Garden Plastics Market

Garden Plastics Market by Plastic Type (Commodity Plastics (HDPE, LDPE, PP, PVC), Engineering Plastics, Performance Plastics (ABS, PA, PVDF, POM, TPE)), Application (Pots & Containers, Irrigation Systems, Greenhouse & Tunnel Coverings, Raised Beds & Garden Liners, Mulch Films), Composition (Unfilled, Mineral Filled, Glass Fiber Reinforced), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The garden plastics market is projected to reach USD 4,654.2 million by 2030 from USD 3,605.6 million in 2025, at a CAGR of 5.2% from 2025 to 2030. The demand for garden plastics is rising due to their versatility, durability, and ability to meet evolving consumer preferences for sustainable and aesthetic outdoor solutions. Plastics offer lightweight, weather-resistant, and cost-effective alternatives to traditional materials like metal or ceramic, making them ideal for planters, garden furniture, irrigation components, and decorative items. The growing trend of home gardening, fueled by urbanization and the desire for green living spaces, has further increased the need for easy-to-handle and low-maintenance plastic products.

KEY TAKEAWAYS

-

BY PLASTIC TYPEBy plastic type includes commodity plastics and engineering plastics. The commodity plastics (PP, HDPE, LDPE, PVC and others), engineering plastics (ABS, PA, PVDF POM and others). Commodity plastics will continue to see strong demand due to their versatility, low cost, and extensive use across packaging, consumer goods, agriculture, and construction sectors. Meanwhile, engineering plastics are experiencing accelerated growth in high-performance applications, including automotive, electronics, healthcare, and industrial equipment.

-

BY COMPOSITIONThe garden plastics market spans key compositions including unfilled, mineral filled, glass fiber reinforced and other compositions. Unfilled plastics will continue to dominate high-volume applications such as packaging, consumer goods, and medical devices, owing to their cost-effectiveness, ease of processing, and recyclability. Mineral-filled plastics, enhanced with additives like talc, calcium carbonate, or mica, are gaining traction in automotive, electrical, and appliance sectors due to improved dimensional stability, stiffness, and thermal resistance. Glass fiber reinforced plastics (GFRP) are witnessing accelerated growth, particularly in automotive, aerospace, and construction applications, where lightweighting, strength, and fatigue resistance are critical.

-

BY APPLICATIONSThe garden plastics market serves diverse applications including mulch films, irrigation systems, greenhouse & tunnel coverings, raised beds & garden liners, pots & containers and other applications each contributing to its sustained expansion. Mulch films, irrigation systems, greenhouse coverings, and garden containers are witnessing steady growth driven by modern farming and home gardening trends. Demand is fueled by the need for water conservation, climate-resilient agriculture, and sustainable materials. With advancements in bio-based and UV-stabilized plastics, these applications are becoming more efficient, durable, and eco-friendly, strengthening the long-term growth of the garden plastics industry.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 6.6%, due to rapid urbanization, expanding middle-class populations, and increasing interest in home gardening and green spaces. The region’s strong agricultural base, coupled with government initiatives promoting water-efficient irrigation and sustainable farming, further boosts demand for plastic-based solutions like mulch films and greenhouse coverings.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Keter (Israel), THE HC COMPANIES, INC. (US), Scheurich GmbH & Co. KG (Germany), Elho B.V. (Netherlands),Horst Brandstätter Group (Germany). These companies are advancing garden plastics and broadening end-use adoption, reflecting the growing demand for garden plastics in various applications

The garden plastics market is projected to reach USD 4,654.2 million by 2030 from USD 3,605.6 million in 2025, at a CAGR of 5.2% from 2025 to 2030. The garden plastics market encompasses a wide range of plastic-based products designed for use in gardening, landscaping, and outdoor living applications. These include planters, pots, trays, garden furniture, storage containers, irrigation components, protective films, and decorative accessories made primarily from materials such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC). Garden plastics are valued for their durability, lightweight nature, UV resistance, and weatherproof performance, making them ideal for both residential and commercial environments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The garden plastics market is experiencing transformative shifts, driven by sustainability mandates, consumer preference for eco-friendly outdoor products, and tightening regulations on plastic waste. One of the most prominent trends is the rising demand for recyclable and biodegradable alternatives to traditional fossil-based polymers, prompting businesses to rethink their product design and material sourcing strategies. Regulatory pressure, particularly in the EU and North America, is compelling brands to adopt higher post-consumer recycled (PCR) content and comply with Extended Producer Responsibility (EPR) frameworks. This has disrupted long-standing supply chains and increased operational complexity for garden product manufacturers as they now face the dual challenge of maintaining performance while reducing environmental impact. Additionally, disruptions in global resin supply partly due to logistics constraints and geopolitical instability, have increased input costs, forcing companies to explore localized production and alternative materials such as bio-composites or repurposed ocean plastics. These evolving dynamics are compelling customers in the garden plastics space to prioritize supplier transparency, invest in R&D partnerships, and align procurement with circular economy principles to future-proof their offerings and brand reputation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising popularity of home gardening and urban landscaping

-

Increasing preference for lightweight, weather-resistant plastic products

Level

-

Fluctuating prices of raw plastic materials such as PP and PE

-

Limited biodegradability of conventional plastics

Level

-

Rising demand for recycled and bio-based plastics in garden products

-

Growth in demand for smart gardening tools and modular plastic planters

Level

-

Increasing competition from biodegradable and natural alternatives such as clay, metal, and wood

-

Balancing cost vs. sustainability in material selection

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Popularity of Home Gardening and Urban Landscaping

The rising interest in backyard gardening/home gardening/urban gardening is one of the key drivers of growth in the garden plastics sector. The changes to consumer lifestyles, and the greater awareness around the need for more environmentally responsible/sustainable and self-sufficient options all shaped this change in consumer behavior. This trend was helped by the COVID-19 pandemic, as consumers were also thinking about improving their homes and living spaces and improving their mental wellness through gardening. More specifically, things like at-home gardening supplies, which are simply plastic products for home gardeners, like pots, planters, seed trays, composters, and raised garden beds, saw an uptick in demand.Plastic gardening products have unique advantages to meet the demand changes, since they are inexpensive, lightweight, durable, and versatile. For example, regions such as North America and Europe are well established with a higher disposable income and have a history of established landscaping culture; however, regions within Asia-Pacific and South America are realizing the need for rooftop gardens and more vegetated vertical gardens as urban spaces become more restrictive. Moreover, social media and online gardening communities are improving marketability and heightening awareness for garden materials, thereby increasing consumer engagement.

Restraint: Fluctuating Prices of Raw Plastic Materials such as PP and PE

The garden plastics sector is heavily reliant on a variety of raw materials, primarily polypropylene (PP) and polyethylene (PE), both of which are derived from petroleum. These polymers represent a significant proportion of the cost to manufacture garden plastics, as a result the garden plastics industry is sensitive to the price of crude oil - and its volatility. Crude oil prices are frequently volatile on the marketplace due to various circumstances including geopolitical unrest and conflict, supply chain disruptions and macroeconomic uncertainty. Supply chain disruptions and geopolitical tensions have led to increased oil prices and in turn increased plastic resin prices which flow through to increased costs for suppliers throughout the supply chain. When resin prices increase from one month to the next, or week to week, suppliers must then tread a fine line when deciding whether they absorb the increase in resin price and reduce margins or increase the price to their customers, which then may negatively impact demand from consumers. Many of the major domestic manufacturers in the garden plastics industry are small suppliers without the long-term supply contracts and market strength to hedge themselves against volatility. Added to the impacts of unstable global oil prices, the garden plastics industry also must consider indefinite shipping disruptions and delays, processing plant shutdowns, and raw material shortages, all of which increases the complexity and unpredictability in raw plastic prices. With these increases and instability in resin pricing, as well as shipping delays, price uncertainty makes financial planning and operating planning nearly impossible. Price instability directly spreads throughout the supply chain and affects productions and shipments at the supplier level but also impacts distributor pricing and consumer price points as well.

Opportunity: Rising Demand for Recycled and Bio-Based Plastics in Garden Products

A rising importance on environmental sustainability - is resulting in a need for recycled and bio-based plastics across the garden applications. With a global shift towards circular economies, and as both governments and industries adopt similar approaches, the use of post-consumer recycled (PCR) plastics and renewable bio-resins is quickly increasing for pots, planters, compost bins and lawn edging. Materials like recycled polyethylene (rPE), recycled polypropylene (rPP), and polylactic acid (PLA) are being used to manufacture eco-friendly alternatives that lower the carbon footprint. These products align well with consumer preferences for sustainable, low-impact goods and offer manufacturers a path to meet emerging regulatory requirements. For example, EU regulations requiring minimum recycled content in plastic products are forcing producers to shift towards green materials. This shift is creating opportunities for firms to differentiate themselves in the market and reach environmentally conscious customers, as well as enter an interesting new sustainable market segment.

Challenge: Increasing competition from biodegradable and natural alternatives such as clay, metal, and wood

Natural and biodegradable materials such as clay, metal, bamboo, wood, and stone are creating increased competition in the garden plastics market. Environmentally aware consumers are choosing sustainable, aesthetically pleasing, and lower environmental impact natural materials. Products such as terracotta pots, wooden planters, and metal garden containers can last a lifetime, even after they have outlived their usefulness, they do represent the more biodegradable materials. As such, sustainability is evident with these products being deployed by consumers becoming more visible, for example, consumers who want durable products, with greater resale life cycle, and improved aesthetics for their patio or outdoor areas. Natural materials are generally more environmentally safe than plastic products made from polyethylene (PE) or polypropylene (PP) products, which do not decompose. Materials such as renewables like wood and bamboo sources decompose simply, and metals like galvanized steel and aluminum are recyclable, and durable. Although environmentally safe products labeled "eco-safe" or "sustainable" promote sales via garden centers and online shops, but the simplest materials such as wood and bamboo could lessen/neglect plastics consumption. In Europe, public procurement programs service suppliers based on restrictions prohibiting certain plastics and promoting biodegradable alternatives.

Garden Plastics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces resin-based garden storage, outdoor furniture, and planters for residential and commercial use. | Durable, UV-resistant, lightweight products that are easy to handle and maintain. |

|

Manufactures modular garden planters, outdoor storage units, and decorative landscaping solutions. | Versatile designs with recyclable materials, supporting sustainability and flexible garden setups. |

|

Offers functional garden products like pots, planters, and self-watering systems for homes and commercial spaces. | Eco-friendly, recyclable materials with innovative designs that simplify gardening and reduce water usage. |

|

Provides premium flower-pots and decorative planters for indoor and outdoor applications. | High-quality aesthetics with excellent weather and UV resistance for long-lasting use. |

|

Produces branded outdoor and garden solutions, including Playmobil-themed planters and children’s gardening sets. | Durable, child-safe, and visually appealing products that enhance brand-driven consumer engagement. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the garden plastics market comprises a well-integrated network of stakeholders across the value chain, including raw material suppliers, plastic component manufacturers, product assemblers, distribution channels, and end-use sectors. Key raw material providers supply polymers such as polypropylene (PP), polyethylene (PE), and recycled plastics, which form the base materials for outdoor garden products. Manufacturers and molders convert these into a wide variety of items like planters, storage bins, garden furniture, and fencing. Distributors and retailers, including large-format home improvement stores and e-commerce platforms, serve as essential links in delivering products to end consumers such as residential gardeners, commercial landscapers, and urban developers. Increasing demand for durable, lightweight, and eco-friendly plastic solutions continues to influence innovations and sustainability efforts across the ecosystem. Collaboration across these stages is vital to address cost pressures, environmental regulations, and shifting consumer preferences.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Garden Plastics Market, By Plastic Type

By plastic type, the commodity plastics segment was the largest segment in the global garden plastics market in 2024, largely due to the number of uses for polypropylene (PP) in producing many outdoor and garden-related products, including planters, tool boxes, storage containers, water tanks, and outdoor furniture. The inherent properties of PP, including lightweight, excellent resistance to chemicals and relative ease of fabrication by mold, and an attractive price point makes it the material of choice for all mass-market products in a garden environment. Additionally, PP is long-lasting, recyclable and, in recent years, has seen renewed interest as consumers and regulators are increasingly seeking sustainable, yet economical materials for garden use. As more manufacturers realize the positive attributes and growing markets associated with commodity plastic, the commodity plastic segment will continue finding opportunities to provide a better balance of price and performance. Through this growth, commodity plastics, and primarily PP, have positioned themselves in 2024 to emerge as the most commercially viable segment.

Garden Plastics Market, By Composition

In terms of composition, unfilled plastics represented the largest segment of the market in 2024. Unfilled grades, plastics that contain no reinforcements or fillers, are used more and more in application areas such as gardens, where high stiffness or flame resistance are not particularly important. They are easier to process, cheaper to produce, and lighter, which is favorable for injection molded items such as planters, trays, watering cans, and ornamental features. It is also important to note that the mechanical properties of unfilled plastics are typically sufficient for typical use-cases in the garden, where not much intense load or heat are applied. The widespread use of unfilled polypropylene and polyethylene in consumer garden products is a key contributor to this trend. This segment also benefits from consumer inclination towards visually appealing, lightweight, and budget-friendly gardening solutions that are still durable enough for outdoor exposure

Garden Plastics Market, By Application

Based on application, the garden plastics market has been segmented into mulch films, irrigation systems, greenhouse & tunnel coverings, raised beds & garden liners, pots & containers and other applications. Mulch films are expected to hold the highest market share in the garden plastics market due to their vital role in enhancing agricultural productivity and resource efficiency. These films help conserve soil moisture, regulate temperature, and control weed growth, making them indispensable in both commercial farming and horticulture. Their ability to improve crop yield and quality while reducing water usage and labor costs has made them a preferred choice among growers globally. Moreover, advancements in biodegradable and UV-stabilized mulch films are addressing environmental concerns, further driving adoption across diverse climates and crop types. This combination of performance, sustainability, and cost-effectiveness positions mulch films as the leading application within the garden plastics market.

REGION

Asia Pacific to be fastest-growing region in global garden plastics market during forecast period

The global garden plastics market saw Asia Pacific dominate both revenue and volume share during 2024. Urbanization growth together with expanding middle-class populations and increasing outdoor landscaping interest have made this region a leading manufacturing and consumption center. The manufacturing of plastic garden products such as planters and pots storage bins and decorative fencing provides manufacturers in Asia Pacific with low-cost labor expenses and extensive plastic resin production facilities and expanding regional supply chain networks. The expanding organized retail sector and e-commerce platforms throughout Asia Pacific have improved market reach for garden plastic products because the region's various climates maintain constant demand for different gardening solutions during every season.The implementation of government programs for smart cities together with green spaces and sustainable living indirectly creates demand for lightweight modular and durable garden plastic products. The Asia Pacific area creates perfect conditions for extensive manufacturing facilities and expanding customer bases which demonstrate rising interest in outdoor design and space management trends. The worldwide market for garden plastics remains dominant due to the steady growth of this sector in this region

Garden Plastics Market: COMPANY EVALUATION MATRIX

In the garden plastics market matrix, Keter (Star), a Israel company, leads the market through its manufacturing and distribution of garden plastic equipments due to its strong global presence, extensive product portfolio, and reputation for durable, high-quality plastic solutions. The company specializes in resin-based garden storage, furniture, and planters that combine functionality with aesthetic appeal, catering to both residential and commercial segments. Keter’s focus on innovation, UV-resistant and weatherproof materials, and sustainable practices—including recyclable plastics—enhances its competitive advantage.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Keter (Israel)

- THE HC COMPANIES, INC. (US)

- Scheurich GmbH & Co. KG (Germany)

- Elho B.V. (Netherlands)

- Horst Brandstätter Group (Germany)

- The AMES Companies (US)

- Berry Global Inc. (US)

- RKW Group (Germany)

- BASF (Germany)

- Armando Alvarez Group (Spain)

- Landmark Plastic Inc. (US)

- East Jordan Plastics, Inc. (US)

- CREO Group (US)

- T.O. Plastics, Inc. (US)

- Capi Europe (Netherlands)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3,438.2 Million |

| Market Forecast in 2030 (value) | USD 4,654.2 Million |

| Growth Rate | CAGR of 5.2% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | • By Plastic Type: Commodity Plastics and Engineering Plastics • By Composition: Unfilled, Mineral Filled, Glass Fiber Reinforced and Other Compositions • By Application: Mulch Films, Irrigation Systems, Greenhouse & Tunnel Coverings, Raised Beds & Garden Liners, Pots & Containers and Other Applications |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Garden Plastics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Garden Plastics Manufacturers | • Detailed company profiles of garden plastics competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Assessment of collection, and government policy ecosystem related to garden plastics | • Identified & profiled 20+ garden plastics companies • Track adoption trends in high-growth APAC industries • Highlight new customer clusters driven by sustainability mandates |

| Benchmarking of Garden Plastics Composition (Unfilled, Mineral Filled, Glass Fiber Reinforced) | • Comparative analysis of garden plastics providers, process efficiency, cost structure, and scalability | • Supported clients to identify the most cost-effective garden tools |

| US-based Garden Plastics Raw Material Suppliers | • US-based garden plastics raw material suppliers offer tailored polymer grades, UV-stabilized formulations, and color-specific resins to meet client-specific requirements for pots, containers, mulch films, and irrigation components. | • They provide enhanced durability, weather and UV resistance, and sustainable or recyclable material options, ensuring longer product life, regulatory compliance, and alignment with eco-friendly consumer preferences. |

| Application-based Garden Plastics Products | Application-based garden plastics products are tailored in size, shape, thickness, and functionality—such as self-watering pots, modular raised beds, or UV-stabilized mulch films—to suit specific horticultural or landscaping needs. | Offer enhanced performance, durability, and ease of use, while supporting water efficiency, sustainability, and aesthetic appeal, thereby improving productivity and consumer satisfaction |

RECENT DEVELOPMENTS

- April 2025: The HC Companies merged with Classic Home & Garden under the unified brand name Growscape.

- April 2025: Berry, which previously offered garden plastics under its Engineered Materials division, is now part of Amcor’s integrated packaging platform.

- January 2025: Elho B.V. unveiled its premium collection featuring three elegant series – amber, eden, and june.

- October 2024: Exclusive UK Distribution with AMES Companies, Scheurich signed an exclusive distribution agreement with AMES Companies (UK), launching over 350 SKUs into the UK market via AMES’ retail channels

Table of Contents

Methodology

To accurately estimate the size of the global garden plastics market, this study took four key steps. Through comprehensive secondary research, we compiled data sources relating to garden plastics, related outdoor plastic use, and polymer use more broadly in landscaping and gardening. We cross-referenced this data against primary research based on interviews with stakeholders through the entire value chain of garden plastics, that included raw material suppliers, plastic compounders, product manufacturers, distributors, and end users (retailers & landscapers). An accurate estimation of the total size of the market could take both top-down and bottom-up approaches, with market segmentation and data triangulation methods applied to strengthen size estimates of the various segments and subsegments of the garden plastics market.

Secondary Research

We developed a market landscape for companies providing garden plastics and related solutions using a combination of secondary data sources, both publicly available and paid evaluation of company product portfolios, industry publications, and trade databases. The following sources were examined to assess macroeconomic and industry-level trends influencing garden plastics uptake: Bloomberg, Factiva, Business Standard, and the World Bank. In addition, we used annual reports from our climate policy framework assessment, press releases, sustainability reports, and investor briefings of garden plastics manufacturers and bio-based (derived from renewable biomass) polymer manufacturers and as well as guidance from industry associations, environmental policy frameworks, and whitepapers related to bioplastics. This research led to an understanding of the various components of the garden plastics value chain, the top players in the garden plastics business, how the market is categorized, innovation developments in technology, and related information on the garden plastics ecosystem.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the garden plastics market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of garden plastics offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

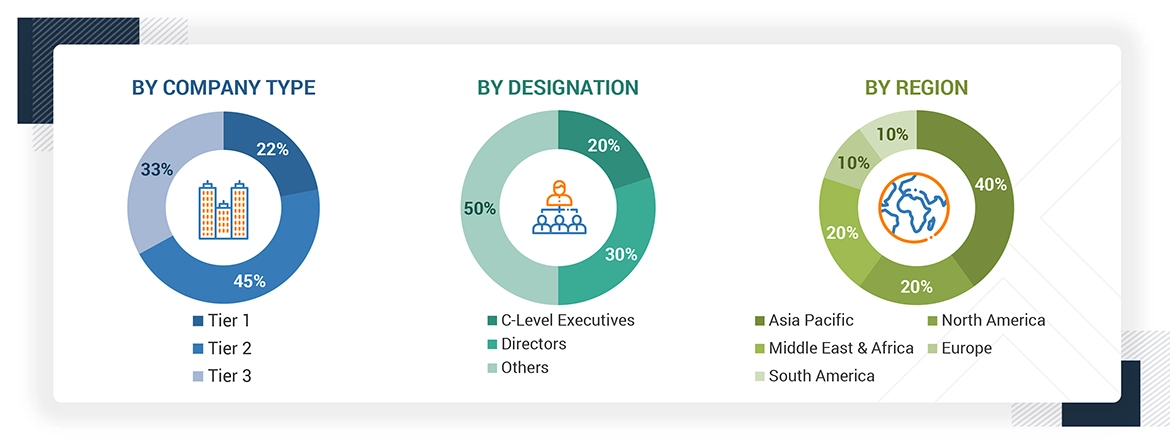

Following is the breakdown of interviews with experts:

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the garden plastics market. These approaches were also used extensively to estimate the sizes of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using standardized market estimation methodologies, the garden plastics market was segmented into multiple applications, plastic types, compositions, and regional markets. Data triangulation and market breakup procedures were applied, wherever necessary, to complete the market engineering process and derive accurate statistical insights for each segment and subsegment. The triangulation process was employed when we analyzed and validated data from the supply-side metrics (production capacities, availability of plastic types, technology adoption) and demand-side trends (application growth, regulatory adoption) to ensure consistency and accuracy in final market estimates.

Market Definition

Garden plastics are a broad category of plastic-based materials developed and designed for outdoor gardening and landscaping. Garden plastics are commonly used to create garden furniture, pots and planters, watering cans, compost bins, storage containers, fencing, and decorative landscaping. Garden plastics can be produced from a variety of materials commonly of polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and increasingly recycled or bio-based plastics. They have many benefits: durability, weather resistance, UV stability, lightweight, and flexible shape/Moldability. In the past, garden plastics were made from fossil-fuel based polymers. Today, environmental awareness and changing regulations are driving garden plastics toward materials containing recycled content, circular plastics, and biodegradable materials. Garden plastics can be manufactured with standard processes such as injection molding, blow molding, rotational molding, and extrusion. The garden plastics market is becoming increasingly important to the plastic and consumer goods industries as urban gardening and DIY landscaping are emerging as popular trends and as demand for both functional and visually appealing outdoor garden and landscape products increases.

Stakeholders

- Garden Plastics Manufacturers

- Raw Material Suppliers

- Downstream Converters and Processors

- Distributors and Traders

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To define, describe, and forecast the size of the global garden plastics market based on type, application, composition, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the garden plastics market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What do you see as the drivers for the garden plastics market?

Increasing demand for durable, weather-resistant, and low-maintenance materials in outdoor applications, growth in urban gardening, home improvement, and landscaping activities are driving the market. The advantages of plastics—such as lightweight, design flexibility, and resistance to rot and corrosion—make them a preferred alternative to traditional materials. Growth in e-commerce and DIY culture further supports the adoption of garden plastic products.

What do you see as the major restraints for the garden plastics market?

Regulatory pressure on plastic use due to environmental concerns, raw material cost volatility, and negative public perception regarding the sustainability of plastics are major restraints. The limited frequency of replacement in mature markets also restricts growth.

What are the main opportunities in the garden plastics market?

Opportunities lie in developing eco-friendly garden plastics from recycled or bio-based materials. Growth in vertical gardens, modular garden systems, smart irrigation planters, and urban green spaces offer new avenues. Government incentives supporting climate-adaptive landscaping, along with expanding demand in emerging markets such as Asia Pacific, Africa, and Latin America, also present strong growth potential.

What are the prime factors restraining the growth of the garden plastics market?

Consumer awareness of plastic waste, limited recyclability of certain polymer blends, lack of standardized eco-labeling, and increasing competition from natural or composite alternatives like wood plastic composites and ceramics are the main restraining factors.

Who are the major players in the garden plastics market?

Major players include Keter (Israel), THE HC COMPANIES, INC. (US), Scheurich GmbH & Co. KG (Germany), Elho B.V. (Netherlands), and Horst Brandstätter Group (Germany).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Garden Plastics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Garden Plastics Market