Europe Facility Management Market

Europe Facility Management Market by Solution (Integrated Workplace Management, Building Information Modeling, Facility Operations & Security Management, Facility Environment Management, Facility Property Management) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe facility management market size is projected to grow from USD 15.8 billion in 2025 to USD 34.4 billion by 2030 at a CAGR of 16.8% during the forecast period. The Europe facility management market is influenced by the high share of aging commercial and public buildings that require regular upkeep and upgrades. Many buildings across Western and Southern Europe were developed several decades ago and now need ongoing maintenance, refurbishment, and compliance-related work. Facility management providers support these transitions through technical services, energy performance tracking, and long-term asset planning. Digital tools are increasingly applied to manage multi-site operations, handle compliance records, and improve visibility across portfolios. Demand remains strong in offices, transport assets, healthcare facilities, and government buildings, where service continuity, safety, and regulatory compliance are essential.

KEY TAKEAWAYS

-

By OfferingThe solutions segment accounted for a 70.6% share in 2025.

-

By SolutionThe facility environment management segment is expected to register the highest CAGR of 17.5%.

-

By End UserThe government & public sector segment is projected to grow at the highest rate from 2025 to 2030.

-

Competitive LandscapeCompanies such as CBRE Group, ISS, Mitie Group plc, and Johnson Controls were identified as some of the star players in the Europe facility management market, given their strong market share and product footprint.

A major structural driver for facility management in Europe is the expansion of data centers and other mission-critical infrastructure linked to cloud services, digital finance, and cross-border data hosting requirements. Countries such as Germany, Ireland, the Netherlands, and the Nordic region have become key hubs due to energy availability, network connectivity, and regulatory stability. These facilities place high demands on facility management providers for thermal management, power redundancy, uptime assurance, and physical security. In addition, European energy pricing volatility and carbon regulations require continuous optimization of cooling strategies and power usage. This has increased demand for specialized technical facility management services rather than generalized building maintenance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In Europe, facility management supports daily business operations, workforce safety, and asset reliability, particularly in dense urban and industrial environments. Organizations in sectors such as manufacturing, healthcare, utilities, and the public sector rely on structured facility services to maintain power availability, safe working conditions, and equipment uptime. In several markets, uneven infrastructure increases the need for regular maintenance and on-site supervision. As companies expand across multiple cities and countries, facility coordination is increasingly handled through centralized teams. Consistent facility operations help limit service disruptions, maintain uniform service levels, and support expansion across locations with differing regulatory and infrastructure requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased outsourcing of building operations to control costs

-

Expansion of multi-site office, retail, and public infrastructure portfolios

Level

-

High labor and operating costs across European markets

-

High dependence on manual processes in smaller facilities

Level

-

Growing adoption of digital tools in facility operations

-

Increasing need for standardized reporting and operational transparency

Level

-

Managing aging and diverse building stock

-

Standardizing service delivery across multiple countries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased outsourcing of building operations to control costs

Energy prices in Europe have remained unstable since 2020. Commercial and public buildings continue to face higher electricity and gas costs than in earlier years. Eurostat data shows that non-household electricity prices in several European countries are still above long-term averages. As energy costs are largely managed through daily building operations, there has been an increased reliance on facility management teams to control consumption and reduce avoidable waste. Building owners are prioritizing continuous monitoring and optimization of heating, ventilation, air conditioning, and lighting systems. Facility management providers are now evaluated on their ability to deliver measurable cost and energy savings, expanding the strategic role of facility management beyond routine maintenance.

Restraint: High labor and operating costs across European markets

The Europe facility management market faces persistent pressure from high labor and operating costs. Wages for skilled technical staff continue to rise, driven by workforce shortages and strong demand for electricians, maintenance engineers, and building system specialists. In addition, operating expenses such as insurance, compliance documentation, and service delivery overheads remain elevated across many European countries. These cost pressures reduce margin flexibility for facility management providers and limit pricing options, particularly in long-term or fixed-price contracts. Smaller service providers are more vulnerable, as they lack scale advantages. High operating costs can also slow outsourcing decisions by building owners, especially in cost-sensitive public sector projects.

Opportunity: Growing adoption of digital tools in facility operations

Digitalization is opening new opportunities in the Europe facility management market. Building owners are adopting digital maintenance systems, energy monitoring systems, and centralized reporting platforms to improve visibility into asset performance. These tools reduce manual effort, shorten response times, and help maintain consistent service levels across multiple sites. Clients managing large or distributed portfolios increasingly prefer facility management providers that can deliver integrated digital capabilities. Wider use of digital systems also supports clearer performance tracking and more informed operational decisions. As adoption increases, service providers are able to expand their role beyond routine maintenance and offer more value-added operational support.

Challenge: Managing aging and diverse building stock

A significant portion of Europe’s building stock is decades old and varies widely in design, usage, and technical condition. Facility management teams must manage buildings with outdated mechanical systems alongside newer assets that use advanced controls. This diversity increases maintenance complexity and limits the standardization of service processes. Older buildings often require frequent interventions, while budget constraints restrict large-scale upgrades. Public buildings, healthcare facilities, and historic properties are particularly challenging to manage. Facility management providers must balance reliability, safety, and cost efficiency in environments that were not designed for modern operational requirements. This structural challenge places continuous pressure on service quality and resource planning.

EUROPE FACILITY MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implements workplace experience platforms integrating smart catering, environmental monitoring, digital concierge, and energy-efficient facility operations. | Enhances employee well-being, reduces energy use, streamlines service delivery, and strengthens sustainability KPIs. |

|

Deploys IoT-enabled facility management solutions, including smart cleaning schedules, sensor-based space management, and automated compliance tracking. | Improves space efficiency, ensures regulatory compliance, reduces cleaning costs, and boosts operational transparency. |

|

Provides facility support models integrating touchless services, smart cafeteria systems, and centralized facility management analytics dashboards. | Improves hygiene standards, lowers operational waste, accelerates service responsiveness, and enhances user engagement. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe facility management ecosystem comprises solutions providers, service providers, and regulatory bodies that support day-to-day building operations across a wide range of facilities. Service providers such as ISS (Denmark), Sodexo (France), Compass Group (United Kingdom), Mitie (United Kingdom), and VINCI Facilities (France) combine hard and soft services with data-driven maintenance, energy optimization, and workplace experience solutions. Solution providers, including Sodexo (France), ISS (Denmark), SAP (Germany), and Planon (Netherlands), provide computer-aided facility management (CAFM), integrated workplace management systems (IWMS), analytics, and digital twin capabilities. Industry bodies such as the International Facility Management Association (IFMA) Europe and national safety regulators support best practices, while European Union regulations continue to drive investment in compliant and high-performance facilities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Facility Management Market, By Solution

Environmental management solutions are gaining steady adoption across Europe as countries strengthen decarbonization targets and focus more closely on healthy building environments. European regulations now require closer monitoring of energy consumption, emissions reporting, and indoor air quality, which is increasing demand for digital tools that provide clear visibility into building performance. Facility management professionals are integrating systems that focus on energy management controls, water-use monitoring, and emissions tracking to meet regulatory and certification requirements. Additionally, the increasing concerns around heatwaves, air pollution, and occupant comfort are pushing organizations to improve environmental oversight within buildings. Together, regulatory requirements as well as workplace standards are influencing the adoption of environmental management systems in offices and industries.

US Facility Management Market, By Facility Property Management

Space and reservation management solutions are gaining relevance in Europe as organizations restructure office portfolios in response to hybrid work and cost pressures. Many companies are reducing permanent desk allocations while increasing shared spaces, meeting areas, and flexible work zones. Reservation systems are used by facility managers to track space usage, schedule maintenance activities, and meet local health and safety requirements. These tools are especially relevant in large offices, universities, and government buildings, where space use needs to be recorded and managed efficiently.

REGION

Nordics is expected to be the fastest-growing country in the Europe facility management market during the forecast period.

The Nordic region is expected to emerge as the fastest-growing area within the Europe facility management market during the forecast period. Sweden, Denmark, Norway, and Finland show high adoption of digital building systems and established outsourcing practices for facility services. Demand is further supported by strict climate policies, extensive district heating networks, and the broad use of smart building controls across commercial and public buildings. In addition, high labor costs encourage automation, predictive maintenance, and centralized service models. Public-sector investments, corporate sustainability commitments, and a mature technology ecosystem together create favorable conditions for rapid growth of advanced facility management solutions across the Nordic region.

EUROPE FACILITY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

In the Europe facility management market company evaluation matrix, CBRE Group (Star) leads with a strong market share and large service footprint. The company offers a comprehensive range of integrated services, including facilities operations, project delivery, and workplace support, which are widely utilized across multi-site portfolios. Sodexo is placed in the emerging leader category and is expanding through sector-focused services in healthcare, education, and government facilities. While CBRE benefits from scale and broad outsourcing coverage, Sodexo’s growth is supported by its operational specialization and long-term service contracts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- CBRE Group (US)

- ISS Global (Denmark)

- Mitie Group (UK)

- Vinci Facilities (UK)

- Atlas FM (England)

- Nemetschek (Germany)

- Johnson Controls (Ireland)

- SAP (Germany)

- Planon (Netherlands)

- Apleona (Germany)

- Sodexo (France)

- Causeway Technologies (UK)

- Service Works Group (UK)

- eFACiLiTY (Switzerland)

- G4S Facilities Management (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.3 Billion |

| Market Forecast in 2030 (Value) | USD 34.4 Billion |

| Growth Rate | CAGR of 16.8% during 2025-2030 |

| Years Considered | 2017-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe |

WHAT IS IN IT FOR YOU: EUROPE FACILITY MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- June 2025 : ISS signed a multi-year integrated facility management contract with Denmark-based VELUX Group. The agreement spans multiple Northern and Central European countries and focuses on harmonizing facility services, improving operational efficiency, and simplifying management across VELUX’s regional sites.

- June 2024 : Nemetschek Group acquired GoCanvas to expand its capabilities in digital field workflows. These workflows enhance data collection and operational efficiency, indirectly contributing to facility management through the continuity of construction to operations.

- May 2023 : SAP entered a strategic partnership with Planon to offer companies an integrated solution for real estate and facility management. The collaboration combines Planon’s first-rate real estate and smart building management solution with SAP’s ERP capabilities.

Table of Contents

Methodology

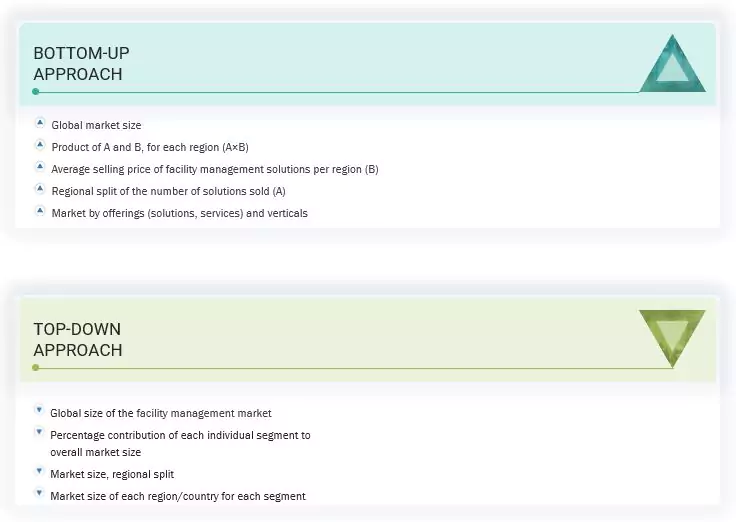

The research study involved four major activities in estimating the Europe facility management market size. Exhaustive secondary research has been done to collect essential information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering europe facility management solutions to various end users was determined based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from europe facility management solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use europe facility management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of europe facility management solutions which is expected to affect the overall Europe facility management market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe facility management market. These methods were also used extensively to estimate the size of various subsegments in the market.

Europe Facility Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

The Europe facility management market was split into several segments and sub-segments after determining the overall market size from the above estimation process. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The Europe facility management market size was validated using top-down and bottom-up approaches.

Market Definition

According to IBM, facility management can be defined as the tools and services that support the functionality, safety, and sustainability of buildings, grounds, infrastructure, and real estate. Europe europe facility management includes lease management (lease administration and accounting), capital project planning and management, maintenance and operations, energy management, occupancy and space management, employee and occupant experience, emergency management and business continuity, and real estate management.

BOMI Institute defines europe facility management as the process of coordinating the physical workplace with the people and work of an organization. The primary function of europe facility management is to plan, establish, and maintain a work environment that effectively supports the goals and objectives of the organization.

Stakeholders

- Europe europe facility management solution providers

- Managed service providers

- Integration service providers

- Cloud service providers

- Europe europe facility management service providers

- Building automation solution providers

- Architects, engineers, and contractors

- Consultancy firms and advisory firms

- Regulatory agencies

- Technology consultants

- Governments

Report Objectives

- To determine, segment, and forecast the Europe facility management market by offering, solution, service, vertical, and region in terms of value

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing market growth

- To study the complete value chain and related industry segments, and perform a value chain analysis of the Europe facility management market landscape

- To strategically analyze the macro and micro markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Europe facility management market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the Europe market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Facility Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Facility Management Market