Functional/Brain MRI System Market Size, Growth, Share & Trends Analysis

Functional/Brain MRI System Market by Component (Magnet, RF Coil, Cooling System, Shim System), Field Strength (1.5T, 3T, 7T), Application (Brain Tumor, Presurgical Planning, Rehab, Epilepsy), Installed Base & Replacement Rate - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY TAKEAWAYS

-

BY REGIONBy region, North America accounted for the largest share of 48.0% of the functional/brain MRI systems market in 2026.

-

BY COMPONENT TYPEBy component type, the magnets & electromagnets segment is expected to register the highest CAGR of 7.5% during the forecast period.

-

BY APPLICATIONBy application, the brain tumor & lesion planning segment is expected to register the highest CAGR of 8.7% during the forecast period.

-

BY END USERBy end user, the hospitals & specialty clinics segment held the largest share of 60.0% of the functional/brain MRI system market in 2026.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompanies such as Siemens Healthineers (Germany), GE Healthcare (US), Philips Healthcare (Netherlands), and Canon Medical Systems Corporation (Japan) were identified as the key players in the functional MRI systems market, given their broad portfolios, sizable installed bases, and strong application-support networks.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies such as Hyperfine, Inc. (US) have established a presence in the functional MRI systems market space by supplying regionally focused solutions for hospitals and diagnostic laboratories, indicating their potential as emerging participants for further competitive assessment.

The functional/brain MRI (fMRI) systems market is transitioning from primarily serving research purposes to becoming a routine clinical tool in hospitals, specialty clinics, and neuroscience centers. Healthcare providers are increasingly prioritizing high-field fMRI systems, as they offer clear, high-resolution images and can easily integrate with existing imaging workflows and hospital IT systems. Consequently, capital investments are shifting toward versatile MRI platforms and software packages that enable facilities to conduct a wide range of neurological and psychiatric assessments using a single system. This shift improves efficiency and utilization. Additionally, the rising prevalence of chronic neurological diseases and the increasing demand for pre-surgical brain mapping are driving the use of functional MRIs. Furthermore, ongoing research into neurodegenerative diseases and mental health disorders is expanding the application of advanced fMRI systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Neurologists, neurosurgeons, psychiatrists, and other brain specialists are increasingly recognizing how functional/brain MRI (fMRI) can enhance patient care. Clinicians appreciate that fMRI provides valuable insights into brain activity and connectivity, which can aid in surgical planning, track recovery after strokes, evaluate epilepsy, and support the diagnosis and management of neurodegenerative and psychiatric disorders. Moreover, physicians are acknowledging that fMRI can reduce the need for invasive procedures, facilitate customized treatment plans, and improve clinical outcomes. Consequently, more hospitals and specialty clinics are incorporating fMRI into their routine workflows, not only for research purposes but also as an essential tool in patient care. Training programs, workshops, and collaborations between imaging companies and healthcare providers are helping to spread awareness of the benefits of fMRI, thereby accelerating its adoption across various clinical settings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of neurological and psychiatric disorders

-

Growth in neuroscience and brain-mapping research

Level

-

High cost of fMRI systems and procedures

-

Complex data interpretation

Level

-

Expansion in precision medicine and personalized healthcare

-

Growing applications in brain–computer interface (BCI) and AI research

Level

-

Regulatory and ethical concerns

-

Competition from alternative neuroimaging techniques

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of neurological and psychiatric disorders

The prevalence of neurological and mental health disorders is steadily increasing, resulting in a growing demand for advanced neuroimaging techniques, such as functional MRI. A significant factor contributing to this trend is the aging global population. As life expectancy rises, more individuals develop age-related conditions, including Alzheimer’s disease, Parkinson’s disease, stroke, and other disorders that impact memory and cognitive function. These conditions involve progressive changes in brain activity over time, which underscores the need for imaging methods that assess not only brain structure but also brain function. As a result, fMRI has become an essential tool for clinicians and researchers who aim to understand and monitor functional changes in the brain.

Restraint: High cost of fMRI systems and procedures

The high cost associated with fMRI systems and procedures presents a significant barrier to their wider adoption. Establishing an fMRI facility requires a substantial initial investment, as MRI scanners are expensive. For many hospitals and research institutions, particularly smaller ones, the financial burden of acquiring and installing such equipment is challenging to justify, given existing budget constraints. In addition to the upfront costs, operating an fMRI system entails considerable ongoing expenses. These include routine maintenance, software updates, and technical servicing to ensure accurate and safe performance. Furthermore, fMRI scanners have high energy requirements and must be maintained under controlled environmental conditions, which further increases operational costs. Collectively, these factors make fMRI a long-term financial obligation rather than a one-time capital expenditure.

Opportunity: Expansion in precision medicine and personalized healthcare

The rise of precision medicine and personalized healthcare is revolutionizing the treatment of diseases, particularly through the use of tools like fMRI. Instead of relying on a one-size-fits-all approach, clinicians and researchers are increasingly focused on understanding how diseases manifest differently in each individual. This shift is driving the demand for technologies that can directly assess brain function, rather than depending solely on general symptoms or standard diagnostic tests. In the fields of neurology and mental healthcare, patients with the same diagnosis can respond very differently to the same treatment. Precision medicine aims to understand these variations by examining brain activity patterns, neural connectivity, and functional changes. fMRI allows researchers to observe how specific regions of the brain respond during tasks or when at rest, helping to link symptoms to underlying brain function and facilitating the development of more personalized treatment strategies.

Challenge: Competition from alternative neuroimaging techniques

Competition from other neuroimaging techniques significantly influences the fMRI market. While fMRI provides detailed information about brain function, alternative methods such as EEG, PET, MEG, and fNIRS offer distinct advantages that may make them more suitable in certain situations. For instance, EEG is relatively inexpensive, widely accessible, and easy to use, making it a practical choice for routine clinical monitoring of brain activity, particularly in conditions like epilepsy. PET scans yield valuable insights into metabolic activity in the brain, which is especially beneficial for studying neurodegenerative disorders. MEG has excellent temporal resolution, allowing it to capture rapid changes in brain activity, while fNIRS is portable and well-suited for bedside or pediatric applications. Each of these methods complements fMRI in different ways, depending on the clinical or research context.

FUNCTIONAL/BRAIN MRI SYSTEM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers syngo.MR Neuro fMRI software, Deep Resolve Swift Brain (AI reconstruction), BioMatrix Technology, and Simultaneous Multi-Slice (SMS). | Used for pre-surgical planning, neurology research, acute neurology, and DTI tractography. |

|

Offers BrainWave (fMRI applications software). | Used for mapping neuro function in the brain, pre-surgical planning for procedures on tumors or epilepsy, and advanced research applications. |

|

Offers functional MR applications (powered by Olea Medical). | Used for pre-surgical planning (seamless brain mapping workflow), functional area mapping, and evaluation of the brain state (related to stroke, trauma, or neurodegenerative disorders). |

|

Offers SmartSpeed Precise (Dual AI acceleration technique). | Used in pre-surgical planning and neurological disease assessment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of functional/brain MRI systems includes instrument manufacturers such as Siemens Healthineers, GE Healthcare, and Philips Healthcare, as well as distributors and end users like hospitals, specialty clinics, and diagnostic centers. Manufacturers differentiate themselves by producing high-field MRI scanners capable of functional MRI (fMRI), utilizing AI-assisted imaging and analysis, offering advanced software for functional mapping, and providing comprehensive service packages. Distributors and channel partners, including regional medical technology companies, help expand geographic reach by managing installation, ensuring regulatory compliance, and handling maintenance. They also offer localized training and support, particularly in emerging markets across the Asia Pacific, Latin America, and parts of Europe. On the demand side, hospital networks, academic medical centers, and research institutes adopt fMRI systems for various clinical applications, such as pre-surgical brain mapping, cognitive assessments, and psychiatric diagnostics, as well as for research purposes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Functional/Brain MRI Systems Market, By Component Type

By component type, the market for functional/brain MRI systems is categorized into magnets & electromagnets, gradient coils & RF coils, RF power amplifiers, cooling systems, shim systems, patient tables, and other components. Among these, magnets & electromagnets hold the largest market share. This is because they are the core components of MRI systems, generating the strong and stable magnetic fields necessary for capturing clear and accurate images of brain activity. These magnets are expensive to purchase and may require occasional upgrades or replacements. As hospitals, research centers, and neuroscience clinics continue to invest in additional functional MRI systems to study brain disorders, monitor brain function, and assist in surgical planning, the demand for high-quality magnets remains strong.

Functional/Brain MRI Systems Market, By Application

By application, the functional/brain MRI systems market is categorized into brain tumor & lesion planning, presurgical functional mapping, epilepsy evaluation, neurorehabilitation & stroke recovery, neurodegenerative disorders, psychiatry and mental health, and other applications. Among these, brain tumor & lesion planning hold the largest market share, as functional MRI (fMRI) assists doctors in mapping critical brain regions prior to surgery. This capability reduces the risk of damaging areas that control speech, movement, and other essential functions. Furthermore, the increasing global prevalence of brain tumors is expected to drive growth in this segment over the forecast period.

Functional/Brain MRI Systems Market, By Field Strength

By field strength, the functional/brain MRI systems market is categorized into <1.3T, 1.5T, 3T, and 7T MRI systems. Among these, the 3T MRI systems segment holds the largest market share due to its widespread acceptance in both clinical and research settings. Hospitals utilize 3T fMRI for various applications, including pre-surgical brain mapping, epilepsy evaluation, and cognitive assessments. Meanwhile, academic and research centers depend on it for neuroscience research and clinical trials.

Functional/Brain MRI Systems Market, By End User

By end user, the functional/brain MRI systems market is divided into hospitals & specialty clinics, diagnostic labs, and other end users. Hospitals & specialty clinics hold the largest share of this market due to the increasing integration of fMRI technology into routine clinical workflows, particularly in the fields of neurology, neurosurgery, and psychiatry. Large hospitals and tertiary care centers are increasingly utilizing fMRI for purposes such as pre-surgical brain mapping, epilepsy evaluation, tumor localization, and the assessment of cognitive and motor functions. As a result, they are the primary purchasers and users of fMRI systems.

REGION

Asia Pacific to be fastest-growing region in global functional/brain MRI systems market during forecast period

The functional/brain MRI systems market is divided into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is experiencing significant growth in the market, driven by several factors, including healthcare expansion, a rising disease burden, and increasing investments in advanced medical technologies. A major factor contributing to this growth is the rapid improvement of healthcare infrastructure in countries such as China, India, Japan, South Korea, and Australia. Both governments and private healthcare providers are heavily investing in modern hospitals, diagnostic imaging centers, and academic medical institutions, which, in turn, creates strong demand for advanced MRI systems, including functional MRI (fMRI). Additionally, the increasing prevalence of chronic diseases in the region is expected to further drive growth over the forecast period. For instance, data published by the Indian Journal of Neurosciences in 2023 indicates that central nervous system (CNS) tumors account for 3% of all cancer cases worldwide. In India, the incidence of CNS tumors is reported to range from 5 to 10 per 100,000 population.

FUNCTIONAL/BRAIN MRI SYSTEM MARKET: COMPANY EVALUATION MATRIX

In the functional/brain MRI systems market, Siemens Healthineers, GE Healthcare, and Philips Healthcare are the leading companies, forming the "stars" cluster. They are supported by comprehensive product portfolios, strong regulatory standing, and seamless integration with hospital and laboratory workflows. Meanwhile, a second tier of notable players, including Aspect Imaging Ltd., Bruker Corporation, and Esaote S.p.A., maintains significant installed bases in hospitals and diagnostic labs. The competitive landscape is becoming more intense as multinational leaders expand long-term service contracts, while emerging suppliers focus on cost optimization and regional market penetration to challenge the market share of established companies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2026 (Value) | USD 0.85 Billion |

| Market Forecast in 2031 (Value) | USD 1.25 Billion |

| Growth Rate | CAGR of 8.0% from 2025–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million), Volume (Unit Installed) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: FUNCTIONAL/BRAIN MRI SYSTEM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Medical Device Companies |

|

|

RECENT DEVELOPMENTS

- June 2025 : Sora Neuroscience, a company specializing in brain AI software, announced that it has received FDA clearance for its Cirrus brain mapping software. Cirrus assists neurosurgeons in making informed clinical decisions by utilizing functional magnetic resonance imaging (fMRI) to create maps of essential brain networks. This technology helps physicians effectively plan for brain surgery.

- June 2025 : Hyperfine, Inc., a health technology company, announced that its AI-powered portable MRI system for the brain, the Swoop system, has received FDA clearance. This clearance includes an entirely new portable MRI scanner powered by the proprietary Optive AI software.

- November 2025 : Royal Philips launched BlueSeal Horizon, a helium-free 3T MRI platform.

Table of Contents

Methodology

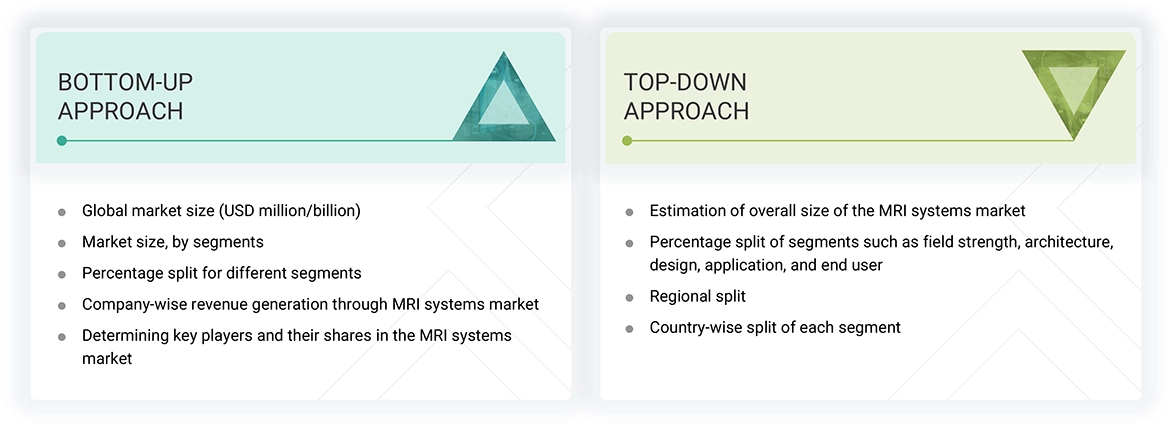

This study analyzed various market variables related to small and medium-sized businesses and major corporations to balance primary and secondary research for the functional/brain MRI system market. The next phase involved conducting primary research with industry experts along the value chain to validate the findings, assumptions, and market sizing. Several methodologies were employed to estimate the overall market size, including both top-down and bottom-up approaches.

This study focuses on key market segments, emerging trends, regulatory frameworks, and competitive environments. It also examines leading market players and their strategies within this sector. In conclusion, the total market size was determined using top-down and bottom-up approaches and data triangulation to arrive at the final figure. Ongoing primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research utilized a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach is aimed at collecting and generating data that offers comprehensive, technical, and market-focused insights into the functional/brain MRI system market. The data provides information on key players and market segmentation based on recent industry trends and significant market developments. Additionally, a database of leading industry figures was created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining both qualitative and quantitative data. Several individuals from the supply and demand sides were interviewed during this phase. On the supply side, participants included key figures such as CEOs, vice presidents, marketing and sales, directors of technology and innovation, and other important leaders. On the demand side, primary sources included academic institutions and research organizations. This real-world primary study was conducted to validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report comprehensively analyzes the global functional/brain MRI system market and reviews major companies and their revenue shares. Key players with significant market shares were identified through secondary research, and their functional/brain MRI system business revenues were calculated and subsequently validated through primary research. The secondary research involved analyzing leading market participants' annual and financial reports. In contrast, primary research included in-depth interviews with influential leaders, such as directors, CEOs, and marketing executives. The segmental revenue was calculated based on the revenue mapping of service and product providers to determine the global market value. The process involved the following steps:

- List of key players that operate in the functional/brain MRI system market at the regional level

- Formation of product mapping of manufacturers of functional/brain MRI system and related product lines at the regional level

- Revenue mapping for listed players from functional/brain MRI system and related products & services

- Revenue mapping of major players to cover at least ~90% of the global market share as of 2024

- Revenue mapping extrapolation for players will drive the global market value for the respective segment

- Summation of market value for all segments and subsegments to achieve the actual value of the global functional/brain MRI system market

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the functional/brain MRI system market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches verified and validated the functional/brain MRI system market.

Market Definition

Magnetic resonance imaging (MRI) is a diagnostic technique designed to visualize/create images of the internal structures of the human body using magnetic and electromagnetic fields, which induce a resonance effect of hydrogen atoms on body parts. The associated software registers and processes the electromagnetic emission created by these atoms to produce images of the body structures. These modalities help healthcare professionals visualize the internal structure and surrounding tissues. functional/brain MRI system are primarily used in hospitals and diagnostic imaging centers.

Stakeholders

- Hospitals

- Clinics

- Diagnostic Imaging Centers

- Manufacturers & Suppliers of Functional/Brain MRI System

- Product Suppliers, Distributors, and Channel Partners

- Research Institutes

- Regulatory Authorities & Industry Associations

- Venture Capitalists & Investment Firms

Report Objectives

- To define, describe, and forecast the size of functional/brain MRI system market based on field strength, architecture, design, application, end user, and region

- To provide detailed information regarding the factors influencing the growth potential of the global functional/brain MRI system market (drivers, restraints, opportunities, challenges, and trends)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the global functional/brain MRI system market.

- To analyze key growth opportunities in the global functional/brain MRI system market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments concerning five regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Spain, Italy, and the rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and the rest of Asia Pacific), Latin America (Brazil, Mexico, and the rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of the Middle East & Africa).

- To profile the key players in the functional/brain MRI system market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global functional/brain MRI system market, such as product launches/approvals, agreements, expansions, collaborations, and acquisitions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Functional/Brain MRI System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Functional/Brain MRI System Market