to European data center deployment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Schneider Electric (France)

- Vertiv (US)

- Eaton (Ireland)

- Rittal (Germany)

- Dell Technologies (US)

- Legrand (France)

- Nvent Electric (UK)

- EFB-Elektronik GmbH (Germany)

- Schafer GmbH (Germany)

- ITRack (Italy)

- EDP (UK)

- HPE (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| market Size in 2024 (Value) | USD 1.05 Billion |

| market Forecast in 2032 (Value) | USD 2.63 Billion |

| Growth Rate | CAGR of 12.1% from 2025-2032 |

| Years Considered | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | UK, Germany, France, Italy, Rest of Europe |

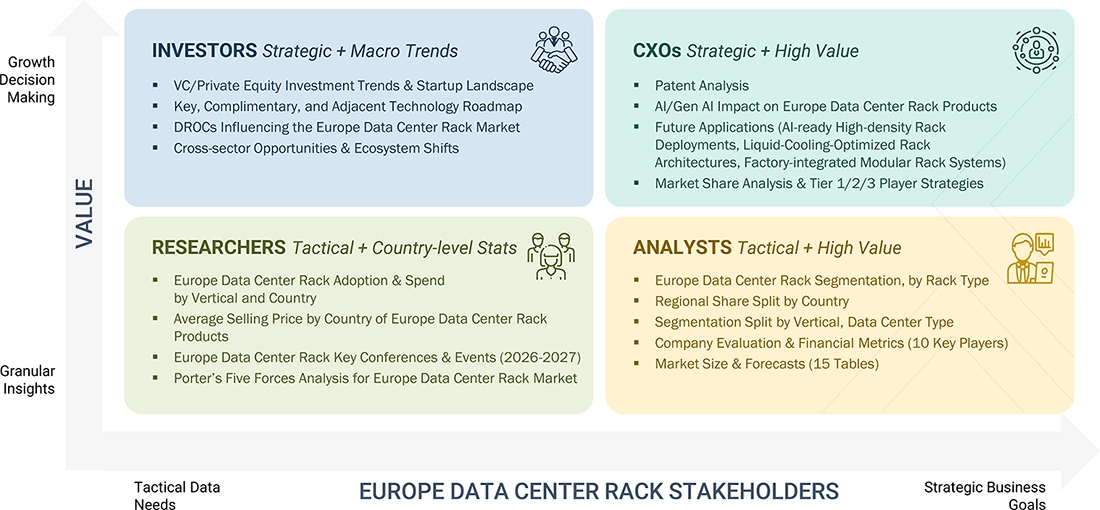

WHAT IS IN IT FOR YOU: EUROPE DATA CENTER RACK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator | Competitive benchmarking: Comparison of data center rack architectures, density configurations, cooling compatibility, and deployment models across peer telecom operators in Europe |

|

RECENT DEVELOPMENTS

- November 2025 : nVent Electric plc strengthened its data center rack portfolio with updated rack designs that integrate liquid cooling and intelligent power. The offering includes rack-based CDUs, rear-door and manifold solutions, and common controls, enabling higher rack densities, improved thermal performance, and scalable deployments for next-generation computing environments.

- February 2025 : Legrand introduced a new Universal Input feature for its intelligent rack PDUs, the PRO4X and PX4 models, enhancing flexibility and scalability for data center operators. The feature supports interchangeable input power cords, allowing a single PDU to be quickly adapted to different global power requirements, reducing deployment time and costs. With plug-and-play functionality and compatibility with worldwide electrical systems, it offers a cost-effective solution for evolving power needs, enabling quick adaptation without replacing the entire PDU.

- April 2024 : Rittal launched the TX Colo rack, targeting the fast-growing colocation data center market. The rack is a preconfigured, ready-to-use solution built for rapid deployment in large data centers, with integrated airflow control, cable management, and enhanced security features. Designed for flexibility and scalability, it meets rising demand driven by AI and digitalization.

- April 2024 : Rittal launched the new AX three-part wall-mounted enclosure, which bridged industrial and IT applications with a modular, fan-like opening design that provided full interior access. It featured flexible cable entry, 19-inch IT mounting, and seamless expansion with Rittal system accessories. The integrated ePOCKET digital documentation replaced the former EL model, supporting more efficient maintenance and updates.

Table of Contents

Methodology

This research study on the Europe Data Center Rack Market involved extensive secondary sources, directories, several journals, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Europe Data Center Rack Market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with different primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants. Primary sources were mainly industry experts from the core and related industries, preferred Data center rack providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess growth prospects. The following figure highlights the market research methodology applied to make the Europe Data Center Rack Market report.

Secondary Research

The market size of companies offering data center rack solutions and services was determined based on secondary data available through paid and unpaid sources. It was also evaluated by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

Various sources were considered in the secondary process to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals and related magazines. Data center rack spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify key players, market classification, and segmentation according to offerings of major players and key developments from market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing data center rack solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and identify the segmentation, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Europe Data Center Rack Market. The first approach involved estimating the market size by the summation of the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following.

- Primary and secondary research was conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, the market was divided into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines “a data center rack as a steel and electronic framework designed to house servers, networking devices, cables, and other data center computing equipment. This physical structure provides equipment placement and orchestration within a data center facility.”

Stakeholders

- Rack Manufacturers

- Colocation Providers

- Telecom Operators

- IT Infrastructure Providers

- System Integrators

- Network Operators

- Component Providers

- Consultants & Data Center Designers

- Data Center Operators

- Channel Partners & Distributors

- Internet Service Providers (ISPs)

- Regulatory Bodies / Standards Organizations

Report Objectives

- To define, describe, and forecast the Europe Data Center Rack Market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market by offering (solutions, services), type, rack height, rack width, data center size, data center type, on-premises/enterprise verticals, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the Europe Data Center Rack Market

Company Information

- Detailed analysis and profiling of five additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Data Center Rack Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Data Center Rack Market