Float Glass Market

Float Glass Market by Thickness (<5 mm, 5-10 mm, 10> mm), Product (Clear float glass, Tempered float glass, Tinted float glass, Laminated float glass), End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Solar Energy), and Region – Global Forecast to 2030

OVERVIEW

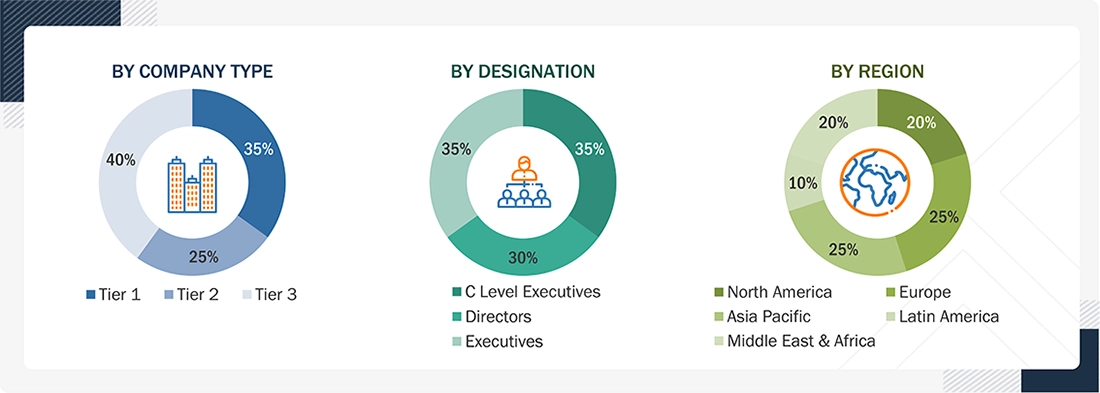

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The float glass market size was USD 171.88 billion in 2025 and is expected to reach USD 298.65 billion by 2030, with a CAGR of 11.7%. The future of the float glass market looks promising, as the glass is a key raw material for various downstream products and is used in numerous construction projects, car manufacturing, solar panels, and consumer electronics. The rapid urbanization and infrastructure development, especially in emerging economies, are driving continuous demand for architectural glass used in residential and non-residential buildings. Simultaneously, the automotive industry is enabling increased demand for float glass in windshield, window, and glazing applications. The growing use of value-added glass products like laminated glass, tempered glass, coated glass, and low-emissivity glass also strengthens demand for float glass, as it is the primary raw material for these products. Moreover, increased investments in renewable energy, particularly in solar photovoltaic systems, are increasing the demand for high-quality float glass that finds application in solar panels.

KEY TAKEAWAYS

-

By ProductBy product, the clear float glass segment is projected to grow at a CAGR of 12.0% in terms of value during the forecast period.

-

By ThicknessBy thickness type, the <5mm segment is projected to grow at a CAGR of 12.2% during the forecast period in terms of value.

-

By End Use IndustryBy end-use industry, the solar energy segment is projected to grow at a CAGR of 25.5% during the forecast period in terms of value.

-

Competitive Landscape (Key Players)Taiwan Glass Group, Saint-Gobain, Sisecam, AGC Inc are the star players in the float glass market, given their broad industry coverage and strong operational & financial strength.

-

Competitive Landscape (SME/Startups)Behrenberg glass, Cardinal Glass Industries, Gold Plus Group, VELUX Group have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios

The enhancement of energy-efficiency policies and sustainability targets in both developed and developing markets drive the demand for float glass. Governments are also implementing strict building energy standards, which are influencing the adoption of high-performance glazing systems, thereby indirectly driving float glass as the primary input material. The increased renovation and refurbishment of old residential and commercial buildings especially in North America and Europe is generating ongoing replacement demand of contemporary glass solutions. Moreover, the intensive adoption of electric and autonomous vehicles is increasing the amount of glass per vehicle, such as large windshields, panoramic roofs, as well as display-built-in glass, all of which are based on float glass substrates. The use of technological integration, such as smart glass, acoustic-insulating glass, and solar-control coating, is also expanding the application range without necessarily depending on increased volumes. In addition, the recycling rates and the development of the circular economy in the sphere of the glass industry are decreasing the costs of production and environmental footprint, which makes the manufacturing of float glass more resilient and appealing to long-term capacity investment, thus helping to maintain market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The float glass market is experiencing a clear shift in the paradigm where an overwhelming majority of the revenue base is traditional to a more progressive future based on high-end applications and customer innovation. Although the current revenues are largely contributed by the common thickness, products, and traditional end-use industries, the future revenues would be achieved in the new technologies, value-added glass solutions, and new use cases. The need to use energy-saving and sustainable float glass is being strengthened by the demand of the automotive manufacturers, solar panel manufacturers, and green building developers. Such developing client demands are translating to deliverables like better brand image, reduced maintenance expenses, regulatory adherence, and better functional performance, on which long-term market expansion is grounded

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for float glass in construction & Infrastructure sector

-

Growth in automotive and transportation sector

Level

-

High production and energy cost

-

Stringent carbon emissions regulation

Level

-

Growth in solar energy and renewable applications

-

Rising adoption in emerging economies

Level

-

High cost of advanced technologies

-

Growing environmental concerns and regulatory pressure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Growing demand for float glass in construction & Infrastructure sector

The float glass market is highly driven by the construction & infrastructure industry which is backed by high rates of urbanization and increase in population in both developed and developing states. The mass production of residential housing and commercial buildings, as well as civic infrastructure, are rising in the use of glass in windows, facades, partitions and interior uses. The current architectural fashion is more inclined to use natural light, transparency and beauty thus the direct effect is high consumption of float glass in a single building. Infrastructure development, which is led by the government through the development of airports, railways stations, and metropolitan routes in addition to institutional buildings, also bolsters the demand. Also, high usage of processed float glass which is an end product of float glass substrates is indirectly supported by the transition to energy efficient and green buildings.

Restraint: High production and energy cost

The manufacturing of float glass is very energy consuming, as it involves a long time operating of furnaces in high temperatures. The cost of production is also exposed to fluctuations in prices due to the high percentage of energy costs (natural gas and electricity) as a total cost of production. Besides, rebuilding of furnace, maintenance, and sourcing of raw materials entail high level of capital expenditure. These huge fixed and variable cost strains the profit margins, particularly during low demand seasons or during high price rivalry. These costs do not usually go into smaller and regional manufacturers, restricting their ability to expand capacity and enter new markets.

Opportunity: Rising adoption in emerging economies

The float glass market has a high growth potential in emerging economies as the markets are growing in terms of construction, infrastructure development, and industry. Due to the fast urbanization, the growth of residential housing and commercial real estate, the consumption of glass in these areas is also growing. In emerging markets, governments are spending a lot of money on transport infrastructure, smart cities, and renewable energy initiatives, which augers well with long-term industry demand of float glass. Local automotive production and installations of solar power are also expanding application capacity. The use of float glass is likely to increase more fast with domestic manufacturing capacities being better and costs being more competitive

Challenge: High cost of advanced technologies

State-of-the-art float glass systems like the low-emissivity, coated, and high-performance glass systems will demand a large amount of specialized equipment and process upgrades. There is an added complexity of production due to the cost of incorporating coating lines, automation, and rigorous quality control mechanisms. Such high prices may limit the market of these products in price-sensitive markets and delay the replacement of traditional by value-added glass products. The payback period is also a longer one in the case of manufacturers especially when the premium product demand is still in its early stages. The float glass market has a challenge on balancing between the technological development, affordability to consumers, and cost efficiency

FLOAT GLASS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies float glass as the base material for architectural glazing used in residential, commercial, and infrastructure projects, including facades, windows, curtain walls, and interior partitions. The company further processes float glass into tempered, laminated, and coated products to meet energy efficiency and safety requirements. | Increased optical transparency, better thermal and solar capability, better safety standards, less energy usage in structures, and extended service life in a wide range of climatic conditions. |

|

Offers automotive and transportation glass, such as windshields, sidelights, rear windows and panoramic roof systems. There is float glass that is used in laminated and tempered passenger vehicle automotive glazing, electric vehicle automotive glazing, and commercial transportation system automotive glazing. | Increased passenger safety, acoustic and thermal insulation, decreased weight of the vehicle, improved view, and integration with the latest driver assistance and visualization technologies. |

|

Uses high quality float glass in solar energy and industrial applications, supplying solar grade glass for photovoltaic modules and specialty flat glass for electronics, appliances, and industrial equipment. | Good light transmission, environmental stress durability, high solar module efficiency, uniform surface quality, and high precision driven industrial performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The float glass market ecosystem is organized in a well interlocked value chain that commences with the raw material manufacturers who provide the required inputs in terms of silica sand, soda ash, limestone, and dolomite. Float glass producers work with these materials and utilize large scale, high capital investment, production facilities to create flat sheets of glass of uniform thickness and optical clarity. The finished products of these manufacturers are in turn sold to intermediaries, such as processors and fabricators who process to get value added products out of the float glass such as tempered, laminated, coated and insulated glass units which are specific to the performance need. These refined glass products are eventually delivered to the final consumers in major sectors like the construction sector, the automobile sector and even in the solar energy sector. Co-ordination involving all these ecosystem in a consistent quality, cost-effectiveness, regulatory adherence, and timely delivery is essential to guarantee that the market of float glass can accommodate the increasing demand of high performance and sustainable glass products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Float Glass Market, By End-Use Industry

The float glass market will experience a smooth increase in terms of value from 2025 to 2030, due to the diversification of its demand in the construction, automotive, and solar energy sectors. The biggest end-use segment is construction and infrastructure, which is sustained by residential, commercial and public infrastructure projects. The automotive and transportation industry offers a stable growth with the help of the rising car production and the glass content per vehicle. The rate of solar energy is expected to be the fastest growing end use Industry as the photovoltaic installations will increase at high rates and the policy of renewable energy will support it. Incremental demand is offered by other end use industries in form of appliances, furniture, and industrial use. On the whole, an increasing role of solar energy is redefining the end use combination of the float glass market during the forecast period.

REGION

Asia Pacific to be fastest-growing region in Float Glass Market during forecast period

Asia Pacific will have the highest rate of growth in the float glass market as it is on the path of high rate of urbanization, massive building of infrastructures and high growth in the industrial sector of major economies in the region like China, India and Southeast Asian countries. The increasing demand of architectural glass is as a result of increasing investments in residential and commercial buildings coupled with the rising population. It is also associated with a robust manufacturing base, where the production of automobiles is growing and the use of electric vehicles is growing, which is driving up the consumption of glass per vehicle. Moreover, there are violent renewable energy plans that are hastening the construction of solar photovoltaic systems, raising the demand of float glasses in solar panels. Positive government policies, reduction in the cost of manufacturing, and the constant increase of capacity by the producers of glass in Asia Pacific also contribute to the growth of the Asian Pacific market.

FLOAT GLASS MARKET: COMPANY EVALUATION MATRIX

AGC Inc is a star player in the float glass company evaluation matrix, given that it has a wide product line, heavy worldwide manufacturing presence, and technological innovation and leadership in high-performance and value-added solutions of glass. The company has established competencies in building, automotive, solar, and specialty glass products, backed by a consistent stream of innovations and bulk production. As an Emerging Leader, Guardian Glass is on the rise with its growing product glass offerings to architects and automobiles, as well as with its strategic capacity building and market penetration across the regions. Though AGC Inc remains dominant with its size, superior technology, and well-established customer relations, Guardian Glass shows evident possibilities to become even nearer to the stars quadrant as the demand for the glazing solution that is both energy-efficient and environmentally friendly grows all over the world.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- TAIWAN GLASS IND. CORP. (Taiwan)

- CSG HOLDING CO.,LTD. (China)

- Fuyao Group (China)

- Nippon Sheet Glass Co., Ltd (Japan)

- Saint-Gobain (France)

- Sisecam (Turkey)

- Central Glass Co., Ltd. (Japan)

- AGC Inc. (Japan)

- Trulite (Georgia)

- SCHOTT (Germany)

- Vitro (Mexico)

- Flat Glass Group Co., Ltd (China)

- Xinyi Glass Holdings Limited (China)

- Guardian Industries (US)

- Cevital (Algeria)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 171.88 Billion |

| Market Forecast in 2030 (Value) | USD 298.65 Billion |

| Growth Rate | CAGR of 11.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Thickness: <5 mm, 5-10 mm, 10> mm I Product: Clear float glass, Tempered float glass, Tinted float glass, Laminated float glass I End-Use Industry: Construction & Infrastructure, Automotive & Transportation, Solar Energy |

| Region Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: FLOAT GLASS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Real Estate Developers & Construction Firms | Assessment of float glass facade and window I thickness selection I energy efficiency testing I cost analysis. | Enhanced performance of buildings I reduced construction expenses I increased architectural quality. |

| Automotive OEMs & Tier 1 Suppliers | Test of float glass quality and suitability to automotive glazing applications I processing suitability I optical performance. | Assisted safety compliance I enhanced passenger comfort I had regular high volume production. |

| Solar PV Module Manufacturers | Evaluation of float glass used in solar panels I light transmission I durability in stress environment. | Increased module performance I increased long term reliability I decreased performance losses. |

| Infrastructure & Smart City Authorities | Technical assessment of float glass in applications as public infrastructure projects I safety glazing requirements I lifecycle assessment. | Less maintenance needs I enhanced safety performance I increased service life. |

| Appliance & Furniture Manufacturers | Specification Analysis of float glass grades used as appliance and furniture surfaces I surface quality I dimensional stability | Better quality of products I minimized processing wastes I minimized manufacturing expenses. |

RECENT DEVELOPMENTS

- August 2025 : Saint-Gobain has started construction on its seventh float glass line and fifth mineral wool insulation line at the Oragadam complex in Chennai, increasing local capacity with a 1,000 tons per day float glass line built for high value-added glass and energy-efficient operations.

- February 2025 : Trulite purchased Dependable Glass Works to increase its presence in Southeast Louisiana and along the I-10 corridor. Dependable Glass Works is well-known for its quick response time, high quality, and specialized products. Trulite is to develop a new plant near Dependable's Glass Works to expand capabilities and support future expansion. This is Trulite's second acquisition in the last week

- February 2025 : AGC and Saint-Gobain officially inaugurated the Volta production line. Volta, at the AGC Barevka plant in Teplice, is a breakthrough pilot project aiming to significantly reduce CO2 emissions and support the transition to sustainable float glass production. The pilot furnace uses innovative glass production technology that has never been used in the world before.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the float glass market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering float glass and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the float glass market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the float glass market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from float glass industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, form type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using float glass were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of float glass products and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the float glass market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in float glass products in different applications at a regional level. Such procurements provide information on the demand aspects of the float glass industry for each application. For each end use industry, all possible segments of the float glass market were integrated and mapped.

Float Glass Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Float glass is a flat glass product created by spreading molten glass into a controlled, continuous layer so that it naturally levels and solidifies into a smooth, uniform sheet. The process ensures consistent thickness and surface quality without the need for mechanical polishing. Float glass functions as the fundamental glass form from which performance-enhanced products such as safety, coated, and insulated glass are developed for use in buildings, vehicles, energy systems, and specialized industrial applications.

Key Stakeholders

- Float Glass manufacturers

- Senior Management

- End User

- Float Glass associations and industrial bodies

- Research and consulting firms.

- R&D Departmen

Report Objectives

- To define, describe, and forecast the float glass market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global float glass market by product, thickness, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the Float glass market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Float Glass Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Float Glass Market