Europe Polymer Foam Market

Europe Polymer Foam Market by Resin Type (PU, PS, PO, Phenolic), Foam Type (Flexible and Rigid), End-use Industry (Building & Construction, Bedding & Furniture, Packaging, Automotive, Footwear, Sports & Recreational), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The European polymer foam market is projected to grow from USD 26.11 billion in 2024 to USD 34.18 billion by 2030, at a CAGR of 5.1% during the forecast period. Growth in this market is driven by increasing demand from key end-use industries, such as automotive, construction, packaging, and furniture, supported by the region’s strong focus on lightweight materials and energy efficiency. Polymer foams are widely used for thermal insulation, sound absorption, and impact resistance, making them essential in sustainable building practices and next-generation vehicle design. The ongoing transition toward circular materials and the adoption of bio-based and recyclable foams are reshaping production trends across Europe. Regulatory frameworks promoting low-emission materials, coupled with advancements in polymer chemistry and foam processing technologies, are enhancing product performance and environmental compliance. Additionally, the expansion of e-commerce and logistics sectors continues to boost the need for protective packaging solutions. Together, these factors underscore steady growth prospects for polymer foams across Europe’s industrial, construction, mobility, and consumer goods sectors.

KEY TAKEAWAYS

-

BY REGIONGermany was the largest polymer foam market in Europe, in terms of value, in 2024; it is projected to register a CAGR of 4.1%, in terms of value, between 2025 and 2030.

-

BY Resin TypePolyurethane is projected to be the fastest-growing resin type in the European polymer foam market, registering a CAGR of 6.1% during the forecast period, in terms of value.

-

BY Foam TypeIn the European polymer foam market, flexible foam is the fastest-growing foam type, driven by its expanding use in automotive, furniture, and packaging applications due to its lightweight, durable, and energy-absorbing properties.

-

BY End-use IndustryThe building & construction industry led the European polymer foam market in 2024, accounting for a share of 32.1%, in terms of value. The market in this end-use industry is estimated to be USD 8,320.6 million in 2024 and is expected to reach USD 10,665.0 million by 2030, registering a CAGR of 4.2%.

The European polymer foam market is experiencing steady growth, driven by strong demand across automotive, construction, packaging, and furniture industries, alongside increasing emphasis on energy efficiency and sustainability. Major economies such as Germany, France, Italy, the UK, and Poland play a leading role, supported by robust manufacturing bases and advanced chemical production capabilities. The market’s expansion is further encouraged by stringent VOC emission regulations, which are propelling innovation in bio-based and recyclable polymer foams. The European Association of Plastic Recycling and Recovery Organizations (EPRO) continues to strengthen recycling initiatives, enhancing circular economy practices across the region. Germany remains the dominant market in terms of consumption and production, while the UK is projected to record the highest growth rate through 2030, driven by technological advancement and increasing adoption in high-performance end-use applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-use industries in the European polymer foam market is being shaped by accelerated innovation in material science, sustainability requirements, and performance-driven design trends across industrial applications. Growing emphasis on lightweight construction, improved insulation, and recyclability is driving the adoption of advanced polyurethane, polystyrene, polyolefin, and phenolic foams. Developments in low-emission formulations, closed-cell technologies, and circular production methods are reshaping manufacturing practices to meet stringent European environmental standards. End users are increasingly seeking foams that offer enhanced durability, thermal stability, and energy efficiency while supporting low-carbon construction and mobility solutions. At the same time, collaboration among polymer producers, technology developers, and downstream OEMs is expanding new application areas and accelerating the shift toward sustainable, high-performance foam systems. These combined forces are redefining competitive dynamics and creating new opportunities within Europe’s evolving polymer foam ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Strong demand from automotive, construction, and packaging industries

-

•Implementation of energy efficiency and circular economy initiatives

Level

-

•Volatility in raw material and energy prices

-

Environmental concerns related to foam waste and recycling

Level

-

•Increasing adoption of bio-based and CO2-derived polyols

-

Expansion of high-efficiency insulation solutions in construction and data centers

Level

-

•Compliance with evolving EU chemical and environmental regulations

-

Competitive pressure from alternative lightweight materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong demand from automotive, construction, and packaging industries

The European polymer foam market is witnessing strong growth supported by sustained demand from the automotive, construction, and packaging sectors, each driving material innovation and performance requirements. In the automotive industry, polymer foams are essential for achieving lightweighting, thermal management, and noise reduction, enabling manufacturers to meet the European Union’s carbon neutrality and vehicle efficiency targets. The construction sector continues to expand its use of polyurethane, polystyrene, and phenolic foams for insulation, sealing, and energy conservation in both new builds and renovation projects, guided by regulations such as the Energy Performance of Buildings Directive. Meanwhile, the packaging sector is leveraging polymer foams for impact resistance, temperature control, and lightweight transport, particularly in e-commerce and cold-chain applications, where efficiency and recyclability are key priorities. Together, these industries are reshaping the regional foam ecosystem through the adoption of advanced formulations, circular material use, and sustainable design practices, reinforcing polymer foams as foundational materials in Europe’s transition toward energy-efficient and low-emission manufacturing.

Restraint: Volatility in raw material and energy prices

The European polymer foam market remains highly sensitive to fluctuations in raw material and energy prices, a factor that continues to constrain profitability and long-term planning for manufacturers across the region. Most polymer foams, including polyurethane, polystyrene, and polyolefin variants, rely on petrochemical feedstocks such as crude oil, natural gas, and their derivatives, which are subject to global supply disruptions and price instability. The geopolitical landscape, particularly energy supply tensions in Europe, has intensified volatility in production costs, transportation, and utilities, directly influencing the pricing structure of polymer foam products. Rising energy expenses have increased the operational costs of polymerization, extrusion, and foaming processes, while downstream sectors face higher input costs for packaging, construction, and automotive applications. Additionally, the shift toward alternative and bio-based feedstocks, though promising for long-term sustainability, remains limited by scalability, availability, and cost competitiveness relative to conventional sources. This dependence on fluctuating petrochemical markets and high energy inputs creates an uneven cost environment that challenges manufacturers to maintain margins and meet customer expectations in a price-sensitive market. As a result, supply chain optimization, localized production, and energy efficiency measures have become critical strategic priorities for European foam producers seeking to stabilize operations in an increasingly uncertain resource landscape.

Opportunity: Expansion of high-efficiency insulation solutions in construction and data centers

The expansion of high-efficiency insulation solutions across Europe’s construction and data center sectors is creating a major opportunity for the polymer foam market, driven by the region’s increasing focus on energy efficiency and sustainability. In construction, the implementation of the Energy Performance of Buildings Directive and the Renovation Wave Strategy is encouraging the use of advanced polyurethane, polystyrene, and phenolic foams that provide strong insulation, air sealing, and long-term thermal stability to help buildings meet near-zero energy targets. At the same time, the rapid development of data centers across Europe, supported by growth in cloud computing, artificial intelligence, and high-performance computing, is significantly increasing the demand for advanced thermal management materials. Data centers are among the most energy-intensive facilities, with cooling systems accounting for a large share of total power use. Polymer foams are being used to improve insulation in containment structures, raised flooring systems, and cooling units, helping to regulate temperature, reduce heat transfer, and optimize airflow management. As operators work toward carbon-neutral and resource-efficient cooling systems, the use of lightweight and thermally stable foams is helping to lower power usage and enhance system reliability. This alignment between sustainable construction practices and the digital infrastructure boom positions polymer foams as essential materials for improving energy efficiency and reducing emissions across Europe’s built and technological environments.

Challenge: Compliance with evolving EU chemical and environmental regulations

The European polymer foam market faces ongoing challenges in meeting the region’s tightening chemical and environmental regulations, which are reshaping how materials are formulated, manufactured, and distributed. Frameworks such as REACH, the European Green Deal, and the Circular Economy Action Plan are imposing stricter limits on the use of hazardous substances, volatile organic compounds, and high global warming potential blowing agents. These evolving standards require manufacturers to continuously reformulate products to reduce emissions, improve recyclability, and align with extended producer responsibility measures. Compliance demands are also expanding to include carbon footprint reporting, eco-label certifications, and end-of-life recovery obligations, all of which add complexity and cost to operations. For many producers, balancing regulatory conformity with performance consistency and cost efficiency has become increasingly difficult, particularly when transitioning away from legacy chemistries or scaling new bio-based alternatives. At the same time, regulatory divergence among EU member states and the need for continuous testing and certification extend development timelines. While these policies are driving innovation in sustainable and low-emission materials, they present persistent compliance, financial, and supply chain challenges for foam manufacturers operating in the European market.

EUROPE POLYMER FOAM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces flexible elastomeric foams (FEFs) and polyethylene foams for thermal, acoustic, and mechanical insulation in buildings, HVAC, and industrial systems | Reduces energy loss in buildings and pipelines; improves indoor air quality; supports EU energy-efficiency directives (EPBD) |

|

Manufactures high-performance rigid insulation panels using polyurethane (PIR) and phenolic foams for building envelopes, walls, and roofing | Enhances fire safety and thermal performance; lowers building carbon emissions; supports net-zero and BREEAM-certified construction |

|

Develops advanced polyolefin and cross-linked foams (AZOTE and ZOTEK ranges) for automotive, aerospace, healthcare, and packaging applications | Reduces vehicle and aircraft weight; provides consistent insulation and impact resistance; supports circular and low-emission manufacturing |

|

Supplies polyurethane, polystyrene, and phenolic foam insulation materials under brands like ISOVER and Izocam for industrial and residential construction | Provides superior thermal and acoustic insulation; ensures compliance with EU building energy codes; enhances sustainability in construction |

|

Produces flexible polyurethane foams and technical foams for mobility, bedding, and industrial applications, emphasizing recycled and bio-based materials | Promotes recyclability and carbon reduction; improves comfort and durability; supports the EU transition to circular foam production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The European polymer foam market ecosystem is defined by a highly interconnected value chain comprising raw material suppliers, foam manufacturers, distributors, and end users operating across diverse industrial segments. Leading raw material producers such as BASF and Covestro provide essential inputs, including polyols, isocyanates, and additives, that form the foundation of polyurethane, polystyrene, and polyolefin foams. Prominent manufacturers such as Armacell, Kingspan, and Zotefoams transform these materials into specialized foam products for insulation, packaging, mobility, and consumer applications. Distribution partners like Biesterfeld and Distrupol play a critical role in ensuring efficient supply chain operations, offering technical expertise, logistics support, and regulatory compliance across regional markets. The ecosystem is completed by major end users such as Volkswagen, IKEA, and DS Smith, which drive downstream demand through applications in automotive components, furniture, and sustainable packaging solutions. Together, these stakeholders form a dynamic and innovation-driven network that supports Europe’s goals for energy efficiency, material circularity, and low-carbon industrial growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polymer foam market, By End-use Industry

The furniture & bedding segment is expected to record the highest growth rate in the European polymer foam market during the forecast period, supported by increasing consumer demand for comfort, durability, and sustainable materials. Rising awareness of indoor well-being and ergonomic design is driving the adoption of advanced polyurethane and viscoelastic foams in mattresses, cushions, and upholstered furniture across both residential and commercial settings. The segment’s expansion is further fueled by strong replacement demand, growing online furniture sales, and rising investments in high-quality home and hospitality furnishings. In addition, European manufacturers are focusing on low-emission, recyclable, and bio-based foam solutions in line with the European Green Deal and circular economy targets, enhancing both performance and environmental compliance. The trend toward premium, lightweight, and design-oriented products, combined with ongoing urbanization and home renovation activity in major markets such as Germany, France, Italy, and the Nordics, is reinforcing the segment’s position as a major growth driver in Europe’s polymer foam industry.

Polymer foam market, By Resin Type

The polyurethane segment, by resin type, is expected to record the highest CAGR in the European polymer foam market during the forecast period, supported by its adaptability, functional performance, and expanding use across key industrial sectors. Polyurethane foams are widely utilized in automotive, furniture, bedding, construction, and packaging applications for their combination of lightweight structure, cushioning properties, and excellent thermal insulation. Europe’s regulatory emphasis on energy efficiency and carbon reduction has significantly increased demand for rigid polyurethane foams in building insulation, refrigeration, and cold-chain logistics, where they deliver high thermal resistance and energy savings. Flexible polyurethane foams, on the other hand, remain essential in furniture and automotive interiors, offering superior comfort, resilience, and acoustic performance. The regional push toward sustainability is also fostering rapid adoption of bio-based and CO2-derived polyurethane systems, supported by ongoing innovation in green chemistry and compliance with the European Green Deal’s climate targets. Furthermore, advancements in recycling technologies, material circularity, and low-emission formulations are enhancing polyurethane’s environmental profile, consolidating its role as the most technically and economically significant resin type in Europe’s polymer foam industry.

REGION

UK will register the fastest CAGR during the forecast period for the European polymer foam market.

The UK polymer foam market is projected to register the highest growth in Europe during the forecast period, supported by strong demand across automotive, construction, and packaging industries. Rising consumption of polyolefin foams in vehicle manufacturing is a key driver, as automakers increasingly adopt lightweight, impact-resistant materials to enhance fuel efficiency and support the shift toward electric mobility. Growth in food and reusable packaging applications is further contributing to market expansion, reflecting the country’s focus on sustainability and circular material use. UK-based manufacturers, such as Zotefoams plc, are playing a central role in advancing high-performance foam technologies for consumer and industrial applications. Additionally, the increased use of polymer foams in furniture, bedding, insulation, and construction underscores the sector’s alignment with energy efficiency and carbon reduction goals. As the UK continues to prioritize sustainable growth and technological innovation, the demand for advanced polymer foams is expected to accelerate, reinforcing its position as one of the fastest-growing markets in Europe.

EUROPE POLYMER FOAM MARKET: COMPANY EVALUATION MATRIX

In the European polymer foam market, Armacell holds a leading position with its broad portfolio of high-performance foam materials designed for thermal insulation, acoustic control, and energy efficiency. Leveraging its expertise in flexible elastomeric and polyethylene foams, the company serves critical sectors such as construction, HVAC, transportation, and industrial manufacturing. Armacell’s strong research capabilities and focus on sustainable material innovation have established it as a trusted supplier for performance-driven and environmentally responsible insulation solutions. NEVEON (Emerging Leader) is rapidly expanding its presence through advanced foam technologies and a comprehensive approach to circular production. The company specializes in flexible and technical foams that cater to mobility, furniture, and construction markets, emphasizing recyclability, digital process optimization, and resource efficiency. By integrating material innovation with sustainability initiatives, NEVEON is reinforcing its position as a next-generation player in Europe’s polymer foam industry, contributing to the region’s goals for energy-efficient, low-emission, and high-performance material development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ARMACELL (Luxembourg)

- Kingspan Insulation, LLC (Ireland)

- Zotefoams plc (UK)

- Saint-Gobain (France)

- NEVEON Holding GmbH (Austria)

- Vita (Holdings) Limited (UK)

- Trocellen (Germany)

- LaPur GmbH (Germany)

- MEGAFLEX Schaumstoff GmbH (Germany)

- Safas (Turkey)

- Organika S.A. (Poland)

- Ikano Industry (Poland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 24.96 BN |

| Market Forecast in 2030 | USD 34.18 BN |

| CAGR (2024–2030) | 5.1% |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the polymer foam market based on resin type, foam type, end-use industry, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles polymer foam manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Resin Type (Polyurethane, Polystyrene, Polyolefin, Phenolic, Other Resin Types) |

| Regional Scope | Italy, Spain, Germany, France, UK, Russia, Turkey, Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE POLYMER FOAM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive Manufacturers | Conduct comparative benchmarking of polymer foams based on weight reduction, thermal insulation, acoustic damping, and recyclability | Enables OEMs to select optimal foam materials for fuel-efficient and electric vehicle applications, ensuring compliance with EU sustainability targets |

| Construction & Insulation Companies | Provide in-depth analysis of foam performance in building insulation under EU energy efficiency and fire safety regulations | Helps manufacturers and builders meet EPBD and eco-design standards while improving energy savings and occupant safety |

| Furniture & Bedding Manufacturers | Evaluate comfort, density, and emission performance of flexible polyurethane foams for furniture and mattress applications | Enhances product comfort, durability, and environmental compliance for sustainable furniture design |

| Packaging & Logistics Companies | Conduct comparative cost-performance analysis of foam packaging solutions, including expanded and extruded polystyrene | Improves packaging sustainability, durability, and recyclability for e-commerce and temperature-controlled logistics |

| Data Center & Electronics Cooling System Providers | Analyze the role of polymer foams in thermal insulation, vibration control, and cooling system containment | Enhances data center energy efficiency and system reliability while supporting low PUE (Power Usage Effectiveness) targets |

| Regulatory & Sustainability Teams | Develop sustainability benchmarking and carbon accounting frameworks for foam production | Ensures compliance with the European Green Deal, REACH, and Circular Economy Action Plan objectives |

RECENT DEVELOPMENTS

- September 2024 : Armacell is investing in expanding ArmaGel XG production capacity in Pune (India), next to one of its largest and advanced plants worldwide. The company announced that this new manufacturing facility will reinforce the company’s aerogel capacity by adding 1 million square metres per annum to meet the rapidly increasing demand for aerogel-based insulation.

- May 2024 : Zotefoams signed a Global Alliance Agreement with Suzhou Shincell New Materials Co., Ltd. This agreement involves sharing Shincell’s technology, collaborating on product developments related to the foaming industry, and jointly marketing Shincell’s products alongside Zotefoams’ offerings. By adding Shincell’s technologies, Zotefoams can create a broader range of products, enter new markets, and develop improved future products.

- February 2024 : Saint-Gobain acquired CSR Limited, a leading Australian building products company, for USD 5.92 per share, totaling 2.96 billion. This acquisition strengthens Saint-Gobain's position in the construction industry, particularly in Australia and the Asia Pacific region. With CSR's portfolio of building products and its emphasis on light and sustainable construction, Saint-Gobain gains access to a broader customer base and enhances its ability to offer comprehensive solutions, including insulation products.

Table of Contents

Methodology

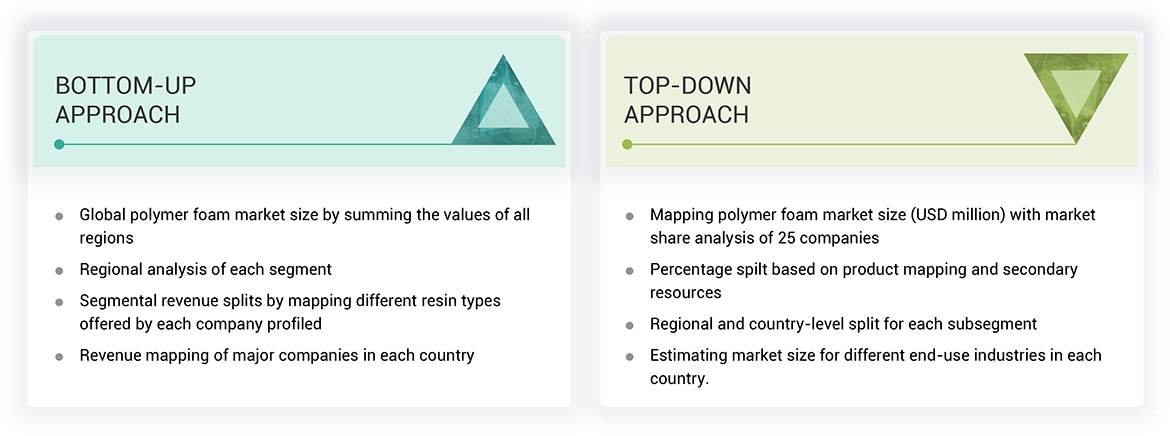

The study involved four major activities in estimating the current size of the Europe polymer foam market—exhaustive secondary research collected information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the europe polymer foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; europe polymer foam manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain critical information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The Europe polymer foam market comprises several stakeholders, such as raw material suppliers, technology support providers, manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the Europe polymer foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Europe polymer foam market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the Europe polymer foam market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for critical insights, both quantitative and qualitative

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the europe polymer foam sector.

Europe polymer foams are made of polymers, blowing agents, and additives. They are produced using different processing methods, such as slab-stock by pouring, extrusion, and other molding forms. They are used in various industries, such as packaging, furniture and bedding, building and construction, and automotive. These foams are classified based on their structures as closed and open cells. Closed-cell foam is rigid, whereas open-cell foam is flexible.

Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of polymer foam

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of the Europe polymer foam market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the Europe polymer foam market based on foam type, resin type, end-use industry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements, and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Polymer Foam Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Polymer Foam Market