Filter Bag Market

Filter Bag Market by Filter Type (Pulse Jet, Reverse Air Bag, Shaker), Filtration Fabric (Polyester, Polypropylene, Fiberglass, Polyimide, Acrylic Fibers, Ceramic, Teflon, Aramid), Media, Filtration Type, and End-use Industry - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global filter bag market is projected to reach USD 3.63 billion by 2030 from an estimated USD 2.81 billion in 2025, at a CAGR of 5.2% during the forecast period. The global filter bag market is primarily driven by increasingly stringent environmental regulations, industrial expansion, and the rising need for efficient dust and particulate control across sectors. A filter bag is a critical component used in baghouse dust collectors to capture fine particulate matter from gas streams or liquid flows, ensuring compliance with air emission and process quality standards. According to the International Energy Agency (IEA), the industrial sector accounts for nearly one-quarter of global carbon dioxide (CO2) emissions, highlighting the importance of advanced filtration systems, such as filter bags, in achieving cleaner operations and sustainability goals.

KEY TAKEAWAYS

-

BY FILTRATION TYPEThe filter bag market by filtration type are Gas filtration, Liquid filtration. Gas filtration holds the largest market share as it is critical in capturing fine particulate matter, hazardous gases, and toxic emissions generated in cement kilns, power plants, incinerators, steel production, and chemical processing units. Filter bags designed for gas filtration provide high-temperature resistance, chemical stability, and superior dust collection efficiency, enabling industries to maintain compliance while ensuring safe workplace environments.

-

BY END-USE INDUSTRYThe end-user industry includes Metals & Mining, Power Generation, Oil & Gas, Food & Beverages, Chemicals, Paint & Coating, Pharmaceuticals, Automotive, and Other End-use Industries. The cement industry leads he end-use industry segment as it is one of the most dust-intensive industries, requiring stringent emission control solutions. Cement manufacturing generates high levels of fine particulate matter at every stage, including crushing, grinding, clinker production, and packaging. Cement plants are increasingly adopting advanced filter bags for dust collection and gas filtration to comply with strict global emission norms such as those enforced by the US EPA and the European Union.

-

BY FILTER TYPEThe filter type includes pulse jet, reverse air bag, and shaker segments. The pulse jet segment leads the filter bag market due to its high efficiency, compact design, and ability to handle large volumes of dust-laden gases in industries such as cement, power generation, steel, and chemicals. Unlike reverse air or shaker systems, pulse jet filter bags use compressed air bursts to continuously clean the bags, which enables uninterrupted operation and reduces downtime. This technology ensures better filtration performance, lower operational costs, and compliance with stringent emission norms, making it the preferred choice in high-demand industrial environments.

-

BY FILTRATION FABRICThe filtration fabric includes Polyester, Polypropylene, Fiberglass, Polyimide, Acrylic Fibers, Ceramic, Teflon, and Aramid The polyester segment holds the largest share in the filter bag market, owing to its cost-effectiveness, versatility, and balanced performance properties. Polyester filter bags are widely used across cement, power generation, pharmaceuticals, chemicals, and food processing industries due to their excellent dimensional stability, resistance to abrasion, and durability under normal operating temperatures up to 150°C. In addition, polyester filter bags exhibit strong resistance to moisture, organic acids, and most oxidizing agents, making them suitable for a range of industrial dust collection and air pollution control applications.

-

BY MEDIAThe media segment includes woven, and non-woven. Non-woven leads the media segment, owing to its superior dust-holding capacity, energy efficiency, and longer service life than woven media. Non-woven filter bags are widely adopted in cement, power generation, mining, and chemicals industries, where high-performance filtration is critical for regulatory compliance and operational reliability. Their ability to handle fine particulates, support high air-to-cloth ratios, and reduce pressure drop makes them the preferred choice for modern baghouse systems.

-

BY REGIONAsia Pacific held the largest share of the filter bag market , driven by rapid industrialization, urbanization, and strict environmental regulations across major economies such as China, India, and Japan. With expanding sectors, including cement, power generation, mining, steel, and chemicals, the demand for high-performance filter bags in emission control is witnessing strong growth. China continues to dominate the regional market due to its large-scale cement and coal-fired power industries, coupled with national-level policies aimed at reducing particulate matter emissions. India is also emerging as a high-growth market supported by government-led clean air initiatives and investments in industrial expansion.

-

COMPETITIVE LANDSCAPEThe market players are using both organic and inorganic strategies such as agreements, acquisitions, product launches and investments to strengthen their positions. Companies like Eaton have launched new products to meet the rising demand for filter bags.

The increasing enforcement of air pollution control regulations across several industries, such as cement, power generation, mining, chemicals, and steel, boosts the adoption of filter bags. With growing industrial output and stricter particulate matter emission norms by agencies such as the EPA, the EU Commission, and China’s Ministry of Ecology and Environment, filter bags are becoming indispensable in dust collection systems. Additionally, the rising emphasis on sustainability, worker safety, and operational efficiency pushes industries to adopt advanced filter bag materials, such as aramid, PTFE, and fiberglass, which can withstand high temperatures and aggressive chemical environments. Emerging economies in Asia Pacific are leading the adoption, driven by rapid urbanization, infrastructure projects, and government-backed clean air programs. However, challenges remain. High maintenance and replacement costs of filter bags, coupled with the growing availability of alternative filtration technologies, such as electrostatic precipitators and cartridge filters, may restrain the pace of adoption in certain industries. Despite these hurdles, the long-term demand outlook remains positive as industries balance cost-efficiency with the need to comply with ever-tightening global environmental norms.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The filter bag market is transforming significantly, driven by key trends and technological disruptions. These factors reshape how industries deploy filtration systems across sectors such as cement, power generation, metal & mining, and chemicals. By understanding these dynamics, businesses can identify new revenue streams, mitigate regulatory and operational risks, and adapt to the evolving industrial landscape. This strategic approach enables companies to position themselves effectively, capitalize on emerging opportunities, and drive long-term growth in the filter bag market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid industrial growth and implementation of air quality regulations

-

Increasing infrastructure development and urbanization

Level

-

High maintenance and replacement costs

Level

-

Technological advancements in filter media

Level

-

Environmental and disposal challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Industrial growth and air quality regulations

Rapid industrialization, particularly in high-emission sectors, such as cement, steel, power generation, and chemicals, drives a surge in demand for effective air pollution control technologies. As industries expand, the volume of particulate matter released into the atmosphere increases proportionally, creating an urgent need for reliable emission control. Fabric filter bags used in baghouse systems are among the most efficient particulate collection solutions, capable of achieving 99–99.9% collection efficiency for particles, according to the US EPA. This superior performance ensures compliance with environmental standards while supporting operational efficiency, making them a critical component of industrial expansion strategies. Regulatory frameworks worldwide are becoming increasingly stringent, creating a non-negotiable demand for high-performance filtration systems. These regulations compel industries to adopt advanced dust collection technologies, particularly filter bags, which can consistently meet or exceed compliance requirements even in challenging industrial environments. In China and India, where industrial expansion is rapid, national air pollution control programs enforce compliance through regular inspections and penalties, directly boosting demand for high-efficiency filter bags that meet or exceed these requirements. As industrial production capacity scales up, so does the regulatory oversight on emissions. In developing regions, such as Asia Pacific, industrial activity is accelerating at a rapid pace, while governments are introducing tighter environmental controls to address urban air quality concerns. This dual push of economic expansion and environmental regulation ensures that demand for high-efficiency filter bags will continue to grow as a compliance measure and part of corporate sustainability initiatives.

Restraint: High maintenance and replacement costs

High maintenance and replacement costs restrict the filter bag market growth due to the combined burden of materials, labor, and operational downtime. According to the US EPA’s Control Cost Manual, filter bags typically last between one and five years, with an average service life of about two years under standard operating conditions. Facilities report that full change-outs, especially when dealing with large numbers of bags or complex layouts, can exceed 24 hours of downtime, with substantial operational disruptions and labor costs. This combination of accessibility constraints, large-scale replacements, and extended shutdowns contributes to higher ownership costs and can deter timely upkeep or system upgrades. When replacements are required, the process is material-intensive and labor-heavy, and large baghouses can contain hundreds of bags. These costs are further magnified in premature wear due to abrasive dust, high temperatures, or chemical attack, which can force more frequent changeouts. In one documented case, a plant experiencing severe abrasion needed new filter bags every five weeks, with each unplanned changeout causing around 12 hours of downtime and costing an estimated USD 250,000 in lost production. When combined with potential production losses, such expenses can make the total cost of ownership for filter bag systems a challenge for operators, especially in cost-sensitive industries. This financial weight often pushes companies to delay replacements or opt for cheaper, lower-performance bags, which can in turn affect compliance and operational efficiency.

Opportunity: Technological advancements in filter media

Technological advancements in filter media present a significant opportunity for the filter bag market, enabling manufacturers to meet the evolving demands of industries while expanding into new application areas. Innovations such as high-temperature resistant fibers, nanofiber coatings, PTFE membrane lamination, and surface treatments have greatly enhanced the performance capabilities of filter bags. These advanced materials offer superior resistance to extreme temperatures, in some cases up to 280–290°C, and corrosive chemical environments, making them suitable for high-stress applications, including cement kilns, steel furnaces, biomass boilers, and waste-to-energy facilities. By overcoming the limitations of traditional polyester or acrylic filter bags, such media advancements allow suppliers to tap into industries where filtration requirements were previously too demanding, opening new revenue streams. Stricter global emission regulations also boost the adoption of advanced filter media. High-performance membranes and nanofiber coatings can capture ultrafine particles, including PM2.5 and sub-micron particulates, ensuring compliance with stringent standards, such as the EU Industrial Emissions Directive (often requiring particulate emissions below 10 mg/Nm³ for large combustion plants) and the US EPA’s NAAQS PM2.5 limits. These technologies improve environmental compliance and provide operational benefits, such as lower pressure drop, reduced energy consumption, and longer bag service life. As a result, plant operators facing high operational costs or environmental penalties are increasingly investing in premium filter media, creating a strong upgrade and retrofit market for existing baghouse systems.

Challenge: Environmental and disposal challenges

Most industrial filter bags are made from synthetic fibers, such as polyester, PTFE, or PPS, which do not decompose naturally. Handling or transporting used bags can pose pollution risks as they are coated with dust packed with heavy metals, dioxins, or other contaminants. Cleaning these bags is also tricky; washing them generates toxic runoff that’s costly to treat. Recycling them into new fibers is technically challenging due to the blend of synthetic materials and contamination issues. Incineration is a common alternative disposal method, especially in waste-to-energy plants—bags are often fed directly into furnaces along with regular incineration feed. While this eliminates physical waste, it brings its own burden: the fly ash attached to filter bags may contain contaminants such as lead, cadmium, or mercury, which can end up in emissions or solid residues. The American Society of Mechanical Engineers (ASME) conducted a study on this issue and raised environmental health concerns over airborne toxins and the cumulative emissions footprint. Given these challenges, the most practical method remains landfilling, despite its environmental drawbacks. Poor biodegradability, complex logistics (collection, transportation, cleaning), and high disposal costs make managing spent filter bags expensive and problematic for operators. These factors weigh on lifecycle costs and raise regulatory and sustainability concerns, especially in industries under increasing pressure to reduce waste and minimize environmental impact.

filter-bag-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys filter bag systems in chemical manufacturing plants to capture dust and particulates from exhaust gases during production processes. | Lower operational costs, reduced emissions, enhanced worker safety through improved air quality. |

|

Implements filter bags in food processing operations to remove suspended solids and impurities from liquids like juices, milk, and syrups for continuous production. | Improved product quality and consistency, reduced waste, extended equipment life with fewer clogs. |

|

Installs filter bag systems in power generation facilities and commercial science parks to control particulate emissions from flue gases and ensure clean air in research environments. | Increased energy efficiency, decreased utility costs, compliance with environmental regulations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The busbar market ecosystem includes various key participants such as raw material suppliers, manufacturers, distributors, end users, and after-sales maintenance service providers. This list is not exhaustive but is provided to illustrate the primary players involved in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Filter Bag Market, By Filtration Type

Based on filtration type, the filter bag market is segmented into gas and liquid filtration. The filter bag market is witnessing steady growth due to the rising need for air pollution control, wastewater treatment, and process filtration across industries. Filter bags are widely used in cement, power generation, mining, pharmaceuticals, chemicals, food & beverages, and water treatment plants to capture dust particles and remove impurities from liquids. Stringent environmental regulations, such as emission standards for particulate matter, and the global focus on sustainability and cleaner production processes strongly influence the filter bag market expansion. Industries increasingly adopt high-efficiency and high-temperature filter bags to ensure compliance, enhance operational efficiency, and reduce maintenance downtime.

Filter Bag Market, By media

Based on media, the filter bag market is classified into woven and non-woven filter bags, each catering to distinguish industrial requirements. Woven filter bags are known for their durability, tensile strength, and ability to handle coarse dust particles, making them widely used in heavy industries, such as cement, mining, and power generation. In contrast, non-woven filter bags are engineered to provide fine particle retention, higher dust-holding capacity, and enhanced energy efficiency, making them ideal for pharmaceuticals, food & beverage, and chemical processing applications.

Filter Bag Market, Filtration Fabric

In the filter bag market, the filtration fabric is highly diverse, comprising materials such as polyester, polypropylene, fiberglass, polyimide, acrylic fibers, ceramic, Teflon, and aramid. Each fabric type is engineered to meet specific industrial requirements ranging from cost-effective general-purpose filtration to high-performance, extreme-condition applications. Polyester and polypropylene filter bags dominate the market due to their affordability, chemical resistance, and adaptability across industries such as cement, food & beverages, pharmaceuticals, and wastewater treatment. On the other hand, fiberglass, polyimide, and aramid filter bags are increasingly preferred in industries such as power generation, steel, mining, and waste-to-energy, where high-temperature endurance, fine particulate capture, and long service life are critical. Ceramic and acrylic fiber filter bags also serve niche applications where specialized resistance to chemicals, heat, or abrasion is required.

Filter Bag Market, By Filter Type

Based on filter type, the filter bag market is primarily classified into pulse jet, reverse air, and shaker filter bags, each catering to distinct industrial needs. Pulse jet bag filters dominate the market due to their high efficiency, compact design, and ability to handle continuous operations, making them ideal for large-scale industries, such as cement, power generation, and mining. On the other hand, reverse air bag filters are widely used in heavy-duty applications, including steel, chemicals, and metal processing, owing to their durability and cost-effectiveness. Due to their low maintenance and simple operation, Shaker bag filters continue to find traction in small- to medium-scale industries, including food & beverages, woodworking, and pharmaceuticals. These filter types form the backbone of dust collection systems across industries, enabling compliance with stringent emission standards while supporting operational efficiency and workplace safety.

Filter Bag Market, By End-use Industry

The filter bag market is strongly shaped by its diverse applications across multiple end-use industries, driven by unique regulatory, operational, and environmental needs. Cement and mining & metals continue to be dominant consumers, as these sectors generate large volumes of particulate matter that require efficient dust collection solutions. Power generation and oil & gas industries increasingly adopt bag filters to comply with strict emission standards and to enhance operational efficiency in combustion and refining processes. Meanwhile, industries such as food & beverages, pharmaceuticals, and chemicals fuel the demand for specialized high-performance filter bags to ensure clean air, product purity, and worker safety in sensitive production environments. Emerging demand from automotive, paints & coatings, and other sectors such as textiles and pulp & paper reflects the broader industrial trend toward sustainable and energy-efficient filtration solutions.

REGION

Asia Pacific to be fastest-growing region in global filter bag market during forecast period

During the forecast period, Asia Pacific is expected to grow as the fastest region for the filter bag market in 2024, driven by rapid industrialization, strict environmental regulations, and heavy investments in infrastructure development. Countries such as China, India, Indonesia, and Vietnam are witnessing surging demand for filter bags in cement, power generation, chemicals, pharmaceuticals, and mining industries. Additionally, growing urbanization and rising energy consumption fuel the need for large-scale cement production and power generation, driving the demand for high-performance filtration solutions. The rapid growth of manufacturing hubs in Southeast Asia further opens new opportunities for filter bag suppliers to cater to localized demand.

filter-bag-market: COMPANY EVALUATION MATRIX

In the filter bag market matrix, Donaldson Company, Inc stands out as a leader due to its strong market presence and extensive product portfolio, which supports large-scale adoption across various industries. The other market consists of a few competitive players, including regional manufacturers and new entrants in Asia Pacific, Europe, and North America. The competitive landscape is shaped by growing demand for stricter emission control, increasing awareness of workplace air quality, advancements in filter media technology, and the global shift toward sustainable industrial practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.69 Billion |

| Revenue Forecast in 2030 | USD 3.63 Billion |

| Growth Rate | CAGR of 5.2% from 2025-2030 |

| Actual data | 2021-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors and trends |

| Segments Covered | By Filtration Type: Gas Filtration, and Liquid Filtration |

| Regional Scope | Asia Pacific, Europe, North America, South America, and the Middle East & Africa. |

WHAT IS IN IT FOR YOU: filter-bag-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End-Use Industry & Filter Type Segmentation | • Comprehensive list of customers with segmentation by end-use industry & filter type |

|

RECENT DEVELOPMENTS

- April 2024 : Eaton’s Filtration Division introduced two new liquid filtration solutions, SENTINEL and DURAGAF filter bag ranges. These advanced, fully welded polypropylene needle-felt bags integrate particle retention and oil absorption into a single step.

- February 2024 : Thermax Group signed an agreement to acquire a 51% stake in TSA Process Equipments Pvt. Ltd., a Mumbai-based company specializing in high-purity water treatment systems, with over 500 installations worldwide. This strategic acquisition would allow the company to be upgraded to full ownership over the next two years, and bolsters Thermax’s water purification capabilities, allowing it to offer comprehensive, end-to-end solutions in high-growth sectors, such as pharmaceuticals, biopharma, personal care, and food & beverages.

- May 2023 : 3M announced a substantial USD 146 million investment to enhance its biopharma filtration capabilities. The initiative is designed to accelerate the development and delivery of advanced filtration technologies tailored for bioprocessing, biological, and small-molecule pharmaceutical manufacturing.

- February 2023 : Donaldson Company, Inc. acquired Isolere Bio, Inc., an early-stage biotechnology company specializing in innovative IsoTag reagents and filtration processes. This acquisition strengthens Donaldson’s Life Sciences portfolio by integrating Isolere’s novel affinity-phase separation technology, which delivers higher product quality and faster, more cost-effective production timelines.

- January 2023 : Babcock & Wilcox strengthened its environmental product portfolio by acquiring Hamon Research-Cottrell (HRC), a company with a long-standing history in electrostatic precipitator (ESP) technology and advanced air quality control systems. This acquisition enhances B&W’s capabilities with HRC’s expertise in wet and dry ESPs, fabric filters, flue gas desulfurization systems, spray dryer absorbers, and circulating dry scrubbers.

Table of Contents

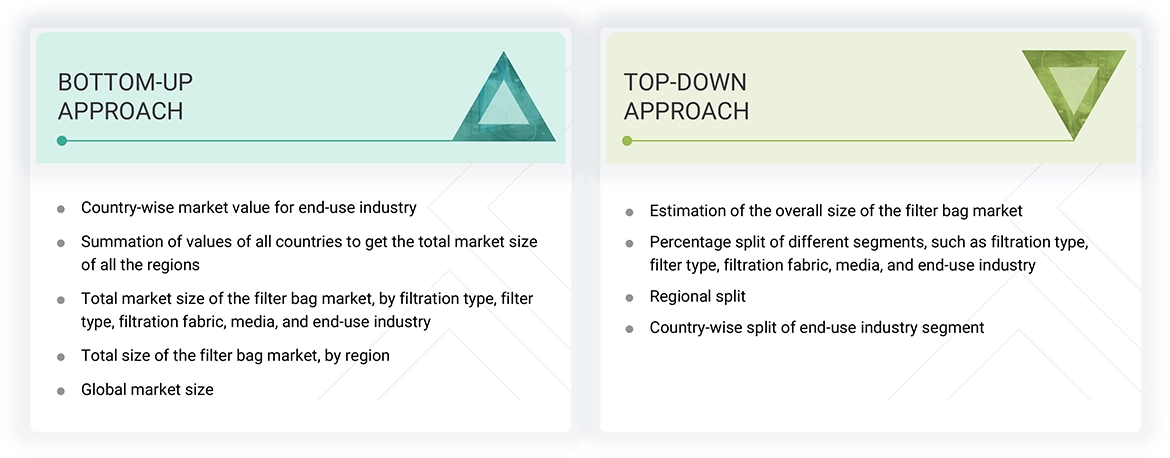

Methodology

The study involved major activities in estimating the current size of the filter bag market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

The study involved major activities in estimating the current size of the filter bag market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Primary Research

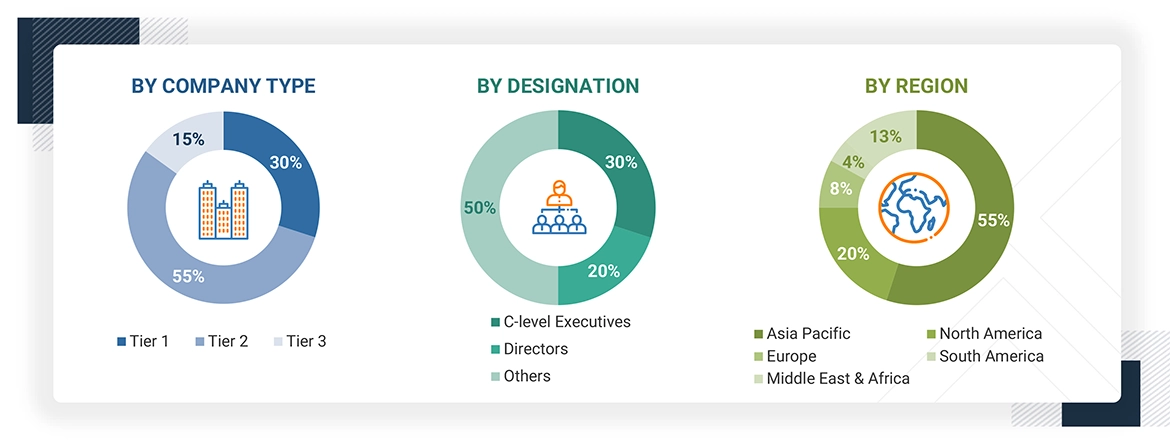

The filter bag market comprises stakeholders such as filter technology providers, infrastructure developers, and support service providers in the supply chain. The demand side of this market is characterized by the rising demand for filter solutions in countries due to the increasing need for efficiency, real-time data analytics, and predictive operations in infrastructure. The supply side is characterized by the rising demand for smart infrastructure contracts from authorities and operators, and mergers and acquisitions among major industry players. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: “Others” include sales managers, engineers, and regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the filter bag market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the filter bag market.

Filter Bag Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown processes were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The market was also validated using the top-down and bottom-up approaches.

Market Definition

According to industry assessments, the filter bag market refers to the global industry for fabric-based filtration systems to capture and remove solid particles and pollutants from industrial gas streams, liquids, and dust-laden processes. Filter bags are used across various industries, such as cement, power generation, chemicals, pharmaceuticals, food & beverages, and mining, to comply with emission standards, ensure workplace safety, and enhance production efficiency.

Filter bags are typically made of advanced materials, such as polyester, polypropylene, aramid, PTFE, and fiberglass. These provide high durability, chemical resistance, and efficiency in dust collection and gas or liquid filtration. By trapping fine particulates, filter bags are critical in reducing air pollution, ensuring product purity, and supporting sustainable operations. The adoption of filter bags has been strongly influenced by the growing implementation of environmental regulations worldwide, particularly concerning industrial emissions and occupational health standards. Furthermore, the push toward energy efficiency, decarbonization, and circular economy practices has accelerated investments in advanced filter bag technologies.

Stakeholders

- IoT and cloud-based solution providers

- Sustainability sector research & consulting companies

- Filter bag manufacturers

- Filter equipment manufacturers

- AI solution providers

- Technology providers

- Emission control bodies

- Government organizations

- Investors/shareholders

- Logistic companies

- Rail operators

- Terminal operators

- Refinery owners

Report Objectives

- To describe, segment, and forecast the filter bag market, by filtration type, filtration fabric, media, filter type, and end-use industry, in terms of value

- To describe and forecast the filter bag market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the filter bag value chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations and codes, pricing analysis, Porter’s five forces analysis, the impact of AI, and the 2025 US tariff impact

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with detailing the market’s competitive landscape.

- To analyze growth strategies adopted by market players, such as joint ventures, partnerships, mergers and acquisitions, contracts, agreements, and product launches, in the filter bag market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the filter bag by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the filter bag market size in 2024?

The filter bag market was valued at USD 2.69 billion in 2024.

What are the major drivers for the filter bag market?

The filter bag market is mainly driven by the growing need to enhance the efficiency of energy operations, reduce carbon footprint, and the surge in the adoption of Industry 4.0 technologies.

Which region is projected to be the fastest-growing filter bag market during the forecast period?

Asia Pacific is expected to be the fastest-growing market between 2025 and 2030, fueled by rapid trade growth, major modernization initiatives, and strong government-led digitalization efforts.

Which segment, by media, will hold a larger market share during the forecast period?

The non-woven segment is expected to hold a larger share of the filter bag market from 2025 to 2030.

Which segment is projected to be the largest, by filter type, in the filter bag market throughout the forecast period?

The pulse jet segment is likely to account for the largest market share during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Filter Bag Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Filter Bag Market