Gas Detection Market Size, Share Analysis

Gas Detection Market by installation (fixed, portable), device (single gas, multi-gas), technology (electrochemical, catalytic, MOS, Infrared, Photoionization), gas type (Oxygen, carbon monoxide, carbon dioxide, ammonia, VOCs) - Global Forecast to 2030

OVERVIEW

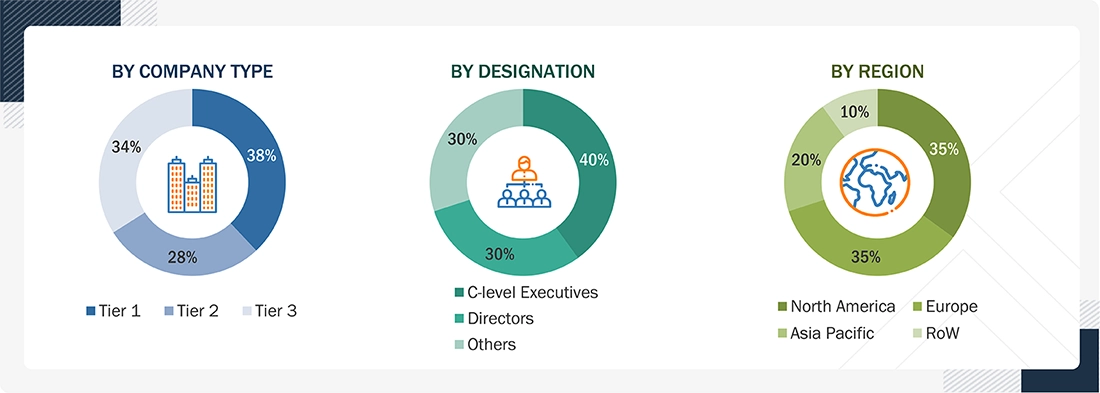

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The gas detection market is projected to grow from USD 3.84 billion in 2025 to USD 5.18 billion by 2030, at a CAGR of 6.1% from 2025 to 2030. The gas detection market is accelerating due to stricter global safety and environmental regulations, compelling industries to adopt continuous monitoring solutions. Rising industrial automation and digital transformation initiatives are driving demand for smart, connected gas detection systems with predictive analytics. Additionally, the expansion of oil & gas, chemicals, renewable energy, and high-risk manufacturing is increasing operational complexity, heightening the need for real-time hazard detection. Growing emphasis on worker safety, ESG compliance, and incident prevention further strengthens market adoption.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific dominated the gas detection market in 2024, accounting for 34.1% of the global market.

-

BY INSTALLATION TYPEBy installation type, the portable installation segment is expected to register the highest CAGR of 7.8%.

-

BY GAS TYPEBy gas type, the market for volatile organic compounds contributed 15.0% in 2024.

-

BY TECHNOLOGY TYPEBy technology type, the infrared technology segment is expected to grow at the highest CAGR during the forecast period.

-

BY DEVICE TYPEBy device type, the multigas detector segment is expected to dominate the market, growing at the highest CAGR during 2025 to 2030.

-

BY VERTICALBy vertical, the manufacturing & industrial segment is expected to register highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE - Key PlayersCompanies such Honeywell International Inc, MSA and DRÄGERWERK AG & CO. KGAA were identified as key players in the gas detection market, given their broad industry coverage and strong operational & financial strength.

-

COMPETITIVE LANDSCAPE - StartupsCompanies such as Emerson Electric Co., RIKEN KEIKI CO., LTD, and GFG, among others, have distinguished themselves among SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The gas detection system market is projected to grow optimally driven by stringent safety regulations, rising industrialization, and the increasing need to mitigate hazardous gas-related risks across high-risk sectors. Industries such as oil & gas, chemicals, manufacturing, and power generation are rapidly adopting advanced fixed and portable detectors to enhance operational safety and compliance. The shift toward smart, connected, and IoT-enabled monitoring solutions is further accelerating adoption. Additionally, heightened focus on ESG standards and workplace safety is reinforcing sustained demand for reliable gas detection technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The gas detection market is being reshaped by rapid digitalization, with IoT-enabled, cloud-connected, and AI-driven detectors enabling real-time analytics, remote monitoring, and predictive maintenance. Miniaturization and integration of multisensor technologies are improving accuracy and reducing false alarms, while wireless and wearable detectors are gaining traction in high-risk sectors. ESG pressures and stricter global safety regulations are accelerating industry-wide adoption of advanced detection platforms. Meanwhile, disruptive innovations such as drone-mounted gas sensors, edge computing, and automated shutdown systems are transforming industrial safety practices. Growing demand for smart factories and connected worker solutions further amplifies the shift toward intelligent, interoperable gas detection ecosystems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent global safety and environmental regulations

-

Rising industrialization and automation

Level

-

High installation and maintenance costs

-

Technical limitations

Level

-

Growth of smart factories and connected worker solutions

-

Emerging industrial expansion

Level

-

Integration complexities

-

Harsh operating environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising industrialization and automation

Rising industrialization and automation are major drivers of the gas detection market, as expanding manufacturing, chemical processing, oil & gas, and energy facilities create more complex operational environments with higher safety risks. Automation and Industry 4.0 initiatives are pushing organizations to deploy advanced, connected gas detection systems that integrate seamlessly with control rooms, SCADA, and IoT platforms. These systems enable continuous, real-time monitoring, faster decision-making, and automated responses to hazardous gas leaks. As factories modernize and adopt robotics, smart sensors, and digital workflows, the need for reliable, precise, and low-maintenance gas detection solutions intensifies, accelerating market growth

Restraint: High installation and maintenance costs

High installation and maintenance costs pose a significant restraint in the gas detection market, especially for fixed, networked, or IoT-enabled systems. Deploying these solutions requires specialized wiring, integration with existing control systems, and compliance-driven installation standards, all of which increase upfront investment. Ongoing maintenance—such as frequent calibration, sensor replacement, and technical servicing adds further operational expenses. These cost barriers limit adoption among small and mid-sized enterprises and in cost-sensitive developing regions

Opportunity: Growth of smart factories and connected worker solutions

The rise of smart factories and connected worker solutions presents a significant opportunity for the gas detection market. As industries adopt Industry 4.0 frameworks, the need for real-time, data-rich, and interoperable safety systems is accelerating. Gas detectors equipped with IoT, wireless communication, and cloud analytics seamlessly integrate into automated workflows, enabling predictive maintenance, remote monitoring, and faster incident response. Connected worker platforms featuring wearables, location tracking, and mobile alerts further enhance safety by delivering instant exposure notifications and situational awareness. This shift toward intelligent, integrated ecosystems drives strong demand for advanced, scalable gas detection technologies across modern industrial operations

Challenge: Integration complexities

Integration complexities with legacy systems and industrial platforms represent a major challenge in the gas detection market. Many older facilities operate with outdated control systems, limited communication protocols, and non-standardized architectures, making seamless integration difficult. Connecting modern IoT-enabled detectors to such environments often requires costly retrofits, custom interfaces, or middleware. These complexities not only delay deployment but also increase overall project costs and hinder the adoption of advanced, interconnected gas detection solutions

gas-detection-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Upstream/midstream oil & gas, petrochemical plants, utilities, confined-space monitoring, and large industrial facilities. | Fast deployment at scale| Deep enterprise integration|Single-vendor lifecycle support (procure → install → service). |

|

Mining, construction, chemical, utilities and maintenance teams requiring rugged personal monitors. | High reliability in harsh environments|Strong service & distribution model reduces OPEX risk for rollouts. |

|

Petrochemical tank farms, chemical plants, confined space entry, industrial hygiene and emergency response teams. | Proven system engineering for complex sites| Lowers integration risk and improves safety governance/compliance. |

|

Field operations, contractors, municipal utilities, confined space and entry monitoring with workforce analytics. | Rapid ROI via worker-centric telemetry|Simplified fleet management and data-driven compliance reportin |

|

Cold-storage (refrigerants), HVAC, chemical plants, utilities and general industrial safety monitoring | Flexible modular products reduce inventory complexity| Niche expertise (refrigerants/warehouse) speeds targeted deployments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gas detection market ecosystem comprises a network of sensor manufacturers, device OEMs, components providers, system integrators, distributors, and end-use industries. Sensor suppliers develop electrochemical, infrared, catalytic, and ultrasonic sensing technologies that feed into portable and fixed detector manufacturers. IoT, cloud, and analytics vendors enable data management, predictive maintenance, and real-time monitoring platforms. System integrators ensure seamless deployment with SCADA, DCS, and plant automation systems. Distributors and service partners handle calibration, compliance, and lifecycle support. End-users including oil & gas, chemicals, manufacturing, mining, and utilities—drive demand for reliable, connected, and standards-compliant detection solutions

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Gas Detection Market, By Installation Type

Fixed installations are expected to contribute the largest market share as industries prioritize continuous, real-time monitoring in high-risk environments such as oil & gas, chemicals, and manufacturing. Their integration with automation systems, long-term reliability, and ability to cover large areas make them the preferred choice for regulatory compliance and operational safety.

Gas Detection Market, By Gas Type

Hydrogen gas detection is projected to record the highest CAGR due to the rapid expansion of hydrogen production, storage, and fuel-cell infrastructure driven by clean energy transitions. Its high flammability and leak-prone nature necessitate highly sensitive detectors. Growing investments in mobility, renewable energy, and industrial hydrogen applications further accelerate market adoption exhibits the highest CAGR, driven by the growing shift toward cloud-based biometric platforms and subscription models. The rise of multimodal authentication, mobile SDK integration, and continuous model updates is accelerating the demand for scalable, intelligent, and adaptive biometric software solutions worldwide.

Gas Detection Market, By Technology Type

Infrared (IR) technology in gas detection is expected to witness a significant CAGR due to its high accuracy, rapid response, and low maintenance compared to traditional methods. Its ability to detect a wide range of combustible gases, even in harsh industrial environments, makes it ideal for oil & gas, chemicals, and manufacturing applications as the demand surges for mobile and field-deployable identity solutions. Their compact design and connectivity enable remote authentication for law enforcement, healthcare, and border control, supporting real-time identification in decentralized and on-the-go environments.

Gas Detection Market, By Device Type

Multigas detectors are expected to experience significant growth as industries increasingly prefer equipment capable of detecting multiple hazardous gases simultaneously. Their versatility, cost efficiency, and enhanced worker safety make them ideal for complex industrial environments. Rising adoption in oil & gas, mining, chemicals, and confined-space applications further accelerates their market expansion

Biometric System Market, By Vertical

The oil & gas sector is expected to hold a significant share of the gas detection market due to its high-risk environments, stringent safety regulations, and constant need to monitor combustible and toxic gases across exploration, production, refining, and transportation. Continuous monitoring for leak prevention and operational safety drives strong, sustained adoption.

REGION

Asia Pacific to grow at the fastest rate in the global biometric system market during the forecast period

Asia Pacific is projected to register the highest CAGR from 2025 to 2030, driven by rapid industrialization, expanding oil & gas and chemical sectors, and rising infrastructure investments. Strengthening safety regulations and widespread adoption of smart factory technologies further accelerate demand across China, India, South Korea, and Southeast Asia.

gas-detection-market: COMPANY EVALUATION MATRIX

In the gas detection market matrix, Honeywell International Inc leads with a strong global presence and a comprehensive gas detection portfolio spanning several models across fixed, portable, multisensor, flame, and specialty detectors (extensive accessory & integration kits). Its extensive integration in manufacturing & industrial, oil & gas, and petrochemical plants drives widespread adoption and market leadership. RIKEN KEIKI CO., LTD. (Emerging Leader) is rapidly gaining momentum through its innovative components of gas detection systems, including alarming units, checkers, and so on.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Honeywell International Inc. (US)

- MSA (US)

- Drägerwerk AG & Co. KGaA (Germany)

- Industrial Scientific (US)

- Halma Plc (UK)

- ABB (Switzerland)

- Teledyne Technologies (US)

- Emerson Elecrtic Co (US)

- GFG GESELLSCHAFT FÜR GERÄTEBAU MBH (Germany)

- RIKEN KEIKI CO., LTD. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.64 Billion |

| Market Forecast in 2030 (Value) | USD 5.18 Billion |

| Growth Rate | CAGR of 6.1% from 2025-2030 |

| Years Considered | 2021-2024 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Installation Type: Fixed and Portable, Gas Type: Oxygen (O2), carbon monoxide (CO), carbon dioxide (CO2), ammonia (NH3), chlorine (Cl), hydrogen sulfide (H2S), nitrogen oxide (NOx), volatile organic compounds (VOCs), sulfur dioxide (SO2), methane (CH4), hydrocarbons, hydrogen. Device Type: Single-use, Multi-use, Vertical: Oil & Gas, Mining, Manufacturing & Industrial, Chemical & Petrochemical, Power generation, Building & Construction and Others |

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: gas-detection-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Gas Detection OEM | Deep competitor benchmarking across fixed, portable, and multisensor gas detectors | End-user adoption insights across oil & gas, chemicals, power, and mining |

| European Industrial Safety Solutions Provider | Sensor-level comparison of electrochemical, IR, catalytic bead, and ultrasonic technologie | Technology positioning strategy for next-gen product portfolio |

| APAC-based Industrial Automation Integrator | Regional market sizing for fixed gas detection integration with SCADA/DCS | Integration roadmap and cross-industry deployment opportunities |

| Middle East Oil & Gas Operator | Evaluation of hazardous-area certified detectors (ATEX, IECEx, SIL ratings) | Optimization of safety architecture and vendor qualification process |

| Global Manufacturing Conglomerate | Multi-site demand forecasting for portable and connected worker gas monitors | Cost–benefit assessment for adopting IoT and cloud-enabled monitoring |

RECENT DEVELOPMENTS

- November 2025 : MSA Safety has introduced the ALTAIR io 6 Multigas Detector at the 2025 A+A International Trade Fair and Congress in Düsseldorf, Germany.The company designed the six-gas detector for confined space monitoring and sampling applications.

- September 2025 : Crowcon has unveiled the IQ range, a new family of connected, portable gas detectors built to transform how safety teams protect people, manage fleets, and stay compliant in high-risk industries.From single-gas wearables (UnoIQ and DuoIQ) to rugged area monitors (DetectiveIQ) and real-time cloud-based insights, the IQ range combines modular design with smart connectivity

- June 2025 : ANYbotics, a global leader in AI-driven robotic inspection solutions, launched a new Gas Leak and Presence Detection solution for its ANYmal robot, which is set to transform how industrial sites identify and manage costly and hazardous gas leaks.ANYmal’s new solution offers a comprehensive approach to industrial gas leak detection. It integrates advanced, modular gas detectors with a 360° acoustic imaging payload to precisely pinpoint leak sources and simultaneously measure ambient gas concentrations.

- May 2025 : KARAM Safety unveiled its latest innovation ,the Portable Multi Gas Detector at the Annual Channel Partner Meet 2025 in Baku, Azerbaijan. Engineered for performance and reliability, the Portable Multi Gas Detector is a compact and rechargeable device designed to simultaneously detect Oxygen (O2), Hydrogen Sulfide (H2S), Carbon Monoxide (CO), and Combustible Gases (LEL). Built for use in hazardous industrial environments, it features visual, audible, and vibration alarms that provide immediate alerts on dangerous gas levels, ensuring real-time worker safety

- March 2025 : Industrial Scientific, one of the global leaders and innovators in connected gas detection programs that automate safety workflows, has revealed its latest area monitoring solution the Vector AM7 Area Monitor. The Vector AM7 is designed to streamline gas detection needs with unparalleled versatility and efficiency, significantly improving situational awareness, site uptime, communications, and multiple facets of day-to-day operations.? Engineered with customer needs at its core, the Vector AM7’s innovative design enables easier mounting and transport, making deployment a breeze.

Table of Contents

Methodology

The research process for this study involved the systematic gathering, recording, and analysis of data on customers and companies operating in the gas detection market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the gas detection market.

In-depth interviews were conducted with primary respondents, including experts from core and related industries, as well as preferred manufacturers, to gather and verify critical qualitative and quantitative information and assess growth prospects. Key players in the gas detection market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research involved studying the annual reports of top players and conducting interviews with key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

Various sources were used in the secondary research process to identify and collect information crucial for this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases. Secondary research was primarily used to gather key information about the industry’s value chain, the total pool of market players, market classification according to industry trends at the most detailed level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

Primary research was conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the gas detection market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the gas detection market scenarios through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies have been defined based on their total/segmental revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 1 billion–USD 500 million, and Tier 3 = USD 500 million. ‘Others’ include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

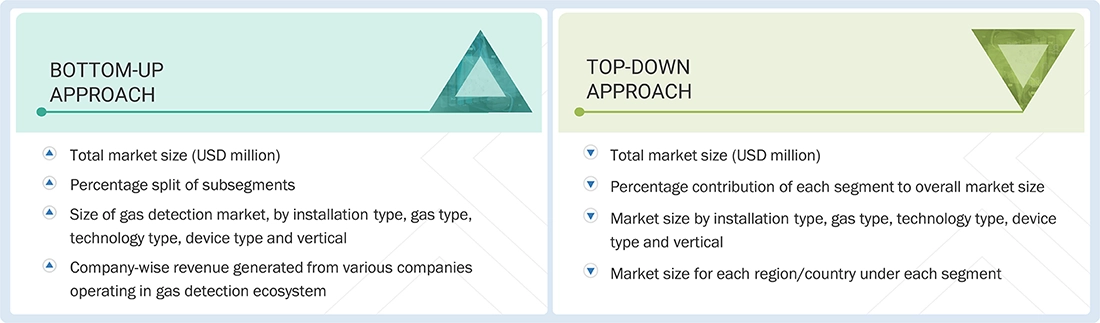

Market Size Estimation

In the comprehensive market engineering process, the top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the gas detection market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players and interviews with experts (CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Gas Detection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the market size estimation process, as explained above, the total market has been divided into several segments and subsegments. Market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and obtain precise statistics for all segments and subsegments. The data have been triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

Gas detection is the process of identifying and measuring the presence of hazardous gases in an environment to ensure safety, operational continuity, and regulatory compliance. It involves using specialized sensors and devices such as fixed detectors, portable monitors, and multi-gas instruments to detect toxic, combustible, or oxygen-deficient atmospheres before they reach dangerous levels.

Key Stakeholders

- Hardware system integrators

- Sensor providers

- Raw material suppliers

- Original equipment manufacturers (OEMs) and systems integrators

- Research organizations and consulting companies

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists and private equity firms

- Associations, organizations, and alliances

- End users (Mnaufacturing & Industrial, Mining, Oil & Gas , Chemicals, Power, etc)

Report Objectives

- To describe and forecast the size of the gas detection market, by installation type, technology type, device type, gas type, and vertical, in terms of value

- To estimate the size of the gas detection market, by installation type, in terms of volume

- To forecast the market for various segments with regard to four main regions: North America, Europe, Asia Pacific, and RoW, along with their respective countries, in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the gas detection market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete supply chain and allied industry segments, and perform a value chain analysis of the gas detection landscape

- To strategically analyze the regulatory landscape, tariffs, standards, patents, Porter’s Five Forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To analyze the impact of AI/Gen AI and the 2025 US tariff impact and the macroeconomic outlook for regions covered under the study

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the gas detection market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, partnerships, and expansions, in the gas detection market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gas Detection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Gas Detection Market