Europe Medical Tubing Market

Europe Medical Tubing Market by Material (Plastics, Rubber, Specialty Polymers), Application (Bulk Disposable Tubing, Catheters & Cannulas, Drug Delivery Systems), Structure (Single Lumen, Multi Lumen, Co-Extruded, Braided), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe medical tubing market size is projected to grow from USD 3.64 billion in 2025 to USD 5.14 billion by 2030, registering a CAGR of 7.1% during the forecast period. The growing number of elderly people and the increasing use of less invasive surgeries are the main reasons for the rise in demand for medical tubing. The EU MDR and sustainability regulations also fuel the demand for superior, biocompatible polymer materials in high-tech medical devices.

KEY TAKEAWAYS

-

By CountryGermany dominated the Europe medical tubing market with a share of 23%, in terms of value, in 2025.

-

By MaterialBased on material, the rubber segment leads the Europe medical tubing market with a share of 57.2% in 2025, in terms of value.

-

By StructureThe braided tubing segment is expected to record the highest CAGR of 8.9%, in terms of value, during the forecast period.

-

By ApplicationThe drug delivery system is the fastest-growing application of the medical tubing market in Europe.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as B. Braun and Trelleborg Medical were identified as some of the star players in the Europe medical tubing market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSSpolyflon Medical, Puresil Techniflex, and Flexicare Medical, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Europe medical tubing market is witnessing steady growth, driven by the rising adoption of non-invasive operations, chronic disease management, and high-quality loss tubing. Furthermore, innovations in multi-lumen, co-extruded, and braided forms, together with the adoption of silicone, TPU, and specialty polymers, are increasing performance levels. Market trends are also influenced by the tactical partnerships of OEMs with tubing producers, increased funding for clean-room production, and the invention of eco-friendly and bioabsorbable materials.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The demand for higher-quality materials, changing regulations, and the emergence of new companies in the supply chain are driving profound changes in the Europe medical tubing market. The introduction of biocompatible polymers as well as smart tubing alternatives has been the basis of recent product variations. Additionally, firms are under stress due to issues stemming from the supply chain, and they are also being compelled to adopt sustainability, which is resulting in the use of new production techniques.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Ageing population & chronic-care demand

-

Rise of minimally invasive and catheter-based procedures

Level

-

Stringent regulatory burden (EU MDR)

-

Procurement cost pressure in public healthcare

Level

-

Nearshoring & localized manufacturing

-

Sustainable & specialty-material innovations

Level

-

Supply-chain volatility & geopolitical sourcing risks

-

Workforce & capacity constraints in EU manufacturing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Ageing population & chronic-care demand

An aging population and the increasing requirement for chronic care are the major long-term factors that will continue to drive the medical tubing market in Europe. One of the world's oldest populations, Europe is also experiencing a rapid increase in the number of individuals aged 65 and above, with Germany, Italy, France, and Spain being the most affected countries. The change in age distribution is resulting in a corresponding increase in chronic diseases like cardiovascular diseases, diabetes, kidney failure, and lung diseases. Hence, there is a growing need for medical tubing in dialysis systems, vascular access devices, infusion therapies, urinary catheters, and respiratory care. Long-term treatments, regular hospital visits, and an increase in home-care options are additional factors contributing to the demand for high-quality, disposable tubing assemblies. Minimally invasive procedures and supportive therapies cannot be performed without precise tubing. The co-occurrence of an aged population and a high prevalence of chronic diseases results in uninterrupted and continuous demand for medical tubing in Europe.

Restraint: Stringent regulatory burden (EU MDR)

The EU Medical Device Regulation (EU MDR) imposes heavy regulatory requirements, which substantially lower the demand for the Europe medical tubing market. They are the main source of confusion, extra costs, and long periods for manufacturers to get their products out of the market. The regulation lays down stricter requirements for clinical evidence, material traceability, biocompatibility testing, labeling, and post-market monitoring, even for the least risky components, such as medical tubing. This situation is much worse for small and medium-sized tubing manufacturers as they have fewer regulatory resources, and thus higher certification costs. The situation has been further aggravated by the lack of notified bodies causing delays in the certification process, which in turn, slow down new product launches and technology upgrades. Regulatory measures increase the costs of manufacturing and quality control, thus, making it unprofitable for manufacturers to innovate and enter the market.

Opportunity: Nearshoring & localized manufacturing

The Europe medical tubing market presents a significant opportunity through nearshoring and localized manufacturing. The medical and health sectors, as well as OEMs, are putting more emphasis on the resilience, reliability, and quickness of the supply chain. If global logistics disruptions and stringent regulations for medical devices persist, manufacturers will need to shift their production to markets where these products will be utilized. Moving or expanding tubing extrusion plants in Europe provides the manufacturer with the advantages of tight quality control, quick customer response, and compliance with EU MDR standards. Additionally, local production enables product customization, allows for small quantities, and facilitates partnering with local neighbors in the medical device industry. The shift in production to Europe is partly due to the increasing pressure for sustainable operations and minimal carbon footprints, which are becoming more prevalent. Nearshoring, while making manufacturers more competitive, is also helping them meet the demand for high-performance medical tubing, which is intensifying in Europe.

Challenge: Supply-chain volatility & geopolitical sourcing risks

The medical tubing market in Europe is highly impacted by volatility in supply chains and geopolitical sourcing risks. They cause shortages of materials, cost variations, and uncertain deliveries, which interfere with smooth production and contracts with buyers. The reliance on non-EU countries for the supply of polymers, specialized additives, and extrusion parts makes extruders vulnerable to trade disruptions, export controls, and shipping delays. On the other hand, sudden tariffs, sanctions, and hikes in energy prices not only increase the cost of inputs but also lower the margins. Such risks add significant complexity to the potential of dual sourcing, as they require more qualification time and a greater regulatory burden. Manufacturers are caught in a situation where they must either maintain higher inventory levels or invest in costly near-term capacity buffers. For small and mid-sized tubing suppliers, it is difficult to flexibly adapt their manufacturing processes and absorb such shocks.

EUROPE MEDICAL TUBING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Medical tubing used in infusion therapy sets, catheters, and dialysis lines for hospitals and home-care applications | Safety, precise fluid delivery, high biocompatibility, reduced infection risk, and improved patient outcomes |

|

Catheter and cannula tubing for vascular access, intensive care, and minimally invasive procedures across European hospitals | High reliability, precision performance, flexible customization, and regulatory compliance |

|

Multi-lumen, silicone, and thermoplastic tubing for respiratory therapy, surgical instruments, and diagnostic devices | Enhanced procedural efficiency, reduced device failure risk, improved patient safety, and supported complex device functionality |

|

Extruded and assembled medical tubing for interventional cardiology, urology, and home-care systems | Offers precision fluid/drug delivery, long-term durability, compatibility with minimally invasive procedures, and regulatory compliance |

|

Tubing used in intermittent and indwelling catheters, urology devices, and home-care therapy sets | Improved patient comfort, reduced hospital visits, safe disposable use, and supported chronic-care therapy adoption |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical tubing ecosystem in Europe consists of raw material suppliers that offer medical-grade polymers, silicones, and fluoropolymers, along with specialty additives, to tubing manufacturers who produce high-precision, biocompatible tubing for various medical applications. Distributors, contract manufacturers, and medical device OEMs connect tubing producers with end users and provide finished tubing sets for hospitals, home-care, diagnostics, and minimally invasive therapies. The collaboration of these stakeholders facilitates a seamless transition from sourcing certified materials to producing regulatory-compliant, high-performance tubing, thereby delivering safe and reliable solutions for incorporation into critical medical devices and patient care systems.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Medical Tubing Market, By Structure

The market for medical tubing consists of various segments, such as single-lumen, co-extruded, multi-lumen, tapered or bump, and braided tubing. Among all these, multi-lumen tubing is the largest segment owing to its support for complex fluid handling and multifunctional uses. On the other hand, single-lumen and co-extruded tubing remain the most popular choices for uncomplicated and less demanding medical procedures.

Europe Medical Tubing Market, By Material

The market for medical tubing is segmented based on material into plastics, rubbers, specialty polymers, and other materials. The rubber segment, which includes silicone and TPE, leads the market due to its flexibility, biocompatibility, and suitability for long-term or implantable applications. Plastics have a major share in the market for disposable applications due to their low cost and versatility. Specialty polymers like fluoropolymers and PEEK are slowly gaining popularity in the applications that require chemical resistance and precision. Other materials used in the market are bioabsorbable polymers.

Europe Medical Tubing Market, By Application

The medical tubing market has been categorized into various segments, namely, bulk disposable tubing, catheters & cannulas, drug delivery systems, and special applications. The catheters & cannulas segment lead the market due to their utilization in minimally invasive procedures and patient care that lasts for long periods. On the other hand, drug delivery and special applications are experiencing high growth.

REGION

The Netherlands to be fastest-growing country in Europe medical tubing market during forecast period

The Netherlands is projected to be the fastest-growing medical tubing market in Europe during the forecast period. This high growth is attributed to its robust healthcare system, a strong medical device manufacturing base, and increasing acceptance of new medical technologies. Many of the world's top medical device firms and contract manufacturers have set up their plants in the country, which consequently leads to the need for a significant amount of precise tubing to be used in making catheters, drug delivery systems, and minimally invasive devices. The Dutch healthcare system is dedicated to delivering the highest quality patient care possible. This fuels the demand for single-use and specialty medical tubing that meets the stringent safety and regulatory requirements. The rise in the number of chronic disease cases, along with an increase in the elderly population, is also fueling the demand for sophisticated tubing solutions. The Netherlands' geographic position in Europe not only makes it easy to ship products to neighboring countries but also supports the establishment of efficient supply chains that can respond quickly to market demands.

EUROPE MEDICAL TUBING MARKET: COMPANY EVALUATION MATRIX

In the Europe medical tubing market matrix, B. Braun (Star) leads with a strong regional presence and a broad portfolio of infusion, vascular access, and specialty tubing supported by its integrated manufacturing and wide hospital network. Freudenberg Medical (Emerging Leader) is strengthening its position through expansion in biopharma and single-use assemblies, leveraging its silicone extrusion and molding expertise to target high-growth segments such as mRNA and cell therapies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. Freudenberg Medical (US)

- 2. RAUMEDIC AG (Germany)

- 3. Vygon (France)

- 4. B. Braun (Germany)

- 5. Saint-Gobain (France)

- 6. Trelleborg Medical (Sweden)

- 7. Teleflex (US)

- 8. Coloplast (Denmark)

- 9. Smiths Medical (US)

- 10. TE Connectivity (Ireland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.64 Billion |

| Market Forecast in 2030 (value) | USD 5.14 Billion |

| Growth Rate | CAGR of 7.1% from 2026-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2025 |

| Forecast Period | 2026–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Italy, Spain, Netherlands, and Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE MEDICAL TUBING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Medical Device Manufacturer |

|

|

| Hospital & Healthcare Systems |

|

|

| Catheter & Cannula OEMs |

|

|

| European Medical Tubing Raw Material Supplier |

|

|

| Drug Delivery System OEMs |

|

|

RECENT DEVELOPMENTS

- Aug-24 : Freudenberg Medical expanded its biopharma portfolio with custom single-use assemblies, leveraging its silicone extrusion and molding expertise to strengthen its position in the biopharma market.

- October 2023 : RAUMEDIC AG expanded its biocompatible fluid-processing tubing portfolio with new brands made from braided silicone, standard silicone, PVC, TPE, and FEP, strengthening its offerings across diverse medical applications.

- July 2021 : RAUMEDIC AG undertook the expansion of its presence with two new production facilities at its German headquarters, scheduled for completion by 2025, to boost silicone tubing manufacturing and strengthen its position in Europe’s pharmaceutical and vaccine sectors.

- September 2020 : Freudenberg Medical acquired dedicated manufacturing equipment and assets from Merit Medical Systems to strengthen its hypotube production capacity.

Table of Contents

Methodology

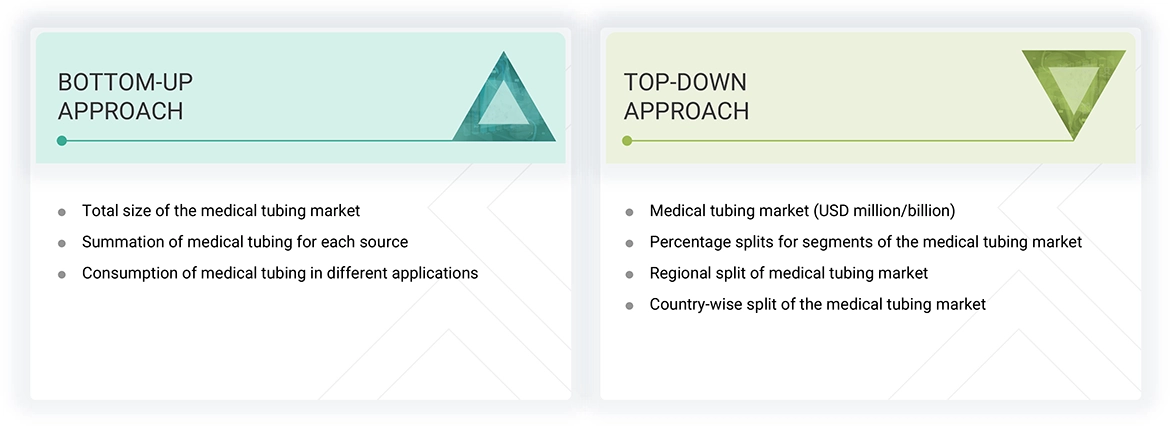

The study involved four major activities for estimating the current size of the Europe medical tubing market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Europe medical tubing through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Europe medical tubing market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the Europe medical tubing market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The Europe medical tubing market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Europe medical tubing market. Primary sources from the supply side include associations and institutions involved in the Europe medical tubing market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the Europe medical tubing market by material, application, structure, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the Europe medical tubing market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Medical tubing is flexible, hollow tubing used in a range of medical and pharmaceutical uses for the transfer of fluids and gases. Medical tubing is a critical component in healthcare environments for uses including drug delivery, respiratory therapy, catheters, intravenous (IV) therapy, and peristaltic pumps. Medical tubing is produced from materials such as silicone, polyvinyl chloride (PVC), thermoplastic elastomers (TPE), and polyethylene, providing biocompatibility, chemical resistance, and flexibility. The market for medical tubing is growing due to improving healthcare spending, expanding demand for minimally invasive treatments, and technological innovation in medical devices. The growing prevalence of chronic diseases, such as cardiovascular diseases and diabetes, has also fueled demand for Europe medical tubing solutions.

Stakeholders

- Europe Medical Tubing Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the Europe medical tubing market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, application, structure, and region.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the Europe medical tubing market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Medical Tubing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Medical Tubing Market