Europe Plasticizer Market

Europe Plasticizer Market by Type (Phthalate, Non-phthalate), Application (Floor & Wall Coverings, Wires & Cables, Coated Fabrics), End-use Industry (Construction, Automotive, Electronics, Healthcare, Packaging), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

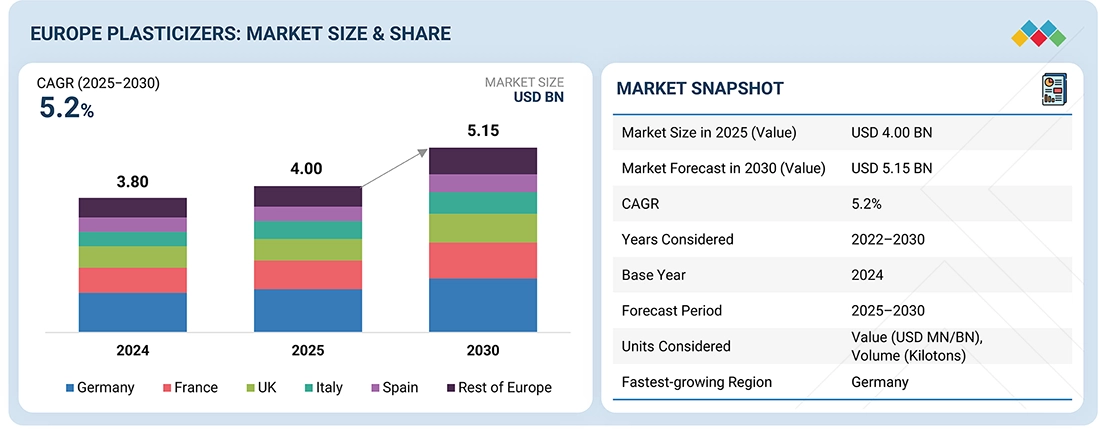

The Europe plasticizer market is projected to grow from USD 4.00 billion in 2025 to USD 5.15 billion by 2030, at a CAGR of 5.2% during the forecast period. The market for plasticizers in Europe is experiencing a steady increase, which is primarily due to the strict regulations imposed by the EU (REACH and phthalate restrictions) that encourage the quick replacement of phthalates and bio-based alternatives in line with the growing environmental and health concerns. The gradual rise in the market is also attributed to consumer demand for green materials, corporations' ESG programs, and ongoing research into sustainable plasticizers—though these advances face challenges from the slowdown in construction and competition from imports.

KEY TAKEAWAYS

-

By CountryGermany is expected to be fastest growing market with a CAGR of 4.9% during the forecast period.

-

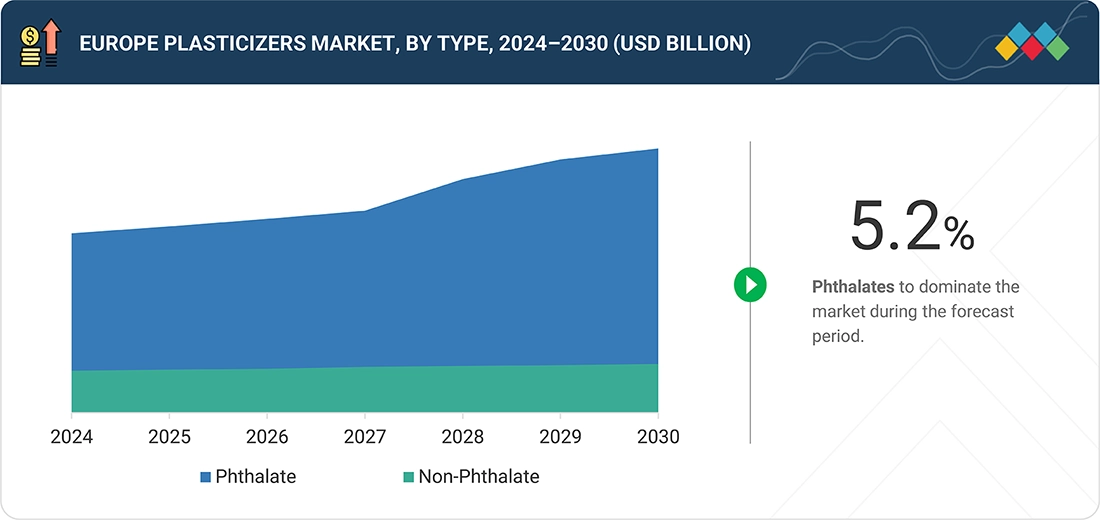

By TypeThe non-phthalate segment will be the fastest-growing market with a CAGR of 5.7%

-

By ApplicationFlooring & wall coverings will hold the highest market share of approximately 23% during the studied year.

-

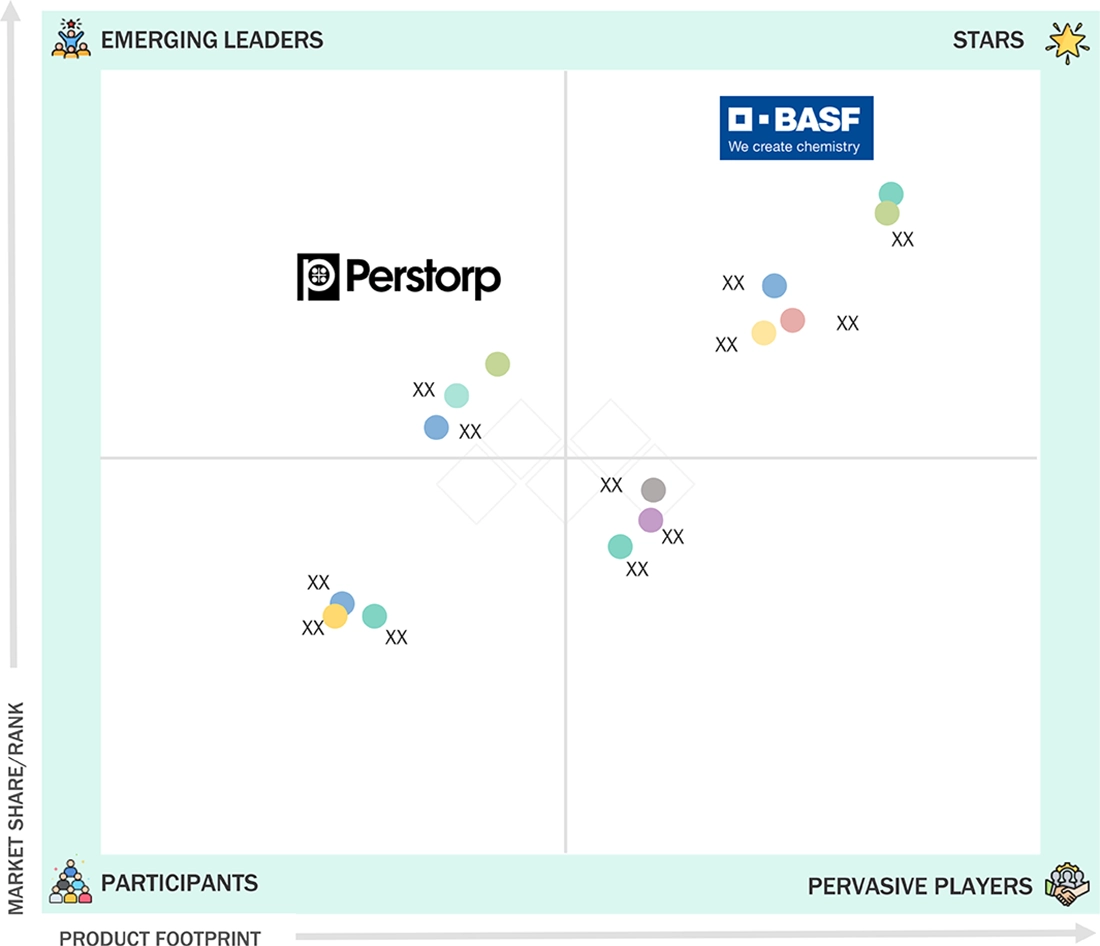

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as BASF SE, Evonik, Arkema, LANXESS, and Perstorp, among others, were identified as some of the star players in the Europe plasticizers market globally, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSBio Base, UPM, GF Biochemicals, Greenchemicals S.r.l., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Plasticizers are additives that are added to synthetics such as polyvinyl chloride (PVC) to improve the properties of the material and make the rigid plastics more pliable for various uses such as flooring, cables, packaging, and automotive parts. By 2025, plasticizer consumption in Europe will be stable, though not very high. The main reason will be the use of plasticizers in sectors such as construction (flooring, wall coverings, cables), automotive interiors, and packaging, but the building activity in the region will not be as high as it has been. The tough European Union regulations (REACH) and health issues are playing a big part in the shift towards the use of non-phthalate and bio-based plasticizers that are safer and are rapidly being adopted. In fact, traditional phthalates are being restricted, driving high demand for eco-friendly alternatives even as the overall market faces challenges.

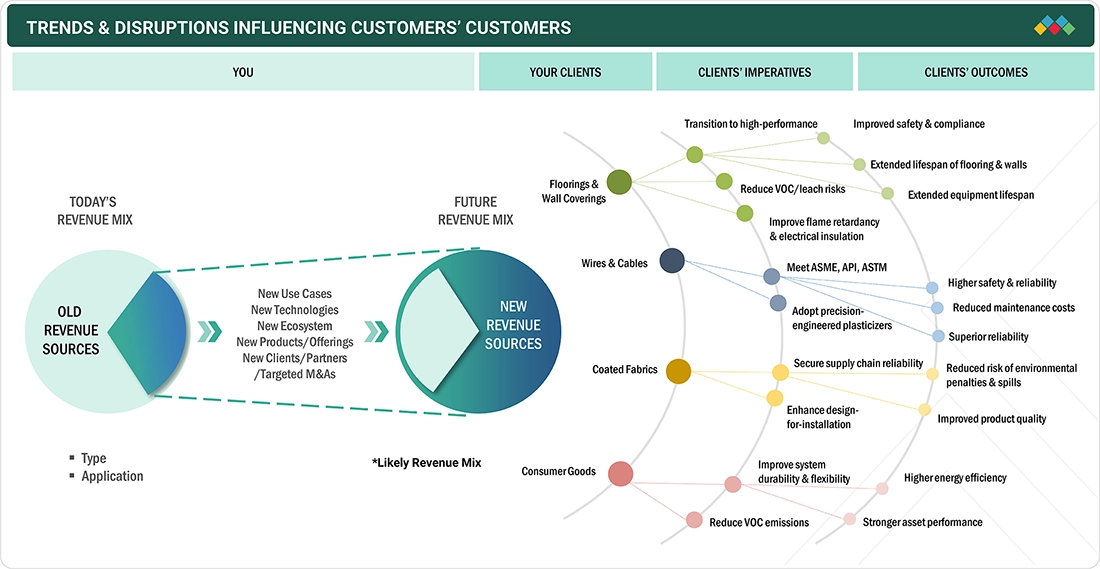

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The plasticizers market in Europe is undergoing a transformation as a result of several disruptive trends that are impacting demand, preferences for products, and competition strategies. The most significant of these disruptions is the strict regulatory environment under REACH and national phthalate restrictions, which is leading to rapid substitution from traditional phthalates to non-phthalate and bio-based alternatives. As a result, the manufacturers are compelled to change the chemical structure of their products, support the safer chemistries, and even change their entire supply chain to comply with the regulations and, at the same time, satisfy the consumers who demand less-toxic products. The demand is being weakened further by the global economic situation and less activity in the construction sector, while the competition has been intensified by the low-priced imports, especially from Asia, of DOTP and specialty esters, which, in fact, is the reason for European manufacturers facing difficulties leading to plant closures and a decrease in domestic production. The sustainability pledges accompanying the EU's circular economy and green deal initiatives are disrupting procurement practices by giving precedence to material additives that are renewable, biodegradable, and recyclable.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for plasticizers in construction and automotive sectors

-

Increased adoption of bio-based plasticizers due to EU sustainability regulations

Level

-

Stringent EU regulations on phthalate plasticizers (REACH, EU RoHS)

-

High cost of bio-based plasticizers compared to conventional options

Level

-

Rising demand for sustainable and eco-friendly plasticizers in Europe

-

Growth of bioplastics and green PVC solutions driven by EU Green Deal policies

Level

-

Volatility in raw material prices affecting production cost

-

Health and environmental concerns over traditional phthalate-based plasticizers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for plasticizers in construction and automotive sectors

The main factor behind the Europe plasticizers market is the increasing demand from major end-use industries such as construction (for flexible PVC in flooring, wall coverings, and cables) and automotive (for interiors and lightweight components), which is further reinforced by continuous infrastructure development and vehicle production. This enduring consumption, along with the region's emphasis on durable, high-performance materials, remains the main reason the plasticizer market is stable despite the broader economic challenges.

Restraint: Stringent EU regulations on phthalate plasticizers (REACH, EU RoHS)

The strict regulations of the EU, which cover REACH and RoHS, as well as some national bans on phthalates, are big barriers that restrict the usage of traditional plasticizers to a great extent since their use is not supported for health and environmental reasons. The rules have made it faster to eliminate some phthalates, and as a result, manufacturers relying on standard formulations have to bear the brunt of increased compliance costs and have their supply chains disrupted.

Opportunity: Rising demand for sustainable and eco-friendly plasticizers in Europe

The increasing necessity for eco-friendly, sustainable alternatives, especially non-phthalate and bio-based plasticizers, is a key opportunity in this market. The demand for such alternatives is mainly driven by the EU's sustainability goals, companies' commitments to environmental, social, and governance (ESG) issues, and consumers' preference for non-toxic materials. The introduction of renewable feedstocks and biodegradable materials not only conforms to the EU's Green Deal and circular economy plans but also creates new opportunities for growth in the areas of packaging, medical devices, and consumer goods.

Challenge: Volatility in raw material prices affecting production cost

The fluctuations in the raw material prices due to the changes in petrochemical feedstocks and the disruptions in the supply chain have made the production process more expensive and have thus reduced the profits of European producers. European producers are faced with this situation and thus have to fight through the intense competition coming from low-cost imports (particularly DOTP from Asia and Turkey) and lack of demand in the construction and automotive industries. This scenario is continually creating uncertainty and overwhelming domestic production.

EUROPE PLASTICIZER MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

BASF has a wide range of plasticizers in its non-phthalate and specialty plasticizers portfolio (e.g., Hexamoll DINCH, Palatinol alternatives) that are used in flexible PVC for flooring, cables, automotive interiors, consumer goods, and medical applications across Europe. Its Production and R&D are particularly strong in Germany and other EU locations. | European clients are sure of bogus, long-term performance with the REACH-compliant, low (volatile organic compounds) VOC, and non-Very High Concern Substances (SVHC)-containing solutions. The manufacturing footprint of BASF at local sites secures the supply, provides support in regulatory matters, and is in a sustainability conflict that covers both mass-balance and bio-attributed options. |

|

Evonik also provides specialty plasticizers and plasticizer intermediates, such as isononanol (INA) and other C9–C10 alcohol derivatives, with the main focus on the PVC compounding for automotive, construction, cables, and specialty polymers in Europe. | The purity of intermediates and specialty grades made by the company can be the cause of the developments in being more durable, lower migration, and quality being more stable. |

|

Arkema, through its specialty chemicals portfolio, provides specialty and bio-based plasticizers for flexible PVC, adhesives, sealants, coatings, and specialty polymer systems with a strong presence in Western Europe. | Arkema’s offering can be seen as the main driver behind the low-carbon, non-phthalate, and bio-based formulations, which further assist the customers in achieving the goals set by the EU Green Deal. Advantages that come along include greater flexibility at lower temperatures, better aging resistance, and a significant reduction of the regulatory risk for European converters and brand owners. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe plasticizers market ecosystem can be described as an interconnected value chain involving feedstock suppliers, chemical manufacturers, compounders, converters, and end-users. On the upstream side, companies from the petrochemical industry supply the main inputs, namely, phthalic anhydride, alcohols, and other bio-based feedstocks. In the midstream section, the largest manufacturers of plasticizers, such as BASF, Evonik, LANXESS, and Eastman, produce phthalate, non-phthalate, and bio-based plasticizers, which are more or less fitted to standard flexible PVC and specialty polymers. After this step, the products go to PVC compounders and processors who then use them for flooring, cables, films, automotive parts, and consumer products. Downstream, the construction, automotive, packaging, medical, and electronics sectors create final demand and thus dictate required product attributes through rules, sustainability, and performance-related demands. This ecosystem has distributors, testing agencies, regulatory bodies, and technology providers as support systems that are mainly involved in the areas of innovation, compliance, and supply chain efficiency.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Plasticizers Market, By Type

The non-phthalates segment has become a rapidly growing part of the market and is mainly influenced by tough EU regulations such as REACH and RoHS, which have set strict limits or even banned some conventional phthalates on the grounds of their health and environmental risks. Consequently, the use of non-toxic phthalate alternatives, which are comparable with their phthalate counterparts in terms of flexibility and durability, and which are used in low-toxicity applications such as children's toys, food contact materials, medical devices, and indoor products, has been accelerated. Such alternatives include adipates, citrates, trimellitates, and terephthalates. Even bio-based plasticizers obtained from renewable resources, specifically vegetable oils, e.g., epoxidized soybean oil and castor oil-based variants, are coming up very fast.

Europe Plasticizers Market, By Application

In Europe, flooring and wall coverings are among the most dynamic sectors in the plasticizers market, with the demand for these materials being very strong; the plasticizers market is supported by the availability of various PVC-based materials that are not only durable and flexible but also aesthetically appealing for residential, commercial, and renovation projects. In the production of vinyl flooring, wall coverings, and protective coatings, used often in traffic-heavy areas of homes, offices, and medical and retail, plasticizers are major contributing factors in giving these products softness, elasticity, toughness, and ease of installation. The gradual transition towards non-phthalate and bio-based plasticizers within this segment meshes well with the EU’s stringent safety and environmental regulations. Other factors driving the market further include urban renewal programs and consumer trends that demand not only moisture-resistant and easy-to-maintain but also design-forward surfaces that go along with modern lifestyles.

REGION

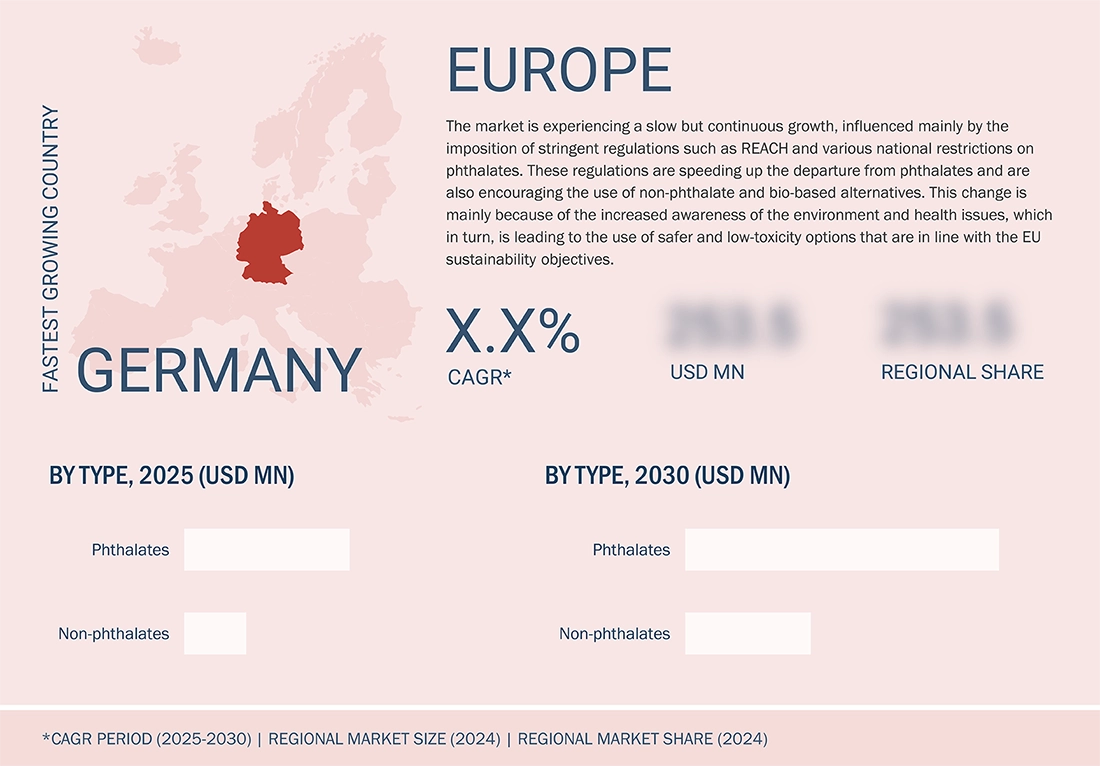

Germany to be fastest-growing region in Europe region during forecast period

Germany is the fastest-growing country in the Europe plasticizers market, mainly because of its quick adoption of bio-based and non-phthalate plasticizers. The primary reason for this is strict EU regulations like REACH and RoHS that have banned nearly all phthalates. This, along with Germany's strong industrial base in the automotive sector (which is the largest in Europe), drives demand for lightweight and eco-friendly materials for electric vehicles, boosting consumption in interiors, wiring, and sealing systems. The country's building and packaging industries also support this trend by using renewable materials for flooring, roofing, and food-contact applications, aligning with its ambitious net-zero target by 2045 and the EU Green Deal. Germany is home to world-class innovators like BASF, Evonik, and LANXESS, and it benefits from substantial R&D investments in sustainable formulations, corporate ESG commitments, and consumer demand for green products. These factors strengthen its position as both the largest and most active plasticizers market in Europe, despite challenges posed by higher costs and import competition.

EUROPE PLASTICIZER MARKET: COMPANY EVALUATION MATRIX

BASF SE is a prominent contender among the top plasticizers manufacturers in Europe, thanks to its German location, which is also the main stem for its vast production plants at the Ludwigshafen Verbund site, and its all-encompassing portfolio made of classic phthalates (namely Palatinol N and Palatinol 10-P), non-phthalates (the star Hexamoll DINCH of sensitive applications such as medical devices, toys, and food contact), adipates, polymeric plasticizers, and even biomass-balanced sustainable options. Besides the strong hold in the market, the company also leads the way in terms of pioneering eco-friendly and high-performance alternatives, which are in line with the EU regulations, such as REACH and RoHS, that have already started the gradual phase-out of conventional phthalates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF (Germany)

- Evonik Industries (Germany)

- Arkema (France)

- Lanxess (Germany)

- Perstorp (Sweden)

- Polynt (Italy)

- Clariant AG (Switzerland)

- Croda International (UK)

- Proviron (Belgium)

- Eastman Chemical Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.00 Billion |

| Market Forecast in 2030 (Value) | USD 5.15 Billion |

| Growth Rate | CAGR of 5.2% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Italy, Spain, Rest of Europe |

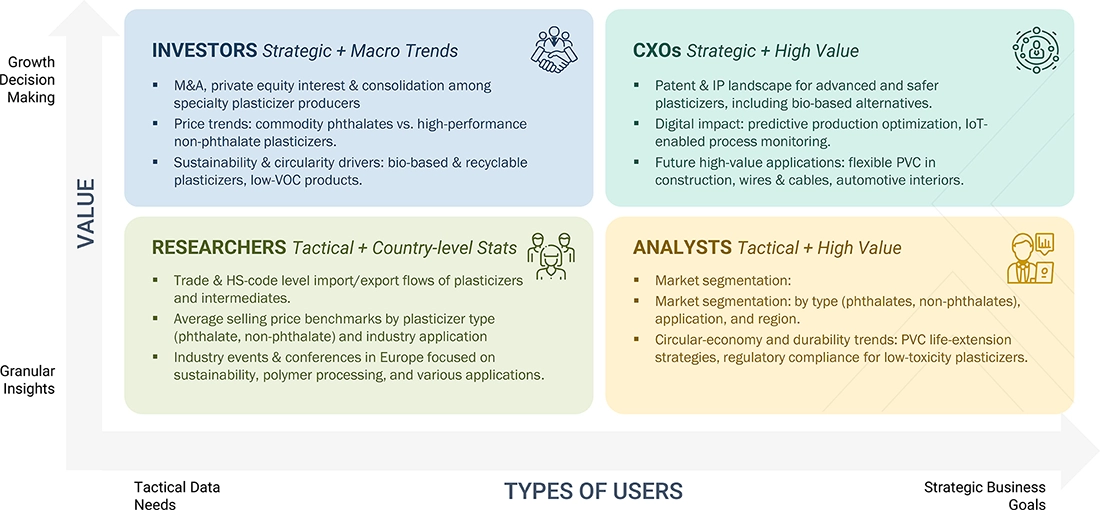

WHAT IS IN IT FOR YOU: EUROPE PLASTICIZER MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European PVC Compounder |

|

|

| Automotive Interior Components Manufacturer |

|

|

| Construction Materials Producer (Flooring & Wall Coverings) |

|

|

| Chemical Distributor Expanding Plasticizer Portfolio |

|

|

| PVC Film & Packaging Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : Evonik Oxeno has declared the expansion of its production capacities for the production of the plasticizers ELATUR CH (DINCH) and ELATUR DINCD, which are based on INA, at the Marl site, which is located in Germany. This step was taken to meet the growing European demand and secure a steady supply of top-quality non-phthalate alternatives.

- June 2025 : BASF's participation in the K 2025 trade fair enabled the company to showcase progress in its plasticizer portfolio under the hashtag #OurPlasticsJourney. The company accentuated circularity, sustainable formulations, and innovations in the manufacture of phthalate-free plasticizers for the construction and automotive sectors.

- March 2024 : Arkema, in its Virtucycle program and Agiplast recycling operations, has made an indirect but significant contribution to the sustainable use of plasticizers in compounded materials by increasing the availability of certified recycled-content grades for high-performance polymers.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the Europe Plasticizer market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases, were considered for identifying and collecting information for this study. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, monetary chain of the market, the total number of market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, consultants, and related key executives from major companies and organizations operating in the market. Primary sources from the demand side include lab technicians, technologists, and sales/purchase managers in the industry. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe Plasticizer market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Definition

Plasticizer are low molecular weight compounds added to other polymeric substances to aid polymer processing and impart flexibility, plasticity, softness, and reduce brittleness. They are primarily used in PVC cables, PVC resins, wire jacketing, vinyl flooring, medical equipment, automobile parts, and others. Europe Plasticizers make the polymer solution more suitable for various applications such as films & coatings.

The key stakeholders of the plasticizers market include Raw Material Suppliers, Manufacturers (Plasticizer Manufacturers), Plasticizer Traders, Distributors, and Suppliers, End-use Industry Participants, Government and Research Organizations, Associations and Industrial Bodies, Research and Consulting Firms, Research & Development (R&D) Institutions, Environmental Support Agencies.

Objectives of the Study

- To define, describe, segment, and forecast the Europe Plasticizers market size, by technology, meter type, component, and application

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the Europe Plasticizers market

- To strategically analyze the Europe Plasticizers market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the Europe Plasticizers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Plasticizer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Plasticizer Market