GPU as a Service Market Size, Share & Trends 2030

GPU as a Service Market by Service Model (IaaS, PaaS), GPU Type (High-end GPUs, Mid-range GPUs, Low-end GPUs), Deployment (Public Cloud, Private Cloud, Hybrid Cloud), Enterprise Type (Large Enterprises, SMEs) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The GPU-as-a-Service market is projected to reach USD 26.62 billion by 2030 from USD 8.21 billion in 2025, at a CAGR of 26.5%. The GPU-as-a-Service market is driven by the growing adoption of AI, machine learning, and data analytics across industries requiring high-performance computing (HPC) capabilities. Businesses increasingly rely on cloud-based GPU resources for scalable AI training, predictive analytics, and real-time data processing.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to dominate the GPU-as-a-Service market with a share of 48.5% in 2025.

-

BY SERVICE MODELBy service model, the IaaS accounted for the largest market size in 2024.

-

BY DEPLOYMENTBy deployment, the public cloud segment accounted for a share of 49.9% in terms of value in 2024.

-

BY ENTERPRISE TYPEBy enterprise type, the SMEs segment is projected to grow at a CAGR of 29.1% during the forecast period.

-

BY TECHNOLOGYHigh-end GPU segment is estimated to record the highest CAGR in the forecasted timeline, driven by increasing requirement for accelerated computation in AI, ML, and complicated simulations.

-

BY APPLICATIONArtificial intelligence & machine learning (AI/ML) applications are estimated to hold the largest market share during the forecast period, due to their huge computational demands.

-

COMPETITIVE LANDSCAPEVULTR, Nebius B.V., Yotta Infrastructure, Rackspace Technology, E2E Networks Limited, and DigitalOcean, LLC have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The market for GPU-as-a-Service is driven by the surge in AI and machine learning applications. Industries such as healthcare, finance, and automotive require high-performance computing for tasks like data analysis, image recognition, and autonomous driving. NVIDIA’s GPUs are widely used in AI research and development, enabling companies to access powerful computational resources without significant upfront investments. This demand for scalable and efficient AI solutions fuels the growth of GPUaaS, allowing businesses to leverage advanced technologies without the need for extensive infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The GPU-as-a-Service (GPUaaS) market is witnessing a significant transformation due to emerging trends and disruptions that impact customer business models and revenue streams. Traditionally, revenue sources in this market have been driven by AI and ML workloads, on-demand instances, cloud gaming services, and GPU applications in the medical and entertainment sectors. However, the future revenue mix is expected to evolve, driven by deep learning, generative AI, metaverse applications, and enterprise AI-driven digital transformation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of GPUaaS in Gaming and Virtualization

-

Surging use of cloud-powered AI, ML, and DL frameworks

Level

-

Limited availability of high-end GPUs due to supply chain constraints

Level

-

Rising investments in AI infrastructure by cloud service providers

-

Increasing investments in AI infrastructure by cloud service provider

Level

-

Managing high power consumption and cooling needs in cloud GPUs

-

Confronting security, performance, and scalability challenges in multi-tenant environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of GPUaaS in Gaming and Virtualization

The gaming industry's increasing demand for high-performance GPUs to support real-time rendering, ray tracing, and AI-driven character modeling is a major driver for the GPU-as-a-Service market. Cloud gaming platforms, such as NVIDIA GeForce NOW, Xbox Cloud Gaming, and PlayStation Now, offer scalable and cost-effective GPU power, enabling users to stream graphically demanding games without requiring powerful local hardware. This eliminates the necessity for costly gaming consoles or PCs, opening up AAA gaming for low-end hardware.

Restraint: Limited availability of high-end GPUs due to supply chain constraints

One of the major restraints in the GPU-as-a-Service market is the lack of availability of high-end GPUs due to supply chain constraints. The increasing demand for AI, ML, gaming, data analytics, and HPC has surpassed the production of GPUs, resulting in bottlenecks for cloud-based vendors. In January 2025, Taiwan was severely hit by a 6.4-magnitude earthquake that heavily damaged the Taiwan Semiconductor Manufacturing Company (TSMC), destroying more than 30,000 high-end wafers used in GPU manufacturing, particularly affecting NVIDIA's Blackwell architecture. Consequently, the supply of NVIDIA RTX 5090 cards has been significantly delayed.

Opportunity: Rising investments in AI infrastructure by cloud service providers

A major opportunity in the GPU-as-a-Service market is driven by the increasing investments in AI infrastructure by cloud service providers (CSPs), such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Oracle Cloud. These companies are heavily investing in high-performance computing (HPC) and AI-optimized GPU clusters to support the growing demand for AI-powered applications.

Challenge: Managing high power consumption and cooling needs in cloud GPUs

One of the major challenges in the GPU-as-a-Service market is handling the intense power usage and cooling requirements of cloud GPUs. High-end GPUs, such as NVIDIA H100, A100, and AMD MI300, are very power-hungry, and AI clusters consume megawatts of electricity while running large-scale AI models. As cloud providers expand their infrastructures, power-efficient solutions become necessary to control operational expenses and achieve sustainability goals.

GPU as a Service Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

On-demand GPUaaS for AI/ML model training, graphics rendering, and large-scale scientific simulations | Scalable resource provisioning, pay-as-you-go cost structure, access to the latest GPU hardware without capex |

|

GPU-powered cloud instances for deep learning, analytics, and video processing in multi-regional data centers | Rapid deployment, high performance, global reach, workload flexibility, and simplified infrastructure management |

|

GPUaaS enabling hybrid cloud workflows, with integration of AI-optimized hardware for enterprise workloads | Seamless hybrid-cloud scaling, enterprise security, continuous access to the newest GPU tech, and low-latency operations |

|

High-performance GPU clusters for industrial simulations, large language models, and personalized analytics | Advanced data privacy, lower infrastructure burden, dynamic scaling, and improved business continuity |

|

Bare-metal and virtual GPU instances for compute-intensive rendering, AI development, and HPC workloads | Renders hardware control, competitive pricing, flexibility between VMs and bare-metal, and accelerated performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The GPU-as-a-Service market ecosystem comprises chip manufacturers, infrastructure & platform providers, specialized GPU service providers, and end users. Each collaborates to advance the market by sharing knowledge, resources, and expertise to attain end innovation in this field. Manufacturers such as NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), and Intel Corporation (US) are at the core of the GPU-as-a-Service market, responsible for developing GPU-as-a-Service offerings for various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

GPU-as-a-Service Market, by Service Model

The Infrastructure-as-a-Service (IaaS) segment is estimated to hold the largest market share during the forecast period. Major cloud providers such as AWS, Microsoft Azure, and Google Cloud have invested heavily in IaaS, providing customizable platforms that cater to both large enterprises and startups. The adaptability of IaaS enables organizations to allocate computing power according to real-time requirements, providing cost-effective resource utilization while accelerating innovation.

GPU-as-a-Service Market, by Deployment

By deployment, the hybrid cloud segment is projected to grow at a high CAGR during the forecast period because of its ability to balance data security, cost-effectiveness, and flexibility. Hybrid cloud models are being increasingly adopted by businesses to leverage both on-premises infrastructure and public cloud resources.

GPU-as-a-Service Market, by Enterprise Type

By enterprise type, the small and medium-sized enterprises (SMEs) segment is projected to record the highest CAGR, driven by the increasing adoption of AI, machine learning (ML), and data analytics. SMEs often lack the capital to invest in expensive on-premises GPU infrastructure, making cloud-based GPUaaS a cost-efficient and scalable option. AWS, Azure, and Google Cloud provide SMEs with on-demand access to high-performance GPUs, which can be used to accelerate AI model training, video rendering, and data analysis without requiring significant initial investments. GPUaaS offers pay-as-you-go pricing, allowing SMEs to efficiently manage their operational costs.

GPU-as-a-Service Market, by Technology

The high-end GPU segment is expected to have the highest CAGR during the forecasted timeline, driven by increasing adoption in sectors such as healthcare and scientific research for drug discovery and medical imaging analysis. With the increasing adoption of AI across industries, businesses are opting for high-end GPUs to address their growing computational needs. The flexible pay-as-you-go cloud model provides greater access to such powerful assets, further increasing the growth of the high-end GPU segment.

GPU-as-a-Service Market, by Application

Artificial intelligence & machine learning (AI/ML) applications are estimated to account for the largest market share during the forecast period, due to their huge computational demands. AI and ML algorithms require substantial processing power for functions such as image and speech recognition, NLP, predictive analytics, and autonomous decision-making.

REGION

Asia Pacific to be fastest-growing region in global aerospace materials market during forecast period

North America is poised to maintain the largest market share in the GPU-as-a-Service market due to its strong technological base, high investment in AI, and the availability of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The region is a global hub for AI innovation, with widespread adoption of GPUaaS across various industries, including healthcare, automotive, finance, and gaming. Key innovations in AI model development, such as large language models and generative AI, continue to drive demand for horizontally scalable GPU infrastructure.

GPU as a Service Market: COMPANY EVALUATION MATRIX

In the GPU-as-a-Service market matrix, Amazon Web Services, Inc. (Star) leads with a strong market share and extensive product footprint, driven by wider product capabilities, geographical footprint, and a robust product portfolio. Star companies primarily focus on acquiring a leading market position through their high financial capabilities and well-established brand equity. CoreWeave (Emerging Leader) is gaining considerable visibility. These companies are concerned about their product portfolio and must continue to develop strong product strategies to expand their business and stay competitive.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 6.54 Billion |

| Market Forecast, 2030 (Value) | USD 26.62 Billion |

| Growth Rate | CAGR of 26.5% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: GPU as a Service Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Cloud Infrastructure Provider |

|

|

RECENT DEVELOPMENTS

- February 2025 : Google (US) introduced the preview of A4X VMs, powered by NVIDIA GB200 NVL72, a system featuring 72 NVIDIA Blackwell GPUs and 36 Arm-based NVIDIA Grace CPUs connected via fifth-gen NVLink. Designed for next-gen AI reasoning models, A4X VMs offered the performance and efficiency needed to handle massive datasets, long context windows, and complex problem-solving.

- September 2024 : IBM introduced GX3D instances with NVIDIA H100 Tensor Core GPUs for IBM Cloud Kubernetes Service (IKS) and Red Hat OpenShift on IBM Cloud (ROKS). It was designed for AI and ML workloads, offering up to 30 times faster AI inferencing and nine times faster AI training compared to A100 GPUs, with six times faster chip-to-chip communication.

- April 2024 : Oracle and Palantir Technologies Inc. partnered to deliver secure cloud and AI solutions for businesses and governments worldwide. By combining Oracle’s distributed cloud and AI infrastructure with Palantir’s AI and decision acceleration platforms, the collaboration aimed to help organizations maximize data value, enhance efficiency, meet sovereignty requirements, and gain a competitive edge.

Table of Contents

Methodology

The research process for this technical, market-oriented, and commercial study of the GPU as a Service market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the GPU as a Service market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC), and the International Monetary Fund (IMF).

List of key secondary sources

|

Source |

Web Link |

|

European Association for Artificial Intelligence |

https://eurai.org/ |

|

Association for Machine Learning and Application (AMLA) |

https://www.icmla-conference.org/ |

|

Association for the Advancement of Artificial Intelligence |

https://aaai.org/ |

|

Generative AI Association (GENAIA) |

https://www.generativeaiassociation.org/ |

|

International Monetary Fund |

https://www.umaconferences.com/ |

Primary Research

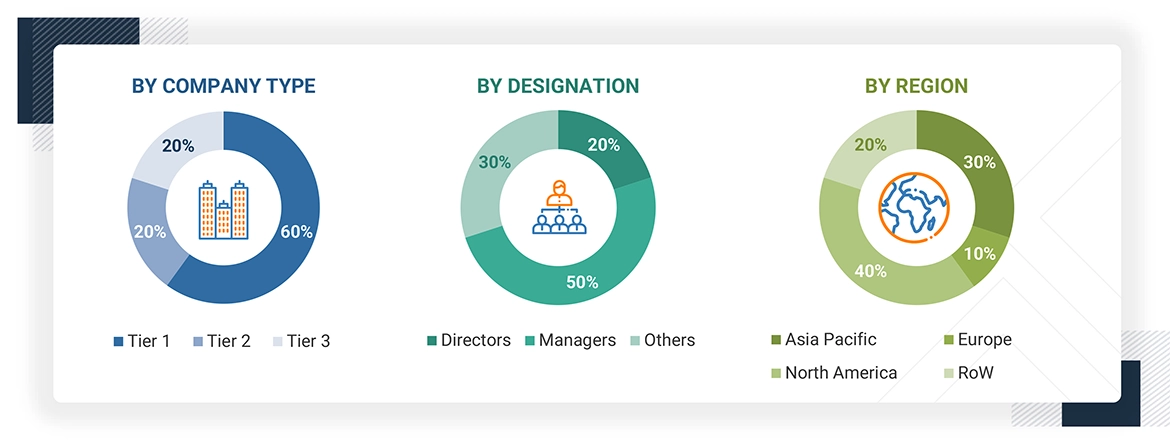

Extensive primary research was accomplished after understanding and analyzing the t GPU as a Service market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side, and 70% with the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2023 ? Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Bottom-Up Approach

- The first step involved identifying key countries with a strong cloud computing penetration and a high number of data centers. Countries with significant AI adoption and robust technological infrastructure were prioritized.

- The second step measured GPUaaS adoption in each country to assess market demand, considering factors like AI workloads, enterprise adoption, and cloud service investments.

- The market was segmented by different categories, such as by service model, by deployment, by enterprise type, and by application using GPUaaS.

- The country-level data was agreegated to estimate regional and global market sizes.

- To confirm the global market size, primary interviews were conducted with major cloud service providers, GPU manufacturers, and enterprise customers leveraging GPUaaS.

- To determine the compound annual growth rate (CAGR) of the GPU as a Service market, both historical and projected market trends were analyzed by examining the industry's penetration rate, as well as the supply and demand in various application areas.

- All estimates at each stage were confirmed through discussions with key opinion leaders, including corporate executives (CXOs), directors, and sales heads, as well as industry experts from MarketsandMarkets.

- Several paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were also reviewed during the research process.

Top-Down Approach

- To estimate the global size of the GPUaaS market, the key companies providing GPUaaS solutions, included leading cloud service providers (CSPs) as well as startups in the ecosystem were identified through secondary research, and information was confirmed through brief discussions with industry experts.

- The product and service portfolios of these companies were thoroughly analyzed to determine their market contribution.

- The specific business segments within these companies that provide GPUaaS solutions was identified. The revenue generated by these units was assessed to understand their wallet share within the GPUaaS market. Additionally, partnerships, acquisitions, and strategic alliances related to GPUaaS were considered to estimate their market influence.

- The revenue from major GPUaaS players was aggregated, and extrapolated to estimate the global GPUaaS market size, considering industry trends, regional expansions, and technological advancements.

GPU as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the GPU as a Service market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

GPU as a Service (GPUaaS) is a cloud-based computing model that provides on-demand access to Graphics Processing Units (GPUs) for high-performance computing tasks. It enables businesses, researchers, and developers to leverage the parallel processing power of GPUs without the need for investing in expensive hardware infrastructure. GPUaaS is widely used in applications such as artificial intelligence (AI), machine learning (ML), deep learning, data analytics, and rendering-intensive tasks like 3D modeling and video processing. By offering scalable and flexible GPU resources, cloud providers help organizations optimize performance while reducing costs, enabling them to run complex workloads efficiently in a pay-as-you-go or subscription-based model.

Key Stakeholders

- Cloud Service Providers (CSPs)

- GPU Hardware Manufacturers

- Software & Platform Providers

- Enterprise Users

- Developers & Researchers

- Gaming & Content Creators

- Cloud Orchestration & Management Providers

- Data Center Operators

- Telecom & Networking Companies

- Regulatory Bodies & Industry Associations

Report Objectives

- To define, describe, segment, and forecast the size of the GPU as a Service market, in terms of service model, GPU type, business model, deployment, enterprise type, application, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and RoW

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide an value chain analysis, ecosystem analysis, case study analysis, patent analysis, Trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter's five forces analysis, investment and funding scenario, and regulations pertaining to the market

- To provide a detailed overview of the value chain analysis of the GPU as a Service ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape.

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the GPU as a Service market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the GPU as a Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in GPU as a Service Market