Europe High-Torque Synchronous Motor Market Size, Share & Trends

Europe High-Torque Synchronous Motor Market for Marine by Application (Propulsion, Auxiliary Systems, Deck Machinery), Vessel Type (Yachts, Ferries, Containers, Bulk Carriers, Tankers, Corvettes, Submarines), Torque and Power - Regional Forecast to 2030

OVERVIEW

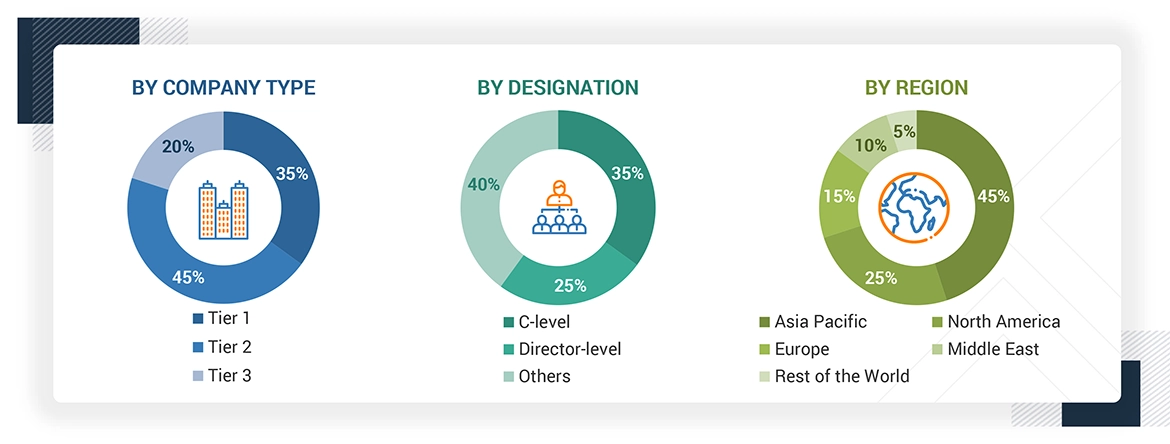

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe High-Torque Synchronous Motors Market is projected to grow from USD 0.79 billion in 2025 to USD 1.17 billion by 2030 at a CAGR of 8.1%. The market is driven by factors such as the rising demand for energy-efficient propulsion and machinery systems and the shift toward low-emission marine and industrial operations.

KEY TAKEAWAYS

- The Netherlands is expected to account for a share of 14.9% of the Europe high-torque synchronous motors market in 2025.

- By vessel type, the commercial vessels segment shows the strongest growth trajectory, expanding at a CAGR of 8.3%.

- By torque, the 500–3,000 Nm segment is set to grow at the fastest pace, registering a CAGR of 8.4%.

- By power, the >800 kW category remains the most influential, contributing the largest share to the market during the forecast period.

- ABB, NIDEC Corporation, and WEG were identified as some of the star players in the Europe high-torque synchronous motors market, given their strong market share and product footprint.

- YASA Limited, Baumuller, and Innomotics, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Europe high torque synchronous motors industry outlook is strong, driven by industrial automation, marine trade, and vessel modernization. Advances in efficiency, torque performance, and integration with AI systems will boost scalability and resilience, ensuring wider adoption through 2030.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe high torque synchronous motors market is transitioning from traditional revenue streams to new sources. Key drivers include retrofits, AI-driven automation, and high torque synchronous motor solutions for autonomous vessels. These shifts enhance efficiency, compliance, and resilience in maritime operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing number of megaships due to expanding global trade

-

Increasing marine passengers and tourism

Level

-

High manufacturing cost

-

Market cyclicality in shipbuilding industry

Level

-

Upcoming autonomous and remotely operated vessels

-

Electrification of auxiliary systems

Level

-

Global supply chain disruptions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing number of megaships due to expanding global trade

Expanding global trade and rising container volumes are driving demand for larger vessels in Europe. These ships require high-torque synchronous motors to handle heavy loads efficiently and reduce port handling times. The shift toward energy-efficient, high-torque solutions supports sustainable operations and lower costs for shipowners.

Restraint: Market cyclicality in shipbuilding industry

The shipbuilding industry’s cyclical nature, driven by fluctuating trade volumes and economic downturns, impacts market demand. During slowdowns, ship orders decline, reducing the need for high-cost motors and delaying fleet modernization. This volatility can cause demand swings of up to 30% between boom-and-bust cycles.

Opportunity: Upcoming autonomous and remotely operated vessels

The rise of autonomous and remotely operated vessels is driving strong demand for high-torque synchronous motors in Europe. These vessels require precise propulsion, energy efficiency, and reliable torque for unmanned operations.

Challenge: Global supply chain disruptions

Delays in critical components like bearings and control systems hinder vessel construction and retrofitting timelines. Rising freight costs and shortages further squeeze margins, reducing competitiveness for European high torque synchronous motor manufacturers.

Europe high-torque synchronous motor market for marine: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Retrofit of ferries with hybrid-electric propulsion using HTSMs, batteries, and frequency drives demand for efficient port and voyage operations. | Delivered 15–20% fuel savings, EU Stage V compliance, reduced emissions, and set a benchmark in eco-friendly maritime operations |

|

Upgrade of German Navy supports ships with HTSMs, VFDs, and digital control systems for winches, cranes, and deck handling. | Reduced deck machinery energy use by 25%, cut maintenance by 30%, enabled quieter operations, and extended equipment lifecycle |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe high torque synchronous motors ecosystem comprises leading manufacturers, such as ABB, VEM, Nidec, Danfoss, SEW-Eurodrive, and others delivering advanced motor solutions. It integrates motor design, components, and drive technologies to ensure high performance, efficiency, and reliability across industrial and marine applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe High Torque Synchronous Motors Market, By Torque

Motors above 3,000 Nm dominate the EU market, driven by demand from large commercial vessels and heavy-duty deck equipment. High torque ensures efficient propulsion, load handling, and compliance with maritime efficiency standards.

Europe High Torque Synchronous Motors Market, By Power

Motors above 800 kW are the largest power segment, supporting propulsion and deck machinery in mega ships. Their ability to deliver reliable high output makes them critical for modernization of European fleets.

Europe High Torque Synchronous Motors Market, By Application

Deck machinery dominates segment due to its reliance on high-torque motors for cranes, winches, and handling systems. These applications require constant efficiency upgrades to reduce energy use and maintenance costs.

Europe High Torque Synchronous Motors Market, By Vessel Type

Commercial vessels dominate the market, driven by container ship expansion and offshore trade growth. Fleet operators invest in high torque synchronous motors solutions to enhance propulsion reliability and operational sustainability.

REGION

Denmark to be fastest-growing country in Europe high torque synchronous motors market during forecast period

Denmark is projected to be the fastest-growing country in the Europe high torque synchronous motors market, driven by industrial adoption and supportive efficiency regulations. Robust demand for high-performance motors across marine and industrial sectors reinforces Denmark's role as a key growth hub in the region.

Europe high-torque synchronous motor market for marine: COMPANY EVALUATION MATRIX

The company evaluation matrix categorizes companies into Stars, Emerging Leaders, Pervasive Players, and Participants based on market strategy and product footprint. They include leaders with strong innovation and market presence while showing growth opportunities for smaller players. This framework helps assess competitiveness and future potential in the high torque synchronous motors market ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top EU HTSM Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.79 Billion |

| Market Forecast in 2030 (Value) | USD 1.17 Billion |

| Growth Rate | CAGR of 8.1% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Europe |

WHAT IS IN IT FOR YOU: Europe high-torque synchronous motor market for marine REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- May 2025 : ZOLLERN GMBH & CO. KG introduced a new synchronous motor perfectly suited for harsh environments, such as construction, recycling, industrial, or offshore applications.

- March 2024 : Innomotics GmbH and Danfoss Drives A/S announced the next phase of their strategic, non-exclusive partnership at the HANNOVER MESSE. This partnership aimed to offer customers comprehensive motor and drive solutions by bundling Innomotics' low-voltage motors with Danfoss' low-voltage drives.

- September 2024 : WEG S.A. signed an agreement with Volt Electric Motors, a Turkish manufacturer specializing in industrial and commercial electric motors.

Table of Contents

Methodology

The research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect useful information on the Europe high-torque synchronous motor market for marine. Secondary sources for this research study included the aviation library and product brochures of leading high-torque synchronous motor providers. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the Europe high-torque synchronous motor market for marine. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the Europe high-torque synchronous motor market for marine was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources referred to for this research study include corporate filings such as annual reports, investor presentations, financial statements, and trade, business, and professional associations. The secondary data were collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Europe high-torque synchronous motor market for marine through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and the Rest of the World to obtain qualitative and quantitative information on the market. This primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the trends related to torque, power, application, and vessel type.

Note: The tiers of companies have been defined based on their total revenue as of 2024. Tier 1 = >USD 1 billion; Tier 2 = between USD 100 million and USD 1 billion; and Tier 3 = USD 100 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the size of the Europe high-torque synchronous motor market for marine.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Europe High-torque Synchronous Motor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Europe high-torque synchronous motor market for marine from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures have been used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using top-down and bottom-up approaches.

Market Definition

The Europe high-torque synchronous motor market for marine refers to the analysis of the high-torque synchronous motor market for commercial and military marine vessels across the following European countries: France, Germany, Italy, Netherlands, Norway, Spain, UK, Sweden, Denmark, and Finland. With a focus on motors exhibiting torque and power specifications as per the segmentation mentioned, the report delves into the onboard application of these motors in various marine systems. These applications include propulsion, auxiliary systems, deck machinery, pumps & compressors, automation & control systems, and steering gear systems. This study describes current market trends, along with customer and competitive insights. It aims to equip stakeholders with actionable insights and strategic guidance tailored to the evolving dynamics of the Europe high-torque synchronous motor market for marine.

Key Stakeholders

- OEMs

- Marine System Integrators & Propulsion Providers

- Shipbuilders & Marine Yards

- Defense Ministries & Naval Forces

- Commercial Vessel Owners & Operators

- Port & Harbor Authorities

- Technology R&D Institutions

- Regulatory Bodies & Policy Stakeholders

- Investors

- Government Authorities

Report Objectives

- To define, describe, and forecast the size of the Europe high-torque synchronous motor market for marine by torque, power, application, and vessel type from 2025 to 2030

- To forecast the size of market segments with respect to major countries, including France, Germany, Italy, Netherlands, Norway, Spain, UK, Sweden, Denmark, and Finland

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the growth trends, prospects, and their contribution to the global market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as acquisitions, agreements, contracts, partnerships, product launches, and R&D activities in the Europe high-torque synchronous motor market for marine

- To provide a detailed competitive landscape of the market, as well as an analysis of business and corporate strategies adopted by leading market players

Available customizations:

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the other regional level

Company Information

- Detailed analysis and profiling of up to five additional players

Key Questions Addressed by the Report

What is the current size of the Europe high-torque synchronous motor market for marine?

In terms of value, the Europe high-torque synchronous motor market for marine is estimated at USD 790.9 million in 2025.

Who are the winners in the Europe high-torque synchronous motor market for marine?

The winners in the Europe high-torque synchronous motor market for marine are ABB (Switzerland), Nidec Corporation (France), WEG (Brazil), Danfoss (Denmark), and VEM GmbH (Germany).

What are the factors driving the market?

Key driving factors include: Rise of mega-ships due to expanding global trade, Increasing marine passenger and tourism, Strategic fleet renewal

Which country is estimated to hold the largest share of the Europe high-torque synchronous motor market for marine in 2025?

The Netherlands is estimated to hold the largest share of 15% of the Europe high-torque synchronous motor market for marine in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe High-Torque Synchronous Motor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe High-Torque Synchronous Motor Market