Furniture Plastic Market

Furniture Plastic Market by Plastic Type (Virgin Grade, Compounded Grade), Composition (Unfilled, Mineral Filled, Glass Fiber Reinforced, Other Compositions), Furniture Type, Application, End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

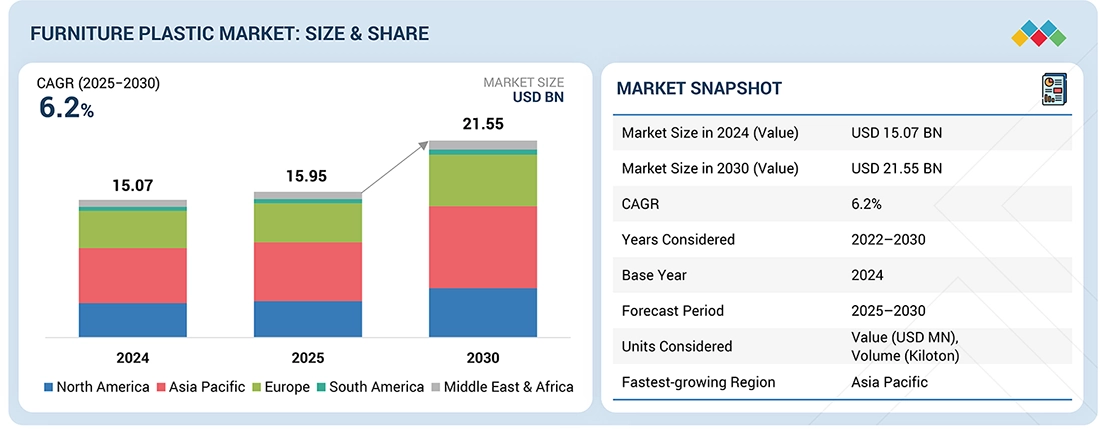

The furniture plastic market is expected to reach USD 21.55 billion in 2030 from USD 15.95 billion in 2025, at a CAGR of 6.2% during the forecast period. The thriving urban housing, along with the growth of commercial and institutional sectors, is a major factor fueling the demand for plastic-based furniture in residential as well as non-residential areas. Manufacturers of furniture are turning to plastics in order to lessen product weight, have unlimited design possibilities, as well as to cut production and logistics costs, especially in high-volume and price-sensitive markets. The rapid urbanization and shrinking size of living areas have led to the increasing popularity of modular, ready-to-assemble, and space-efficient furniture. Simultaneously, the development of the hospitality industry, office spaces, healthcare facilities, and educational institutions has led to an increasing demand for furniture made of durable materials and featuring other characteristics, such as easy-to-clean and low-maintenance properties. Regulations to reduce environmental impact are leading to a shift to recycled plastics, bio-based polymers, and circular economy models. On the other hand, innovations in UV-stabilized, fiber-reinforced, and impact-modified plastics are enhancing plastic furniture's mechanical strength and weather resistance.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for the largest share of 40.0% in the global furniture plastic market in 2024.

-

By Plastic TypeBy plastic type, the virgin grade segment is expected to register the highest CAGR of 5.8% from 2025 to 2030, in terms of value.

-

By CompositionBy composition, the unfilled segment is expected to grow at the highest CAGR of 6.1% during the forecast period.

-

By Furniture TypeBy furniture type, the institutional furniture segment is expected to dominate the market from 2025 to 2030, in terms of value.

-

By ApplicationBy application, the indoor segment is expected to dominate the market in 2024 in terms of value.

-

By End-use IndustryBy end-use industry, the residential segment is projected to grow at the highest rate during the forecast period.

-

Competitive Landscape - Key PlayersKeter, Inter IKEA Systems B.V., Nilkamal, and Tramontina are identified as Star players in the furniture plastic market. They are focused on innovation and have broad industry coverage and strong operational & financial strength.

-

Competitive Landscape- StartupsPrima Plastics, Vondom, and Kartell S.p.A., among others, have distinguished themselves among startups and SMEs due to their strong product portfolios and effective business strategies.

The demand for furniture plastics is predicted to rise due to the increasing trend of urbanization and the growth of commercial and institutional infrastructure in both developed and developing countries. Affordable, lightweight, and durable furniture products are increasingly being preferred in residential housing, offices, hotels, hospitals, and schools, thus accelerating the penetration of plastics as substitutes for wood and metal. The expansion of modular, ready-to-assemble, and space-saving furniture, particularly in urban areas with high population density, is expected to be a major factor in driving market demand. The increasing costs of logistics, labor, and materials, coupled with the need for faster production cycles, are among the reasons why furniture manufacturers are adopting advanced plastic processing and injection molding techniques to reduce material wastage and increase production efficiency.

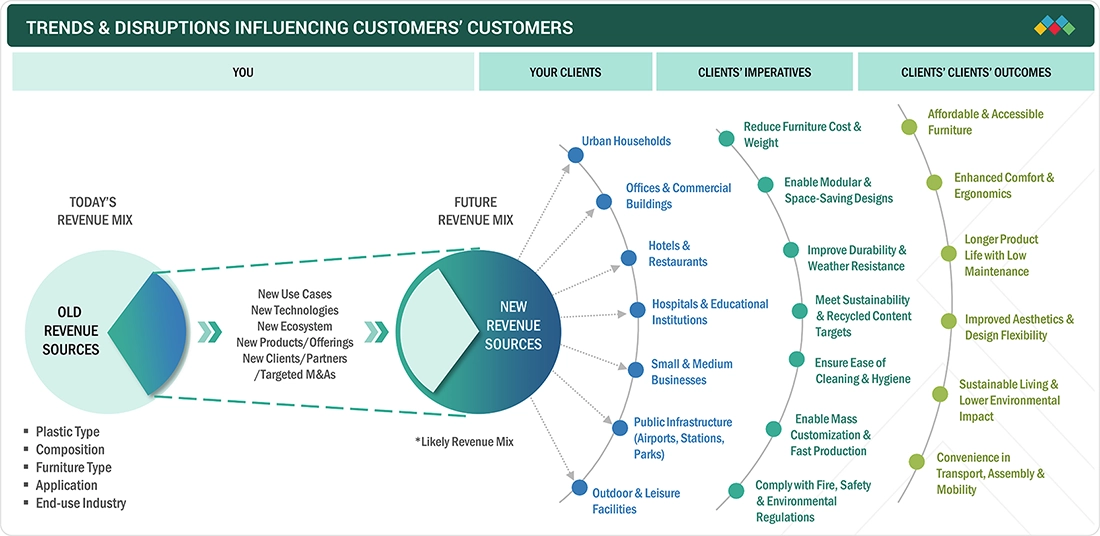

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence of end-use industries on the furniture plastic market has been largely dictated by urbanization trends. Lifestyle changes among people and companies seeking cost-effective and environmentally friendly products have had a significant impact on the market as well. Some of the major end-use sectors are residential housing, office and commercial buildings, hospitality, healthcare, education, and public infrastructure, where plastics are being increasingly used in seating, tables, storage units, and outdoor furniture. The demand for these products is driven by the transition to modular and ready-to-assemble furniture, the growth of e-commerce distribution, and the increasing use of lightweight, durable, and easy-to-clean materials. Industry disruptions, such as regulatory pressure on plastic use, recycled and bio-based polymer technology, and changes in raw material pricing, are among the factors reshaping material selection and product design. The changes in construction, renovation cycles, buying by institutions, and the habits of consumers directly influence the production volume, pricing strategies, and investment decisions of furniture plastic manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid urbanization and growth in affordable housing

-

Rising demand for modular and ready-to-assemble (RTA) furniture

Level

-

Environmental concerns and plastic waste perception

-

Stringent regulations on plastics and recyclability

Level

-

Adoption of recycled and bio-based plastics

-

Growth of e-commerce and flat-pack furniture

Level

-

Recycling and end-of-life management of mixed plastics

-

Balancing durability, aesthetics, and sustainability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid urbanization and growth in affordable housing

The increasing urban population, decreasing living area sizes, and higher housing densities are stimulating the demand for light, inexpensive, and space-saving furniture. Plastic furniture offers the advantages of low material cost, ease of handling, and suitability for mass production; thus, it is a perfect solution for large-scale residential and urban development projects.

Restraint: Environmental concerns and plastic waste perception

Waste plastic is considered a significant environmental hazard. Hence, regions across the globe have implemented stringent environmental regulations about the use and recyclability of plastics. Authorities in Europe and certain regions of North America are implementing extended producer responsibility (EPR), recycled-content mandates, and stricter waste management regulations. These steps make it more expensive for furniture manufacturers to comply with regulations, and they also limit the use of certain plastic formulations, especially in areas with strict sustainability policies.

Opportunity: Adoption of recycled and bio-based plastics

The adoption of recycled and bio-based plastics represents a major opportunity for the furniture plastics market. Manufacturers are increasingly incorporating recycled polypropylene and polyethylene to meet sustainability goals and improve brand acceptance. Recycled plastics can achieve improved strength, durability, and aesthetic quality due to advances in material processing and compounding. This improvement is leading to a wider application of these plastics in the residential, commercial, and institutional furniture segments.

Challenge: Balancing durability, aesthetics, and sustainability

Furniture items consist of mixed polymers, additives, and composite materials, which makes them extremely difficult to recycle technically and unprofitable economically in most areas. Due to the limited recycling facilities and collection systems, circularity is additionally constrained; therefore, producers need to invest in redesign, material standardization, and take-back schemes to be in line with sustainability requirements.

FURNITURE PLASTIC MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IKEA globally integrated polypropylene (PP) and recycled PP compounds in its mass-market chairs, stools, and storage furniture lines, replacing wood-only and metal-intensive designs to enable flat-pack logistics and high-volume injection molding. | The company was able to reduce the product weight by 20–30%, enhance transport efficiency, increase the possibility of high design repeatability, and increase the usage of recycled content while maintaining the product's cost level. |

|

Nilkamal switched to the use of HDPE and PP injection-molded plastics for residential and institutional chairs, tables, and cabinets across Asia, with a primary focus on the product's features, including durability, stackability, and moisture resistance. | The company managed to raise the load-bearing capacity, prolong the product life in the presence of moisture in the air, reduce maintenance costs, and also initiate large-scale mass production for price-sensitive markets. |

|

Herman Miller opted for the use of glass fiber-reinforced polypropylene in office chair shells and seating components to achieve a balance of ergonomics, strength, and lightweight design for corporate environments. | Along with the feat of weight reduction of 15–20%, the company has also achieved structural integrity improvement, increased design flexibility, and supported the objectives of a long lifecycle and recyclability. |

|

Keter employed UV-stabilized polypropylene resins in the manufacturing of plastic storage boxes that were made for the outdoors, garden furniture, and patio seating, which were sold all over Europe and North America. | The product became highly resistant to weather, minimizing color fading, improving impact resistance, and extending the outdoor product lifespan with minimal maintenance required. |

|

Grosfillex turned to injection-molded polypropylene and composite plastics for the production of hospitality furniture intended for use in hotels, restaurants, and poolside areas. | The company delivered furniture with high UV resistance, stackability, corrosion resistance, and compliance with the commercial fire and safety standards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem map of the furniture plastic market reveals a deep and interrelated network of stakeholders who pass through the furniture and polymer value chain. It comprises raw material suppliers offering polypropylene, polyethylene, ABS, PVC, polycarbonate, additives, color masterbatches, and recycled plastic feedstocks; compounders and resin processors creating reinforced, UV-stabilized, and impact-modified plastic formulations; and furniture manufacturers and OEMs fabricating injection-molded, rotationally molded, and thermoformed furniture components and finished products. Moreover, the ecosystem comprises distributors, retailers, e-commerce platforms, and contract furniture suppliers, as well as tooling and mold manufacturers, and logistics providers that facilitate large-scale production and distribution. End-use sectors, including residential housing, offices, commercial buildings, hospitality, healthcare, education, public infrastructure, and outdoor leisure facilities, are dependent on furniture plastics for delivering cost efficiency, durability, design flexibility, and ease of maintenance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Furniture Plastic Market, By Plastic Type

The virgin grade segment is anticipated to register the highest CAGR of 5.8% in terms of value during the forecast period. This is driven by the robust demand for products that are consistent in terms of quality, have superior mechanical performance, and an attractive aesthetic finish. Virgin plastics are adopted in applications where strength, color uniformity, surface finish, and long-term durability are critical. Stringent regulations and standards regarding performance, safety, and fire-resistance, particularly in high-traffic and load-bearing scenarios, are fueling the adoption of the virgin-grade plastics.

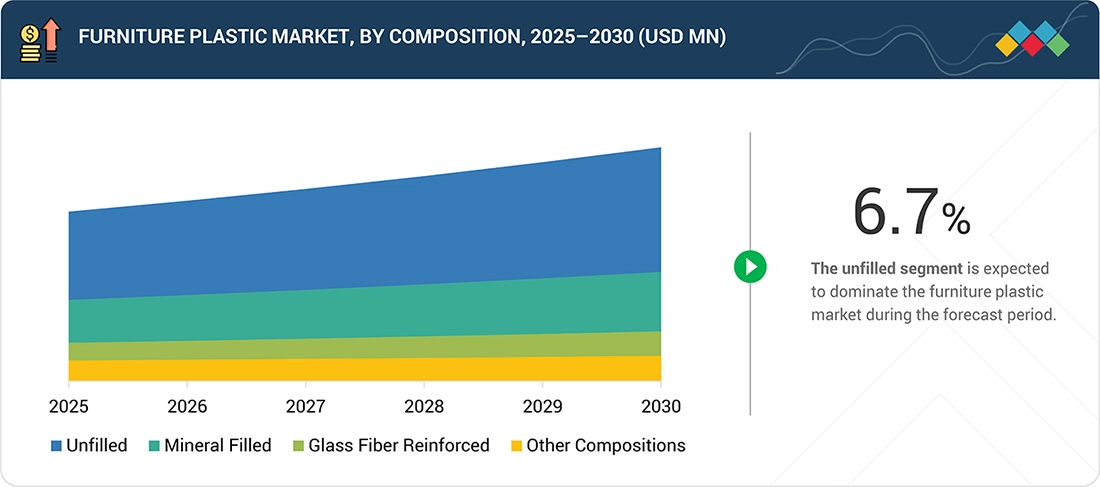

Furniture Plastic Market, By Composition

The unfilled plastics segment is projected to register the highest CAGR of 6.1% during the forecast period. Modern furniture is more inclined towards light materials, aesthetically superior, and design flexibility. Unfilled plastics provide a better finish to the surface, color easily, and have a high degree of processability. The recyclability of these plastics and their compatibility with advanced molding techniques further facilitate sustainable goals, allowing for cost-efficient mass production. As demand rises for stylish, ergonomic, and environmentally responsible furniture across residential and commercial spaces, the adoption of unfilled plastic compositions is accelerating.

Furniture Plastic Market, By Application

By application, the indoor furniture segment is expected to dominate the market from 2025 to 2030, in terms of value, supported by extensive use across residential, office, hospitality, and institutional environments. In indoor applications, the focus is on visual appeal, comfort, and durability, which are the factors that drive the consumption of engineered plastics with enhanced surface finishes and design flexibility. The demand for plastic-based furniture solutions remains high due to the regular replacement cycles and renovation activities in indoor spaces.

Furniture Plastic Market, By Furniture Type

The institutional furniture segment is estimated to lead the overall market during the forecast period. The dominance of institutional furniture can be attributed to the constant demand arising from schools, hospitals, offices, public infrastructure, and commercial facilities. Plastic furniture offers durability, lightness, ease of cleaning, and resistance to wear and moisture. With plastic furniture, hygiene, and safety requirements, especially in healthcare and educational settings, can be easily met through mass production and standardized designs. Significant investments in public infrastructure and commercial construction are the primary factors sustaining the dominance of this segment.

Furniture Plastic Market, By End-use Industry

By end-use industry, the residential segment is forecasted to experience the highest growth rate between 2025 and 2030. This is attributed to urbanization at a rapid pace, housing construction on the rise, and the increasing demand for affordable and modular furniture are the main driving factors. One of the major reasons why plastic furniture is gaining popularity in residential markets is that it is a lightweight and cost-effective product, easy to transport, and comfortable for compact living spaces. Additionally, the growth of e-commerce furniture platforms and ready-to-assemble products is a significant enabler in the residential sector.

REGION

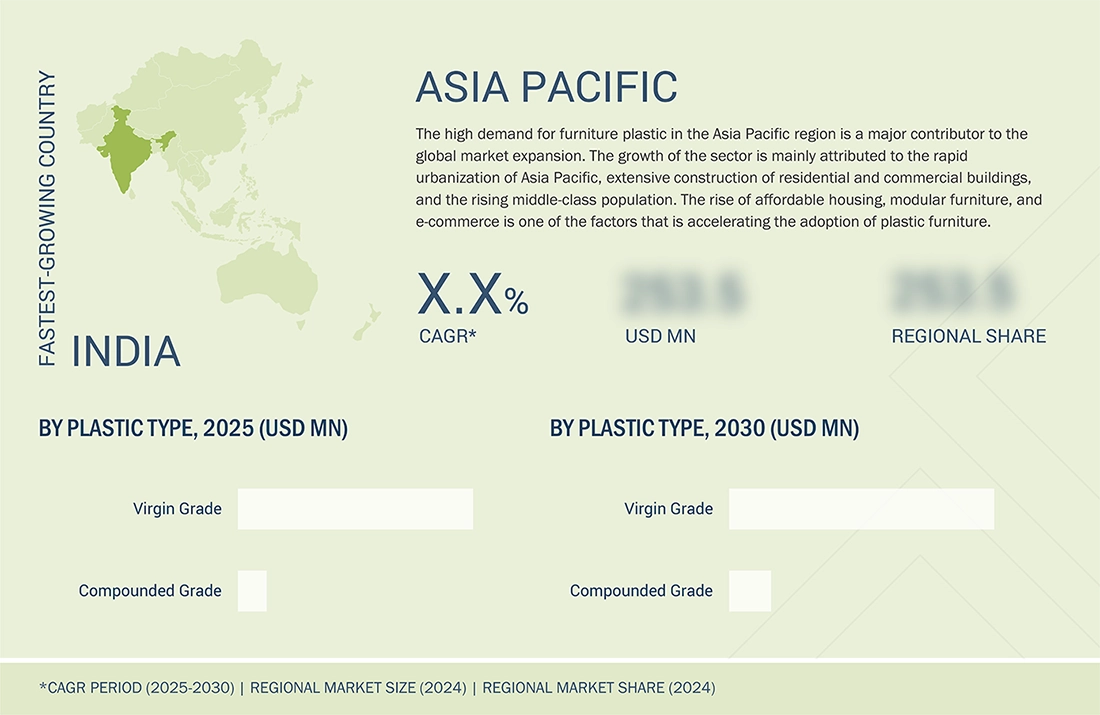

Asia Pacific to be fastest-growing region in the global furniture plastic market during the forecast period

Asia Pacific is expected to witness the fastest growth in the furniture plastic market. This high growth is driven by rapid urbanization, increased disposable incomes, and the growth of the residential and commercial construction sectors throughout the region. The demand for affordable, lightweight, and durable furniture products in China, India, Southeast Asia, and Australia has driven the expansion of the plastics furniture industry in the region. The rise in the adoption of modular, ready-to-assemble, and space-efficient furniture, which are characteristics of products most suitable for cramped urban areas, has led to increased demand for plastics such as polypropylene, polyethylene, and engineered polymers. The growth of e-commerce furniture sales, combined with the rising logistics efficiency requirements, has also increased the demand.

FURNITURE PLASTIC MARKET: COMPANY EVALUATION MATRIX

Keter Group (Star) is able to sustain a leading position in the furniture plastics market due to its extensive global footprint, vertically integrated manufacturing capabilities, and expertise in injection- molded and resin-based outdoor and indoor furniture solutions. The company offers a wide range of storage, garden, and patio furniture. Keter's commitment to design, durability, and sustainability allows it to respond to the changing consumer preferences, while at the same time keeping cost efficiency and scale at work in leading global markets. Supreme Industries (Emerging Leader) is expanding its presence in the furniture plastics market, particularly in Asia, leveraging its deep polymer processing expertise and strong domestic manufacturing base. With a wide-ranging portfolio of plastic chairs, tables, storage units, and modular furniture, Supreme Industries is meeting the high demand of the residential, institutional, and commercial segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Keter Group

- Nilkamal

- The Supreme Industries

- Tramontina

- Cello

- Inter IKEA Systems B.V.

- MillerKnoll, Inc.

- Grosfillex

- Poly-Wood, LLC.

- NARDI S.p.A.

- Harwal Group of Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.07 BN |

| Market Size in 2030 (Value) | USD 21.55 BN |

| CAGR | 6.2% |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN) Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

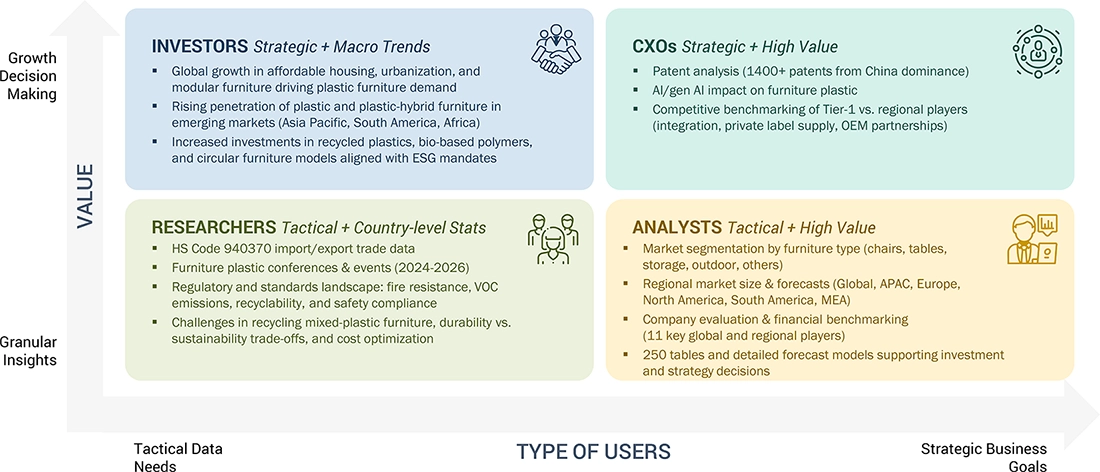

WHAT IS IN IT FOR YOU: FURNITURE PLASTIC MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Furniture Plastic Manufacturer |

|

|

| Polymer Resin & Compound Supplier |

|

|

| Institutional & Commercial Furniture OEM |

|

|

RECENT DEVELOPMENTS

- December 2025 : MillerKnoll launched its first mainland China showroom, showcasing its full portfolio, including Herman Miller’s plastic-intensive office seating lines. The expansion increases market access for its plastic-based office furniture solutions in China’s rapidly evolving workplace segment.

- May 2025 : Tramontina expanded its hospitality-focused furniture portfolio with new plastic furniture models Gabriela and Isabelle, made from plastics recovered from the Brazilian coast, combining durability with environmental responsibility.

- April 2024 : Nilkamal invested in new injection moulding machines and moulds specifically for plastic furniture, crates, and pallets, enhancing production capacity and operational efficiency in its plastics division.

- April 2024 : Herman Miller, in collaboration with Studio 7.5, introduced the Zeph Side Chair. The chair features a one-piece plastic mono-shell with a flexible kinematic back, an optional 3D Knit recycled seat cover, and monochromatic/two-tone color-dipped options, designed for workspaces, collaboration, and education settings.

Table of Contents

Methodology

The study involved four main activities to estimate the current size of the furniture plastic market. Extensive secondary research was conducted to gather information on the market, peer product markets, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of tools plastic through primary research. Both top-down and bottom-up approaches were used to estimate the market’s overall size. Then, market segmentation and data triangulation procedures were applied to determine the size of various segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were used to identify and collect information for this study on the tools plastic market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The tools plastic market includes several stakeholders in the supply chain, such as raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various key sources from both the supply and demand sides of the market have been interviewed to gather qualitative and quantitative data. On the demand side, primary participants include key opinion leaders, executives, vice presidents, and CEOs of companies in the tools plastic market. On the supply side, primary sources consist of associations and institutions involved in the tools plastic market, key opinion leaders, and processing companies.

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the tools plastic market by type, application, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s value chain and market size were determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns were established using secondary sources and verified via primary sources.

- All relevant parameters influencing the markets covered in this study were thoroughly considered, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research involved reviewing reports, reviews, and newsletters of top market players and conducting extensive interviews with leaders such as directors and marketing executives to gather opinions.

Data Triangulation

After estimating the overall size of the tools plastics market, the data was divided into several segments and subsegments. Data triangulation and market breakdown methods were used, where appropriate, to complete the market analysis and determine precise statistics for all segments and subsegments. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

The tools plastic market is defined as the segment involved in manufacturing plastics used in tools, including hand tools, power tools, garden tools, medical tools and devices, manual tools, and industrial equipment. The plastics used, often ABS, polycarbonate, nylon, and polypropylene, are selected for their qualities such as strength and durability, lightweight nature, chemical and heat resistance, and impact resistance. The tools plastic market has many end-use sectors, including construction, automotive, healthcare, and manufacturing. With advances in material technology and consumer demand for ergonomic, affordable, high-performance tools, the tools plastic market, with various consumer and professional applications, is diverse and expanding globally.

Stakeholders

- Tools plastic manufacturers

- Raw material suppliers

- Regulatory bodies and government agencies

- Distributors and suppliers

- End-use industries

- Associations and industrial bodies

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the size of the tools plastic market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on type, application, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals in the tools plastic market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Furniture Plastic Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Furniture Plastic Market