EVA Films Market

EVA Films Market By Type (Standard EVA Film, Anti-PID EVA Films), Production Method (Extrusion, Casting), Application (Solar Panel Encapsulation, Lamination, Heat Seal), End-Use Industry (Renewable Energy, Packaging, Automotive) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

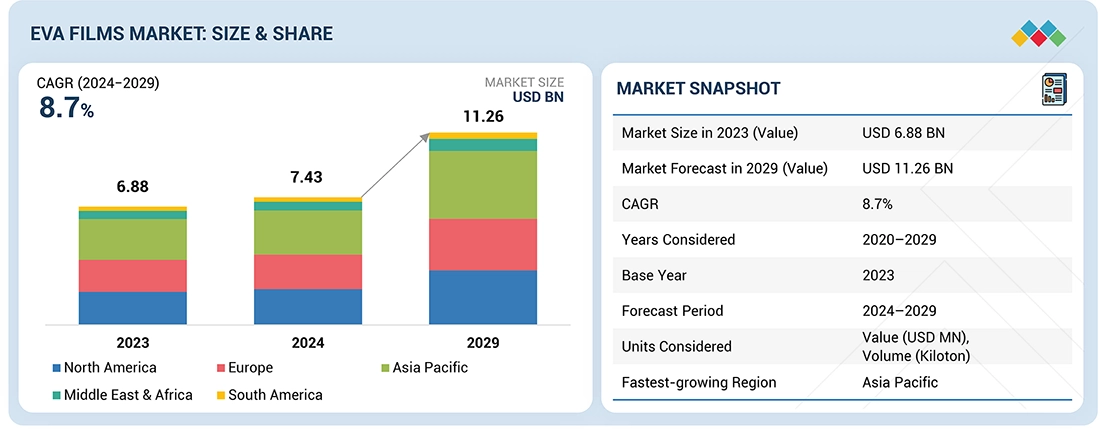

The EVA films market is projected to grow from USD 7.43 billion in 2024 to USD 11.26 billion by 2029, at a CAGR of 8.7% during the forecast period. EVA films are polymeric materials used for their durability, flexibility, and good adhesion. These films are heavily applied in sectors like solar energy (photovoltaic encapsulation), automotive, packaging, and electronics. Major drivers of the EVA films market include the rising demand for solar energy solutions, rising applications for laminated glass and safety glazing, and growing applications for flexible packaging. Also, technological innovation in film manufacturing, growing demand for environmentally friendly materials, and rising construction activities further drive the market growth

KEY TAKEAWAYS

-

BY TYPEThe EVA films market comprises standard EVA films, rapid curing EVA films, anti-PID EVA films, and ultra-transparent EVA films. Standard EVA films are widely used for general applications due to their cost-effectiveness and versatility, driven by demand in packaging and basic lamination. Rapid curing EVA films are gaining traction in high-speed manufacturing processes, propelled by efficiency needs in automotive and construction sectors. Anti-PID EVA films address potential induced degradation in solar modules, driven by the expansion of renewable energy and stringent performance standards in PV installations. Ultra-transparent EVA films enhance optical clarity, fueled by growth in high-end applications like advanced solar panels and architectural glass.

-

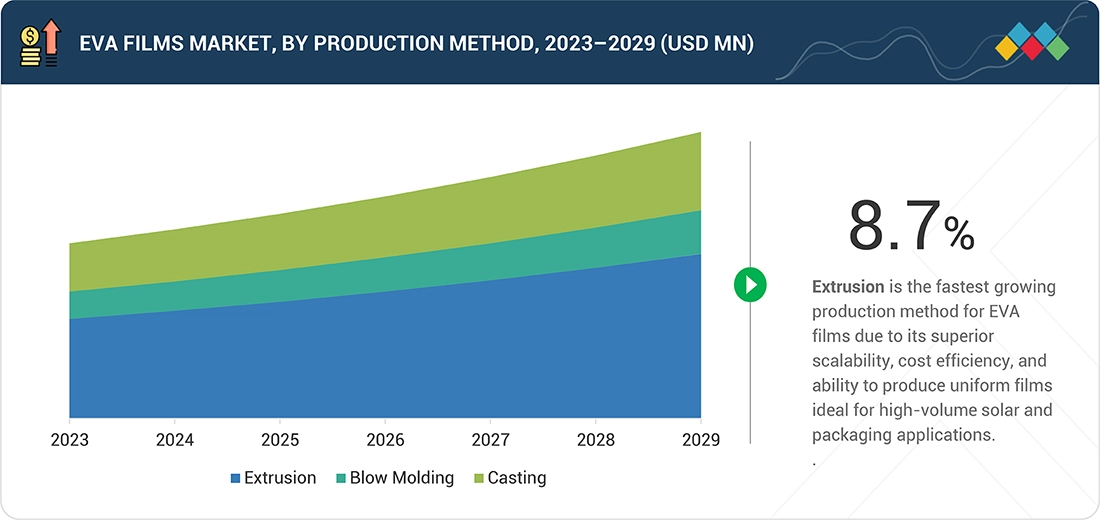

BY PRODUCTION METHODKey production methods for EVA films include extrusion, blow molding, and casting. Extrusion is the dominant method for producing thin films, driven by its scalability and cost-efficiency in large-volume solar and packaging applications. Blow molding supports the creation of tubular films, motivated by demand for flexible packaging in food and pharmaceuticals. Casting is preferred for high-quality, uniform films, propelled by precision requirements in lamination and heat-seal processes for automotive and construction industries.

-

BY APPLICATIONKey applications of EVA films span printing, solar panel encapsulation, lamination, heat seal, and thermo welding. Solar panel encapsulation is the largest segment, driven by global renewable energy initiatives and increasing solar PV installations. Lamination benefits from EVA's adhesion properties, fueled by growth in laminated glass for construction and automotive safety. Heat seal and thermo welding are propelled by packaging innovations for moisture and oxygen barriers in food preservation. Printing applications are driven by demand for flexible, durable substrates in graphics and labels.

-

BY END-USE INDUSTRYThe EVA films market serves renewable energy, packaging, automotive, construction, and others. Renewable energy is the leading industry, driven by the surge in solar power adoption and government incentives for clean energy. Packaging grows due to e-commerce expansion and sustainable material preferences. Automotive applications are motivated by lightweighting and safety enhancements in interiors and glazing. Construction is propelled by demand for energy-efficient building materials like insulated glass. Other industries include electronics and agriculture, driven by protective and encapsulant needs.

-

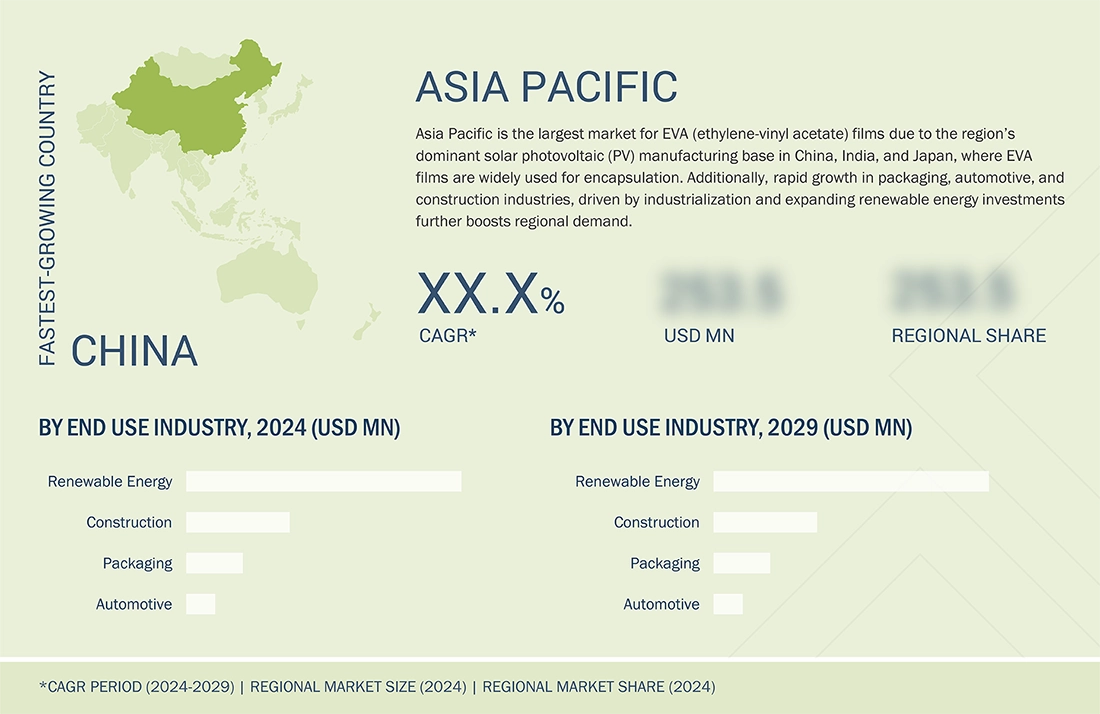

BY REGIONThe EVA films market covers Asia Pacific, North America, Europe, South America, Middle East & Africa, and others. Asia Pacific is the largest market, driven by manufacturing hubs in China and India, rapid solar energy deployment, and packaging industry growth. North America benefits from technological innovations and automotive advancements. Europe emphasizes sustainability and regulatory compliance in renewable applications. Emerging regions like South America and Middle East & Africa are propelled by infrastructure development and energy transitions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance,H.B. Fuller Company (US), 3M (US), JA SOLAR Technology Co., Ltd. (China) have entered into a number of agreements and partnerships driven by the need to meet rising solar PV requirements and sustainability goals in the EVA films sector.

The EVA (ethylene-vinyl acetate) films market is driven by rising demand from solar photovoltaic, packaging, and construction industries. These films offer superior flexibility, adhesion, and optical clarity, making them ideal for solar panel encapsulation, laminated safety glass, and flexible packaging. Growth is further fueled by the global shift toward renewable energy and lightweight, sustainable materials. Asia Pacific dominates the market, led by China’s strong solar manufacturing base and expanding industrial activity. Ongoing advancements in extrusion technology and UV-resistant formulations are enhancing performance, durability, and efficiency, positioning EVA films as a key material in high-performance and eco-friendly applications.

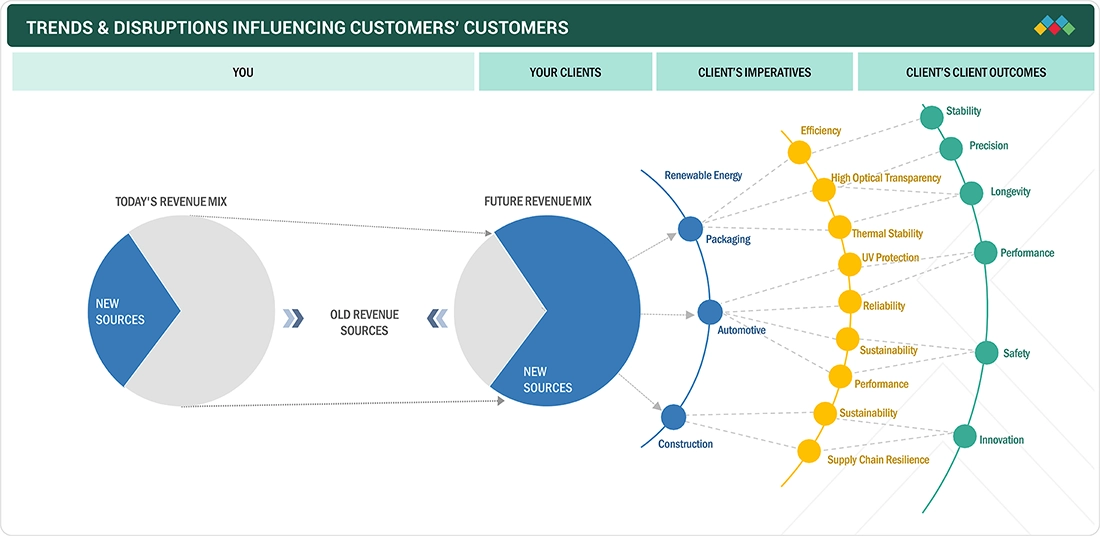

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The EVA films market is witnessing trends like increasing adoption in solar photovoltaic modules, flexible packaging, and automotive applications due to superior durability, adhesion, and UV resistance. Sustainability is reshaping the market, with manufacturers developing recyclable and bio-based EVA formulations. Technological disruptions include advanced extrusion techniques enabling uniform, high-quality films and innovations in anti-yellowing and high-temperature resistant grades. Rapid growth in Asia Pacific, especially China and India, is driving competitive pricing and large-scale production. Additionally, integration of digital process controls and automation is improving efficiency. However, raw material price volatility and competition from alternative encapsulants like PVB or TPO pose challenges.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Improved bond strength in lamination, better impact resistance, and a wider service temperature range.

-

Growth of solar energy industry driving demand for EVA films in solar panels

Level

-

Competition from other materials such as polyolefin, thermoplastic polyurethanes (TPUs), and other polymer films with similar properties.

Level

-

Development of eco-friendly and biodegradable EVA film solutions.

-

Emerging application in agriculture, particularly in greenhouse coverings and agricultural mulch films.

Level

-

EVA films tend to turn yellow or black after extended exposure to sunlight due to UV degradation

-

Limited recyclability of EVA films poses environmental challenges.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of solar energy industry driving demand for EVA films in solar panels

The rapid growth of the solar power industry has accelerated the demand for EVA films, a key material used in photovoltaic (PV) module production. With the world turning toward renewable energy to combat climate change and lower the reliance on fossil fuels, solar power has become a top choice because it is sustainable, scalable, and decreasing in cost. Governments around the world are enforcing policies, subsidies, and incentives to promote solar power uptake, resulting in explosive growth in the installation of solar panels. The increased demand for solar panels in turn drives the need for EVA films, which is a critical encapsulant material in PV modules that prevents solar cells from degradation by the environment and adds durability and efficiency. EVA films are also vital to the durability and functionality of solar panels since they ensure the best adhesion, optical clarity, and UV and moisture resistance. They ensure maximum light transmission while sustaining their structure in the worst environmental conditions, which is why they are not only valuable but essential in the solar market. With the improving efficiency of solar modules, EVA films are being continuously developed by manufacturers to offer enhanced thermal stability, better cross-linking properties, and reduced degradation rates, increasing demand further.

Restraint: Competition from other materials such as polyolefin, thermoplastic polyurethanes (TPUs), and other polymer films with similar properties.

EVA films have been extensively utilized in many industries, most particularly in solar panel encapsulation, laminated glass, and packaging. However, increased competition from other materials, especially polyolefin elastomer (POE), is severely inhibiting the demand for EVA films. The main cause of this transformation is the improved performance properties provided by POE in some applications, most notably in the photovoltaic (PV) market. POE shows superior resistance to potential-induced degradation (PID), thus increasing the life and efficiency of solar panels. This has earned POE popularity as a solar manufacturer’s best choice to boost the lifespan and performance of solar products. POE films also offer higher transparency and improved moisture resistance over EVA and are, therefore, a sought-after option in high-humidity and harsh climate regions. The laminated glass and packaging industries are also changing material use as a result of evolving customer needs and legislative demands. In the packaging industry, POE films provide better sealing ability and flexibility and are, therefore, better suited to some uses previously dominated by EVA films. Likewise, in the automobile and building industries, the need for more durable and weather-resistant laminated glass has seen the increased use of POE films.

Opportunity: Emerging application in agriculture, particularly in greenhouse coverings and agricultural mulch films.

EVA films are increasingly finding applications in agriculture, especially in greenhouses and agricultural mulch films, because of their special combination of flexibility, strength, and optical properties. The films have tremendous potential for enhancing crop yield, maximizing growing conditions, and increasing sustainability in today’s farming operations. One of the major strengths of EVA films in greenhouse covers is that they can control light transmission and diffusion. EVA films provide better thermal insulation, cutting heat loss during nighttime and ensuring consistent temperature inside the greenhouse. This characteristic is especially useful in areas with changing temperatures, as it reduces plant stress and ensures uniform growth. Besides, EVA films can be made to possess anti-fog, anti-drip, and ultraviolet-resistant qualities, preventing any excess moisture from forming on the film surface as well as defending plants against injurious ultraviolet radiation. The efficiency of photosynthesis is boosted through enhanced diffusion of light by these films, resulting in improved crop yields as well as yield quality. In addition, EVA mulch films can be formulated with certain light transmission characteristics, e.g., reflective or colored films, to repel pests, suppress weed germination, and affect plant morphology. These features lead to enhanced resource efficiency, minimizing the use of herbicides and excessive irrigation, thereby enhancing sustainable agriculture.

Challenge: Limited recyclability of EVA films poses environmental challenges.

One of the most significant challenges to the EVA films market is their limited recyclability, which is of serious environmental and economic concern. EVA films, particularly solar panel encapsulation and laminated glass, tend to be very hard to segregate from other materials, making recycling expensive and complicated. In contrast to materials like polyethylene terephthalate (PET) or polypropylene (PP), for which there is a well-defined recycling stream, EVA does not have a standardized and effective recycling process. This deficiency leads to a large amount of EVA waste being deposited in landfills or burned, leading to environmental contamination and greenhouse gas emissions. In the solar market, for instance, the increasing number of retired solar panels poses an increasing waste management problem since the EVA layers employed in encapsulation hinder the recovery of valuable materials like silicon and silver. Moreover, in the packaging industry, films based on EVA are commonly blended with other polymers, which further makes recycling difficult and lowers the prospects of environmentally friendly disposal. The environmental issues related to the disposal of EVA films have created a situation of enhanced regulatory attention, and governments across the globe are introducing stricter waste management regulations and demanding more sustainable substitutes. This puts pressure on the manufacturers to come up with innovations and invest in sustainable substitutes like biodegradable or recyclable polymer films.

eva-films-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of EVA films for encapsulation in solar photovoltaic modules. | High UV and weather resistance| enhanced durability and longevity of modules| improved energy efficiency and performance. |

|

Integration of EVA encapsulants in high-performance solar panels. | Superior adhesion to glass and cells| reduced potential induced degradation (PID)| lower long-term maintenance costs. |

|

Application of EVA films in protective coatings and adhesives for electronics and automotive components. | Excellent flexibility and chemical resistance| lightweight design| improved impact and scratch protection. |

|

Use of EVA interlayers in laminated safety glass for construction and vehicles. | Enhanced impact resistance and shatterproof properties| superior sound insulation| UV protection for extended service life. |

|

Employment of EVA films in flexible packaging for food and pharmaceuticals. | Outstanding sealability and barrier against moisture and oxygen| extended product shelf life| reduced packaging weight for cost savings. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of the EVA films market. The profiled companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. The value of the ecosystem analysis in the EVA films market is its ability to uncover essential relationships among key stakeholders. It identifies the variables driving technological innovation, regulatory pressures, and market demand. By understanding these relationships, businesses can identify opportunities for innovation, optimize supply chains, and align with market trends to gain a competitive advantage.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EVA Films Market, By Type

Standard EVA films led the market because of their remarkable combination of cost-effectiveness, versatility, and performance across a variety of industries. These films are popular in the solar energy industry for encapsulating photovoltaic (PV) modules, which has heavily contributed to their demand. The increased trend toward using renewable sources of energy, specially solar energy, has been a significant driving force in the increased usage of standard EVA films as a result of their high transparency, excellent adhesive capabilities, and durability in resisting weathering conditions such as UV exposure and humidity. Standard EVA films are also widely used in laminated glass applications for automotive and construction sectors, offering safety, durability, and optical clarity. Such industries use conventional EVA films rather than other encapsulants because of their stable performance and affordability. Also, with progress in manufacturing technology, conventional EVA films are found to possess higher thermal stability and cross-linking capabilities compared to conventional films, which enables them to perform efficiently and durably. Their economic viability compared to other high-performance film types makes them the choice for manufacturers looking for a compromise between performance and economic feasibility. The demand for such films is also driven by their ease of processing, enabling manufacturers to incorporate them into current production lines without much change, resulting in mass adoption.

EVA Films Market, By Production Method

The extrusion production method holds the largest market share in the EVA films market because of its efficiency, cost-effectiveness, and production of high-quality film with uniform properties.. Extrusion is the process of melting the EVA resin and molding it into thin films using a die. It provides the advantage of continuous and automated processing with uniform thickness, high mechanical strength, and good optical characteristics. One of the most important reasons for its market dominance is its scalability because extrusion is capable of accommodating high-volume production with little material wastage, and hence, it is the first choice of manufacturers who seek to minimize cost and maximize volume. Extruded EVA films also have great adhesion characteristics, flexibility, and UV radiation resistance, making them suitable for solar panel encapsulation, one of the most rapidly growing areas of application. Relative to other production methods such as casting or calendaring, extrusion also provides greater control over formulation, which enables producers to vary the composition of EVA films to achieve precise performance specifications, for example, different levels of transparency, thermal stability, and crosslinking characteristics. In addition, technological advances in extrusion, including multilayer co-extrusion, have further consolidated its market position through the capability to produce high-performance EVA films that incorporate higher durability and functional layers.

EVA Films Market, By End-use Industry

The renewable energy industry accounts for the largest share of the EVA films market owing to the significant role played in the process of solar panel production. EVA films find extensive application as encapsulants in solar modules and act as a shield for photovoltaic cells against environmental conditions like moisture, UV radiation, and mechanical stress, maintaining the durability and longevity of solar panels. As the need for clean and renewable energy has increased worldwide, the use of EVA films in the production of solar panels has grown strongly. This can be attributed to government interventions, green campaigns, and new solar technologies. Governments from all over the globe are extending subsidies, bonuses, and incentives as well as regulatory schemes that encourage the generation of electricity with the help of solar power, further stimulating the demand for EVA films. Also, declining costs of solar panels, increasing energy efficiency, and increased investment in solar equipment have helped the market for EVA films to grow. The other major factor is the better performance of EVA films over other encapsulants; their high clarity, good adhesion, and resistance to harsh weather conditions have made them the industry standard. Additionally, improvements in EVA formulations have allowed for the development of better-performing films that are more durable, to accommodate the changing solar industry demands.

EVA Films Market, By Application

Solar panel encapsulation occupies the largest share of the EVA films market because of the vital role played by EVA films in the efficiency, strength, and life of photovoltaic (PV) modules. EVA films are extensively employed as an encapsulant material in solar panels as a protective covering that holds the various layers of the panel, such as the glass, solar cells, and back sheet. This encapsulation procedure is necessary for improving the performance of PV modules by offering mechanical support, enhancing light transmission, and safeguarding solar cells from external conditions like moisture, dust, UV light, and high temperatures. The worldwide movement toward renewable sources of energy, which is triggered by the issues related to climate change, governmental stimuli, and falling production costs for solar energy, has enhanced demand for solar panels, driving growth in the EVA films market. Moreover, EVA films have good optical transparency, low thermal resistance, and high adhesion properties, which are the reasons why solar panel manufacturers prefer them. The growth of large-scale solar farms, residential rooftop solar installations, and industrial solar uses has created an exponential demand for the use of EVA films. In addition, ongoing improvements in encapsulation technology have created high-performance EVA films possessing excellent anti-PID properties, better UV stability, and superior weather resistance, further cementing their market leadership.

REGION

Asia Pacific to be fastest-growing region in global EVA Films market during forecast period

Asia Pacific is the leading region for the EVA films market attributed to a number of primary reasons like rapid industrialization, increasing demand for solar energy applications, robust base of manufacturing industries, and rising infrastructure development. The major driver among them is the huge solar energy market, mainly in China, India, and Japan, where governments are seriously investing in renewable energy as part of achieving sustainability objectives. EVA films play an important role in photovoltaic (PV) module encapsulation, which safeguards solar cells against environmental degradation and increases their efficiency. China, the world’s largest solar panel producer, has driven the demand for EVA films enormously high because solar panel producers need good-quality encapsulants to make panels more durable. Besides, urbanization and infrastructure growth at a fast pace in emerging markets such as India and Southeast Asia have driven the construction sector, where EVA films find broad applications in laminated glass for safety, energy efficiency, and durability in skyscrapers, residential apartments, and office spaces. The Asia Pacific is supported by a robust manufacturing ecosystem, with various EVA film producers having units in China, South Korea, Taiwan, and Japan. Easy availability of raw materials, reduced costs of production, and government favor have turned the region into an international hub of EVA film manufacturing, where local players are able to provide for both the domestic and export markets.

eva-films-market: COMPANY EVALUATION MATRIX

In the EVA films market matrix, 3M (Star) leads due to its extensive portfolio, strong R&D capabilities, and established presence in protective coatings and electronics, delivering high-performance, reliable solutions globally. Mativ (Emerging Leader) by leveraging innovative, flexible packaging applications and sustainable EVA formulations, rapidly expanding its market footprint and gaining traction in high-growth regions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- H.B. Fuller (US)

- 3M (US)

- JA SOLAR Technology Co., Ltd. (China)

- Jiangsu Sveck Photovoltaic New Material Co., Ltd. (China)

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD. (China)

- Shanghai HIUV New Materials Co., Ltd. (China)

- Guangzhou Lushan New Materials Co., Ltd. (China)

- Hanwha Group (South Korea)

- Cybrid Technologies Inc. (China)

- Betterial (China)

- Mativ (US)

- Zhejiang Sinopont Technology Co., Ltd. (China)

- Satinal SpA (Italy)

- Folienwerk Wolfen GmbH (Germany)

- Shenzhen Gaoren Electronic New Material Co. Ltd. (China)

- Zonpak New Materials Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.43 Billion |

| Market Forecast in 2029 (Value) | USD 11.26 Billion |

| Growth Rate | CAGR of 8.7% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

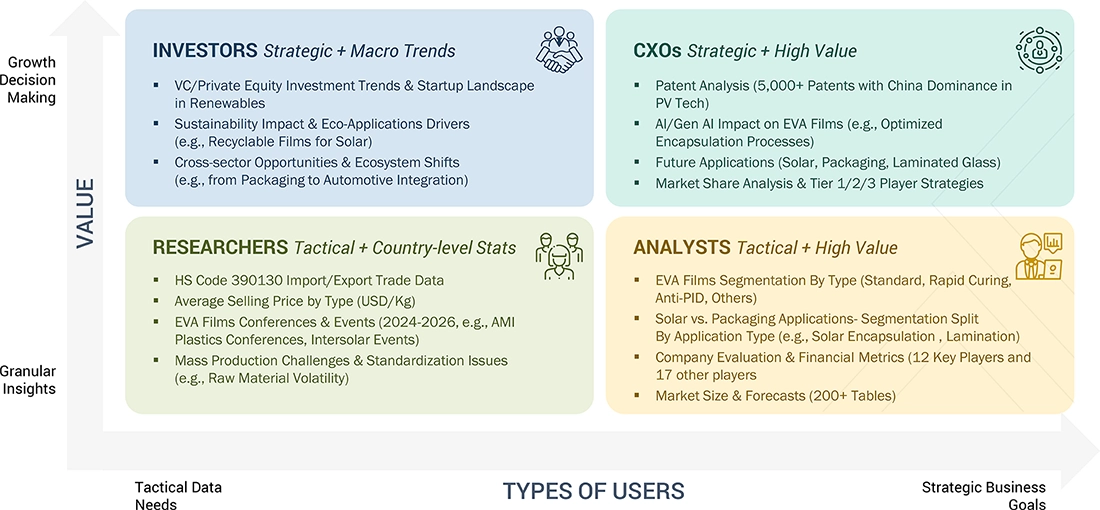

WHAT IS IN IT FOR YOU: eva-films-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solar Module OEM |

|

|

| EVA Film Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : HIUV and H.B. Fuller signed a strategic partnership for boosting encapsulation solutions for the American market. Through HIUV’s encapsulation film expertise, including EVA films, and the wide market presence and adhesive formulating expertise of H.B. Fuller, the partnership is ready to provide higher-quality products that meet local demands.

- October 2023 : Hangzhou First Applied Materials Co., Ltd. invested USD 270 million to set up three new plants in China, Thailand, and Vietnam for producing encapsulation films like EVA films and backsheets for solar panels.

- March 2023 : Hanwha Advanced Materials Georgia, a subsidiary of Hanwha Group, opened a new factory in Cartersville, Georgia, with an investment of USD 147 million. The plant specializes in manufacturing encapsulant materials, such as EVA sheets.

- February 2023 : Jiangsu Sveck Photovoltaic New Material Co., Ltd. built a new factory in Yancheng City, Jiangsu province, with an investment of USD 192 million. The plant is expected to raise the production capacity of Sveck, with an output of 420 million square meters of EVA films.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the EVA Films market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key EVA Films, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The EVA Films market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the EVA Films market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the EVA Films industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of EVA Films and future outlook of their business which will affect the overall market.

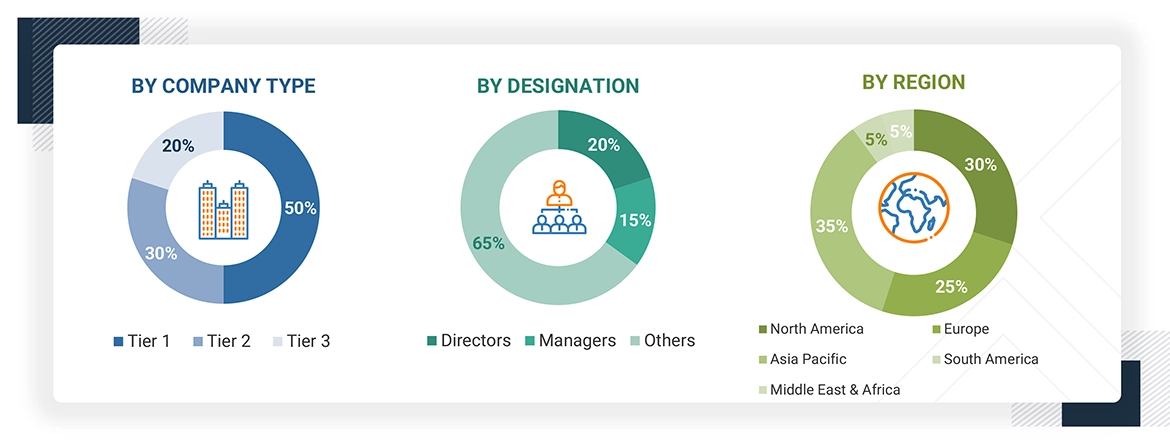

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for EVA Films for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, production method, application, end-use industry, and regions were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

EVA FILMS MARKET: BOTTUM-UP AND TOP-DOWN APPROACH

Data Triangulation

After arriving at the total market size from the estimation process EVA Films above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The EVA films industry is a fast-developing segment in the polymer and specialty films market, owing to its broad applications in solar energy, automobiles, building construction, electronics, and packaging. EVA films are extensively used for solar encapsulation in PV modules because they possess high transparency, UV stability, and adhesion to glass and other materials. The growing use of solar energy, especially in floating solar panels and high-efficiency PV modules, is one of the key drivers for the demand for EVA films. The construction sector also widely uses EVA films for laminated glass applications, providing better impact resistance, durability, and optical clarity, which are suitable for architectural glazing, smart glass, and privacy glass. Leading producers are committing to research and development to enhance EVA film properties, such as improved crosslinking efficiency, thermal stability, and recyclability.

Stakeholders

- EVA Films Manufacturers

- EVA Films Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the EVA Films market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, production method, application end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent development such as partnership, joint venture, collaboration, and expansion in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the EVA Films Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in EVA Films Market