Food Inspection Devices Market Size, Share & Trends, 2030

Food Inspection Devices Market by X-ray Inspection Devices, Metal Detectors, Checkweighers, Vision Inspection Systems, Meat, Bakery & Confectionery, Catering & Ready-to-Eat Meals, Food Packaging, Retail Chains & Hypermarkets - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global food inspection devices market is estimated to grow from USD 3.25 billion in 2025 to USD 5.08 billion by 2030 at a CAGR of 9.3% during the forecast period. Growth is driven by rising food safety concerns, stringent regulations, and technological advancements such as AI-based vision systems, spectroscopy, and microbial detection, enhancing inspection accuracy and automation across food production and packaging industries.

KEY TAKEAWAYS

- The North American food inspection devices market accounted for a 31.6% revenue share in 2024.

- By product, the spectroscopy devices segment is expected to register the highest CAGR of 13.7%.

- By food category, the catering & ready-to-eat meals segment is projected to grow at the fastest rate from 2025 to 2030.

- By vertical, the food manufactures & processors segment is expected to dominate the market.

- By technology, the automated/computerized systems segment is expected to dominate the market, growing at the highest CAGR of 10.1%.

- Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., and ISHIDA CO., LTD. were identified as some of the star players in the global food inspection devices market, given their strong market share and product footprint.

- Mekitec Group, Novolyze, and ZoomAgri, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The food inspection devices market plays a key role in ensuring food safety and quality across manufacturers, processors, retailers, and regulators. Devices such as X-ray systems, metal detectors, checkweighers, vision systems, and microbial detectors enable rapid detection of contaminants and defects. Rising demand for processed foods, strict safety regulations, and growing consumer awareness are driving the adoption of automated and advanced inspection technologies. The market is expected to grow steadily, supported by technological innovation, increasing contamination detection needs, and efficiency requirements across the food industry.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. It illustrates how companies' revenue mix is expected to evolve over the next 4–5 years, moving from current offerings to new use cases, technologies, and markets. The future of the food inspection devices market is shaped by two major trends: the shift from traditional hardware-based detectors (X-ray, metal, and microscopic systems) to AI-powered and automated solutions for predictive quality control and real-time anomaly detection, and the disruption of cloud-based analytics and advanced imaging (ultrasound and 3D scanning), which enable seamless traceability and compliance across food supply chains in meat, dairy, bakery, and ready-to-eat segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global food safety concerns

-

Surging demand for processed and packaged foods

Level

-

High equipment and maintenance costs

-

Complexities in integrating with legacy systems

Level

-

Technological advancements in inspection systems

-

Rising demand for advanced contaminant detection

Level

-

Difficulty in standardizing inspection across varied food products

-

Growing cybersecurity risks associated with data-driven inspection infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand for processed and packaged foods

Rising demand for processed and packaged foods, fueled by changing lifestyles, urbanization, and higher disposable incomes, is driving the adoption of food inspection devices. As production scales increase, manufacturers and packers are investing in automated, high-accuracy inspection systems to ensure safety, quality, and regulatory compliance across the food supply chain.

Restraint: High equipment and maintenance costs

The high upfront cost of advanced inspection systems, including X-ray, vision, spectroscopy, and microbial detection devices, coupled with ongoing expenses for calibration, software upgrades, and skilled support, limits adoption among SMEs. Operational downtime and high total ownership costs further restrain broader market growth.

Opportunity: Rising demand for advanced contamination detection

The rising demand for advanced contamination detection presents a significant opportunity in the food inspection devices market. Next-generation technologies, such as hyperspectral imaging, spectroscopy, biosensors, and AI-driven vision systems, enable real-time, multi-contaminant detection, enhancing food safety, reducing recall risks, and supporting brand protection, particularly in high-risk segments like meat, dairy, and ready-to-eat products.

Challenge: Difficulty in standardizing inspection across varied food products

A key challenge in the food inspection devices market is standardizing processes across diverse food products. Variations in texture, moisture, shape, and packaging complicate consistent detection. Developing modular, AI-enabled systems can improve adaptability, but high costs and training requirements limit adoption, especially among small and medium-sized enterprises.

Food Inspection Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced X-ray, metal detection, and checkweighing for contamination, weight verification, and quality checks | High detection sensitivity | Compliance with global food safety standards (BRC, IFS) | Modular, automated systems | Real-time data analytics for process optimization |

|

X-ray, metal detection, and spectroscopy systems for contaminant detection and product integrity verification | Superior analytical accuracy | Robust contamination detection | Integrated Data Management | High throughput for large-scale food processing |

|

Checkweighers, X-ray, and vision systems for weight control, seal integrity, and foreign object detection | High-speed inspection | Precision weighing | Reliable packaging quality | Enhanced productivity through automation and digital monitoring |

|

X-ray and metal detection for contamination control and package quality consistency | High-resolution imaging | Advanced detection algorithms | Reduced false rejects | Compliance with international safety and quality regulations |

|

Metal detectors, checkweighers, and X-ray systems for automated end-of-line contamination and weight checks | Durable, hygienic designs | Easy integration with production lines | User-friendly interface | Global service support and regulatory compliance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The food inspection devices ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including component suppliers, food inspection device manufacturers, system integrators & distributors, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Food Inspection Devices Market, by Product

X-ray inspection devices are estimated to form the largest segment. Their ability to detect a wide range of contaminants, such as metal, glass, plastic, and bone, makes them indispensable for ensuring product integrity across packaged and processed food categories. Rising automation in food processing, coupled with stringent global food safety regulations, continues to drive adoption. Additionally, advancements in digital imaging and software analytics are enhancing detection accuracy and operational efficiency, solidifying X-ray inspection systems as the dominant product segment.

Food Inspection Devices Market, by Food Category

The meat industry is projected to account for the largest market share, driven by growing global consumption of processed and packaged meat products. The high risk of contamination, coupled with strict hygiene and traceability standards, has accelerated the deployment of advanced inspection technologies. Devices such as X-ray systems, metal detectors, and microbial detection units are increasingly integrated into meat processing lines to ensure safety compliance and prevent recalls. Rising export demand and quality certification requirements further reinforce this segment’s dominance.

Food Inspection Devices Market, by Vertical

Food manufacturers & processors are estimated to remain the largest vertical segment throughout the forecast period. They represent the core users of inspection technologies for detecting contaminants, ensuring quality consistency, and meeting regulatory standards. The trend toward automation and digital quality assurance within production environments is fueling the use of integrated inspection systems. Growing pressure from global retailers and consumers for safe, traceable, and high-quality products strengthens the reliance of manufacturers on advanced inspection solutions.

Food Inspection Devices Market, by Technology

Automated/computerized inspection systems are anticipated to dominate the market and grow at the fastest rate. These systems offer high-speed, accurate, and data-driven analysis, enabling real-time detection and quality control. The transition from manual to automated inspection is being propelled by the need for efficiency, labor optimization, and compliance with increasingly rigorous food safety standards. Asia Pacific is expected to register the highest CAGR, driven by rapid industrialization, expanding food exports, and strong regulatory enforcement across emerging economies.

REGION

Asia Pacific is projected to be the largest segment in the global food inspection devices market during the forecast period

Asia Pacific is estimated to account for the largest share of the food inspection devices market by 2030, driven by rising food safety concerns, regulatory enforcement, and growing demand for processed foods across China, India, and Japan. Government initiatives, industrial expansion, and automation adoption further strengthen the region’s market dominance.

Food Inspection Devices Market: COMPANY EVALUATION MATRIX

In the food inspection devices market matrix, Mettler-Toledo International Inc. (Star) holds a leading position with its comprehensive portfolio of X-ray, metal detection, and checkweighing systems, delivering high precision and compliance for global food manufacturers and processors. Fortress Technology Inc. (Emerging Leader) is rapidly gaining momentum through its advanced metal detection technologies and customizable inspection solutions, positioning itself as a key innovator catering to diverse food processing and packaging applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 3.03 Billion |

| Market Forecast, 2030 (Value) | USD 5.08 Billion |

| Growth Rate | 9.3% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: Food Inspection Devices Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key regional and global players, including market share, product portfolio, pricing trends, and strategic initiatives in X-ray, metal detection, checkweighing, vision, and microbial inspection systems | Facilitated competitive benchmarking and guided strategic positioning for technology differentiation and market expansion |

| Regional Market Entry Strategy | Country-specific go-to-market strategies addressing food safety regulations, certification requirements, infrastructure gaps, and distribution partnerships | Analyzed about minimizing entry barriers and accelerating product commercialization across regulated and emerging food markets |

| Local Risk & Opportunity Assessment | Identification of regulatory risks, supply chain inefficiencies, infrastructure constraints, and emerging opportunities in processed and packaged food sectors | Helped with proactive risk mitigation, policy alignment, and targeted investment planning in high-potential regions |

| End-User Demand Mapping | Assessment of demand trends across food manufacturers & processors, packaging companies, and retail chains, highlighting procurement patterns and automation levels | Provided focused sales strategies, channel development, and partnership models across key end-user categories |

RECENT DEVELOPMENTS

- June 2025 : Loma Systems (UK) brought the X5DE Dual Energy X-ray Inspection System into North America. The system was designed for best-in-class detection of low-density contaminants such as bone, rubber, and glass in challenging or multilayer food applications. It was also designed for high-throughput processing lines in convenience food, snacks, bakery, and packaged meat/poultry applications with enhanced sensitivity, reduced false rejects, and a sanitary design.

- June 2025 : Fortress Technology Inc. (Canada) launched the Icon X-ray, an all-inclusive, sanitary X-ray inspection system designed specifically to maximize contaminant detection, processing rates, and food safety during high-care food manufacturing. The Icon features internal view cameras, an autonomous reject unit, and a proprietary IA+ algorithm for adaptive detection of metal, ceramic, glass, and high-density plastic contaminants.

- December 2024 : ISHIDA CO., LTD. (Japan) launched the IX-PD X-ray inspection system. Foreign body detection precision is improved with a high-advanced dual-energy X-ray system. It detects foreign objects with greater accuracy, particularly minute contaminants such as fish bones. The PD line sensor of the system directly acquired raw X-rays without a scintillator from a generator and improves image brightness as well as detection accuracy. It was designed to have a characteristic of high endurance and a long life, which improves food safety as well as company operations.

- September 2023 : Mettler-Toledo International Inc. (US) introduced the X12 as an economical entry-level X-ray system of the new X2 Series, designed specifically for small- to mid-sized food packs with built-in software and sophisticated contaminant detection.

Table of Contents

Methodology

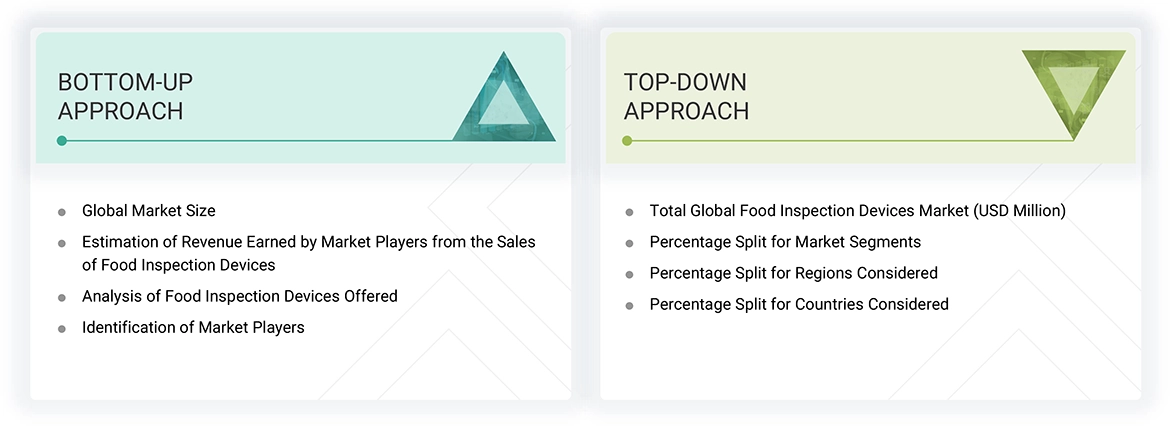

The research study involved four major activities in estimating the size of the food inspection devices market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect the information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology-oriented perspectives.

The food inspection devices market report estimates the global market size using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

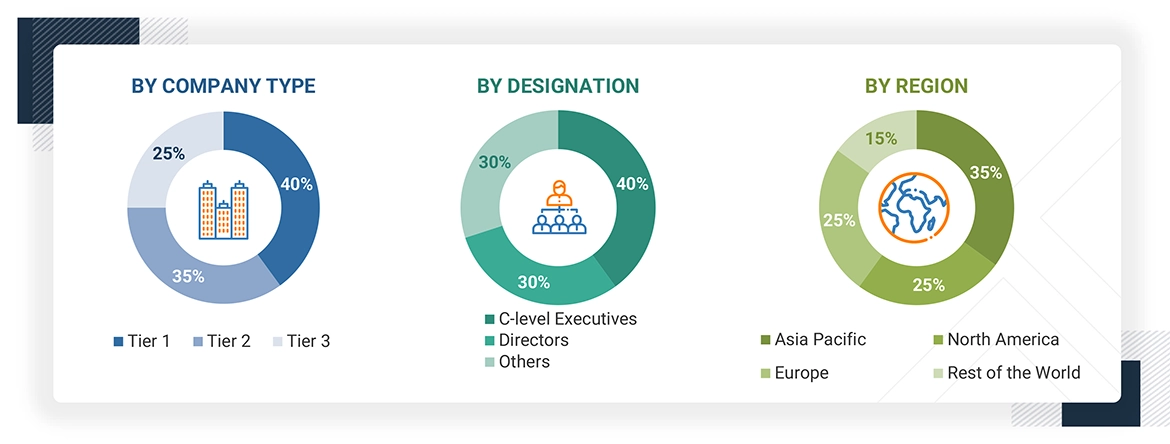

Primary Research

Extensive primary research has been conducted after understanding the food inspection devices market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the food inspection devices market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the food inspection devices market, including certification bodies, regulatory authorities, accreditation agencies, consulting firms, and industry participants across the value chain

- Analyzing major providers of food inspection devices and their key offerings, including x-ray inspection devices, metal detectors, spectroscopy devices, checkweighers, vision inspection systems, microbial detection systems, and other food inspection devices

- Studying trends of food inspection devices across food categories such as meat, poultry & seafood, dairy, bakery & confectionery, and catering & ready-to-eat meals, based on product, technology, vertical, and region

- Tracking recent market developments, including regulatory updates from agencies like the U.S. FDA, EFSA (Europe), and FSSAI (India), introduction of advanced inspection technologies (e.g., AI-integrated X-ray and spectroscopy systems), and product launches of key players to accurately forecast market size and growth trends

- Conducting multiple discussions with key opinion leaders across equipment manufacturers, food processors, quality assurance consultants, and regulatory auditors to understand real-time adoption dynamics, operational challenges, and the shifting focus toward automation, compliance, and traceability in food inspection workflows

- Validating market estimates through in-depth consultations with industry experts—ranging from R&D heads of leading device manufacturers to quality heads of food processing units and technical advisors at regulatory bodies—and finally aligning insights with the domain experts at MarketsandMarkets to ensure robustness and precision in market projections

Food Inspection Devices Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall food inspection devices market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated through the top-down and bottom-up approaches.

Market Definition

The food inspection devices market comprises a diverse array of technologically sophisticated systems designed to detect, monitor, and prevent contamination or defects throughout various stages of food production and packaging. These devices are essential for ensuring food safety, maintaining quality standards, and achieving regulatory compliance. They utilize advanced technologies such as X-ray imaging, metal detection, vision inspection, spectroscopy, and microbial detection.

Increasingly, food inspection systems are being integrated into automated production environments to facilitate real-time monitoring, reduce the incidence of product recalls, and enhance overall operational efficiency. These systems are deployed by food manufacturers, processors, packaging companies, and retailers to identify foreign objects, verify weight accuracy, assess packaging integrity, and confirm product compliance with industry norms and regulatory requirements.

The market is undergoing significant transformation, propelled by heightened consumer awareness, stricter regulatory frameworks, and escalating demand for safe, traceable, and high-quality food products. This shift is driving the adoption of predictive, data-centric solutions powered by artificial intelligence (AI), the Internet of Things (IoT), and machine learning. Consequently, food inspection devices are evolving from traditional manual systems into strategic assets that not only mitigate compliance risks and protect brand equity but also contribute to greater productivity and profitability across the global food supply chain.

Key Stakeholders

- Equipment Manufacturers and OEMs

- System Integrators and Automation Solution Providers

- Digital Solution Providers

- Calibration, Validation, and Maintenance Service Providers

- Food Safety and Quality Auditing Firms

- Regulatory Authorities and Food Safety Agencies

- Industry Associations and Technical Consortiums

- Research Institutions and Academic Bodies

- Food Processing and Packaging Companies

- Retail Chains, Hypermarkets, and Foodservice Operators

- End-use Industries

Report Objectives

- To define, describe, segment, and forecast the size of the food inspection devices market, by product, technology, vertical, food category, and region, in terms of value

- To forecast the market size for the product segment for metal detectors, in terms of volume

- To forecast the size of various segments for four regions: North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To offer detailed information on drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the food inspection devices market value chain

- To strategically analyze the micromarkets1 concerning individual growth trends, prospects, and contributions to the overall market

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook for each region

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To benchmark the key players and analyze their market position in terms of revenue, market share, and core competencies2 and provide a detailed competitive landscape for the market leaders

- To analyze competitive developments such as product launches carried out by players in the food inspection devices market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the global food inspection device market size in 2024, and at what CAGR will it grow during the forecast period?

The food inspection devices market is expected to reach USD 5.08 billion by 2030 from USD 3.25 billion in 2025 at a CAGR of 9.3%, from 2025 to 2030.

Who are the key players in the global food inspection device market?

Mettler-Toledo International Inc. (US), Thermo Fisher Scientific Inc. (US), ISHIDA CO., LTD. (Japan), Anritsu Corporation (Japan), and Loma Systems (UK) are the key market players.

Which region is expected to hold the largest market share and why?

Asia Pacific is set to lead the food inspection devices market due to rising food safety concerns, expanding processed food consumption, and stricter regulatory enforcement. Government support, growing exports, and increased investment in advanced inspection technologies further drive regional growth, positioning Asia Pacific as a critical hub for food safety innovation.

What are the primary forces fueling growth and the significant opportunities within the food inspection devices market?

Food inspection devices are gaining importance as global food safety concerns rise and regulatory standards become more stringent. The surge in processed and packaged food consumption is further driving inspection demand. Technological advancements, portable testing tools, and growing needs for precise contaminant detection are creating strong opportunities, especially in emerging markets and decentralized settings.

What are the prominent strategies adopted by market players?

The key players have adopted product launches to strengthen their position in the food inspection devices market.

What is the impact of Gen AI/AI on the food inspection devices market on a scale of 1–10 (1 - least impactful and 10 - most impactful)?

The impact is as follows: Inspection Accuracy & Defect Detection 9 Inspection Speed & Throughput 8 Waste Reduction & Sustainability 8 Predictive Maintenance & Operational Efficiency 7 Regulatory Compliance & Traceability 7

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Food Inspection Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Food Inspection Devices Market