Foam Core Material Market

Foam Core Material Market by Product Type (PET, PVC, SAN, PMI, PEI), End-Use Industry (Wind Energy, Marine, Aerospace & Defense, Automotive & Transportation, Construction & Industrial), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

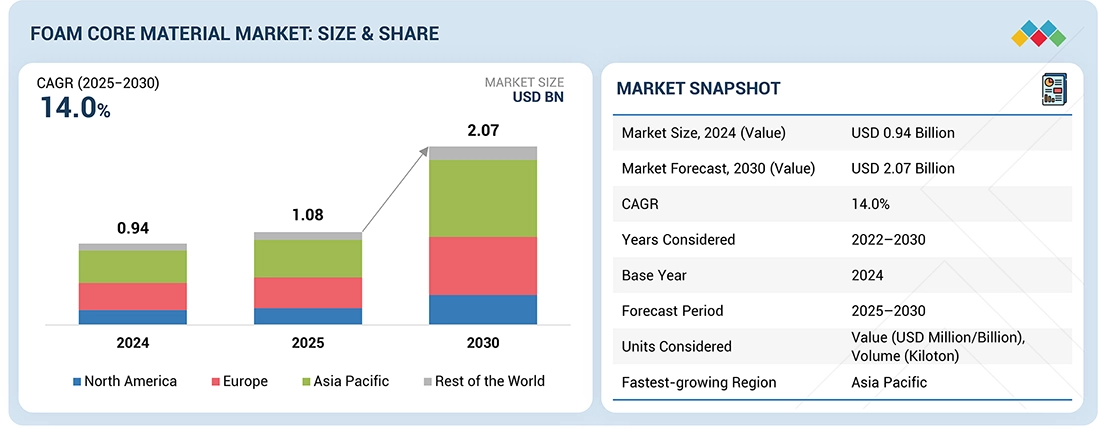

The foam core materials market is projected to grow from USD 1.08 billion in 2025 to USD 2.07 billion by 2030, at a CAGR of 14.0%. The growing adoption of lightweight solutions in aerospace and automotive industries has increased the demand for foam core materials globally. These materials help improve the fuel efficiency and driving range of electric vehicles. The rapid expansion of the renewable energy sector has also increased the need for high-strength, low-density materials in the production of larger, more efficient wind turbine blades. Other than the structural applications, these materials are also used for thermal and acoustic insulation in green construction as well as in protective packaging.

KEY TAKEAWAYS

-

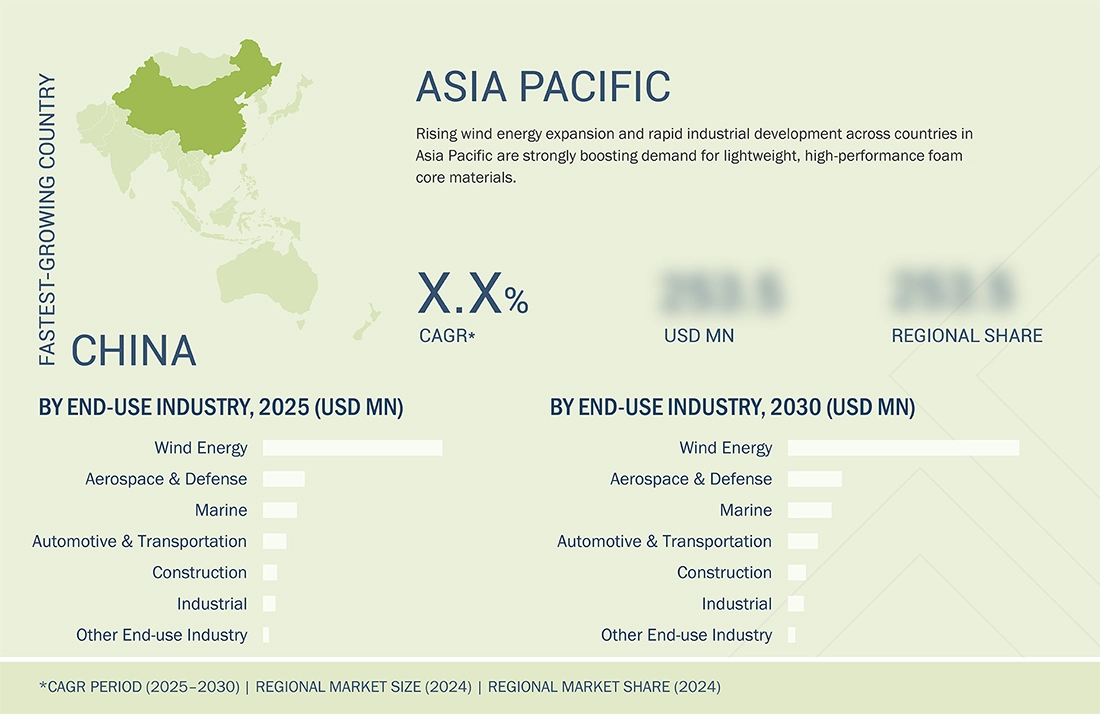

By RegionAsia Pacific is projected to register the highest CAGR of 15.5% during the forecast period.

-

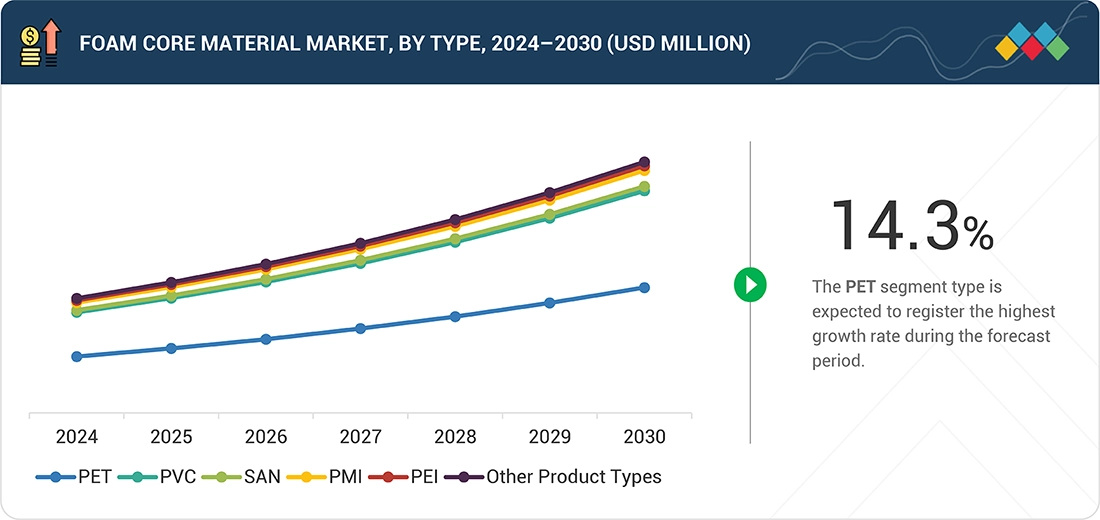

By Product TypeBy product type, the PET segment is projected to register the highest CAGR of 14.3% during the forecast period.

-

By End-use IndustryBy end-use industry, the wind energy segment is estimated to dominate the market.

-

Competitive Landscape - Key PlayersGurit Holdings AG, 3A Composites, Evonik Industries AG, Armacell, and Diab Group were identified as some of the star players in the foam core materials market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsPolyumac USA, LLC, Carbon-Core Corporation, and Dongying Horizon Composite Co., Ltd. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The foam core material market is growing rapidly due to the demand for lightweight and high-strength composite structures from the major industrial sectors. The market expansion is triggered by the wind energy sector, which highly employs PET, PVC, and SAN cores to manufacture longer and lighter turbine blades to achieve maximum energy in onshore and offshore wind energy components. The aerospace industry further pushes the demand since OEMs universally adopt the use of advanced sandwich structures to optimize fuel efficiency, payload capacity, and minimize carbon footprints. In the automotive sector, the global shift toward electric vehicles (EVs) is a critical growth engine where vehicle lightweighting is necessary to compensate for battery heft and maximize range.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of foam core materials market suppliers, which, in turn, impacts the revenues of foam core materials market manufacturers.Furthermore, sustained fluctuations in demand from end users can cause a decline in production, slower procurement cycles, and pricing pressure throughout the supply chain. Greater risk of unsold inventory and compressed margins may also impact the market players more, prompting manufacturers to rethink their strategies on capacity planning, cost structures, and long-term planning to ensure that they remain profitable.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for foam core materials in wind turbine blades and solar panels

-

Imperative to improve fuel efficiency

Level

-

High cost of foam core materials in end-use industries

-

Difficulty in recycling foam core materials

Level

-

Pressing need for foam core materials in medical industry

-

Evolving industrial requirements

Level

-

Development of low-cost technologies

-

Volatility in raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for foam core materials in wind turbine blades and solar panels

Due to the worldwide shift to renewables, the demand for foam core materials in wind turbine blades and solar panels is rising, with rigid foam cores (PVC, PET, and SAN) offering structural support, thermal insulation, and fatigue resistance to improve the components’ durability and effectiveness. In wind turbine blades, these foams fill sandwich composites for spars and roots areas, allowing bigger shapes of over 100-meter offshore wind turbine blades, reducing weight and cyclic loads. The wind energy foam core market is growing rapidly with renewable energy projects. For solar panels, PET and similar foam cores enhance backsheet insulation and reduce heat transfer from cells, and increase electrical safety and protection against environmental stress such as UV rays and moisture.

Restraint: High cost of materials in end-use industries

The principal causes for the high cost of foam core materials in various end-use industries, including aerospace, automotive, wind energy, and marine construction, are due to instability of raw material costs, mainly petroleum-based resins (PVC and polyurethane), which are affected by fluctuations in the global oil market and interference in supply routes. Manufacturing complexities involving intricate foaming processes, specific additives tailored for UV resistance, fire retardancy, and high density contribute to increased production costs, and custom dimensions and quality grades necessitate more materials and wastage.

Opportunity: Pressing need for foam core materials in medical industry

The foam core materials are increasingly crucial in the medical industry because of their unique ability to combine lightweight construction with excellent cushioning, biocompatibility, and hygienic properties for patient comfort, device efficacy, and infection prevention in an atmosphere of growing chronic ailment incidences and cutting-edge medical needs. These materials excel in applications like surgical positioning pads, MRI/CT scanning supports, wearable devices, and wound dressings, where their closed-cell structures resist moisture and microbes, enable easy sterilization via gamma radiation or disinfectants, and provide radiolucency for undistorted imaging without compromising structural integrity.

Challenge: Development of low-cost technologies

Designing low-cost technologies for foam core materials is challenging, as it demands a delicate balancing act of minimizing costs while also maintaining essential mechanical characteristics such as rigidity, toughness, and heat retention. Foam core materials are essential constituents of composite materials that are lightweight and employed across transdisciplinary domains such as automobiles, airplanes, and buildings. However, the manufacturing of foam core materials relies upon expensive primary materials and complex fabrication processes that are the primary factors of manufacturing cost.

FOAM CORE MATERIAL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Foam core composites in aircraft interior panels, fairings, wing components | Weight reduction, higher fuel efficiency, improved stiffness-to-weight |

|

Foam core materials in large wind turbine blades (spar caps, shear webs) | Higher blade stiffness, reduced mass, improved fatigue life |

|

Uses PET/PVC foam used in turbine blade shells | Structural stability, corrosion resistance, extended blade life |

|

Foam core sandwich structures in premium interior trims and structural inserts | Weight savings, improved rigidity, enhanced comfort |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The foam core materials market ecosystem is composed of a network of manufacturers, suppliers of raw materials, distributors, and end customers who, together, sustain the sector. Key players are Diab Group, Gurit Holding AG, and 3A Composites, who manufacture sophisticated PVC, PET, SAN, and PMI foam core materials for wind energy, marine, aerospace, and transportation. The upstream supply chain is sustained by the large-scale resin, polymer, and blowing agent chemical manufacturers that are needed for the production of high-performance foam materials. These production activities are aided by a large number of distribution partners that provide global coverage and material availability, along with technical support. Vestas, Siemens Gamesa, Airbus, and Boeing, among others, are the major end users and sustain recurrent demand for the composites due to the need for lightweight, stiff, and highly durable materials.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Foam Core Material Market, by Product Type

The PET type accounted for the most significant share of the foam core material market due to the high strength-to-weight coupling it provides, along with the thermal stability and durability it offers, making the material ideal for structural uses like in wind turbine blades, marine, and automotive & transportation usages. Its closed cell structure and high resistance to moisture and chemicals, coupled with its full recyclability and adherence to strict environmental laws, have triggered preference over the conventional core materials, such as polyvinyl chloride (PVC) and balsa wood.

Foam Core Material Market, by End-use Industry

It is projected that the wind energy sector is projected to register the highest CAGR in the foam core material market because of the rapid expansion of wind power capacity across the globe, which is fueling immense demand for light but high-strength composite materials used in manufacturing turbine blades. Foam core materials are becoming more preferred in onshore and offshore wind installations as they augment a blade’s performance and efficiency by significantly decreasing its weight without compromising its structural integrity. In addition, the renewable energy targets and investments, alongside technological efficiency in blade designs and composites processing, are increasing the rate of foam cores consumption in the wind energy industry compared to other end-use industries.

REGION

Asia Pacific to be the fastest-growing region in the global foam core material market during the forecast period

Asia Pacific is anticipated to be the fastest-growing region in the foam core material market due to rapid industrialization and large-scale infrastructure development activities across major economies, including China, India, Japan, and Southeast Asian countries, driving the demand for high-performance composite materials. This is largely driven by the region’s growing manufacturing and investments in renewable energy facilities, which include the wind energy and automotive & transportation industries. Growth of policies and incentives that promote sustainable construction and renewable energy adoption by governments, coupled with the region’s cost-competitive production capabilities, is contributing to speeding up growth.

FOAM CORE MATERIAL MARKET: COMPANY EVALUATION MATRIX

In the foam core material market matrix, Gurit Holdings (Star) leads with a strong market share and extensive product footprint, which are widely adopted in wind energy, marine, transportation, and industrial sectors. Euro Composites (Emerging Leader) is gaining visibility as it focuses on innovation and backs this with high-performance structural foams for wind turbine blades, rail transit, and marine applications. While Gurit Holdings dominates through scale and a diverse portfolio, Euro Composites shows significant potential to move toward the leaders’ quadrant as demand for lightweight foam core materials continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Gurit Holdings AG (Switzerland)

- 3A Composites (Switzerland)

- Evonik Industries AG (Germany)

- Armacell (Luxembourg)

- Diab Group (Sweden)

- Changzhou Tiansheng New Materials Co., Ltd. (China)

- CoreLite (US)

- Sicomin (France)

- I-Core Composites (US)

- Maricell Core Composites (Italy)

- SAERTEX GmbH & Co. KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.94 Billion |

| Market Forecast, 2030 (value) | USD 2.07 Billion |

| Growth Rate | CAGR of 14.0% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

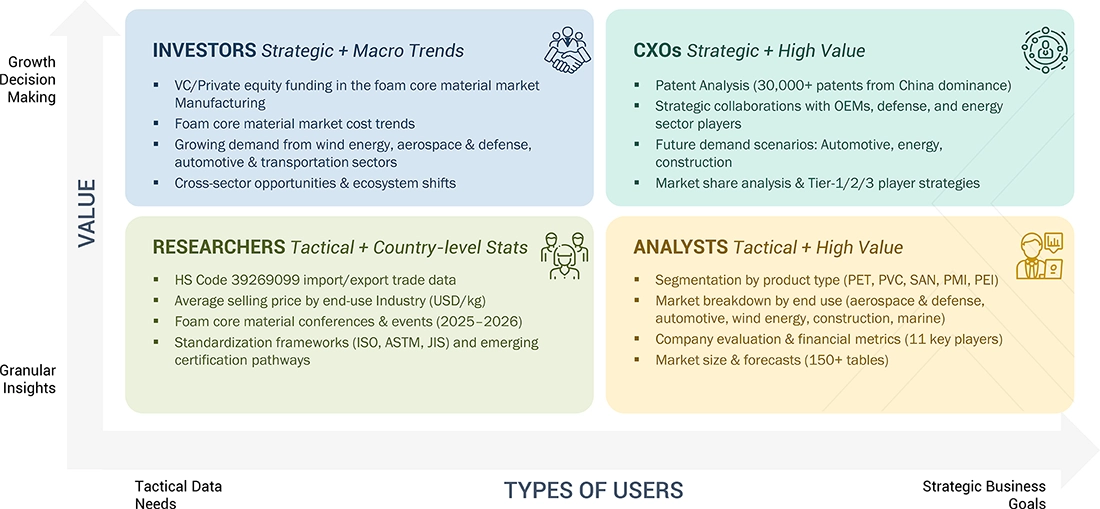

WHAT IS IN IT FOR YOU: FOAM CORE MATERIAL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Foam Core Material Manufacturer |

|

|

| Foam Composites Fabricator / Laminator |

|

|

| APAC Resin & Feedstock Supplier |

|

|

| Wind Blade & Marine Structure Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2024 : Gurit Holding AG launched two different products. One was Gurit Kerdyn FR+, a PET recycled structural foam with Class C – EN13501 test and certification. It offered good compressive strength and stiffness. The other one was Balsaflex Lite, which is a next-generation balsa and PET core material with a novel coating system that reduces resin uptake during infusion processes.

- October 2023 : Gurit Holding AG announced major long-term supply contracts with two leading OEMs, expected to generate substantial net sales over the contract periods.

- May 2022 : 3A Composites Core Materials acquired SOLVAY’s TegraCore PPSU resin-based foam, which became part of the portfolio under AIREX TegraCore. Both companies agreed to continue their collaboration to further develop AIREX TegraCore.

Table of Contents

Methodology

The study involved two major activities in estimating the current size of the Foam Core Material Market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering core materials and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the core material market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the core material market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from core material industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the core materials, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of core materials and future outlook of their business which will affect the overall market.

Market Size Estimation

The research methodology used to estimate the size of the core material market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations of core materials in different applications at a regional level. Such procurements provide information on the demand aspects of the core materials industry for each application. For each application, all possible segments of the core material market were integrated and mapped.

Data Triangulation

After arriving at the overall Foam Core Material Market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. In order to complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the wind energy, aerospace & defense, marine, automotive & transportation, and other end-use industries.

Market Definition

The term "core materials" describes a wide variety of materials that are used as essential parts of composite structures in a variety of sectors. These substances function as the inner or central core of sandwich composite structures, offering crucial characteristics including insulation, rigidity, and strength while keeping a thin profile. Core materials, which are commonly classified into categories like foam, balsa wood, and honeycomb structures, are widely used in a variety of industries, including construction, wind energy, aerospace, marine, automotive, and industrial manufacturing. The market for core materials is always changing due to advances in materials science and the increased emphasis on lightweight and sustainable solutions. This is because a variety of end-use sectors are seeing a growing need for high-performance and affordable alternatives.

Key Stakeholders

- Core materials manufacturers and distributors

- Key application segments for composites

- Research and consulting firms

- R&D institutions

- Associations and government institutions

- Environmental support agencies

Report Objectives

- To analyze and forecast the size of the Foam Core Material Market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on type and end-use industry

- To analyze and project the market based on four regions, namely, Europe, North America, Asia Pacific (APAC), and Rest of World (RoW)

- To strategically analyze the micro markets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC Foam Core Material Market

- Further breakdown of Rest of Europe Foam Core Material Market

- Further breakdown of Rest of world Foam Core Material Market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Foam Core Material Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Foam Core Material Market