Foley Catheters Market Size, Growth, Share & Trends Analysis

Foley Catheters Market by Insertion (Suprapubic), French Size (16Fr), Tip (Coudé), Balloon Size (5 mL), Lumen Number (2-way), Material (Silicone), Coating Type (Hydrophilic), Gender (Male), End User (Hospitals & ASCs) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The foley catheters market is projected to reach USD 1.20 billion by 2030 from USD 0.93 billion in 2025, at a CAGR of 5.3% from 2025 to 2030. The growth of the foley catheters market is driven by the rising prevalence of urological disorders, increasing rates of hospitalization, ICU admissions, and surgical procedures, and growing awareness of infection control, government initiatives promoting better urological care.

KEY TAKEAWAYS

-

BY INSERTION TYPEThe foley catheters market comprises urethral catheter, and suprpubic catheter.

-

BY FRENCH SIZEKey french sizes include 12Fr and below, 14Fr, 16Fr, 18Fr, and 20Fr and above

-

BY TIP TYPEKey tip types of foley catheters span the Straight–Tipped Catheter, Coude–Tipped Catheter, and Other–Tipped Catheter.

-

BY BALLOON SIZEThe foley catheters market comprises of 5 ml balloons, 10 ml balloons, and other balloon sizes.

-

BY LUMEN NUMBERKey lumnen number of foley catheters include 2–way, and 3–way & 4–way.

-

BY MATERIALKey materials of foley catheter market comprises of latex foley catheter, silicone foley catheter, and hybrid foley catheter.

-

BY COATING TYPEThe foley catheters market comprises of Antimicrobial-Coated Foley Catheters, Hydrophilic or Lubrication-Coated Foley Catheters, and Uncoated Foley Catheters.

-

BY GENDERThe foley catheters market comprises of Males, and Females.

-

BY END USERKey end users of foley catheter market include Hospitals & ASCs, Long-Term Care Facilities, and Other End Users.

-

BY REGIONThe foley catheter market covers Europe, North America, Asia Pacific, Latin America, and the Middle East, and Africa. Europe is the largest market for foley catheters and is home to several prominent companies. Europe has a rapidly ageing population, which expands the prevalence of urinary retention, incontinence and chronic conditions that require indwelling catheterisation.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Becton, Dickinson and Company (US) partnered with Bactiguard AB (US) to serve as the exclusive global license partner (excluding China) for Foley catheters coated with Bactiguard’s infection prevention technology.

The Foley catheters market is growing steadily, driven by rising urinary disorders, an aging population, and demand for advanced, patient-friendly devices. Innovations such as antimicrobial-coated, hydrophilic, and silicone-based catheters reduce infection risks and comply with strict safety standards. Strategic partnerships, investments in infection-prevention research, and adoption in homecare and outpatient settings are reshaping the market, making safety, comfort, and innovation the key drivers of growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on healthcare providers’ business emerges from patient trends and clinical disruptions. Hospitals and homecare providers are clients of Foley catheter manufacturers, while surgical and chronic care applications are end users. Shifts such as rising CAUTI concerns, aging populations, and outpatient care adoption affect end-user revenues. Changes in end-user demand influence hospital procurement budgets, which in turn impact the revenues of Foley catheter manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of urological disorders

-

Increasing surgical volumes and ICU admissions

Level

-

Patient discomfort and stigma

-

Growing preference for alternative catheterization methods

Level

-

Innovation in catheter design and material composition

-

Development of smart Foley catheters

Level

-

High risk of catheter-associated urinary tract infections (CAUTIs)

-

Improper insertion or maintenance of Foley catheters

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing prevalence of urological disorders

Rising cases of urinary retention, incontinence, and other urological conditions are expanding the patient pool requiring catheterization. Factors such as an aging population, higher incidence of chronic diseases like diabetes and prostate disorders, and increased surgical interventions contribute to greater clinical need. This trend drives higher demand for both hospital-based and homecare catheter solutions, encouraging adoption of advanced, patient-friendly, and infection-reducing catheter technologies across healthcare settings.

Restraint: Patient discomfort and stigma

Patient discomfort and social stigma can limit the adoption of Foley catheters. Many patients experience physical discomfort, irritation, or pain during insertion and prolonged use. Additionally, the association with urinary incontinence or chronic illness can lead to embarrassment and reluctance to use catheters, especially in outpatient or homecare settings. These factors may reduce patient compliance and demand, influencing healthcare providers’ decisions and impacting overall market growth.

Opportunity: Innovation in catheter design and material composition

Advancements in catheter design and material composition are driving enhanced patient outcomes and clinical efficiency. Innovations such as antimicrobial coatings, hydrophilic surfaces, and flexible silicone materials reduce infection risks, improve comfort, and support longer indwelling periods. Novel designs, including 2-way, 3-way, and specialty catheters, enable precise clinical applications. These developments are encouraging wider adoption across hospitals, outpatient facilities, and homecare settings, while addressing stringent safety standards and evolving healthcare provider requirements.

Challenge: High risk of catheter-associated urinary tract infections (CAUTIs)

The high incidence of catheter-associated urinary tract infections (CAUTIs) poses significant clinical concerns, affecting patient safety and recovery outcomes. CAUTIs can lead to prolonged hospital stays, increased antibiotic use, and higher treatment costs, placing additional burden on healthcare systems. This situation drives hospitals and care providers to adopt advanced antimicrobial-coated and hydrophilic Foley catheters, implement strict infection-control protocols, and focus on patient education to minimize infection rates and improve overall care quality.

Foley Catheters Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Folysil silicone Foley catheters including designs to reduce UTI risk and tailored versions for neobladder patients. | Larger drainage channel, biocompatibility, latex-free comfort, enhanced drainage, and lower infection risk. |

|

Comprehensive Foley catheter portfolio including specialty designs for various clinical needs and procedural preferences | Wide clinical compatibility, reliable drainage, option of specialty catheters for complex cases, high safety profile. |

|

Rüsch Foley catheters (latex, silicone, armoured variants, post-operative, and long-term drainage solutions) | Biocompatible materials, high drainage capacity, inhibition of encrustation, broad range for both short- and long-term use, easy insertion and handling. |

|

Dover Latex Coated Coude, silicone Foley catheters for drainage, retention, and post-surgical needs. | Smooth insertion, enhanced comfort, supports patients with BPH or urinary retention, improved hygiene, diverse product range for all patient types. |

|

Pre-lubricated and hydrophilic-coated Foley catheters | Reduced risk of urinary tract infections, minimized insertion trauma, enhanced patient comfort, supports global standards for catheterization |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Foley catheters market ecosystem consists of raw material suppliers (Kent Elastomer, Elkem), device manufacturers (Coloplast, Becton Dickinson, Teleflex incorporated), and end users (hospitals, clinics). Materials are processed into advanced catheters, including hydrophilic and antimicrobial-coated designs. End users drive demand for patient safety, infection prevention, and ease of use, while manufacturers deliver innovative, high-quality devices. Collaboration across the value chain is essential for product innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Foley Catheters Market, By Insertion Type

As of 2024, urethral catheters segment dominated the foley catheters market, this dominance can be attributed to their widespread use in hospitals, long-term care facilities, and home care settings for managing urinary retention, incontinence, and post-surgical drainage. Urethral Foley catheters are preferred due to their ease of insertion, lower procedural complexity compared to suprapubic catheters, and suitability for both short- and long-term catheterization. Additionally, the growing incidence of urological disorders, increasing number of surgical procedures, and rising geriatric population have further boosted the demand for urethral Foley catheters globally.

Foley Catheters Market, By French Size

In 2024, the 16Fr Foley catheters segment held a significant portion of the market by French size. This can be attributed to its suitability for a wide range of adult patients and its optimal balance between drainage efficiency and patient comfort. The 16Fr size is widely recommended for general urinary catheterization in both male and female patients, making it the most commonly used size in hospitals and long-term care settings. Its versatility across various clinical applications, including postoperative care, urinary retention management, and incontinence treatment, continues to support its broad adoption among healthcare professionals.

Foley catheters Market, By Tip Type

In 2024, straight-tipped Foley catheters accounted for a substantial share of the market by tip type. Their extensive clinical use is supported by ease of insertion, versatility across patient groups, and compatibility with a variety of drainage procedures. Straight-tipped designs are preferred for routine catheterization as they facilitate smooth navigation through the urethra and reduce the risk of trauma during insertion. Their broad application in hospitals and home care settings for both short- and long-term urinary management continues to reinforce their strong presence in the market.

Foley catheters Market, By Balloon Size

In 2024, Foley catheters with a 5 ml balloon size accounted for a substantial share of the market by balloon volume. This prevalence is supported by their frequent use in routine short-term catheterization procedures, particularly in adult patients. The 5 ml balloon size offers adequate retention while minimizing discomfort and urethral irritation, making it a preferred choice across hospitals and clinical settings. Its suitability for standard drainage applications and compatibility with a wide range of catheter materials further reinforce its consistent use in everyday urological care.

Foley catheters Market, By Lumen Number

In 2024, the 2-way Foley catheter segment accounted for a major portion of the market by lumen number. This trend reflects its extensive use for routine urinary drainage across hospitals, clinics, and home care settings. The 2-way configuration, comprising one lumen for urine drainage and another for balloon inflation offers a simple, cost-effective, and efficient solution for short- and medium-term catheterization. Its ease of insertion, reduced risk of complications, and broad clinical applicability make it the preferred choice among healthcare providers for general urinary management.

Foley catheters Market, By Material

In 2024, latex Foley catheters accounted for a major share of the market by material. Their widespread use is supported by advantages such as high flexibility, ease of insertion, and cost-effectiveness compared to alternative materials. Latex catheters also offer good drainage performance and patient comfort, making them suitable for both short- and medium-term catheterization. Continuous availability across healthcare facilities and strong clinician preference for their handling characteristics further reinforce the extensive utilization of latex-based Foley catheters in clinical practice.

Foley catheters Market, By Coating Type

In 2024, antimicrobial-coated Foley catheters accounted for a significant portion of the market by coating type. Their widespread adoption is driven by the growing emphasis on infection prevention and the need to reduce catheter-associated urinary tract infections (CAUTIs) in healthcare settings. These catheters, coated with materials such as silver alloy or nitrofurazone, help inhibit bacterial growth and biofilm formation, thereby enhancing patient safety and improving clinical outcomes. The rising awareness of hospital-acquired infection control protocols and the increasing preference for advanced, infection-resistant devices have further supported the use of antimicrobial-coated Foley catheters across hospitals and long-term care facilities.

Foley catheters Market, By Gender

In 2024, the male patient segment accounted for a significant share of the Foley catheters market by gender. This trend is linked to the higher prevalence of urinary tract complications among men, including prostate-related issues and urinary retention, which frequently require catheterization. Male-specific Foley catheters are designed to accommodate anatomical differences, ensuring effective drainage and patient comfort. The consistent use of these catheters in hospitals, surgical procedures, and long-term care settings has contributed to their prominent presence in the market.

Foley catheters Market, By End User

In 2024, hospitals and ambulatory surgical centers (ASCs) accounted for a significant portion of the Foley catheters market by end user. Their extensive use is driven by the high volume of surgical procedures, patient admissions, and post-operative care requirements that necessitate urinary catheterization. Hospitals and ASCs benefit from well-established supply chains and trained medical staff capable of managing catheter use efficiently, ensuring patient safety and reducing complications. Additionally, the increasing prevalence of urological conditions and the growing geriatric population contribute to sustained demand for Foley catheters in these clinical settings.

REGION

Asia Pacific to be fastest-growing region in global foley catheters market during forecast period

In 2024, the Asia Pacific region is expected to register the highest CAGR in the Foley catheters market by region. This growth is driven by increasing healthcare infrastructure investments, rising hospital admissions, and a growing geriatric population with a higher prevalence of urinary disorders. Additionally, expanding awareness about urinary health, improving access to advanced medical devices, and the growing number of surgical procedures across countries such as China, India, and Japan are contributing to the rapid uptake of Foley catheters in the region.

Foley Catheters Market: COMPANY EVALUATION MATRIX

In the Foley catheters market, Coloplast A/S (Star) maintains a leading position with a broad portfolio of catheters, innovative designs, and strong global distribution, making it a preferred choice across hospitals and long-term care settings. Medline Industries (Emerging Leader) is gaining momentum through a focus on cost-effective solutions, expanding hospital partnerships, and increasing presence in emerging markets. While Coloplast benefits from scale, brand recognition, and product diversity, Medline demonstrates strong growth potential as demand for high-quality, patient-friendly, and affordable urinary care products rises worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.90 Billion |

| Market Forecast in 2030 (value) | USD 1.20 Billion |

| Growth Rate | CAGR of 5.3% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Foley Catheters Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2025 : Amsino International, Inc. (US) launched new AMSure Foley Catheter Trays, now featuring dual antiseptic skin prep, an updated SteriGuide IFU, and the Bedal flexGRIP Securement Device to enhance patient safety and catheter stability.

- May 2025 : Medline Industries, LP (US) entered into a distribution and supply agreement with Texas-based TenderHeart (US) Health Outcomes, under which Foley catheters and related urological supplies will be delivered directly to patients' homes through the Medline Home Direct Program, enhancing access to essential continence care products.

- December 2023 : Becton, Dickinson and Company (US) serves as the exclusive global license partner (excluding China) for Foley catheters coated with Bactiguard’s infection prevention technology.

Table of Contents

Methodology

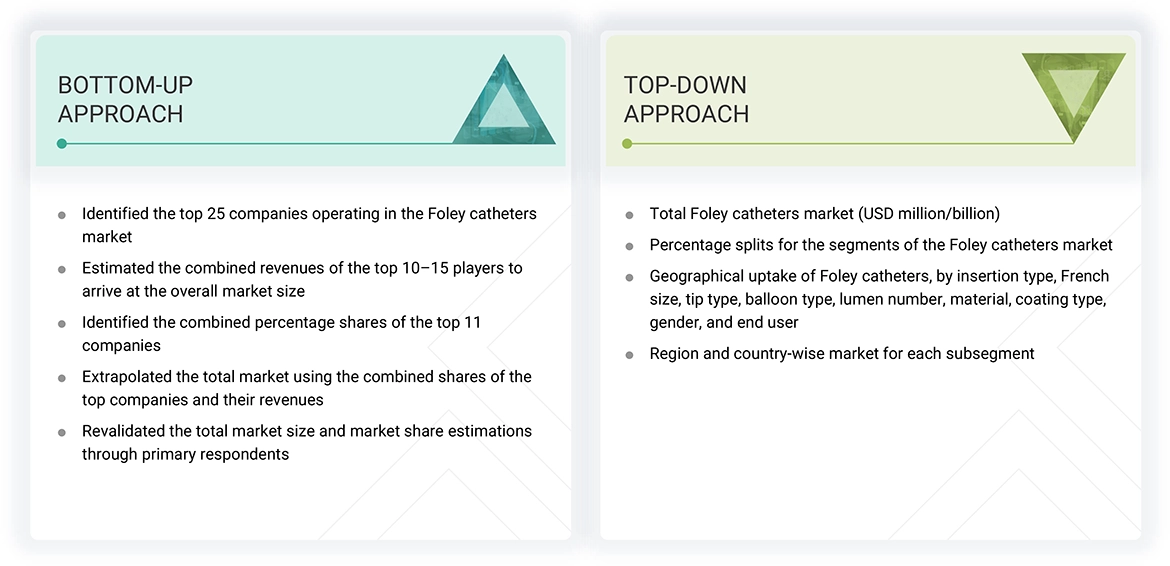

This study involved the extensive use of both primary and secondary sources. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next step involved conducting primary research to validate our conclusions and assumptions regarding market sizes and engaging with industry experts across the entire value chain. We employed both top-down and bottom-up methods to evaluate the overall market size. Subsequently, we estimated the market sizes of various segments and subsegments using data triangulation techniques and detailed market breakdowns.

Secondary Research

The secondary research process extensively utilized various secondary sources, including directories and databases such as Bloomberg Businessweek, Factiva, and D&B Hoovers. Additionally, we referred to white papers, annual reports, investor presentations, and SEC filings from companies. Publications from government sources, such as the National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), the American Urological Association (AUA), the European Association of Urology (EAU), the International Continence Society (ICS), and the Urology Care Foundation, were also consulted to gather information for the global Foley catheters market study.

This research helped us acquire crucial insights regarding key players, market classification, and segmentation based on industry trends. We aimed to cover these aspects down to the most detailed level while also identifying significant developments in market and technology perspectives. As a result of this secondary research, a comprehensive database of key industry leaders was created.

Primary Research

During the primary research process, interviews were conducted with various sources from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, primary sources included industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, as well as other key executives from prominent companies and organizations in the Foley catheters market. On the demand side, primary sources comprised hospitals & ASCs, long-term care facilities, and other end users. This primary research aimed to validate market segmentation, identify key players, and gather insights on important industry trends and market dynamics.

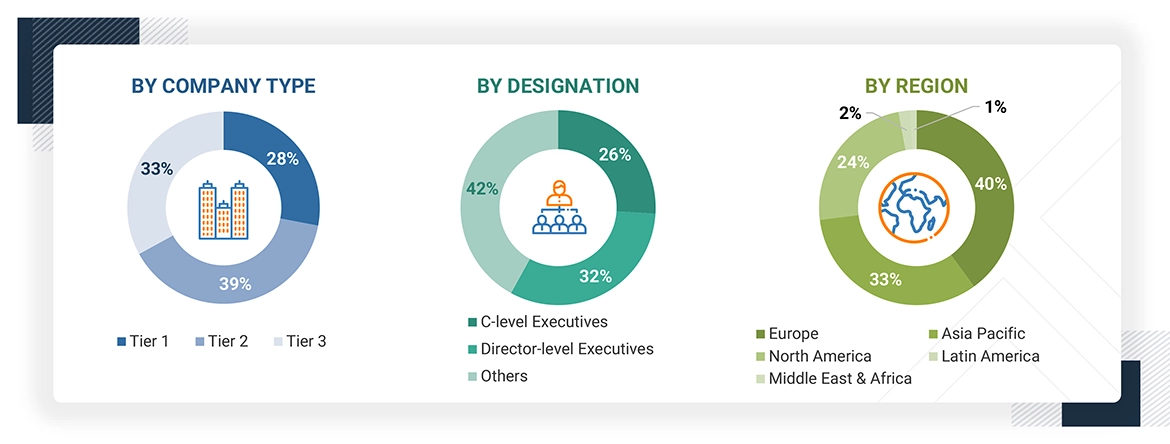

A breakdown of the primary respondents is provided below:

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024, Tier 1= >USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = < USD 1 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global Foley catheters market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The global Foley catheters market was split into various segments and subsegments based on the:

- List of major players operating in the products market at the regional and/or country level.

- Product mapping of various Foley catheter manufacturers at the regional and/or country level.

- Mapping of annual revenues generated by listed major players from Foley catheters (or the nearest reported business unit/product category).

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments.

- Summation of the market value of all segments/subsegments to arrive at the global Foley catheters market.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up Approach & Top-down Approach)

Data Triangulation

After arriving at the overall size of the global Foley catheters market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. Examining several macro-variables and regional trends from demand- and supply-side players helped triangulate the extrapolated market data.

Market Definition

The Foley catheters market encompasses medical devices consisting of flexible, sterile tubes designed for insertion through the urethra into the bladder, where they are secured in place by an inflatable balloon. These catheters are widely utilized for both short-term and long-term urinary catheterization in patients with conditions such as urinary retention, incontinence, post-surgical recovery needs, or for precise urine output monitoring in critical care settings. Market demand is driven by their essential role in managing diverse urological and post-operative conditions across healthcare environments.

Stakeholders

- Manufacturers & vendors of Foley catheters

- Research associations involved in catheterization

- Research and consulting firms

- Distributors of Foley catheters

- Healthcare institutions

- Government bodies/municipal corporations

- Regulatory bodies

- Business research and consulting service providers

- Venture capitalists

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the Foley catheters market based on insertion type, French size, tip type, balloon size, lumen number, material, coating type, gender, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To assess the Foley catheters market through the Porter’s Five Forces framework, regulatory landscape, the value chain, the supply chain, patent analysis, pricing analysis, key stakeholders, and buying criteria

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Foley catheters market

- To analyze the opportunities in the Foley catheters market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the Foley catheters market in five primary regions (along with countries): North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players operating in the Foley catheters market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as partnerships, agreements, expansions, and product developments

- To benchmark players within the Foley catheters market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the categories of business strategies, market share, and product offerings

- To understand the impact of AI/generative AI on the market

Key Questions Addressed by the Report

Which are the top industry players in the global Foley catheters market?

Prominent players include Coloplast A/S (Denmark), Becton, Dickinson and Company (US), Cardinal Health, Inc. (US), Teleflex Incorporated (US), Medtronic Plc (Ireland), Sterimed Group (India), Medline Industries, LP (US), Amsino International, Inc. (US), B. Braun SE (Germany), Bactiguard AB (US), and McKesson Corporation (US).

What are some of the major drivers for this market?

Major drivers include the increasing prevalence of urological disorders, rising surgical volumes and ICU admissions, rapid growth in the global geriatric population, and a shift toward post-acute and home-based care.

Which end users have been included in the global Foley catheters market?

The report includes hospitals & ambulatory surgery centers (ASCs), long-term care facilities, and other end users.

Which type of Foley catheter is the most lucrative in the market?

The urethral catheters segment is expected to witness the highest growth rate during the forecast period.

Which region is the most lucrative in the Foley catheters market?

The Asia Pacific region is expected to witness the highest CAGR during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Foley Catheters Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Foley Catheters Market