Exhaust Aftertreatment System Market

Exhaust Aftertreatment System Market by Product Type (DOC, DPF, LNT, SCR, GPF, Sensors), Fuel (Gasoline, Diesel), Vehicle Type (Passenger Cars, LCVs, HCVs), Sales Channel (OE-Fitted, Aftermarket), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

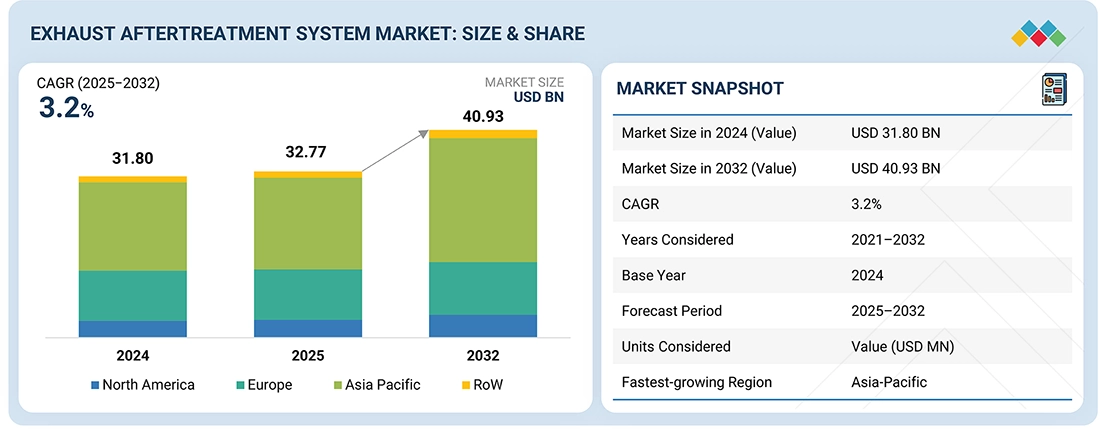

The exhaust aftertreatment system market is expected to grow from USD 32.77 billion in 2025 to USD 40.93 billion by 2032 at a CAGR of 3.2%. The market is expanding due to stricter emission regulations and the increasing use of advancements in engines for commercial, off-highway, and specialty vehicle applications. The adoption of SCR, DPF, DOC, and GPF systems is growing across the globe. However, the market faces challenges from high system costs, fluctuating catalyst prices, and varying regional emission standards, which limit standardization in this market.

KEY TAKEAWAYS

-

By RegionAsia Pacific is estimated to account for more than 50% revenue share in 2025.

-

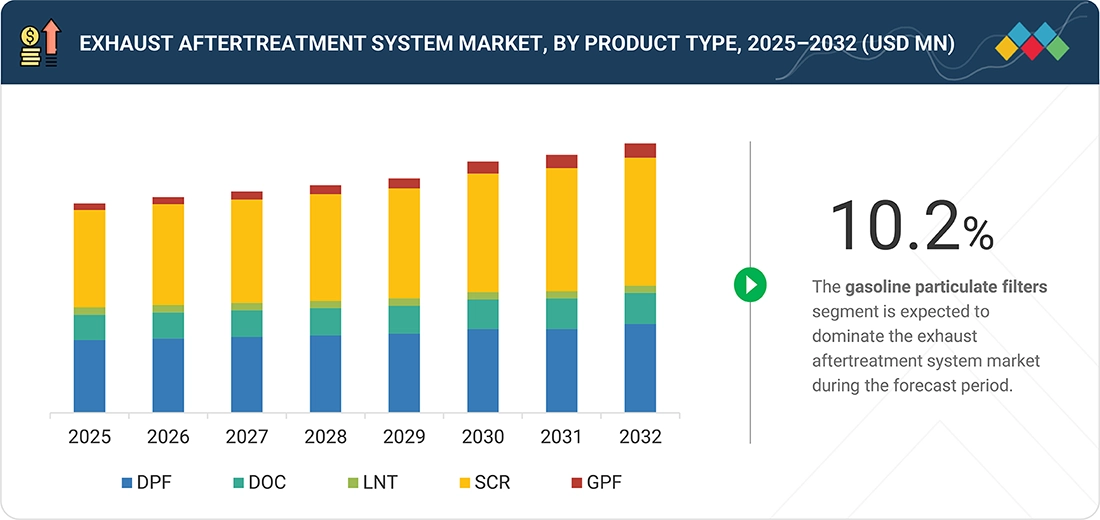

By Product TypeThe gasoline particulate filters segment is expected to record the highest CAGR of 10.2% between 2025 and 2032.

-

By FuelThe gasoline segment is expected to grow at a CAGR of 3.8% during the forecast period.

-

By Vehicle TypePassenger cars are expected to dominate the exhaust aftertreatment system market during the forecast period.

-

Competitive LandscapeTenneco Inc. (US), FORVIA (France), Continental AG (Germany), Eberspacher (Germany), and Futaba Industrial (Japan) were identified as the star players in the exhaust aftertreatment system market, given their strong market share and product footprint.

The exhaust aftertreatment market is expanding steadily due to stringent global emission regulations and the continued deployment of combustion engines across passenger vehicles, commercial vehicles, and off-highway equipment. OEMs and Tier 1 suppliers rely on systems such as SCR, DPF, GPF, and catalytic converters to ensure the controlled reduction of NOx, particulate matter, and unburned hydrocarbons under both laboratory and real-world driving conditions. Rising production of light and heavy commercial vehicles, extended in-use compliance requirements, and higher vehicle parc age are sustaining demand across OEM and aftermarket channels. Advancements in catalyst formulations, substrate materials, thermal management, and sensor integration are improving conversion efficiency and packaging performance under high-temperature and high-load operating conditions.

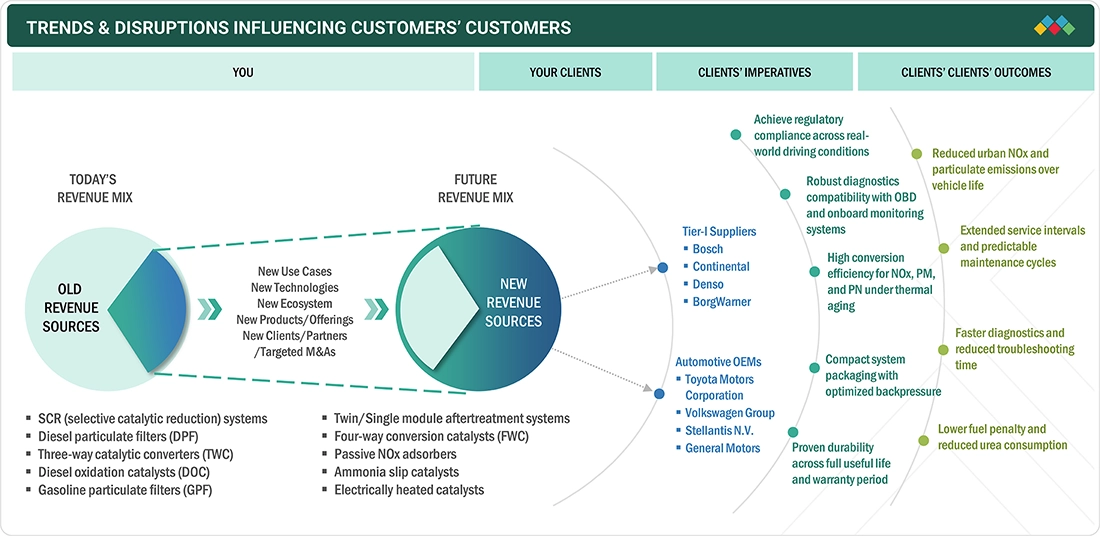

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The present revenue in the exhaust aftertreatment system market is primarily generated from conventional SCR systems, DPFs, DOCs, and three-way catalytic converters, utilizing established substrate, catalyst coating, and canning technologies for regulatory compliance. Future revenue streams will be driven by high-efficiency catalyst formulations, compact and lightweight aftertreatment modules, sensor-integrated systems for real-time diagnostics, and advanced DPF/GPF designs with improved regeneration efficiency and extended service life.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strict NOx and PM regulations mandating SCR, DPF, and GPF use

-

Large fleet of long-life diesel and GDI vehicles driving retrofit and replacement demand

Level

-

Robust growth of BEVs

Level

-

Adoption of diagnostic and sensor-based predictive maintenance

Level

-

Catalyst and filter degradation from thermal aging, sulfur, and ash accumulation

-

Regulatory variation and platform-specific integration constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strict NOx and PM regulations mandating SCR, DPF, and GPF use

The increasing demand for advanced exhaust aftertreatment systems, such as Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Gasoline Particulate Filters (GPF), is increasing in response to stringent standards such as Euro 7, Multi-Pollutant Standards, BS VI (Phase II), and China 7. These regulations place stringent limits on particulate matter and NOx, which cannot be completely regulated by exhaust gas recirculation (EGR) or engine calibration. The SCR systems reduce NOx by 90% under transient and high-load situations and are crucial for high-output diesel engines. DPFs and GPFs efficiently absorb sub-micron particulate emissions, ensuring particulate matter compliance over the vehicle lifecycle. Also, the increased aftermarket demand for catalysts, filters, dosing modules, and electronic control units is maintained by technological necessity and regulatory requirements, making SCR, DPF, and GPF critical parts of global emission compliance programs.

Restraint: Robust growth of BEVs

The rapid acceleration of BEV adoption, supported by zero-emission mandates, fiscal incentives, and OEM electrification strategies, is significantly restraining the growth of the exhaust and aftertreatment systems market. BEVs eliminate the requirement for exhaust architectures, including catalytic converters, SCR systems, DPFs, GPFs, sensors, and mufflers, thereby reducing the ICE vehicle bill of materials. As BEV penetration increases, especially in passenger cars, OEM demand for exhaust systems declines structurally, resulting in compressed new-installation volumes. Over the long term, the shrinking ICE vehicle parc also weakens aftermarket demand, limiting replacement and service revenue opportunities for exhaust system suppliers

Opportunity: Adoption of diagnostic and sensor-based predictive maintenance

The integration of advanced diagnostic and sensor-based monitoring in exhaust aftertreatment systems offers a technical growth opportunity by enabling condition-based maintenance of critical components. The degradation of SCR catalysts, DPFs, and GPFs from thermal cycling, ash and soot accumulation, sulfur-induced poisoning, and mechanical stress affects NOx conversion efficiency, particulate filtration, and backpressure. Sensors tracking parameters such as differential pressure, temperature gradients, NOx and ammonia slip concentrations, and dosing rates enable real-time performance assessment. Predictive algorithms use these data streams to identify early deviations from optimal operation, flagging issues like catalyst deactivation, filter clogging, or urea dosing system malfunctions before regulatory thresholds are breached. This reduces unscheduled downtime, maintains emission compliance, and optimizes maintenance intervals. Increasing enforcement of in-service conformity and emission verification in regions such as North America, Europe, and Asia Pacific further drives demand for sensor-driven predictive maintenance, making it a technically significant growth avenue in the aftermarket.

Challenge: Catalyst and filter degradation from thermal aging, sulfur, and ash accumulation

Catalyst degradation is a critical challenge in exhaust aftertreatment systems, which primarily results from thermal aging, sulfur contamination, and ash accumulation. Extended exposure to high exhaust temperatures causes sintering of the catalyst substrate, reducing the available surface area and lowering NOx and particulate matter conversion efficiency. Sulfur compounds present in fuel and lubricants chemically deactivate active catalyst sites, adversely affecting reaction kinetics and system performance. The ash generated from engine oil additives deposits within catalyst channels and filters, which increases exhaust backpressure, disrupting flow uniformity and reducing mass transfer efficiency. These degradation mechanisms gradually decline the catalytic activity, shorten the component service life, and increase the frequency of replacements. Additionally, they complicate system calibration, dosing control, and maintenance procedures, directly impacting compliance with emission standards and overall operational reliability of diesel and gasoline aftertreatment systems.

EXHAUST AFTERTREATMENT SYSTEM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplied precious-metal catalyst formulations used in replacement catalytic converters under high-mileage fleet repair programs (e.g., taxis and urban vehicles). Catalysts restored oxidation and reduction efficiency lost due to aging and thermal degradation. | Large reductions in NOx, HC, and CO emissions; rapid recovery of emission compliance without engine modification |

|

Provided ceramic honeycomb substrates used in replacement catalytic converters and DPFs deployed in urban fleet servicing and retrofit programs. Substrates acted as the structural carrier for washcoats and soot filtration media. | High thermal durability, resistance to cracking during regeneration, and extended service life in high-duty cycles |

|

Supplied DOC and DPF replacement systems for heavy-duty trucks and buses in regulated retrofit and compliance programs. Systems were designed for in-use vehicles rather than new installations. | Particulate matter reduction often exceeding 90%, improved fleet uptime, and compliance with urban emission zones |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Exhaust aftertreatment systems are supplied through a multi-tiered ecosystem where OEMs such as Tenneco, Bosal, and HJS Emission Technology design and integrate complete solutions for both original fitment and aftermarket replacement. These OEMs rely on Tier-1 suppliers for modules, housings, and pre-assembled components, while sourcing critical raw materials from specialized suppliers: ceramic substrates and honeycomb carriers from Corning, NGK/Niterra, and Ibiden; precious metal catalysts, including platinum, palladium, and rhodium, from Johnson Matthey and Umicore; and structural metals and alloys from Mitsubishi Materials and Dowa Holdings. This supply chain enables OEMs and aftermarket specialists like Walker Exhaust and Bosal to deliver fully integrated exhaust aftertreatment systems, including catalytic converters, diesel particulate filters, SCR units, and mufflers, for both new vehicles and servicing replacements across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Exhaust Aftertreatment System Market, By Vehicle Type

The passenger car segment represents the largest market for exhaust aftertreatment systems, including SCR, DPF, and catalytic converters, driven by high production volumes and extensive global deployment. OEMs such as Volkswagen Group, Toyota, Stellantis, Hyundai-Kia, and General Motors procure these systems from suppliers such as Bosch, FORVIA, Tenneco, and Eberspächer, integrating them with engine control units to achieve compliance with Euro 6d, China 6, and equivalent standards. For example, Volkswagen’s Euro 6d diesel passenger car platforms are equipped with DPF and SCR systems supplied by leading global Tier 1 suppliers to meet real-world driving emission requirements. The installed base of passenger cars generates continuous demand for component replacements and retrofits. The supplier-to-OEM framework enables precise integration of aftertreatment modules with engine management systems, optimizing emissions control while minimizing impact on combustion efficiency and overall vehicle performance.

Exhaust Aftertreatment System Market, By Product Type

Gasoline particulate filters (GPFs) are the fastest-growing segment in the exhaust aftertreatment aftermarket due to the rapid increase in gasoline direct injection (GDI) vehicle production. GDI combustion generates higher particulate number emissions than port-fuel injection, which requires particulate filtration to comply with regulated PN limits. Emission standards such as Euro 6d and China 6 enforce particle number limits under real-driving conditions, leading to large-scale integration of GPFs in gasoline passenger cars since the late 2010s. This has created a growing installed base now moving into the out-of-warranty phase. Over vehicle life, GPF substrates experience ash accumulation from engine oil additives, thereby increasing exhaust backpressure and reducing filtration effectiveness. Urban duty cycles with frequent cold starts restrict passive regeneration, accelerating service and replacement needs. Compared with diesel aftertreatment, the gasoline fleet is expanding faster in key regions, increasing absolute aftermarket volumes.

Exhaust Aftertreatment System Market, By Fuel

Diesel remains the largest fuel segment in the exhaust aftertreatment system market due to the higher system complexity and value per vehicle. Global OEMs such as Volkswagen Group, Stellantis, Ford, and Daimler Truck deploy diesel models across passenger and commercial vehicle platforms with SCR and DPF systems supplied by Bosch, Tenneco, FORVIA, and Eberspächer. The need to control real-world NOx emissions under high-load and transient operating conditions drives multi-component aftertreatment architectures, significantly increasing system value per vehicle. Additionally, longer vehicle lifecycles and intensive duty cycles in commercial and utility applications sustain recurring replacement demand. Stricter real-driving emission limits further push higher SCR penetration and dosing sophistication, enabling diesel to retain revenue leadership despite moderating unit growth.

REGION

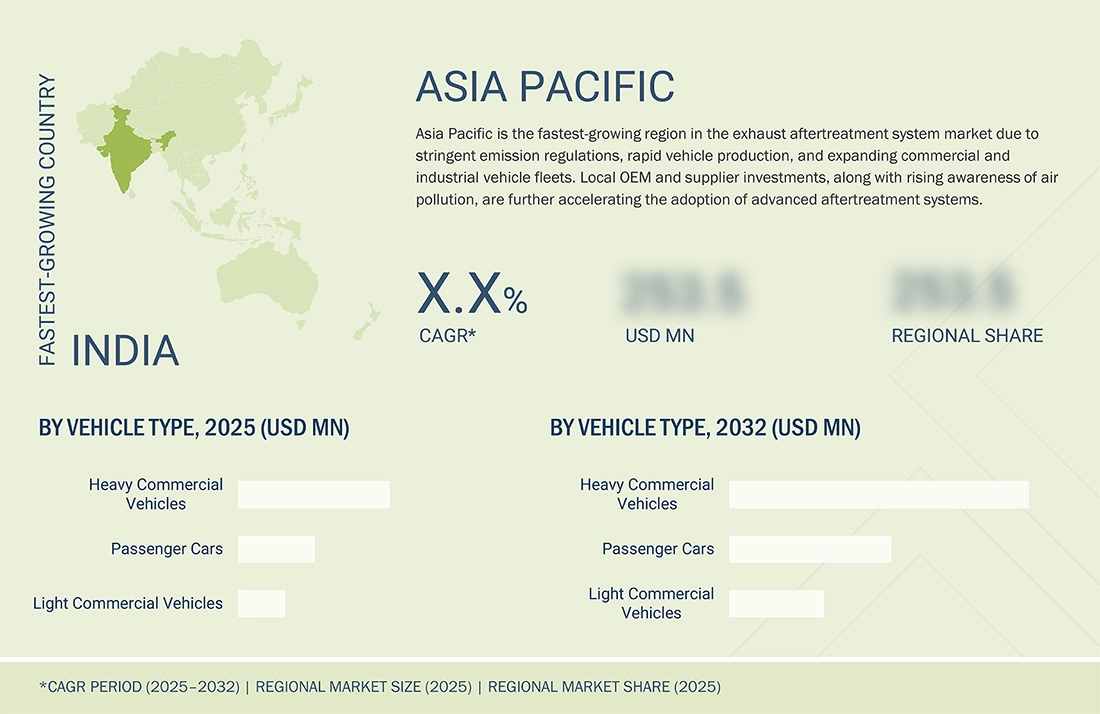

Asia Pacific to be fastest-growing region in global exhaust aftertreament system market during forecast period

The Asia Pacific is the fastest-growing region for the exhaust aftertreatment systems market, driven by regulatory escalation combined with a rapidly expanding in-use vehicle base and higher replacement intensity. In China, nationwide enforcement of China 6 has tightened NOx and particulate limits under real-world driving, increasing premature failure and replacement of catalytic converters, GPFs, and DPFs in high-mileage passenger and commercial vehicles. India’s Bharat Stage VI introduced SCR, DPF, and advanced oxidation catalysts at scale, creating a structurally new aftermarket as thermal loading, short-trip usage, and fuel sulfur variability accelerate clogging and catalyst degradation, especially in LCVs and buses. Japan and South Korea contribute through stringent periodic inspection regimes, where emissions compliance is enforced via component replacement rather than recalibration, sustaining steady aftermarket demand. In Southeast Asia (Thailand, Indonesia, Vietnam), migration from Euro 2/3 toward Euro 4/5 standards, combined with dense urban driving and high annual vehicle utilization, increases soot accumulation and ash loading, reducing aftertreatment service life. These demand factors are reinforced by localized ceramic substrate manufacturing, regional precious-metal processing, and lower system replacement costs, enabling faster aftermarket penetration compared with Europe and North America.

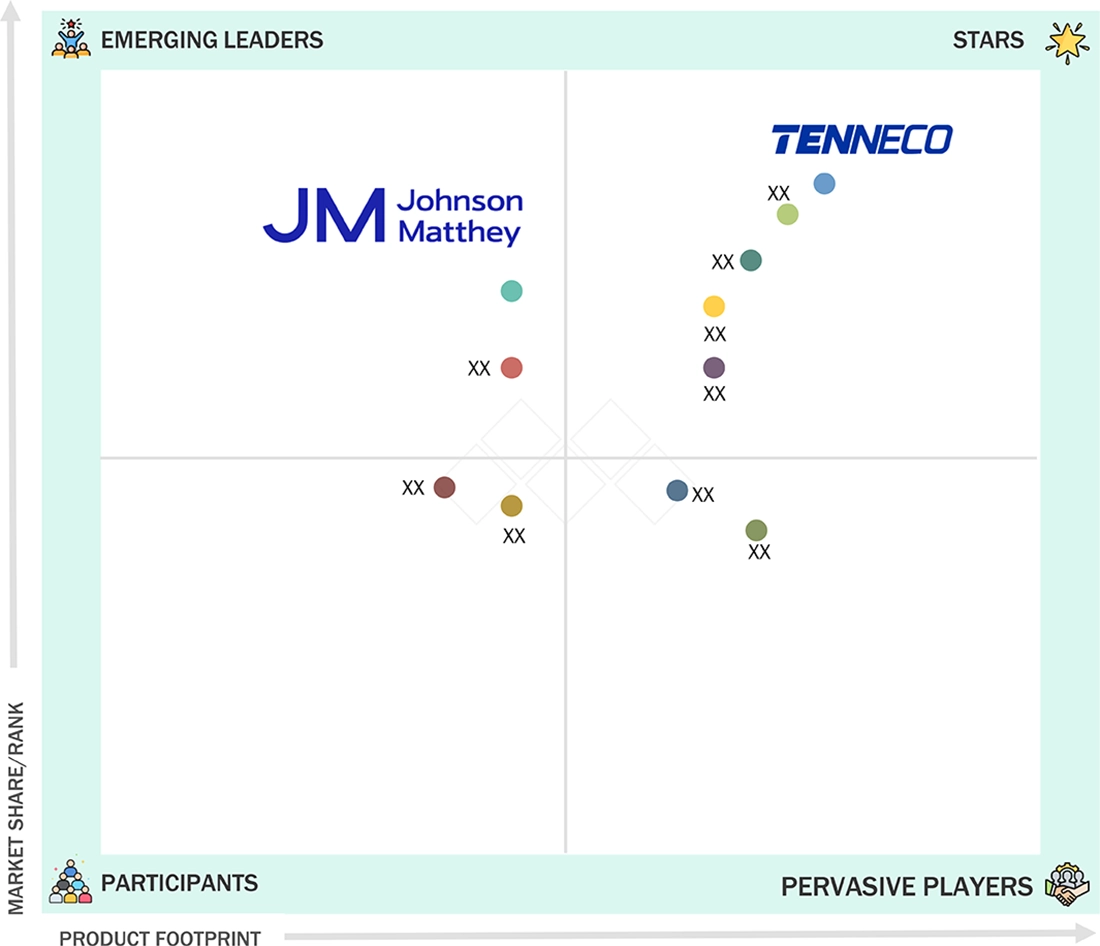

EXHAUST AFTERTREATMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX

In the exhaust aftertreatment system market matrix, Tenneco (Star) leads with a robust global market share and a comprehensive portfolio covering Selective Catalytic Reduction (SCR) systems, Diesel Particulate Filters (DPF), Gasoline Particulate Filters (GPF), and catalyst solutions. Its position is strengthened by long-standing OEM partnerships, presence across high-volume passenger and commercial vehicle platforms, and proven performance in both light- and heavy-duty applications during 2024–2025. Johnson Matthey (Emerging Leader) is expanding its footprint through growing manufacturing capacity and an evolving product portfolio that includes SCR catalysts, oxidation catalysts, and integrated aftertreatment modules. The company is increasing adoption across passenger vehicles, commercial trucks, and industrial machinery, supported by technological innovation, cost-competitive solutions, and alignment with OEM emission compliance programs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Tenneco Inc. (US)

- FORVIA (France)

- Eberspächer (Germany)

- BOSAL (Belgium)

- BENTELER (Austria)

- Johnson Matthey (UK)

- BASF (Germany)

- Umicore(Belgium)

- Corning (US)

- NGK Insulators (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 31.80 BN |

| Market Size in 2032 (Value) | USD 40.93 BN |

| Growth Rate | CAGR of 3.2% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: EXHAUST AFTERTREATMENT SYSTEM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Fleet Operator / Large End User | Cost-benefit analysis of aftertreatment replacement vs. retrofit vs. vehicle replacement scenarios | Lower total cost of ownership, reduced downtime, and predictable compliance costs |

RECENT DEVELOPMENTS

- Februray 2025 : Johnson Matthey commissioned a dedicated hydrogen combustion and aftertreatment testing facility in Sweden to develop catalyst systems capable of controlling NOx under hydrogen ICE operating conditions.

- March 2025 : HJS Emission Technology expanded modular DPF and SCR retrofit solutions targeting in-use commercial vehicle fleets to support urban low-emission zone compliance.

- July 2025 : BorgWarner advanced integration of Dinex capabilities into its global exhaust portfolio, expanding heavy-duty and aftermarket aftertreatment coverage.

Table of Contents

Methodology

The study encompassed four primary tasks to determine the present scope of the exhaust aftertreatment system market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, these findings, along with assumptions, were corroborated and validated through primary research involving industry experts across the value chain. Employing both bottom-up and top-down methodologies, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to for the study of the exhaust aftertreatment system market are directly dependent on end-use industry growth. Exhaust aftertreatment system sales and end-use industry demand are derived through secondary sources such as the International Council on Clean Transportation (ICCT), Organisation Internationale des Constructeurs d'Automobiles (OICA); the National Mobility Equipment Dealers Association (NMEDA), the Organization for Economic Co-operation and Development (OECD), World Bank, corporate filings such as annual reports, investor presentations, and financial statements, and paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as exhaust aftertreatment system market sizing estimation and forecast, future technology trends, and upcoming technologies in the exhaust aftertreatment systems. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from the demand-side (end-use industries) and supply-side (exhaust aftertreatment system providers) across four regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 60% and 40% of the primary interviews were conducted on the OEMs and component manufacturer sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. After communicating with primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the exhaust aftertreatment system market and other dependent submarkets, as mentioned below.

- Key players in the exhaust aftertreatment system market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of major market players (public), as well as interviews with industry experts for detailed market insights.

- All vehicle level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Exhaust Aftertreatment Systems: The key components of an exhaust aftertreatment system are the exhaust manifold, downpipe, and tailpipe. Exhaust gases released from engine cylinders are accumulated and cooled down by the exhaust manifold and passed on to the catalytic converter through the downpipe. The catalytic converter acts as an exhaust gas purifier and removes the harmful constituents from the gases. These gases travel through the muffler, which minimizes the noise level and finally emits the cleansed exhaust gases from the tailpipe.

After-treatment Devices: These devices remove harmful constituents such as carbon monoxide (CO), carbon dioxide (CO2), nitrogen oxide (NOX), and particulate matter (PM) from the exhaust gas. After-treatment devices considered under this study for diesel engines include a diesel particulate filter, a diesel oxidation catalyst, a lean NOx trap, and a selective catalytic converter, and for gasoline engines, a gasoline particulate filter (GPF).

Key Stakeholders

- Senior Management

- End User Finance/Procurement Department

- R&D Department

Report Objectives

-

To define, describe, and forecast the size of the exhaust aftertreatment system market in terms of value (USD million) and volume (units) between 2024 and 2030 based on the following segments:

- OE market, by after-treatment device (DOC, DPF, SCR, LNT, and GPF)

- OE market, by component (manifolds, downpipes, catalytic converters, mufflers, tailpipes, sensors, and Hangers)

- OE market, by vehicle type (passenger cars, LCVs, buses, and trucks)

- Aftermarket, by after-treatment device (DOC, DPF, GPF, and SCR)

- OE market, by off-highway vehicle (agricultural tractors, construction equipment and mining equipment)

- Off-highway vehicle, by after-treatment device (DPF, DOC, SCR)

- OE market, by fuel type (diesel and gasoline)

- By sales channel (OEM and aftermarket)

- By region (Asia Pacific, North America, Europe, and the Rest of the World)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market

- To analyze the market share of leading players in the exhaust aftertreatment system market and evaluate competitive leadership mapping.

- To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

- Trends and Disruptions Impacting Customers’ Businesses

- Market Ecosystem

- Technology Analysis

- Supply Chain Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Trade Analysis

- Investment and Funding Scenario

- Pricing Analysis

- To analyze recent developments, including product launches, partnerships, acquisitions, expansions, and other developments undertaken by key industry participants in the market

- To give a brief understanding of the exhaust aftertreatment system market in the recommendations chapter

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Exhaust Aftertreatment System Market, By Aftertreatment Devices & Vehicle Type

- DOC

- DPF

- SCR

- GPF

Note: The after-treatment devices OE market can be offered for IC vehicle types - Passenger Cars, LCVs, Trucks, and Buses.

Exhaust Aftertreatment System Components Oe Market, By Vehicle Type

- Passenger Cars

- LCVs

- Trucks

- Buses

Note: The component (exhaust manifolds, downpipes, catalytic converters, mufflers, tailpipes, and sensors) OE market can be offered for IC vehicle types - Passenger Cars, LCVs, Trucks, and Buses at the regional level- North America, Europe, Asia Pacific, and Rest of the World.

Hybrid Vehicle Exhaust Aftertreatment System Oe Market, By After-Treatment Device

- LNT

- GPF

Note: The hybrid vehicle (HEV & PHEV) exhaust aftertreatment system OE market can be offered by after-treatment devices - LNT and GPF. The off-highway vehicle (construction equipment and agricultural tractors) market can be offered by after-treatment devices - DOC, DPF, and SCR at the regional level - North America, Europe, Asia Pacific, and the Rest of the World.

Two & Three-Wheeler Vehicle Exhaust Aftertreatment System Oe Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Note: The exhaust aftertreatment system OE market can be offered at the regional level - North America, Europe, Asia Pacific, and the Rest of the World.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Exhaust Aftertreatment System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Exhaust Aftertreatment System Market