Flexible Graphite Market

Flexible Graphite Market by Type (Sheets, Foils, Tapes), Application (Gaskets & Seals, Thermal Management, Emi Shielding), End-Use Industry (Automotive, Aerospace, Electronics, Oil & Gas, Power & Energy), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The flexible graphite market is estimated to be USD 0.35 billion in 2025 and is projected to reach USD 0.45 billion by 2030, at a CAGR of 5.5% from 2025 to 2030. The flexible graphite market is experiencing robust growth, driven by increasing demand from high-performance sectors and industries such as oil & gas, automotive, electronics, and industrial. These industries and sectors face complex sealing, gasketing, and thermal management requirements, often involving extreme temperatures, high pressures, and corrosive environments. Flexible graphite is uniquely positioned to meet these challenges due to its exceptional thermal conductivity, chemical resistance, and long-term durability. Global investments in energy infrastructure are on the rise, supported by strict emission regulations and enhanced efficiency standards. These factors further fuel the demand for advanced materials such as flexible graphite. Additionally, rapid industrialization across Asia Pacific is accelerating the development of the power generation and automotive sectors, creating significant downstream opportunities. Innovations in composite graphite raw materials and advancements in manufacturing technologies are improving product performance and expanding application potential. As a result, flexible graphite continues to gain traction as a critical material in demanding industrial applications.

KEY TAKEAWAYS

-

By TypeThe flexible graphite market comprises Sheets, Foil, Tapes, Other Types. the sheets segment is expected to hold the largest market share, driven by their extensive use in sealing, insulation, and heat management applications across automotive, electronics, and industrial sectors, coupled with rising demand for durable, high-performance, and asbestos-free materials that ensure superior thermal and chemical resistance.

-

BY ApplicationApplication includes Gaskets & Seals, Thermal Management, EMI Shielding, Other Applications. The gaskets and seals segment is expected to hold the largest volume share in the flexible graphite market, supported by its extensive use in high-temperature, high-pressure applications across automotive, petrochemical, and power generation industries, where leak prevention and durability are essential.

-

By End-use IndustryEnd-use industry includes Automotive, Aerospace, Electronics, Industrial Manufacturing, Oil & Gas, Power & Energy, Other End-use Industries. The electronics segment is set to capture the largest market share in the flexible graphite market, propelled by its growing utilization in thermal management and heat dissipation components for consumer electronics, semiconductors, and advanced communication devices, ensuring performance efficiency and compact system design.

-

BY REGIONIndustrial Evaporators market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. The Asia-Pacific region is projected to hold the largest market share in the flexible graphite market, supported by rapid industrialization, strong manufacturing output, and expanding automotive and electronics sectors, along with increasing investments in energy storage and clean technology driving regional demand for high-performance graphite materials.

The flexible graphite market is experiencing robust growth, driven by increasing demand from high-performance sectors and industries such as oil & gas, automotive, electronics, and industrial. These industries and sectors face complex sealing, gasketing, and thermal management requirements, often involving extreme temperatures, high pressures, and corrosive environments. Flexible graphite is uniquely positioned to meet these challenges due to its exceptional thermal conductivity, chemical resistance, and long-term durability. Global investments in energy infrastructure are on the rise, supported by strict emission regulations and enhanced efficiency standards. These factors further fuel the demand for advanced materials such as flexible graphite.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-user industries is being shaped by evolving performance requirements, sustainability goals, and advancements in thermal and material technologies. Rising demand for energy efficiency, emissions control, and lightweight thermal solutions across sectors such as automotive, electronics, energy, and chemical processing is accelerating the adoption of flexible graphite materials. End-use industries are increasingly integrating flexible graphite for heat management, sealing integrity, and operational reliability in high-temperature and high-pressure environments. Downstream stakeholders, including OEMs, energy developers, and regulatory bodies, are emphasizing durable, recyclable, and high-performance materials that align with global decarbonization and circular economy objectives. These shifts are redefining industrial material strategies, creating strong growth opportunities for manufacturers, converters, and technology integrators within the flexible graphite ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for high-performance gasketing & sealing solutions

-

Rising demand for thermal management in electronics industry

Level

-

Availability for substitutes

-

Environmental & regulatory challenges in flexible graphite processing

Level

-

Increasing use of electric vehicles (EVs) and battery technology

-

Rising adoption in aerospace & defense industry

Level

-

High production costs and raw material dependence

-

Supply chain disruptions and geopolitical risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for high-performance gasketing and sealing solutions

The flexible graphite market is gaining significant momentum, driven by the escalating demand for high-performance sealing solutions across the oil & gas, petrochemical, and automotive industries. These industries operate in environments characterized by extreme temperatures, high pressures, and chemically aggressive media—conditions that necessitate advanced materials capable of delivering long-term reliability and operational integrity. Flexible graphite has firmly established itself as the material of choice for critical sealing applications, owing to its exceptional thermal stability, chemical inertness, and superior conformability to surface irregularities. Its compressibility and elastic recovery make it particularly well-suited for use in valve packings, gaskets, and industrial seals deployed in refineries, gas transmission systems, and automotive exhaust assemblies—ensuring leak-proof sealing in high-demand operating environments. As global investments in energy infrastructure continue to rise and regulatory frameworks impose more stringent safety and efficiency standards, the need for durable, high-performance sealing materials is intensifying. Flexible graphite offers a distinct performance advantage, particularly in systems subjected to thermal cycling and dynamic mechanical load conditions under which conventional materials like PTFE or elastomers often fail. Moreover, ongoing advancements in material science, including composite graphite formulations and ultra-thin graphite foils engineered for precision applications, are enhancing the functional capabilities of flexible graphite. These innovations broaden their applicability and reinforce their strategic value in mission-critical operations. As a result, flexible graphite is increasingly recognized for its performance and reliability and as a key enabler of equipment longevity, reduced maintenance frequency, and improved sustainability in complex industrial systems.

Restraint: Availability of substitutes

One of the primary challenges constraining the growth of the flexible graphite market is the increasing adoption of substitute materials such as polytetrafluoroethylene (PTFE), mica, and other synthetic polymers. These alternatives are gaining traction in sealing, gasketing, and thermal management applications due to their ability to deliver comparable performance characteristics—namely, chemical resistance, thermal stability, and effective sealing—at a lower cost. In price-sensitive industries such as automotive, general manufacturing, and construction, the economic attractiveness of these materials makes them a preferred choice over flexible graphite. Additionally, the high availability and well-established global supply chains of these substitutes further intensify competitive pressures for flexible graphite suppliers. Synthetic materials also offer advantages in terms of ease of manufacturing and application-specific customization, making them highly versatile and adaptable. These characteristics, combined with cost-effectiveness, align closely with the priorities of many industrial end-users, particularly those seeking scalable and flexible solutions. As a result, the growing reliance on alternative materials poses a considerable threat to the long-term market share of flexible graphite. To remain competitive, flexible graphite manufacturers must emphasize their unique value proposition—particularly the superior performance of their materials in extreme environments where substitutes may fall short. Additionally, strategic investments in product innovation, cost optimization, and targeted differentiation will be essential to enhance market positioning and sustain growth amid evolving industry dynamics.

Opportunity: Increasing use of electric vehicles (EVs) and battery technology

The accelerating growth of the electric vehicle (EV) industry presents a compelling opportunity for flexible graphite, particularly in battery thermal management and power electronics. As EVs become more powerful and energy-dense, managing the heat generated by lithium-ion batteries, inverters, and charging systems is critical to ensuring safety, extending service life, and optimizing overall performance. Due to its exceptional thermal conductivity, light weight, and engineered structural flexibility, flexible graphite is preferred for heat spreaders and thermal interface materials (TIMs). It plays a vital role in dissipating excess heat, mitigating the risk of thermal runaway, and enhancing the operational efficiency of battery systems. The transition toward next-generation battery technologies, such as solid-state lithium-ion cells and high-energy-density lithium chemistries, further underscores the need for advanced thermal management solutions. Flexible graphite is increasingly recognized as a foundational component in these applications, offering reliable performance under demanding thermal and mechanical conditions. Automobile OEMs and battery manufacturers are actively integrating graphite-based materials to improve energy efficiency, extend battery lifespan, and support the development of longer-range, high-performance electric vehicles. With global EV adoption accelerating and regulatory bodies enforcing stricter battery safety and thermal performance standards, flexible graphite is well-positioned to capture significant market share in this evolving landscape.

Challenges: Supply chain disruptions and geopolitical risks

A significant challenge for the flexible graphite market players is high reliance on natural graphite—a raw material subject to considerable supply chain and geopolitical risks. Although natural graphite is sourced from various regions, global production remains highly concentrated, with China alone accounting for a dominant share. This geographical concentration heightens exposure to trade restrictions, export controls, and political instability, which can significantly disrupt material availability and lead to price volatility. Trade tensions among major global economies further exacerbate these risks. Limited presence of multinational mining operations outside key producing countries restricts diversification opportunities and amplifies the impact of geopolitical events. Moreover, the environmental footprint associated with natural graphite extractions such as deforestation, high carbon emissions, and ecosystem disruption—adds complexity to sourcing strategies and increases scrutiny from regulators and stakeholders. The COVID-19 pandemic underscored the fragility of global supply chains, exposing the flexible graphite market to operational bottlenecks, shipping delays, and labor shortages. These disruptions have contributed to higher production costs and delayed delivery timelines, undermining operational efficiency across the value chain. Geopolitical risks such as regional conflicts, economic sanctions, and trade policy shifts continue to threaten the availability and cost stability of critical raw materials. These compounded challenges affect manufacturers and introduce uncertainty for end users, who may begin to favor alternative materials with more stable and sustainable supply dynamics. In response, flexible graphite producers must prioritize supply chain resilience by diversifying sourcing regions, investing in sustainable and traceable mining practices, and accelerating the development of synthetic graphite and other innovative alternatives. These strategic actions will mitigate risk and secure long-term competitiveness in a rapidly evolving materials market.

Flexible Graphite Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops and supplies high-performance flexible graphite sheets and foils for sealing, thermal management, and insulation applications. The company integrates advanced graphite processing technologies to serve automotive, electronics, and energy industries globally. | Ensures superior thermal conductivity, chemical resistance, and durability while supporting high-efficiency operations in demanding industrial environments. |

|

Provides engineered flexible graphite materials used in heat spreaders, gaskets, and battery applications. Its proprietary exfoliation and lamination processes deliver consistent quality and high customization for thermal management and sealing solutions. | Enhances energy efficiency, maintains performance stability, and extends product life through superior heat control and adaptability to complex system designs. |

|

Offers flexible graphite products tailored for thermal, electrical, and chemical process applications. The company combines material innovation with system integration expertise to serve industries such as semiconductors, renewable energy, and process engineering. | Improves process safety, operational efficiency, and long-term reliability by delivering consistent performance in high-temperature and corrosive environments. |

|

Produces premium-grade flexible graphite foils and composite materials for applications in automotive, chemical, and power generation industries. The company focuses on precision manufacturing and sustainable production practices. | Provides stable thermal and mechanical performance, reliable sealing under pressure, and reduced maintenance needs in critical operations. |

|

Manufactures high-purity flexible graphite materials used in advanced thermal management, semiconductor equipment, and clean energy systems. The company emphasizes innovation in graphite purity and process control. | Enables exceptional heat resistance, electrical stability, and product longevity, supporting efficient operation in precision and high-tech manufacturing sectors. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

SGL Carbon (Germany), Neograf (US), Mersen Property (France), and Toyo Tanso Co., Ltd. (Japan) are prominent flexible graphite companies. These companies are well-established, financially stable, and have a global presence in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Flexible Graphite Market, By End-Use Industry

Electronics is projected to be the fastest-growing end-use industry in the flexible graphite market, fueled by surging demand across consumer electronics, data centers, and electric vehicles (EVs). With its high thermal conductivity, chemical inertness, and lightweight composition, flexible graphite is ideally suited for use in thermal interface materials (TIMs), heat spreaders, and electromagnetic interference (EMI) shielding. As electronic devices become more compact and powerful, efficient thermal management is critical to maintaining performance and reliability. Flexible graphite effectively dissipates heat from critical components such as CPUs, GPUs, batteries, and power modules—making it indispensable in high-density electronic packaging for smartphones, tablets, 5G infrastructure, and high-performance computing systems. The accelerating shift toward vehicle electrification in fully electric and hybrid platforms further strengthens demand for flexible graphite in battery thermal management layers, inverters, and power electronics. Traditional thermal management solutions often fall short in these compact, high-temperature environments, while flexible graphite delivers superior performance, durability, and thermal resilience. As electronic innovation and miniaturization continue to evolve, flexible graphite is increasingly positioned as a strategic material, enabling the next generation of advanced electronics and EV systems.

Flexible Graphite Market, Application

The gasket & seals segment dominates the flexible graphite market. Flexible graphite offers exceptional chemical resistance, thermal stability, and reliable performance under extreme temperature and pressure conditions. These characteristics make it the material of choice for gaskets used in flange connections across critical sectors and industries, including automotive, chemical processing, oil & gas, power generation, and refining—where traditional metal and elastomeric seals often fall short. Asbestos-free and engineered for high compressibility and recovery, flexible graphite gaskets deliver secure, leak-proof sealing even under thermal cycling and in the presence of surface irregularities. Its ability to resist degradation in aggressive chemical environments and maintain oxidative stability at temperatures exceeding 400°C makes it particularly suitable for hazardous and corrosive applications. Continued innovation is driving market demand, with developments such as reinforced graphite sheets, laminated gasket composites, and proprietary product lines—including SIGRAFLEX (SGL Carbon), PAPYEX (Mersen), and NICAFILM (Nippon Carbon)—offering enhanced mechanical strength and improved application-specific performance. Regulatory shifts toward environmentally sustainable and safe sealing materials are further accelerating adoption. Over the forecast period, the gaskets and seals segment is expected to remain the dominant application area for flexible graphite, with growing penetration into next-generation energy systems and clean technology applications.

Flexible Graphite Market, By Type

The sheets segment is set to be the fastest growing segment in the flexible graphite market over the forecast period. This strong growth arises from increased use of graphite sheets in sealing, thermal insulation, and heat management applications across a wide range of industries such as automotive, electronics, energy, and petrochemicals. Flexible graphite sheets have excellent heat resistance, chemical stability, and compressibility; hence, they are widely preferred in n high-temperature and high-pressure environments. They are also widely adopted as a safer and more sustainable alternative to asbestos, which was previously used in industrial sealing and insulation but has been phased out due to its health hazards. Moreover, the growing focus on energy efficiency and electric mobility, particularly in EV batteries and fuel cells, is creating additional demand for flexible graphite sheets that help manage heat and improve system performance. These advantages collectively make the sheets segment the fastest growing and most widely adopted form of flexible graphite in the global market.

REGION

Asia Pacific to grow at significant rate during forecast period

Asia Pacific is projected to register a notably high CAGR in the flexible graphite market, driven by rapid industrialization and robust expansion across key industries. Countries such as China, India, Japan, and South Korea are witnessing increasing demand for flexible graphite due to its superior sealing and thermal management capabilities in high-temperature and chemically aggressive environments. The region’s growth is underpinned by large-scale development in automobile manufacturing, electronics, power generation, and petrochemical processing—industries where flexible graphite is preferred for critical components such as gaskets, seals, and thermal interface materials. China, in particular, plays a dominant role due to its abundant natural graphite reserves, cost-efficient manufacturing base, and vertically integrated supply chains. Government-led initiatives—such as China’s industrial modernization programs and India’s Make in India campaign—further incentivize domestic production and accelerate adoption across downstream industries. Favorable economic conditions, access to key raw materials, and the rise of technologically advanced end-use sectors position Asia-Pacific as a global hub for both the production and consumption of flexible graphite. As a result, the region is expected to significantly contribute to the overall growth and competitiveness of the flexible global graphite market.

Flexible Graphite Market: COMPANY EVALUATION MATRIX

In the flexible graphite market, SGL Carbon (Star) leads with a strong market share and an extensive product portfolio, driven by its advanced graphite processing technologies and broad applications across automotive, electronics, energy, and industrial sealing sectors. The company’s focus on high-performance thermal management solutions and global supply reliability reinforces its leadership position. East Carbon (Emerging Leader) is rapidly gaining recognition with its innovative, cost-efficient graphite products and focus on customized flexible graphite sheets and foils catering to evolving industrial needs. The company’s emphasis on sustainability, performance optimization, and regional expansion is enhancing its competitive edge. Meanwhile, other market participants are actively broadening their product capabilities and strengthening distribution networks to meet the growing demand for durable, energy-efficient, and environmentally compliant flexible graphite solutions, positioning themselves for future market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.33 BN |

| Market Forecast in 2030 | USD 0.45 BN |

| CAGR (2025–2030) | 5.5% |

| Years considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the flexible graphite market based on type, application, end-use industry and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles flexible graphite manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Type (Sheets, Foil, Tapes, Other Types) |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Flexible Graphite Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive Component Manufacturers | Performance benchmarking of flexible graphite seals and gaskets under high-temperature, high-pressure conditions for next-generation engines and EV platforms. | Improved sealing efficiency, enhanced material reliability, and compliance with emission and safety standards. |

| Aerospace System Integrators | Material suitability assessment for lightweight, thermally stable insulation and shielding components in aircraft and space systems. | Reduced component weight, improved heat resistance, and extended operational durability in extreme conditions. |

| Electronics & Semiconductor OEMs | Design optimization of graphite-based heat spreaders and interface materials for compact electronic assemblies. | Enhanced thermal conductivity, device efficiency, and heat dissipation, supporting higher performance and miniaturization. |

| Industrial Equipment & Machinery OEMs | Evaluation of flexible graphite gaskets and foils for use in pumps, turbines, and high-temperature processing units. | Increased operational uptime, minimized leakage risk, and improved long-term equipment performance. |

| Oil & Gas Equipment Supplier | Specification development for graphite sealing components in pipelines, refineries, and offshore applications under corrosive and high-pressure conditions. | Greater chemical resistance, reduced maintenance cycles, and ensured operational safety compliance |

| Energy System Developers & Power Plant Operators | Feasibility studies on graphite foils for heat insulation and conductivity in fuel cells, batteries, and turbines. | Boosted energy efficiency, improved system lifespan, and alignment with renewable and sustainability goals. |

RECENT DEVELOPMENTS

- February 2024 : Toyo Tanso Co., Ltd. increased its production capacity of SiC and TaC-coated graphite products used in the epitaxial process of SiC wafer production. With the rising demand for SiC power semiconductors, the company invested in expanding its manufacturing capacity, which will help it continue to achieve steady growth by strengthening its production and sales systems.

- December 2023 : Mersen Property inaugurated its Columbia site in the US. It spans 240,000 square meters and currently employs around 80 people. This will help increase graphite production, thereby increasing revenue.

- October 2022 : SGL Carbon increased its graphite production capacities for the semiconductor industry at the Shanghai (China), St. Marys (US), and Meitingen (Germany) sites. In St. Marys and Shanghai, capacities for purification and high-precision, computer-controlled processing of graphite components and felts were expanded. A new plant to produce carbonized and graphitized soft felt was constructed in Meitingen. This will increase the company’s graphite production capacity and revenue.

Table of Contents

Methodology

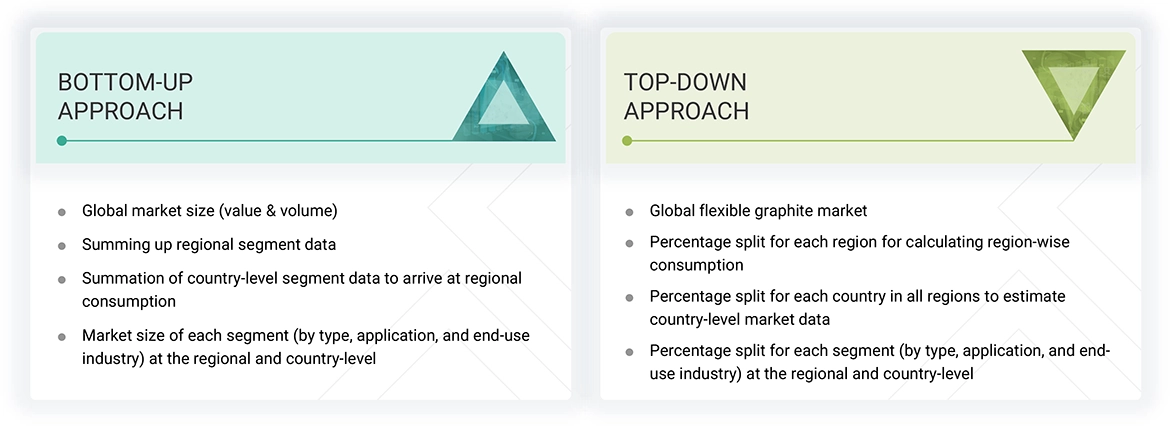

Four main steps were conducted to evaluate the flexible graphite market size. To compile data on the parent, peer, and market sectors, thorough secondary research was conducted. The next phase was verifying these results, hypotheses, and dimensions with industry experts using primary research across the flexible graphite value chain. Both top-down and bottom-up approaches helped estimate the market size. Data triangulation and market segmentation study helped determine the size of the market segments and sub-segments.

Secondary Research

The research method used to evaluate and project the access control market begins with gathering revenue data from notable suppliers utilizing secondary research. Many secondary sources—including D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines—were used during the secondary research to find and synthesize material for this study. The secondary sources included white papers, accredited publications, writings by prestigious writers, announcements from regulatory authorities, trade directories, databases, annual reports, news releases, and corporate investor presentations. Vendor offers have been taken into consideration to determine market segmentation.

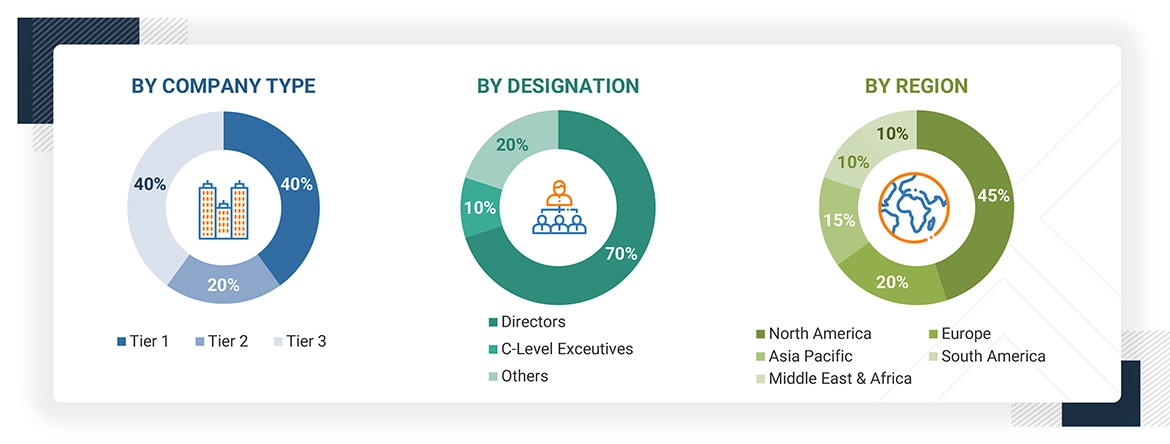

Primary Research

In the supply chain, the flexible graphite market includes manufacturers, suppliers, traders, associations, and regulatory bodies, among other players. The development of the automotive, electronics, and appliances industries defines the demand side of this market. Technological progress defines the supply side. Several primary sources from the supply and demand sides of the market were contacted to get qualitative and quantitative data.

The breakdown of primary responders is represented below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the flexible graphite market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the flexible graphite market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Flexible Graphite Market Size: Bottom-up and Top-down Approaches

Data Triangulation

Following the above-described market size estimation procedures, the market was divided into segments and sub-segments once arrived at the general market size. Wherever relevant, data triangulation and market breakdown techniques were used to finish the whole market engineering process and arrive at the precise statistics of each market segment and subsegment. Summing up the country-level and regional-level data helped estimate the size of the market worldwide.

Market Definition

Flexible graphite, also known as exfoliated graphite, is synthesized from natural graphite flakes through a series of chemical and thermal treatments. Initially, the natural graphite flakes undergo oxidation with a highly oxidizing acid, forming intercalation compounds. These compounds are subsequently subjected to a rapid high-temperature treatment, which induces the exfoliation process, resulting in a significant increase in volume and the formation of flexible, lightweight graphite structures. The resulting exfoliated graphite exhibits unique properties, including high thermal and electrical conductivity, significant compressibility, and excellent mechanical flexibility. Following expansion, the exfoliated graphite is mechanically processed to produce various shaped products, including graphite foils and sheets, which are utilized in various applications, from gaskets and seals to advanced thermal management systems.

Stakeholders

- Flexible graphite manufacturers

- Distributors and suppliers of flexible graphite goods.

- Manufacturers of automobiles and electronic equipment.

- Associations, industrial bodies, and others

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global flexible graphite market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global flexible graphite market

- To analyze and forecast the size of various segments (type, application, and end-use industry) of the flexible graphite market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as product launches and expansions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is flexible graphite?

Flexible graphite, or exfoliated graphite, is a material produced from natural graphite flakes that are chemically treated and expanded by heat. This results in a soft, flexible material used primarily in the form of foils and sheets.

What are the different applications of flexible graphite?

Gaskets and seals, thermal management, and EMI (Electromagnetic Interference) shielding.

What are the key driving factors for the growth of the global flexible graphite market?

The rapid growth of the electronics and automotive industries, which require high-performance thermal and sealing solutions, is a major driver of the flexible graphite market.

Which are the leading companies in the flexible graphite market?

SGL Carbon (Germany), Neograf (US), Mersen (France), and Toyo Tanso Co., Ltd. (Japan)

Which are the key regions in the global flexible graphite market?

Asia Pacific

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Flexible Graphite Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Flexible Graphite Market