Europe Infusion Pump Market Size, Growth, Share & Trends Analysis

Europe Infusion Pump Market by Product [Accessories (Dedicated, Non-dedicated), Device (Insulin, Syringe, Volumetric, Enteral, PCA Pump)], Application (Chemotherapy, Diabetes, Analgesia), Mode of Administration (Subcutaneous, Epidural) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe infusion pump market, valued at USD 4.78 billion in 2025, stood at USD 5.10 billion in 2026 and is projected to advance at a resilient CAGR of 6.8% from 2026 to 2031, culminating in a forecasted valuation of USD 7.09 billion by the end of the period. Infusion pumps are advanced devices used in medical settings to deliver precise amounts of fluids, such as nutrients and drugs, into the body. The rising incidence of lifestyle diseases, including diabetes, cardiovascular diseases, and cancer, which require infusion therapy, is the most important factor driving this market. Other major drivers include growing demand for advanced drug delivery systems and a trend toward infusion therapy in ambulatory and home healthcare settings. Additionally, the integration of technology in smart infusion systems and the patient safety regulatory framework in the European healthcare industry will be vital in facilitating this market during the forecast period.

KEY TAKEAWAYS

-

By CountryGermany accounted for 18.7% of the Europe infusion pump market in 2025.

-

By ProductBy product, the devices segment is expected to register the highest CAGR of 7.3%.

-

By Mode of AdministrationBy mode of administration, the intravenous segment is expected to dominate the market with a 39% share in 2025.

-

By ApplicationBy application, the diabetes management segment is projected to grow at the fastest rate from 2026 to 2031.

-

By End UserBy end user, the home care settings segment is expected to dominate the market, growing at the highest CAGR of 8.1%.

-

Competitive Landscape - Key PlayersCompany BD, Baxter, Fresenius Kabi AG and B.Braun SE were identified as some of the star players in the European infusion pump market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsCODAN Companies and Eitan Medical, among others, have distinguished themselves among startups and SMEs by due to their strong product portfolio and business strategy.

The Europe infusion pump market is projected to reach USD 7.09 billion by 2031, up from USD 5.11 billion in 2026, growing at a CAGR of 6.8% from 2026 to 2031. The Europe infusion pump market is poised to grow over the next decade with minimal fluctuations, driven by increased healthcare requirements in European nations, technological advancements in infusion pumps, and higher demand for accurate-dosing infusion pumps in Europe. The demand for infusion pumps in Europe is driven by their ability to deliver controlled, accurate doses of drugs. As a result, infusion pumps are increasingly being used in European nations to manage chronic diseases, cancer, and pain. Increased awareness in European nations of home healthcare and advances in connected infusion pumps have significantly improved patient safety and education in Europe. Infusion pumps will become a vital part of Europe’s advanced healthcare system in future years.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe infusion pump market is influenced by healthcare trends and system changes observed in the region. The main consumers of infusion pumps in Europe are hospitals, clinics, and home healthcare. Oncology, diabetes, and critical care are major application segments for infusion pumps in Europe. The increasing trend towards home healthcare, a growing interest in smart infusion pumps, and an increased focus on regulation in European healthcare policies and medical systems directly affect both end-use industries and industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological innovation for development of automated pumps

-

Increasing demand for ambulatory infusion pumps in home care settings

Level

-

Increasing number of product recalls

-

Increasing number of refurbished and rental infusion pumps

Level

-

Increasing adoption of specialty infusion systems

-

Expansion of homecare and smart infusion adoption in Europe

Level

-

Increasingly frequent medication errors and connectivity gap in hospitals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological innovation for development of automated pumps

Europe's rapid technological changes are the main drivers behind the development of smart, connected, and automated infusion pumps for both hospital and home care settings. Advanced infusion systems are increasingly focused on improving the accuracy of drug delivery, reducing medication errors, and, ultimately, enhancing patient safety by introducing features such as wireless connectivity, integration with electronic health records (EHRs), dose error reduction systems, and real-time monitoring. These capabilities enable personalized therapy and remote monitoring, improving workflow efficiency and making these pumps highly attractive to digitally advanced healthcare systems in Europe, thereby facilitating wider uptake of these technologies in both acute and long-term care settings.

Restraint: Increasing number of product recalls

Product recalls have been a major factor holding back the Europe infusion pump market over time. Recalls are frequently associated with software issues, cybersecurity vulnerabilities, or device malfunctions, creating safety concerns for healthcare providers and resulting in higher regulatory scrutiny under the EU Medical Device Regulation (MDR) for the affected providers. In addition, recalls slow the issuance of new products and replacements, causing financial and reputational problems for the companies that manufacture the products. Ultimately, the slow adoption of new products and limited overall market growth across Europe are the consequences of these recalls.

Opportunity: Expansion of homecare and smart infusion adoption in Europe

Moving treatment to outpatient and home care is a trend observed in most European countries and represents a significant growth opportunity for the infusion pump market. Aging populations, rising incidence of chronic diseases, and healthcare cost-containment measures are among the main reasons European healthcare systems are relocating therapies from hospitals to homes and ambulatory settings. This trend drives increased consumption of portable, easy-to-use, and smart infusion pumps equipped with remote monitoring features. Moreover, Europe's emphasis on digital health, interoperability, and patient safety, in accordance with the EU Medical Device Regulation (MDR), facilitates the entry of manufacturers with advanced, connected infusion solutions and allows them to expand their presence not only in hospitals but also in the homecare sector.

Challenge: Increasingly frequent medication errors and connectivity gap in hospitals

The rise of medication errors in various hospital departments with limited wireless connectivity has been the main challenge for the Europe infusion pump market in recent years. Poor integration of hospital IT systems and a lack of real-time monitoring can lead to the underutilization of smart infusion technology. Additionally, dose-programming or usability errors can lead to patient safety issues, increasing regulatory scrutiny. Consequently, the pace of adoption can slow, and the need for staff training, system interoperability, and more robust connectivity solutions in European healthcare facilities can be emphasized.

EUROPE INFUSION PUMP MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Large-volume infusion pumps designed for hospitals and ICUs, equipped with Guardrails drug libraries to support safe and accurate medication delivery | Reduced medication errors, improved patient safety, streamlined clinical workflow |

|

Smart infusion pumps featuring wireless connectivity and seamless EMR integration for advanced hospital use | Real-time data transfer, remote monitoring, reduced manual documentation |

|

Syringe infusion pumps specifically engineered for neonatal and pediatric care, ensuring accurate low-rate infusions of critical medications | High dosing accuracy at low infusion rates, safer drug delivery for sensitive patients |

|

Advanced infusion systems integrating multi-channel volumetric and syringe pumps with centralized monitoring platforms for critical care settings | Centralized control of multiple infusions, enhanced workflow efficiency, better patient monitoring |

|

Infusomat Space Large Volume Pump, compact large-volume pump designed for acute and intensive care with drug library and wireless connectivity | Small footprint for bedside use, advanced safety features, flexible drug library integration, seamless hospital IT connectivity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe infusion pump market ecosystem involves identifying and analyzing interlinking relationships among stakeholders such as component suppliers, infusion pump manufacturers, infusion pump distributors, healthcare providers, and end-use consumers. Component suppliers in Europe provide critical components such as sensors, valves, tubes, and software modules to infusion pump manufacturers. Infusion pump manufacturers incorporate these components using advanced technology to produce volumetric, syringe, and ambulatory infusion pumps. The Europe infusion pump market ecosystem comprises the identification and analysis of relationships among different stakeholders, including suppliers of infusion pump components, infusion pump manufacturers, infusion pump distributors, healthcare providers, and end-use consumers. Suppliers of infusion pump components in Europe serve as a bridge between infusion pump manufacturing companies and healthcare providers. Patients rely on infusion pumps in healthcare settings for safe and accurate drug dosing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Infusion Pump Market, By Product

Devices accounted for the largest share of the Europe infusion pump market in 2025. Infusion pumps are used in hospitals and clinics to deliver drugs accurately. With the rising incidence of chronic diseases and the acceptance of advanced infusion pumps in European countries, this segment is driven. Moreover, technology-driven innovation in infusion pumps has driven this segment and placed devices in a leading position in this market.

Infusion Pump Market, By Mode of Administration

The intravenous segment led the European infusion pump market in 2025. IV infusion remains the most common and effective mode of delivering fluids, drugs, and nutrients directly into the veins. As a direct consequence of their widespread use in European hospitals and intensive care settings, especially among chronic patients, cancer patients, and post-operative patients, demand for IV infusion pumps remains very high in Europe. The need for accurate dosing, rapid therapeutic results, and reliable drug delivery continued to maintain the preeminence of intravenous infusion pumps in Europe.

Infusion Pump Market, By Application

The chemotherapy & oncology application segment accounted for the largest market share in Europe in 2025. This can be attributed to an increasing incidence of cancer in Europe. Infusion pumps play an important role in ensuring patient safety in oncology. They also play a crucial role in reducing medication errors and improving patient safety in oncology treatments.

Infusion Pump Market, By End User

In 2025, the hospital segment accounted for the largest share of the European infusion pumps market. This can be attributed to a steady influx of patients in hospitals. Moreover, as an increasing number of patients that require immediate attention are referred to hospitals, infusion pumps have become an indispensable tool in these settings. Furthermore, an increasing number of healthcare professionals in Europe, along with the rising demand for advanced technology in infusion pumps, has cemented a leading foothold in these settings.

REGION

Germany to be fastest-growing country in Europe infusion pump market during forecast period

Germany is predicted to record the highest CAGR during the study period. This is mainly due to Germany's excellent healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced medical technologies. With its well-established hospital network and a large aging population, the country is witnessing rising demand for infusion pumps used in the management of chronic diseases, oncology treatments, and critical care applications. The surge in Germany is also attributed to the quick acceptance of smart and connected infusion pump systems designed to enhance medication safety and workflow efficiency. Hospitals in Germany are progressively equipping themselves with infusion pumps featuring dose error reduction systems (DERS), wireless connectivity, and integration with hospital information systems. This aligns with national patient safety and digital health initiatives. The transition from conventional pumps to advanced smart infusion solutions is being accelerated by the increasing focus on reducing medication errors and improving clinical outcomes.

EUROPE INFUSION PUMP MARKET: COMPANY EVALUATION MATRIX

In the infusion pump market matrix, Fresenius Kabi AG (Star) leads with a strong global presence and an extensive product portfolio, driving widespread adoption of advanced infusion systems in hospitals and critical care settings. Shenzhen Mindray Animal Medical Technology Co., LTD. (Emerging Leader) is gaining momentum with innovative solutions tailored for veterinary and specialized applications, positioning itself for rapid growth. While BD maintains dominance through scale and established market leadership, Mindray shows strong potential to move into the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BD (US)

- Baxter (US)

- B. Braun SE (Germany)

- ICU Medical, Inc. (US)

- Fresenius Kabi AG (Germany)

- Medtronic (Ireland)

- Terumo Corporation (Japan)

- Nipro (Japan)

- AVNS (US)

- Insulet Corporation (US)

- F.Hoffmann-la-Roche Ltd (Switzerland)

- Moog, Inc. (US)

- Teleflex Incorporated (US)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China)

- Ypsomed (Switzerland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.78 Billion |

| Market Forecast in 2031 (Value) | USD 7.09 Billion |

| CAGR | 6.80% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | Germany, UK , France, Italy, Spain, Netherlands, Sweden, Rest of Europe |

| Parent & Related Segment Reports | Infusion Pump Market |

WHAT IS IN IT FOR YOU: EUROPE INFUSION PUMP MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis |

|

|

| Company Information |

|

Insights on revenue shifts toward emerging therapeutic applications and device innovations |

| Geographic Analysis | Performed an elaborate analysis on regional demands within the Rest of Europe - examined country-by-country analysis on adoption, production capacity, and market appeal | Supported regional strategy planning by identifying high-growth countries for expansion, localization opportunities, and collaboration hubs across Europe |

RECENT DEVELOPMENTS

- April 2025 : Medtronic announced that the US FDA approved the Simplera Sync sensor for use with its MiniMed 780G system. This approval expands flexibility for users of the company’s most advanced insulin delivery system, which now supports Meal Detection technology with both the Guardian 4 sensor and the Simplera Sync sensor.

- February 2025 : ICU Medical, Inc. announced that its Plum 360 smart infusion system was rated the top-performing Smart Pump EMR-Integrated system by KLAS Research, a prominent global healthcare research firm. ICU Medical earned the 'Best in KLAS' recognition for eight consecutive years.

- September 2024 : BD completed the USD 4.2 billion acquisition of Edwards Lifesciences’ Critical Care business and rebranded it as BD Advanced Patient Monitoring. The move strengthens BD’s infusion systems portfolio, particularly the BD Alaris Infusion System, by integrating advanced monitoring capabilities, AI-driven decision support tools, and closed-loop hemodynamic monitoring.

Table of Contents

Methodology

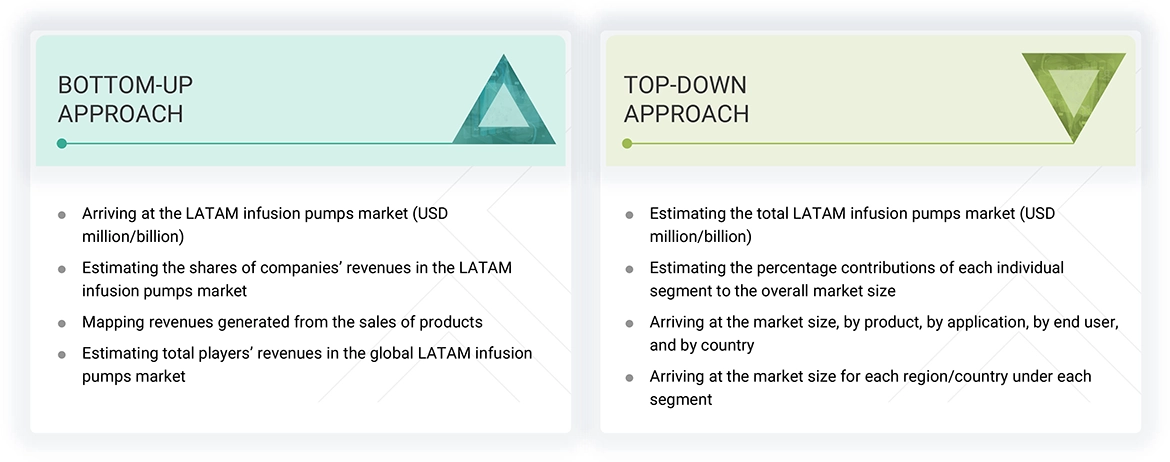

The study involved four major activities to estimate the current size of the Europe infusion pump market—exhaustive secondary research collected information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were utilized to identify and gather information to study the Europe infusion pump market. These sources included company annual reports, press releases, investor presentations, white papers, certified publications, and articles by recognized authors. We also consulted reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva.

This research aimed to gather crucial information about the leading companies in the industry, market classification, and segmentation based on industry trends, down to the most detailed levels, including geographic markets. Additionally, we focused on key developments related to the market. Through this secondary research, a database of key industry leaders was created.

Primary Research

Extensive primary research was conducted after gathering information about the Europe infusion pump market through secondary research. Several primary interviews were held with market experts from both the demand and supply sides across Europe. Data was collected through questionnaires, emails, and telephone interviews. The primary sources from the supply side included various industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), Directors of business development, marketing, product development/innovation teams, and other key executives from manufacturers and distributors operating in the Europe infusion pump market, as well as key opinion leaders.

Primary interviews were conducted to gather valuable insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. This primary research also provided an understanding of various trends related to technologies, applications, industry verticals, and regions. Stakeholders, including customers and end users, were interviewed to gain the buyers' perspective on suppliers, the products themselves, their current usage, and the future outlook of their businesses. This information is crucial as it impacts the overall market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Europe infusion pump market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the Europe infusion pump market was obtained from the annual presentations of leading players and secondary data available in the public domain. Shares of products in the overall Europe infusion pump market were obtained from secondary data and validated by primary participants to arrive at the total Europe infusion pump market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

Industry experts contacted during primary research validated the assumptions and approaches at each point. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall Europe infusion pump market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Europe infusion pump Market Size: Bottom-up Approach & Top-down Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size, using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Europe infusion pump market.

Market Definition

An infusion pump is a medical device that administers controlled amounts of fluid into a patient’s body. Various pumps deliver nutrients or medication, such as insulin or other hormones, antibiotics, chemotherapy drugs, and pain relievers to patients. These devices offer significant advantages over manual fluid administration, including delivering fluids in minimal volumes and at precisely programmed rates or automated intervals.

Stakeholders

- Infusion Pump & Accessories Manufacturers

- Infusion Pump Device & Accessories Distributors

- Healthcare Service Providers

- Various Research Associations related to Infusion Pumps

- Research Institutes

- Health Insurance Payers

- Market Research & Consulting Companies

- Venture Capitalists & Investors

- Healthcare Professionals

- Procurement Managers

- Various Research & Consulting Companies

- World Health Organization (WHO)

- Organisation for Economic Co-operation and Development (OECD)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

Report Objectives

- To define, describe, and forecast the Europe infusion pump market based on product, application, end user, and country

- To provide detailed information regarding the primary factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate the size and growth potential of the infusion pumps market in the Europe region

- To profile the key players operating in the market and comprehensively analyze their revenue shares, core competencies, and market shares

- To track and analyze competitive developments such as expansions, acquisitions, collaborations, product launches, agreements, and partnerships in the market

- To benchmark players in the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business strategy and product offering

- To evaluate and analyze the impact of generative AI on the infusion pumps market across the Europe region

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Infusion Pump Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Infusion Pump Market