Europe Rodenticides Market

Europe Rodenticides Market by Type (Chemical, Mechanical, Biological, Software & Services), Mode of Application (Pellets, Spray, Powder), End Use (Agriculture, Warehouses, Urban Centers), and Rodent Type - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The European rodenticides market is expected to grow from USD 1.57 billion in 2025 to USD 2.10 billion by 2030, at a compound annual growth rate (CAGR) of 6.0% during the forecast period. The market's growth is mainly driven by increasing instances of rodent infestation in urban centers with a heavy population, expansion of food processing and storage infrastructure, and strict enforcement of hygiene and safety requirements in the commercial, industrial, and public health sectors.

KEY TAKEAWAYS

-

BY COUNTRYFrance dominated the European rodenticides market, with a 37.7% share in 2024.

-

BY TYPEBy type, the software & services segment is expected to register the highest CAGR of 6.5%.

-

BY MODE OF APPLICATIONBy mode of application, the spray segment is projected to grow at the highest rate of 5.6% from 2025 to 2030.

-

BY END USEBy end use, the urban centers segment will grow the fastest during the forecast period.

-

BY RODENT TYPEBy rodent type, the mice segment is expected to dominate the market.

-

COMPETITIVE LANDSCAPE - Key PlayersBASF SE, Syngenta, Rentokil Initial plc, and Anticimex were identified as Star players in the European rodenticides market, as they have focused on innovation, have broad industry coverage, and possess strong operational & financial strength.

-

COMPETITIVE LANDSCAPE - Startups/SMEsFutura GmbH, Bell Labs, and Neogen Corporation have distinguished themselves among startups and SMEs due to their strong product portfolios and business strategies.

The European rodenticides market is driven by rapid urbanization, climate change, and the expansion of food processing and storage facilities. With an increasingly health-conscious general public and growing concern about diseases transmitted by rodents, like leptospirosis, hantavirus, and salmonellosis, there has been an acceleration in the uptake of effective rodent control solutions. Strict hygiene and safety regulations in industries such as food manufacturers, pharmaceutical companies, and the hospitality sector are pushing for businesses to adopt integrated rodent management programs

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers’ businesses. These shifts influence the revenues of end users. As a result, the revenue impact on end users is likely to affect the earnings of European rodenticide manufacturers and rodent control service providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Food safety and export compliance requirements

-

Rising pest pressure linked to climate change

Level

-

Tightening EU regulation of anticoagulant rodenticides

-

Environmental & wildlife exposure concerns

Level

-

Non-chemical & integrated solutions

-

Scale-up of digital monitoring and IoT-enabled service models

Level

-

Increase in resistance to conventional rodenticides

-

Inconsistent performance of alternative approaches

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Food safety and export compliance requirements

In Europe, strict food safety standards and export compliance requirements are major drivers of the rodenticides market. Rodent control measures have gained more significance than before among agricultural, food processing, and storage companies in their investment activities geared towards better prevention of contamination, compliance with regulations, and access to markets-the entries into international markets. Some products that need certification, such as ISO 22000, BRC, and other EU food safety directives, have been used to boost demand for reliable and approved rodenticide products, especially those with an eco-friendly and non-anticoagulant standard.

Restraint: Tightening EU regulation of anticoagulant rodenticides

The tightening of EU regulations on anticoagulant rodenticides is significantly restraining the European rodenticides market. Greater Biocidal Products Regulation (BPR) requirements that not only include restrictions on the active ingredients of such products but also on applications and environmental safety standards drastically reduced the amount of commonly and widely used anticoagulants. Companies have been burdened with compliance costs, resultantly affecting the availability of products and creating barriers for conventional formulations of rodenticides, hence the slowdown in market growth and the shift towards alternative non-anticoagulant and integrated pest management options.

Opportunity: Non-chemical & integrated solutions

The increasing demand for non-chemical integrated rodent control methods provides a major opportunity for the European continent. Around the continent, the laws governing the use of anticoagulant rodenticides are becoming stringent, and consumers are veering towards eco-friendly alternatives. Such questions have queued up many companies to invest in mechanical traps, biological agents, fertility control products, and smart monitoring systems. Integrated pest management (IPM) strategies that utilize preventive measures, digital monitoring, and selective rodenticides would offer safer, more sustainable, and more effective means of rodent control, thereby opening new opportunities for market expansion within urban, industrial, and agricultural sectors.

Challenge: Increase in resistance to conventional rodenticides

The increasing resistance of rodents to traditional anticoagulant rodenticides presents a significant challenge in the European market. Continuous exposure to active ingredients commonly used has given rise to resistant populations of rats and mice which reduce the effectiveness of the ordinary chemical baits. This not only forces the industry to reformulate their products or give higher-dose options but also causes added costs for the consumers who would use the products. This makes it necessary to introduce various new and integrated modality pest control approaches for the management of resistant rodent populations.

EUROPE RODENTICIDES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies professional rodenticides used in factories and warehouses to control rats and mice and prevent contamination of raw materials and finished food products | Ensures EU food safety compliance, reduces recall risk, and maintains high hygiene standards |

|

Provides rodenticide solutions used on dairy farms and storage facilities to protect feed, milk storage, and processing infrastructure from rodent activity | Protects product quality, reduces infrastructure damage, and supports regulatory compliance in the dairy value chain. |

|

Delivers rodenticide-based pest management services for retail stores and logistics hubs as part of integrated pest management (IPM) programs | Minimizes health risks, safeguards brand reputation, and ensures adherence to strict European hygiene regulations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the leading companies in this market include well-established and financially strong manufacturers and service providers for rodent control. These companies have been operating for over a decade, possess diversified portfolios, utilize the latest technologies, and have excellent global sales and marketing networks. Notable companies in this market include BASF SE (Germany), Syngenta Group (Switzerland), Anticimex (Sweden), and Rentokil Initial plc (UK).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Rodenticides Market, By Type

The type segment include chemical, biological, and mechanical ones, as well as software and services. Chemical rodenticides account for the largest market share in Europe as for type segment of the rodenticides market. These are broadly used in agriculture, food processing, storage, and urban areas to control rat and mouse populations, yielding reliable outcomes while meeting regulatory standards. Multinational corporations such as BASF, PelGar International, and Syngenta maintain their leadership position in this segment by offering diverse anticoagulant and non-anticoagulant rodenticides tailored for the European market.

Europe Rodenticides Market, By Mode of Application

The mode of application segment includes pellets, spray, and powder. Due to the ease of handling, longer shelf life, and possibility of use indoors as well as outdoors, pellets are the dominant form in the European rodenticides market. Since they have been formulated to withstand weathering, their effectiveness lasts longer in the harshest environments such as farms, warehouses, and industrial sites. For agricultural and pest control works in urbanized areas, pellet bait is preferred because of efficient delimitation for placement, reduced waste, and acceptance by rodents, which leads to reliable population control.

Europe Rodenticides Market, By End Use

The end-use segment comprises agricultural fields, warehouses, and urban centers. Urban centers constitute the largest market sector for rodenticides in Europe, with rodent population densities, decaying infrastructure, and growing public health risks traversing the densely populated cities. Municipalities, commercial buildings, transport systems, and residential blocks rely heavily on rodent control solutions for property damage prevention, disease transmission, and food contamination. With the sweeping growth of cities and waste generation over recent years, the demand for sustainable and advanced rodent management increases across Europe.

Europe Rodenticides Market, By Rodent Type

The rodent type segment includes rats, mice, chipmunks, hamsters, and other rodents. Mice have the largest share in this rodent type segment of the European rodenticides market because of their rapid reproduction, habit of living inside human structures, and increasingly serious infestations into residential, commercial, and industrial places. The small size of these animals, along with their nesting habits, make them difficult to monitor and control, and this leads to more demand for rapid detection and effective baiting solutions.

REGION

France is expected to be the fastest-growing country in the European rodenticides market during the forecast period

France is the fastest-growing country in the European rodenticides market, driven by the intense rodent infestation problems that have been witnessed in metropolitan cities like Paris, Marseille, Lyon, or Lille. This is because the extensive market strength of the country concerning professional pest control services is inclusive of commercial, residential, and municipal services offered to the population. With growing food processing and logistics-cold storage facilities as well as national and EU regulations on hygiene, food safety, and environmental quality standards, this demand will keep increasing in the future for effective rodent control solutions.

EUROPE RODENTICIDES MARKET: COMPANY EVALUATION MATRIX

In the European rodenticides market matrix, BASF SE (Star) leads the market with its comprehensive portfolio of anticoagulant and non-anticoagulant products, which are widely adopted across commercial, residential, and agricultural applications. PelGar International (Emerging Leader), meanwhile, is emerging as a strong player by expanding its range through its focus on developing high-efficacy formulations such as brodifacoum and difenacoum-based products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF SE (Germany)

- Rentokil Initital plc (UK)

- Syngenta (Switzerland)

- Rollins, Inc. (US)

- Ecolab (US)

- PelGar International (UK)

- Impex Europa S.L. (Spain)

- Futura GmbH (Germany)

- Anticimex (Sweden)

- Pelsis Group (UK)

- Environmental Science U.S. LLC (US)

- Liphatech, Inc. (US)

- Colkim srl (Italy)

- Bell Labs (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.57 Billion |

| Market Forecast in 2030 (Value) | USD 2.10 Billion |

| Growth Rate | CAGR of 6.0% during 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (KT) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | France, Germany, Spain, Italy, UK, Netherlands, Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE RODENTICIDES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Rodenticide Manufacturers |

|

|

| European Pest Control Service Providers |

|

|

| European Agriculture Cooperatives & Food Storage Operators |

|

Quantified economic loss reduction & compliance benefits under EU food-safety mandates (HACCP, ISO 22000) |

RECENT DEVELOPMENTS

- May 2023: Syngenta launched TALON GT Pro Rodenticide Grain Bait Block, a high-quality extruded block that kills rats and mice in a single feed, suitable for homes, as well as agricultural, commercial, and industrial buildings.

- May 2023: Liphatech launched TakeDown II, small blocks with the active component bromethalin, which produce faster results than anticoagulant rodenticides.

- May 2022: Rentokil Pest Control introduced the Internal Dual Autogate (IDAG) system, an intelligent rodent control monitoring system for internal settings.

- November 2021: Bell Laboratories introduced four new iQ rodent monitoring devices powered by Bell Sensing Technologies.

- November 2020: BASF SE (US) launched Selontra rodent bait in Europe.

Table of Contents

Methodology

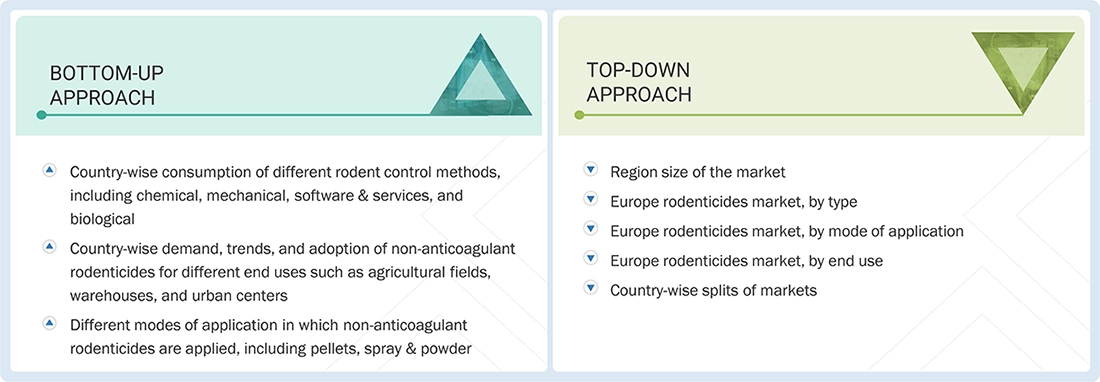

The study involved four major activities in estimating the current size of the Europe Rodenticides Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Europe Rodenticides Market .

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Europe Rodenticides Market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

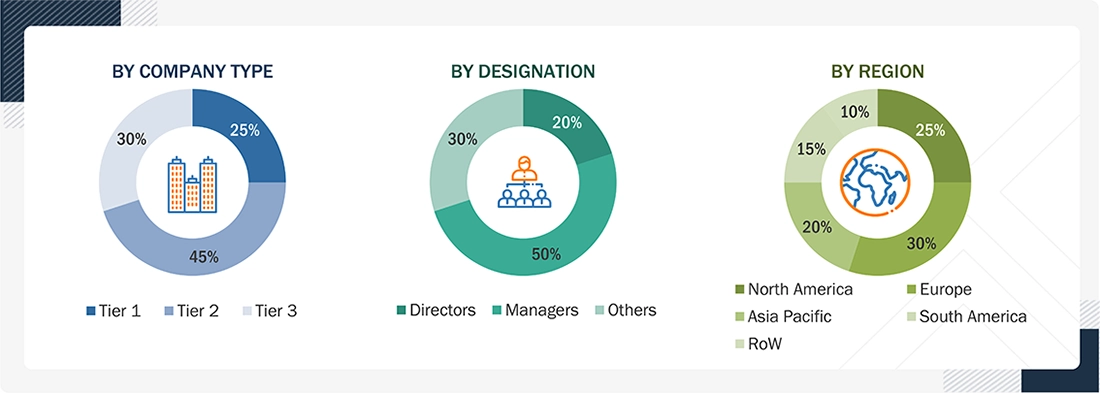

Extensive primary research was conducted after obtaining information regarding the Europe Rodenticides Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across Europe. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, mode of application, end use, rodent types, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Europe Rodenticides Market . These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the Europe Rodenticides Market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Europe Rodenticides Market :Top-Down and Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall Europe Rodenticides Market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the National Pesticide Information Center (US), ‘Rodenticides are pesticides that kill mice and rats.’ Even though rodents play an important role in nature, they are increasingly required to be controlled, as they damage crops, transmit diseases, and in some cases, cause ecological damage. Rodenticides are formulated as baits, which are designed to attract rodents.

Key Stakeholders

- Rodenticide manufacturers and suppliers

- Traders, distributors, and retailers of pest control products

- Farmers, warehouse owners, and logistics providers

- Government and private research organizations

- Public hygiene organizations, government regulatory institutions, and food safety agencies

- Pest control companies and users of pest control services

-

Associations and industry bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- British Pest Control Association

- National Pest Management Association (NPMA)

- National Pest Technicians Association

- Confederation of Europe Pest Management Association (CEPA)

-

Venture capitalists and investors

- Organization for Economic Co-operation and Development (OECD)

Report Objectives

Market Intelligence

- Determining and projecting the size of the Europe Rodenticides Market with respect to type, mode of application, end use, rodent types, and region.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework and market entry process related to the Europe Rodenticides Market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the Europe Rodenticides Market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the country

- Providing insights on key product innovations and investments in the Europe Rodenticides Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Greece and Ukraine.

- Further breakdown of the Rest of Asia Pacific into New Zealand and Vietnam.

- Further breakdown of the Rest of South America into Argentina, Paraguay, and Peru.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Rodenticides Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Rodenticides Market