Expandable Graphite Market

Expandable Graphite Market by Flake Size, Application (Flame Retardant, Conductive Additive, Flexible Graphite), End-use Industry (Electronics & Energy Storage, Automotive, Building & Construction), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global expandable graphite market is projected to grow from USD 0.29 billion in 2025 to USD 0.42 billion by 2030, at a CAGR of 7.4% during the forecast period. This growth is fueled by rising demand for flame-retardant, energy-efficient, and sustainable materials across industries such as construction, automotive, and electronics. The material’s superior thermal stability and conductivity make it vital for batteries and thermal management systems. Additionally, the shift toward halogen-free flame retardants and stricter fire safety regulations is driving broader market adoption.

KEY TAKEAWAYS

-

BY TYPEThe Types include Natural Expandable Graphite and Synthetic Expandable Graphite

-

BY FLAKE SIZEThe Flake Size includes Jumbo Flakes and Medium & Large Flakes

-

BY END-USE INDUSTRYThe End-Use includes Electronics & Energy Storage, Automotive, Building & Construction, Industrial Manufacturing, Aerospace & Defense, and Others

-

BY APPLICATIONThe Applications include Flame Retardant, Conductive Additive, Flexible Graphite, and Others

-

BY REGIONThe Expandable Graphites Market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

-

COMPETITIVE LANDSCAPESGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmühl GmbH (Germany), Nacional de Grafite (Brazil), and Qingdao Xinghe Graphite Co., Ltd. (China) are the key players with distribution networks spread ac regions and explore geographic diversification alternatives to grow their businesses. They focus onross Asia Pacific, North America, the Middle East & Africa, South America, and Europe. These companies are vital in their domestic increasing their market shares through agreements and expansions.

The growth of the expandable graphite market is fueled by the rising demand for flame-retardant, energy-efficient, and sustainable materials across key industries such as construction, automotive, and electronics. Its superior thermal stability, electrical conductivity, and fire-resistant properties make it indispensable in advanced batteries, insulation, and thermal management systems. The global shift toward halogen-free flame retardants and stricter fire safety regulations is accelerating adoption across residential, commercial, and industrial sectors. Moreover, the ongoing electrification of transportation, expansion of renewable energy systems, and government initiatives supporting green building practices are driving manufacturers to invest in innovative graphite technologies, strengthening its role as a critical functional material in the global market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The increasing demand for battery-operated devices from various industries and the growth of the electric vehicle sector are driving the lithium-ion battery market, which is indirectly leading to an increase in demand for expandable graphite.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure.

-

Increasing demand for energy-efficient building materials.

Level

-

Safety concerns during production process

Level

-

Increasing bans on hazardous fire-resistant materials

Level

-

Supply chain disruption & geopolitical risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure

The global market for expandable graphite is experiencing significant growth, driven primarily by the increasing adoption of high-performance fire protection materials in residential, commercial, and industrial infrastructures. As fire safety regulations tighten worldwide—especially in major urban centers and high-density environments—there is a growing emphasis on the use of flame-retardant materials that offer thermal stability and low toxicity. Expandable graphite is increasingly preferred for its unique property of expanding when exposed to heat, which generates an insulating barrier that effectively slows the spread of flames and smoke. This characteristic makes it an exceptionally versatile construction material, suitable for applications in fire-resistant insulation, coatings, and wall linings that mitigate toxic smoke and flames. Moreover, with the evolving understanding of the environmental and health impacts associated with halogen-based flame retardants, both governmental and industrial stakeholders are shifting toward safer, non-halogenated alternatives. Non-toxic, halogen-free expandable graphite aligns seamlessly with this trend and is witnessing widespread adoption in construction materials, electrical enclosures, and industrial equipment housings. This dual advantage of regulatory compliance and superior performance positions expandable graphite as a preferred choice in fire retardant applications. As nations implement stricter safety codes—especially concerning retrofitting projects and new constructions—the demand for expandable graphite is expected to remain robust and continue its rapid expansion in international markets.

Restraints: Safety concerns during production process

Safety-related issues stemming from the manufacturing process of expandable graphite represent a significant constraint on market growth. The industrial production of expandable graphite requires the use of strong acids and oxidizing agents to intercalate graphite flakes. Each of these chemical treatments presents heightened acute and chronic occupational health and safety risks. For example, releasing acidic vapors and handling corrosive substances elevate the risk of chemical burns, respiratory irritation, and long-term health implications for workers. Furthermore, the reaction process is highly exothermic and must be conducted under stringent temperature and pressure control. Even minor deviations from these parameters can result in runaway reactions or toxic releases. Such hazards necessitate substantial investments in specialized predictive equipment, safety infrastructure, and strict adherence to comprehensive environmental and industrial safety regulations. This poses a considerable challenge, even for larger manufacturers, while smaller firms may find their ability to comply with these stringent regulatory and safety standards further restricted, hindering their capacity to scale operations. The imperative for rigorous disposal protocols for acidic waste and chemical byproducts adds additional layers of expense to both manufacturing and ongoing operational costs. These challenges impede the entry of new market participants and deter potential investors, adversely affecting the development and expansion of both domestic and international markets for expandable graphite.

Opportunity: Increasing bans on hazardous fire-resistant materials

The regulatory landscape concerning hazardous fire-resistant materials has become increasingly stringent, particularly regarding halogenated flame retardants such as brominated and chlorinated compounds. These substances have historically been utilized in various applications, including building materials, electronics, textiles, and automotive components. However, research has demonstrated that these compounds can release toxic gases and persistent pollutants when exposed to high temperatures, posing significant environmental and human health risks. Considering these findings, regulatory authorities—including the European Chemicals Agency (ECHA), the US Environmental Protection Agency (EPA), and various agencies in China—are implementing stringent controls and phase-out initiatives for such materials. Consequently, manufacturers and end-users are actively seeking safer and more sustainable alternatives, with expandable graphite emerging as a leading option. Expandable graphite is a non-halogenated, environmentally friendly flame retardant known for its unique property of expanding when exposed to elevated temperatures. This expansion forms a protective insulating char layer that effectively inhibits the spread of fire while avoiding the emission of toxic gases. As a result, it is increasingly being adopted in industries such as textiles, wood finishing, construction, and plastic processing, positioning it as a favorable solution in response to evolving regulatory demands and safety considerations.

Challenge: Supply chain disruptions and geopolitical risks

The market for expandable graphite is on the brink of substantial growth, driven by increasing applications in flame retardants, flexible graphite products, and energy storage solutions. However, it faces significant challenges exacerbated by supply chain disruptions and geopolitical tensions. The production and sourcing of raw materials for expandable graphite are heavily concentrated in a limited number of countries, creating a tripartite risk. This concentration makes the market highly vulnerable to unilateral export bans, escalating political strife, and shifts in international trade policies. For example, any alteration in China’s export policies or the introduction of new tariffs could swiftly trigger widespread repercussions on the global supply and pricing of expandable graphite. Additionally, ongoing supply chain disturbances—such as those stemming from the Russia-Ukraine conflict and congestion at key American ports—have highlighted the fragility of international supply chains, complicating the timely delivery of high-quality graphite materials to manufacturers across the globe. Geopolitical instability further complicates this landscape, raising barriers to investment in new production facilities and injecting volatility into the procurement strategies of downstream industries, including electronics, automotive, and construction. This environment of unpredictability undermines long-term market planning and pricing stability, essential for both suppliers and end-users seeking sustainable growth. Rising logistics costs, including freight rate increases and container shortages, compound the current challenges, creating significant deterrents to the consistent expansion of the expandable graphite market. Consequently, there is an urgent need for diversified sourcing strategies and enhanced regional supply chain resilience to navigate these complexities.

Expandable Graphite Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SGL Carbon produces high-quality expandable graphite used for fire retardant additives in engineering plastics, rubbers, and insulation materials. | Provides efficient flame retardancy, passive fire protection, and improved thermal insulation in various industrial sectors. |

|

NeoGraf offers expandable graphite for use in flame retardants, flexible graphite sheets, gaskets, and energy storage devices. | Delivers high thermal and electrical conductivity, enhances fire resistance, and extends product life span and performance. |

|

Manufactures expandable graphite for use in electronics, automotive, construction, and fire safety materials. | Supplies reliable fire and heat protection, as well as improved conductivity in thermal and electrical applications. |

|

Manufactures expandable graphite materials for use in lubricants, flame retardants, and energy storage. | Adds significant lubricity and heat stability, while boosting fire resistance in treated materials. |

|

Produces expandable graphite for industrial applications including fire retardant foams, gaskets, and sealing systems. | Ensures high fire protection efficiency, chemical durability, and cost-effective processing across multiple industries |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The expandable graphite market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of expandable graphite. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks. Prominent companies in this market include SGL Carbon (Germany), Nacional de Grafite (Brazil), Evion Group (Australia), and among others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Expandable Graphite Market, By Application

In the expandable graphite market, flame retardants are projected to exhibit the highest compound annual growth rate (CAGR) in terms of volume during the forecast period. This growth is primarily driven by increasing global awareness and stringent regulatory compliance regarding fire safety standards. Expandable graphite demonstrates exceptional properties when exposed to fire and high temperatures; it significantly expands in less than a minute, forming a dense, insulating char layer. This characteristic positions it as one of the most effective, non-toxic, and non-halogenated flame retardants available. The environmental advantages of expandable graphite have broadened its application in the building and construction sector, particularly in insulation panels, wall linings, fire-resistant doors, and protective coatings. As urban development accelerates and infrastructure projects proliferate in both developed and developing markets—especially within the Asia Pacific region—the demand for materials that comply with the highest fire safety standards is rapidly increasing. Stricter fire safety regulations in developed regions such as Europe and North America are compelling manufacturers to transition from traditional halogenated flame retardants to eco-friendly and safer alternatives like expandable graphite. The global movement toward safer, more sustainable materials and growing consumer and regulatory pressure to eliminate toxic substances in consumer products is further propelling this demand. With its low toxicity, enhanced thermal stability, and compatibility with a wide range of polymers, expandable graphite effectively addresses the evolving requirements for fire safety. These factors collectively contribute to the robust growth trajectory of its flame retardant applications.

Expandable Graphite Market, By End-Use Industry

The electronics & energy storage segment is anticipated to register the highest compound annual growth rate (CAGR) in volume within the expandable graphite market throughout the forecast period. This growth can be attributed to the escalating demand for advanced thermal management solutions and innovations in energy storage technologies. Expandable graphite is characterized by its exceptional electrical conductivity, thermal conductivity, and flame-retardant properties, making it indispensable in the electronics industry. These attributes render expandable graphite ideal for manufacturing thermal interface materials, heat sinks, and protective casings for high-performance electronic devices. As electronic components become increasingly compact and performance-driven, effective heat dissipation is paramount to optimizing performance and preventing overheating, thereby driving the demand for expandable graphite further. Simultaneously, the energy storage sector, particularly with respect to lithium-ion batteries utilized in electric vehicles (EVs), renewable energy systems, and portable electronics, is experiencing unprecedented growth. Expandable graphite plays a critical role as a key ingredient in the production of flexible graphite, which is increasingly employed in battery anode applications due to its stability, conductivity, and enhanced thermal runaway protection. Global investments in clean energy infrastructures and electric mobility have reached historic levels, resulting in an unprecedented demand for high-capacity, safe, and durable batteries. Additionally, governmental initiatives advocating for green technologies and energy storage solutions fuel this trend. Collectively, these innovations in electronics and the transition to sustainable energy are significantly bolstering the demand for expandable graphite within the electronics and energy storage sectors.

REGION

Asia Pacific is to be fastest-growing region in global zeolites market during forecast period

The Asia Pacific region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) in volume for the expandable graphite market throughout the forecast period. This growth is attributed to a combination of rapid industrial development, heightened fire safety regulations, and the swift expansion of the energy storage and electronics sectors. Key nations such as China, India, South Korea, and Japan are scaling up their manufacturing capacities across various end-use industries, including automotive, construction, electronics, and industrial manufacturing, major consumers of expandable graphite. As urbanization and industrialization accelerate in developing countries like India, there is an increasing demand for enhanced fire safety measures within residential, commercial, and industrial infrastructures. This trend is driving market growth for flame-retardant materials, particularly expandable graphite. Moreover, the rising adoption of electric vehicles (EVs) and renewable energy initiatives in the Asia Pacific is further boosting the demand for advanced batteries, where expandable graphite serves critical roles in anode materials and thermal management systems. Supportive government initiatives promoting non-halogenated flame retardants and bio-based sustainable alternatives in the building, construction, and electronics sectors are contributing positively to market dynamics. Given the robust natural graphite deposits, the expanding array of application industries, and a favorable regulatory and economic landscape, the Asia Pacific region is poised to capture the largest share of the global expandable graphite market in the coming years.

Expandable Graphite Market: COMPANY EVALUATION MATRIX

In the expandable graphites market matrix, SGL Carbon (Star) players in the Star matrix in the market, having wide product portfolios, strong market presence, and effective business strategies. The wide product portfolios enable them to serve most regions worldwide. Stars focus on acquiring leading market positions through their strong financial capabilities and wellestablished brand equities.. Evion Group (Emerging Leader) the players involved in developing and innovating products in the market have been included in this matrix. The players in this matrix have broad product portfolios and robust potential to build strong business strategies to expand their businesses. However, they have not adopted effective growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.27 BN |

| Market Forecast in 2030 (value) | USD 0.42 BN |

| Growth Rate | CAGR 7.4% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN), Volume (Ton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, South America, and Middle East & Africa. |

WHAT IS IN IT FOR YOU: Expandable Graphite Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| onstruction Materials Manufacturer | Formulation of expandable graphite-based flame-retardant additives for insulation boards, foams, and coatings | Enhances fire resistance, supports compliance with global building safety standards, and promotes sustainable, halogen-free construction materials |

| Automotive Component Supplier | Development of expandable graphite composites for EV battery casings, gaskets, and interior components | Improves fire safety and thermal stability, extends component lifespan, and supports vehicle lightweighting and energy efficiency goals |

| Electronics & Energy Storage Company | Evaluation of expandable graphite as a conductive additive and thermal interface material for batteries and circuit boards | Boosts thermal conductivity, prevents overheating, and enhances performance and lifespan of electronic and energy storage systems |

| Industrial Manufacturing Firm | Benchmarking of expandable graphite for use in sealing materials, gaskets, and lubricants under high-temperature environments | Ensures superior sealing performance, corrosion resistance, and reliability in demanding industrial operations |

| Coatings & Polymer Producer | Tailoring of graphite expansion ratios for use in intumescent coatings and polymer flame-retardant systems | Enables advanced fire protection in lightweight plastics, improves formulation stability, and aligns with environmental safety standards |

RECENT DEVELOPMENTS

- July 2024 : Evion Group announced that its joint venture partner, Panthera Graphite Technologies, signed an agreement with Technografit GmbH to acquire an additional 1,000 tons of graphite concentrate to meet production demands for the rest of the year. This is in addition to the material already on-site and in production. The acquired graphite will primarily consist of large/jumbo flake with a fixed carbon (FC) content of 90–95%, with CIF pricing to India varying based on FC content. The joint venture has also secured lower-cost pricing for lower-specification graphite, which may be purchased to meet short-term demand from specific buyers. The company views this agreement as a key step in addressing the growing global shortage of graphite concentrate.

- February 2023 : CDI Products acquired EGC Enterprises, Inc., a producer of graphite-based sealing products with facilities in Ohio and North Carolina. The acquisition, finalized on January 31, aims to expand CDI’s global reach, operational expertise, and service offerings. This move aligns with CDI’s strategy to grow in power generation, industrial, aerospace & defense, and water treatment sectors while enhancing its flexible graphite capabilities. The acquisition will also support expanded production in Houston and Singapore and add thermal management solutions to CDI’s portfolio.

- August 2022 : SGL Carbon planned to significantly expand its graphite product production for the semiconductor industry by 2024. The company will invest a mid-range double-digit million-euro amount over the next two years as part of its Business Unit Graphite Solutions’ medium-term strategy. This expansion responds to rising demand and supports the global digitalization trend.

Table of Contents

Methodology

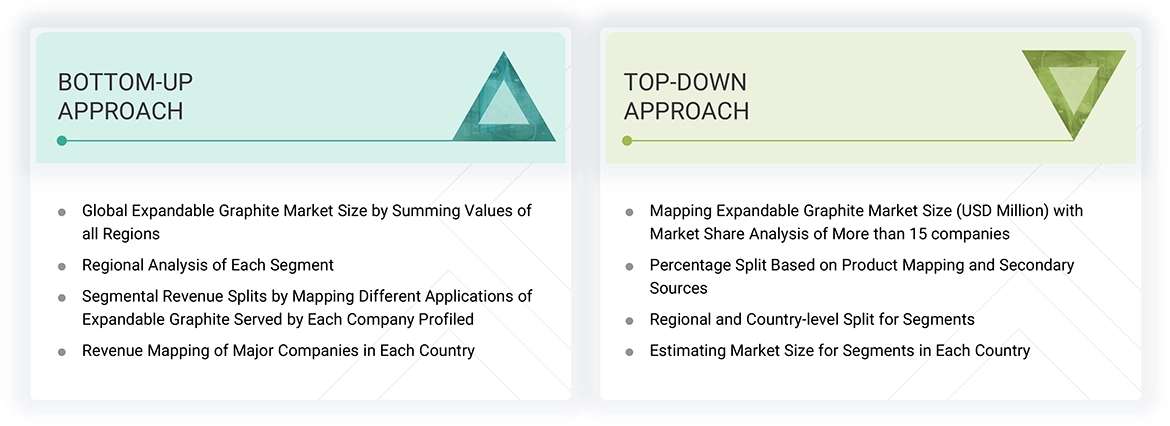

The research encompassed four primary actions in assessing the present market size of expandable graphite. Comprehensive secondary research was conducted to gather information on the market, peer, and parent markets. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the expandable graphite value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market begins with the collection of revenue data from prominent suppliers using secondary research. During the secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The expandable graphite market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of electronics & energy storage, automotive, building & construction, industrial manufacturing, aerospace & defense, and other end-use industries. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

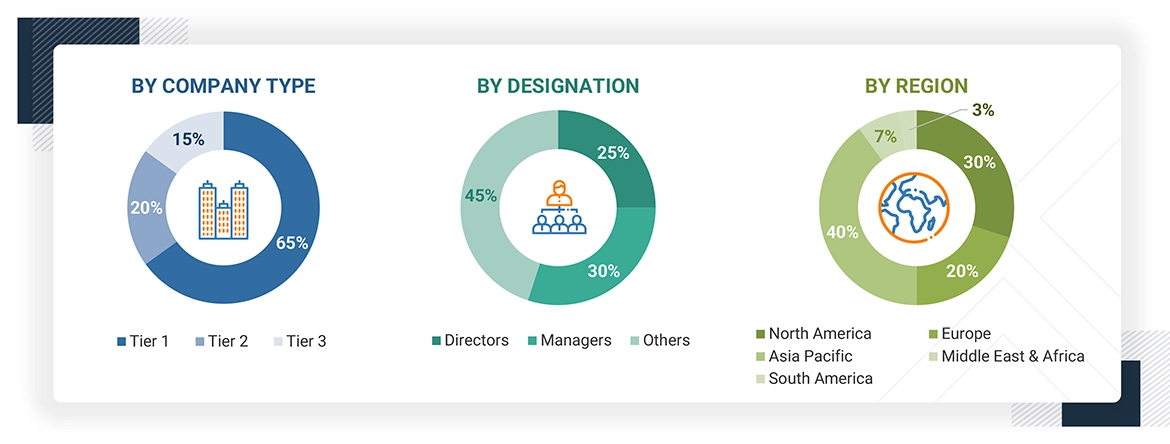

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the expandable graphite market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the expandable graphite market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Expandable graphite is an advanced derivative of natural flake graphite that experiences substantial volumetric expansion upon exposure to elevated temperatures. This expansion occurs through the intercalation of chemical compounds, such as sulfuric acid, between the graphite layers. When subjected to heat, these compounds decompose and release gases, resulting in the separation of the graphite layers. This distinctive characteristic makes expandable graphite highly valuable across various applications, particularly as a flame retardant. Additionally, it finds utility in the production of gaskets, seals, and other materials that require both thermal and chemical resistance. The rapid expansion of expandable graphite forms a protective barrier, enhancing its effectiveness in fire protection and other high-temperature environments.

Stakeholders

- Expandable graphite manufacturers

- Expandable graphite suppliers

- Expandable graphite traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global expandable graphite market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global expandable graphite market

- To analyze and forecast the size of various segments (end-use industry, flake size, and application) of the expandable graphite market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the expandable graphite market?

Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure is the critical driver for the expandable graphite market.

Which region is expected to register the highest CAGR in the expandable graphite market during the forecast period?

The expandable graphite market in Asia Pacific is estimated to register the highest CAGR during the forecast period.

What is the primary end-use industry of expandable graphite?

Electronics & energy storage is the major end-use industry for expandable graphite.

Who are the major players in the expandable graphite market?

Key players include SGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmühl GmbH (Germany), Nacional de Grafite (Brazil), and Qingdao Xinghe Graphite Co., Ltd. (China).

What is expected to be the CAGR of the expandable graphite market from 2025 to 2030?

The market is expected to record a CAGR of 7.4% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Expandable Graphite Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Expandable Graphite Market