Fleet Telematics Market Size, Share & Analysis

Fleet Telematics Market by Vehicle Type (LCV, HCV), Package Type (Entry Level, Mid Tier, Advanced), Vendor Type (OEMs, Aftermarket), Solution Type (Embedded, Portable, Smartphone/Cellular), and Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fleet telematics market is projected to grow from USD 10.42 billion in 2025 to USD 21.95 billion by 2032 at a CAGR of 11.2%. The fleet telematics market is growing as fleets depend on remote diagnostics and over-the-air support to keep modern powertrains and ADAS systems operating within warranty and uptime requirements. OEMs are adding built-in telematics to create new connected-service revenue streams, and this shift toward factory installed systems is reducing the aftermarket’s role in long haul and vocational fleets while giving OEMs greater control over data access. Fleets are also demanding more detailed operational intelligence, including driver behavior analytics, cargo condition monitoring, and predictive maintenance based on OEM diagnostic data. In addition, stricter regulations on hours of service, overloading, and safety compliance are making telematics mandatory in certain segments, particularly heavy commercial vehicles.

KEY TAKEAWAYS

-

By RegionThe North America fleet telematics market is estimated to account for a share of 65.0% by value in 2025.

-

By Package TypeBy package type, the advanced segment is projected to register the highest growth of 14.8% by value during the forecast period.

-

By Solution TypeBy solution type, the smartphone/cellular segment is projected to grow at the highest rate by volume from 2025 to 2032.

-

By Vehicle TypeBy vehicle type, the heavy commercial vehicle segment is projected to dominate the market by volume during the forecast period.

-

By Vendor TypeBy vendor type, the OEMs segment is projected to grow at a higher rate (12.8%) than the aftermarket segment by volume during the forecast period.

-

Competitive LandscapeGeotab Inc. (Canada), Verizon (US), and Trimble Inc. (US) were identified as star players in the fleet telematics market, given their strong market share and product footprint.

-

Competitive LandscapeMotive Technologies, Inc. (US), Mahindra&Mahindra Ltd. (India), and Volkswagen Commercial Vehicles (Germany) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Advanced telematics platforms are moving toward real-time edge analytics, reducing cloud dependence for events such as harsh braking, collision detection, and route deviations and improving response times for safety critical fleets. Large logistics operators are now requiring their partner fleets to use the same telematics systems and data standards, creating a cascading adoption effect in fragmented markets where smaller fleets adopt telematics to meet shipper requirements. Telematics data is increasingly used to audit contract performance in freight, last-mile, and rental segments, leading to increased demand for tamper-proof data streams and auditable driver logs. Regional variations are widening, with North America prioritizing compliance and insurance linked scoring, while Europe focuses on cross border roaming and harmonized data standards.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the fleet telematics market reveal the current and future trends. The market is undergoing rapid transformation as fleets shift from basic tracking solutions to deeply integrated, data-driven operations. Advancements in AI, connected ECUs, ADAS integration, and cloud-based analytics are disrupting traditional hardware-led telematics models. Fleets now expect telematics platforms to deliver real-time visibility, predictive maintenance, automated compliance, remote diagnostics, and energy or battery intelligence for electric trucks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for intelligent fleet operations

-

Focus on fuel efficiency and reducing vehicle downtime

Level

-

Connectivity limitations in remote areas and developing markets

-

Integration complexity with legacy fleet systems and multi-brand vehicles

Level

-

Digital transformation through AI and smart infrastructure

-

Expanding opportunities in logistics and transportation

Level

-

Escalating total cost of ownership (TCO)

-

Lack of standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for intelligent fleet operations

Operators are shifting from basic tracking to AI-enabled decision systems that reduce fuel wastage, prevent unplanned downtime, and optimize driver productivity. These AI-driven systems also integrate data from engines, tires, braking events, and cargo sensors, enabling fleets to automate interventions like dynamic rerouting or early fault alerts that directly improve operating margins and contractual performance.

Restraint: Connectivity limitations in remote areas and developing markets

Fleets often lose data streams on highways, mining routes, and cross border corridors where 4G/5G coverage is patchy. This disrupts live tracking, predictive maintenance alerts, and driver behavior analytics, forcing operators to rely on partial or delayed data. As a result, many fleets hesitate to invest in advanced telematics packages that depend on continuous, high quality connectivity.

Opportunity: Digital transformation through AI and smart infrastructure

Operators can leverage sensor fusion, edge analytics, and real-time traffic intelligence to reduce turnaround times and improve asset utilization as fleets integrate telematics with smart roads, automated tolling and Al based dispatch systems. This creates a strong opportunity for telematics providers to deliver higher value, intelligence driven services customized for connected logistics networks.

Challenge: Lack of standardization

As OEMs, aftermarket providers and regulators use different data formats and communication protocols while fleets struggle to integrate telematics across mixed vehicle portfolios. This fragmentation limits seamless data exchange and forces operators to maintain multiple dashboards or adapters. The lack of uniform standards increases integration costs and slows the adoption of advanced analytics.

FLEET TELEMATICS MARKET SIZE, SHARE & ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys telematics for logistics fleets to monitor vehicle health, fuel usage, routing efficiency, and driver behavior across large enterprise fleets | Lowers fuel cost, reduces downtime through predictive maintenance, and improves delivery reliability |

|

Supports municipal and public-sector fleets with tracking, routing, incident response, and fuel optimization tools | Enhances service quality, reduces operational cost, and improves fleet accountability |

|

Provides telematics solutions for mining and heavy equipment | Enables engine diagnostics, geofencing, and load-cycle monitoring | Improves safety compliance, lowers maintenance cost, and maximizes equipment lifetime |

|

Delivers telematics for school-bus and passenger-transport fleets, including inspection tools, GPS routing, and student safety monitoring | Improves route efficiency, enhances safety oversight, and ensures regulatory compliance |

|

Provides video telematics for commercial fleets to monitor driver safety, behavior scoring, and event-based alerts | Reduces accident rates, lowers insurance costs, and improves overall fleet safety culture |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fleet telematics market ecosystem includes telematics software providers, telematics service providers, OEMs, system integrators, end users, and government & regulatory bodies. Some of the major fleet telematics service providers include Geotab Inc. (Canada), Verizon (US), Trimble Inc. (US), Samsara Inc. (US), and Powerfleet (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fleet Telematics Market, By Vehicle Type

The heavy commercial vehicle segment is projected to dominate the fleet telematics market during the forecast period, as long haul and high-utilization trucks generate the strongest RoI from fuel analytics, predictive maintenance, and route optimization, making adoption financially compelling. additionally, stricter compliance requirements and the need for real-time visibility in long distance freight further accelerate telematics penetration in the heavy truck segment.

Fleet Telematics Market, By Package Type

The advanced segment is projected to dominate during the forecast period, as fleets shift from basic GPS tracking to solutions that deliver measurable ROI through predictive maintenance, driver behavior analytics, fuel optimization, and workflow automation. Large logistics operators increasingly demand integrated platforms that combine sensors, engine data, and Al driven insights, making advanced packages the preferred choice for operational efficiency and SLA compliance.

Fleet Telematics Market, By Vendor Type

The OEMs segment is projected to dominate the market during the forecast period, as automakers embed connected modules, sensors, and diagnostics capabilities directly into the vehicle to enable data rich maintenance, uptime, and subscription services. Fleet buyers increasingly choose factory integrated systems for their deeper vehicle insights, higher reliability, and seamless compatibility with ADAS and powertrain electronics.

Fleet Telematics Market, By Solution Type

The smartphone/cellular segment is projected to dominate during the forecast period as fleets prioritize low-cost, rapidly deployable options that do not require hardware installation or vehicle downtime. These solutions allow operators to extend basic tracking, driver-behavior monitoring, and job workflow features across mixed or older vehicle fleets without relying on OEM systems. The flexibility to scale instantly across contractors and leased vehicles further accelerates the adoption of smartphone/cellular telematics in last mile and gig-delivery segments.

REGION

North America to grow at highest rate during forecast period

North America is projected to grow at the highest rate in the fleet telematics market during the forecast period, due to the accelerating adoption of Al-driven safety systems, ELD-linked compliance requirements, and the rapid scaling of electrified commercial fleets that rely on deeper telematics integration. Large logistics operators are also standardizing advanced platforms for uptime management and service automation, driving high per-vehicle spending on connected solutions. Moreover, strong ecosystem support from OEMs, insurers, and freight platforms further accelerates telematics upgrades across LCVs and HCVs in the region.

FLEET TELEMATICS MARKET SIZE, SHARE & ANALYSIS: COMPANY EVALUATION MATRIX

In the fleet telematics market, Geotab Inc. (Star) leads with a strong global presence and comprehensive fleet telematics offerings, driving market expansion and revenue growth through strategic partnerships and product launches. Omnitracs (Emerging Leader) is also gaining traction with enhanced safety analytics, workflow automation tools, and deeper integrations with transportation management systems. The company shows strong growth potential to advance toward this quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Geotab Inc. (Canada)

- Verizon (US)

- Trimble Inc. (US)

- Samsara Inc. (US)

- Powerfleet (US)

- Omnitracs (US)

- Teletrac Navman US Ltd. (US)

- Masternaut Limited (UK)

- TomTom International BV (Netherlands)

- Microlise Limited (UK)

- PTC (US)

- Azuga, a Bridgestone Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 | USD 10.04 Billion |

| Market Forecast in 2032 | USD 21.95 Billion |

| Growth Rate | CAGR of 11.2% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Thousand Units) and Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America |

WHAT IS IN IT FOR YOU: FLEET TELEMATICS MARKET SIZE, SHARE & ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Telematics Provider |

|

|

| Commercial Fleet Operator |

|

|

| OEM |

|

|

| Insurance Company |

|

|

| Logistics & Delivery Platform |

|

|

| Telecom Operator |

|

|

RECENT DEVELOPMENTS

- Novermber 2025 : TomTom and GeoInt partnered to advance telematics and mobility solutions in Africa. Under this partnership, GeoInt would use TomTom’s maps, traffic data, and geocoding APIs to support real-time fleet tracking, route optimization, and driver behavior analysis. This integration enabled GeoInt to offer accurate local mapping, frequent updates, and dependable global coverage, helping fleet operators improve tracking precision, safety, and operational efficiency based on live road conditions.

- October 2025 : Geotab Inc. (Canada) acquired the commercial operations of Verizon Connect’s telematics business in Australia, the UK, Ireland, Italy, France, Portugal, Poland, the Netherlands, and Germany. This strategic move, which excludes Verizon Connect’s product, engineering, and other non-sales teams, expanded Geotab’s global presence and strengthens its position in the small and mid-sized fleet market across key international regions.

- October 2025 : Samsara Inc. (US) entered into a strategic partnership with Allianz UK to make advanced risk management technology more accessible to a wider range of fleet operators in the UK. Through this partnership, commercial customers insured by Allianz would gain preferred access to Samsara’s AI-powered dual-facing dash cams and connected operations platform.

- July 2025 : Teletrac Navman US Ltd. introduced OEM Telematics, a new solution that allows customers to connect the TN360 fleet management platform with factory-installed telematics hardware from various vehicle manufacturers. By entering a vehicle’s VIN number into TN360, fleet managers can easily access key telematics data such as vehicle identification, location, usage patterns, speed, fuel levels, and EV battery charge status, all within a single platform.

- July 2025 : Trimble partnered with KT Corporation to provide high-precision positioning services across South Korea using the Trimble RTX Fast network. Together, they will offer combined telecom, correction, and precise positioning services to automotive OEMs and IoT companies in the region. Trimble’s real-time GNSS correction services are designed for a connected future, offering global coverage through cellular and satellite networks.

Table of Contents

Methodology

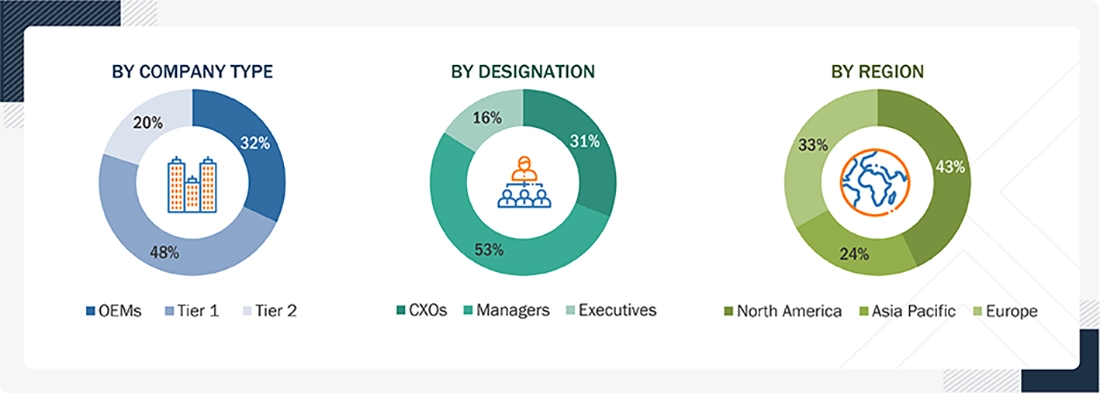

This research study involved the extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, the World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the fleet telematics market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players (fleet telematics service provider), and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the fleet telematics market for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

Extensive primary research was conducted after understanding the fleet telematics market scenario through secondary research. Several primary interviews were conducted with market experts from demand-side vehicle manufacturers (in terms of component supply), country-level government associations, trade associations, and supply-side OEMs and component manufacturers across three major regions: North America, Europe, and Asia Pacific. Approximately 20% and 80% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report.

In the canvassing of primaries, various departments , such as sales, operations, and marketing, within organizations were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings, as described in the remainder of this report.

Tiers of companies are based on the supply chain of the fleet telematics market.

Tier 1 covers fleet telematics service providers.

Tier 2 covers technology and component suppliers providing hardware, connectivity, and data software that enable telematics service providers.

To know about the assumptions considered for the study, download the pdf brochure

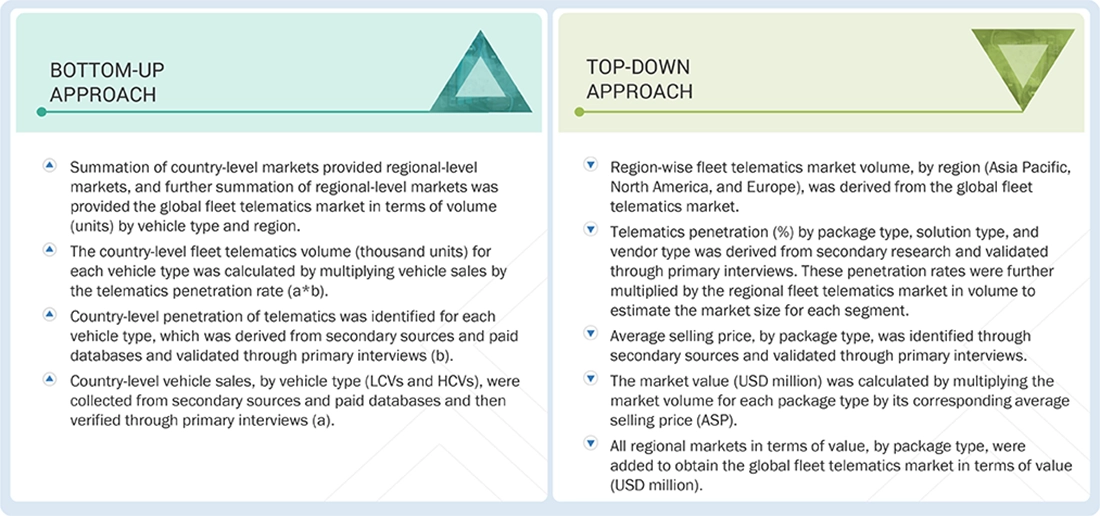

Market Size Estimation

Bottom-up and top-down approaches were used to estimate and validate the total size of the fleet telematics market. This method was also used extensively to estimate the size of various subsegments in the market.

Fleet telematics market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to Geotab Inc., telematics is a method of monitoring cars, trucks, equipment, and other assets using GPS technology and on-board diagnostics (OBD) to plot asset movements on a computerized map. Also known as fleet tracking or GPS vehicle tracking, telematics has become an essential management tool for many commercial and government fleets. Commercial vehicle telematics enables real-time monitoring and management of vehicles, facilitating enhanced operational efficiency, safety, and compliance. By leveraging data from telematics systems, businesses can optimize routes, reduce fuel consumption, perform proactive maintenance, and improve overall fleet performance and longevity.

Key Stakeholders

- Authorized Service Centers and Independent Aftermarket Service Providers

- Automobile Organizations/Associations and Government Bodies

- Commercial Vehicle Original Equipment Manufacturers (OEMs)

- Automotive Camera Manufacturers

- Automotive Research Organizations

- Automotive TCU and ECU Manufacturers

- Automotive Telematics Hardware Suppliers

- Automotive Telematics Service Providers

- Automotive Telematics Software and Platform Providers

- Autonomous Driving Platform Providers

- Cloud Service Providers

- Fleet Leasing Companies

- Fleet Owners and Operators

- Fleet Telematics Vendors

- Managed Service Providers

- Support and Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

Report Objectives

- To segment and forecast the fleet telematics market in terms of volume (thousand units) and value (USD billion)

- To define, describe, and forecast the market based on package type, solution type, vehicle type, vendor type, and region

-

To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market by package type (Entry Level, Mid Tier, Advanced)

- To segment and forecast the market by solution type (Embedded, Portable, Smartphone/Cellular)

- To segment and forecast the market by vehicle type (Light Commercial Vehicle, Heavy Commercial Vehicle)

- To segment and forecast the market by vendor type (OEMs and Aftermarket)

- To forecast the market by region (Asia Pacific, Europe, and North America)

- To analyze technological developments impacting the market

- To provide detailed information about the major factors (drivers, challenges, restraints, and opportunities) influencing market growth

-

To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

- To study the following concerning the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Impact of AI/Gen AI

- Trend and Disruption Impact

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Impact of Fleet Telematics on Cost Savings of Key Players

- Insights on Fleet Telematics Data Plans, by OEM

- Insights into Commercial Vehicle Telematics Architecture

- Future Applications in Commercial Vehicle Telematics Ecosystem

- Sustainability Initiatives

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments, such as product launches, deals, expansions, and others, carried out by key industry participants.

Customization Options

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs. The customization options are given below:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fleet Telematics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fleet Telematics Market